norok

@t_norok

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Monero Confirmed Breakout

Monero XMRUSD has broken the local high at 470 with a Weekly closing bar of 470.38. Even if by 0.38 this is still a rule followed to confirm the breakout. The next Resistance will be at the All Time High at 517.60. Given the breakout confirmation and momentum it is the highest probability that price will test the ATH and then we will see if it that weekly bar closes to confirm it as well. How High Can Monero Go? I do not presume to accurately call tops. Given the progression of ATHs the most likely next high would be around 593. Using a projection of 3 Year Historic Volatility the target could be 793. Caveat: Such a fast rise in price means inheirent high volatility and a look at Monero's long term history shows that a dramatic snap back is eventually very likely. This is a very difficult ticker to go long at this point. That being said - I still continue to believe that Monero is the best asymmetric bet in cryptocurrency right now.

Monero: "Delisting is a Feature"

What if NOT being listed on major Centralized Exchanges is Monero's greatest bull case? Most investors assume the same thing: Assets go up because they attract speculative capital. Liquidity, listings, leverage, and visibility are treated as prerequisites for valuation. So Monero’s biggest “problem” — being delisted from major centralized exchanges due to its privacy guarantees — is usually framed as fatal. But what if that assumption is backward? What if removal from the speculative casino is precisely why Monero behaves differently — and arguably better — than the rest of crypto? The common criticism (and why it persists) The standard argument goes like this: Monero’s privacy features make it non-compliant with evolving regulations. That forces centralized exchanges to delist it. Without exchange access, speculative inflows dry up. Without speculation, price stagnates. That narrative has circulated for years. It sounds logical. It’s also increasingly contradicted by reality. Despite repeated delistings, Monero has emerged as one of the most uncorrelated assets in the entire crypto market. And correlation — not volatility — is what quietly destroys portfolios. What the charts are actually showing BTCUSD ETHUSD SOLUSD DOGEUSD XRPUSD This morning’s sharp up/down move rippled across crypto almost uniformly. Bitcoin, Ethereum, Solana, Doge, XRP — all displayed the same pattern: A volatility spike A break from bearish consolidation A quick rejection back into the range or lower It was a textbook “low-volume volatility quake.” Monero barely reacted. While the rest of the market moved as a single organism — pushed and pulled by the same algos, market makers, and thin liquidity — Monero’s bullish trend remained largely uninterrupted. When everything moves together except one asset, that exception matters. The delisting that changed the story On February 6, 2024, Monero dropped over 30% overnight. At first, I assumed the worst — a cryptographic failure or privacy compromise. Instead, the cause was simple: Binance delisted Monero for regulatory non-compliance with privacy coins. In other words, Monero was punished for working exactly as designed. I held. This ended up being a market reaction quickly abated and Monero has rallied over 300%. The selloff faded quickly. Since that low, Monero has rallied more than 300%. Being removed from the highest-volume exchange did not suppress Monero’s value. If anything, it may have liberated it. The overlooked mechanism Most cryptocurrencies are now: Heavily centralized around exchanges Continuously arbitraged Priced primarily through leverage and relative flows That makes them efficient — and tightly correlated. Monero exists increasingly outside that system. With fewer algos, less leverage, and limited access to reflexive speculation, Monero’s price is influenced more by: Actual usage Holder conviction Intrinsic demand for private settlement That doesn’t make it exciting every day. It makes it structurally different. And markets eventually reward assets that don’t break the same way everything else does. A thought worth sitting with Most people believe delistings remove value. That belief feels obvious — until you watch an asset stop reacting to the same forces that destabilize everything else. Monero may not be underperforming because it lacks speculation. It may be outperforming because it no longer depends on it. In a market addicted to correlation, independence is not a bug. It’s the feature everyone overlooks — right up until it matters.

