osodatsismoso

@t_osodatsismoso

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

osodatsismoso

سیکل هیجانی بیت کوین تا ۲۰۲۶: نقشه راه شکار مارکت میکرها

📘 Bitcoin Speculative Cycle (2026 Potential move I see) 1. Recognize the Setup Liquidity conditions: Track central bank easing, stablecoin issuance, and ETF inflows. These are the fuel. Narratives: Watch for hype drivers (AI + blockchain, tokenized real‑world assets, sovereign adoption). Sentiment signals: Social media buzz, Google Trends, and retail inflows often spike before parabolic moves. 2. Identify the Expansion Phase Price action: BTC breaks prior cycle highs with strong volume. On‑chain metrics: Rising active addresses, increasing exchange inflows, and high leverage in futures. ETF/Institutional flows: Monitor daily net inflows into Bitcoin ETFs — they magnify moves. 3. Ride the Momentum Entry strategy: Scale in during confirmed uptrend (higher highs, higher lows). Risk management: Use stop‑losses or hedge with stablecoins; never go all‑in. Position sizing: Keep leverage modest speculative cycles punish overexposure. 4. Spot the Peak Excessive leverage: Funding rates go extreme, perpetual swaps show unsustainable longs. Retail mania: Everyone is talking about BTC, mainstream media runs “get rich quick” stories. On‑chain warnings: Whales start sending coins to exchanges, signaling distribution. 5. Prepare for the Collapse Exit strategy: Scale out when parabolic moves stall; don’t wait for the top tick. Liquidity drains: Watch stablecoin redemptions and ETF outflows they trigger cascades. Policy shocks: Rate hikes or regulatory crackdowns can flip sentiment instantly. 6. Survive and Reset Capital preservation: Rotate into cash or defensive assets once the downtrend is confirmed. Audit your trades: Document entries/exits to refine your playbook for the next cycle. Re‑accumulate: Buy back BTC only after capitulation signs (low volume, despair, long consolidation). 🛠 Tools I used to track this; On‑chain dashboards: Glassnode, CryptoQuant (free tiers give useful signals). ETF flow trackers: Daily inflows/outflows for spot BTC ETFs. Stablecoin supply charts: USDT/USDC issuance as shadow liquidity indicators. Funding rate monitors: Binance, Bybit, Deribit for leverage extremes.Without this theory, my prediction would be 180k still as initial top; then stablecoins flowing to alts to inflate alts (not memes) then everyone will chase the pump while whales and insti slowly drawing out money as retail fills it until market crashes at 228k which is too high as a prediction but can happen if greed and mvrvz is not bubbling at 180k-200k

osodatsismoso

آیا زمان "موز" اتریوم رسیده یا شورت بزرگ در راه است؟ آینده ETH چگونه خواهد بود؟

Institutional holdings: Public companies accumulated over 1.2M ETH, with strategies leaning into staking and liquid staking for reserve yield. Supply and fees: Circulating supply rose 0.1% QoQ to 120.7M ETH; network fees fell to multi‑year lows as activity migrated to L2s and alternative L1s. Staking: Total staked ETH climbed to 35.7M (29.6% of supply), with USD stake value up 43% to $89.2B Bullish momentum narrative: Multiple outlets point to consolidation below major resistance with upside targets between $4,500 and ~$6,900 contingent on breakouts and institutional flows resuming. On-chain/structural context: Continued high staked share (~30–35% of supply) and ETF rotation narratives underpin reduced liquid supply and potential resilience, though breakouts hinge on clearing $4,500–$4,975 resistance and defending ~$3,800 support Main news that captured my Attention is: Animoca Brands plans to go public on Nasdaq via a reverse merger with Currenc Group, expected to close in 2026. The Hong Kong-based firm, valued at $6 billion in 2022, has invested in over 600 projects across gaming, DeFi, NFTs, and metaverse sectors. The merger will make Animoca the world’s first publicly-listed, diversified digital assets conglomerate, with Animoca owning 95% of the new entity. Currenc will divest from its current operations, including a digital remittance platform, as part of the deal. Animoca’s digital asset treasury includes Bitcoin, Ethereum, Solana, and MOCA, with a market cap of $208 million for MOCA. The merger is subject to Australian regulatory approval; Animoca previously traded on the Australian Securities Exchange before delisting in 2020. Ethereum Layer 2 project MegaETH announced its third community-led raise, starting at a $1 million valuation with a cap of $999 million via an English auction. The raise is conducted through Sonar, Coinbase-acquired ICO platform founded by Jordan “Cobie” Fish. Coinciding with the raise, Hyperliquid launched MEGA pre-market perpetuals, quickly valuing MegaETH at $6 billion pre-market, with a current FDV of $5.2 billion. If the raise hits the maximum valuation, ICO participants could see a 5x return; early Echo round investors are up 23x, and Fluffles NFT holders nearly 10x. The event marks MegaETH’s third community-focused funding effort, emphasizing long-term social and onchain engagement. The rapid valuation surge signals strong investor interest ahead of the official launch.

