EXCAVO

@t_EXCAVO

Ne tavsiye etmek istersiniz?

önceki makale

پیام های تریدر

filtre

EXCAVO

What I Expect from 2026

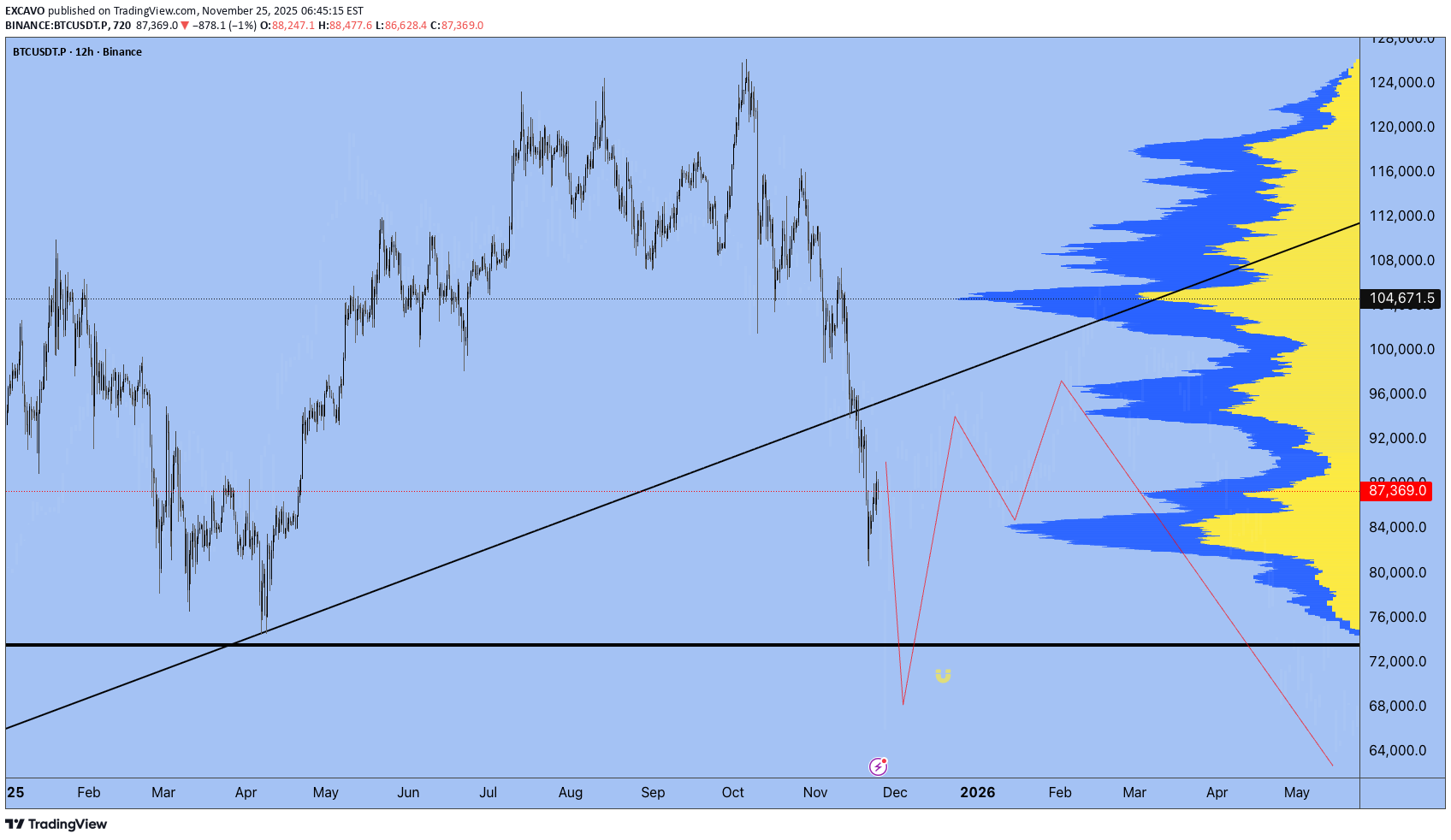

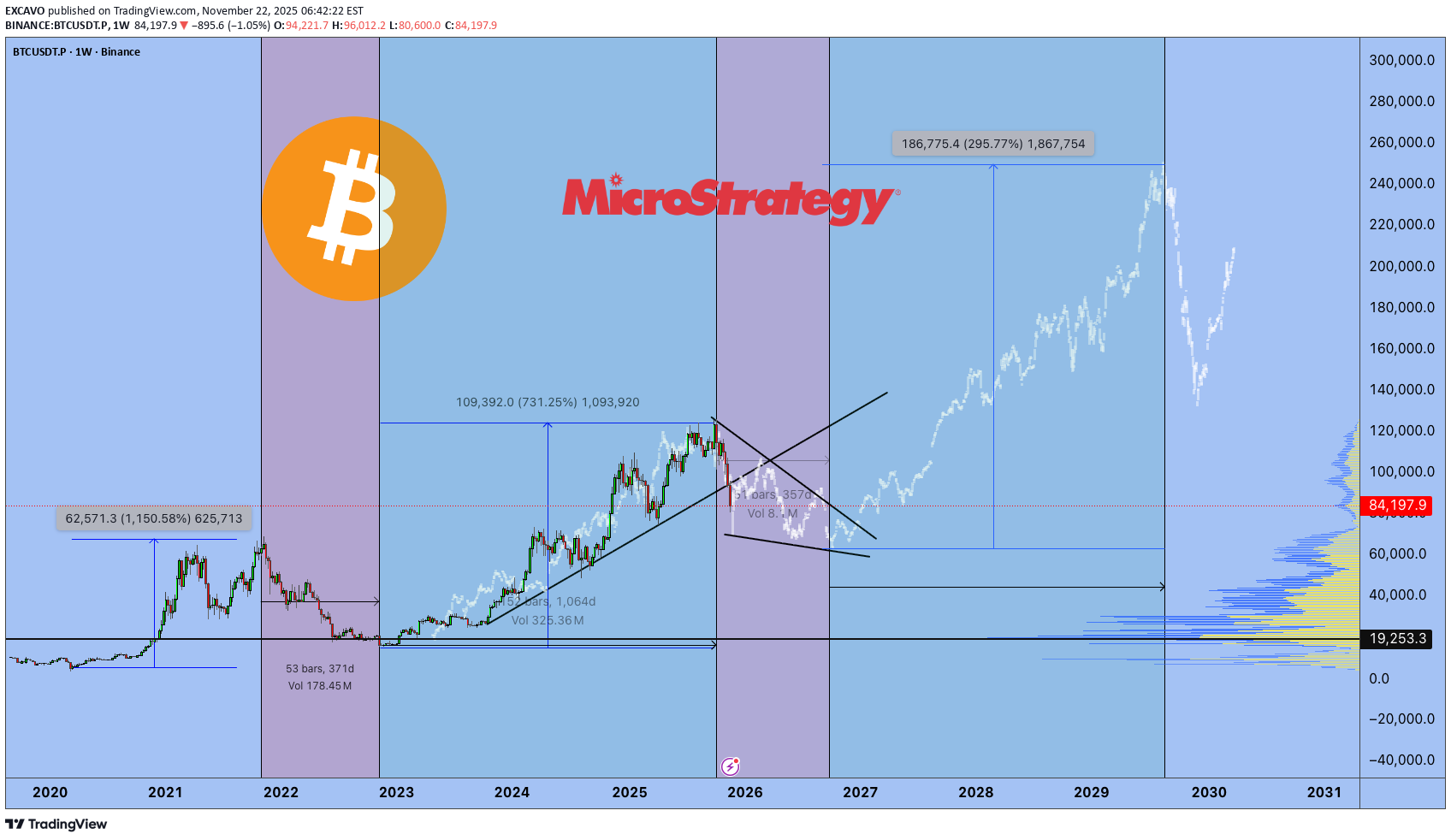

Scenarios • Markets • Levels • Positioning First of all, I want to thank everyone for the activity under my previous post . More than 300 likes are not just numbers to me — they show that you read, think, and ask the right questions. These are exactly the people who motivate me to keep sharing my perspective. I don’t write for algorithms. I write for those who want real results and understand that results come through process, discipline, and the right environment. This text is not about fast growth or guessing the bottom. It is about patience, structure, and working during moments of maximum pain. In 2026, the market will be selective: opportunities will become fewer, and the cost of mistakes will be higher. This is exactly when an advantage is built — by those who can wait and work systematically, not alone. ___________________________________________ Context and Philosophy of 2026 2026 is a year of reassessment and awareness. A year when the market stops rewarding haste and illusions. We are in a bearish phase, and according to my calculations, it will likely last almost until the end of the year. This is not a time for emotions or hope — it is a time for learning and preparing for the next cycle. It’s important to accept a simple truth: the market does not owe you opportunities every day. No trade is also a position. I’ve been in financial markets since 2009 and in crypto since 2016. I’ve seen how every cycle looks different but ends the same way — disappointment and denial. That is exactly where the market pushes the majority in 2026. ___________________________________________ What Really Happened in 2025 2025 became the year of maximum institutional involvement. ETFs, derivatives, structured products, and complex instruments fully integrated crypto into the global financial system. And the global financial market is: - highly competitive - professional - cold and calculated This is not a place for belief — this is where capital positions, hedges, and extracts liquidity. Crypto remains a young industry, but it is already playing by adult rules. Many failed to understand this — and paid for it. ___________________________________________ The Main Mistake Most Will Make in 2026 Two things: 1. Believing in a quick reversal 2. Increasing risk in an attempt to “win it back” Hope is the most expensive emotion in the market. The market does not pay for hope — it pays for timing, structure, and execution. Most people will leave not because the market is “bad,” but because they will break psychologically. I’ve seen it many times: different cycles, different faces — the same mistakes. If you stay in the market, you must relearn it every cycle. ___________________________________________ Macro Environment and Market Conditions Key factors I’m watching: - interest rates - regulation - capital flow direction - narratives that attract new liquidity Regulation is neither an enemy nor a savior — it is reality. Licenses, requirements, and rules are shaping a market that is becoming part of the global financial system. 2026 is a year of redistribution and accumulation, not growth. Liquidity is fragmented. There are too many projects, too many tokens, and not enough capital for everyone. Stablecoins are growing, but still not enough to “feed” the entire market. ___________________________________________ Altcoins in 2026: My View My position is strict and honest: Most altcoins face collapse, cleansing, and increased regulatory pressure. The reasons are clear: - an excessive number of tokens - fragmented attention - constant unlock pressure - funds sitting in long-term profit - lack of sustainable economics There will be exceptions — but they will be rare. Paradoxically, memecoins (despite my skepticism) did one useful thing: they forced people to learn on-chain analysis, search for inefficiencies, and track capital flows. What remains structurally alive RWA (tokenized real-world assets) infrastructure DeFi v2 as an alternative to the traditional system At the same time, we must be honest: potential returns in altcoins are structurally declining compared to previous cycles. ___________________________________________ Bitcoin — Base Scenario for 2026 and Key Levels My base scenario is continued pressure and bottom formation. Capitulation will affect: - traders - investors - miners - funds - large corporations The market will be cleansed of large holders. This process is always painful — and always necessary. Key ranges - base: 48,000 – 74,000 - extreme zones: 38,000 – 46,000 My operating logic - the first meaningful accumulation zone is around 64k - limit orders are placed lower - buying only during moments of panic - no rush, no emotions There is an old saying: “ We enter the market when there is blood in the streets .” This is not drama — this is how asymmetric advantage is built. Short squeezes are possible, but they will be short-lived. Markets do not trend higher on disappointment. In my view, the final deep phase of this cycle and the shift toward early bullish conditions align closer to September 2026. ___________________________________________ Other Markets and Diversification One of the biggest mistakes crypto traders make is thinking the world ends with crypto. Blockchain is infrastructure — not the entire market. That’s why in 2026 I diversify across: - gold - oil - indices - stocks - and only very selectively crypto assets Other markets are: - more liquid - more structured - often cleaner in execution S&P 500 So far there are no clear reversal signals, but after new highs I expect correction or stagnation. The reasons are obvious: the AI bubble, debt pressure, and liquidity concentration. Gold A historical safe haven. The trend remains intact. My long-term target is $6,000 ± $1,000. DXY Weakening is possible, but the dollar is likely to maintain dominance due to digitization and global settlement demand. Oil One of my key instruments. Expensive oil is not beneficial for the US, and I see no strong reasons for sustainably high prices in the short term. ___________________________________________ Narratives Beyond Crypto The world is reaching the limits of energy supply. Energy is becoming a strategic advantage. Those who produce electricity efficiently will be in a strong position. Alternative energy sources and the entire energy chain will play a key role. AI is not just hype. AI will drive breakthroughs in medicine, energy, data analysis, and financial markets. Global instability is no longer a forecast — it is a condition. We are moving toward a reset of global processes and agreements. ___________________________________________ My Trading Approach in 2026 - more cash - short-biased trading when structure allows - only selective entries - waiting for panic - minimized risk If there is no setup - there is no trade. That is discipline. And one more thing: if you are tired - rest. The market will not disappear. Your capital and your mindset are your main assets. ___________________________________________ Personal Commitment and Community In 2026, I will relaunch the Academy and deeply integrate AI tools. For members of my community, the Academy will be free under specific conditions. Discipline is not motivation. Discipline is the ability to follow a plan regardless of emotions. Growth is slow alone. It is faster in the right environment. I am building a strong trading community where: - thinking evolves - on-chain capital flows are analyzed - portfolios with limit orders are structured - experience is shared, not illusions Some of these portfolios have already started activating, and one position is around +15%. This is not luck — this is systematic work. ___________________________________________ One Honest Question Ask yourself honestly: Are you here to prove something to the market — or to achieve a sustainable result? Because results only come through self-study, discipline, and a repeatable process. ___________________________________________ Final Thoughts Markets reward preparation, not urgency. Give the market time. Give the system time. If you are still here in 2026 — you are already ahead of most. The main task is simple: stay in the game. Build positions when it hurts. Grow when it is quiet. Best regards EXCAVO

EXCAVO

Bull Market 2023–2025: Final Results (27.12.25)

Public history, responsibility, and the environment without which you don’t belong in the market First of all, I want to thank TradingView In 2025, I received the WIZARD badge. This is not just a label — it is recognition of my contribution as an active member of the TradingView Community. For me, this matters not because of status, but because of responsibility. This badge means I have the ability to propose changes and improvements to the platform, and some of these proposals have already been implemented. I’m genuinely glad to be one of those community members who helps make TradingView better for everyone. Why TradingView is about responsibility, not social media I have been an active member of the TradingView Community for a long time, and I strongly believe this platform is fundamentally different from any other financial media space. First — the chart as the core tool of analytical thinking. Second — publications and the Play button, which lock ideas in time. Third — and most important — the impossibility of deleting published ideas. Fourth - indicators You cannot rewrite history here. You cannot erase mistakes. You cannot hide behind “the context has changed.” That is why I approach every single publication on TradingView with full responsibility. Why there is no noise or random content here I do not use TradingView the way many people use Twitter or Telegram. There are no: emotional reactions random thoughts posts made for reach or hype As of December 2025, my audience consists of 132,000 followers, and I fully understand the responsibility that comes with that. Yes, every publication is not financial advice. But for myself, I set a clear internal rule: every idea must be logical, verifiable, and honest. Why the timeline starts in 2023 I intentionally start this review from 2023 because that is when the bottom of the previous cycle was forming. At the time, it was not obvious to the majority of the market: - fear was at its peak - trust was minimal - negative narratives dominated I’ve been in the market for a long time and have lived through multiple full cycles. This Bitcoin cycle was my third, and I consider it the most professionally executed one so far. Each cycle is different: - different narratives - different audiences - different speed But market logic and crowd psychology repeat. Publications that cannot be adjusted after the fact Back in late 2022, an idea was published: Bitcoin cycles + logistic curve = New bull run 2023–2025. This was done before the move, not after. Every marker you see on this chart represents a public idea published in real time on TradingView. It’s important to highlight: - all key ideas were LONG - there were no public SHORT ideas during the bull phase Why? Because in a true bull market, speculating against the trend makes no sense. The upside potential always outweighs the logic of catching small pullbacks. Timing and the end of the cycle If you open each publication, you’ll see: - market phases - time-based expectations - structural projections On most higher-timeframe ideas, the end of the bull market was publicly marked in red. My key time reference was stated in advance — September 2025. September 2025: when most still believed in continuation Starting in September 2025, while market euphoria was still present, I began publishing ideas stating that: - the bull market was over - positions were closed - Bitcoin was forming a reversal - the market was entering a bull trap phase - you were warned in advance These ideas were based not on emotions, but on market structure, cycles, and psychology. Experience, no FOMO, and a mature position After years in the market, I have zero FOMO. I don’t worry about: - missing a coin - missing a narrative - not participating in every move The market is: - fast - volatile - heavily manipulated You cannot be everywhere. The core task of the market is simple: buy low — sell high. That’s exactly what I’ve been doing for over 12 years, with more than 10,000 hours spent in the market. The reality of the modern market Today’s market consists of: - funds - corporations - algorithms - quantitative strategies On lower timeframes and chaotic moves, retail traders are simply outmatched. The gap between emotional decision-makers and those who operate with structure, data, and discipline will only continue to widen. If you are in the market — you must be in the environment Here I’ll be as direct as possible. If you are in financial markets, if you plan to continue trading, if you want to survive and adapt — you must be part of a strong community. A lone trader in today’s market is easy prey. Over the years, a community of like-minded traders has formed around me — people who: approach the market systematically - discuss scenarios - analyze entries and exits - stay connected during difficult periods I share my public ideas for free, and that remains a core principle. But if you truly intend to stay in this market, you need an environment, feedback, and shared logic. What you do next is your decision. Trading is a marathon Trading is not a sprint. It’s a marathon. Sometimes the best position is no position. Sometimes the best trade is the one you didn’t take. Patience, waiting, and discipline are skills — without them, you don’t belong in this market. The current moment and what’s ahead At the moment, crypto is in a phase where I take very few trades. Some positions are already open — at predefined levels, within a structured risk framework. I’m not leaving financial markets: - crypto - Forex - equities - tokenized assets - gold - oil Instruments change. Principles don’t. In conclusion If this chart receives 300 likes, I will publish a separate post outlining: - goals - scenarios - positioning for 2026. Wishing everyone clarity, discipline, and a cold mind. May 2026 be better than 2025. And may there be peace on our planet. Yours, EXCAVO