Bitcoin Price History Rhymes

As I look at the chart for BTCUSD on the Weekly timeframe with Ichimoku overlayed the similarities to the 2021-2022 cycle top are eerie. Let's break down what I mean: The key indicator of Ichimoku is price relative to the Kumo Cloud. A trend on the respective timeframe begins when price is above the cloud. I also use Chickou as momentum for confirmation. This means that the current Bull trend of Bitcoin began officially on the Weekly in November 2023. The inverse to this rule is when price and momentum are on the opposite side of the cloud. The last Bear trend of Bitcoin began officially on the Weekly in May 2022. So we can see how close Bitcoin is to true Bearish territory; getting below 80k and staying there for a prolonged time. The other eerie similarity is the double false breakouts or "Spikes." If you learn ONE price action indicator remember the false breakout! There is no more reliable signal of reversal than when price makes a new high/low and then CLOSES back inside the prior range. Once again this year as in 2021 there were two such signals weeks apart. It means that the market stopped buying at critical moments where breakouts should have occurred if price were to continue. These false breakouts are past being tradeable now but everyone should take note of just how frequent and reliable these instances are.

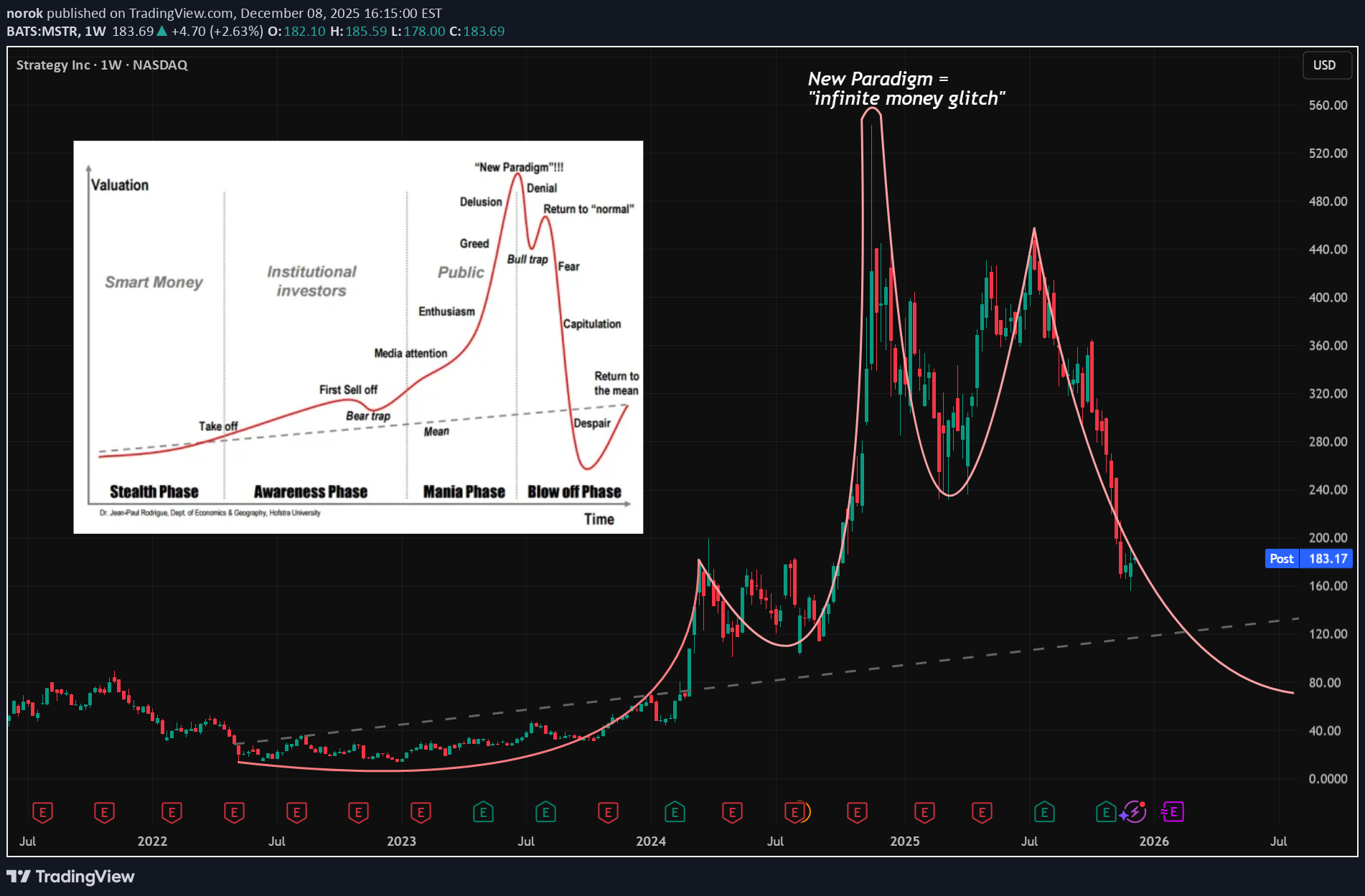

MSTR: Now I can't unsee it

Was on a Livestream Friday talking about my (now closed) short and migrated to the Monthly timeframe on $NASDAQ:MSTR. I've seen this pattern many times before and now I can't unsee it. Turns out there is nothing new under the sun... of finance. All the same patterns of human behavior repeat just with different narratives.

پیشبینی بلندمدت بیتکوین: پایان رالی گاوی و آغاز فاز خرسی تا ۲۰۲۶!

