moonypto

@t_moonypto

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

moonypto

رکوردشکنی هولناک هک صرافیهای رمزارز: سالی که میلیاردها دلار ناپدید شد!

2025 The Year Crypto Exchanges Got Torn Apart The $36 million hack on Upbit has officially sealed 2025 as the worst year ever for exchange breaches. Eight platforms have already been compromised, and the total damage now sits at $1.69 billion, a brutal reminder of how fragile centralized custody still is and Funds are Not SAFU The Major 2025 Exchange Breaches Phemex — $85M (Jan 23) Bybit — $1.34B (Feb 21) Nobitex — $85M (Jun 18) BigONE — $27M (Jul 16) CoinDCX — $44.2M (Jul 19) WOOX — $14M (Jul 24) BtcTurk — $48M (Aug 14) Upbit — $36M (Nov 27) Each case involves different attack vectors, but the pattern is the same: inconsistent security practices, opaque systems, and weak operational discipline. Why This Keeps Happening? Exchanges love to market themselves as safe, regulated, user friendly platforms. But behind the glossy dashboards, a lot of them are running with: hidden key management systems, unclear wallet workflows, vague operational security practices, and incident response plans that only become visible after a meltdown. Good UI/UX is nice, but it’s worthless if the backend is a black box. The Core Problem: “Trust Us” Isn’t Good Enough With billions in user funds on the line, the industry can’t afford security theater anymore. If exchanges want to be taken seriously, they need to disclose far more about how they operate at least at a high level: key custody models wallet automation and approval flows internal SecOps policies team access controls how they respond when something goes wrong No sensitive details, just enough to prove they’re not running hedge-fund-level money on hobby-grade infrastructure. Self Custody Is the Ideal but Not the Reality Yes, crypto natives prefer self custody. It’s the safest option. But for most people, managing private keys is still confusing, stressful, and risky. The majority will continue using centralized exchanges whether we like it or not That’s why exchanges need to raise the bar, not just slap “secure” on their homepage. We’re past the point where marketing copy can cover technical debt. If Crypto Wants Mainstream Adoption, Security Must Become a Feature Not an afterthought. Not a checkbox. Not a press release gimmick Exchanges should treat security the way aerospace treats engineering paranoid, audited, verified, and hardened against every possible failure. Until then, we’ll keep seeing headlines like the ones that defined 2025 And users will keep paying the price

moonypto

خسارت یا نگهداری تا صفر؟ ۳ عامل کلیدی که آینده XRP را روشن میکنند!

The XRP Army moves fast, hits hard, and doesn’t blink at FUD! But can all that firepower actually turn into a Lambo or are they just revving their engines in the driveway ? Lets Check 3 Key Factors That Could Drive XRP Higher RLUSD Surpasses $1 Billion Market Cap Ripple’s stablecoin, RLUSD, is showing serious momentum, Launched on December 17, 2024, it has already surpassed a $1 billion market cap in under a year. This rapid growth highlights not only growing adoption but also market confidence in Ripple’s broader ecosystem For XRP holders, RLUSD’s rise signals a strengthening foundation that could support price growth in the months ahead. Institutions Are Starting to Take Notice Institutional interest in RLUSD is picking up Habibi ! Abu Dhabi has now opened its financial zone to licensed firms that want to use RLUSD, marking a major step toward mainstream adoption Even more significant is RLUSD’s new ability to be used as collateral in lending and borrowing activities. This positions it as a practical tool for financial institutions, which could increase demand for XRP as the network’s native token and liquidity driver XRP Is Holding Its Ground Despite a challenging market over the past two months, XRP has consistently remained above its key support line. While it briefly dipped below this level twice since October 10th, it bounced back both times, demonstrating resilience. Maintaining this support suggests that XRP could be ready for a significant move upward once market conditions align. Why This Matters Ser! For a long time, XRP had the potential, but the underlying fundamentals were not immediately obvious. With the launch and growth of RLUSD, those fundamentals are becoming clearer. Institutional adoption, a strong stablecoin ecosystem, and consistent price support together create an environment where XRP is well-positioned for a potential breakout Investors should keep an eye on these developments, as the combination of adoption and market strength could make XRP an interesting opportunity in the coming months XRP could rally strongly if BTC returns to its all time high and shows some strength

