SuperTradeish

@t_SuperTradeish

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

SuperTradeish

EigenLayer EIGEN Token Price Prediction and Technical Analysis

EIGEN/USDT has broken out strongly, surging from the 1.503 demand base and blasting through the 1.728 resistance zone, extending toward the 2.00 area before stalling. This breakout shows strong bullish momentum, and as long as price holds above 1.728, continuation toward the 2.098 resistance looks likely. A retest of 1.728 could provide a healthy entry, while a deeper correction back into the 1.503 demand zone would still keep the bullish structure intact. 📈 Key Levels: Buy trigger: Retest/hold above 1.728 support Buy zone: 1.503 – 1.728 region Target 1: 2.00 psychological zone Target 2: 2.098 resistance Invalidation: Daily close below 1.503 (would weaken breakout structure) 👉 Follow me for More Real Time Opportunities. Share your Thoughts if you have any?

SuperTradeish

Prom Coin Token Price Prediction and Technical Analysis

PROM/USDT has broken out of its extended consolidation range, surging from the 10.233 resistance-turned-support and spiking toward the 12.261 resistance zone. This breakout confirms strong bullish momentum, but price is now consolidating just under the major resistance. If buyers manage to hold above 10.233, continuation toward 12.261 and potentially higher is likely. However, a failure to sustain could see a pullback into the 8.611 demand base before another leg higher. 📈 Key Levels: Buy trigger: Retest/hold above 10.233 support Buy zone: 10.23 – 10.50 region (secondary entry at 8.61 if deeper retrace) Target: 12.261 resistance Invalidation: Daily close below 8.611 (would weaken bullish setup) 👉 Follow me for More Real Time Opportunities. Share your Thoughts if you have any?

SuperTradeish

NMR Coin Numeraire Token Prediction and Technical Analysis

NMR/USDT is currently consolidating inside a symmetrical triangle pattern, showing compression after the explosive move at the end of August. Price is coiling between rising support and descending resistance, preparing for a breakout. A bullish breakout above 23.419 resistance would likely trigger strong continuation toward the 31.702 zone. On the flip side, failure to hold the triangle support could send price back into the mid-range before any recovery attempt. 📈 Key Levels: Buy trigger: Break and hold above 23.419 resistance Buy zone: 18.00 – 19.20 (pre-breakout positioning inside triangle) Target 1: 23.419 breakout zone Target 2: 31.702 resistance Invalidation: Breakdown below triangle support (~17.00) would weaken the bullish structure 👉 Follow me for More Real Time Opportunities. Share your Thoughts if you have any?

SuperTradeish

BakeryToken Bake Coin Price Prediction and Technical Analysis

BAKE/USDT just made a massive spike from the 0.0457 demand base, reclaiming lost ground after weeks of decline. Price has now surged into the 0.1137–0.1150 resistance zone, where sellers are showing signs of pressure. If bulls manage to hold above this reclaimed level, continuation toward 0.1820 looks possible. However, if price fails here, a healthy pullback toward 0.0823 support could unfold before another attempt higher. 📈 Key Levels: Buy trigger: Retest/hold above 0.1137 support-turned-demand Buy zone: 0.0823 – 0.1137 region Target 1: 0.1820 resistance Target 2: Extension toward 0.20+ if momentum continues Invalidation: Daily close below 0.0457 (would negate the bullish recovery) 👉 Follow me for More Real Time Opportunities. Share your Thoughts if you have any?

SuperTradeish

OG Fan Token Coin Price Prediction and Technical Analysis

OG/USDT has exploded higher with a parabolic move, surging from the consolidation range and breaking past the 16.964 resistance with strength. Price is now trading near 22.7, showing signs of possible short-term exhaustion after the steep rally. If buyers manage to hold above 16.964, continuation toward higher levels remains likely. However, if momentum cools, a retest of 16.964 or even the deeper 12.344 demand zone could occur before another bullish leg. 📈 Key Levels: Buy trigger: Retest/hold above 16.964 support Buy zone: 16.96 – 17.20 region (secondary at 12.34 if deeper pullback) Target: 22.70+ continuation zone Invalidation: Daily close below 12.344 (would signal weakening bullish momentum) 👉 Follow me for More Real Time Opportunities. Share your Thoughts if you have any?