Always early, never in doubt I have already exited my Bitcoin related ( IBIT Puts) shorts and MSTR Puts. I felt confident I would be early as that that is my habit. There will undoubtably be a relief rally at some point that I may re-enter. My long term forecast is that the bull phase of the Halvening price cycle has ended and the bear phase has begun. Let's break down each price action component I am watching... First let's take a step back to learn why we got here. The false breakout or "Spike" as I call them are one of the most trustworthy signals that I trade. If you study one single element of price action it should be this. When price fails to close above a prior ATH (or below a major low) this is the highest probability of a reversal. Market psychology is on display that traders refused to continue the rally and now many are "trapped". This was the reason for the mass liquidations in October that started this bear trend. Many thought a breakout was in order but the confirmation failed. One day after the "Trump tweet" the Daily Ichimoku Cloud trend confirmed bearish. This is another indicator of Bitcoin's trend that has been useful for all of Bitcoin's history. It is also what we will evaluate later on the Weekly. At this point the most important level to watch is the 50% Retracement for the entire bull phase going back to November 2022 low. There are Volume Profile levels to watch but we assume that price will retest the 50% and evaluate what will happen in the Ichimoku Cloud trend context there. Back in April 2025, when price on the Weekly made a move to the Weekly Ichimoku Cloud, price never hit or got inside the cloud nor did Momentum have a reasonable chance of crossing into bearish. "This time it's different" because if price does test the 50% Retracement it will signal full bearish trend confirmation on the Weekly timeframe. During the last cycle, the bearish trend ended when the timing element of the Monthly Ichomoku cloud turned upwards. There is a similar timing element on the Monthly now in November 2026. My fundamental, market psychology based speculation is that the ETF buyers from January 2023 must have their patience tested. That price is around 43k. TL:DR; Price will trend bearish down to 43k with the bear phase ending around November 2026.

سقوط بزرگ مایکل بری در راه است؟ بستن پوزیشن شورت MSTR با طعم سود!

