TUT

Tutorial

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Tutorial

سود 3 Months :

سیگنالهای Tutorial

Filter

Sort messages by

Trader Type

Time Frame

DragonCaoB

سیگنال خرید فوری: فرصت طلایی اسکالپ با اهرم سود 1 به 3.48!

🚀 Scalp Long – TUT Buying volume is rising sharply as price holds above a strong support zone. Price action suggests a potential move to retest the local high, while RSI has re-entered the buying region — indicating renewed bullish strength. 🎯 Trade Setup: Take Profit (TP): 0.02201 Stop Loss (SL): 0.01901 Risk/Reward Ratio (RR): 1 : 3.48 A clean long setup supported by increasing volume, strong support defense, and bullish momentum confirmation from RSI.

CryptoSkullSignal

$TUT/USDT is holding above a rising trendline with steady higher

$TUT/USDT is holding above a rising trendline with steady higher lows. Price is consolidating in a bullish structure, and the chart suggests a continuation toward $0.14+ if momentum holds. 📈

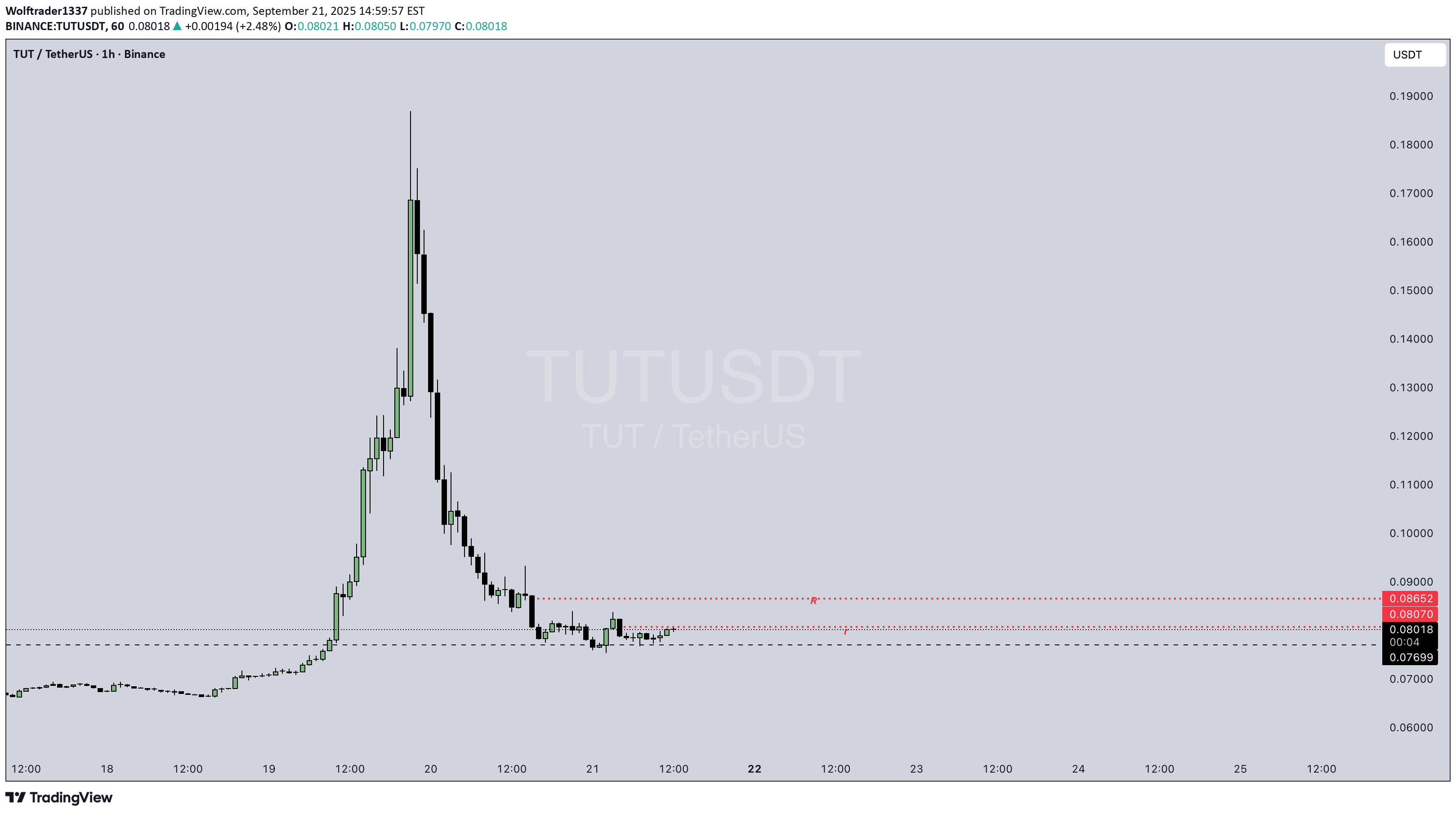

Wolftrader1337

Tut / Usdt

TUTUSDT Enjoy It And next target Set Disclaimer : Not Financial Advice.

