minno91

@t_minno91

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

minno91

BTCUSDT - Upper-Range Fade

A) Market Summary BTC is spending the morning hovering around 88.6–88.9k, basically doing cardio without going anywhere. Intraday range so far: 87.5k low → 88.9k high, slightly green day after yesterday’s close near 88k. The vibe? 👉 Post-New-Year indecision. 👉 Everyone waiting for a breakout… 👉 90k still acting like a bouncer with a very strict guest list. Below 87k sits the first “oh no” intraday support. Until one of these breaks, BTC is just ping-ponging inside the box. ⸻ B) Trade Decision ✅ Intraday trade available Yes, we trade boredom too. ⸻ C) Setup – Range Fade Short @ 88.9–89.3k Because when the market refuses to trend, you fade the edges. •Direction: Short (mean-reversion, not a heroic top call) •Entry (limit): 88,900 – 89,300 (aka “just below where Twitter gets bullish”) •Stop-loss: 90,200 (Above short-liq heaven and fake-breakout territory) •Take-profit: •TP1: 88,000 (pay yourself, feel good) •TP2: 87,400 (pay yourself again, feel smarter) •R:R: ~1 : 2.0 – 1 : 2.5 •Time validity: Today only, until end of US session (~22:00 CET) After that → this trade turns into a pumpkin 🎃 ⸻ D) Trade Logic (Why This Isn’t Random Gambling) Macro context •No FOMC. No NFP. No Powell jump-scares. •Post-holiday sentiment is mildly optimistic, but not “send it” bullish. •Translation: price respects levels, not headlines. ⸻ Market structure & liquidity •BTC has been stuck between ~87k support and ~90k resistance for days. •Today’s high at 88.9k sits right under the 90k short-liq danger zone. •Until 87.5k breaks, structure = range, not trend. This setup is simply: 👉 Sell the ceiling, 👉 Buy it back closer to the floor. Not sexy. Just effective. ⸻ Derivatives & positioning •BTC futures open interest dropped ~5% into year-end and is only slowly rebuilding. •This is a post-leverage hangover environment, not a squeeze factory. •Less fuel for a violent breakout → more room for range fades. Bonus: Recent liquidations were not massive, meaning the 90k short-liq cluster is still juicy and untouched. ⸻ Order book – confirmation / warning signs •Aggregated L2/L3 data shows: •Asks stacked above 89k •Real bids waiting lower near 88k → 87.5k That’s textbook fade conditions. ⚠️ Warning: •If a fat bid wall suddenly camps at 89k and absorbs everything → this short idea gets demoted to “nice try”. Right now though, 90k looks more like supply than support. ⸻ E) Invalidation Rules (How Not to Die on a Hill) Price-based •Hard invalidation: •15M close above 90,200 •Or a fast, impulsive move above 90.5k with volume and no rejection At that point, this is no longer a fade — it’s a breakout audition. You exit. You don’t argue. •If price never reaches 88.9–89.3k → no trade. Do not short the middle of the range like a bored raccoon. ⸻ Time-based •Valid only today. •After 22:00 CET: •Either TP/SL hit •Or close manually and sleep like a responsible adult No overnight “hopium holds”. ⸻ Macro-based •Surprise ETF headlines, regulation bombs, or major hacks? •Instantly changes the game. •In that case: close first, think later. ⸻ Order-book-based •Strong, persistent bid absorption at 88.9–89.3k → skip or exit. •Spoof asks above 89k + fast wick rejection → good fade confirmation. •Clean acceptance above 90k → hands off, no revenge trades