I started my MSTR short last November during the retail yeet. I really took a dislike to Saylor telling people to mortgage all they could to buy Bitcoin and then later to buy stock in his company. The history of finance is littered with con men saying and doing such things. History doesn't repeat but it rhymes. Now the stock sits on a key Support; the March 2024 high and the prime Volume Profile level of the run up. Its time to unwind the position in profit and see what happens next. MSTR hitting a Support coincides with BTCUSD also hitting a major Volume Profile Support. The Weekly Ichimoku chart remains bullish. A recovery pullback up could happen from here. Over the last year I've had to go through the cycle of being "right" and being "wrong" all the while being public in my position among Bitcoin Maxi friends. They enjoyed poking fun at me the whole way. Their arrogance and jabs did not change my mind, rather they gave me some confidence that I was properly contrarian. Hubris never pays off in investing. Every great trade I have made has begun (and lasted) in deep uncertainty. That is what it means to take risk. I still believe that the narrative of MSTR has yet to completely dissolve among the faithful but I have a habit of always taking profit "too early." Trade wisely. Stay convicted.

نوسان قیمت بیت کوین: رمزگشایی حرکت صعودی یا سقوط مجدد؟

There was a price spike on the 1 Hour BTCUSD that stalled the recovery off 100,300 Support. That sets up the bullish breakout and then on to test the ATH, again. Otherwise, price coming down to retest Support, again. The big Support is the 50% Retracement of the April low to recent All Time High.

مونرو (Monero): بهترین شرط غیرمتقارن کریپتو که نباید آن را معامله کرد!

"Your winners are never big enough." I don’t recall who said it first, but I credit legendary trader Peter Brandt for popularizing this maxim — the one that comforts every risk-conscious trader whose conviction proves right but whose position size was too small. A little over two years ago, I realized that Monero embodies the ethos Bitcoin once had: private, decentralized, uncensorable money free from government and corporate control. Bitcoin has since drifted from that ideal. It may function as a store of value today, but it has surrendered most of its role as a medium of exchange on the internet. Monero has quietly taken that mantle. Watching major Bitcoin thefts be traced and seized — because Bitcoin is, in fact, traceable — only reinforced my view: Monero’s value as true private money would keep growing as the market caught on. Since forming that conviction, I’ve seen two events that seemed to threaten Monero’s survival — yet ultimately proved its resilience. The first was Monero’s delisting from Binance, forced by European regulations banning privacy coins. The market panicked; XMR dropped 30% overnight. At first, I feared its code had been compromised. But the truth was simpler — and far more bullish. Monero was being recognized as working exactly as intended: too private for governments to track. The second came this year with an attempted 51% hashrate takeover. Confusion reigned, and even I questioned whether this was an existential threat. Yet I decided that if the world could no longer sustain private money, little else would matter. I held my conviction — and Monero endured. Through all of it, Monero has proven to be the pluckiest cryptocurrency alive — rising now amid one of the most skeptical phases of the current bull cycle. From a price-action standpoint, the weekly close above the prior $420 high (yes, that number) would confirm a breakout. But I don’t think it matters. As a trader, I’ve found Monero almost un-tradable — my usual methods simply don’t apply to XMR/USD. Its chart behaves unlike any other asset. That doesn’t frustrate me anymore. It fascinates me. The best move with Monero isn’t to trade it — it’s to own it. Monero remains the best asymmetric bet in crypto.