Climate Change as a Global Trade Disruptor

1. Climate Change and Global Trade: The Interconnection Trade depends on geography, climate, and natural resources. Historically, favorable weather and fertile lands enabled agricultural exports, while stable oceans and rivers facilitated shipping routes. Climate change disrupts all three: Geography: Rising sea levels threaten coastal cities and ports, where nearly 90% of international trade passes through. Climate: Heatwaves, floods, and droughts directly impact agricultural yields and energy production. Natural Resources: Water scarcity and declining biodiversity affect commodity supply. In short, climate change doesn’t just affect the environment—it directly alters the conditions of trade. 2. Extreme Weather Events and Supply Chain Disruptions One of the most immediate trade-related consequences of climate change is the increase in extreme weather events. Hurricanes, cyclones, floods, and wildfires damage factories, ports, and transport infrastructure. Hurricane Katrina (2005): Shut down Gulf Coast oil refineries, sending global oil prices soaring. Thailand floods (2011): Disrupted automotive and electronics supply chains worldwide. Australia’s bushfires (2019–2020): Reduced coal exports and disrupted agriculture. Today’s supply chains are highly interdependent and globalized. A single event in one country can delay production worldwide. For example, flooding in Vietnam affects garment exports to Europe, while droughts in Brazil push up global coffee prices. Climate-induced supply chain shocks are becoming the new normal. This creates price volatility, inflationary pressures, and higher insurance premiums for shipping and logistics. 3. Agriculture and Food Security in Global Trade Agriculture is one of the most climate-sensitive sectors and a cornerstone of global trade. Crops like wheat, rice, coffee, and cocoa rely on predictable weather patterns. Climate change threatens this balance in multiple ways: Droughts in Africa: Reduce maize and sorghum yields, raising import dependency. Heat stress in India: Threatens rice and wheat production, impacting global food markets. Coffee production in Brazil & Vietnam: Faces declining suitable land due to rising temperatures. Food security becomes a trade issue when nations impose export bans to protect domestic supply. During the 2008 food crisis, countries like India and Vietnam restricted rice exports, causing prices to spike globally. Similar patterns may repeat more frequently as climate shocks worsen. This also affects agribusiness trade patterns. Countries that can adapt (through irrigation, genetic crop engineering, or technology) may dominate future food exports, while vulnerable regions face dependency and trade deficits. 4. Maritime Trade and the Impact on Shipping Around 80–90% of global trade moves by sea. Climate change is disrupting this backbone in several ways: Rising Sea Levels: Ports in Bangladesh, Miami, Rotterdam, and Shanghai face flooding risks. Hurricanes & Cyclones: More frequent storms damage ships and delay cargo. Melting Arctic Ice: While it opens new shipping routes (e.g., Northern Sea Route), it also creates geopolitical tensions and environmental hazards. Shallow Water Levels: Droughts in rivers like the Rhine (Europe) and Mississippi (U.S.) reduce shipping capacity. Insurance and shipping costs rise as companies face unpredictable risks. In turn, these higher costs filter down to consumers through inflation in global trade prices. 5. Energy Trade and Transition Energy is the engine of trade, but climate change is reshaping both supply and demand. Fossil Fuel Disruption: Rising storms affect offshore oil rigs. Droughts limit water needed for cooling in coal and nuclear plants. Heatwaves reduce energy efficiency in transportation. Green Energy Transition: Demand shifts toward renewable energy technologies (solar panels, wind turbines, EV batteries). Countries rich in critical minerals (lithium, cobalt, rare earths) gain new trade power. Nations dependent on fossil fuel exports (like Gulf countries) face future trade risks. Energy trade is entering a transitional phase, with climate change accelerating the shift toward renewables while simultaneously destabilizing fossil fuel-dependent economies. 