mahshiddadashzadeh

@t_mahshiddadashzadeh

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

mahshiddadashzadeh

LINK Mid‑Term 129% Potential Return After Major Correction

Body: In the mid term, this cryptocurrency has the potential to deliver a 129% return. The price has completed a 56% correction and has now reached a key long‑term annual level where previous resistance has turned into support. We expect the price to consolidate with some negative ranging around this support zone before resuming its upward movement. Mid‑Term Target: $22

mahshiddadashzadeh

BNB Analysis Long‑Term Perspective

BNB Analysis | Long‑Term Perspective BNB is currently trading near a key support level at 845 845 ,with secondary support zone around 823. From a price‑structure standpoint, this area represents a favorable zone for long‑term investment. As long as these support levels hold, the broader long‑term trend remains bullish. Short‑term volatility is natural, but within a long‑term framework, such pullbacks can provide additional opportunities for gradual accumulation.

mahshiddadashzadeh

Solana Analysis | Strong Demand Zone and 145% Long‑Term Upside

Solana remains one of the most closely watched cryptocurrencies by market participants. Price has reacted multiple times from the 111 – 111– 117 support zone, as well as the $95 swing low, confirming strong buying interest in this area. Based on the long‑term structure, a potential move toward $270 is projected, representing approximately 145% upside from current levels.

mahshiddadashzadeh

Bitcoin Outlook | Institutional Interest & Weekly Support

With the Federal Reserve moving toward interest rate cuts, Bitcoin could regain the attention of institutional investors. At the same time, after a 35% correction across altcoins, investor preference within the crypto market has shifted back toward Bitcoin. From a technical perspective, the weekly timeframe reaction to the Kumo (Senkou Span B) support is a key level to monitor. If this area is confirmed as a resistance‑to‑support flip, it would strengthen the long‑term bullish structure. Under this scenario, Bitcoin could resume its upward trend, potentially targeting higher levels during 2026, or even earlier in the first months of the year.

mahshiddadashzadeh

High-Demand Zone and 2026 Growth Outlook

From a long-term perspective, Solana is currently trading within a strong and high-demand zone between 105 𝑎𝑛𝑑 105and 114. Based on this long-term structure, a 115% upside potential is projected for 2026. This upward path may be accompanied by minor corrective pullbacks, however the overall long-term bias remains bullish as long as price holds within this demand zone.

mahshiddadashzadeh

تحلیل هفتگی یونی (UNI): آیا فرصت خرید در حمایت 4.8 دلار آغاز شده است؟

On the weekly timeframe, UNI has undergone a deep corrective phase and is now trading at a level worth close monitoring. From a broader market perspective, this structure suggests that altcoins may be entering a mid-term investment opportunity phase. As long as the current price level holds, spot-based positioning becomes favorable. A strong support zone is identified at 4.8 and maintaining this level could allow UNI to initiate a recovery move toward the first upside target 7 $

mahshiddadashzadeh

بیتکوین در آستانه ریزش؟ حمایت داینامیک 4 ساعته در معرض خطر!

On the 4 hour timeframe Bitcoin is facing a key resistance at 94334 USD and is currently moving along a dynamic support line. If this support is broken the next strong support is located around 84000 USD which could be suitable for swing trading and potential long setups.

mahshiddadashzadeh

UNI at Critical Support: No Breakout Below the Flat Kumo

Support: 5.12 Resistance: 5.91 – 5.98 Price is still trading below the flat Kumo cloud, which means we shouldn’t expect a meaningful bullish move until UNI can close and hold above the cloud. But from a mid‑term investment perspective, this zone is still acceptable because the broader structure hasn’t broken down.

mahshiddadashzadeh

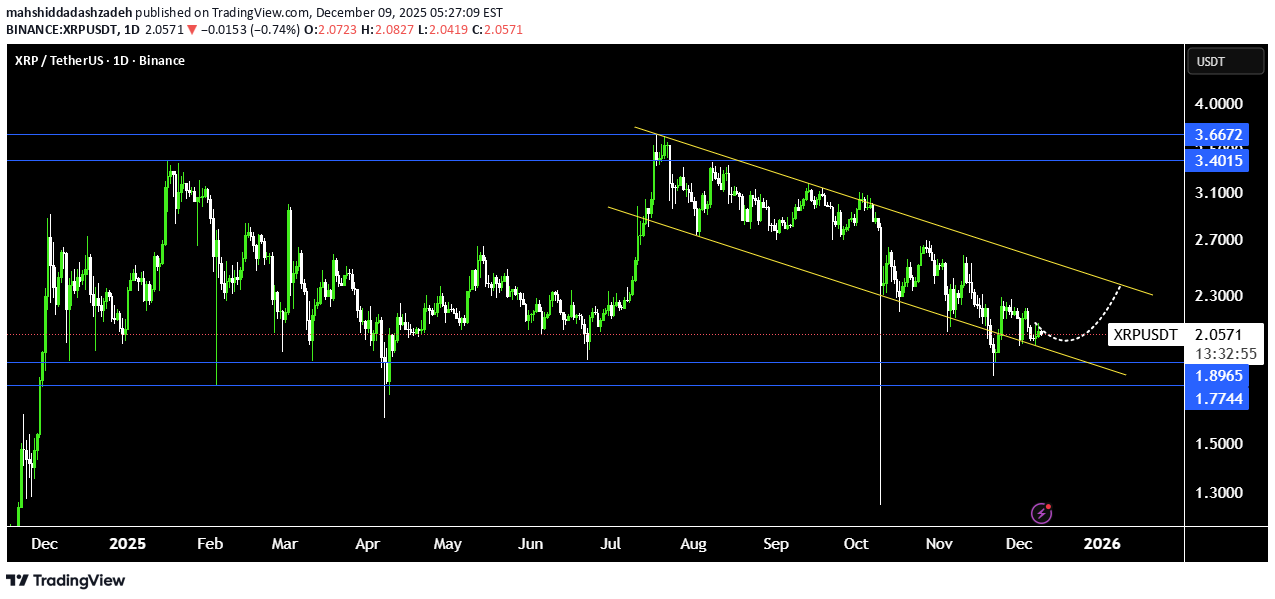

Testing Its Long-Term Support Zone Inside a Descending Channel

XRP | Key Long-Term Support Zone Near 1.89 – 1.89– 1.77 The structure of this market says: XRP is still fluctuating inside a descending channel. The long-term support range at 1.8965- 1.8965 1.7744 has been tested several times and remains the main line holding the structure together. As long as this zone holds, a short-term rebound toward the channel’s dynamic resistance remains possible. Failure to defend this support, however, would confirm a continuation of the bearish structure.

mahshiddadashzadeh

Ethereum Holding Above Support Zone, Waiting for Breakout

🟣 Ethereum – Long‑Term Technical Overview Ethereum, the leading altcoin, is currently oscillating within a moderately ascending channel from a long‑term perspective. Although it hasn’t matched Bitcoin’s scale of growth, its structure remains attractive for swing and short‑term traders. From a classical technical standpoint: Key Support Zone: $2,348 – $2,150 Major Resistance: $4,058 A sustained breakout above $4,058 is essential for confirming any long‑term bullish continuation. If a deep correction occurs, the likely reaction point will be around the lower boundary of the ascending channel, rather than a structural breakdown. 📊 Summary: Ethereum is consolidating inside a controlled upward path — suitable for tactical trading setups, but not yet showing confirmed momentum for a strong trend expansion.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.