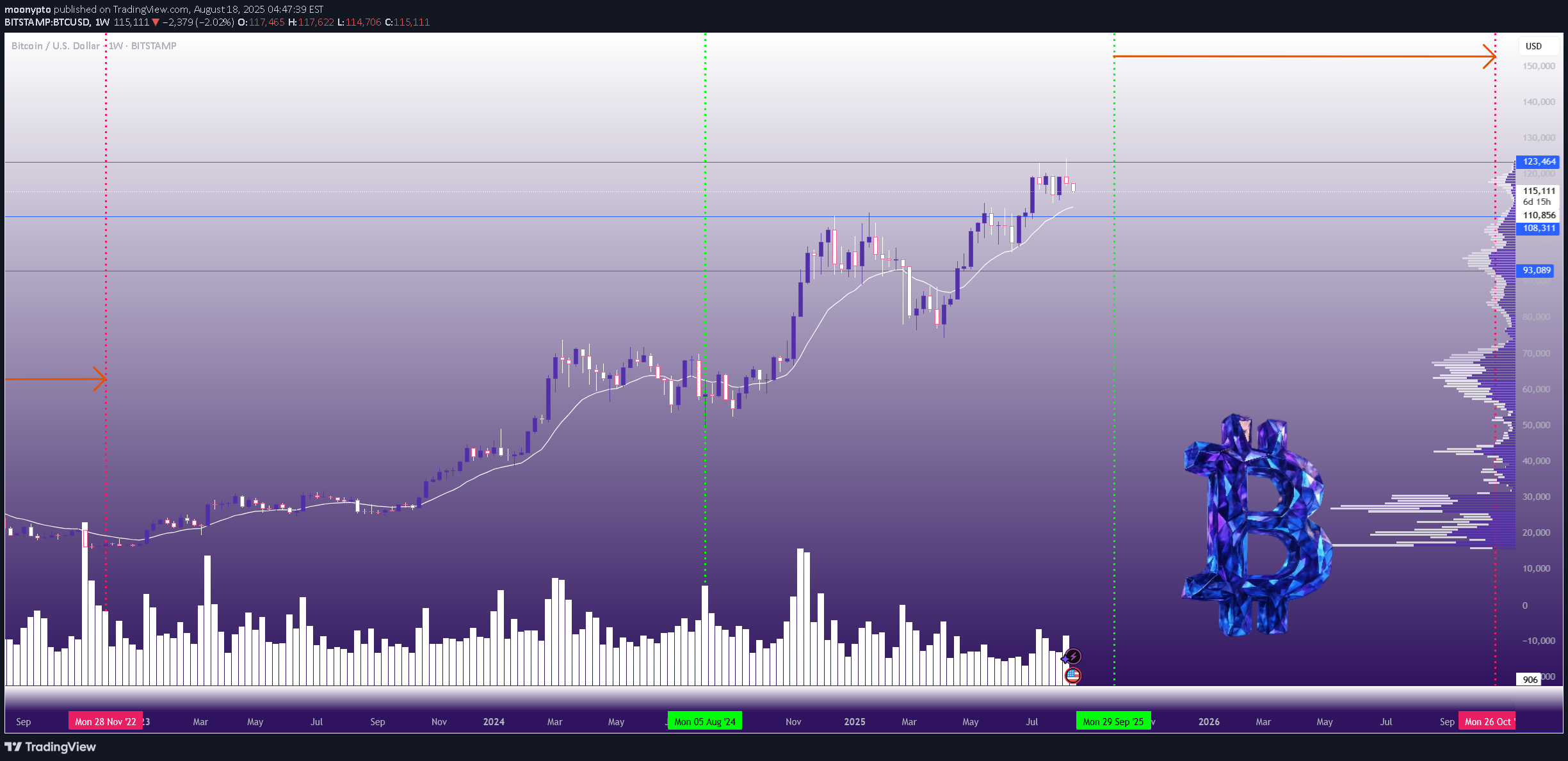

Technical analysis by moonypto about Symbol BTC on 8/18/2025

moonypto

Crypto markets saw a sharp selloff overnight, with more than $440M in long positions wiped out as Bitcoin fell from $118K to $115K and Ethereum slipped from $4,500 to $4,300. The drop adds to last week’s drawdown, when BTC lost about 5% from record highs amid $1B+ in liquidations across DeFi lending and heavy profit taking. The move, while sudden during Asian trading hours, wasn’t entirely unexpected. Funding rates had already signaled stress: BTC perpetuals across exchanges had been drifting lower since Friday. On Deribit, funding flipped from over 20% last week to negative by Saturday, echoing a similar setup seen on August 1 before BTC slid from $118K to $112K. With Jackson Hole coming up Thursday, some traders see this flush as pre event de risking. Spot remains mid range, leaving room for more profit-taking before Powell’s speech. Options markets are tilted bearish, with risk reversals favoring puts. Still, not everyone is backing away. Tokyo listed Metaplanet added 775 BTC over the weekend, showing corporate buyers remain comfortable at current levels. Implied volatility is subdued, suggesting markets expect range-bound action buyers likely emerge near $112K while supply caps rallies around $120K, at least until Powell speaks Friday. Adding to the uncertainty, hotter-than-expected PPI data (0.9% MoM vs. 0.2% forecast) has muddied the Fed’s policy outlook.so far as you see on chart we have healthy correction Last year Powell used Jackson Hole to signal easing; this time, tariffs and political pressure create a far trickier backdrop heading into September’s meeting.