w.savage11

@t_w.savage11

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

w.savage11

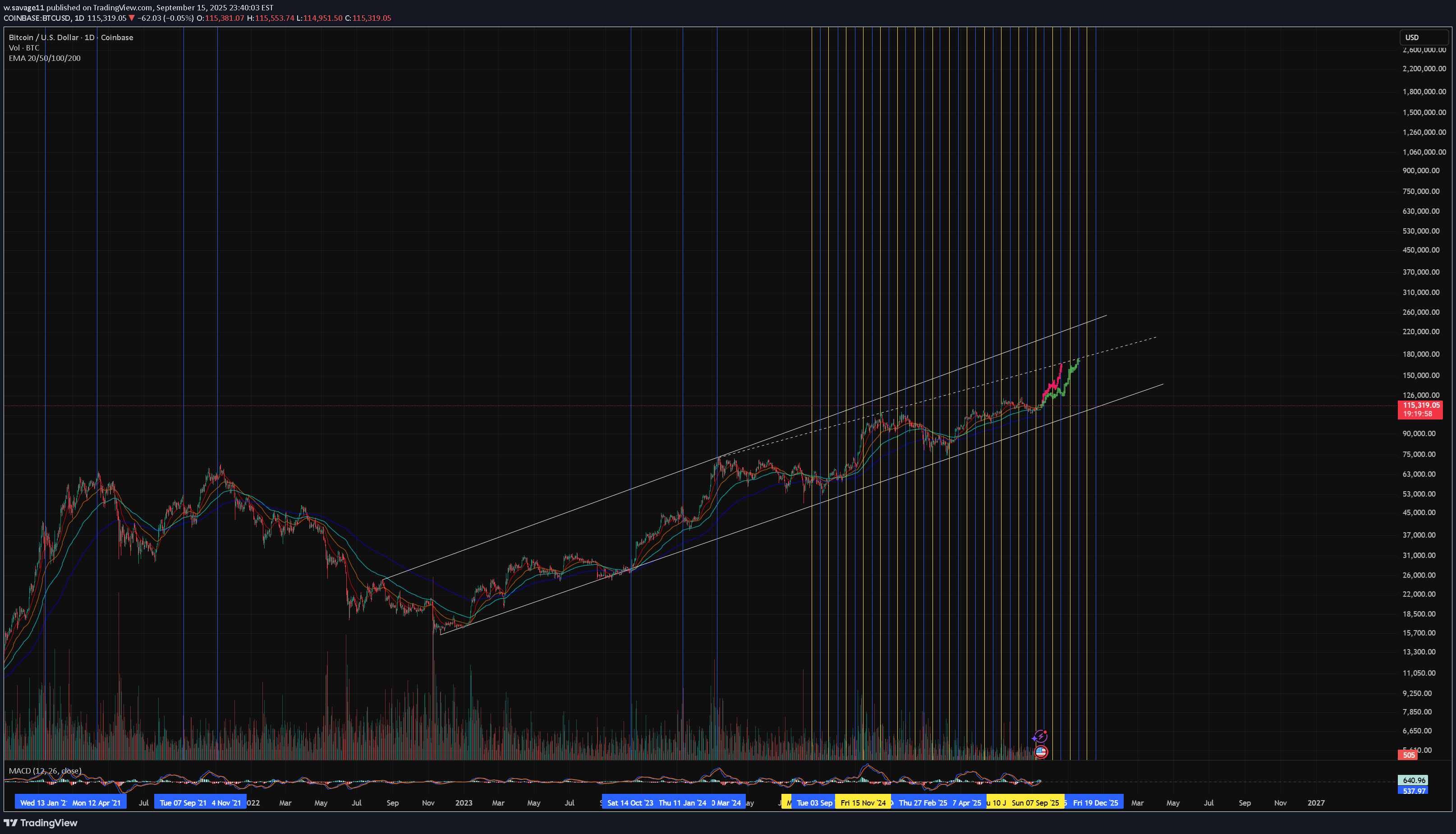

Wehn Mewn, BTC?? Wehn Mewn?