moonypto

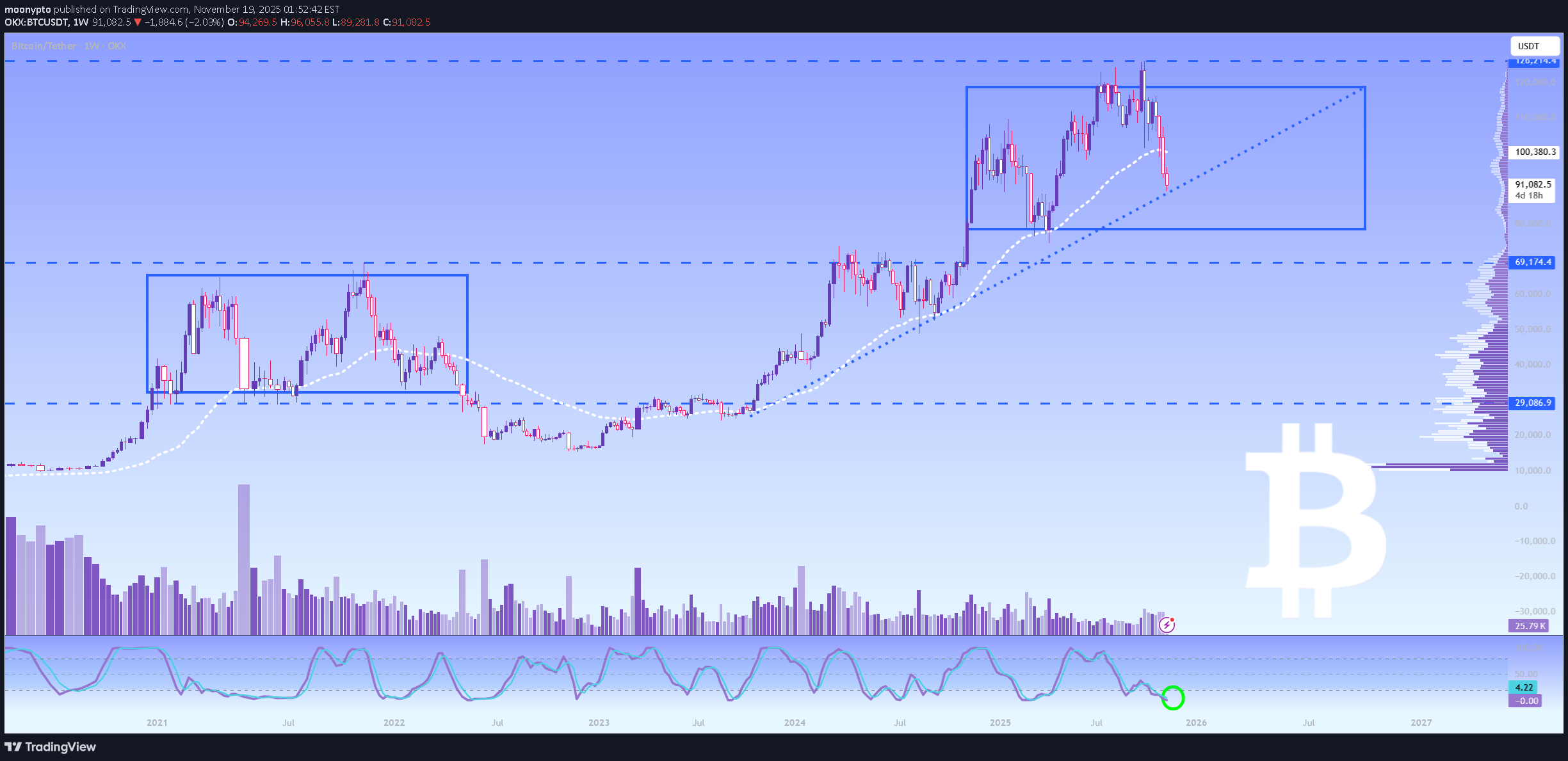

اصلاح یا خرس: نشانههای حیاتی بیت کوین در کف قیمت!