minno91

BTCUSDT – 90k Liquidity Fade

A) Market Summary BTC is back in calmer waters around 88–90k after the weekend flush did its job and cleaned out most downside liquidation clusters below 85k. With weak hands already rinsed, price is now naturally gravitating back toward the 90k resistance / liquidity magnet. Derivatives remain large but not euphoric — no fresh parabolic OI expansion. Instead, this looks like continued deleveraging digestion after recent flash-crash episodes, not the start of a new impulsive leg. Translation: the market is tired, not dead. ⸻ B) Trade Decision A slightly aggressive short fade near 90k, only if price taps into the liquidity zone. No chase, no early shorts, no hero trades. ⸻ C) Intraday Setup (Only on 89.8–90.5k Test) •Direction: Short •Entry (limit zone): 89,800 – 90,200 •Stop-loss: Above 91,200 (Above the nearest visible upside liquidity block) Targets: •TP1: 88,300 – 88,800 •TP2: 86,800 – 87,200 •R:R: ~1 : 2.0 – 1 : 2.5 •Time validity: Today’s EU + US session only After 22:00 CET → setup expires ⸻ D) Trade Logic (Why Fading 90k Makes Sense Here) •Macro context: Today’s macro calendar is relatively light — no FOMC, no NFP, no nuclear-grade data. That shifts intraday price action back toward derivatives positioning, ETF flows, and local order flow, rather than macro shocks. •Market structure & liquidity: After the recent flush, BTC is holding above ~85.5k, a key demand / MA zone referenced in prior analyses. Price is now oscillating below 90k, a level that historically struggles to hold closes. This is a textbook range-top environment, ideal for a mean-reversion fade, not blind breakout chasing. •Liquidation dynamics: The 84.5–85.5k downside liquidation cluster has already been fully swept. The next major liquidity magnet sits at 89.8–90.2k, directly above current price — a natural intraday target for stop-hunts before a pullback. •Derivatives & positioning: Open interest remains elevated but is no longer expanding aggressively after Q4 deleveraging. A push into 90k is therefore more likely to overload late longs and trigger a short-term squeeze, which provides fuel for a fade, not confirmation of a new trend leg. •Order book – confirmation / warning: On Binance BTCUSDT, watch for: •Stable sell walls •Absorption of aggressive market buys around 89.8–90.2k That behavior supports the fade thesis. If instead: •Ask walls get pulled •Hidden bids step in aggressively above 89k → this is likely continuation / breakout behavior, not a fade. Step aside. ⸻ E) Invalidation Rules (When the Short Is Wrong) Price-based •The intraday short is invalid if BTC holds a 15M / 1H close above 91,200 and starts printing higher lows above 90k. That means 90k is no longer a liquidity trap — it’s turning into support. Time-based •If 89.8–90.5k is never tested today and BTC stays stuck in the 87–89k mid-range, the setup expires. No auto-carry to tomorrow — heatmaps and OI can change overnight. Macro-based •Any unexpected macro headline (Fed commentary, ETF regulation news, major geopolitical shock) that spikes volatility → pause the plan. In those moments, 90k can flip from fade zone to launchpad. Order-book-based •If, at 90k, large ask walls disappear and the book flips into a strong bid imbalance, the short is invalid. •If already filled and you see persistent aggressive buying absorbing every dip, reduce risk quickly or exit. ⸻ Risk Management Note For this single fade setup, risk is best capped at ~0.5–0.7% of account. That keeps dry powder available in case the US session delivers a cleaner second opportunity. ⸻ Bottom line: 90k is a liquidity magnet, not a guaranteed ceiling — but until proven otherwise, it’s a sell-the-reaction level, not a place to FOMO long. Fade smart. Respect invalidation. Let the market prove you wrong — not your ego.

minno91

بیت کوین در تعطیلات: ترید کمحجم با انتظار پایین؛ ورود به محدوده 85,600!