Bitcoin has topped on new moons, going back all the way to 2013 ... April 2013? New Moon. November 2013? New Moon. December 2017? New Moon. April 2021? New Moon. The most inaccurate measure for a new moon local top occurred in November 2021... New moon = Nov. 4th, 2021 The cycle top occurred 6 days later. Remaining new moon dates in 2025? October 20th - I give a 25% chance - this date also lines up with avg. total cycle duration (peak-to-trough) from previous 4 year cycles. November 20th - I give this a 65% chance. Since there was no 'double cycle' this cycle, (no early spring bubble) as with 2013, 2021 - this cycle could extend longer in duration, as with 2017. This phenomena has also been referred to as "right leaning" vs. "left leaning" cycles coined by other analysts. Also, bitcoin loves to repeat history. No top has ever occurred in October. December 20th - I give this a 10% chance. This would make it the longest cycle on record. Note: the (2014-2017) cycle was 55 days longer ~ 2 months ~ than the (2018-2021) cycle AND it had no spring-time bubble. Just a single impulse blow-off top.

w.savage11

w.savage11

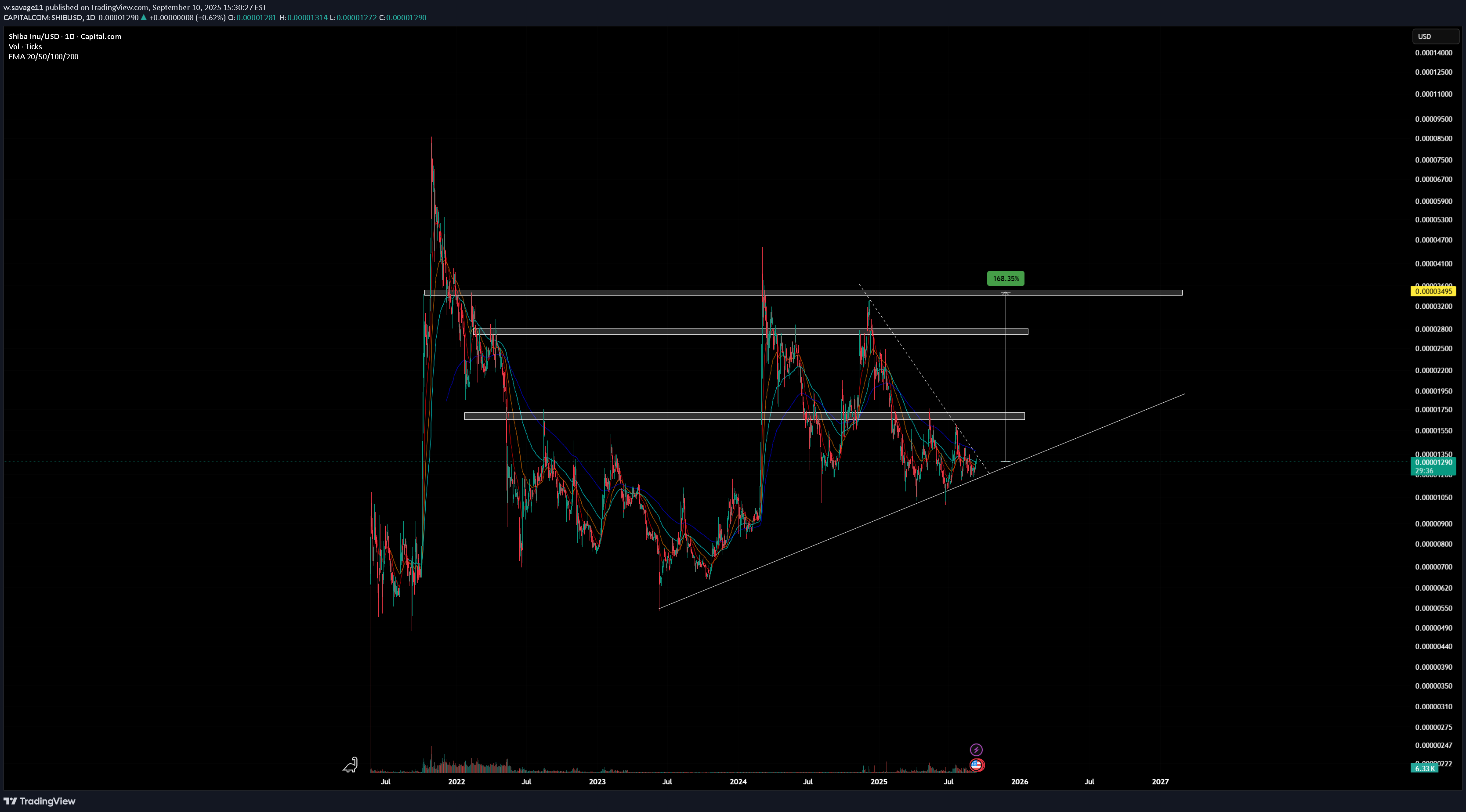

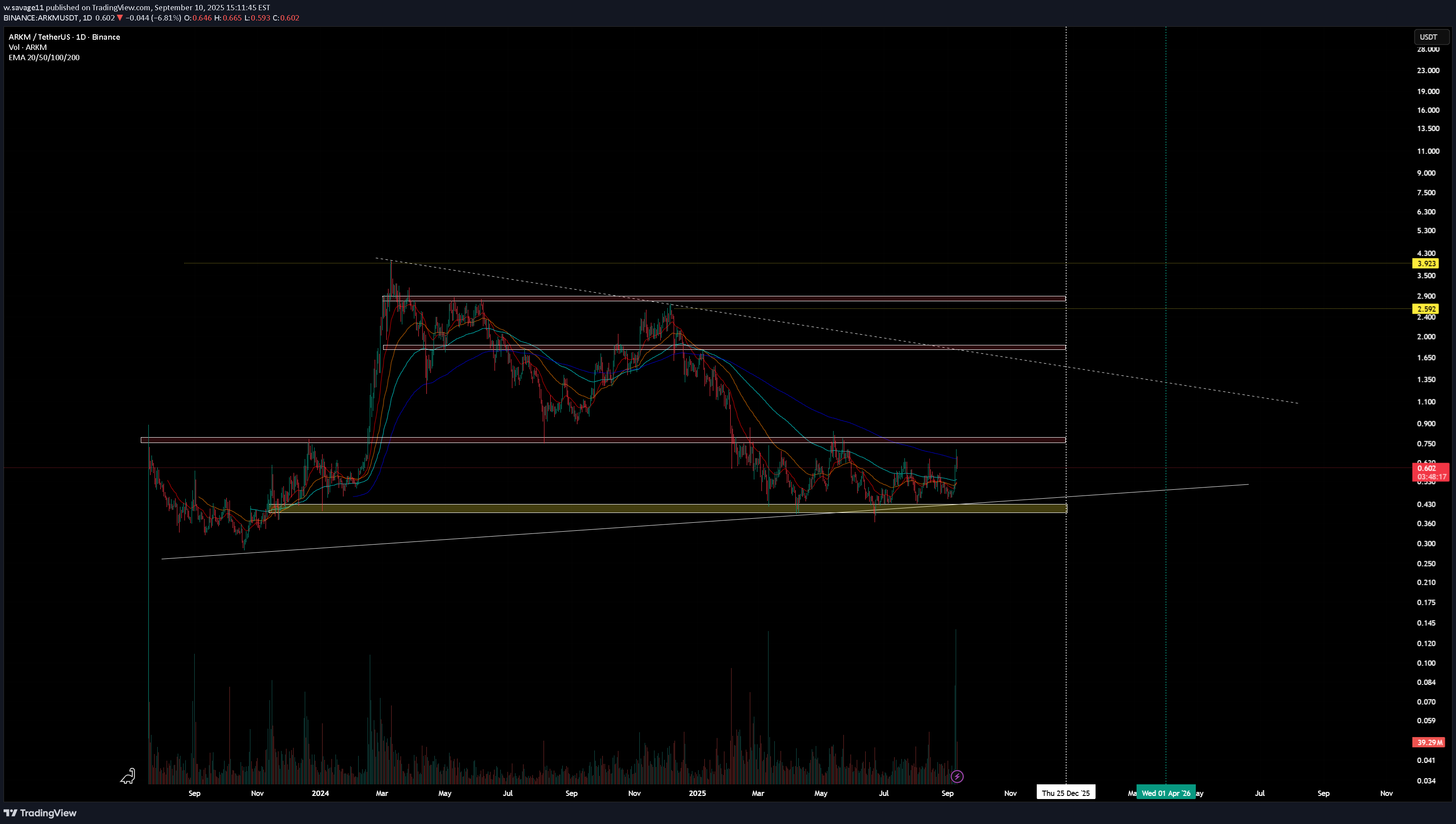

ARKM Q4 Outlook

Forecasting a generally less than spectacular alt-season. $ARKM recently saw it's largest buying-volume since march 2025, and one other time february 2024, which preceeded a significant price rally. Targets are muted. No new highs anticipated. Rally expected to last 30-60 days in Q4 before a massive correction.