6. Climate-Induced Migration and Labor Disruptions Climate change displaces millions of people due to floods, droughts, and rising seas. According to the World Bank, by 2050, over 200 million people may become climate migrants. This has direct trade implications: Labor shortages in agriculture and manufacturing. Shifting consumer bases as populations relocate. Trade tensions between host and origin countries. For example, migration from Central America to the U.S. is partly driven by droughts destroying crops. This alters not just migration policies but also regional trade agreements. 7. Geopolitical Tensions and Trade Wars Linked to Climate Climate change also fuels geopolitical trade disruptions. Nations with scarce resources (water, arable land, minerals) may restrict exports or engage in conflicts. Water wars: Between India and Pakistan, or Egypt and Ethiopia, may affect food and trade flows. Carbon tariffs: The EU’s Carbon Border Adjustment Mechanism (CBAM) imposes costs on imports from high-emission industries, creating new trade barriers. Resource nationalism: Countries with critical minerals (like Chile for lithium, Congo for cobalt) may restrict exports for domestic benefit, disrupting global supply chains. Climate change is not just an environmental issue—it’s a geo-economic disruptor reshaping trade alliances and policies. 8. Financial Risks and Trade Insurance Trade finance and insurance are also feeling the impact: Rising premiums for ships navigating storm-prone routes. Higher borrowing costs for exporters in climate-vulnerable regions. Credit risk as companies in flood-prone areas default on loans. International banks and insurers are now pricing climate risk into trade deals. This makes it more expensive for vulnerable developing countries to participate in global trade. 9. Adaptation Strategies: Business and Government Responses Despite the risks, nations and corporations are adapting strategies to reduce disruptions: Diversification of Supply Chains: Companies are sourcing from multiple regions to reduce climate risks. Resilient Infrastructure: Investments in flood-resistant ports, smart logistics, and renewable energy. Trade Policy Reforms: WTO and regional trade blocs are incorporating climate clauses into agreements. Technological Innovations: AI, blockchain, and IoT for supply chain visibility and risk prediction. Sustainable Shipping: Investments in low-carbon fuels and energy-efficient vessels. Adaptation is no longer optional—it is becoming central to trade competitiveness. 10. Future Outlook: Trade in a Climate-Disrupted World Looking ahead, climate change will continue to reshape trade in profound ways: Winners and Losers: Climate-resilient nations (Nordics, Canada) may gain trade advantages, while vulnerable regions (South Asia, Sub-Saharan Africa) face disruptions. Regionalization: To reduce risk, companies may shorten supply chains and rely more on regional trade than global trade. Climate-Linked Trade Agreements: Carbon border taxes and environmental standards will redefine competitiveness. Innovation-Driven Trade: Renewable energy technologies, carbon-capture products, and climate-adaptation tools will dominate exports. In short, climate change will not stop trade, but it will transform it. Conclusion Climate change is one of the greatest disruptors global trade has ever faced. Unlike temporary crises—such as financial crashes or pandemics—it is a long-term, structural challenge. It reshapes production, transportation, labor, and even the rules of trade itself. From floods that halt factory production to tariffs on carbon-heavy imports, climate risks ripple through every link of the global supply chain. The future of trade depends on how quickly nations, businesses, and institutions adapt. Those who build resilience, embrace sustainability, and innovate will thrive. Those who delay will face escalating costs, shrinking markets, and geopolitical vulnerabilities. Ultimately, climate change is not just an environmental problem—it is a trade problem, an economic problem, and a global governance problem. Recognizing it as a trade disruptor is the first step toward building a system that can withstand its impact.