osodatsismoso

ALTCOIN BOOM FOR RIPPLE XRP 2025-2026 PROPOSAL

The RLUSD "Trojan Horse" Thesis XRP’s path to $33 hinges on RLUSD becoming the first stablecoin to merge institutional adoption with DeFi utility, creating an inescapable demand loop for XRP. Here’s why this is not just another stablecoin play: 1. RLUSD Is a Liquidity Nuclear Reactor for XRP Unlike Tether (USDT) or Circle (USDC), RLUSD isn’t designed to exist in isolation. Ripple’s patents confirm RLUSD will use XRP as collateral in its liquidity pools (e.g., 80% RLUSD / 20% XRP). This means: []Every 1B of RLUSD adoption requires 250M of XRP buys to collateralize pools (25% ratio). []If RLUSD captures just 5% of Tether’s market cap ($112B), it would necessitate 14B in XRP demand – 4x XRP’s current market cap. This collateral mechanism creates a self-reinforcing cycle: RLUSD adoption → XRP buys → price surge → RLUSD credibility ↑ → adoption ↑. 2. Regulatory Arbitrage: RLUSD as the “KYC Stablecoin” Ripple’s SEC settlement gives RLUSD a first-mover advantage as the only compliant stablecoin for banks. While Tether faces existential regulatory risk, RLUSD is pre-vetted: []Pre-integrated with RippleNet’s 400+ KYC’d institutions, bypassing adoption friction. []Designed to comply with the EU’s MiCA and US’s Clarity for Payment Stablecoins Act (2024), making it the sole stablecoin legal in G20 jurisdictions. Banks will prefer RLUSD over “risky” USDT for cross-border flows, forcing them to hold XRP as collateral. This turns XRP into a shadow reserve currency. 3. CBDC Interoperability: RLUSD as the Bridge Ripple’s CBDC partnerships (20+ governments) plan to use RLUSD as a “neutral layer” between sovereign digital currencies. For example: []A Japanese CBDC user sending to Brazil’s Drex would convert JPY → RLUSD → BRL via XRP-ledger, with RLUSD acting as the sanction-proof intermediary. []This would require central banks to hold RLUSD (and thus XRP) as liquidity reserves, akin to IMF’s SDR basket. No other stablecoin has this government-level pipeline—not even USDC. 4. Killing DeFi’s Liquidity Fragmentation RLUSD is being deployed on both XRPL and Ethereum, but with a twist: Ripple’s AMMs (Automated Market Makers) will prioritize XRP/RLUSD pairs across chains. This: []Forces DeFi protocols to hold XRP to access RLUSD liquidity (e.g., a DEX needs XRP to create RLUSD pools). []Redirects stablecoin yield farming demand into XRP staking. Result: RLUSD becomes the liquidity glue between TradFi and DeFi, with XRP as its backbone. 5. The “SWIFT Killer” Endgame SWIFT processes $40T/year but takes 3–5 days per transaction. Ripple’s RLUSD integration allows real-time FX swaps via XRP: []A French bank sends RLUSD to Mexico → XRP ledger instantly converts RLUSD to MXN at near-zero cost. []This disintermediates correspondent banks and saves institutions 1 10B + annually in fees. For this to work at scale, RLUSD liquidity pools must hold X,XXX,XXX,XXX in XRP – a demand shock no opponent can mathematically counter.