w.savage11

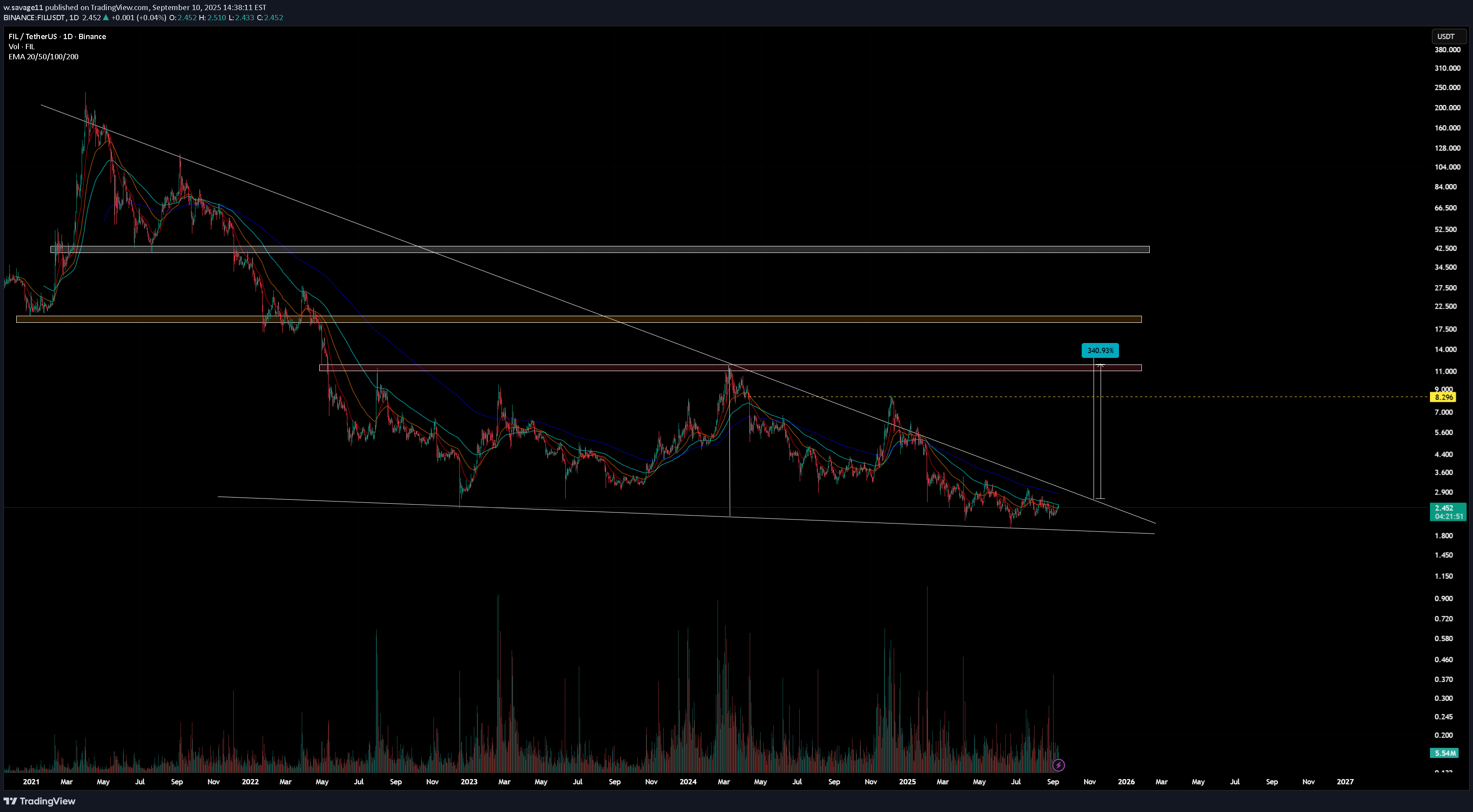

Filecoin - Mild Alt-Summer

Best case scenario for a likely-to-not-happen alt cycle... FIL may make a rally in October/November this year, but to a fraction of it's former 2021 price levels. Significant resistance around the $11.00. Fingers crossed for the last 'hoo-rah' for this and several other alt-coins. Long until mid-Q4 then short for 2026 & beyond.

