UNI

Uniswap

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

JuliiaRank: 111 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 12/12/2025 | |

SwallowAcademyRank: 30616 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 12/11/2025 | |

behdarkRank: 31397 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 12/21/2025 | |

CryptoSkullSignalRank: 31897 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 12/23/2025 | |

خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 12/22/2025 |

Price Chart of Uniswap

سود 3 Months :

خلاصه سیگنالهای Uniswap

سیگنالهای Uniswap

Filter

Sort messages by

Trader Type

Time Frame

CryptoSkullSignal

$UNI is sitting on a major long term demand zone, and historical

UNI is sitting on a major long term demand zone, and historically every time price respected this base, it delivered a strong upside move, the last comparable setup resulted in a ~156% pump. Right now, the focus is clear: support lies at $4.70–$5.26 with deeper demand at $3.30–$4.10, while $7.18–$7.80 remains the key resistance that must break to unlock real upside.

behdark

UNI Analysis (4H)

A trigger line has been broken on the chart. We have a bullish CH, and a Three Drive pattern is also visible at the bottom. These patterns usually push price upward toward the nearest supply zone. Price has been fueled from a strong origin, suggesting sufficient buy-side orders. We currently have two re-buy entry points. If price pulls back to the downside, we can enter the position using a DCA approach. The targets are marked on the chart. Please note: if price reaches our entry zones before touching the red supply zone, we will enter the position. However, if price first reaches the supply zone and then returns to our entry area, we will not enter. A daily candle close below the invalidation level will invalidate this analysis. For risk management, please don't forget stop loss and capital management When we reach the first target, save some profit and then change the stop to entry Comment if you have any questions Thank You

UNIUSDT 30Min Chart Analysis 21-Dec-25

Stop Loss: 6.50 Sell Stop: 6.30 Take Profit 1: 6.10 Take Profit 2: 5.90 After a sustained bullish trend, a bearish divergence has formed across the 4H, 1H, 45-minute, and 30-minute timeframes, signaling weakening bullish momentum and a potential trend reversal. If the price breaks below the Sell Stop level at 6.30, it may confirm a bearish move, with downside targets at 6.10 and 5.90. ⚠️ Always remember to protect your capital with a proper stop-loss and disciplined risk management.

IvanLabrie

DakuNit

آیا زمان خرید یونیسواپ (UNI) فرا رسیده؟ پیشبینی حرکت بزرگ قیمت!

Do we dare to set a long position to UNI i am thinking that UNI, it is at the edge of, making a sharp decision, go long x1 or go to 1$ personally i am thinking to go long.. nfa dyor

mahshiddadashzadeh

تحلیل هفتگی یونی (UNI): آیا فرصت خرید در حمایت 4.8 دلار آغاز شده است؟

On the weekly timeframe, UNI has undergone a deep corrective phase and is now trading at a level worth close monitoring. From a broader market perspective, this structure suggests that altcoins may be entering a mid-term investment opportunity phase. As long as the current price level holds, spot-based positioning becomes favorable. A strong support zone is identified at 4.8 and maintaining this level could allow UNI to initiate a recovery move toward the first upside target 7 $