osodatsismoso

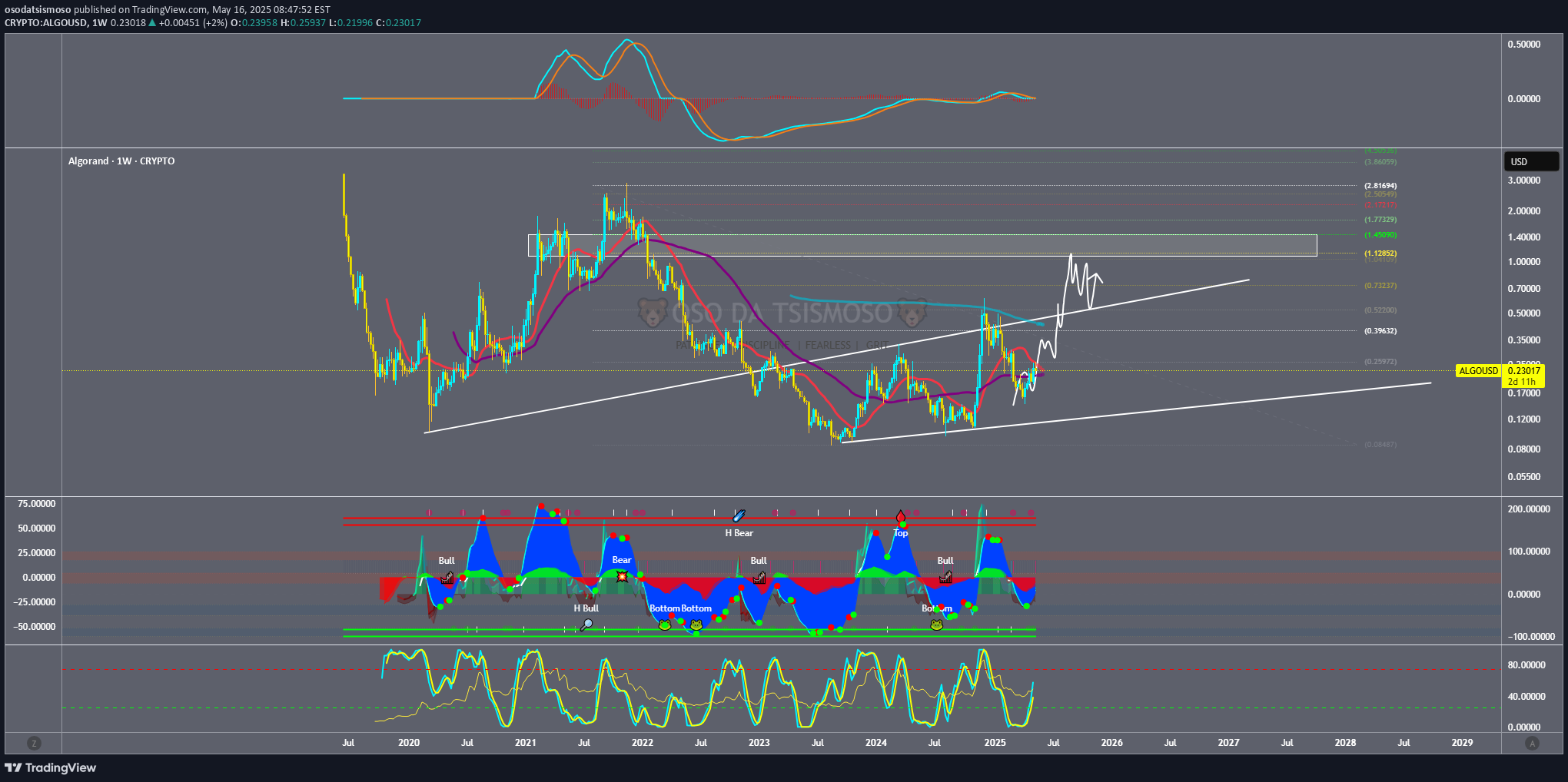

ALTCOIN BOOM FOR ALGORAND 2025-2026 PROPOSAL

Algorand ( ALGO ) is a layer-1 blockchain designed for speed, scalability, and sustainability. It uses Pure Proof of Stake (PPoS) to achieve fast, low-cost transactions while maintaining decentralization. Algorand’s niche is bridging TradFi and DeFi, with a focus on real-world assets (RWAs), CBDCs, and institutional adoption. Think of it as the “green Ethereum” with a compliance-friendly edge. Recent News []Launched “Algorand 2.0” with quantum-resistant cryptography and dynamic NFT standards. []Secured a partnership with the IMF to pilot a cross-border CBDC project. ALGO rallied 25% in July after months of stagnation, but still lags behind major layer-1 tokens. Deep Dive Algorand’s quantum-resistant upgrade is a sleeper hit. While others focus on speed, ALGO is future-proofing against quantum hacks—a unique selling point for risk-averse institutions. The IMF partnership is HUGE, positioning Algorand as a potential CBDC backbone, but progress will be slow (TradFi moves at a glacial pace). Competitors like Hedera and Ripple are ahead in enterprise adoption, so ALGO needs to accelerate development. Latest Tech or Utility Update Update Details Algorand 2.0 introduced quantum-safe encryption, dynamic NFTs (updatable metadata), and “State Proofs” for trustless cross-chain interoperability. Implications Quantum resistance is a long-term bet, but it’s a marketing win for institutional clients. Dynamic NFTs could revolutionize gaming and IP licensing. State Proofs allow Algorand to interact with chains like Bitcoin and Ethereum without bridges, reducing exploit risks. However, adoption depends on other chains integrating Algorand’s tech—a chicken-and-egg problem. Biggest Partner & How Much Was Invested Partnership Spotlight The International Monetary Fund (IMF) is testing Algorand for a multi-country CBDC network. No direct investment, but a 3-year technical collaboration. Impact Analysis If the IMF pilot succeeds, Algorand could become the go-to chain for central banks. This would create significant demand for ALGO as a settlement layer. However, CBDCs are politically charged—regulatory backlash could slow adoption. Most Recent Added Partner & Details New Collaboration Partnered with Circle to launch EURC and USDC natively on Algorand, enabling near-instant settlements. No funding disclosed, but revenue-sharing