SaltSugar

@t_SaltSugar

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

SaltSugar

پیشبینی سود 3 تا 5 برابری CAKE/USDT: رازهای حمایت قوی و صعود در تایم فریم روزانه!

Long CAKEUSDT. x3-x5 probably entry - current level TP1 - 10 SL - close below DMA200 (around 2.3 with confirmation on daily TF) FA. BSC DEX from last cycle. BSC narrative. TA. 1) High-volume buys in feb-march 2025 on a second retest of the lows (1.5 zone). 2) 200DMA - strong support for 3-4 months. 3) Just look at BNB/USDT chart and you'll get it :) No need to overcomplicate. p.s. NFA, DYOR

SaltSugar

Long Sonic on H4-D1.Entry: current level or limit order @ 0.48TP: 1.5 and 2Exit: confirmation on D1 below 0.38 (2nd test on Feb,8 of local lows)FA: Sonic - EVM L1-chain with high performance (10k TPS with subsec finality)Previously it was Fantom but recently rebranded.CTO - Andre Cronje.Trades on all major CEX.Top-21 among Chains (Defillama) by TVL - 393mln1/ Strategic angel investors: Michael (Curve), Stani (Aave), Robert (Compound), Tarun (Gauntlet), and Sam (FRAX), as well as our venture partners Hashed, Signum Capital, and UOB Venture Management (source: soniclabs).2/ FDV = MCap!!!3/ Massive airdrop on June around 100mln (current TVL - 393mln, so it's 25% profit on you locked capital if the price remains the same)4/ 90%-revenue sharing with dApps built on SonicTA:1/ EMA21 and 55 cross on H42/ strong bounce on high volume above PoC and MA-cross3/ capitulation on Feb,3 (weak hands shakeout)Can repeat that SUI did.

SaltSugar

Long KAVAUSDT (D1). X2

Long KAVAUSDT on D1 Entry : current price (0.49-0.5) TP : 1 (x2) Exit : confirmation on D1 below PoC & MA200 (0.4). RR = 5:1 Duration: from 2 weeks to 1.5-2 moths probably. Why? After the great capitulation we witnessed yesterday (more than 2bln liquidations of 700k traders) KAVA shows unprecedented signs of strength. Bounced on big volume from PoC and MA200 (which are also above multi-month consolidation in july-nov 2024). Haven't done a thorough research on project's fundamentals. So, in case you DYOR'ed it please leave a comment if there's red flags from this perspective. But regarding TA, that's exactly that I wanted to see.Currently not seeing appropriate PA as planned. Better to close this trade manually than wait on sidelines...

SaltSugar

Long ALT/USDT (D1). x3-x5 potential

Long ALT/USDT. TF D1 x3-x5 probably. Setup specs: Entry - 0.12 (or current level. But I usually prefer to wait for a retracement and make an entry using limit order). Tp1 - 0.35 Tp2 - 0.55-0.57 SL - below 0.095 with confirmation on D1 FA: AltLayer is a blockchain infrastructure project. MC - 300mln. FDV - 1.3bln Next unlock - in 4 months Backed by top-tier VC + Binance labs TA: - consolidation breakout - LTF (h4) MAs inverted back to an uptrend after a squeeze - unusually high volume + green candle - S/R flip at 0.10 (support retest) - HH and HL TH-H4 screen for TA in details:

SaltSugar

Long SUI/USDT D1 (x3-x5 potential)

Long SUI/USDT. TF D1. Right ticker + right timing. x3-x5 probably. Entry - current price level Target - $2 (x4) Stop - below PoC level (0.43) with confirmation on D1. Will start with FA and benchmark analysis of other L1-project (Aptos) which is quite similar: 1/ Decent L1-project with strong backing and recently listed on top-tier CEXs. So, not a lot of locked-in traders/hodlers. 2/ Around 250ml of investments from top-tier VCs (both SUI and APTOS). 3/ APT/USDT made around x5 in January, 2023 right after 4-month post-ICO bleeding period. (According to PA, it was rather possible to take x4 on APT/USDT within 1 month): 4/ SUI is currently at the end of this bleeding. TA: 1/ Buying volume appeared (green encircled zone) + rising PA. 2/ MA squeeze (EMA 21 and EMA 55) 3/ trending RSI 4/ Price is consolidating above PoC and EMA21 and preparing to make a strong move upwards.To whom it may concern.... Yesterday's red candle was a leveraged long-squeeze. But! You can only understand and be 100%-sure only after it has happened. So, I'm kind of Captain Obvious.... But!! When this kind of move happens, you should always wait for a reaction and how will Price Action develop. It's only possible if you trade: - without leverage - higher TF (H4-D1). This strategy gives you a lot of time to think, wait and make a right decision.Metrics update accrording to Defillama: Aptos - #32 place with $64 mln in TVL SUI - #22 place with $135mln in TVL and around $10mln volume (last 24H)SUI has started to making its way through DMA200 (yellow line that recently) and its volume cluster. Also, we witnessed yesterday a green pin-bar on high volume (retest). Hope, thing will accelerate from this point.Those who have patience, will be rewarded in the end..SUI - #15 place with $260 mln in TVL and around $35mln volume (last 24H) On Nov, 21 SUI was at #22 with $135ml in TVL1st target hit - x3SUI is in TOP-10 protocols by TVLA quick TA update on SUI: Market structure while printing HH-HL (higher highs and higher lows) indicates that SUI is about to further continue its upward movement. Eventually it'll test its historical highs around $2. And, without doubt, there will be some consolidation/retracement around this price level as well as correction during the movement towards this high. It's hard to predict and tell for sure will SUI break its high or not because it depends a lot on the overall market conditions. But, as far as I see, SUI is one of the strongest assets (definitely stronger than the wider altcoin market).I'm currently have an opened position in SUI. But if I haven't one I could possible enter in the following trade: 1/ wait for retracement to 1.1-1.05 price level (good entry point). 2/ TP1 - 2 (close 30-50%). 3/ TP2/3 - wait and see the reaction around price level of $2 and then I will decide. 4/ SL - close below 0.75 on D1 (24-48 hours)

