SnarkyPuppy

@t_SnarkyPuppy

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

SnarkyPuppy

راز نهفته در رالی بزرگ اتریوم: آیا بازار سهام کوچک، کلید صعود ETH است؟

There's still hope for Ethereum and Altcoins into 2026 Why Altcoins Never Caught the Bull: The Missing Piece in the Crypto Cycle Bitcoin, gold, and the S&P 500 (SPY) have long proven their close relationship with M2 money supply — when liquidity expands, they rise. But Ethereum and the broader altcoin market play by a slightly different rulebook. They don’t just need liquidity… they need optimism. Specifically, expanding small-cap stocks and a strong business sentiment environment. Higher-risk assets — from growth stocks to altcoins — thrive when the economy believes in itself. And throughout this entire crypto cycle, that optimism never fully materialized. Despite strong narratives, legal wins, and technological progress, altcoin expansions never sustained. Why? Because the business cycle is the true king of risk-taking. 🧭 Where to Watch: IWM & PMI Two of the best gauges for this optimism are: IWM (Russell 2000) – tracks small-cap stocks and risk appetite ISM PMI – measures manufacturing activity and future order expectations When the PMI is above 52, the economy is in expansion mode — and that’s historically when IWM hits new highs. Interestingly, Ethereum has mirrored IWM’s trend, even showing outperformance when IWM pushes into all-time highs. That means ETH’s bullish potential could be closely tied to the next leg of small-cap and business expansion. 💡 The Takeaway In the past, money supply (M2) and business optimism rose together. Now, they’ve decoupled — giving us a clearer way to separate which catalyst drives which asset. So, the big question: 👉 If business sentiment improves in 2026… does Ethereum finally get its real bull run? Only time — and the next PMI reading — will tell.New developments in understanding about small cap behavior. . . based on small cap outperformance history. you can see that these degenerate behviors actually respond to the alleviation of pressure more than the optimism itself. So all we really need is a shift in expectations from Bad environment to better.. not necessarily to see the actual fruits. this is why PMI and IWM tend to break out together. . they respond to the same shift in expectations. in a way that large caps do not (spY and Bitcoin) Small Caps (and altcoins) = Beach Balls Suppressed underwater until pressure eases Don’t rise on optimism Rise when pain stops Lift as: credit spreads narrow rates stabilize recession risk recedes solvency pressure falls