w.savage11

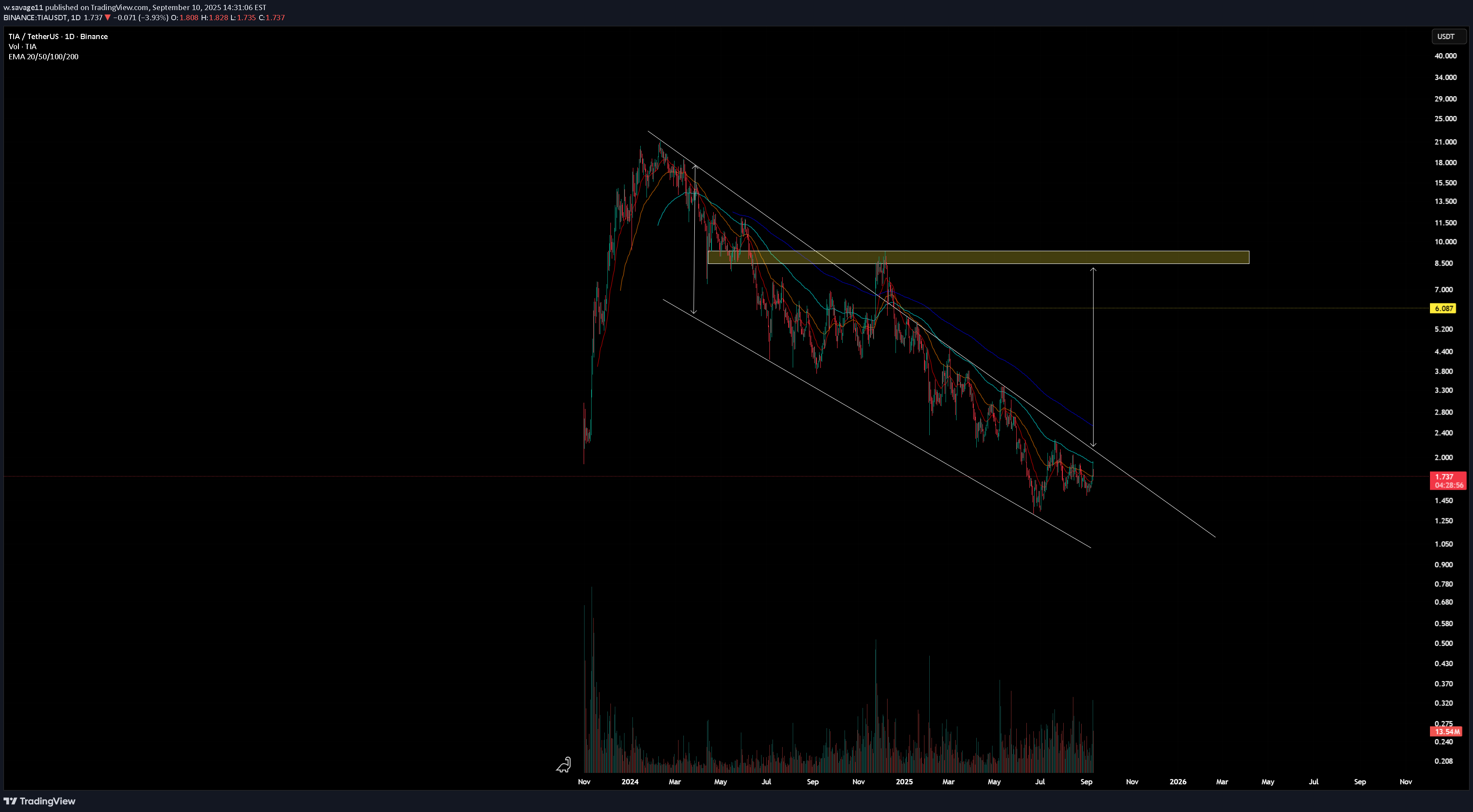

Simple Re-Test (Alt-Season)

Forecasting a mild alt-season this cycle. More regulation, absence of schemes (FTX) and the broad sweeping naivete about crypto this time around, alt-season performance will go through a necessary dampening. No new highs for TIA this cycle. This project will be lucky to see a revisit to the level above, where I expect significant resistance. Perhaps price will merely wick this area and commence another -80%+ drawdown.