A) Market Summary BTC is trading around 87.2k during the European morning, once again chilling in the 85–90k “gamma prison” after yesterday’s data delivered exactly… nothing. Most global markets are on holiday mode (or running half-days), meaning: •thinner liquidity •more algos •fewer real humans The only US data point today is Initial Jobless Claims at 14:30 CET — not top-tier macro, but in a thin market it can still create ugly wicks. Conclusion: this is a slow, boring, range day — perfect for one clean trade, terrible for overtrading. ⸻ B) Trade Decision ✅ Intraday trade available But only as a low-frequency, holiday mean-reversion setup with reduced risk. No scalping frenzy. One shot. If it doesn’t trigger — fine. ⸻ C) Intraday Setup (BTCUSDT Perps) •Direction: Long •Entry (limit): 85,600 •Stop-loss: 84,900 (Below today’s sweep low + key 5M/15M swing) •Take-profit: 87,800 •R:R: ~3 : 1 Time Rules (holiday discipline): •Limit valid until 14:00 CET •If filled, position must be closed or SL moved to BE by 14:20 CET •No exposure into 14:30 CET Jobless Claims ⸻ D) Trade Logic (Why This Makes Sense on a Boring Day) •Macro context: Holiday trading = lower volume, higher algo participation, and more exaggerated wicks. That favors a single pre-event range trade, not multiple scalps. Jobless Claims are medium-impact, but in thin liquidity they can still spike price hard. •Market structure & liquidity: On 4H / 1H, BTC continues to oscillate cleanly inside the 85–90k range, with repeated failures at 90k and consistent reactions from 85–86k. The 85.6k entry sits slightly below the middle of this support zone — exactly where buyers have already stepped in twice. •Gamma & options context: From recent sessions, 85k acts as a gamma / options support area, reinforcing the idea that quick dips below 86k tend to get pulled back toward 87–88k rather than cascade lower. •Derivatives & positioning: BTC open interest remains elevated, but there have been no major OI shocks in the last 24h. After recent liquidations, leverage is somewhat cleaner — reducing the probability of an immediate waterfall through 85k. •Liquidation dynamics: Liquidation heatmaps show long-liq clusters around 85–86k, with short-liq clusters above 90k. This setup aims to catch a liquidity sweep of weak longs, followed by a move back toward mid-range. •Order book (confirmation only): Before entry, Binance/Bybit should still show layered bids at 85.4–85.8k, with relatively light asks up to 87.5–88k. That structure supports absorption of a market-sell flush and a bounce. ⸻ E) Invalidation Rules (When to Walk Away) Price-based •If a 15M candle closes below 84,900, the idea is invalid. Support failed, gamma defense is gone — respect the stop. •If BTC rallies directly above 88.8–89k without dipping to 85.6k, cancel the limit. Context flips to high-range trading, not a bottom sweep. Time-based •Auto-cancel the limit at 14:00 CET. •If in the trade and price can’t reach 87.2–87.4k by 14:20 CET, close manually. No holding even small PnL through data. Macro-based •Any unexpected Fed / geopolitical headline before 14:30 CET with strong DXY or index movement → don’t enter; if already in, reduce risk immediately (partial or BE). Order-book-based •Do not take the trade if bids disappear near 85.6k and large static ask walls build between 86–87k — that directly contradicts the bounce thesis. •Exit immediately if, after entry, you see aggressive market sells slicing through 85k on thin bids with no absorption. That’s a real breakdown, not a sweep. ⸻ Final Note This is a holiday trade: •low expectations •low frequency •clean execution If it works — great. If it doesn’t trigger — even better. Preserving capital on boring days is a win.

minno91

معامله سریع بیت کوین: شکار نقدینگی قبل از دادههای بزرگ آمریکا!

