Technical analysis by osodatsismoso about Symbol LINK: Buy recommendation (5/16/2025)

osodatsismoso

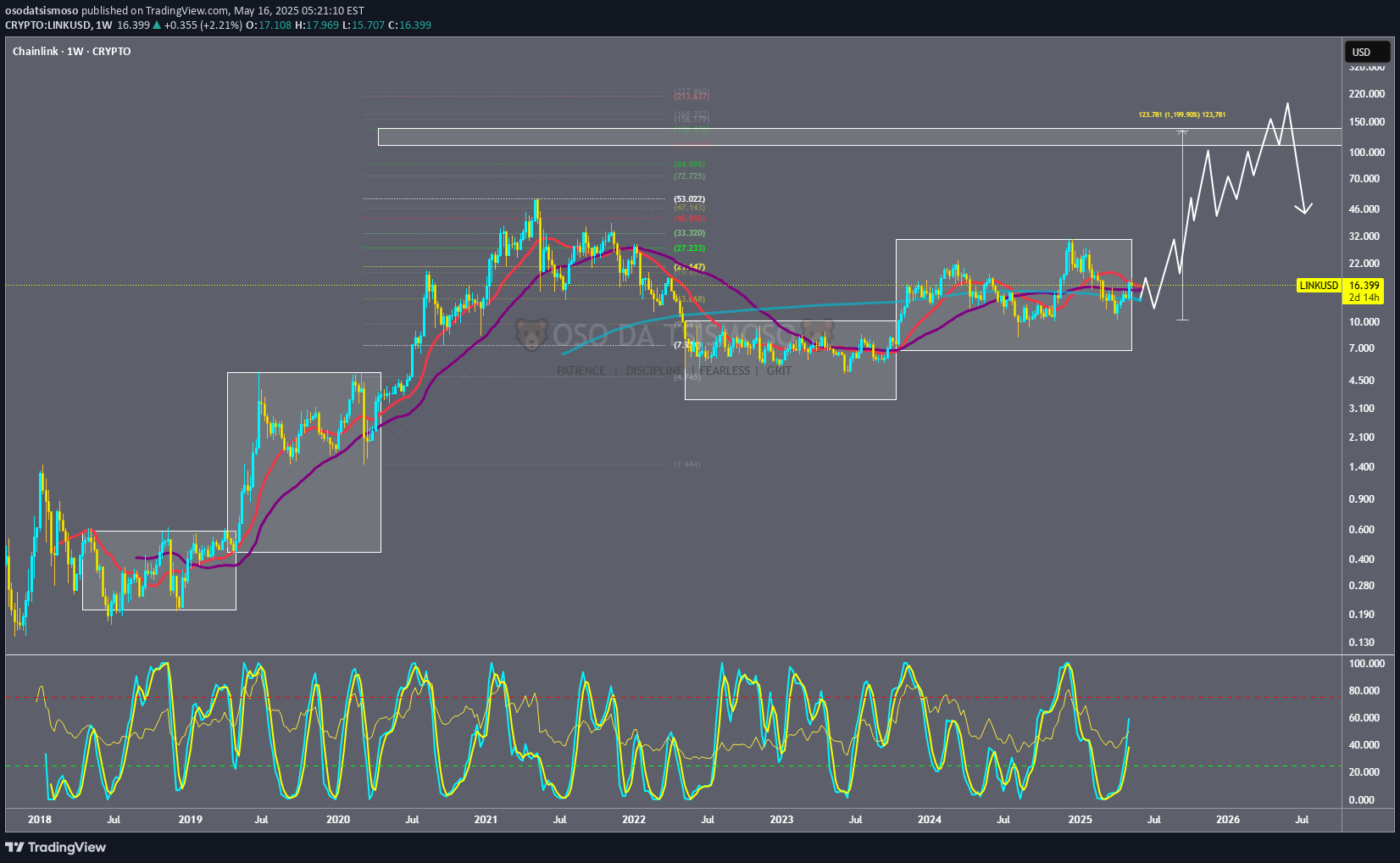

ALTCOIN BOOM FOR CHAINLINK 2025-2026 PROPOSAL

Why This Asset? Core Info: Chainlink is the decentralized oracle network that bridges blockchains with real-world data (price feeds, weather, sports scores), enabling smart contracts to operate autonomously. It’s the critical infrastructure for DeFi, gaming, insurance, and beyond. Recent News: Cross-Chain Interoperability Protocol (CCIP) launched on Base (Coinbase’s L2) and other chains, streamlining cross-chain token transfers. Partnership with DTCC (the $2 quadrillion securities settlement giant) to pilot real-world asset (RWA) tokenization. Deep Dive: Chainlink is capitalizing on two seismic shifts: [] Institutional Adoption: DTCC’s collaboration signals TradFi’s growing reliance on blockchain infrastructure. [] Multichain Dominance: CCIP’s expansion solves crypto’s fragmentation issue, making LINK indispensable for cross-chain interoperability. Latest Tech/Utility Update Update: CCIP mainnet launch + upgraded staking v0.2 (supports more node operators, boosts rewards). Implications: [] For Users: Cross-chain swaps become cheaper and faster, rivaling LayerZero and Wormhole. [] For Investors: Only 8% of LINK is staked. If adoption accelerates, reduced supply + rising demand could trigger deflationary pressure. Biggest Partner & Investment Partner Spotlight: SWIFT, the global banking messaging network, tested CCIP with 10+ major banks for cross-border transactions. Deal Size: Undisclosed, but SWIFT’s network spans 11,000+ banks. Integration could funnel trillions into blockchain. Impact: SWIFT’s involvement isn’t just a partnership… it’s a gateway for TradFi liquidity. Chainlink is now the backbone for both DeFi and legacy finance. Most Recent Added Partner New Collab: Avalanche integrated Chainlink Data