SnarkyPuppy

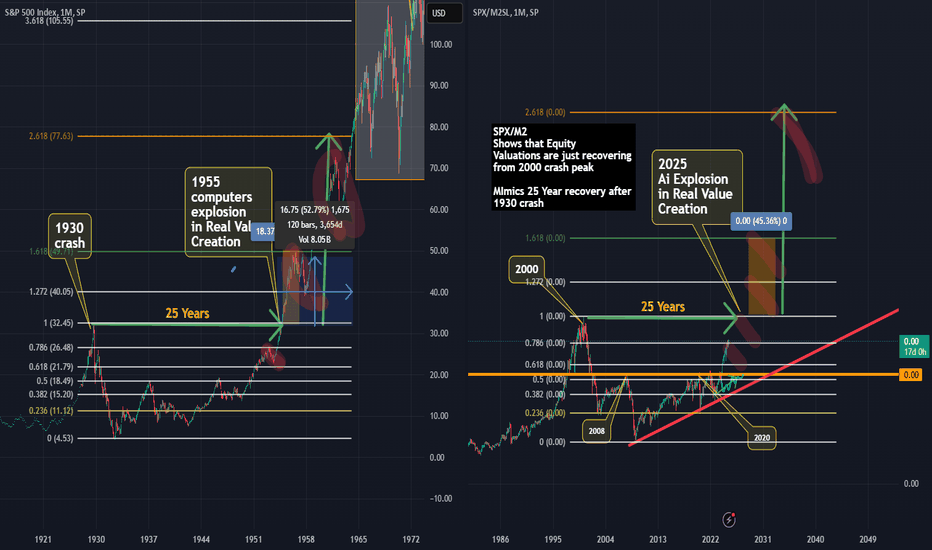

SPX Real Value ATH? Repeat 25 year 1930-1955 recovery fractal

Measuring SPX real valuation (SPX versus money supply) Spx is on its way to recovering the 2000 all time high that wa seen in the dot com bubble. The real valuation has never recovered this point. This fractal is very similar to the 25 year recovery from the 1930 crash is this lining up for continued bullish momentum into a new territory of value for Equities as Ai ushers in real value creation to companies and economies in the US and around the world. Hmmmm. Bullish? Rethinking this after Real valuation highs have been broken (see related posts) and since i believe that this is justified since technological innovation is driving more value to equity versus other investment types (bonds, commodies, maybe even land) . *****Land is interesting since new technology makes land more productive you actually need less of it to do the same things. very very interesting, but i would not count against it as a store of value as more dollars are printed.*** fun times. lets see what this looks like in the future

SnarkyPuppy

$SUI & the Raul Paul Effect?

I thought it was strange for Raul Paul to come out and openly talk about his investement in SOL back in 2023 Usually VC's do this once they have secured their position, but Raul talked like it was God's gift to crypto and he shamelessly brought SOL up in every single talk he ever had Now he has begun to talk about Sui in the same way. There are rumors that Sui has a large market maker who was highered to push the price to $14. Idk about that but the rumor alnong with this odd support from Raul seems good. Took a position in the ecosystem... lol mostly just bought the memes though fud hsui scb simba probably will buy others fun to see how this plays out also gives exposure to the "move" narrative where Aptos, Sui and others are competing for this new standard. kind of just another rotation in the never ending hunt for evm alternatives that can actually handle high transaction volumes... Sol was first maybe move also thinking hashgraph style L1's might get a narrative... but all that is not really what im watching here.. This sui bet is simply just wondering if Raul Paul can strike twice?fyi only holding 2 memes in this ecosystem spam Fud both have strong communities and would get a bid if sui catches a bid.. probably looking at q1-q2 2025 for non evm tokens to run really thats the time target for anything that doesnt move in 2024 lolStarting to see more thought leading large names talking about SUI Raul Paul Ansem Kyle Chasse others.. looks like this one may play out Meme's im looking at are sstill SPAM and FUD but $blub also seems to have a bit of grifty cabal vibes that may try to send it to the stratosphere. but the memes are all so cheap that it doesnt take much for any of these to win

SnarkyPuppy

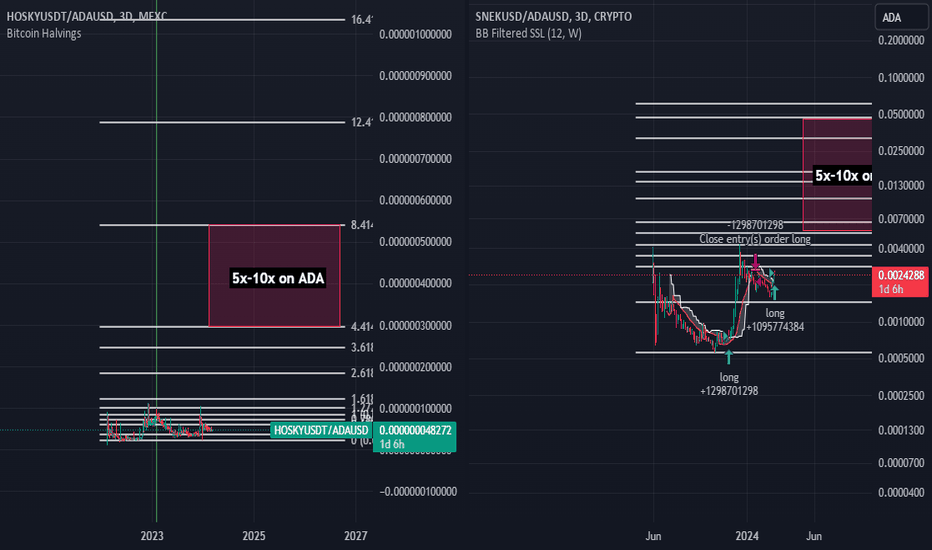

$Hosky and $Snek ... Meme plays for ADA during Midcap Mania?