Wen chaos swallowed the horizon and hope thinned to a whisper, the MoonMaster returned Wall Street’s sharks carved through the weak, painting the crypto ocean in blood, believing the tide belonged to them, But they forgot the oldest law of War : “In the darkest waters, the unseen Whales decides the battle” So step aside , let me show you the move that decides what happens next.. Hitting rock bottom kinda sucks in the moment, but the cool part is there’s literally nowhere to go but up. That’s where I think crypto is right now. In under two months the Fear & Greed Index went from “BTC to 1M $” greed straight into the Extreme Fear “Ponzi goes to 0 $” We haven’t seen it this low since the Terra/Luna mess dragged everything down in 2022!(good old days) It’s not a fun place to be, I get it.. But that old silver lining thing still applies: once you’re scraping the bottom, the only direction left is up.. Doesn’t mean we instantly flip to Moonboy mode,history says we rarely stay in Extreme Fear for more than a month. We’ve been parked here since November 10, so if the past is any guide, we should climb out sometime in the next couple three weeks. Yeah, we’ll probably just go from “Extreme Fear” to regular old “Fear.” Not exactly party time. It doesn’t scream “new all-time highs tomorrow.” Fair. But a lousy mood in the market doesn’t rule out decent strength over the next few months. Think back to 2021 that insane bull run where you could basically throw a dart at the token list and make money. What people forget is we spent May, June, and half of July bouncing between Fear and Extreme Fear… and then Bitcoin still went on to double in like three or four months and hit brand new highs. Point is: this stretch feels awful, and we might have more short-term pain (another dip, more sideways chop, whatever) But sentiment is basically as low as it gets, so we can’t really sink much further on that front. History gives us two useful nuggets: We’re probably out of Extreme Fear in 2-3 weeks. Crappy sentiment right now doesn’t kill the chance of new highs in the medium term.. That’s why Coinglass colors Extreme Fear green and Extreme Greed red. Old Warren Buffett line still works: be fearful when others are greedy and greedy when others are fearful. On a similar “this looks ugly but isn’t automatically the end” note Bitcoin closed below its 50-week moving average this past Sunday. Weekly closes under the 50 week SMA aren’t what you want to see. Do it a few times in a row and it can get ugly, But it’s not a guaranteed death sentence. Sometimes it’s the start of a bear market, sometimes it’s just a speed bump before new highs.. 2020: spent two months below it, then Bitcoin went up 16x 2021: closed below it, then ripped to fresh all time highs Early 2022: closed below it… and yeah, that one did mark the top The big difference? 2020 and 2021 had oceans of new money flooding into the system from all the stimulus. People had cash burning holes in their pockets, and a chunk of it found its way into crypto. So we’re treating this 50 week close the same way we’re treating the sentiment bottom: not great, but not fatal, and history says new highs are still very possible in the medium term. Why are we even here, though? The “reasons” feel kinda weak compared to past blow-ups. Trump floated 100% tariffs on China market freaked for a minute, then he walked it back pretty fast. We’ve seen that movie before and usually shrug it off. Government shutdown fears? Sure, but shutdowns don’t have a super consistent track record of tanking risk assets. Sometimes yes, sometimes no.. So what’s actually moving the needle? Probably a combo of things, with the main one being institutional outflows plus way too much leverage in the system. Crypto loves leverage some platforms still let you trade 100x! Put up $1k and you control $100k. Price moves 1% in your favor and you double your money. Moves 1% against you and you’re wiped out, your position gets forcibly closed, and that creates a cascade of buying or selling depending on which way people were leaning. That’s why small price moves lately have felt like a chainsaw massacre.. One bright spot in all the bleeding: the miners. You’d expect miners to be panic-selling everything they dig up, but the data actually looks pretty calm and strategic. Wen price was flying from Oct... well, from October 10 to late October, miners were net buyers adding 800+ BTC a day on average. Once we rolled over in early November, they flipped to net selling (about 830 BTC a day for a week or so), which makes sense they’ve got bills to pay and electricity isn’t free But here’s the encouraging part: over the last 30 days they’ve sold on only 11 days and bought on 19. Total sold vs. total accumulated is basically break-even (6,048 sold, 6,467 bought). The heaviest selling day was November 6 when price was still more than $102k locking in fat profits And the last seven days? They’ve been net buyers again, adding 777 BTC even though price is 12-13% lower than a month ago. Their 30 day net position is back in positive territory. Translation: the weak hand miners who had to sell already did. The selling pressure from that crowd looks mostly done, and they’re starting to accumulate again at these levels. Wait MoonMaster, why are some of them selling? They’re switching to AI.. When miners flip from distribution back to accumulation near lows, it’s usually one of the earlier signs that the worst of the supply overhang is behind us. So yeah, the chart looks rough, sentiment is in the gutter, and we’re probably not out of the woods yet. But almost every signal that actually matters for the next few months,sentiment extreme, miners cleaning house and turning buyers, historical precedent after these setups is flashing the same message: This is the part where it hurts, but it’s also the part where the next leg up gets set up.. Why is BlackRock selling? They loaded at 16K–20K, so taking profits now is the smart move, they never chase dreams. But then why is Tom Lee loading ETH? He’s always thinking long-term, betting on the future. ETH is AI money, so if you’re not trading with 100x leverage in 10 seconds, having a longnterm vision makes perfect sense.. Wen Michael Burry leaves the game, Peter Thiel dumps NVDA, and Buffett loading GOOG, you need to be careful, In this phase of the bull market, you can lose all your easy profit.BTC got a boost after dovish Fed comments pushed December rate-cut odds to 75%, giving the market some relief. Price action is still bearish after a 30%+ drop, but derivatives show mixed sentiment: traders remain defensive yet still hold heavy year-end Call exposure at major strikes. Max Pain sits at 104k, and record-high options OI makes it more meaningful. Perp markets have reset with negative funding, reducing the risk of another wipeout. Thanksgiving week will reveal whether Friday’s rebound holds, with focus on US-session selling pressure and whether ETF flows start to flip positive. Key data this week: PPI, Retail Sales, Jobless Claims, and Core PCE.Bitcoin is stabilising in the high $80Ks as broader risk sentiment improves, not because of crypto-specific catalysts. Markets now see an 85% chance of a December rate cut, but macro signals remain mixed inflation is still sticky while labour data continues to soften. AI driven momentum is cooling, with widening credit spreads and rising Nvidia inventories raising doubts about the sustainability of AI capex. At the same time, crypto ETFs are seeing persistent outflows, and MicroStrategy faces renewed scrutiny as its stock appears on MSCI’s delisting watchlist. Options markets show cautious positioning: demand for downside protection stays firm, implied volatility is slipping, and BTC’s correlation with AI equities is climbing. For now, rallies toward the mid-$90Ks are likely capped by ETF-related supply, while $80K–$82K remains a key support zone. Overall, crypto continues to trade as a barometer of broader market risk appetite.