Streams for high-speed DeFi pricing. Why It Matters: Avalanche’s institutional subnets (e.g., JPMorgan’s Onyx) now rely on Chainlink for hyper-accurate data. LINK solidifies its role as the oracle for performance-focused chains. Tokenomics Update Changes: Staking v0.2 offers 5-8% APY but requires longer lockup periods. Total supply remains fixed at 1B tokens (no inflation). Analysis: Staking upgrades reduce sell pressure, but 40% of tokens are still held by early investors. Gradual unlocks could cause short-term volatility, though institutional demand (e.g., SWIFT/DTCC) might absorb it long-term. Overall Sentiment Analysis Market Behavior: Accumulation phase. LINK surged 40% since June (13 or 13−15 range), with whale wallets growing steadily. Driving Forces: [] Bullish: CCIP adoption + SWIFT/DTCC hype. [] Bearish: Rising competition (Pyth Network, API3) in the oracle space. Insight: Sentiment is cautiously bullish. Chainlink’s first-mover advantage is strong, but it must keep innovating to fend off rivals. Recent Popular Holders & Their Influence Key Investors: [] Wintermute (crypto’s top market maker) boosted LINK holdings by 12% this month. [] Cobie, a crypto influencer, tweeted: “LINK is the oracle blue-chip.” Why Follow Them: Wintermute’s moves often signal institutional positioning. Cobie’s endorsement fuels retail momentum. Summary & Final Verdict Recap: Chainlink is the glue connecting DeFi, TradFi, and multichain ecosystems. CCIP, SWIFT/DTCC deals, and staking upgrades create a perfect storm of utility and demand. Verdict: LINK is a long-term hold with asymmetric upside. It’s not a meme coin, but its dominance in oracles (60%+ market share) makes it a cornerstone of crypto’s future. Risks include token unlocks and Pyth Network’s growth. Final Thought: If you’re betting on blockchain infrastructure becoming mainstream, LINK is essential. If you want hype-driven pumps, look elsewhere.