w.savage11

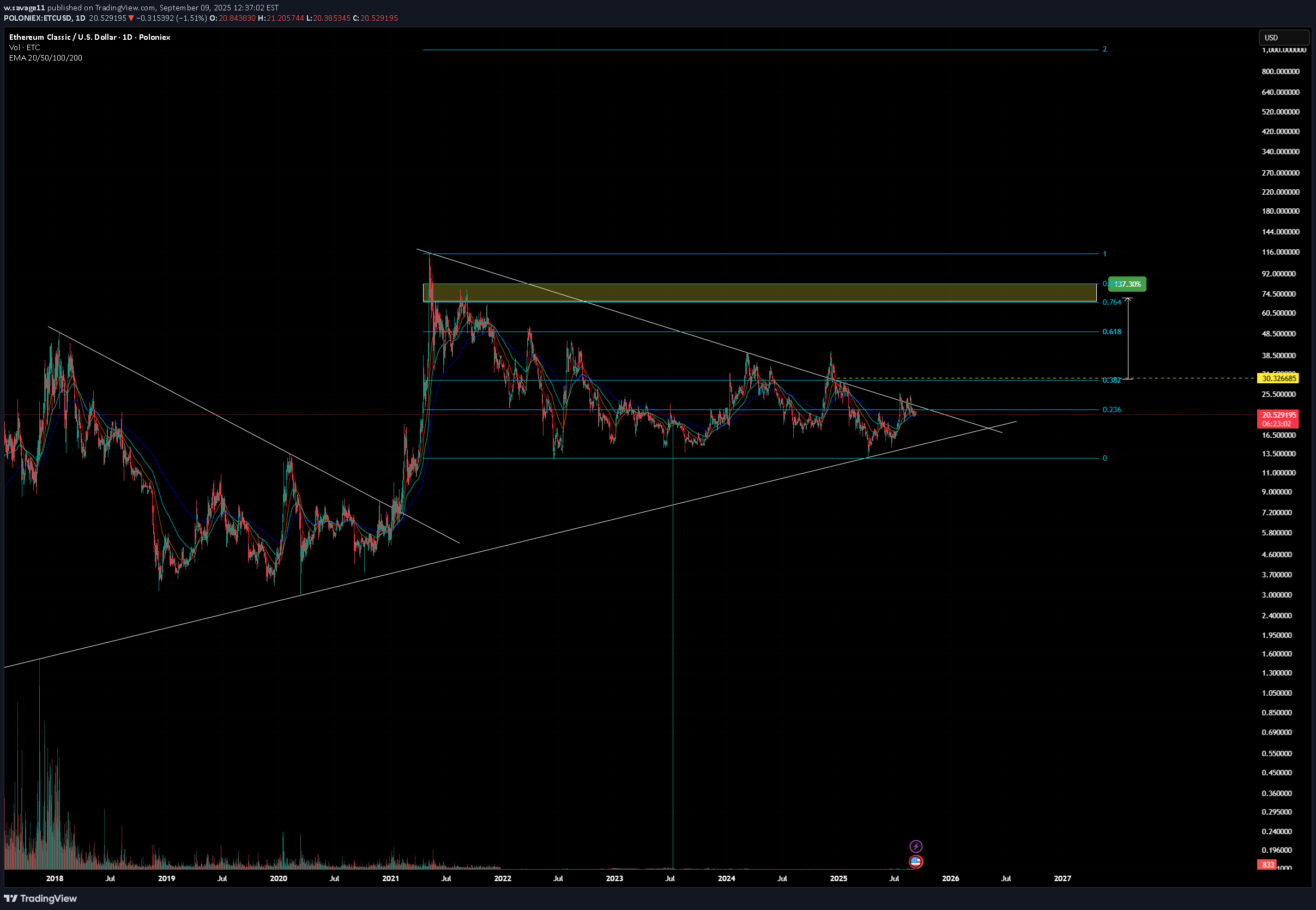

ETH Beta & Decaying returns

As it becomes clearer and clearer that alt-coin relevance is being dampened, I expect a couple of things: 1) The ETC fractal will play out again as with 2020-2021. Reaching it's conclusion by end of Q4 2025, and starting a year's long bear market thereafter. 2) The return for said fractal will not exceed the previous cycle high. (See altcoin return decay in legacy altcoins like LTC , XRP , etc. in 2021). Target = $80-$100 This entire rally is dependent upon BTC not entering a bear-market this month or in October, which is still TBD. If a bear market happens, the entire structure of the altcoin market will be permanently compromised, heralding in a much needed but painful wipeout of projects not named 'Bitcoin' ETH survivorship however, would bode well for ETC in future cycles.