EXCAVO

اهداف بیت کوین ۲۰۲۵: توهم یا واقعیت؟ حقیقت تلخ پیشبینیها

Tahmin yapmak kolaydır. Haklı olmak hard'dır. 1. Hedefler İllüzyonlara Dönüştüğünde Şu tabloya bakın. Bitcoin 90.000 Dolar. 2025'e on altı gün kaldı. Ve her "uzman" hedef - JPMorgan, VanEck, Standard Chartered, Tom Lee, Kiyosaki, BlackRock, Cathie Wood - hepsi kaçırdı. Her biri. Neden? Çünkü tahmin ettiğiniz varlığın sahibi olduğunuzda objektif kalmanız neredeyse imkansızdır. Bir pozisyonu tuttuğunuzda zihniniz sonsuzluğu resmeder. Piyasayı görmeyi bırakırsınız; umutlarınızı görmeye başlarsınız. Analiz etmeyi bırakırsınız, inanmaya başlarsınız. Bu fiyat hedefleri asla tahmin değildi. Analiz kisvesine bürünmüş, arzulu düşüncelerdi bunlar. 2. Benim Durumum — Aklı başında kalın Yazılarımda her zaman objektif ve ayakları yere basan olmaya çalışıyorum. Duygu alışverişi yapmıyorum. Görmek istediklerimi değil, gerçekte gördüklerimi gözlemliyor, analiz ediyor ve paylaşıyorum. Ve işte şimdi gördüğüm şey: Bu yükseliş hedeflerine bir gün hâlâ ulaşılabilir. ancak 2025'in sonuna kadar değil. 2026'nın sonuna kadar bile değil. Döngü analizime göre bir sonraki gerçek boğa piyasası zirvesi 2029 civarında gerçekleşecek. Ve o zaman bile kesin bir sayıyı belirtmek hard'dir. Ancak tarih tekerrür ederse ve her yeni döngü bir öncekini ikiye katlarsa, o zaman 250 bin dolar, 275 bin dolar ve hatta 300 bin dolar gibi seviyeler mümkün. Yine de bu sözlerin bile sorgulanması gerekir. Çünkü piyasanın değişmez bir dersi var: alçakgönüllülük. Ve kendinden çok emin görünen kişiler genellikle ilk yanılanlardır. 3. Bitcoin Neden Her Şekilde Büyümeye Devam Edecek? Tüm kaosa ve belirsizliğe rağmen bir şey açık: Bitcoin uzun vadede büyümeye devam edecek. Sebepler duygusal değil yapısaldır: madencilik zorluğu artmaya devam ediyor, Madenciler arasındaki rekabet artıyor, endüstri genişliyor, kurumsal ilgi artıyor, dolaşımdaki arz azalıyor, Piyasa daha yoğunlaşmış, kaldıraçlı ve değişken hale geliyor. Birkaç yıl önce hayal bile edilemeyecek hamlelere tanık oluyoruz. Günlük 20.000 dolarlık bir dalgalanma artık şok edici değil; bu yeni normal. 11 Ekim'e dönüp bakın — Bitcoin tek bir günde 20.000$ düştü. Bu bir rekor. Ve yine kırılacak. Çünkü oyun giderek kızışıyor. Bitcoin ölmeyecek. Unutulmaya yüz tutan binlerce altcoin'in aksine, Bitcoin'nin yok olması mümkün olmayan çok fazla oyuncusu, çok fazla sermayesi ve çok fazla yerçekimi var. 4. Şimdi Neredeyiz Dürüst olalım — Bu ayı piyasasının yarısına bile gelmedik. Yakın bile değil. Belki de yolun %20'si. Gerçek acı hâlâ önümüzde; hayal kırıklığı, teslimiyet ve yorgunluk. Ve sadece perakende tüccarlar arasında değil. Fonlar, madenciler, şirketler; hepsi bununla yüzleşecek. Her döngü maksimum ret gerektirir. Kalabalığın pes etmesi gerekiyor. Piyasalar böyle sıfırlanıyor. Ayı piyasaları çöküş değildir; yavaştırlar, umutları yok eden ezici düşüşlerdir. Önce sermayeyi yok etmiyorlar; inancı yok ediyorlar. 5. Bisiklet Metaforu Eğer sonuna kadar bu pazarda kalmayı planlıyorsanız, Seni yokuş aşağı bisiklet süren bir adama benzeteceğim. Kendi kendine şöyle diyor: “Evet aşağı iniyorum ama pedal çevirmeye devam edeceğim. Diğerleri vazgeçtiğinde ben önde olacağım.” Ama gerçek şu ki — dibe ulaştığında, ve bir sonraki yokuş yukarı başlıyor, Tırmanacak gücü kalmayacak. Zihinsel, finansal ve duygusal olarak tükenecek. Bir sonraki dağa çıkamayacak. 6. Şimdi Neler Oluyor Şu anda düzeltme aşamasındayız. move dürtüsü bitti. Gördüğünüz küçük sıçramalar bir geri dönüş değil, Bir sonraki ayak aşağı inmeden önce sadece geçici bir rahatlama. Bu yeni bir boğa piyasasının başlangıcı değil; düşüşler arasında bir duraklama. Makro kurulum henüz büyümeyi desteklemiyor. Yapı orada değil. Piyasa henüz hazır değil. Her döngü daha da ağırlaşıyor. Her biri daha fazla acı, daha fazla zaman, daha fazla temizlik talep ediyor. 7. İşin Özeti Hiçbir hayalim yok. Anlık 300 bin dolara yükseliş fantezisi yok. Yalnızca gerçekçilik ve sabır. Piyasa kendi kendine düzelecek. Ancak bir sonraki gerçek boğa koşusu başladığında, şu anda hâlâ "yokuş aşağı pedal çevirenlerin" çoğu tekrar tırmanacak enerjiye veya inanca sahip olmayacak. Saygılarımızla, EXCAVO