exposure to the largest memes/Nft's in an ecosystem is a way to capitalize on the coming midcap mania The key is to find ecosystems that have very little competition and a clear main winner that is cheap (so memes on bnb may not be a good choice b/c there are too many to choose from) view meme as a leverage play on future capital inflows to an ecosystem. but with no liquidation risk other than rug risk. meme vs NFT is a bit of a judgement call (based on the chain ecosystem). NFT is good if u can get into the Major #1 collection early .. AND the chain has thriving NFT/Gaming focus (Example Aptos Monkeys on Aptos .. Bad kids on Stargaze) for most thought the easiest and safest way is to go for the top Meme with strong ecosystem support. if it is backed by a dex or a team even better and YES institutional money IS using meme as exposure b/c of the marketing and limited risk (no team, no security classification, ability to control liquidity) can look at SOL / Base /Optimism /other l2's which have launched and laid out the playbook

SnarkyPuppy

$ORDI Why Ordianls Is So Interesting: Across the Adoption Chasm

Ordinal Ecosystem crossing the "Chasm" of tech adoption as it becomes a main crypto Narrative. As money comes in over the next year, opportunities to get in on the ground floor of new "lucrative' concepts Ordinals have been printing $$$ for folks minting and participating in various tokens and nft's. NOw, Ordinals is Getting first liquidity swaps and growing infrastructure Why am I bullish on this concept. 1. New 2. Passionate and Talented community 3. Money still needs to inflow 4. People are dreaming .. when markets price possibilites usually it untethers to the upside 5. there is a grass roots and degen appeal 6. provides a new narrative and use case for Bitcoin Doge and Doginals 1. degen community 2. cheaper fees = product market fit (like bsc chain in defi) 3. accepted 4. Ultra tiny 5. Long Shot is Elon may leverage the Doge/Doginal ecosystem in twitter. Also other non-token assets like rare satoshis, ordinal nft's, bitmaps (metaverse lands based on bitcoin blocks) , etc The ordinal ecosystem (bitcoin) and Doginal ecosystem (doge) looks to be a narrative that is only gaining more momentum As a new development for this cycle, the opportunity is big to capture imaginations of crypto users. Usually in the year before the halving and during the halving year a new "twist" on the crypto space is introduced. That starts as degenerate on chain action. Ordinals standard which were made available through the taproot upgrade has inspired enthusiast to build and trade individual satoshis and the data inscribed on those satoshis.doginals link to two main market places. .. mindshare, resources and interest moving toward doginals. (it's about 6 months behind ordinals ecosystem so lots of opp) drc-20.org/ doggy.market/

SnarkyPuppy

BRC20/Ordianals -Trac & Sats = Respectable Degeneracy?

fun punts on possible narrative. Ordinals are New, Interesting, and have very low capital attention. BRC20 and Ordinals has All the best ingredients to capture value Broader crypto market still needs to become more aware infrastructure being built now to provide ways for capital to inflow. Whehter Ordinals and bRC20 standard is sustainable..idk. and truthfully we don't care for now. These are respectable degenerate punts Sats and Trac have become the two largest token ecosystems where the devs, participants, and followers have created / are creating both usable product and communities. Trac (indexer/dex ecosystem) Sats (indexer/dex ecosystem) 2024 -2025 could see capital infolws to this space and I think these two tokens have a chance to benefit. Early minters are already in profit but so small with no liquidity means many have to wait for this to get big for players to really start selling. Fun stuff, different stuff....Links for DYOR trac.network/ unisat.io/ bonus - they are also building on DogeCoin drc-20.org/ ordifind.com/token can find socials from sites as well.Ecosystems expanding for SATS and especially TRAC. Trac could see another push toward 1B market cap. Decisions will need to be made likley these next months will see a last gasp blow off top of ordinals for this part of the cycle. Will be around again maybe in a year might be time to use the next inflow of liquidity rotate profits into other crypto areas that have not pumped. Doginals will likely see large gains during this time as well. however short lived when mainstream people start talking about $DOGI I will know it's almost over. lol