A) Market Summary BTC is trading around 88.5–89k early Tuesday after getting rejected at 90k (again). Price is stuck inside a wide daily range of 84–95k, basically doing cardio but going nowhere. At 14:30 CET, we get the US macro triple boss fight: •GDP (2nd estimate) •Durable Goods Orders •Corporate Profits Translation: wick city. Big candles, fakeouts, chaos. This is not a “hold and pray” day — it’s a quick liquidity trade before the storm. ⸻ B) Trade Decision ✅ Intraday trade available A conservative mean-reversion long from a liquidity pocket below Asia lows, with a hard time stop before 14:30 CET. We take the bounce — we do not marry the position. ⸻ C) Intraday Setup (BTCUSDT Perps – Binance / Bybit) •Direction: Long •Entry (limit): 87,000 •Stop-loss: 85,600 •Take-profit: 89,800 •R:R: ~2 : 1 Time Rules (non-negotiable): •Limit valid until 14:00 CET •If filled, position must be closed or SL moved to BE by 14:20 CET •No exposure into 14:30 CET macro roulette ⸻ D) Trade Logic (Why This Isn’t Random Gambling) •Macro context (the clock matters): Today’s US data regularly causes violent moves in DXY, yields, and BTC. This trade is designed as a pre-event technical play, not a hero trade through news. •Structure & liquidity: BTC is sitting in the middle of a multi-week range (84–95k). 4H / 1H structure shows lower highs below 90k, with a well-defined support zone around 86.5–87.5k — exactly where short-term long stops are hiding. •Derivatives & liquidations: CoinGlass shows BTC futures OI around $58–60B — still elevated, but partially reset. This favors an intraday stop-hunt rather than a full trend shift. Liquidation heatmap highlights long-liq clusters at 86.5–87.5k, while short-liq clusters sit above 92k. •Funding & sentiment: Funding is slightly positive to neutral, sentiment cautious rather than euphoric. That’s ideal for range behavior: flush liquidity → bounce → back to balance. •Order book (confirmation only): Binance & Bybit order books show stacked bids around 86.8–87.3k and solid asks near 89.5–90k. This supports a scenario where a dip into 87k gets absorbed, followed by a push back toward the sell walls. ⸻ E) Invalidation Rules (Read This Before You Click Buy) Price-based •Setup is invalid if a 1H candle closes below 85,500 → Liquidity support failed, risk shifts toward 84k or lower. •Cancel the 87k limit if BTC breaks and holds above 90,500 on 1H → Context flips to breakout, not mean reversion. Time-based •If the 87k limit is not filled by 14:00 CET, cancel it. •If in the trade and price fails to bounce above 88.5k by 14:20 CET, close manually. We do not babysit trades into macro spikes. Macro-based •Any surprise macro headline (Fed comment, geopolitical shock) before 14:30 CET with aggressive DXY/index moves → trade is invalid, reduce or don’t enter. Order-book-based •Before entry: If bid clusters near 87k disappear and large asks stack aggressively above price → do not enter. •After entry: If price taps 87k, order book stays thin, and BTC slices through 86k with volume → respect the SL. No moving stops. No adding. No coping. ⸻ Final Thought This is a “touch the liquidity, grab the bounce, get out” type of trade. We’re trading time + structure, not vibes. Fast in, fast out — and flat before the fireworks 🎆closed early as part of the plan

minno91

BTCUSDT – Swing Long on the Dip?