w.savage11

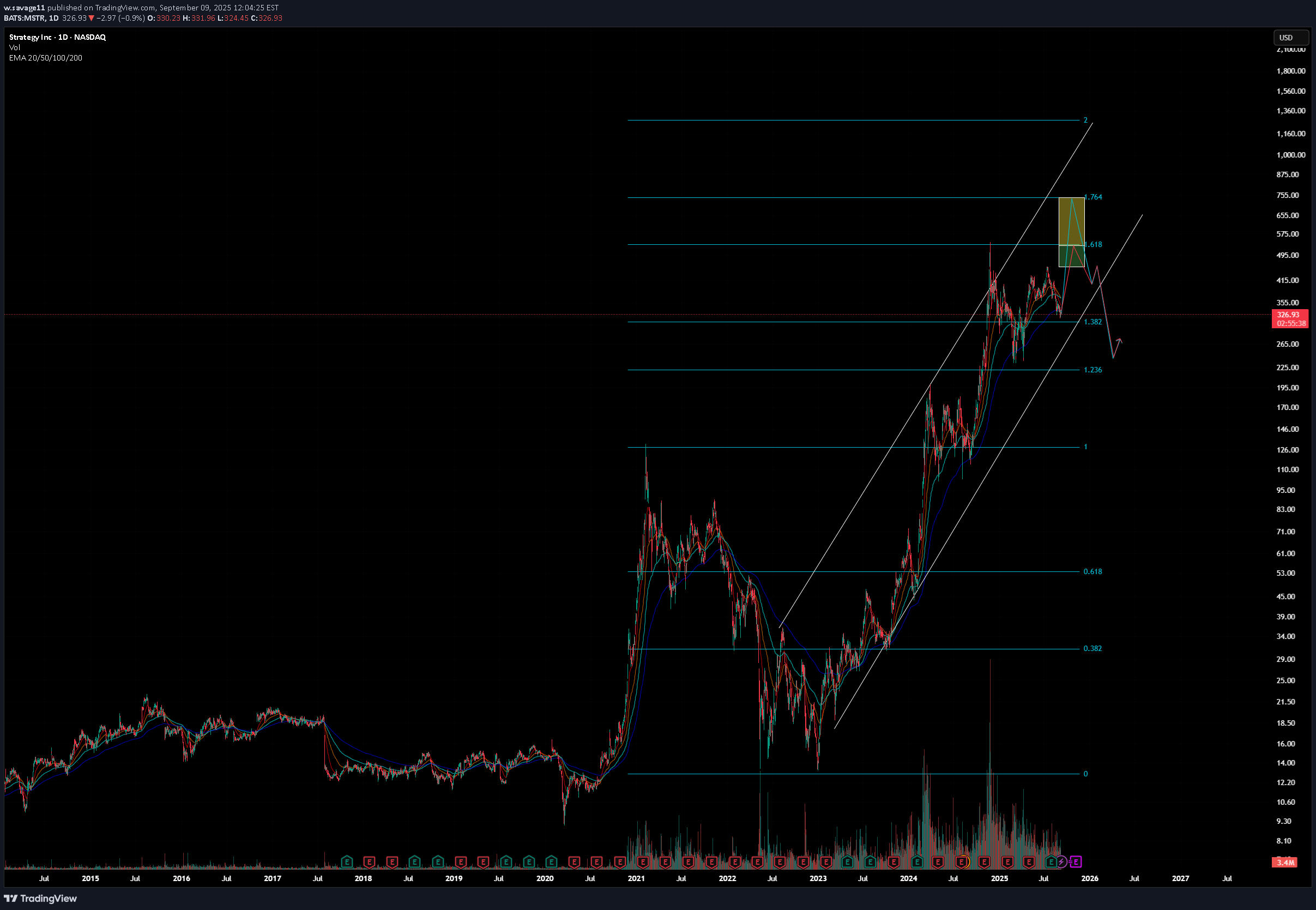

Do or Die - Q4 Edition

Not stirring controversy with this take. Higher in Q4 followed by a year-long bear market. Using Fibonacci extensions from last cycle's top & bottom to hit a maximum of a 1.618 target by EOY. Open to the possibility of price targets from most recent ATH ($550) and up to the 1.618 fib level. This calls for aggressive appreciation within the next 3.5 months. Price targets will be invalidated by immediate downward move or sideways chop, with the latter scenario resulting in a lower price target. Stated differently, price needs significant upward volatility by the end of September/early October this forecast will not play out Either scenario, this is nearly the end before the an imminent correction lasting a year or more. I predict the next bear market for MSTR will be aggressive, with BTC price likely to fall beneath the Strategy's bitcoin dollar-cost-average of $73k as of 9/8/25.