moonypto

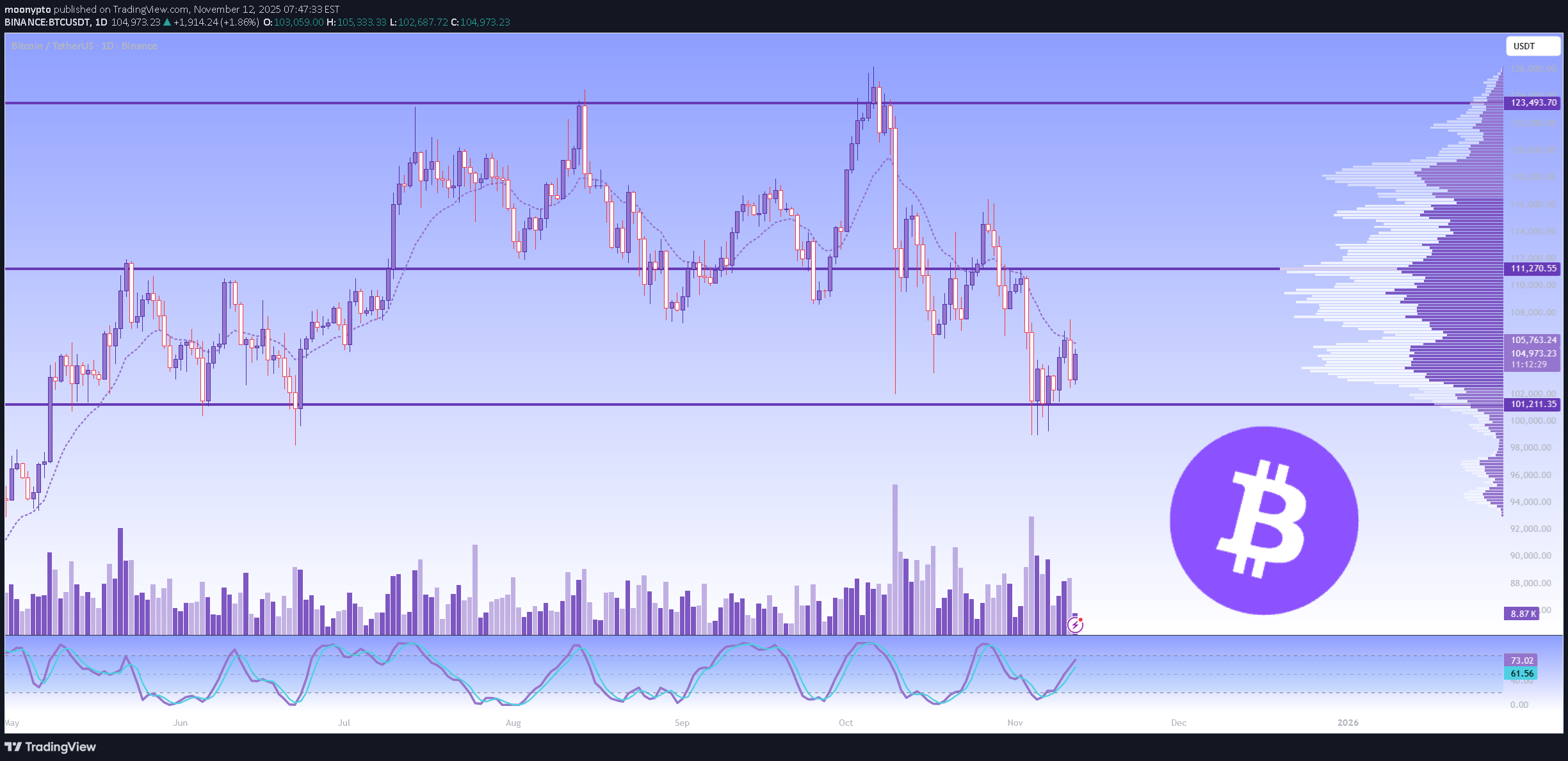

BTC | Bitcoin : Buy, Hodl or Rekt?

Bitcoin's been riding the same wave as the overall risk mood driven by headlines. It dipped during the US trading hours but settled around 103k once Asia kicked in. The government shutdown is still dragging on, but there's a clearer path to ending it now. Yesterday's ADP report flipped the script, bringing back talk of a softening job market right before the December FOMC meeting on the 9th and 10th. That's tricky timing, especially with no word on when the official BLS numbers will drop The Senate passed a short term funding bill that keeps things going until January 30. It's heading to the House next, and if it clears there, it'll go to the president to sign. This buys some time and avoids a mess over the holidays, but it just pushes the next fight into early next year. Classic kick the can move it clears the immediate danger but doesn't fix the bigger problems. Markets will be watching closely for any hiccups or delays in the House vote. Polymarket's got a 96% chance that the shutdown wraps up between November 12 and 15 ! Data and Market Tone With government data on hold, we're leaning hard on private reports. The NFIB small business survey showed sentiment dipping a bit. Companies say day-to-day operations are steady, but they're worried about slower sales ahead, tighter margins, and trouble finding workers. That lines up with the weak ADP numbers and keeps the Fed in this "easing but careful" mode. As soon as the government gets back online, we'll probably see a bunch of delayed official data that could back up this cooling trend. We've got shutdown drama, trade tariff worries, some choppiness in credit markets, and softer economic reads all pointing to a bumpy ride through the end of the year. Still, possible rate cuts from the Fed and solid company earnings should keep things buoyant for risk assets and Bitcoin heading into the new year. Into 2026, the setup looks pretty supportive with both easier money policy and government spending acting as tailwinds for growth.. what you gonna do ? buyin Lmabo or waitin for Moon ?Strategy has acquired 8,178 BTC for ~$835.6 million at ~$102,171 per bitcoin and has achieved BTC Yield of 27.8% YTD 2025. As of 11/16/2025, Strategy hodl 649,870 BTC acquired for ~$48.37 billion at ~$74,433 per bitcoin.

moonypto

روبینهود در یک سال: رشد درآمد 100% و سود سه برابری! راز شگفتی سومین فصل چیست؟

How Robinhood Doubled Revenue and Tripled Earnings in One Year What’s up? Hope you didn’t lose too much sleep over that market massacre, I just dug into Robinhood's Q3 2025 earnings, and man o man, it's one of those reports that makes you sit up and pay attention. The numbers are strong across the board, and it feels like the company is finally hitting its stride after years of building out the platform. Let me walk you through the highlights and what they actually mean The Big Picture Robinhood pulled in $1.27 billion in net revenue, beating estimates by about $60 million and doubling what they did this time last year. Even better, GAAP earnings per share came in at $0.61 way above the $0.54 analysts expected and more than triple the year-ago figure. That's not just growth; that's acceleration Where the Money's Coming From? Transaction revenue remains the engine, up 129% to $730 million. Options led the charge at $304 million (up 50%), equities surged 132% to $86 million, but crypto while still up over 300% year over year to $268 million actually missed estimates by about $19 million. That's the one soft spot in an otherwise green report. Net interest revenue jumped 66% to $456 million, showing how much they're benefiting from higher rates and growing cash balances. "Other revenue" doubled to $88 million, likely tied to the rapid growth in Robinhood Gold subscribers, which I'll get to in a sec Customer Growth and Engagement They're now at 26.8 million funded customers (up 10%) and 27.9 million investment accounts (up 11%). Total assets on the platform hit $333 billion more than double last year. Net deposits were $20.4 billion in the quarter, putting them on pace for $68.3 billion over the trailing twelve months. The real standout? Robinhood Gold subscribers grew 77% to 3.9 million. That's premium users paying for better rates, instant deposits, and pro tools. ARPU (revenue per user) climbed 82% to $191, which tells you they're not just adding bodies they're adding profitable ones Costs & Capital Operating expenses rose 31% to $639 million, but adjusted EBITDA still exploded 177% to $742 million. Net income? $556 million, up 271%. They've got $4.3 billion in cash and bought back $107 million in shares this quarter ($810 million over the past year). Solid capital return without looking desperate. Early Look at October Management teased some preliminary October numbers, and they're eye-popping: record monthly volumes across equities, options, and even prediction markets/futures. Margin balances topped $16 billion (up 150%+), equity notional volumes around $320 billion (also up 150%+), and options contracts over 260 million (up 60%+). Crypto volumes hit $32 billion, with Bitstamp contributing more than the app itself nice validation of that acquisition. Leadership Note CFO Jason Warnick is transitioning out, with Shiv Verma stepping in. Smooth handoffs matter, especially when the numbers are this good. This wasn't just a beat and raise quarter, it was a statement. Robinhood's turning into a full stack financial platform, not just the "meme stock app" from 2021. Crypto dipped a bit relative to expectations, but everything else from options trading to Gold subscriptions to interest income is firing on all cylinders. October's early read suggests the momentum hasn't slowed. If they keep shipping products at this pace (and Vlad says they won't slow down), the growth runway still looks long. Definitely one to watch..