SnarkyPuppy

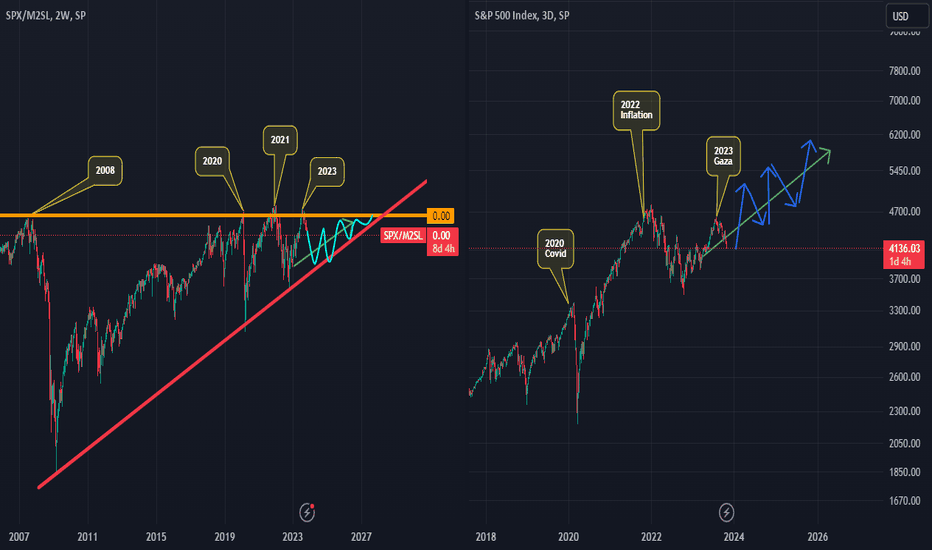

SP500 Choppy Bullish Decade: To all time highs but not really

2023 has another peak and rejection from the real valuation line in the sand (Yellow LIne) real valuation is SPX/Monetary supply Reset in progress, Expecting rally again to test in 2024 and 2025. This produces choppy, fearful activity however over time value will trend higher. Again mid term bearish when we hit bottom line Breaking red line is change of character into real Ultra bearish possibilities. (might happen in 2027 - 2030) where market is trained to buy dips but will be a legitimate bear trend

SnarkyPuppy

BONE target if shibarium release hype hits in Q3

BONE target if shibarium release hype hits in Q3 A target of $7 per token would put the value of Shibarium at about 2.1B Where the hype goes after that depends on the direction of the project. My thoughts are that I hope the focus on NFT gaming/metaverse stays strong and that the NFT market place on the chain sees good volume. Could support an active chain and nFT's are engaging enough to keep the community interested. Would be awsome in Robin Hood NFT trading through their defi wallet or in their platform was done via shib. otherwise this is just another evm and hype will fade and returns will be average. I am not particularly bullish on L1 and L2 chains outperforming the general market this cycle only a special few.

SnarkyPuppy

LINK ath reprice before halving?

LINK ath reprice before halving? With polkadot capitulating to change narratives and chainlink's CCIP in testing Chain link set to be the internet of blockchains w/ very little competition. Prob like buying ethereum at in 2016 for $7. (actually the price i paid for my first eth btw) Link finishes this cycle in the top 5 on crypto market cap?

SnarkyPuppy

LTC Pre-Halving Pump into Q2 2023 -Crypto's first sign of spring

LTC Pre-Halving Pump into Q2 2023 -Crypto's first sign of spring Price Action into LTC halving seems consistent without regard to market sentiment. SENTIMENT AND ENVIRONMENT INTO LTC HALVINGS: 2014 - "MT Gox.. Silk road... etc" 2018 - "ICO crash, BlockWars, China Crypto Banning, Fed tightening. . .etc" 2022 - "FTX collapse, Fed Tightening, 3 arrows capital, etc etc" LTC seems to not care and its halving is usually about 9-18 months before BTC halving event Watching to see how this plays out will be useful to know if money is still interested in this space.Comment: 1.5 moths before halving, litecoin has moved sideways since Dec 2022. It has shown to be a great place to park capital and avoid the volatility seen in many alts. Likely there should be a bullish move into the halving from here, but I am taking very clear note of the DIMINISHED RETURNS here. This chart, for me, is a warning signal to be weary of older coins. Many of the older coins (top 25) saw diminished returns from 2017 vs 2021. This trend could continue and may show up in coins that did have good 2021 performance like Ada and FTM. taking notes on this for sure

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.