w.savage11

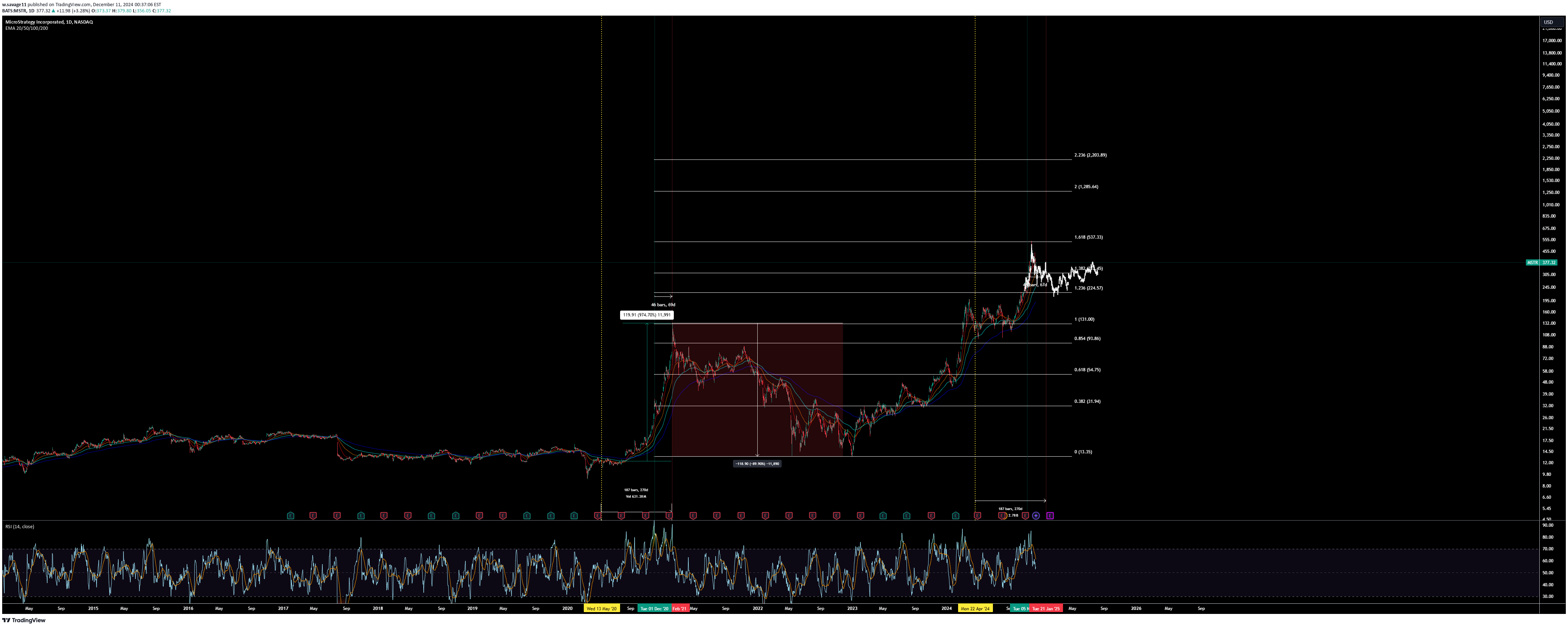

2021 Repeat - Distributed Top

No new highs for MSTR in 2025. I'm looking for a repeat fractal of 2021 in 2025.This fractal has played out nearly identically, though it's unclear if there's going to be a final push upwards in price with support at the 200 EMA. Bear market forecasted for 2026

w.savage11

ETC Classic - Breakout

Going long here. Excellent rally in 2021 and the same set-up is happening here.

w.savage11

The 2024 Cycle L1

Solana did spectacularly well in 2020, with a delayed breakout in 2021 (as Bitcoin proceeded to break out of the 20k range in December 2020) which produced even better returns.The following chart shows the Elliot impulse wave (with fib-retracement levels) from Solana (2020-2021) projected onto to Celestia.I see that Celestia had a spectacular year in 2024, and is having a delayed outbreak in relation to bitcoin which is creating new all-time-highs as of November 5th. If this pattern follows, I expect Celestia to breakout in December/January with jaw-dropping performance during the ATH year, 2025. Note: There are many L1 coins this (2024) cycle, (Ondo, etc.) that could be similar to Solana 2021, so perhaps the returns won't be as pronounced. Celestia is my racehorse.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.