SuperTradeish

ARKM Coin Arkham Token Price Prediction and Technical Analysis

ARKM/USDT has broken out strongly from the 0.4576 demand zone, rallying with momentum and reclaiming the 0.5609 resistance-turned-support. This breakout confirms bullish strength, and if buyers hold above 0.5609, continuation toward the next key resistance at 0.6439 looks probable. In case of a pullback, a healthy retest of 0.5609 would provide an opportunity for buyers, while losing this level could send price back toward 0.4576 demand before another leg higher. 📈 Key Levels: Buy trigger: Retest/hold above 0.5609 support Buy zone : 0.5609 – 0.58 region Target: 0.6439 resistance Invalidation: Daily close below 0.4576 (would weaken bullish outlook) 👉 Follow me for More Real Time Opportunities. Share your Thoughts if you have any?

SuperTradeish

PENGU Coin Pudgy Penguins Token Price Prediction and Technical

PENGU/USDT has broken out of a falling wedge pattern, signaling potential bullish momentum. Price bounced from the 0.0278 demand zone and reclaimed above the 0.0311 support, which now acts as the key pivot level. If this breakout holds, continuation toward the upper resistances at 0.0414 and 0.0461 is likely. A retest of 0.0311 could provide a healthy entry zone before another leg higher, while failure to hold this level risks sending price back into the 0.0278 demand base. 📈 Key Levels: Buy trigger: Retest/hold above 0.0311 support Buy zone: 0.0280 – 0.0311 region Target 1: 0.0414 resistance Target 2: 0.0461 resistance Invalidation: Daily close below 0.0278 (would weaken breakout momentum) 👉 Follow me for More Real Time Opportunities. Share your Thoughts if you have any?