SaltSugar

Long GMX/USDT D1 (R/R = 3)

Long GMX/USDT D1 (R/R = 3) Long GMX Entry - from current price level (around 39). TP1 - 50 (30%) TP2 - 55-56 (50%) TP3 - 70 (20%). Technical analysis. 1/ Capitulation on 17, Aug on decent volume (low - $28) 2/ failure of printing new lows below $28. Weakness on downward movement with no significant volume resulting in failure to print new lows below $28. That's the point where one should seek for signs of reversal. But there's still no entry point. 3/ On 20, Oct we witnessed an enormous volume but on rather small-spread green candle. As for me, that's enough to have a good long setup: - There's a trigger for entry - HLs and HHs (that's that I want to see as a long price action) - POC - as a stop-loss level (pretty tight stop) - a lot of room to grow up. No significant pressure until 50-55 level. Fundamentals. No need to present this alt. No.1 perpDEX (TVL-wise; like dYdX) which is constantly in top 5-10 projects in terms of fee generating. And it's very important to search for projects that generates positive cash-flow on a daily-weekly basis.

SaltSugar

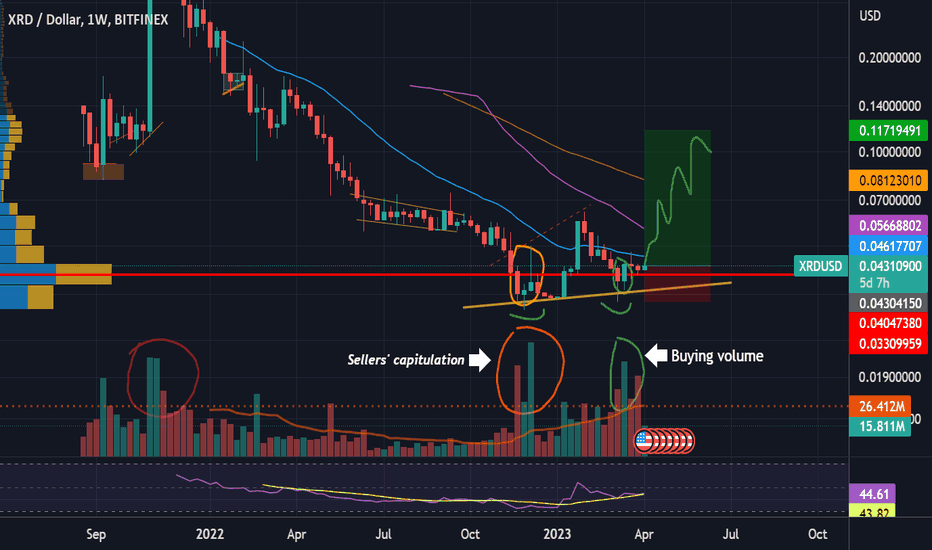

Buy XRD/USDT W1-D1 (TF = 2-3 months)

Buy XRD/USDT (spot: Bitfinex, Gate, Kucoin) entry: current price (0.042-0.043) target: 0.11-0.17 (incremental fix) invalidation: close below 0.033 on TF D1 FA/events/news: upcoming major release called "Babylon" in June 2023 TA: After slow bleeding in summer 22, XRD witnessed seller's capitulation in the end of Nov, 22 on high volume. In Jan, 23 higher high (HH) was printed (obviously, it was a resistance at 0.06). Then, we saw a successful retest of support (0.035-0.037) in March on high volume with higher lows. RSI on W1 is trending up. Overall narrative is also positive. So, I don't see any selling pressure until 0.11-0.17 Decent R/R trade.Pretty huge move upwards as expected. I've fixed 30%.30% closed with limit orders (0.00000450-500 range - XRD/BTC market). The rest - 0.09-0.01 manually.