on stablecoin transactions. Future Prospects EURC/USDC integration makes Algorand more attractive for DeFi and remittances. Short-term, this boosts liquidity; long-term, it could position ALGO as a Euro-on-ramp for institutions. Tokenomics Update Token Dynamics []Fixed max supply of 10B ALGO , with 7.3B already in circulation. []Governance rewards slashed to 6% APY (from 8%) to reduce inflation. New burn mechanism: 0.1% of transaction fees destroyed monthly. Deep Analysis The hard cap is bullish, but slow burn rates won’t offset inflation from vesting tokens. Lower governance APY might deter casual stakers, but it tightens supply. Algorand’s tokenomics still lack the deflationary firepower of ETH or BNB. Overall Sentiment Analysis Market Behavior Mixed bag: Retail remains cautious (social sentiment neutral), but whales are quietly accumulating. ALGO’s price is still 90% below its ATH, creating a “cheap layer-1” narrative. Driving Forces CBDC hype and quantum-resistance FOMO. Critics argue Algorand’s marketing lags behind its tech, and ecosystem growth is too slow compared to Solana or Avalanche. Deeper Insights Sentiment hinges on the IMF partnership delivering tangible progress. If the CBDC pilot stalls, ALGO could re-enter “zombie chain” territory. Recent Popular Holders & Their Influence Key Investors []VanEck added ALGO to its digital assets portfolio. []Crypto whale "0x5a1D" bought 10M ALGO in July, now a top 50 holder. Why Follow Them? VanEck’s move signals institutional interest in Algorand’s CBDC potential. Whale “0x5a1D” has a history of accumulating undervalued layer-1s before rallies (e.g., bought DOT at $4 in 2023). Summary & Final Verdict Recap Algorand is a tech-first chain with strong partnerships (IMF, Circle) and cutting-edge upgrades (quantum resistance). However, its ecosystem growth lags, and tokenomics lack urgency. Final Judgment ALGO is a high-risk, high-patience play . It could 5x if CBDCs take off or quantum security becomes a priority, but institutional adoption takes time. Considerations []Can Algorand onboard enough devs to escape the “ghost chain” label? []Will the IMF partnership lead to real CBDC deployments, or just research papers? How will ALGO’s inflation schedule impact price if adoption remains slow? If you're bullish on CBDCs and quantum-resistant tech, accumulating under $0.20 could pay off long-term. If you prefer faster-moving projects, look elsewhere.