SuperTradeish

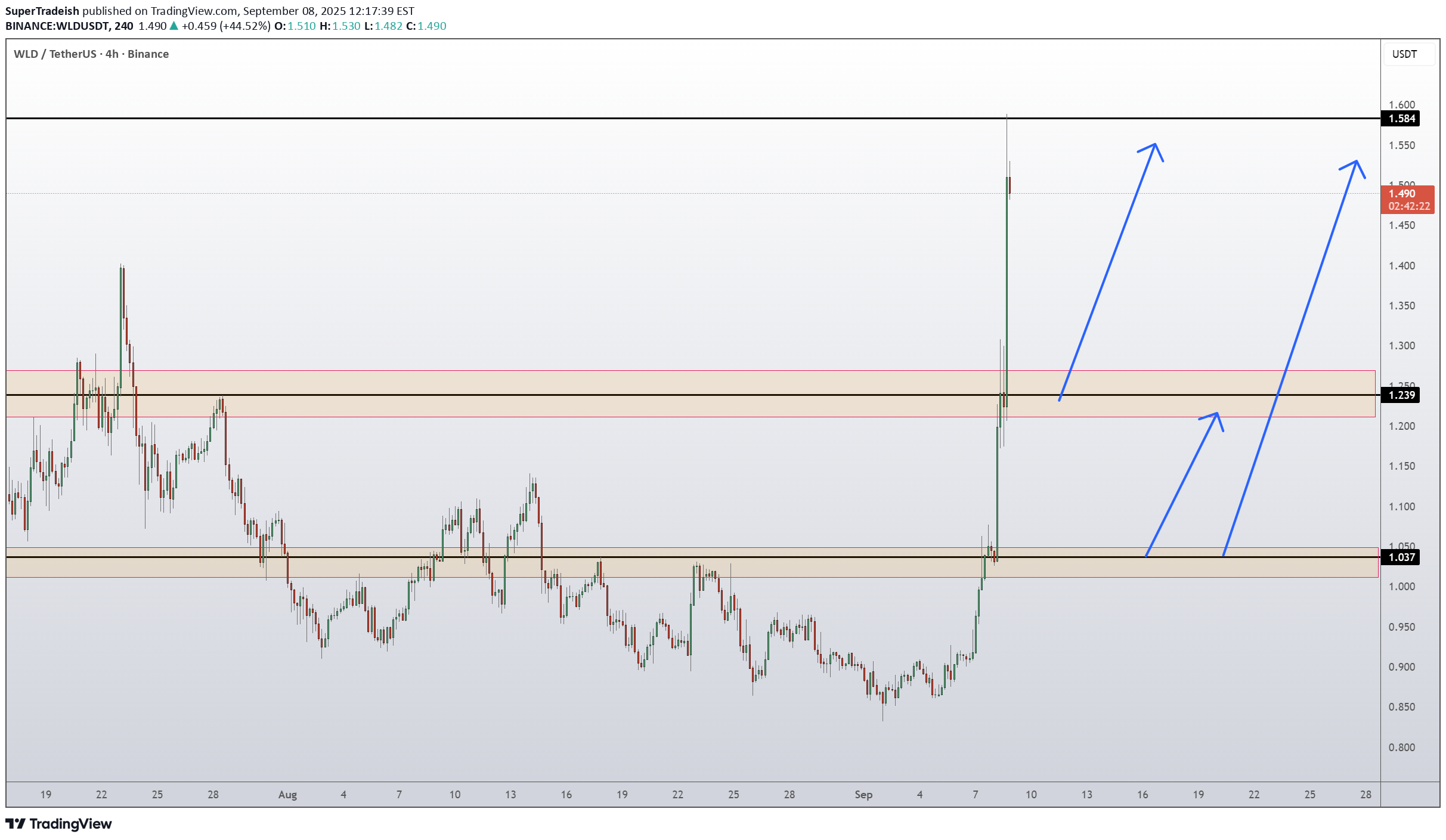

WLD Coin Worldcoin Token Price Prediction and Technical Analysis

WLD/USDT has exploded higher with a massive breakout, surging past the 1.037 resistance and clearing the 1.239 supply zone, which is now turning into support. Price is currently consolidating near the 1.494 area, with upside momentum still strong. If buyers sustain above 1.239, continuation toward the upper resistance at 1.551 – 1.584 looks likely. However, any failure to hold above 1.239 could trigger a pullback toward 1.037 demand before another push higher. 📈 Key Levels: Buy trigger: Retest/hold above 1.239 support Buy zone: 1.23 – 1.25 region Target: 1.551 – 1.584 resistance Invalidation: Daily close below 1.037 (would weaken bullish momentum) 👉 Follow me for More Real Time Opportunities. Share your Thoughts if you have any?

SuperTradeish

NMR Coin Numeraire Token Price Prediction and Technical Analysis

NMR/USDT has shown a powerful rebound after retesting the 12.322 support zone, where demand strongly stepped in. Price has now surged toward the upper range and is attempting to break higher. If momentum continues, bulls could push toward the next key resistance at 21.236, which remains the major upside objective. In case of a pullback, holding above 12.322 would be critical to sustain the bullish structure. A deeper retest of the 8.144 demand base would only come into play if buyers fail to defend the mid-range support. 📈 Key Levels: Buy trigger: Bounce confirmation above 12.322 support Buy zone: 12.3 – 13.0 region Target: 21.236 resistance Invalidation: Daily close below 12.322 (next demand sits at 8.144) 👉 Follow me for More Real Time Opportunities. Share your Thoughts if you have any?

SuperTradeish

BIO Coin Bio Protocol Token- Price Prediction and Technical Anal

BIO/USDT has recently bounced strongly from the 0.1291 demand zone, showing renewed bullish momentum after a prolonged decline. Price has reclaimed above the 0.1463 resistance level, which is now acting as short-term support. If this breakout sustains, the next upside objective lies at the 0.2005 resistance zone, where sellers are likely to reappear. However, if price slips back under 0.1463, a retest of the 0.1291 demand base could unfold before another attempt higher. 📈 Key Levels: Buy trigger: Rejection bounce from 0.1463 or 0.1291 support zones Buy zone: 0.1291 – 0.1463 region Target: 0.2005 resistance Invalidation: Daily close below 0.1291 (would weaken bullish structure) 👉 Follow me for More Real Time Opportunities. Share your Thoughts if you have any?

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.