Market Overview Last week (Dec 15–19) was macro-heavy, with the most important events (US CPI + central banks) already behind us. Today feels more like a cool-down day — lighter data, comments only, no new “market killer” on the calendar. The base macro narrative remains soft landing + cooling inflation, which is generally a friendly environment for risk assets. Bull-market peak indicators on Coinglass are still quiet — none of the major top signals are active. In other words: no historical signs of a cycle top yet. ETF flows remain a big positive. Total cumulative inflows are still massive (~$57–58B), and even though short-term flows are choppy, we continue to see strong dip-buying days (e.g. +$436.9M on Dec 17). Big money hasn’t left the room. On the derivatives side, open interest has been reset without a crash in spot demand. Leverage got cleaned, funding is neutral, and the market looks healthy, not euphoric. TL;DR: BTC is still in a bull market, currently going through a normal correction inside the trend. This is a dip-buying environment, not a “short the cycle” one. ⸻ BTCUSDT – Swing Trade Plan •Direction: Long •Entry zone: $80,500 – $82,000 •Stop-loss: $77,000 – $77,500 •Target 1: $92,000 – $93,000 •Target 2 (optional): $100,000+ •Holding time: 2–6 weeks ⸻ Why This Setup Makes Sense •Cycle context: No bull-market top signals, no extreme sentiment, no valuation excesses. Historically, this is where buying deeper pullbacks works best. •Macro backdrop: CPI and central banks are behind us for now, inflation is cooling, and the soft-landing narrative is intact. That’s usually supportive for BTC, not bearish. •ETF demand: Every meaningful dip keeps getting absorbed by institutional flows. Short-term noise, long-term demand. •Leverage reset: Open interest dropped, funding cooled off — the market is no longer crowded. This reduces downside risk and improves R:R for swing longs. •Structure & levels: The $80.5k–$82k zone aligns with HTF support and offers clean R:R toward the upper range. Stop below $77k protects against a deeper correction without overstaying the trade. ⸻ Invalidation – When This Idea Is Wrong •Trend invalidation: Daily or weekly closes below ~$77k with strong volume + clear shift to risk-off macro (hawkish data, rising DXY) → swing long invalid. •Structure invalidation: If BTC can’t reclaim $90–92k within 4–6 weeks and starts printing lower highs / lower lows on daily, the setup loses momentum. •Macro invalidation: Ahead of new CPI / PCE / FOMC, avoid adding risk. If macro expectations turn clearly hawkish, protecting capital comes first. ⸻ Final note: This is a buy-the-dip swing idea inside a bull market, not a moon bet and not financial advice. Risk management stays king.

minno91

ETHUSDT - Intraday Long From Range Low?

Alright traders, this one is a conservative intraday idea, not a YOLO moon mission. After yesterday’s CPI pre-washout, ETH looks like it still wants to respect the range before doing anything dramatic. I’m not expecting an instant breakdown to 2,700 — more like one more visit to the lower part of the range, and then a bounce. Market Context (Big Picture, No Panic) On the W/D timeframe, ETH is still in a correction inside a broader bull cycle. We’re well above the early-year lows, but also below the last swing high around 3.3k. On-chain + ETF data still look healthy: •increasing treasury / ETF holdings •no signs of cycle euphoria •sentiment is fear, not hype Which usually means: mean-reversion works better than aggressive breakdown bets, unless we’re at extreme levels. Intraday-wise (4H–15M): ETH is chopping in a 2,800–2,900 range. •wicks below 2,800 get bought fast •moves above 2,900 get sold Classic range behavior. ⸻ The Trade Plan (Simple and Boring — the Good Kind) •Direction: ETHUSDT long •Entry (limit): 2,820 •Stop loss: 2,760 (below today’s low and the 2.8k support area) •Take profit: 2,950 (below 1H resistance and the top of the range) Risk is about 60 points, potential reward about 130 points, so roughly R:R = 1:2.2. Not sexy, but very tradable. This setup is valid only until ~14:30 CET. After that, CPI and US data can completely rewrite the structure — and I’d rather be flat than heroic. ⸻ Why This Makes Sense (At Least to Me 😄) •The market is in full “waiting for CPI” mode •Fear dominates sentiment •After a vertical dump, ETH is absorbing sell pressure, not accelerating lower •Rising volume on lower wicks suggests buyers stepping in, not panic continuation A long from 2,820 gives us a clean shot at another reversion leg toward the mid-to-upper range. If price breaks below 2,760, the idea is invalid — that likely opens the door to the 2,700–2,750 liquidity zone, and that’s a different trade, not a reason to hope harder. ⸻ Trade Management Rules (No Negotiation) •Entry only via limit near 2,820 •If ETH runs straight above ~2,890 without a pullback → setup is invalid •If price quickly tags 2,930–2,950 before CPI, take the profit and walk away •No averaging, no forcing, no attachment This is an intraday range play — not a belief system. ⸻ Let’s see if ETH respects the range one more time before macro chaos takes over. Trade safe, manage risk, and let the market do the heavy lifting 📊🚀

minno91

BTCUSDT - Intraday Long From Demand Zone?