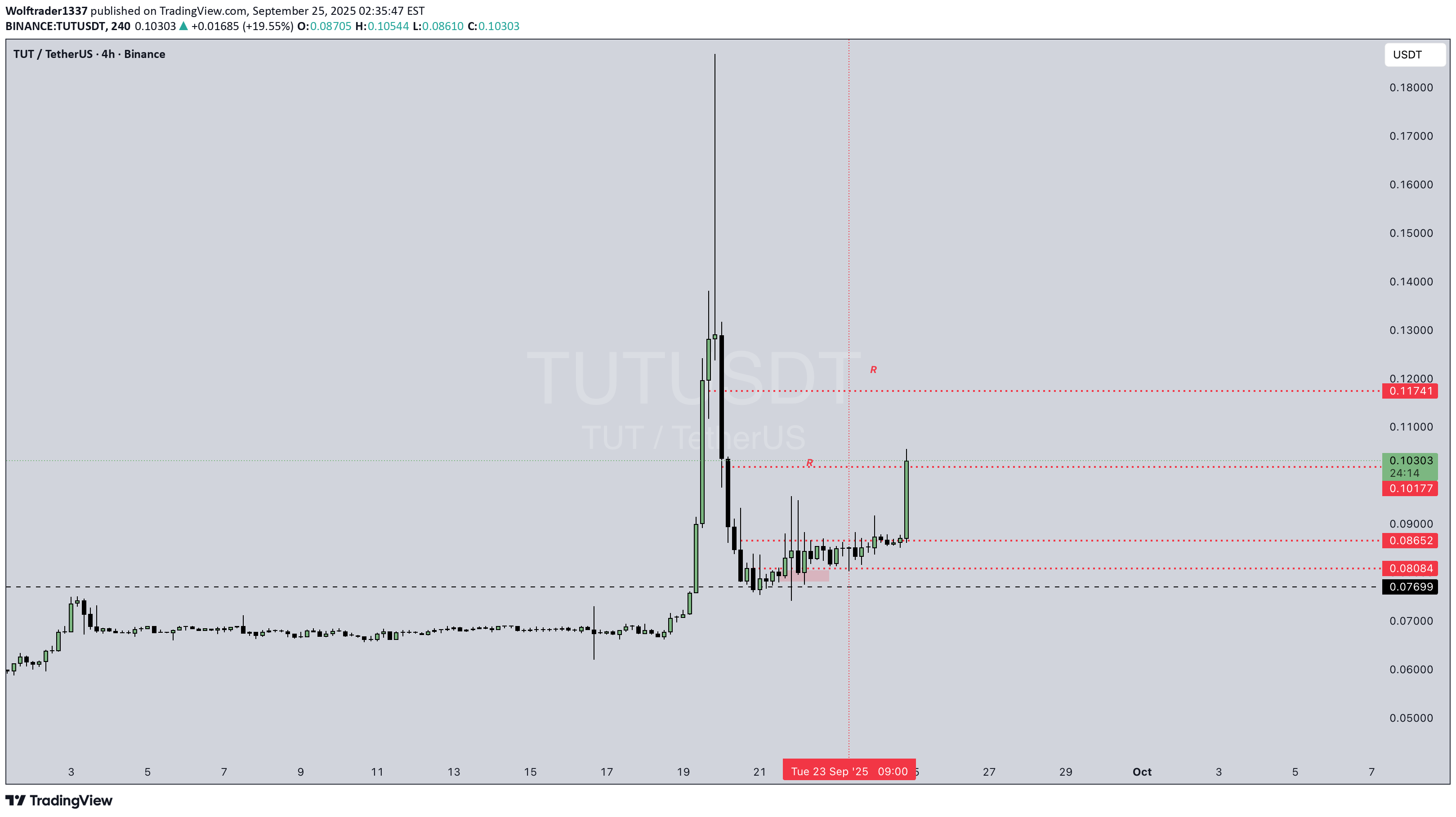

Wolftrader1337

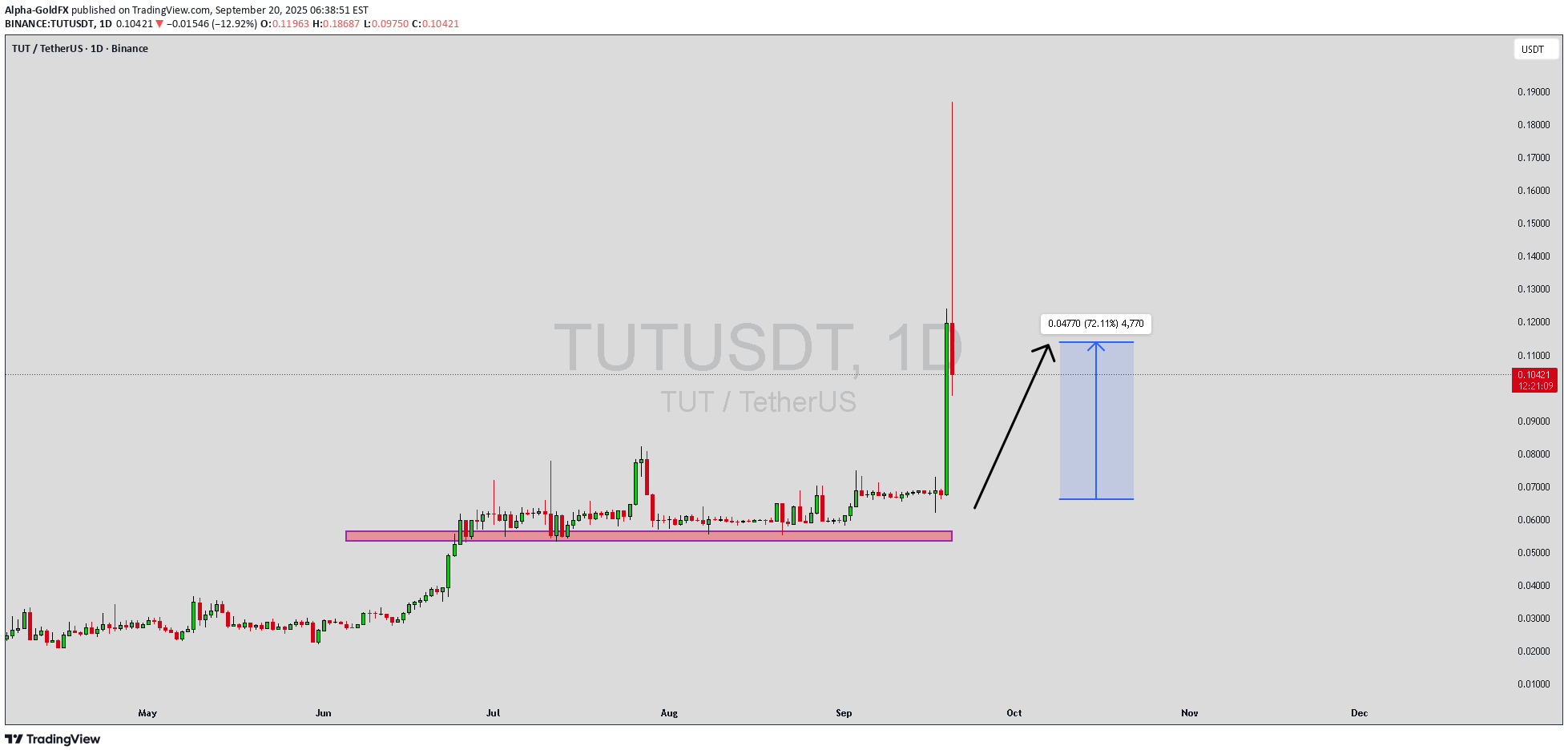

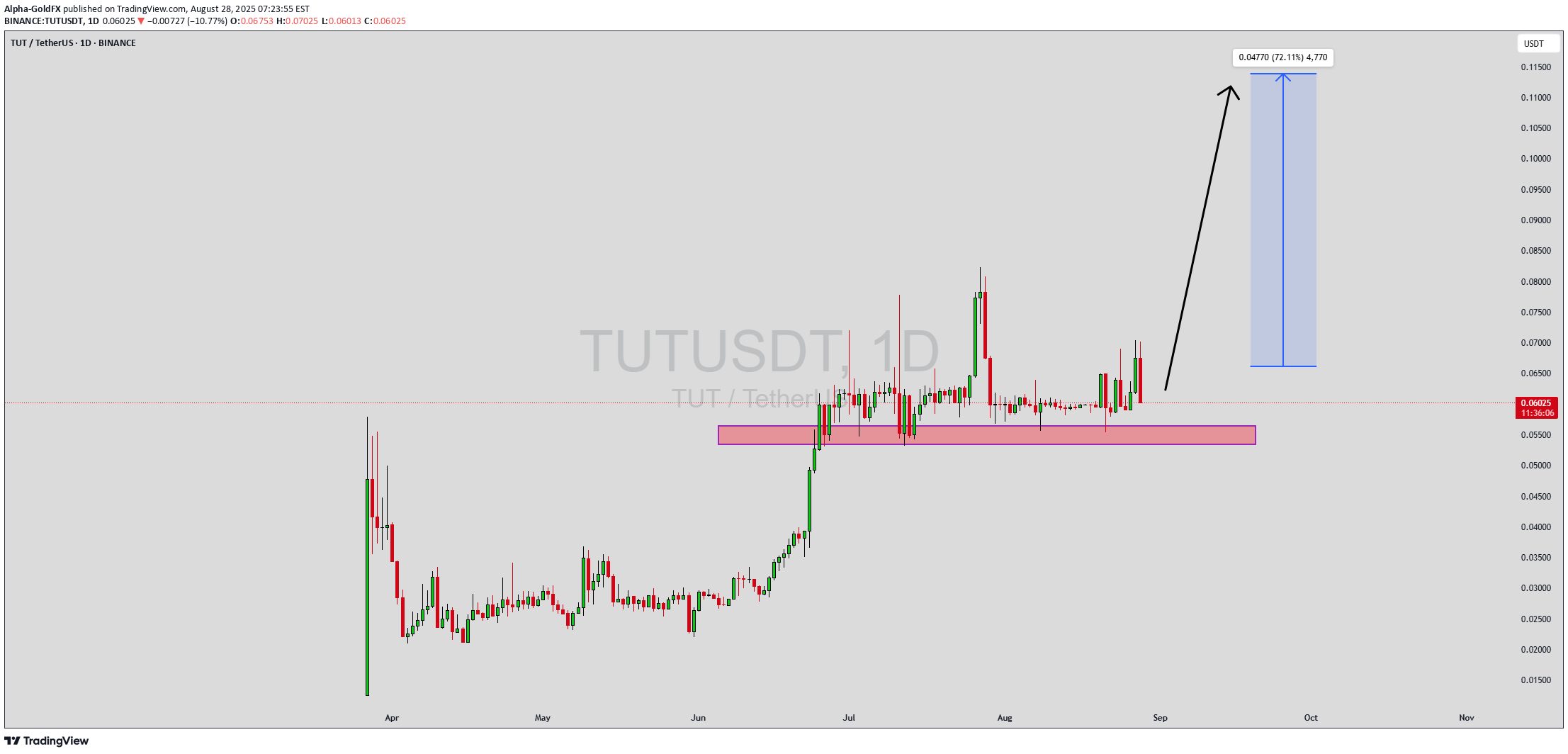

Alpha-GoldFX

TUTUSDT Forming Bullish Momentum

TUTUSDT is showing strong bullish momentum on the charts, supported by consistent volume that indicates growing interest from traders and investors. The current structure reflects a bullish momentum pattern, which often leads to significant upward price continuation. With the market aligning toward positive sentiment, the pair is gaining attention as a potential breakout candidate with room for further growth. If this bullish setup plays out, TUTUSDT could be on track to deliver gains in the range of 60% to 70%+. Such momentum-driven moves are typically fueled by sustained demand and accumulation, suggesting that investors are positioning themselves early ahead of a possible rally. The volume profile also supports this narrative, showing that the market activity behind the price movement is healthy and reliable. Market watchers are keeping a close eye on this setup as momentum-driven breakouts tend to accelerate quickly once resistance levels are broken. With investors showing confidence and taking interest in this project, the probability of a strong upside continuation looks favorable. Short to mid-term traders may find this a compelling opportunity as the technical indicators continue to align. In summary, TUTUSDT is building momentum within a bullish structure that could soon propel it toward higher price levels. The combination of healthy volume, strong investor sentiment, and technical confirmation points toward the potential for a powerful upward move. ✅ Show your support by hitting the like button and ✅ Leaving a comment below! (What is You opinion about this Coin) Your feedback and engagement keep me inspired to share more insightful market analysis with you!