SaltSugar

Long AVAX/USDT D1 (x2 potential)

As you have noticed crypto market/altcoin market has gained a significant rise in price levels. Several alts have bounced +50-100% off the bottom. Some of them still have a decent room to grow. Avalanche (AVAX) is one of them imho. Taking into consideration: - legacy market conditions, FRS policy (inflation + rates) - overall state/cycle of crypto market on W1, we are pretty far from real bull cycle. Better call it local bull market (q1 2023 - maybe q2 2023) and a major correction to 1-year bear market of 2022. Anyway who cares if we see an opportunity to make and take (!!) some profit from it? FA: Firstly we need to focus only on alpha ideas/top alts/decent L-1 infra projects. AVAX, as a L-1 infra with over 1mln wallets suits this. TA: - after great sell off in May 22, there was a selling pressure absorption in the middle of June, 22 (see volume in orange circle). Low on D1 was printed just below $14. - this level was broken on November, but without further continuation - on Jan, 11 wide-spread green candle on big volume broke up the key level of $14 and got the price back in the range. That's when we need to look for "confirmation" - confirmation: DMA 200 was broken. Lower TF DMAs/EMAs are looking to cross DMA200 - since then the volume was building up (almost 3 weeks until now) Entry: 50% on current price level, 50% - 17.5-18 (200DMA retest). RSI indicates we have pretty high probability of correction to 18-19 level. Stop: DMA 200 is invalidated on D1 as a support. PoC is also sitting there... TP1: 37 (take a look at 30 also, maybe close 20-25% to reduce risk) TP2: 53 These are resistance levels on W1. Don't forget we are still in higher TF bear market. So, it's very important to babysit your positions and trade them accordingly. Better safe than sorry. p.s. I think the overall crypto trend will go pretty quickly to catch traders and then prices will print new lows in q2-q3 2023 p.p.s. you can find your own desirable alt based on FA (like alpha, kava, ctsi..) which have similar setups and trade them. Maybe it's a good idea to spread an amount across 2-3 diff alts. Just an opinion. But don't go full risk on all 3-4 alts or whatever number of proper setups would be found: altcoin correlation is almost 100%same thing: GRT/USDTWell played, GRT/USDT shame that I haven't published this idea...made an entry on DMA200 retest @17.9crv/usdt - first mover:) Probably other alts will join its prica actionDecided to close this position. Reasoning: 1/ stop reached 2/ AVAX has been consolidating for 5 days under 200MA and PoC 3/ DMA200 tested and rejected

SaltSugar

Long ATOM/USDT D1

In general it's time for altcoins (blue chips + other decent projects) to make a correction: Pros: 1) Good R/R 2) Seller's exhaustion. Buyers (short- and midterm) are starting to appear 3) Target - 50% fibo correction + 200 dma 4) RSI has found support and trending higher But not to forget: market is still bearish in the long-term perspective. Better to babysit your trades and watch the market carefully. ATOM/USDT: Entry - current market price TP1 - 17-18 SL - below 5.5 Just my 2 cents)After FED news we are witnessing the true action now on the cryptomarkets. As for ATOM, still lagging...but waiting to see its move in UNI, SNX or ETC-style (already did it). But I'm trying to stay calm, don't be ingulfed by euphoria and remember that we had a 8-month downtrend in the past. So, when (or IF) ATOM makes the similar move (price action), I'll close 80-100% of my long position. Better safe and have a planned profit than sorry. That's my point.Like ATOM's price action. Still waiting for my target. I thought it will take less time to get there. But it's moving in the right direction.ATOM seems stronger than overall TOTAL2 (total cryptomarket cap excluding BTC). 1/ ETH and altcoin market are trading below both MA/EMA 50 & 200 which isn't good for a local bullish trend that we were witnessing for the last couple of weeks. Pretty tough time to trade. Better sit on sideways tbh (if we're speaking of the cryptomarket in general). 2/ ATOM is stronger in this terms of MAs 50-200 than the wider market. Thus, I'll keep my position but move SL to break-even point.BTW, almost everything is below these MAs. I've noticed only one another decent project (TONCOIN/USD on FTX) which is trading above them on TF H4. Of, forgot to mention that I'm speaking of all these MAs on timeframe of H4.Forgot to tell that I had fixed 1/3 of my position at around 15.5-16 (ATOM/USDT). Decided to do it on 9 of Sept when saw a big green candle on high volume. Anyway, TP1 (17-18) and other higher TPs remain intactClosed the rest. Didn't like how the previous week closed. Alts are bleeding. Also I was stopped out of my BTC long trade. S&P500 will draw LL most probably. So, better to close my position in profit and wait for better opportunity.

SaltSugar

UNIUSDT Long (H4-D1)

FA: DeFi + DEX narrative TA: 1/ EMA cross (21/55/200) on H4 2/ Higher lows 3/ Decent volume on 26 sept (wide-spread green candle) 4/ diag resistance break-up Entry: 25-26 Stop: 17.5 TP1 - 41.7 (25% fix, R/R - 2:1) TP2 - 130-140 (50% fix, R/R - 13:1)Same PA as ATOM/USDT. UNI will followWill take more time proly. But still active anyway..

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.