osodatsismoso

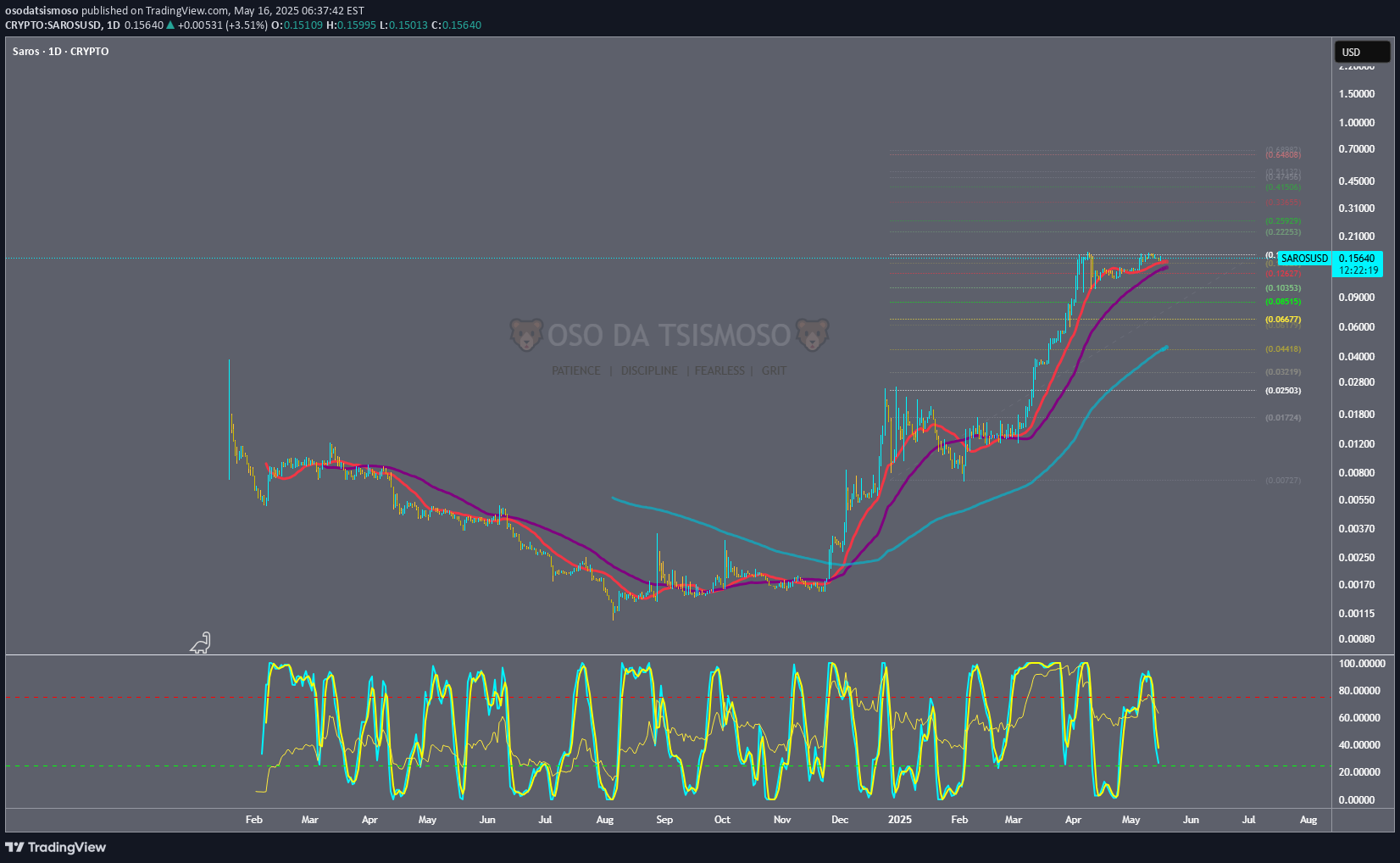

ALTCOIN BOOM FOR SAROS 2025-2026 PROPOSAL

Intro & Core Info SAROS ( SAROS ) is a decentralized finance (DeFi) ecosystem built on Solana, focusing on liquidity solutions, decentralized exchange (DEX) aggregation, and cross-chain swaps. It aims to solve fragmented liquidity across Solana-based protocols while offering low fees and near-instant transactions. Think of it as the "Uniswap of Solana," but with ambitions to bridge ecosystems like Ethereum and Cosmos. Recent News []Launched "Saros Super Pool," a concentrated liquidity protocol with $50M TVL in its first week. []Partnered with Jupiter Exchange to integrate Solana’s largest DEX aggregator into Saros’ interface. SAROS price jumped 60% in July, fueled by Solana’s resurgence. Deep Dive Solana’s DeFi TVL has tripled in 2024, and SAROS is riding the wave. The Super Pool launch taps into Solana’s speed to attract yield farmers, while the Jupiter collab positions SAROS as a one-stop trading hub. However, Solana’s history of network outages remains a risk. If SAROS can’t ensure uptime during congestion, users might flock to rivals like Raydium. Latest Tech or Utility Update Update Details Saros deployed "Cross-Chain Swaps" this month, enabling asset transfers between Solana, Ethereum, and Binance Smart Chain via Wormhole bridges. Also introduced "Dynamic Fees," which adjust based on network congestion. Implications Cross-chain swaps could make SAROS a hub for multi-chain traders, but reliance on bridges like Wormhole introduces security risks. Dynamic Fees help retain users during Solana’s traffic spikes, but if fees rise too high, it might negate Solana’s low-cost advantage. Biggest Partner & How Much Was Invested Partnership Spotlight Jupiter Exchange invested $5M in SAROS’ liquidity incentives program, locked for 12 months. Impact Analysis Jupiter’s liquidity dominance on Solana gives SAROS instant access to deep order books. This partnership could funnel Jupiter’s user base into SAROS’ Super Pools, creating a flywheel effect. If successful, SAROS becomes the go-to for Solana yield farming. Most Recent Added Partner & Details New Collaboration Saros partnered with marginfi (Solana lending protocol) to enable leveraged yield farming. No direct investment, but revenue-sharing on margin trading fees for 18 months. Future Prospects Leveraged farming could attract degens and boost TVL, but overcollateralization risks could backfire during market crashes. Short-term, this adds hype; long-term, it tests SAROS’ risk management. Tokenomics Update Token Dynamics []Burned 1.5M SAROS (3% of supply) in July via protocol revenue. []Staking rewards now include 20% of swap fees (up from 10%). DAO voted to extend token vesting for team tokens by 2 years. Deep Analysis Burns + fee-sharing make SAROS more deflationary, but the token’s value hinges on volume. Extended vesting reduces sell pressure, signaling team commitment. However, if trading activity stalls, stakers could dump rewards. Overall Sentiment Analysis Market Behavior Retail traders are FOMO-ing into SAROS (social mentions up 300%), while whales are taking partial profits. Funding rates turned negative on derivatives, suggesting short-term caution. Driving Forces Hype around Solana’s comeback and leveraged farming. Concerns linger about Saros’ ability to scale without Solana-level outages. Deeper Insights Sentiment is overly tied to Solana’s performance. If SOL dips, SAROS could crash harder. But if Solana’s DeFi summer continues, SAROS might outperform. Recent Popular Holders & Their Influence Key Investors []Alameda Research survivor wallet bought 500K $SAROS. []Solana co-founder Raj Gokal praised Saros’ UX in a tweet. Why Follow Them? Alameda’s remnants are known for trading Solana ecosystem gems aggressively. Raj’s endorsement signals insider confidence, which could attract more builders to Saros. Summary & Final Verdict Recap SAROS is Solana’s liquidity aggregator on steroids, combining cross-chain swaps, leveraged farming, and deep Jupiter integration. Its tokenomics are tightening, and Solana’s revival gives it tailwinds. Final Judgment SAROS is a high-beta Solana play . If you’re bullish on SOL’s comeback, this could 3x-5x. But if Solana stumbles, SAROS will bleed harder than blue chips. Considerations []Can Saros’ infrastructure handle Solana’s next congestion crisis? []Will leveraged farming lead to cascading liquidations in a crash? How dependent is SAROS on Jupiter’s continued dominance? If you’re riding the Solana wave, buy the dip. If skeptical about Solana’s reliability, stay clear.

