norok

@t_norok

تریدر چه نمادی را توصیه به خرید کرده؟

سابقه خرید

تخمین بازدهی ماه به ماه تریدر

پیام های تریدر

فیلتر

نوع پیام

Monero Confirmed Breakout

Monero XMRUSD اوج محلی را در 470 با بسته شدن هفتگی bar از 470.38 شکسته است. حتی اگر 0.38 باشد، باز هم این یک قانون برای تایید شکست است. مقاومت بعدی در تمام زمان ها در 517.60 بود. با توجه به تأیید شکست و حرکت، بیشترین احتمال وجود دارد که قیمت ATH را آزمایش کند و سپس دید که آیا آن bar هفتگی بسته می شود تا آن را تأیید کنیم. چقدر می توان Monero برود؟ من فرض نمی کنم که به طور دقیق با تاپ ها تماس بگیرم. با توجه به پیشرفت ATH ها، به احتمال زیاد بالاترین مقدار بعدی حدود 593 بود. با استفاده از پیش بینی نوسانات تاریخی 3 ساله، هدف می تواند 793 باشد. هشدار: چنین افزایش سریع قیمت به معنای نوسانات بالا ذاتی است و نگاهی به تاریخچه طولانی مدت مونرو نشان می دهد که یک بازگشت چشمگیر در نهایت بسیار محتمل است. در این مرحله انجام این کار بسیار دشوار است. همانطور که گفته شد - من همچنان معتقدم که Monero بهترین شرط نامتقارن در ارزهای دیجیتال در حال حاضر است.

Monero: "Delisting is a Feature"

اگر فهرست نشدن در major صرافی های متمرکز بزرگترین مورد مونرو باشد چه؟ اکثر سرمایه گذاران همین موضوع را فرض می کنند: دارایی ها بالا می روند زیرا سرمایه های سفته بازی را جذب می کنند. نقدینگی، فهرستها، اهرم و قابل مشاهده بودن به عنوان پیشنیازهای ارزشگذاری در نظر گرفته میشوند. بنابراین بزرگترین «مشکل» مونرو - حذف شدن از فهرست major صرافیهای متمرکز به دلیل تضمین حفظ حریم خصوصی آن - معمولاً کشنده است. اما اگر این فرض عقب مانده باشد چه؟ اگر حذف از کازینو سوداگرانه دقیقاً به این دلیل باشد که Monero رفتار متفاوتی - و مسلماً بهتر - نسبت به بقیه ارزهای دیجیتال دارد؟ انتقاد رایج (و چرا ادامه دارد) استدلال استاندارد به این صورت است: ویژگیهای حریم خصوصی Monero باعث میشود که آن را با مقررات در حال تحول سازگار نباشد. این امر صرافی های متمرکز را مجبور به حذف آن از فهرست می کند. بدون دسترسی به مبادله، جریان های سوداگرانه خشک می شوند. بدون حدس و گمان، قیمت راکد می شود. این روایت سالهاست که دست به دست میشود. منطقی به نظر می رسد. همچنین به طور فزاینده ای با واقعیت در تناقض است. با وجود حذف مکرر از فهرست، Monero به عنوان یکی از نامرتبط ترین دارایی ها در کل بازار کریپتو ظاهر شده است. و همبستگی - نه نوسانات - چیزی است که بی سر و صدا سبدها را از بین می برد. آنچه که نمودارها در واقع نشان می دهند BTCUSD ETHUSD SOLUSD DOGEUSD XRPUSD افزایش/کاهش شدید امروز صبح move تقریباً یکنواخت در کریپتو موج زد. بیت کوین، اتریوم، سولانا، دوج، XRP - همه یک الگو را نشان می دهند: افزایش نوسانات شکست از تثبیت نزولی رد سریع به محدوده یا پایین تر این کتاب درسی «زلزله نوسانات کم حجم» بود. Monero به سختی واکنش نشان داد. درحالیکه بقیه بازار بهعنوان یک ارگانیسم واحد حرکت میکرد – تحت فشار و کشش همان الگوها، بازارسازان و نقدینگی کم – روند صعودی مونرو تا حد زیادی بدون وقفه باقی ماند. وقتی همه چیز با هم حرکت می کند به جز یک دارایی، آن استثنا مهم است. حذف از فهرست که story را تغییر داد در 6 فوریه 2024، Monero یک شبه بیش از 30 درصد کاهش یافت. در ابتدا، من بدترین را فرض کردم - شکست رمزنگاری یا به خطر افتادن حریم خصوصی. در عوض، علت ساده بود: Binance Monero را به دلیل عدم رعایت مقرراتی با سکه های حریم خصوصی از فهرست حذف کرد. به عبارت دیگر، Monero به دلیل کار دقیقاً همانطور که طراحی شده بود مجازات شد. نگه داشتم. این یک واکنش بازار بود که به سرعت کاهش یافت و Monero بیش از 300 درصد افزایش یافت. فروش به سرعت محو شد. از آن زمان پایین، Monero بیش از 300٪ افزایش یافته است. حذف شدن از صرافی با بیشترین حجم، ارزش مونرو را سرکوب نکرد. اگر چیزی باشد، ممکن است آن را آزاد کرده باشد. مکانیسم نادیده گرفته شده اکثر ارزهای دیجیتال اکنون عبارتند از: به شدت در اطراف مبادلات متمرکز شده است به طور مداوم آربیتراژ می شود قیمت گذاری در درجه اول از طریق اهرم و جریان های نسبی این باعث می شود آنها کارآمد - و ارتباط تنگاتنگ. Monero به طور فزاینده ای خارج از آن سیستم وجود دارد. با الگوهای کمتر، اهرم کمتر و دسترسی محدود به حدس و گمان انعکاسی، قیمت Monero بیشتر تحت تأثیر موارد زیر است: استفاده واقعی محکومیت دارنده تقاضای ذاتی برای اسکان خصوصی این باعث نمی شود هر روز هیجان انگیز باشد. از نظر ساختاری آن را متفاوت می کند. و بازارها در نهایت به داراییهایی پاداش میدهند که مانند سایر موارد شکست نمیخورند. فکری که ارزش نشستن را دارد اکثر مردم معتقدند حذف از فهرست ارزش را از بین می برد. این باور بدیهی به نظر می رسد - تا زمانی که نبینید یک دارایی به همان نیروهایی که همه چیز را بی ثبات می کنند واکنش نشان نمی دهد. Monero ممکن است عملکرد ضعیفی نداشته باشد زیرا فاقد حدس و گمان است. ممکن است عملکرد بهتری داشته باشد زیرا دیگر به آن وابسته نیست. در بازار معتاد به همبستگی، استقلال یک اشکال نیست. این ویژگی است که همه از آن چشم پوشی می کنند - تا زمانی که مهم باشد.