Alright traders, here’s a clean intraday idea — no moon talk, no hopium overdose, just logic. BTC is currently chilling in a sideways range between 85k–90k after the recent correction. On-chain and bull-market indicators are still far from anything euphoric, so no signs of a cycle top panic just yet. Also worth noting: Yesterday we saw strong ETF inflows (~457M USD), which fits nicely into the classic “buy the dip, ask questions later” narrative. Now the fun part — liquidity. Coinglass is showing: •long liquidity stacked below around 84–85k •heavy short liquidity above in the 89–92k zone, especially near 92–93k Which gives us the classic scenario: 👉 flush a bit lower 👉 grab liquidity 👉 squeeze higher into the short cluster ⸻ The Plan (Simple and Clean) I’m looking for a long from the demand zone around 85–86k. •Entry (limit): 85,700 •Stop loss: 84,700 (clean break below = likely move toward deeper 82k liquidity) •Target: 89,300 (first liquidity pocket below 90k) That gives us a very decent R:R around 1:3.5+, which is exactly what we want for intraday trades. This is purely a range mean-reversion play inside the 85–90k box, especially ahead of important macro data. ⸻ Important Rules (No Exceptions) •Limit order is valid only until 14:30 CET •If it doesn’t fill before macro → cancel the order •No averaging below 85k •Stop loss is respected, no hero trading This is an intraday idea, not a marriage proposal. ⸻ BTC does BTC things, macros do macro things, and liquidity does what it always does. Let’s see if the market plays the script this time. Trade safe, manage risk, and let the range do the work 📊🚀

minno91

HYPEUSDT - Probably Gone by the Time You Read This

Alright traders, this is one of those setups. Quick scalp… or quick dump… and honestly, it will probably be gone by the time I finish writing this analysis. 😅 But hey — let’s try it anyway. Macro just came out mixed, which usually means range mode activated. And when the market ranges, HYPE loves to do its little chaotic moves inside the box. So yeah: •fast idea •fast execution •zero attachment I don’t even have much time to explain this one properly, because it’s probably already moving as we speak. 😂 Quick analysis, quick decision, quick outcome. Enjoy — and good luck traders! 🚀📉😄

minno91

SOL - Taking the Baton from SUI

Alright traders, quick update from the battlefield. The SUI swing trade finished way faster than I expected — which is nice… but also suspicious. 😅 And now? SOL is stepping in with a very similar setup. Same vibes, same structure, same “this probably shouldn’t go lower” feeling. Today’s move looks like nothing more than a liquidity grab to me. Grab the stops, scare everyone, shake the tree. Tomorrow we’re getting better macro data, and if that lines up, we could easily rotate back into the range. Yes, I’m still counting on a little Santa rally 🎅 and yes, I want to be in the position early. Am I okay risking a few % of my account for it? Absolutely. That’s the price of being early — and sometimes wrong. 😄 Let’s see how SOL decides to behave. Good luck traders — and may Santa not skip crypto this year 🎅📈🚀