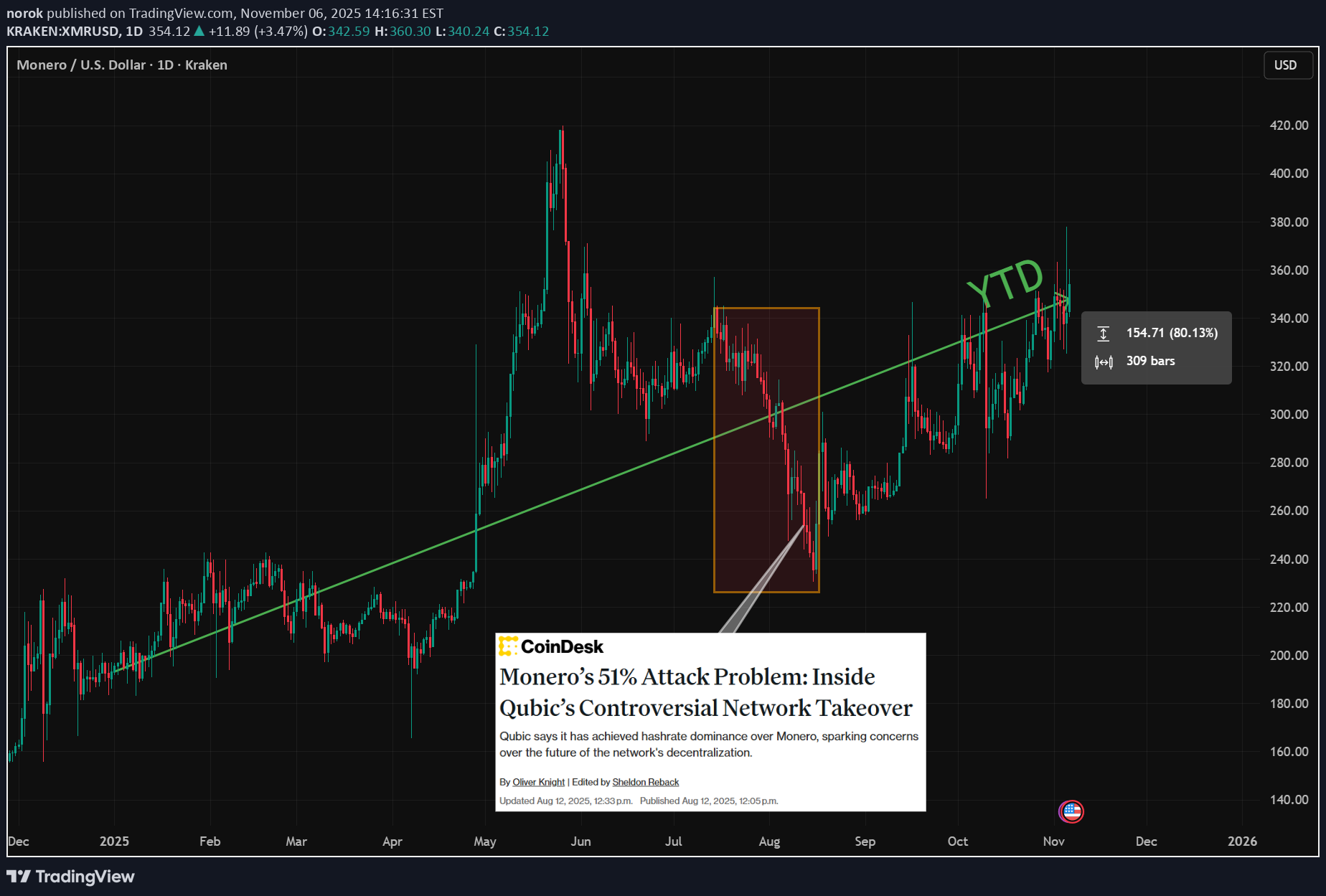

ترس و طمع در بازار: درس بزرگ من از هجمه FUD علیه مونرو

I have been doing this cryptocurrency trading and investing thing for a long time. Any wise trader is constantly learning and I that is what I try to do. But like any human subject vulnerable to mass emotion and hysteria sometimes we need a sharp reminder of how to properly digest or ignore what "everyone" is feeling. Because "everyone is the market and "everyone" (including myself) is the market. I have long been a proponent of Monero XMRUSD because it represents the true ethos of cryptocurrency; truly decentralized, untraceable by default, uncensorable, private money. Its actual usage online as a medium of exchange has remained strong and continues to expand unabated by exchange delistings and government sanctions. Its adoption has been slow, organic, and relentless since its inception over a decade ago. I believe it represents an asymmetric bet with limited downside and large potential upside. I will never bullpost claiming someone is going to make HUGE returns, but history has shown a compounding appreciation of value that is poised to continue. April 2025: Earlier in the year, there was a persistent rumor that a massive price surge was due to a hacker dumping a large quantity of Bitcoin who then proceeded to convert it without regard to exchange rate into Monero. Whether true or not, that was the "reason" framing the narrative as price rocketed from Monero's normal, relatively stable range to a significant breakout. Once this price action peaked, a new "news" cycle began to hit social media... August 2025: In August 2025, another project named Qubic sparked crypto market panic by claiming a 51% attack on Monero via its "Useful Proof of Work" mining pool, alleging temporary control of over 50% of the network’s hashrate, causing minor chain reorgs and drawing miners with triple-profit promises. Outlets like CoinDesk and Cointelegraph amplified the narrative with unverified reports, including CoinDesk’s August 18 tweet falsely stating Qubic had successfully "attacked" Monero. During this time, being the long term advocate for Monero that I am... I became concerned. I voraciously consumed all the information I could online via social media and blogs. I wanted to understand the threat so that I, as an investor, could act appropriately. I let the fear seep into me. I became scared. I was worried, as the market was, that Monero might actually be doomed to fail. By mid-August, independent analyses from RIAT and experts like Luke Parker debunked the claims as statistical impossibilities and marketing hype, with no double-spends or sustained control proven. One thing I did at the time was try to send a transaction on Monero for testing. It worked. The network was functional. Once the attack was exposed as a failure price resumed its normal albeit volatile and steady price appreciation. The best opportunity for an investor