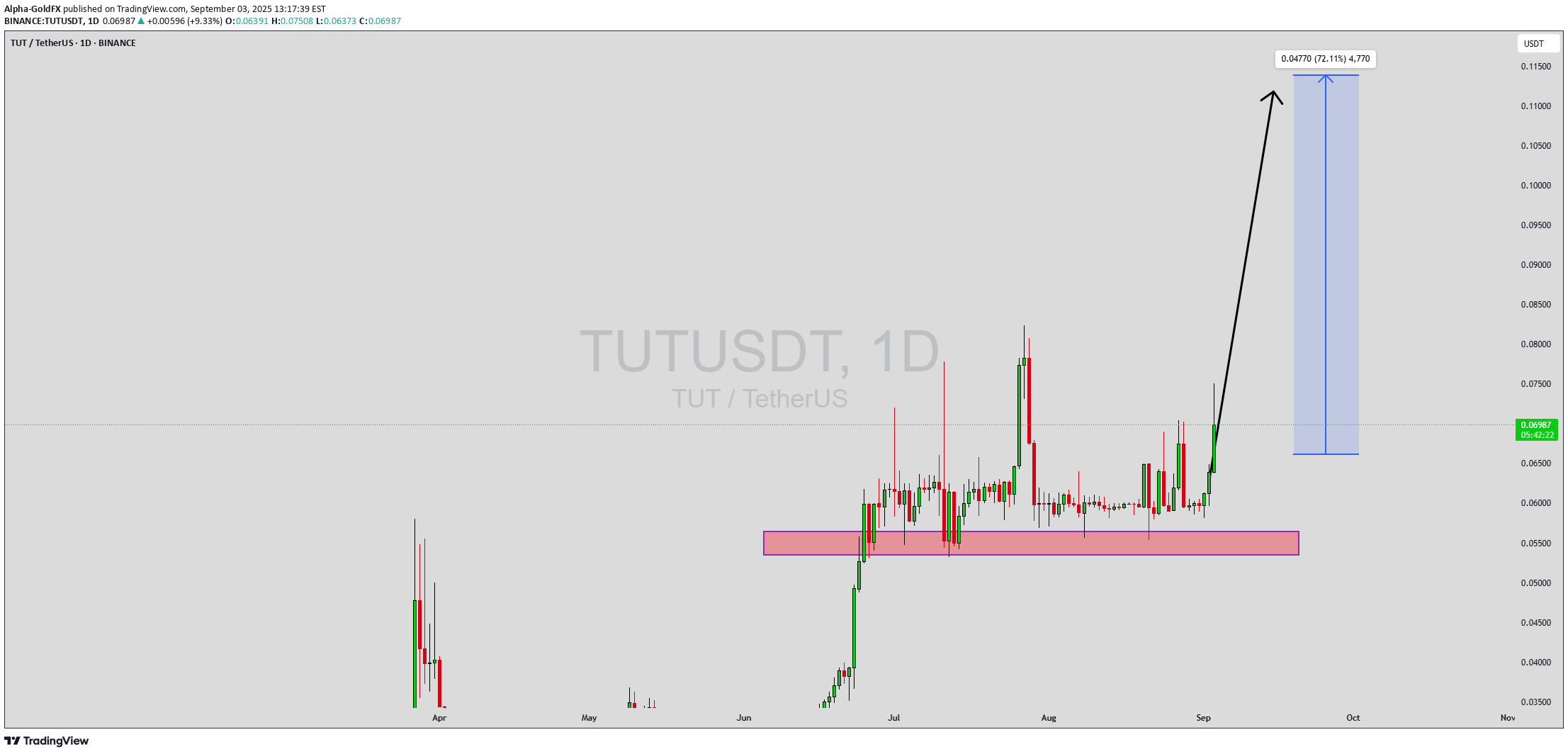

Alpha-GoldFX

TUTUSDT Forming Bullish Momentum

TUTUSDT is showing strong bullish momentum on the charts, supported by consistent volume that indicates growing interest from traders and investors. The current structure reflects a bullish momentum pattern, which often leads to significant upward price continuation. With the market aligning toward positive sentiment, the pair is gaining attention as a potential breakout candidate with room for further growth. If this bullish setup plays out, TUTUSDT could be on track to deliver gains in the range of 60% to 70%+. Such momentum-driven moves are typically fueled by sustained demand and accumulation, suggesting that investors are positioning themselves early ahead of a possible rally. The volume profile also supports this narrative, showing that the market activity behind the price movement is healthy and reliable. Market watchers are keeping a close eye on this setup as momentum-driven breakouts tend to accelerate quickly once resistance levels are broken. With investors showing confidence and taking interest in this project, the probability of a strong upside continuation looks favorable. Short to mid-term traders may find this a compelling opportunity as the technical indicators continue to align. In summary, TUTUSDT is building momentum within a bullish structure that could soon propel it toward higher price levels. The combination of healthy volume, strong investor sentiment, and technical confirmation points toward the potential for a powerful upward move. ✅ Show your support by hitting the like button and ✅ Leaving a comment below! (What is You opinion about this Coin) Your feedback and engagement keep me inspired to share more insightful market analysis with you!