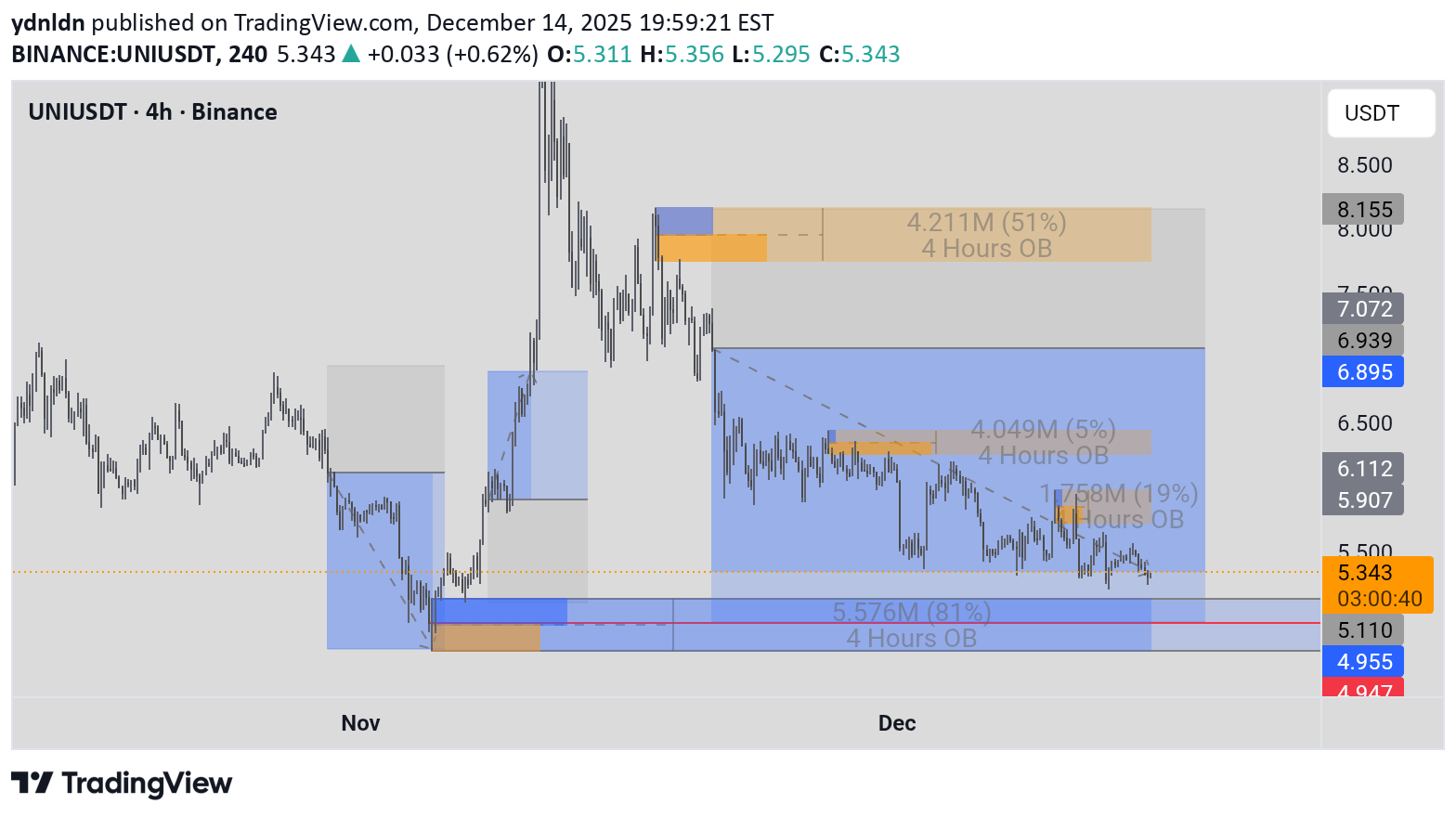

ydnldn

NLDN | UNIUSDT SWING TRADE

I've been holding this perpetual for almost a month. Should I close the position? Should you find this analysis insightful, I invite you to like or leave a comment. Constructive feedback and suggestions are greatly appreciated. For further analyses, please follow me at @ydnldn.

Juliia

سیگنال خرید قوی یونیسواپ (UNI): ورود در 5.58 دلار با پتانسیل سود 3.3 برابری!

— A falling wedge (reversal pattern) has formed, supported by daily-timeframe bullish divergence and a retest of major global support. — Entry: $5.58 (market buy) — Stop: $5.28 (-5% price movement from entry; not percentage loss) — Target: $6.50 Risk per trade: 0.5% of total account (this is the actual potential loss) Position size: 10% of account, 10x leverage RR: 1:3.3

mahshiddadashzadeh

UNI at Critical Support: No Breakout Below the Flat Kumo

Support: 5.12 Resistance: 5.91 – 5.98 Price is still trading below the flat Kumo cloud, which means we shouldn’t expect a meaningful bullish move until UNI can close and hold above the cloud. But from a mid‑term investment perspective, this zone is still acceptable because the broader structure hasn’t broken down.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.