moonypto

پیروزی بزرگ آمازون: سوددهی سرمایهگذاریهای عظیم هوش مصنوعی با قرارداد OpenAI

Amazon’s latest earnings report gave investors exactly what they wanted: proof that its massive AI bets are starting to pay off. The highlight was a new seven year, $38 billion deal with OpenAI, which cements AWS’s position as a top tier provider of AI infrastructure and marks a major win after Microsoft’s Azure lost its exclusivity on OpenAI workloads AWS: Back in the Driver’s Seat Amazon Web Services grew 20% year over year to $33 billion, its fastest rate in nearly three years. The growth reflects strong demand for AI training and inference workloads, along with improved chip design and data center capacity. While AWS still trails Azure and Google Cloud in percentage growth, it leads by a wide margin in absolute revenue showing that AWS remains the backbone of the cloud market. CEO Andy Jassy’s confidence was clear when he said Amazon plans to “keep investing aggressively” as long as demand justifies it. Core Retail Stays Steady Outside of AWS, Amazon’s retail business held firm. Online sales climbed 10%, and international revenue rose 14%, suggesting that consumers continue to value convenience and Prime benefits even amid inflation pressures. Third-party seller services and advertising both higher-margin segments kept driving profitability. Ad revenue jumped 24% to $17.7 billion, outpacing key rivals and strengthening Amazon’s growing role in connected TV and digital marketing. Spending Heavily, but Strategically The one downside in the report was free cash flow, which fell sharply as capital expenditures soared to $116 billion on a trailing twelve-month basis. Most of that is going into data centers and AI infrastructure to support future growth. It’s a bold bet: Amazon is effectively trading near-term cash flow for long-term dominance in cloud and AI computing. Margins Hold Firm Despite heavy investment, operating margins remained stable at around 10%, supported by the higher-margin ad business and operational efficiencies in retail. Adjusted for one-time costs, operating income would have been even stronger. For the next quarter, Amazon expects revenue between $206 and $213 billion and operating income up to $26 billion steady guidance that reflects confidence without overpromising. The OpenAI deal could be the beginning of a broader wave of enterprise AI partnerships that lean on AWS’s scale Amazon has managed to turn skepticism about its slowing cloud growth into renewed optimism. Between the OpenAI partnership, accelerating AWS momentum, and consistent retail performance, the company appears well positioned for the next phase of AI driven expansion. The heavy capital spending may pressure cash flow now, but it signals a company preparing not just to participate in the AI era but to help define it..

moonypto

بیت کوین در آبهای ترس: تعطیلی دولت، گزارشهای اقتصادی و طلا پیشبینی نوامبر!

