IvanLabrie

@t_IvanLabrie

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

IvanLabrie

Hyperliquid bottom?

GN gents, Happy holidays to everyone, I gotta be the only crazy guy working today...8pm here. I wanted to bring to your attention a possible epic bottom in HYPE, we had a series of positive catalysts and a juicy sentiment signal lately: *Validators voted to burn the HYPE accumulated in the AF *No insiders unstaked coins to sell during the unlock that was due *Portfolio margin coming to Hyperliquid, will boost capital efficiency substantially, and increase volume and fees in the platform. *HIP-3 markets are very succesful and growing *Former Bitmex chief scammer and now shitcoin gambler Hayes was bragging that he sold the top and refuses to buy the dip, saying he will buy at $20. And most importantly, we hit a huge key technical level in the weekly chart and the daily is turning around, potentially firing a Chritmas gift of a trend signal today. Keep an eye out for price surging over $25.2375 today, if hit, the trade is on. If not, still watch this token as it is likely to reverse the down trend in this range soon. Best of luck! Cheers, Ivan Labrie.It is on...trend signal confirmed today. I'd say the bottom is in with high confidence.

IvanLabrie

IvanLabrie

IvanLabrie

IvanLabrie

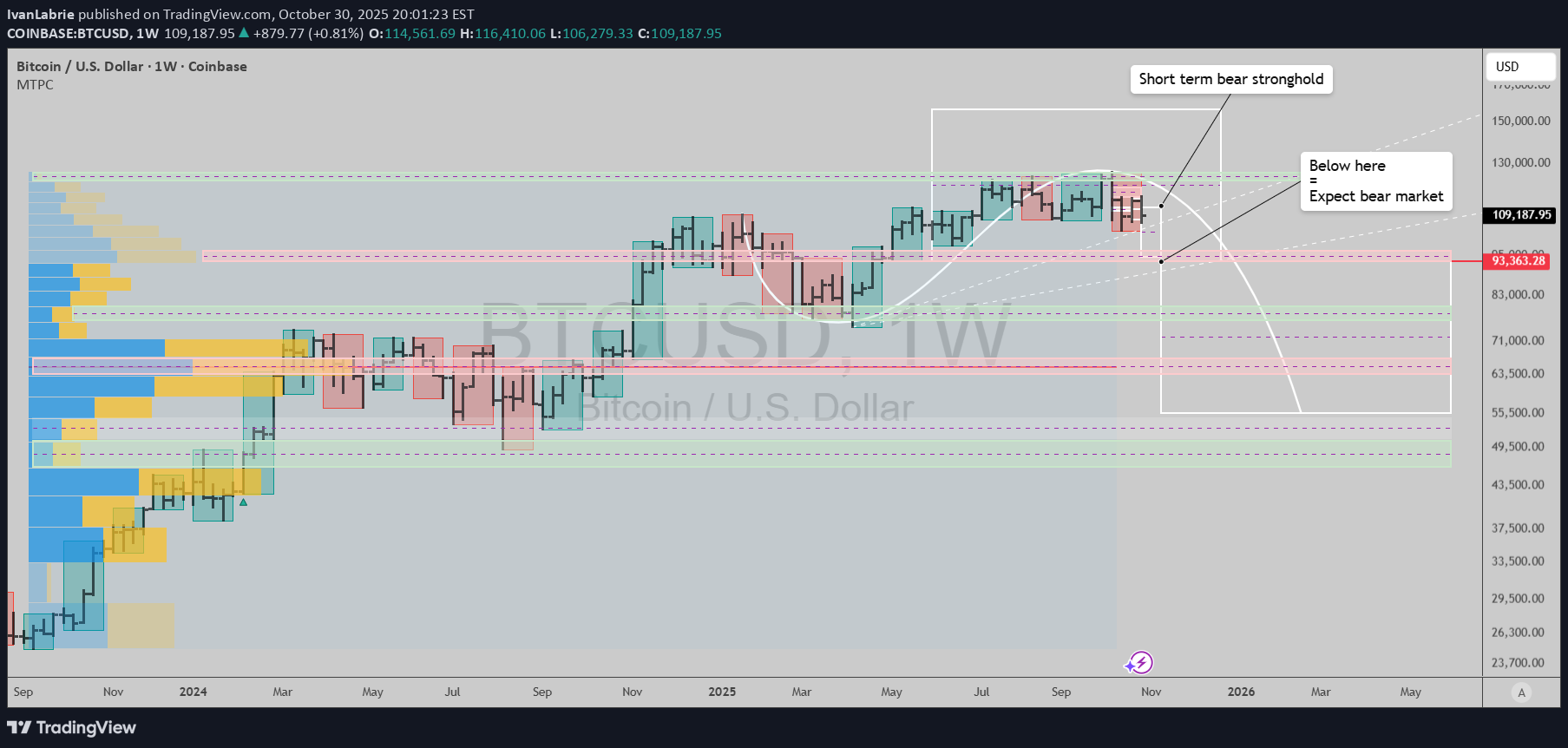

احتمال سقوط بیتکوین تا ۵۶ هزار دلار؛ آیا روند نزولی آغاز شده است؟

GN gents, Observe the key levels on chart: bears are in control short term, if price falls from here, it can easily tag the 93-94k area, as long as below $112k, give or take. If this is the case, downside to $56k becomes a distinct possibility by mid 2026. I've taken the necessary precautions to be capable of surviving such a scenario, while still being hedged in case of sudden onset of bullishness. Crossing fingers! Cheers, Ivan Labrie.1st big support at 80k held so far...I'm gonna DCA into high conviction crypto long term longs from here onwards.

IvanLabrie

IvanLabrie

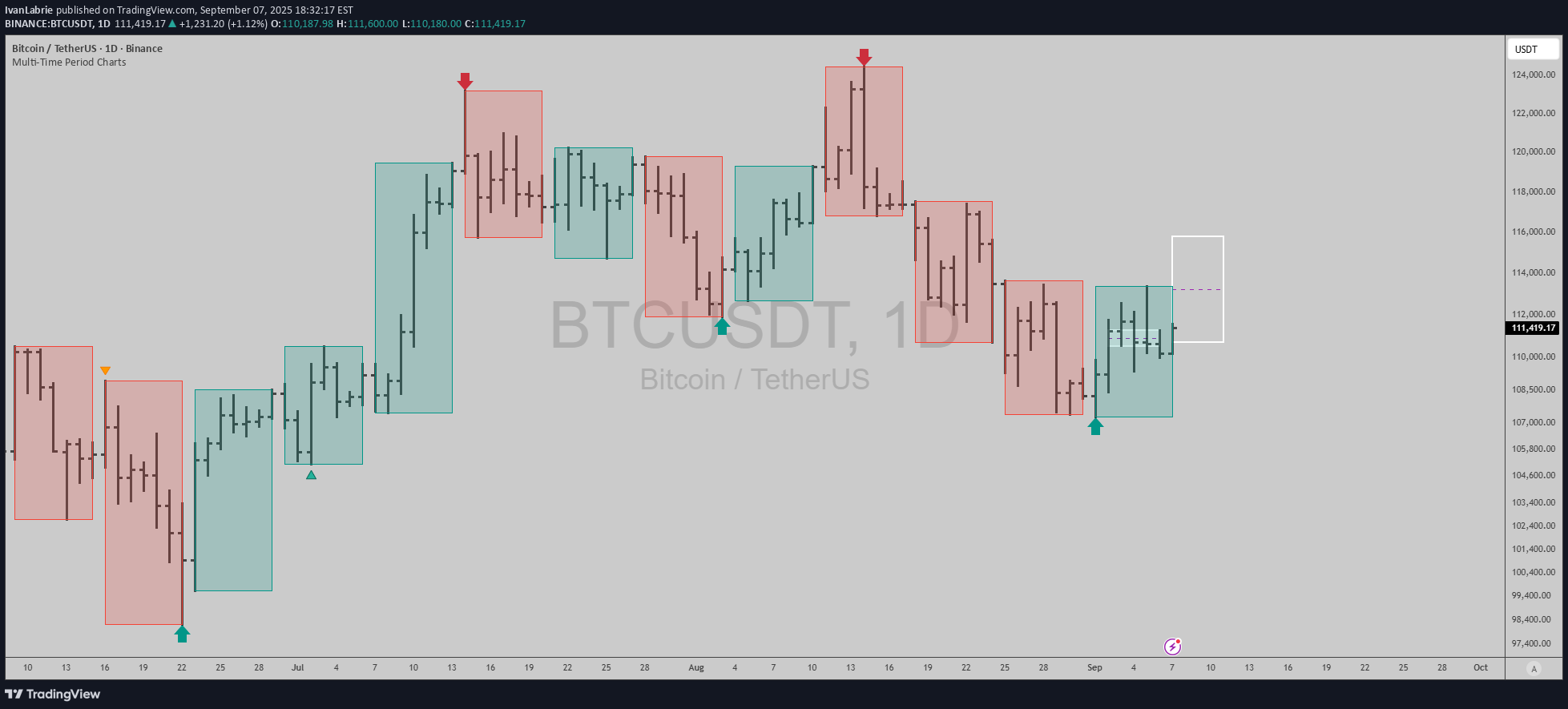

BTCUSD: Correction is over with high probability...