EXCAVO

The Real Bitcoin Bottom: It’s in the Power Bill

The Cost of Mining 1 BTC – Autumn 2025 Deep Dive First of all, I want to say that I already made a similar publication in 2020 about the cost of Bitcoin, and we reached these levels (the chart is below). Introduction: The Bitcoin mining industry in Autumn 2025 stands at a crossroads. Network difficulty has soared to all-time highs, squeezing miner profit margins as hashpower races ahead of price. The hashprice – the daily revenue per unit of hashing power – has slumped to record lows around $54 per PH/s-day (down from ~$70 a year ago). Analysts expect this metric to languish between $50 and $32 until the next halving in 2028, underscoring how challenging the economics have become. In this environment, understanding the cost to mine 1 Bitcoin is more crucial than ever. Below, we present a detailed comparison of popular ASIC miners and analyze which rigs remain profitable (or not) at current prices. We’ll also explore how the cost of production acts like a magnetic price level for BTC – often drawing the market down to this “floor” before a rebound – and what that means for investors now. Cost to Mine 1 BTC by ASIC Miner Model (at $0.03–$0.10/kWh) To quantify Bitcoin’s production cost, we compare leading ASIC miners from Bitmain, MicroBT, Canaan, Bitdeer, and Block. Table 1 below shows key specs and the estimated cost to mine one BTC under different electricity prices (from very cheap $0.03/kWh to pricey $0.10/kWh): Key Takeaways: Electricity price is the dominant factor in mining cost. At an ultra-cheap $0.03/kWh (possible in regions with subsidized power or stranded energy), even older-generation miners can produce BTC for well under $30k per coin. In our table, all models have a cost per BTC between ~$21k and $27k at $0.03/kWh – a fraction of Bitcoin’s current ~$90k–$95k market price. At a mid-tier rate of $0.05/kWh (typical for industrial miners in energy-rich areas), the top machines still show healthy margins. Bitmain’s flagship S21 XP leads with roughly $36k cost per BTC, while other new-gen rigs fall in the ~$39k–$45k range. These figures imply profit margins of 50–60% for efficient miners at $0.05 power. At a pricey $0.10/kWh (common for retail electricity or high-tariff regions), mining costs skyrocket. Only the very latest ASIC (S21 XP) stays comfortably below the current BTC price, at around $72k per coin. Most other models hover in the $78k–$90k range, meaning their operators are earning little to no profit at spot prices. In fact, at $0.10/kWh, a miner like the Avalon A15 Pro would spend about $89k to generate one BTC – essentially breakeven with Bitcoin at ~$90k. This illustrates why high-power-cost miners struggle or shut off during downturns. Profitable vs. Unprofitable: Current Market Reality Which miners are still profitable at today’s rates? Given Bitcoin’s price in the low $90,000s and typical industrial electricity around $0.05–$0.07/kWh, the newest generation ASICs remain comfortably profitable, while older, less efficient models are on the edge. For example: Latest-gen winners: The Bitmain S21 XP – with industry-best ~13.5 J/TH efficiency – can mine a coin for roughly $36k at $0.05/kWh, leaving a huge cushion against price. Even at $0.07/kWh (a common hosting rate), its cost per BTC would be on the order of ~$50k, still well below market price. Other 2024–2025 flagship units (Whatsminer M60S++, Bitdeer A2 Pro, Block’s Proto) likewise have breakeven power costs around $0.12–0.13/kWh; they remain viable in most regions except the very expensive ones. Older-gen on the brink: By contrast, an earlier-gen workhorse like the Antminer S19 XP ( ~21.5 J/TH) or similarly efficient rigs from 2021–2022 generation become marginal at moderate power rates. An S19 XP mining at $0.08/kWh sees its cost per BTC climb to roughly ~$94k (near current price), and at $0.10 it exceeds $110k (mining at a loss). Many such units are only profitable in locales with <$0.05 power. This is why we’ve seen miners with older fleets either upgrade or retire hardware as the margin for profitability narrows. The efficiency gap: The spread between best-in-class and older miners translates directly into survivability. A miner burning 30–40 J/TH can only stay online if they have extremely cheap electricity or if BTC’s price is far above average production cost. As of Q4 2025, Bitcoin’s price is indeed high, but so is the network difficulty – meaning inefficient gear yields so little BTC that electricity costs outweigh revenue in many cases. According to one industry report, the cost of mining 1 BTC varies widely across companies – from as low as ~$14.4k for those with exceptional power contracts (e.g. TeraWulf’s U.S. facilities) to as high as ~$65.9k for others like Riot Platforms, even before accounting for overhead. (Riot’s effective cost was brought down to ~$49.5k after cost-cutting measures.) This huge range shows how electricity pricing and efficiency determine which miners thrive. In early 2025, the situation became so extreme that CoinShares analysts found the average all-in production cost for public mining companies spiked to ~$82,000 per coin – nearly double the prior quarter (post-halving impact) – and up to $137,000 for smaller operators ixbt.com . At that time Bitcoin was trading around $94k, meaning many miners, especially smaller ones, were underwater and operating at a loss. In high-cost regions like Germany, the breakeven cost even hit an absurd ~$200k per BTC, making mining there utterly unviable. Bottom line: At current prices, only miners with efficient rigs and reasonably cheap power are making money. Those with older equipment or expensive electricity have minimal margins or are already in the red. This dynamic naturally leads to miners shutting off machines that don’t profit, which in turn caps the network hashrate growth until either price rises or difficulty drops. It’s a self-correcting mechanism – one that ties directly into Bitcoin’s production cost acting as a market floor. Production Cost as Bitcoin’s “Magnetic” Price Level There’s a saying in the mining community: “Bitcoin’s price gravitates toward its cost of production.” In practice, the production cost often behaves like a magnet and a floor for the market. When the spot price climbs far above the cost to mine, it invites more hashing power (and new investment in miners) until rising difficulty pulls costs up. Conversely, if price falls below the average production cost, miners start to capitulate – selling coins and shutting rigs – until the difficulty eases and the market finds a bottom. This push-pull keeps price and cost loosely tethered over the long run. Notably, JPMorgan’s research this cycle highlighted that Bitcoin’s all-in production cost (now around ~$94,000) has “empirically acted as a floor for Bitcoin” in past cycles. In other words, the market has rarely traded for long below the prevailing cost to mine, because at that point fundamental supply dynamics kick in. As of late 2025, they estimate the spot price is hovering just barely above 1.0 times the cost (~1.03x) – near the lowest end of its historical range. This implies miners’ operating margins are razor-thin right now, and any extended move significantly below ~$94k would likely trigger miner capitulation and supply contraction. In plainer terms: downside from here is naturally limited – not by hope or hype, but by the economics of mining. If BTC dropped well under the cost floor, many miners would simply turn off machines rather than mine at a loss, removing sell pressure and helping put in a price bottom. History supports this magnetic pull. In previous bear markets, Bitcoin has tended to retest its production cost during the worst of capitulations. For example, during the late-2018 crash and again in the 2022 downturn, BTC prices plunged to levels that put numerous miners out of business. But those phases were short-lived. Prices found support once enough miners quit and difficulty adjusted downward, allowing the survivors to breathe. The market “wants” to stay near the cost of production, as that is a sustainable equilibrium where miners neither drop like flies nor earn excessive profits. Whenever price strays too high above cost, it usually invites a surge in competition (hashrate) that raises the cost floor; when price sinks too low, hashpower falls until cost drops to meet price. It’s an elegant economic dance built into Bitcoin’s design. Why Price Often Meets Cost Before Rebounding If Bitcoin production cost is a de facto floor, why do we often see price fall all the way down to it (or even briefly below it) before the next big rally? The answer lies in miner psychology and market cyclicality: Miner Capitulation & Shakeouts: Markets are cruel to the over-leveraged and inefficient. During bull runs, miners expand operations, often taking on debt or high operating costs under the assumption of continually high prices. When the cycle turns, Bitcoin’s price can free-fall toward the cost of production, erasing margins. The weakest miners (highest costs or debt loads) capitulate first – selling off their BTC reserves and unplugging hardware. This wave of forced selling can push price right to (or slightly under) the cost floor, marking a final “shakeout” of excess. Only when the weakest hands are flushed does the market rebound. It’s no coincidence that major bottoms often align with news of miner bankruptcies or mass liquidations. The Iron Law of Hashrate: Miners are competitive and will run at breakeven or even slight loss for some time, hoping for recovery, rather than quit immediately. This means the network can temporarily operate above sustainable difficulty levels. Eventually, however, reality sets in. When enough miners can’t pay the bills, hashrate plateaus or drops, halting difficulty growth or causing it to decline. At that inflection point, the cost of mining stabilizes (or falls), giving relief to the remaining miners. The stage is set for price to rebound off the now-lower equilibrium. In essence, Bitcoin often has to tag its production cost to force a network reset and purge imprudent operators. Only after that cleansing can a fresh uptrend begin with a healthier foundation. Investor Sentiment at the Floor: From a contrarian market perspective, a convergence of price and production cost typically corresponds with maximum pessimism. If Bitcoin is trading at or below what it “should” cost to make, it signals extreme undervaluation to savvy investors. In late 2022, for instance, estimates of BTC’s cost basis in the $18k–$20k range coincided with the market trading in the mid-$15k’s – a level where miners were going bankrupt and sentiment was in the gutter. Yet those willing to be greedy when miners were fearful reaped the rewards when price recovered. The same pattern could be unfolding now in late 2025: the public is fearful of Bitcoin’s recent pullback, but its cost floor (~$94k) suggests fundamental value support. Smart money knows that when price meets cost, downside is limited and upside potential grows. Conclusion – Steeling Ourselves at the Cost Floor In EXCAVO’s signature fashion, let’s cut through the noise: Bitcoin’s production cost is the line in the sand – the magnetized level where price and reality meet. As of Autumn 2025, that line hovers in the mid-$90,000s, and Bitcoin has indeed been gravitating here. The data shows miners barely breaking even on average. This is a make-or-break moment. If you’re bullish because everyone else is, check your thesis – the real reason to be bullish is that BTC is scraping its cost floor, a level from which it has historically sprung back with vengeance. Conversely, if you’re panicking out of positions now, remember that you’re selling into the teeth of fundamental support. The market loves to punish latecomers who buy high and sell low. Yes, the mining industry is under stress; yes, the headlines scream fear. But those very pressures are what forge the next bull run. Every miner that shuts off today is one less source of sell pressure tomorrow. Every uptick in efficiency raises the floor that much higher, like a coiled spring tightening. Bitcoin has been here before – when production cost and price locked jaws in late 2022, and again in early 2025 post-halving. Each time, the doom and gloom was followed by a dramatic recovery as the imbalances corrected. Our contrarian take: The cost of mining 1 BTC isn’t just a number on a spreadsheet – it’s the secret pulse of the market. Right now it’s telling us that the bottom is in or very near. Prices might chop around this magnet a bit longer, even dip slightly below in a final fake-out, but odds of a deep crash under the ~$94k cost basis are slim. The longer Bitcoin grinds at or below miners’ breakeven, the more hashpower will fall off, quietly tightening supply. When the spring releases, the next upward leg could be explosive (as even mainstream analysts like JPMorgan are eyeing ~$170k targets). In summary, Bitcoin tends to revisit its production cost for one last test – and when it holds, it launches. Autumn 2025 appears to be giving us that test. The savvy, data-driven operator will view this not with panic, but with patience and resolve. After all, if you can accumulate Bitcoin near its intrinsic mining value while the herd is fearful, you position yourself on the right side of the trade once the inevitable rebound kicks in. As the saying goes, bears win, bulls win, but miners (and hodlers) who understand the cost dynamics win big in the end. Brace yourself, stay analytical, and remember: Bitcoin’s true floor is built in watts and hashes, and it’s solid as steel. Best regards EXCAVOYesterday, the network's total hash rate fell by ~100 EH/s, representing a decline of ~8%, with at least 400,000 BTC mining rigs being shut down. The main reason for this is the closure of mining farms in Xinjiang, China.