I smell fear and blood in the market this month. The kind of tension that makes weak hands tremble and sharp minds wake up early.. The gov’s playin chicken with the economy, inflation data’s hanging by a thread, and traders are trying to convince themselves the Fed still has their back. It’s the perfect setup chaos dressed as opportunity. November isn’t about playing safe; it’s about reading the fear, finding the cracks, and taking what others are too nervous to touch.. Macro Outlook 🌎 The month’s economic calendar is packed though how much actually happens depends on whether the government shutdown ends soon. Several key reports, like the Consumer Price Index (CPI), Producer Price Index (PPI), and Personal Consumption Expenditures (PCE), could be delayed. These data points are essential for gauging inflation and guiding Federal Reserve decisions. Other scheduled releases include the ISM Manufacturing PMI, ADP Nonfarm Payrolls, and Michigan Consumer Sentiment, all of which offer insight into economic activity and confidence. The FOMC minutes will also shed light on the Fed’s most recent discussions If the shutdown continues and these reports are postponed, it may weaken the case for a December rate cut something investors had been hoping might give markets a lift.. Government Developments 🏛️ The government shutdown remains a key source of uncertainty. Markets don’t tend to like surprises, and a sudden resolution or further standoff could both jolt prices. Prediction markets currently suggest the shutdown could last until early December, which doesn’t inspire much optimism for November. Until then, traders will be navigating a mix of speculation, shifting sentiment, and thinner data releases than usual. Corporate Earnings 💰 Roughly 20% of S&P 500 companies are reporting earnings this week, spanning a range of sectors. Crypto: Robinhood, Hut 8 AI: Palantir, AMD, ARM Consumer & “animal spirits”: DraftKings, Beyond Meat The market will be watching how these companies perform amid broader uncertainty. Strong reports particularly from AI and crypto-linked firms could serve as short-term confidence boosts. Crypto & Charts 📈 November has historically been a strong month for Bitcoin, averaging about a 40% gain. If that pattern holds, Bitcoin could reach around $150k by month’s end, breaking an eight year trend line and flipping a key resistance level into support. BTC 100K level is super important and if bulls lose that line then you must be ready for new patterns or bear market..yup! Ideally, altcoins would rally alongside Bitcoin, signaling a true “alt season” For that to happen, Bitcoin’s market dominance (BTC.D) would likely need to fall, showing that capital is rotating into the broader crypto market. Ethereum could play a big role here. There’s significant potential for forced buying if prices hit certain liquidation levels above the current range. That could push ETH higher and further drag BTC.D down though this remains a “wait and see” setup. This month’s outlook is a mix of promise and uncertainty. Macroeconomic data may be disrupted, the government shutdown lingers, and markets are trying to read between the lines of what’s missing. Still, corporate earnings and crypto trends could offer some upside surprises. For now, stay alert, track the key dates, and as the saying goes make your offerings to the market GodsBitcoin led a broad market pullback overnight, dropping to test the crucial $100,000 support mark. The decline was driven by a stronger dollar and ongoing uncertainty around Federal Reserve policy, both of which dampened risk appetite across various asset classes. This broader macro pressure had a direct impact on cryptocurrency, as U.S. spot Bitcoin ETFs saw consistent outflows of around $1.3 billion over four consecutive sessions. What had been one of 2025’s most reliable market tailwinds quickly turned into a short-term headwind. The weaker demand for spot Bitcoin collided with forced deleveraging, leading to more than $1 billion in long liquidations at the lows. This pushed prices below intraday support levels before buyers stepped in. Options positioning also contributed to the volatility, as dealers holding short positions around the $100k strike prices increased their hedging activity, which intensified the market’s moves. Now, the $100,000 level has become a critical psychological barrier. If ETF flows stabilize, sentiment could quickly shift, unless there’s another major macroeconomic shock. Macro Outlook Remains Positive, but Uncertain The overall macroeconomic outlook remains positive, though clouded by the ongoing government shutdown in Washington. With official payroll data for October delayed, markets are leaning on private-sector indicators to gauge economic momentum. The most recent data showed mixed results: Q2 GDP growth was revised up to 3.8%, while payroll growth slowed to an average of around 29,000 jobs per month, suggesting solid productivity gains. The latest Q3 GDP estimate came in at 4.0% SAAR, bolstered by steady ISM and consumer spending data. This week’s high-frequency data points, including Redbook, ISM, ADP, Challenger, and jobless claims (which are near 218k), should confirm that the economy is expanding at a modest but positive pace. Dollar Strength Driven by Policy Uncertainty Policy direction remains unclear, especially after the Federal Reserve’s 25 basis point rate cut in October, which came with some unusual dissents and a cautious tone. This has tempered expectations of another rate cut in December, with markets now pricing in around 60-65% odds of a follow-up move. However, the longer the policy blackout continues, the more comfortable policymakers may become with holding off on further cuts, which would likely keep the dollar strong and credit conditions tight. For Bitcoin to break higher, we’ll probably need to see a reversal in ETF outflows and renewed confidence in riskier assets.