is when there is "blood in the streets." "Be greedy when others are fearful." But I spent my time trying to imbibe what I believed was useful information to inform my decision. So that when price hit $250, a support level and even a number cited by the leader of Qubic I added to my holdings but did not go full port YOLO long. Now in hindsight, my "error" was clear. It wasn't entirely wrong to be risk conscious as one should in any investment. But this event in an asset for which I had exceptional confidence taught me to take social media FUD with a massive grain of salt. I wonder if I had been better off NOT knowing and just following price action alone. One of the core enigmas of investing is that we have to stay informed, but we cannot be drawn into the emotion of the moment; that emotion is already reflected in price. "If you gaze long into an abyss, the abyss also gazes into you."

ترس بزرگ بیت کوین: آیا این پایینترین قیمت برای ریزش است؟ (تحلیل FUD)

BTCUSD has pulled back to the 50% Retracement of the April 2025 low to the October 2025 high at 100,300. This could be a Support to hold up the recent down move. Bitcoiners have requested the best FUD to affirm that this could be "the local bottom". Bottoms are made in fear so it seems they are trying to manifest as much as possible on social media to confirm this will be as low as it will go for now. The obvious narrative FUD would be something about how the bull phase of the Halvening price cycle ended precisesly when it was predicted to (at 36 months from the November 2022 bottom) and the bear cycle has begun. However, here I think are some even more scary FUDs for post-Halloween: The Compound Annual Growth Rate (CAGR) of Bitcoin for the last decade has been in decline. Bitcoin has been going higher and likely will continue to make higher highs and higher lows into the future BUT at a decreasing rate. Bitcoin's price is following a negative exponential curve. Bitcoin will probably make a higher high at some point in the future, this cycle or the next, but the returns to investors will be far less than have been seen in the past and continue to be even less over time. A more neutral look at future possibilities is to model historic volatility and project the most probable outcome. The 1 Standard Deviation range from today's price for the next 365 days is between 159,600 and 64,800. That means that there is a 68% probability that Bitcoin will trade within this range over the next year. The FUD is that the lower band matches the Volume Profile node from 2024's consolidation creating support in that zone. Trade wisely.One more element of FUD I forgot... Perhaps the narrative is not exchange liquidations nor old whales selling but that Bitcoin has become intrinsically correlated with risk assets and equities as it moves in lockstep with US markets at an increased volatility.Test #2 of the level... we'll see

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.