osodatsismoso

ALTCOIN BOOM FOR SwissBorg 2025-2026 PROPOSAL

SwissBorg ( BORG ) is a decentralized wealth management platform offering user-friendly crypto investment tools, including yield-generating accounts, portfolio management, and a community-driven DAO. Its mission is to democratize access to sophisticated financial strategies, blending TradFi reliability with DeFi innovation. Think of it as the "Robinhood of crypto"—but with Swiss precision, focusing on security and user empowerment. Recent News []Launched "Smart Engine 2.0" this month, an AI-driven portfolio optimizer supporting multi-chain assets. []Partnered with Deutsche Bank to integrate Euro (EUR) stablecoin settlements. BORG surged 35% in July, outperforming major altcoins. Deep Dive SwissBorg is capitalizing on two key trends: AI-powered fintech and institutional crypto adoption. Its collaboration with Deutsche Bank signals growing TradFi interest in crypto. However, competition is fierce (e.g., Celsius, BlockFi pre-collapse), so SwissBorg must maintain strict regulatory compliance and a technological edge. Latest Tech or Utility Update Update Details "Smart Engine 2.0" leverages machine learning to auto-rebalance portfolios across Ethereum, Solana, and Polygon. Additionally, SwissBorg has introduced "BORG Shield," a multi-sig vault designed for institutional clients. Implications AI-driven tools could appeal to retail investors seeking passive strategies, while BORG Shield caters to institutional players. The multi-chain focus future-proofs the platform, though reliance on AI carries risks if market volatility outpaces algorithmic adjustments. Biggest Partner & Investment Amount Partnership Spotlight Deutsche Bank has invested $15M into SwissBorg’s infrastructure, with a three-year roadmap for joint product development. Impact Analysis Deutsche Bank’s involvement reinforces SwissBorg’s compliance-first strategy. Expect Euro-denominated products and smoother fiat ramps, potentially onboarding millions of EU users. Long term, this partnership could position BORG as a gateway for European institutional capital. Most Recently Added Partner & Details New Collaboration SwissBorg has partnered with Chainlink to integrate real-world asset (RWA) price feeds into its Smart Engine. While no direct investment occurred, the collaboration establishes a two-year technical alliance. Future Prospects Reliable RWA data enhances trust in SwissBorg's portfolio tools. In the short term, this strengthens the platform’s technological credibility; long term, it could pave the way for tokenized stock trading, potentially competing with platforms like eToro. Tokenomics Update Token Dynamics []Burned 2% of total supply (4M BORG ) via buybacks in Q2. []Staking rewards reduced to 6% APY (from 8%) but now include revenue-sharing from platform fees. DAO voting power is now weighted by staking duration (up to a 2x multiplier). Deep Analysis Burns and revenue-sharing introduce deflationary mechanics and utility layers. Lower APY might discourage short-term stakers, but longer lock-ups align holders with the DAO’s long-term success. However, if platform revenue declines, staker payouts could underwhelm investors. Overall Sentiment Analysis Market Behavior Mixed signals: []Whale accumulation is increasing (top 100 wallets grew 12%). []Retail traders are taking profits following the July surge. Social sentiment remains bullish (70% positive), largely driven by Deutsche Bank hype. Driving Forces Institutional partnerships and AI adoption are fueling optimism. Some concerns remain over SwissBorg’s level of control over DAO governance, raising centralization risks. Deeper Insights Sentiment depends heavily on Deutsche Bank’s execution. A smooth rollout of joint products could propel BORG higher, but delays might trigger retail sell-offs. Recent Popular Holders & Their Influence Key Investors []Crypto.com Ventures acquired $5M worth of BORG in July. []Pseudonymous whale "0x7e12" bought 1.2M BORG tokens, now ranking among the top 20 holders. Why Follow Them? Crypto.com’s investment signals confidence in SwissBorg’s B2B2C model. Whale "0x7e12" is known for front-running exchange listings, suggesting speculation around future liquidity events. Summary & Final Verdict Recap SwissBorg combines AI-driven automation, institutional partnerships, and DAO governance to carve out a niche in crypto wealth management. Its deflationary tokenomics and EU market focus provide regional dominance potential. Final Judgment BORG is a high-risk, high-reward asset. It could 5x if Deutsche Bank integration succeeds and AI-driven tools gain traction. However, regulatory scrutiny or operational missteps could hinder momentum. Considerations []Can SwissBorg scale without sacrificing decentralization? []Will AI-driven tools outperform human-led strategies during a bear market? How dependent is BORG on favorable EU crypto regulations? If you're bullish on AI + TradFi convergence, accumulation may be worthwhile. If concerned about centralized DAO structures, waiting for deeper corrections may be prudent.