EXCAVO

INTERVIEW: EXCAVO View 12/12/25

In my previous post, I invited you to ask any questions you had about the current market, the cycle structure, Bitcoin dominance, altcoins, timing, and everything in between. You asked - and here are the detailed answers. This is the continuation of our interview series. I have taken every question from the comments, grouped them under your usernames, and provided full, transparent explanations based on my current market view. Let's dive in. just5 Q: Why do you say the bear market started in November? If it started earlier, why not in October? Where does the 126k top come from? Why is Bitcoin dominance so high? Why haven't many altcoins (ETH, SOL) broken their previous highs? How far can they fall? Your analysis is based on past cycles and fractals. Do you admit you can be wrong? A: I do not define the beginning of a bear market strictly by the date of the absolute top. For me, the trigger is the structure on the weekly timeframe. The formal high was reached in October, but the signal that confirmed the start of the bear phase was the first strong red weekly candle, which appeared in November. That is why I mark November as the beginning of the bear market. The 126k level is not something random - the market simply traded there (around 126,250 USD depending on the exchange). So the level itself is not in question. As for Bitcoin dominance - it is very simple. We have one main instrument in the market: BTC. It defines the weather for the entire crypto market. When BTC rises, some alts rise and others lag. When BTC falls, everything falls - especially assets with weaker liquidity or fundamentals. Historically, people traded a lot of alt/BTC pairs. Many even believed altcoins were created mainly to accumulate more BTC. Today this logic still works: liquidity and attention gravitate toward Bitcoin, which naturally leads to high dominance. Regarding ETH and SOL: I honestly expected ETH to break its previous ATH. On SOL, I have written a separate idea (I will attach the link) where, back when ETH was around $1700 and SOL was around $150, I already said that between these two I prefer ETH because cycles matter. Above $200-250 on SOL and $4900-5000 on ETH there is a large liquidity cluster. The market will eventually go there, but the question is when. This expectation kept many people in top altcoins without taking profit. How far can altcoins fall? My baseline scenario is a 50-60% correction from their peaks, and that is the minimum. Crypto cycles often surprise with deeper drawdowns. Regarding the fractal and cycle approach - yes, my view is based on previous cycles. But of course, I admit that I can be wrong. If I am wrong, I will acknowledge it publicly. TradingView does not allow deleting ideas, everything stays visible, so everyone can judge my track record objectively. louistran_016 Q: If the 41% drop (126k -> 75k) happened in 2 months, why would the move to 60k take another 10 months? Is the 60k downside target too high? Is September 2026 too late for a market bottom? If the previous bottom in 2022 was at the 100-month EMA (around 16k), should not the next bottom be around 44k? A: I never said the drop to 60k must take 10 months. The chart is not obligated to move like "stick down -> stick up". We have only two axes: price and time. The market can: drop quickly, then consolidate, then spend months accumulating before the next move. Even if we hit 60k in 3 months, it does not mean the market will immediately reverse. Accumulation can take time. The 60k target is indeed a "high" bottom for a bear market because it is only about a 50% correction from the peak. I do not exclude deeper scenarios: 60-65-70% drawdowns are normal for crypto. But even 60k is a much better long-term buying zone than 90-100k or current prices. September 2026 is not "too late" in my view. It aligns well with the classical cycle structure: distribution -> decline -> depression -> accumulation. Regarding the 44k idea based on the 100-month EMA: It is absolutely possible. I do not rule it out. But tactically, I first target the 60-64k zone and then will reassess whether deeper levels become realistic. ikkie Q: Many people are calling this a bear market. Is that a bad sign? A: What I actually see is many influencers publicly questioning whether this is a bear market because they did not exit in time, and now it is hard for them to admit it to their audiences. The fact that many people call it a bear market is completely normal. The real question is not how people label the market, but what you do with your money. Being out of the market is also a position, sometimes the best one. When price enters a transition phase, staying flat can be a very strong decision. luaselene Q: What about ETH? A: ETH has a large liquidity zone above $4900-5000. I expect this region to be taken in one of the future bullish phases, but not in the near future. More realistically, this is a 2026-2027 story. Within the current part of the cycle, I do not expect ETH to sustainably break the ATH. mpd Q: I expect a retest of 100k before a crash to 35k. Thoughts? A: A very realistic scenario. A retest of 100k is the perfect psychological trap: it attracts the last wave of euphoric buyers, it loads the market with long positions (usually with leverage), and then the market can wipe them out with a deeper drop, even toward your 35k target. Crypto loves this pattern: round number -> FOMO -> leverage -> liquidation. KoDPrey Q: Why should the drop to 70k lead to a long correction instead of being a quick liquidity sweep before a move to 150-200k? Why do you think this cycle repeats previous ones? Can BTC dominance reach 70% in a bear market? Aren't we in the middle of a bull market? If you were wrong on PORTAL longs, can you also be wrong about the entire cycle? A: I do not think the drop to 70k must be a simple wick with an instant reversal. Historically, Bitcoin cycles include a depression phase where people lose hope, liquidity gets washed out, and even long-term holders capitulate. After this phase, a move toward 150-200-250k makes much more structural sense. A simple "drop -> instant all-time-high" scenario resembles the old "supercycle" meme. Possible? Maybe. Likely? In my view - not now. This cycle is indeed different: almost no broad altseason, many more participants, institutions, and countries involved, much more infrastructure that can liquidate traders' positions, more derivatives, more leverage, more points of failure. But Bitcoin's macro-cycle structure is still fractally consistent. The shapes and speeds change - the logic does not. Can Bitcoin dominance hit 70%? Yes. In crypto anything is possible. I consider this scenario totally realistic, even within a bear market. Are we in the middle of a bull market? In my view - no. I do not think we are anywhere near the middle of a bull run. Regarding PORTAL: yes, I was wrong. And not only there, I have been wrong many times. But even with those mistakes, I closed my positions, exited both spot and margin, and avoided much deeper drawdowns. Of course I can be wrong about the cycle. I am sharing my view, not claiming infallibility. My win rate is far from perfect, and every idea remains public on TradingView. Anyone can check them later. houari14 Q: What do you think about the USDT Dominance index (USDT.D)? Is it reliable? A: Honestly, I barely use USDT.D in my analysis. Yes, it shows whether market participants prefer sitting in stablecoins or taking risk, but for me it is not a primary metric. I focus more on: BTC price, market structure, dominance of BTC itself, volume behavior, and how major altcoins react. anatta_ Q: How far can BTC fall in this bear market? How long will the bear market last? If BTC holds 80-85k for a few months, can it start a new bull cycle? A: I expect at least a 50% correction from the top. Realistically, 60-65-70% drawdowns are absolutely possible. More than 75% I do not consider my baseline, but in crypto nothing is impossible. Regarding duration: My estimation is that the bear market should end toward late 2026. Around September 2026 I expect a major bottom, a zone where long-term accumulation becomes attractive. If BTC holds 80-85k for a few months, yes, theoretically it could trigger a new bullish phase, especially if a strong new narrative appears. But I am not betting on that scenario. I prefer staying out of the market until the cycle structure becomes clear. tommayhew Q: Is there a connection between the recent Cloudflare security incident and the crypto drop? A: The timing was surprising, and it is natural to link the two events. But at this moment I do not see solid evidence that the incident caused the market drop. Maybe more information will appear later, but for now I treat it as a coincidence rather than a catalyst. simplejoe1 Q: We already have ETFs and a pro-BTC U.S. president. Could this be the absolute top? A: ETFs and a pro-Bitcoin president do not automatically guarantee continuous growth, nor do they define the market top. The president also has: his own memecoin, check how its chart looks, his own crypto-investing fund, check its token too. These examples show that one person, even the U.S. president, does not determine the entire market. The market is bigger and more complex than a single headline. Best regards, EXCAVO