moonypto

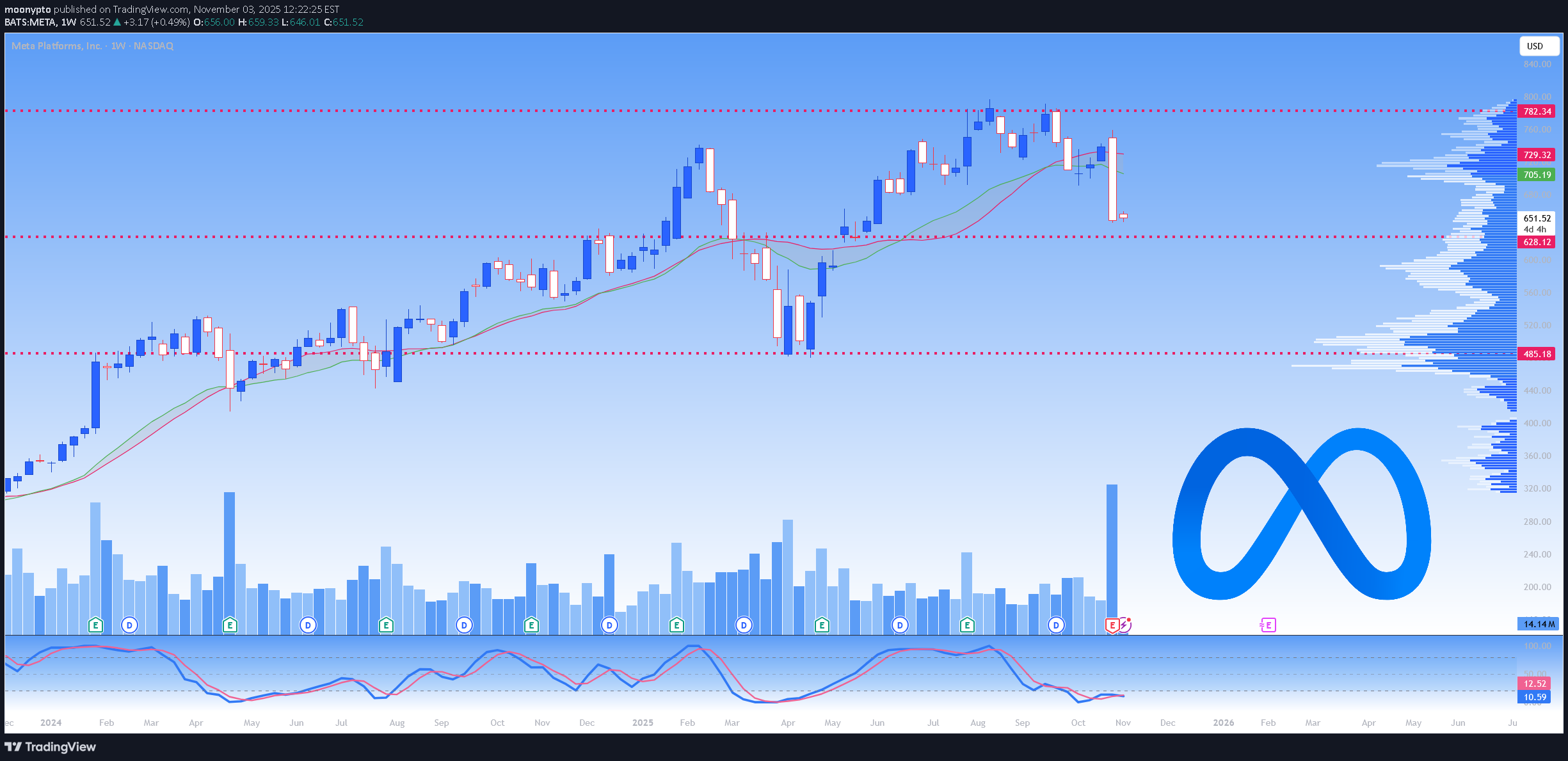

سود مِتا نجومی شد، اما سرمایهگذاران نگرانند: معمای هزینههای عظیم هوش مصنوعی مارک زاکربرگ

Meta’s third quarter results were a study in contrast stellar growth paired with renewed investor skepticism. Revenue jumped 26% year over year to $51.2 billion, far surpassing expectations. Excluding a one time $15.9 billion tax charge tied to a new U.S. tax rule, earnings per share would have landed at $7.25, well above forecasts. Advertising remained the engine of growth, with ad impressions climbing 14% and prices up 10%. Daily users across Meta’s apps reached 3.54 billion, up 8% from last year a sign that the company’s core business is still thriving. Yet investors weren’t celebrating. The concern wasn’t about performance, but spending. Meta slightly raised its 2025 capital expenditure outlook to $70–$72 billion, but what caught attention was the warning that 2026 spending will be “notably larger.” Total expenses are also expected to grow at a “significantly faster” rate. CEO Mark Zuckerberg made it clear he’s betting heavily on AI, describing plans to “aggressively” build out infrastructure aimed at reaching Superintelligence. This ambitious spending spooked the market. Despite strong Q4 revenue guidance of up to $59 billion, shares fell as investors weighed the risks of massive, open-ended AI investments. The moment recalls Meta’s earlier pivot to the Metaverse another costly bet that initially rattled confidence but eventually paid off through disciplined execution. In short, Meta’s Q3 results reaffirm its dominance in digital advertising and its capacity for reinvention. But the company is again asking investors for patience while it spends heavily on the future. Whether this AI push delivers long term rewards will depend on whether history repeats itself for better or for worse

moonypto

پایان محکم اپل در 2025 و پیشبینی جهش بزرگ خدمات و آیفون!

Apple’s fiscal fourth quarter of 2025 showed solid momentum, even with a few mixed details Revenue climbed 8% year over year to $102.5 billion, edging past expectations, while earnings per share came in at $1.85 also ahead of estimates. The main driver was Apple’s record breaking Services segment, which continues to strengthen the company’s profit margins and provide stability beyond hardware sales iPhone revenue rose 6% to $49 billion but fell slightly short of forecasts. Apple explained that some sales had been pulled forward into the prior quarter and that supply constraints on the new iPhone 17 limited availability despite strong demand. Mac sales, on the other hand, jumped 13% to $8.7 billion, showing that Apple’s computing lineup is gaining traction. Services stood out again with 15% growth to $28.8 billion, beating expectations by more than $600 million and pushing annual Services revenue past $100 billion for the first time a major milestone for the company’s recurring revenue strategy Even with a $1.1 billion tariff impact, gross margin ticked up to 47%, reflecting the favorable mix of higher-margin services. Regionally, China slipped 4% from last year, but other markets hit record highs, offsetting the weakness. What really caught attention, though, was Apple’s bullish guidance for the upcoming first quarter. Management expects 10%–12% year over year revenue growth, with iPhone sales returning to double-digit gains and China projected to bounce back Tariff costs are expected to rise to $1.4 billion, but Apple appears confident that strong demand and its heavy R&D push in AI and “Apple Intelligence” will more than compensate! In short, Apple’s September quarter was steady rather than spectacular, but the outlook for Q1 paints a very different picture. The company’s guidance points to renewed growth, continued strength in Services, and strong consumer interest in its new product cycle all signs that Apple’s momentum is far from slowing down. the chart looks, candles get ready for a pullback too