minno91

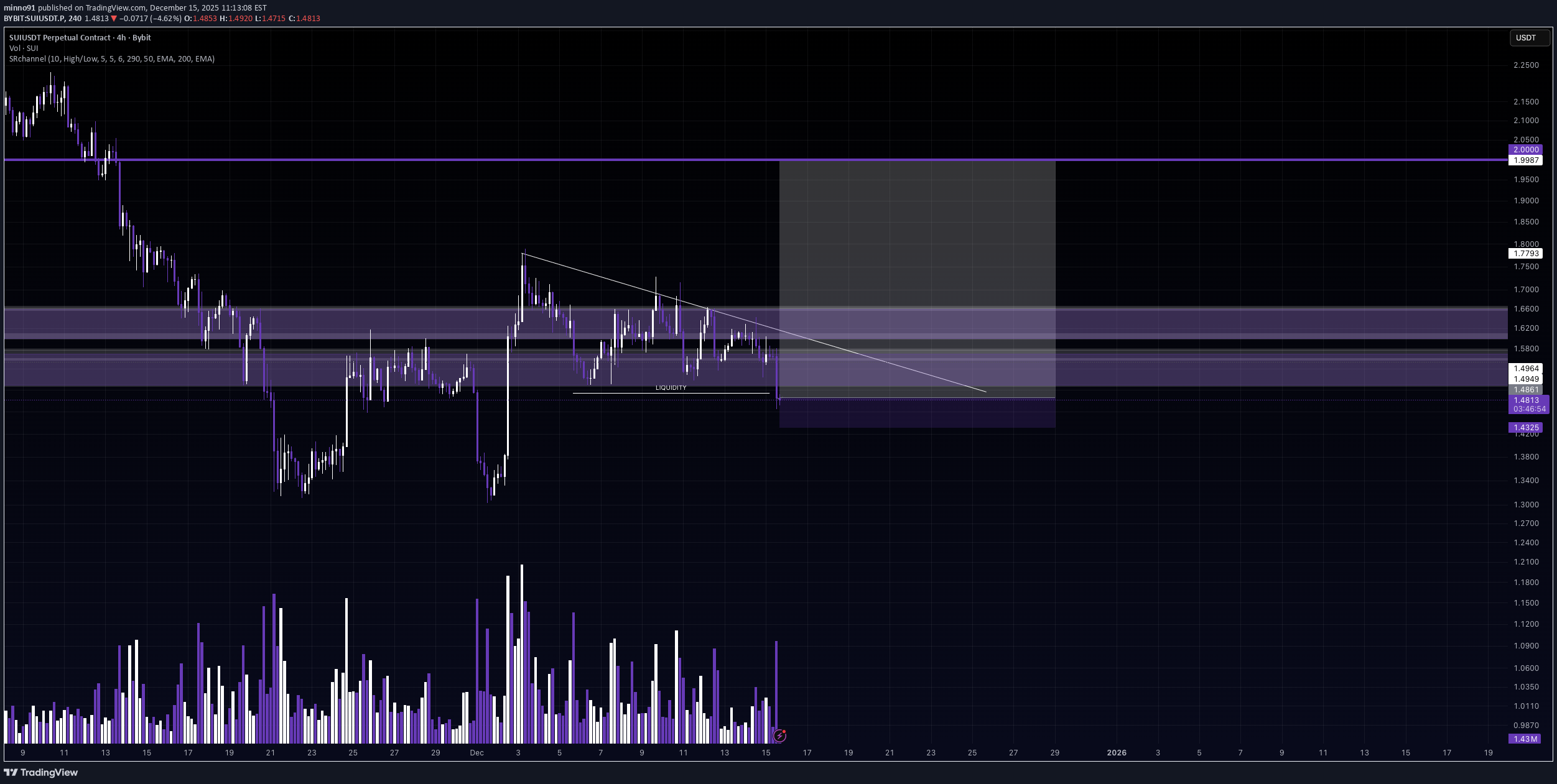

SUI - Catching a Falling Knife

Alright traders, we’re clearly seeing a selloff today… BUT — and this is very scientific — I just don’t feel it. 😄 Somewhere deep inside my trader soul, I still smell a little Santa rally coming for the whole crypto market. Either that… or Trump tweets something weird, and we’re all instantly screwed. 50/50. 🎅💥😂 Now about SUI: Yes, this is technically a falling knife situation. Yes, that sounds scary. But honestly? The probabilities here are not that bad. Why I’m taking it: •liquidity was already taken below •we had a nice upward move a few days back •continuation is still possible •and this whole drop kinda smells like pre-macro manipulation So yeah — this is a swing trade, BUT with a tight stop loss, because I like excitement, not account destruction. 😄 Could this fail? Absolutely. Could it work beautifully? Also yes. That’s crypto. Let’s see how this plays out. Good luck traders — and may the knife stop falling right where we catch it 🔪📈😄

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.