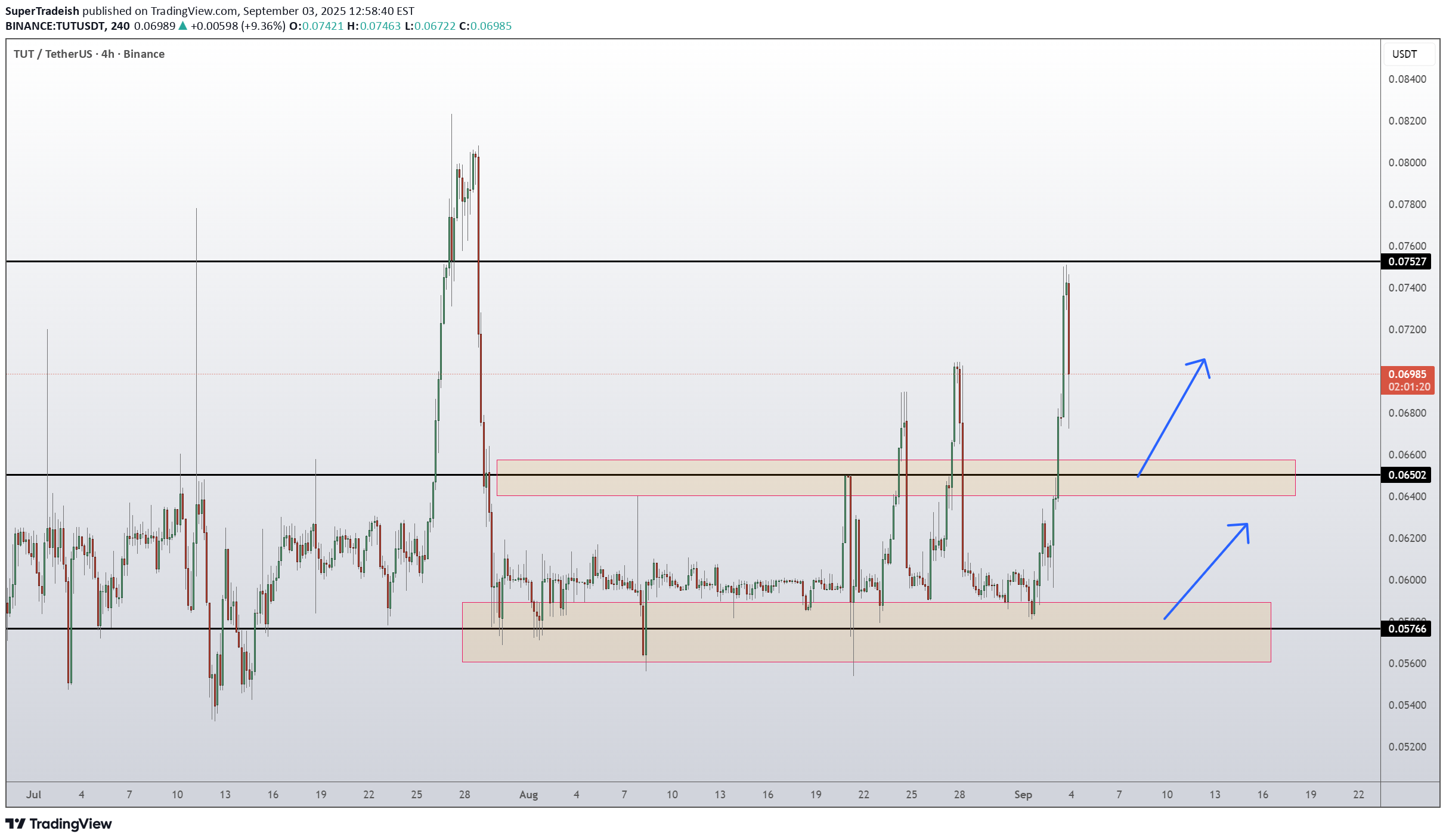

SuperTradeish

TUT Coin Tutorial Token Price News Today - Price Prediction

TUT has recently surged from the 0.0585 support zone, breaking through mid-range resistance at 0.0650 and testing the upper resistance near 0.0755. Price has shown strong bullish momentum, but the sharp rejection wick at the top suggests sellers are defending the 0.0755 barrier. This aligns with the historical supply zone seen in late July. As long as price remains capped below 0.0755, there is risk of a downside retracement back into the 0.0650 zone. If buyers reclaim and sustain above 0.0755, however, momentum could extend toward new highs. 📊 Key Levels Support 1: 0.0650 (mid-level support) Support 2: 0.0585 (major base support) Resistance: 0.0755 (major cap zone) Trading Scenarios 📉 Bearish Setup Sell trigger: Rejection at 0.0755 Sell zone: 0.0735 – 0.0755 Target: 0.0650 support Invalidation: Break and close above 0.0765 📈 Bullish Setup Buy trigger: Break and hold above 0.0755 Buy zone: Retest of 0.0750–0.0760 as support Target: 0.0820–0.0850 extension Invalidation: Drop back below 0.0730 Summary Momentum is bullish short-term, but 0.0755 is a key decision level. A rejection favors a move back to 0.0650. A breakout above 0.0755 opens path to higher highs. 👉 Follow me for More Real Time Opportunities. Share your Thoughts if you have any?

Alpha-GoldFX

TUTUSDT Forming Bullish Continuation

TUTUSDT is currently showing a strong bullish Continuation pattern, signaling the potential for a major upward continuation in price action. The recent structure highlights consistent higher lows and stronger pushes to the upside, reflecting solid demand from buyers. The market has been supported by good trading volume, which adds strength to the current bullish outlook. This setup is often a precursor to explosive moves, especially when investor sentiment is aligned with technical signals. If the momentum continues, TUTUSDT could potentially deliver gains in the range of 60% to 70%+. This type of pattern typically attracts breakout traders and mid-term investors who are looking for significant returns. As the price consolidates with bullish bias, any decisive breakout could act as a catalyst for rapid price acceleration. Investors are already showing interest in this project, which further supports the case for continued upside. With both technical momentum and investor confidence building up, TUTUSDT could be positioned for strong growth in the coming sessions. Traders should keep a close watch on volume spikes and key resistance levels as potential signals for entry and continuation. ✅ Show your support by hitting the like button and ✅ Leaving a comment below! (What is You opinion about this Coin) Your feedback and engagement keep me inspired to share more insightful market analysis with you!

MasterAnanda

Altcoins Market Bullish Continuation, Supporting Signals

TUTUSDT (Tutorial) has been leading the altcoins market. This pair tends to move ahead of the rest of the altcoins. Here I am seeing a breakout from a sideways trading range, something similar to May. Let's say TUTUSDT starts to move forward and this is day one. Why now? Because the market is ready. It starts to move forward and prints a bullish wave similar to June, we know the rest of the market will follow. The fact that this chart shows perfect sideways action followed by bullish breakouts means that the people behind it are in the know. They know about the 2025 bull market, they know about the altcoins and they aren't about to sell when everything is set to grow. So there you have it. This signal supports an altcoins market bullish continuation, what I've been saying in the past few days. It is still early, but the retrace already reached its end. We are going up. Namaste.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.