EXCAVO

تحلیل اختصاصی EXCAVO: بازار خرسی شروع شد! سطح بحرانی بیت کوین و تله قیمتی پیش رو

1. Ayı piyasasının çoktan başladığına inanıyor musunuz? Evet ise - hangi andan itibaren? Evet. Ayı piyasası Kasım 2025'te başladı. Döngüsellik grafiğim bunu açıkça gösteriyor: Tek bir senaryo bile yükselişin devam edeceğine işaret etmiyor. TradingView'de yayınladığım her grafik trendin tersine döndüğünü doğruluyor. 2. Geri dönüşü doğrulayan ana sinyal neydi? Bitcoin'in büyümesinin 153. haftası, neredeyse her zaman bir döngünün sonunu işaret eden tarihi bir tükenme noktasıdır. 3. Aşağı yönlü senaryo için hangi BTC seviyeleri kritiktir? Anahtar yatay seviye 74.000 dolar. En azından altında temiz bir fitil olmasını bekliyorum. 4. Ayı piyasasını hızlandıran temel faktörler nelerdir? Muazzam bir aşırı alım ortamı. 2 yıllık AI balonu, değerlemeleri rayiç değerin çok üstüne çıkardı. AI kalıcı olmasına rağmen piyasa aşırı ısındı. 5. Düşüşü doğrulayan teknik faktörler? Hiçbir gerçek neden olmadan ayrılıyoruz. Herhangi bir küçük başlık satışı tetikler. 11 Ekim Trump ile ilgili değildi; büyük borsalarda yapılan bir balina manipülasyonuydu. Son aşamadaki döngüler böyle davranır. 6. Yatırımcıların çoğu neden bu geri dönüşü göremedi? — Kısa hafıza — 3 yıl boyunca "her düşüşü satın almak" üzere koşullandırıldı — Çıkış planı yok — Açık bir çerçeve yok — Ve elbette: EXCAVO'yu takip etmiyorlardı 😉 7. Önümüzdeki haftalarda BTC nereye gidebilir? Birincisi: kısa pozisyonların tasfiyesi. Hatta 94.000 dolara kadar çıkabiliriz. Ancak bu aşağı doğru devam etmeden önce bir tuzak olacaktır. Aralık ayında döngü diplerinden birinin oluşmasını bekliyorum. 8. Hangi senaryo daha muhtemel görünüyor: Paniğin azalması mı, yoksa adım adım kanama mı? Büyük olasılıkla: adım adım kanama. 9. Daha fazla düşüşten önce sahte bir sıçrama mümkün mü? Evet. Daha önce de bahsetmiştim: kısa bir sıkışma → ardından büyük bir düşüş. Pratik Bölüm 10. Bu pazarda kişisel olarak ne yapıyorsunuz? Bekliyorum. Gözlemliyorum. Çalışıyorum. Her gün ticarette olmanıza gerek yok. Aşırı ticaret, herhangi bir düzeltmeden daha fazla yatırımcıyı yok etti. 11. Yeni başlayanlar şimdi ne yapmalı? Tam olarak profesyonellerin yaptığı şey: giriş noktalarını beklemek. Bizler çalılıklardaki avcılarız; yalnızca hedef yaklaştığında ateş ederiz. 12. Yatırımcılar şu anda stratejilerinde neyi gözden geçirmeli? — Makro döngünün neresinde olduğumuzu anlayın — Neyin işe yaradığını belirleyin — Olmayanları kaldırın — Ayı piyasasının uzun ve yorucu olacağını kabul edin Şu anda umut aşamasındayız. Hayal kırıklığı kapıda. Saygılarımla EXCAVO Sorularınız varsa sormaya çekinmeyin. Bir sonraki yazıda bu altına bıraktığınız sorulardan yola çıkarak başka bir röportaj yapabilirim.

EXCAVO

سقوط بزرگ در انتظار مایکرواستراتژی؟ برنامه سایبر در معرض خطر حذف از شاخصها!

MSCI, Kripto Ağırlıklı Şirketleri Hariç Tutabilir: Bu MicroStrategy ve Piyasa İçin Ne İfade Ediyor? MSCI kısa süre önce, küresel endekslerin büyük kripto riskine sahip şirketlere nasıl davrandığını önemli ölçüde yeniden şekillendirebilecek bir teklif yayınladı. Çerçeveye göre, piyasa değerinin yüzde 50'sinden fazlasını dijital varlıklarda elinde bulunduran şirketler, ulusal ve uluslararası endekslerin dışında tutulabilecek. Bu kulağa teknik geliyor ama sonuçları çok büyük. Bunun Pratikte Anlamı Nedir? Kural uygulanırsa MicroStrategy, Bitfarms, Marathon, Hut8, Coinbase gibi şirketler veya bilançolarında büyük oranda kripto bulunduran herhangi bir firma: major endekslerinin dışında tutulabilir, kurumsal yatırımcılara olan ilginizi kaybedersiniz, emeklilik fonları, sigortacılar ve muhafazakar hedge fonları için yasak olmak, Likiditenin azalması ve zorla satışla karşı karşıya kalınır. Bu küçük bir gelişme değil. Bu yapısal bir değişimdir. 🧩 Neden MicroStrategy En Çok Maruz Kalandır? MicroStrategy'nin iş modeli son derece basittir: yeni hisseler ihraç etmek borcu artırmak (dönüştürülebilir senetler dahil) Bitcoin satın almak için gelirleri kullanın yükselen BTC → yükselen MSTR artan MSTR → daha fazla borçlanma kapasitesi Sürekli bir döngü. Ancak MSTR temel endekslerin dışında bırakılırsa döngü bozulur: Pasif fonlar satılmalı kurumsal yatırımcılar uyum riskiyle karşı karşıya likidite kurur oynaklık artar borçlanma maliyetleri artıyor Ve şunu unutmayın: MicroStrategy şu anda Bitcoin varlıklarının rayiç değerinin altında işlem görüyor. Zorla dışarı akış yapısal dengesizliği artırır. ⚠️ Kurumlar Neden Bitcoin Yerine MicroStrategy Satın Aldı? Pek çok fon yasal olarak Bitcoin'i satın alamıyor. Ayrıca Coinbase gibi yüksek riskli kripto borsa hisselerini de satın alamıyorlar. Ancak şunları satın alabilirler: saygın kurumsal borç dönüştürülebilir notlar borsada işlem gören bir ABD'den özsermaye.S. şirket Michael Saylor onlara düzenleyici bir boşluk verdi: "Bitcoin riske girmek mi istiyorsunuz? Dönüştürülebilir borcumu satın alın. BTC yükselirse banknotları hisselere dönüştürün.” Bu geçici çözüm artık işe yaramıyor. Konvertibl Borç Sahipleri Zor Durumda MSTR'nin endekslerden hariç tutulması durumunda: endeks fonları satışı → hisse fiyatlarında düşüşler düşen fiyat → dönüştürülebilir banknotlar değer kaybeder Borcunu elinde bulunduran kurumlar zararla karşı karşıya Bilanço riski artıyor Bu nedenle düzenleyici kararlar çok önemlidir. İçeriden Bilgi Satışı: MicroStrategy'de Bitcoin Başkan Yardımcısı ~19,7$M Değerinde Hisse Senedi Sattı Zamanlama… ilginç. 18 Eylül'de satışa başladı Birden fazla lotta satılan opsiyon bazlı hisseler 14 Kasım'a kadar satışlara devam edildi Toplam gerçekleşen kâr: ~19,69$M Düzenleme belirsizliğine satış yapmak rastgele bir davranış değildir. Bu bir sinyal. Temel Çıkarımlar 1. MSCI'nın teklifi kuralları değiştiriyor: >%50'den fazla kripto riskine sahip şirketler "indekslenemez" hale gelebilir. 2. MicroStrategy'nin core modeli (BTC satın almak için borç alma) kurumsal girişlere bağlıdır. Endeksin hariç tutulması bunu bozar. 3. Dönüştürülebilir tahvil yatırımcıları ciddi baskıyla karşı karşıya kalabilir. 4. İçeriden bilgi satışı, yapısal risk konusunda kurum içi farkındalığın göstergesidir. 5. MSTR'nin endekslerden çıkarılması durumunda zorunlu satış ciddi bir aşağı yönlü baskı yaratabilir. 📉 Sonuç MicroStrategy, "ETF'ler var olmadan önce de uzun süredir bir Bitcoin ETF'siydi". Kurumlar BTC'ü doğrudan satın alamadıkları için MSTR'yi satın aldılar. Ama şimdi: Bitcoin ETF'ler mevcut, Düzenlemeler sıkılaştırılıyor Endeks sağlayıcıları risk çerçevelerini güncelliyor. MicroStrategy kendi başarı stratejisinin kurbanı olabilir. Saygılarımla EXCAVO