The daily timeframe is flashing a buy signal, likely signifying that the correction in crypto is over with 60%+ chance. Best of luck! Cheers, Ivan Labrie.

IvanLabrie

$AAPL: +57% in 2 years or less

Long term trend will confirm this quarter, nice catalyst with the events that took place a week ago after the latest earnings report: Tim Cook held a rare all hands meeting telling employees the following: The AI revolution is “as big or bigger” than the internet, smartphones, cloud computing and apps. “Apple must do this. Apple will do this. This is sort of ours to grab”. Check out the historical track record of quarterly trend signals in the chart, every single damn one of them worked. Best of luck! Cheers, Ivan Labrie.

IvanLabrie

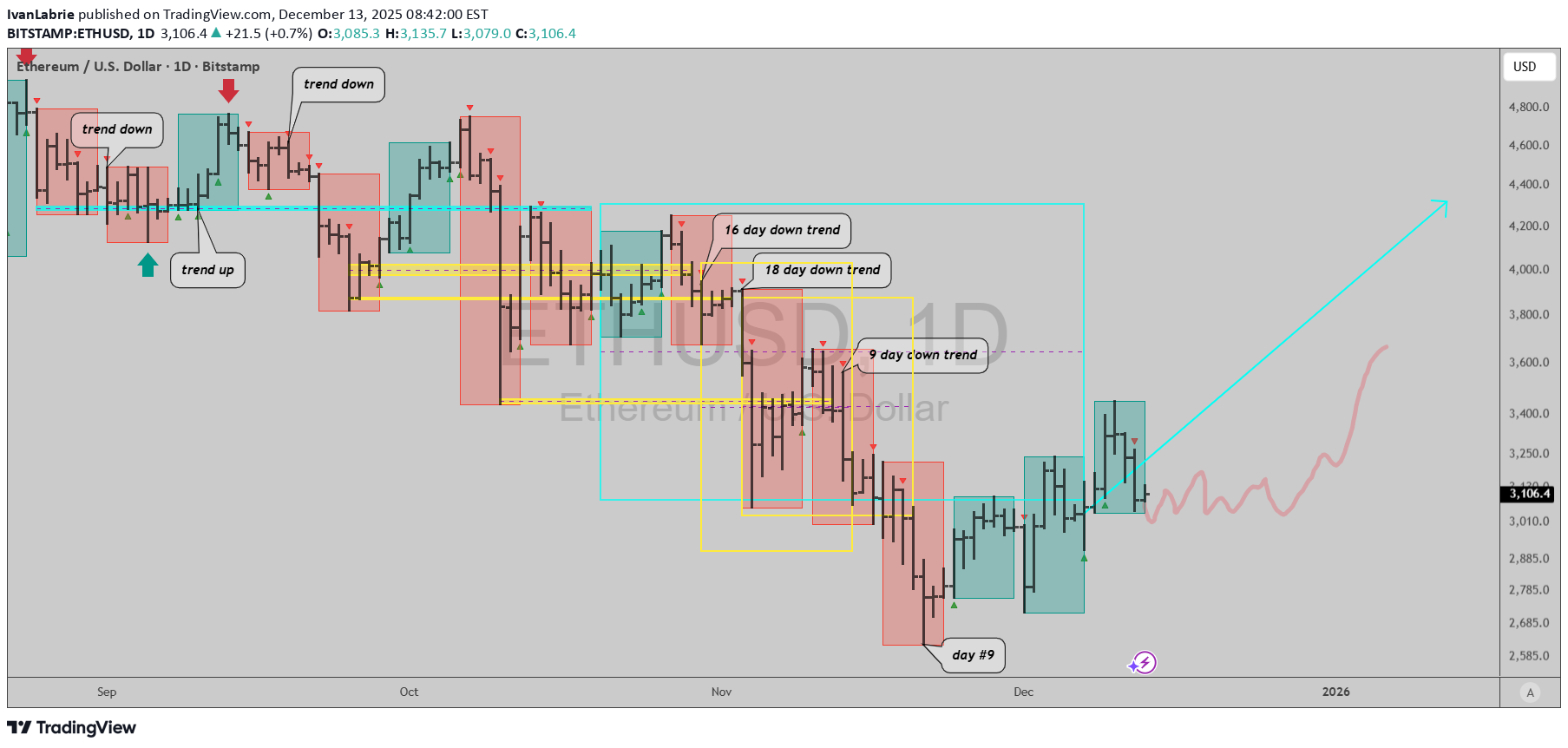

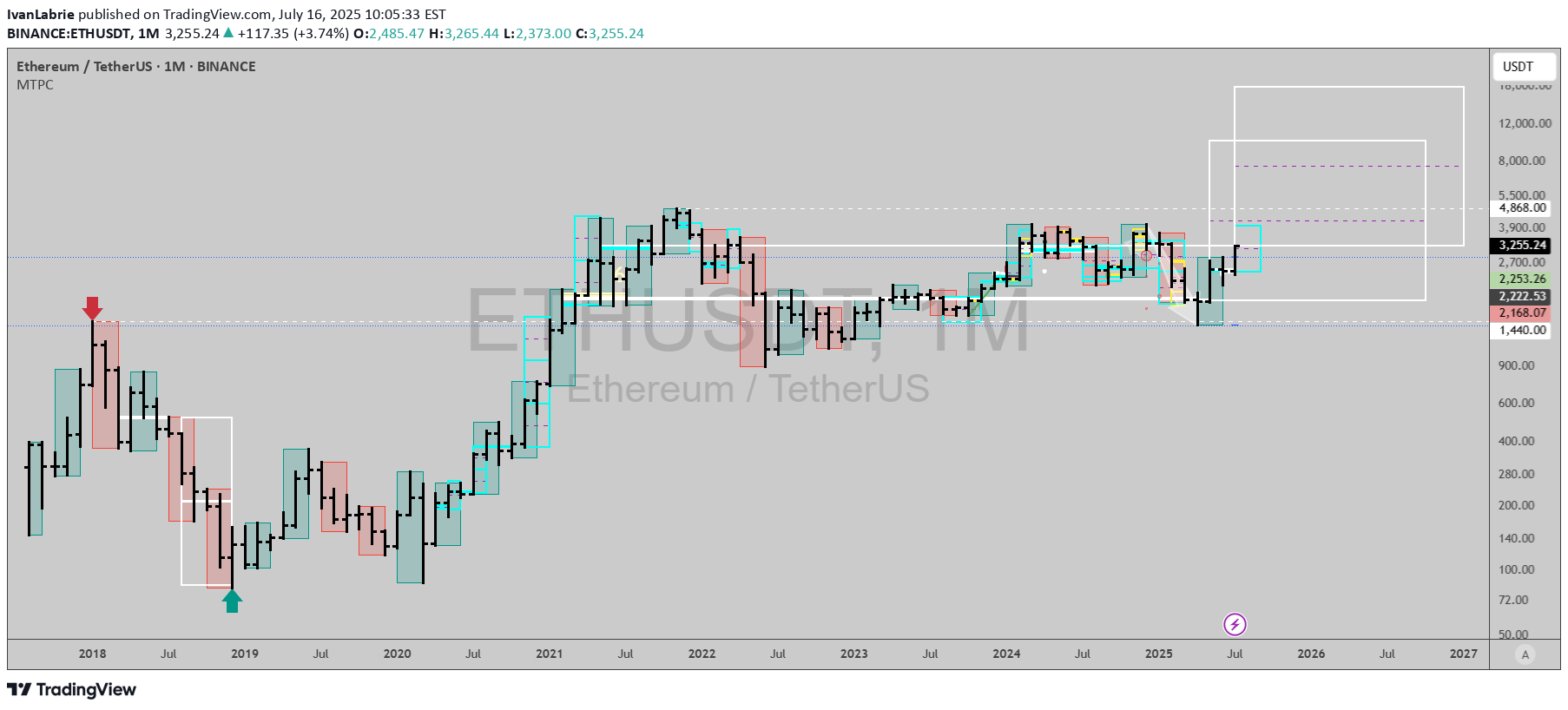

$ETHUSD: Long term trend and cup and handle pattern...

Ethereum is finally very close to breaking out into a new 52wk high following a long term basing pattern that looks like a classic cup and handle. Timemode signals warned us of its bullishness earlier, as the daily, weekly, monthly and now quarterly trends turned bullish one after the other since April this year. If you're sidelined or short, join the bulls and go long ASAP. Risk is a drop under $1715 for the long term patterns at play here, projected targets range from 10k to 95k long term. Fundamentals as you probably know favor a massive bullish trend as ETH transaction count breaks ATH, institutions race to acquire more ETH day to day, ETF flows are steadily bullish and regulations have become favorable for the growth of defi via stablecoin and RWA adoption, as well as potential for new defi primitives and existing ones to gain traction with widespread use. Ethereum defi now is secure and solid enough, and can handle the required throughput, and the wheels are in motion for a spectacular move from here. Best of luck! Cheers, Ivan Labrie.*Forgot to mention 401k's, another 30b+ of demand entering the fold.

IvanLabrie

$ETHUSDT: Time at mode trend signal

Monthly chart signal gives me a 17,975 United States of America Dollars per Vitalik Coin target🎯, within 19 months from now... I don't think many people can fathom this but it is entirely possible, and probable now. (few bulls and those bullish mention 10k as a target, but nothing as high as this) Best of luck! Cheers, Ivan Labrie.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.