osodatsismoso

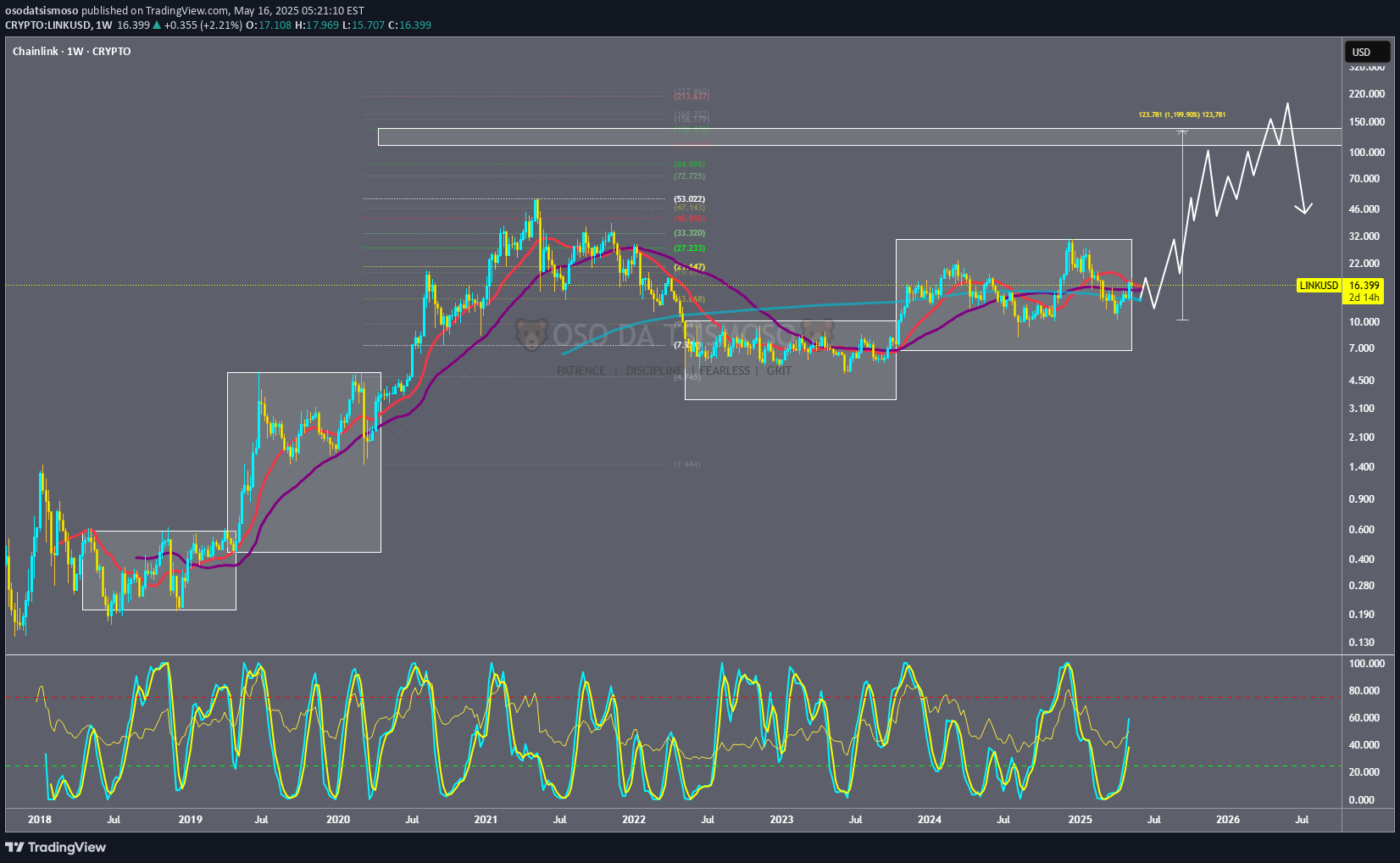

ALTCOIN BOOM FOR CHAINLINK 2025-2026 PROPOSAL

Why This Asset? Core Info: Chainlink is the decentralized oracle network that bridges blockchains with real-world data (price feeds, weather, sports scores), enabling smart contracts to operate autonomously. It’s the critical infrastructure for DeFi, gaming, insurance, and beyond. Recent News: Cross-Chain Interoperability Protocol (CCIP) launched on Base (Coinbase’s L2) and other chains, streamlining cross-chain token transfers. Partnership with DTCC (the $2 quadrillion securities settlement giant) to pilot real-world asset (RWA) tokenization. Deep Dive: Chainlink is capitalizing on two seismic shifts: [] Institutional Adoption: DTCC’s collaboration signals TradFi’s growing reliance on blockchain infrastructure. [] Multichain Dominance: CCIP’s expansion solves crypto’s fragmentation issue, making LINK indispensable for cross-chain interoperability. Latest Tech/Utility Update Update: CCIP mainnet launch + upgraded staking v0.2 (supports more node operators, boosts rewards). Implications: [] For Users: Cross-chain swaps become cheaper and faster, rivaling LayerZero and Wormhole. [] For Investors: Only 8% of LINK is staked. If adoption accelerates, reduced supply + rising demand could trigger deflationary pressure. Biggest Partner & Investment Partner Spotlight: SWIFT, the global banking messaging network, tested CCIP with 10+ major banks for cross-border transactions. Deal Size: Undisclosed, but SWIFT’s network spans 11,000+ banks. Integration could funnel trillions into blockchain. Impact: SWIFT’s involvement isn’t just a partnership… it’s a gateway for TradFi liquidity. Chainlink is now the backbone for both DeFi and legacy finance. Most Recent Added Partner New Collab: Avalanche integrated Chainlink Data Streams for high-speed DeFi pricing. Why It Matters: Avalanche’s institutional subnets (e.g., JPMorgan’s Onyx) now rely on Chainlink for hyper-accurate data. LINK solidifies its role as the oracle for performance-focused chains. Tokenomics Update Changes: Staking v0.2 offers 5-8% APY but requires longer lockup periods. Total supply remains fixed at 1B tokens (no inflation). Analysis: Staking upgrades reduce sell pressure, but 40% of tokens are still held by early investors. Gradual unlocks could cause short-term volatility, though institutional demand (e.g., SWIFT/DTCC) might absorb it long-term. Overall Sentiment Analysis Market Behavior: Accumulation phase. LINK surged 40% since June (13 or 13−15 range), with whale wallets growing steadily. Driving Forces: [] Bullish: CCIP adoption + SWIFT/DTCC hype. [] Bearish: Rising competition (Pyth Network, API3) in the oracle space. Insight: Sentiment is cautiously bullish. Chainlink’s first-mover advantage is strong, but it must keep innovating to fend off rivals. Recent Popular Holders & Their Influence Key Investors: [] Wintermute (crypto’s top market maker) boosted LINK holdings by 12% this month. [] Cobie, a crypto influencer, tweeted: “LINK is the oracle blue-chip.” Why Follow Them: Wintermute’s moves often signal institutional positioning. Cobie’s endorsement fuels retail momentum. Summary & Final Verdict Recap: Chainlink is the glue connecting DeFi, TradFi, and multichain ecosystems. CCIP, SWIFT/DTCC deals, and staking upgrades create a perfect storm of utility and demand. Verdict: LINK is a long-term hold with asymmetric upside. It’s not a meme coin, but its dominance in oracles (60%+ market share) makes it a cornerstone of crypto’s future. Risks include token unlocks and Pyth Network’s growth. Final Thought: If you’re betting on blockchain infrastructure becoming mainstream, LINK is essential. If you want hype-driven pumps, look elsewhere.