EXCAVO

بازار در دمای ۸۰ درجه است: چه اتفاقی در ۱۰۰ درجه (نقطه جوش) میافتد؟

Herkese selamlar. Bugün haberler hakkında konuşmak istemiyorum. Gerçekten önemli olan şey hakkında konuşmak istiyorum: piyasa yapısı. Pek çok trader şu anda mevcut durgunluğu açıklamak ve Bitcoin'in bir sonraki move'ını tahmin etmek için bir haber etkinliği arıyor. Yanlış yöne bakıyorlar. Şunu unutmayın: Haberler move'in nedeni değildir. Bu sadece move olayı gerçekleştikten sonra size sunulan kullanışlı bir açıklamadır. Benim için grafik önceliklidir. Ve şu anda çoğu insanın hoşuna gitmeyecek bir story mesajı veriyor. Küresel Resim: Baloncuk ve Kaynayan Su Ekonomisi era baloncukların içinde yaşıyoruz. Nokta com'lar yaşadık, lale çılgınlığı yaşadık ve şimdi AI balonuna tanık oluyoruz. Evet, AI oyunun kurallarını değiştiren bir gelişme ve ben onu aktif olarak tüm süreçlerime entegre ediyorum; bu eğilimi inkar etmek aptallık olur. Ancak bu, piyasaların aşırı ısındığı gerçeğini değiştirmiyor. Şu anda tüm küresel ekonomi, suyun 80 dereceye kadar ısıtıldığı hissine kapılıyor Celsius. Henüz kaynamadı ama kaynama noktasına yakın. Bir şeyler olmak üzere ve buhar patlamaya hazırlanıyor. Piyasanın Nabzı: Kalabalığın Yanlış Yaptığı Yer Peki ya kalabalık? Kalabalık artık Bitcoin'de değil. Kendilerini "sonsuza kadar garson" olmaya teslim ederek altcoinlerde sıkışıp kaldılar. Bir alt sezon için dua ediyorlar, gördüğümüz kısa %20-30 pump'un alt sezon olduğunu fark etmiyorlar. Zaten meme oldu. Sosyal medyada tasfiyelerle ilgili bitmek bilmeyen paylaşımlar görüyorum. Duygu umutsuz. Çoğu, vadeli işlem pozisyonlarını çoktan kaybetti veya kaybedecek soon. Şu anda piyasada hüküm süren şey korku ya da açgözlülük değil, ayı piyasasının hiçbir zaman gerçekten ayrılmadığının yavaş yavaş farkına varılmasıdır. Grafikteki Ana Kurulum: Klasik Bir Likidite Tuzağı Şimdi en önemli kısma gelelim: Bitcoin grafiğinde neler oluyor? Gördüğünüz gibi kritik bir trend çizgisi desteğinin üzerinde oturuyoruz. Herkes görüyor. Acemiler ve perakende tüccarlar bunu açık bir "düşüşten satın alın" sinyali olarak görüyorlar. Ve bu oyunun bir parçası. Kasıtlı bir tuzak kuruluyor: Konsolidasyon : Fiyat, güç yanılsaması yaratmak ve alıcıların pozisyonlarını biriktirmek için kasıtlı olarak destek hattının yakınında tutuluyor. Zarar Durdurmaların İstiflenmesi : Piyasa yapıcılar kalabalığın duraklarını bu bariz çizginin hemen altına yerleştirdiğini biliyor. Yürütme : Yeterli likidite oluştuğunda keskin bir çöküş yaşanacaktır. Bu, yalnızca düşüşü hızlandıracak bir dizi zararı durdurma tasfiyesini tetikleyecektir. Tüm zamanların en yüksek seviyesinden emin bir kırılma görene kadar tamamen düşüş yönünde kalacağım. Mevcut seviyelerden herhangi bir sıçramayı, kısa pozisyona daha iyi bir giriş fırsatı olarak görüyorum. Sırada Ne Var? Önümüzdeki 2-4 hafta boyunca kendime tavsiyem nedir? Beklemek. Piyasa büyük bir temizliğe hazırlanıyor. Bunları hype için kullanan borsalar dışında kimseye hizmet etmeyen önemsiz projelerin ve meme madeni paraların listeden çıkarılması dalgası geliyor. Bu arınmanın ardından çok cazip fiyatlarla satın almak için inanılmaz fırsatlar karşınıza çıkacak. Artık gerçekten inandığınız projeleri deep araştırma zamanı. Limit emirlerinizi hazırlayıp piyasanın fiyatlarınıza gelmesini beklemenin zamanı geldi. İlginiz için teşekkür ederiz. Saygılarımızla, EXCAVO'nuz.