moonypto

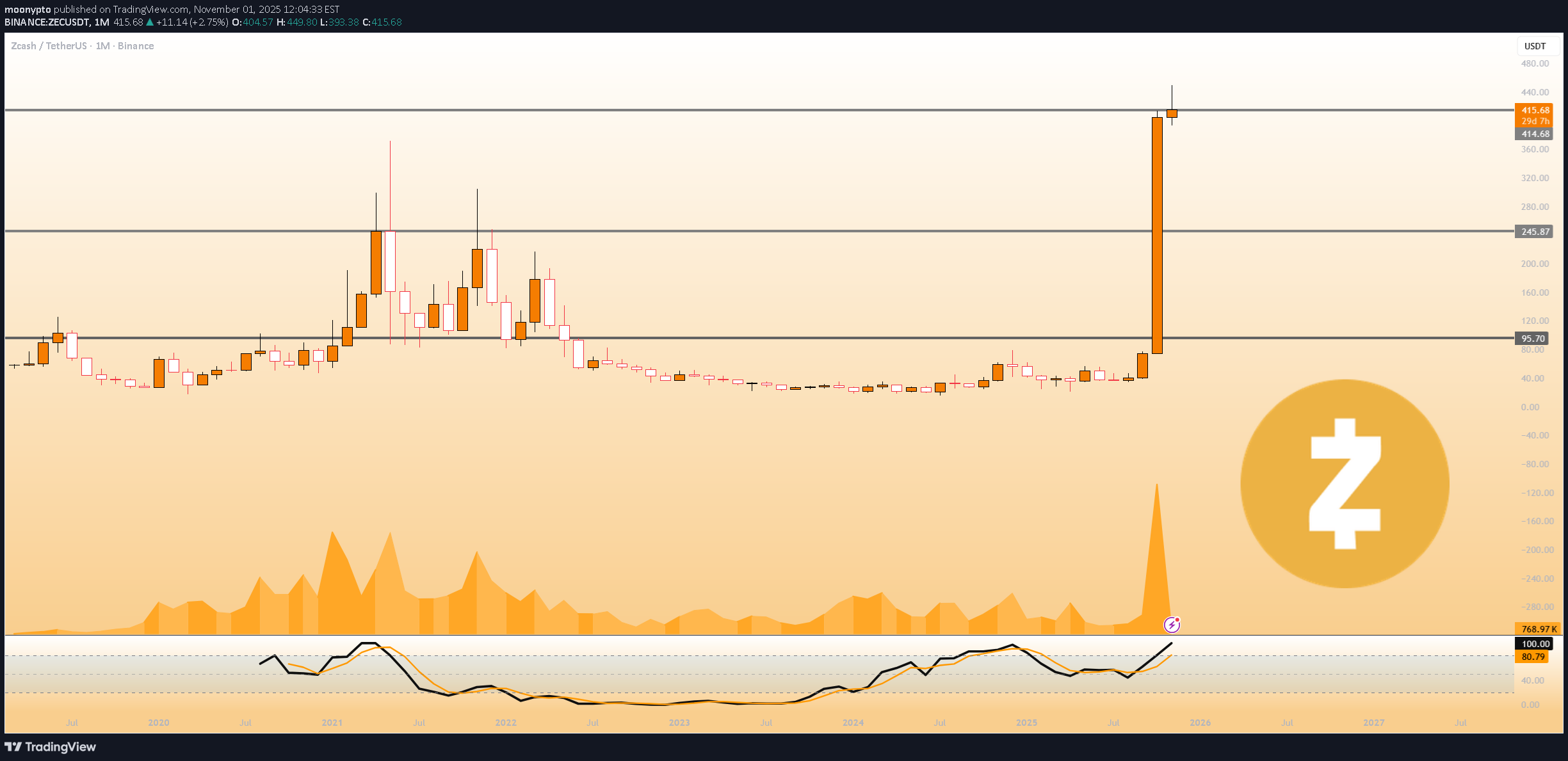

زِکش (Zcash): پادشاه جدید حریم خصوصی با رشد ۵۰۰ درصدی؛ راز جهش بزرگ چیست؟

Grayscale’s Zcash Trust Draws Attention as ZEC Jumps 500% Before Halving Grayscale’s Zcash Trust is back in focus after Zcash pumped more than 500% since early October. The privacy focused cryptocurrency has climbed to about $410, driven by growing interest in digital assets that emphasize transaction confidentiality. Grayscale is still the only US listed fund giving investors direct exposure to ZEC. It currently manages $155 million in assets, and its shares trade over the counter, allowing investors to access Zcash through regular brokerage accounts without holding the coin themselves. Launched in 2017 and listed publicly in 2021, the Grayscale Zcash Trust was designed to make it easier for institutions to invest in ZEC. Each share represents about 0.0818 ZEC and carries a 2.5% annual fee. The technology behind Zcash is a big part of what’s driving renewed institutional interest. Its zero knowledge proof system, known as zk SNARKs, allows for shielded transactions that hide the sender, recipient, and amount. The network’s shielded pool now holds around 4.9 million ZEC about 30% of total supply strengthening privacy across the blockchain. Investor enthusiasm for ZEC grew after Silicon Valley investor Naval Ravikant called it “insurance against Bitcoin,” a comment that helped fuel a rally pushing ZEC past Monero (XMR) in market value. BitMEX co-founder Arthur Hayes added to the optimism, suggesting ZEC could eventually hit $10,000 and describing its recent momentum as “unstoppable.” Meanwhile, institutional investors appear to be expanding their focus beyond Bitcoin. With BlackRock dominating Bitcoin ETF inflows, many investors are exploring alternatives. ZEC is gaining traction alongside proposed ETFs for Solana and Litecoin, giving asset managers new options for portfolio diversification. Zcash’s next halving, set for November, will cut block rewards by half, following the same scarcity model as Bitcoin. The timing coincides with increased global scrutiny of privacy technologies. The U.S. Treasury recently sought public feedback on privacy tools, and the EU continues to debate its “chat control” legislation Now worth around $6.9 billion, Zcash’s comeback stands out as one of the most significant developments in the privacy focused crypto space this year. If this trend continues, Zcash’s surge may signal a new phase for privacy coins, one that balances financial confidentiality with accountability in an increasingly regulated environment.BitMEX co-founder Arthur Hayes posted that Zcash has become the second-largest crypto asset in his family office Maelstrom’s portfolio, behind only Bitcoin. Driven by the privacy-trading narrative, ZEC has recently surged to around $750, marking its highest level since 2018. Hayes wrote: "Due to the rapid ascent in price, ZEC is now the 2nd largest liquid holding in the Maelstrom portfolio."

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.