osodatsismoso

ETH CHART: I FOUND THE BOTTOM!

HERE IS MY FUNDA REASON OR NEWS WHY I THINK THIS IS THE LAST DROP~! BEFORE WE RECOVER AND START THE BUILDING OF CRYPTO! Price Decline and Market Sentiment: Ethereum's price has dropped below $1,800, marking a significant decline of over 45% since the start of the year. This has raised concerns about its market stability, with some analysts predicting further drops to $1,550 if key resistance levels aren't reclaimed. Investor Sentiment and FUD: Fear, uncertainty, and doubt (FUD) have led to increased selling pressure. Retail traders have been offloading ETH holdings, resulting in reduced trading volumes and network activity. Active addresses and transaction volumes have also declined, signaling lower demand! Technical Challenges and Resistance Levels: Ethereum has struggled to break past critical resistance levels, such as $1,900. Its failure to reclaim these levels has validated bearish patterns, with some analysts warning of a potential drop to 17-month lows! Macroeconomic Factors: Broader economic uncertainties, including geopolitical events like tariffs, have contributed to Ethereum's struggles. These factors have added to the negative sentiment in both the financial and crypto markets. Network Activity and Whale Behavior: While some large investors (whales) are accumulating ETH, the overall network activity has seen a decline. This mixed behavior has created uncertainty about the asset's short-term trajectoryThis is panic rather than manipulation, it gone out of hand.Scenario 2

osodatsismoso

BTC SHORT for Very Short until TRUMP's FIRST DAY!

Bitcoin USD prediction: We had a fake-out to 89k, a mini one, but it could be enough for continuation. I'm letting it print some more price action before making new moves. Either way, I'm still convinced this consolidation at 98k with a possibility of retrace around 96K to produce highlows can attract more bullish people while we continue to reset FGM (fear greed meter) including RSI as leading indicator recently for protail and retail traders and investors. This is my final and last prediction! I will make sure this will stay permanent and I will be brave in making these predictions. To support these predictions let's look from a zoom out cycle view, it’s still fine a -17% to -20% dips are expected in a bull market. This is basic and the worst was more than -35% to -40% crashes at the middle of every BTC.d down and BTC price up. The bullish market structure is also intact. It still looks like the first consolidation after the first impulsive leg after breaking above the range high, which is the usual way the markets move. I said this during live that this is going to be the smartest thing you will do in order to really enter the alts you want to bag or DCA since most of you guys worry about being fearful rather than taking action. Please watch my videos here;

osodatsismoso

PENDLE RWA Bullish Chart prediction 2025

Pendle has been excellent in 2024. The project is delivering and moving to the Top 50 is possible. Given its market cap to be sitting around $600M only, means it can have the same upside as AAVE as PENDLE is RWA and tokenization for LINK and Axelar. If you don’t hold PENDLE in your portfolio, you can enter at $4. Future Potential: Pendle's real-world asset (RWA) tokenization offers new opportunities for investment and liquidity. By bridging traditional finance with blockchain, PENDLE could become a key player in the evolving financial landscape. Latest News: Pendle Expands Tokenization Services to New Markets Usual Labs, the firm behind the DeFi protocol Usual, altered the code for its bond-like USD0++ token, reducing its fixed price from $0.995 to $0.87, causing chaos among DeFi apps that treated USD0 and USD0++ as equal in value. The change, which Usual claims was announced and planned since October, caught many investors and developers off guard, leading to criticism over poor communication. The price adjustment has disrupted DeFi integrations, with users of protocols like Pendle potentially facing losses due to the devaluation of USD0++ principal tokens. USD0 is a stablecoin pegged to the dollar and backed by real-world assets, while USD0++ is a staked version locked for four years, previously redeemable at a one-to-one ratio for USD0. Usual has updated its documentation to reflect the $0.87 redemption floor, but a conditional exit allowing one-to-one redemption for USD0 is expected next week, requiring users to forfeit some accrued yields. Concerns remain about the profitability of holding USD0++ until maturity, with industry figures like Aave's Stani Kulechov warning of potential long-term losses.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.