EXCAVO

فاجعه رمزارزها: چرا بازار خونین شد و کف قیمت کجاست؟

Bu tabloya yakından bakmanızı istiyorum. Bunlar sadece çizgiler ve mumlar değil. Bu bir uyarı zaman çizelgesidir. 12 Eylül, 23, 30 Eylül, 6 Ekim, 10 Ekim – Zirvenin geldiğini haykırıyordum. Piyasadan çekildiğimi söylemiştim. Bunun için tüm kariyerim boyunca aldığımdan daha fazla nefret aldım. Yorumların %90'ı benimle aynı fikirde değil. Ama neye kaydolduğumu biliyordum. Seni uyarmak istedim. Ve dinleyenlere minnettarım. Ve bugün piyasanın mutluluk için ödediği bedeli gördük. Bu bir Meme değil. Bu bir trajedi Bugün sadece bir "likidite kapma" değildi. Bu, 1,6 milyon tüccarın 10 milyar dolar karşılığında soyulmasıydı. Ve bunlar sadece rakamlar değil. Bugün yarışmalardan tanıdığım bir tüccar olan Kostya Kudo intihar etti. Bu artık bir şaka değil. Bu bir meme değil. İnsanlar ölüyor. En iyiler gidiyor. Gerçek hayatlar yok edilirken bunu internet meme gibi izleyemeyiz. Bu Nasıl Oldu? Kusursuz Fırtınanın Anatomisi Elbette birisi büyük miktarda boşalttı. Peki düşüş neden bu kadar deep ve bu kadar hızlıydı? Basamaklı Tasfiyeler: İlk satış dalgası zincirleme bir reaksiyonu tetikledi. Sipariş Defterinde Bir Boşluk: Bunu 2019'dan beri biliyorum. Bunun gibi çöküşler sırasında piyasa yapıcılar para kaybetmemek için algoritmalarını kapatırlar. Likiditelerini çekiyorlar. Sipariş defteri boşalır. Herhangi bir satış emri fiyatı yüzlerce, binlerce dolar düşürür. Burası bir pazar değil. Bu bir boşluk. Kazanan Borsalar Oldu: O 10 milyar dolar şimdi nerede? Merkezi borsalarla. Ve hiç kimseye tazminat ödenmeyecek. Size sadece "Bir dahaki sefere riskinizi yönetin" söylenecek. Neden Bu Sadece Başlangıç? Dibe Giden Yol Tasfiye edilemem. Söylediğim gibi tamamen stablecoin'deyim. Bu agresif ortamdan bıktım. Peki neden daha aşağılara ineceğimizden eminim? Şu ana kadar sadece vadeli işlem tacirleri tasfiye edildi. Ancak teminat yoluyla kaldıraç kullanan bir oyuncu ordusu var. BTC/ETH'yi teminat altına alıyorlar, stabilcoinler alıyorlar, onlarla daha fazla BTC/ETH satın alıyorlar ve tekrar teminat altına alıyorlar... bir piramit oluşturuyorlar. BTC'ü 200 bin dolardan bekliyorlar. Zirveden yüzde 40-60'lık bir düşüşle bu piramit çökmeye başlayacak ve yeni bir zorunlu satış dalgasına neden olacak. Hesaplamalarıma göre alt kısım 60.000 ila 65.000 dolar civarında olacak. Peki bu tasfiyelere kimin ihtiyacı var? İyi bir giriş noktasına ihtiyaç duyan major finans oyuncuları. Yüksek fiyatlardan alım yapmıyorlar. Kanla satın alıyorlar. Her Yatırımcının Adresi Her birinizle konuşmak istiyorum. Analistler, tüccarlar, yatırımcılar, spekülatörler. Yalnız çalışıyorsun. Kararlarınızla, sorunlarınızla bire bir ekranın front'sında. Bu yola adım atan herkese sonsuz saygım var. En akıllı algoritmaların ve tüm şirketlerin paranızı almak istediği düşmanca bir ortama girdiniz. Kendimi hayal kırıklığına uğrattım. Asla gelmeyecek bir "alt sezon" bekliyordum. Ve bunu zamanında itiraf ettim: "Altseason" bir dolandırıcılıktır. Piyasadaki bir milyon jetonla artık çalışmayan bir meme. Bu bir flip-flop değil. Planımı takip ediyordum: Eylül ayına kadar burada kalacağım. Piyasanın artık "fazla bagaj olmadan" yükselişini bekleyenlere iyi şanslar. Ben buna katılmıyorum. Eylül 2026'ya yaklaştıkça aktif satın almaya döneceğim. Piyasayı yukarı çekecek kim kaldı? Tasfiye edilen 1,6 milyon tüccar mı? Artık aramızda olmayan tüccarlar mı? Bu yazı övünme amaçlı değil. Bu acıdır. Ve bu son bir uyarıdır. Kendinizi ve sermayenizi koruyun. Saygılarımla EXCAVO

EXCAVO

BTC is in 'The Final Trap' Before the Crash (Wyckoff Phase C)

Son yazımda, boğa döngüsünün sonunu duyurdum ve önümüzdeki iki yıl boyunca oyun planımı paylaştım. Ne yaptığımı ve neden makroekonomik bir perspektiften açıkladım. Bu yazıda, teknik analiz kullanarak bu sonuçlara nasıl geldiğimi göstereceğim. Bu bağırsak hissi değil. Şu anda grafikte oluşan bir yapıdır - klasik bir Wyckoff dağıtım şeması. Wyckoff dağılımı nedir? Basitçe söylemek gerekirse, Wyckoff Dağıtım "akıllı para" (büyük oyuncular, içeriden gelenler) varlıklarını pazarın zirvesindeki perakende yatırımcılara nasıl sattığını gösteren bir modeldir. Bu süreç, azalma başlamadan önce maksimum öfori oluşturmak ve mümkün olduğunca çok alıcıda cazibe etmek için tasarlanmış çeşitli aşamalardan oluşur. Ayrıntılı açıklama: Örnekler: Bitcoin grafiğinin faz-faz dökümü (Gönderinin ana özelliği olacak grafiğinize bakın) Şimdi, Bitcoin grafiğine bakın. Bir ders kitabı örneğine benzerlik dikkat çekicidir: A -Aşaması (eğilimi durdurarak): Yukarı eğilimin ivmeyi kaybetmeye başladığı ön arz (PSY) ve satın alma doruğunu (BC) gördük. Aşama B ("Sebep" in Binası): "Akıllı para" nın fiyatı çökertmeden pozisyonlarını dikkatle dağıtmaya başladığı uzun bir konsolidasyon aralığı. Faz C (son tuzak): En kritik faz. UTAD'a tanık olduk (dağılımdan sonra uphrust) - devam eden bir miting yanılsamasını yaratan son bir itme. Bu, son alıcıları tuzağa düşürmek için tasarlanmış en yüksek öfori anıdır. Burası tam olarak şimdi olduğumuz yer. Faz D & E (işaretleme): Şematik gösterildiği gibi, C aşamasından sonra, ayı piyasasının başlangıcını işaret eden sürekli bir düşüş (işaretleme) başlar. Grafikteki öngörülen yörünge, Eylül 2026'ya kadar piyasadan uzak durma planımla mükemmel bir şekilde uyuyor. Sonuç ve Tartışmaya Çağrı Bu grafik geleceğin% 100 doğru bir tahmini değildir. Pazar psikolojisinin bir haritasıdır. Mevcut durumun kaos değil, tarih boyunca birçok kez gerçekleşen yapılandırılmış bir süreç olduğunu gösterir. Bana piyasadan çıkma kararıma güven veren bu yapıdır. Duygulara güvenmiyorum; Bir sisteme güveniyorum. Grafikte ne görüyorsunuz? Bu analize katılıyor musunuz? Bu şematik hakkında hangi sorularınız var? Yorumlarda tartışalım. PS. Zirveyi arayan son gönderim çok nefret etti. 160+ yorum okudum. İşte Bulls'tan 3 ana argümana cevaplarım. Argüman #1: "Ama ETFS ve Kurumlar! Farklı!" Cevabım: Yeni oyuncular, aynı oyun. Oyun insan psikolojisidir. Euphoria hala öfori, kim satın alıyor olursa olsun. Tartışma #2: "Çok erken! Gerçek bir altseason yoktu!" Cevabım: Kesinlikle. 2017 tarzı bir altseason eksikliği, döngünün tükendiğini kanıtlıyor. Pazar bize en yüksek gücünü gösterdi ve işte bu. Tartışma #3: "Sadece zirveyi zamanlamaya çalışıyorsun!" Cevabım: En iyi mumu zamanlamıyorum. Dağıtım aşamasında çıkıyorum. Erken olmak bir stratejidir. Geç olmak bir felakettir. Yorumlarımdaki duygusal öfke, ihtiyacım olan son onay. Çağrımın yanında duruyorum. 2026'da görüşürüz. #Bitcoin Saygılarımızla Excavo

Sorumluluk Reddi

Sahmeto'nun web sitesinde ve resmi iletişim kanallarında yer alan herhangi bir içerik ve materyal, kişisel görüşlerin ve analizlerin bir derlemesidir ve bağlayıcı değildir. Borsa ve kripto para piyasasına alım, satım, giriş veya çıkış için herhangi bir tavsiye oluşturmazlar. Ayrıca, web sitesinde ve kanallarda yer alan tüm haberler ve analizler, yalnızca resmi ve gayri resmi yerli ve yabancı kaynaklardan yeniden yayınlanan bilgilerdir ve söz konusu içeriğin kullanıcılarının materyallerin orijinalliğini ve doğruluğunu takip etmekten ve sağlamaktan sorumlu olduğu açıktır. Bu nedenle, sorumluluk reddedilirken, sermaye piyasası ve kripto para piyasasındaki herhangi bir karar verme, eylem ve olası kar ve zarar sorumluluğunun yatırımcıya ait olduğu beyan edilir.