Bitcoin Price History Rhymes

همانطور که من به نمودار برای BTCUSD در بازه زمانی هفتگی با پوشش ایچیموکو، شباهتها به چرخه بالای 2021-2022 وهمآور است. بیایید منظورم را بشکنیم: شاخص کلیدی Ichimoku قیمت نسبت به Kumo Cloud است. یک روند در بازه زمانی مربوطه زمانی شروع می شود که قیمت بالاتر از فضای ابری باشد. من همچنین از Chickou به عنوان حرکت برای تأیید استفاده می کنم. این بدان معنی است که روند فعلی بول Bitcoin به طور رسمی در هفته نامه در نوامبر 2023 آغاز شد. معکوس این قانون زمانی است که قیمت و حرکت در طرف مقابل ابر قرار دارند. آخرین روند خرس Bitcoin به طور رسمی در هفته نامه در ماه می 2022 آغاز شد. بنابراین می توانیم ببینیم که Bitcoin چقدر به قلمرو واقعی نزولی نزدیک است. به زیر 80 هزار رسید و برای مدت طولانی در آنجا ماند. شباهت وهمآور دیگر، انفجارهای دروغین دوگانه یا "Spikes" است. اگر یک اندیکاتور اکشن قیمت را یاد گرفتید، شکست نادرست را به خاطر بسپارید! هیچ سیگنال قابل اعتمادتری برای برگشت از زمانی که قیمت یک بالا/پایین جدید ایجاد می کند و سپس در محدوده قبلی بسته می شود وجود ندارد. یک بار دیگر امسال مانند سال 2021، دو سیگنال از این نوع با هفته ها فاصله داشت. این بدان معناست که بازار در مقاطع حساسی که در صورت تداوم قیمت باید شکست ها رخ می داد، خرید خود را متوقف کرد. این شکست های نادرست در حال حاضر قابل مبادله بوده اند، اما همه باید توجه داشته باشند که این موارد تا چه حد مکرر و قابل اعتماد هستند.

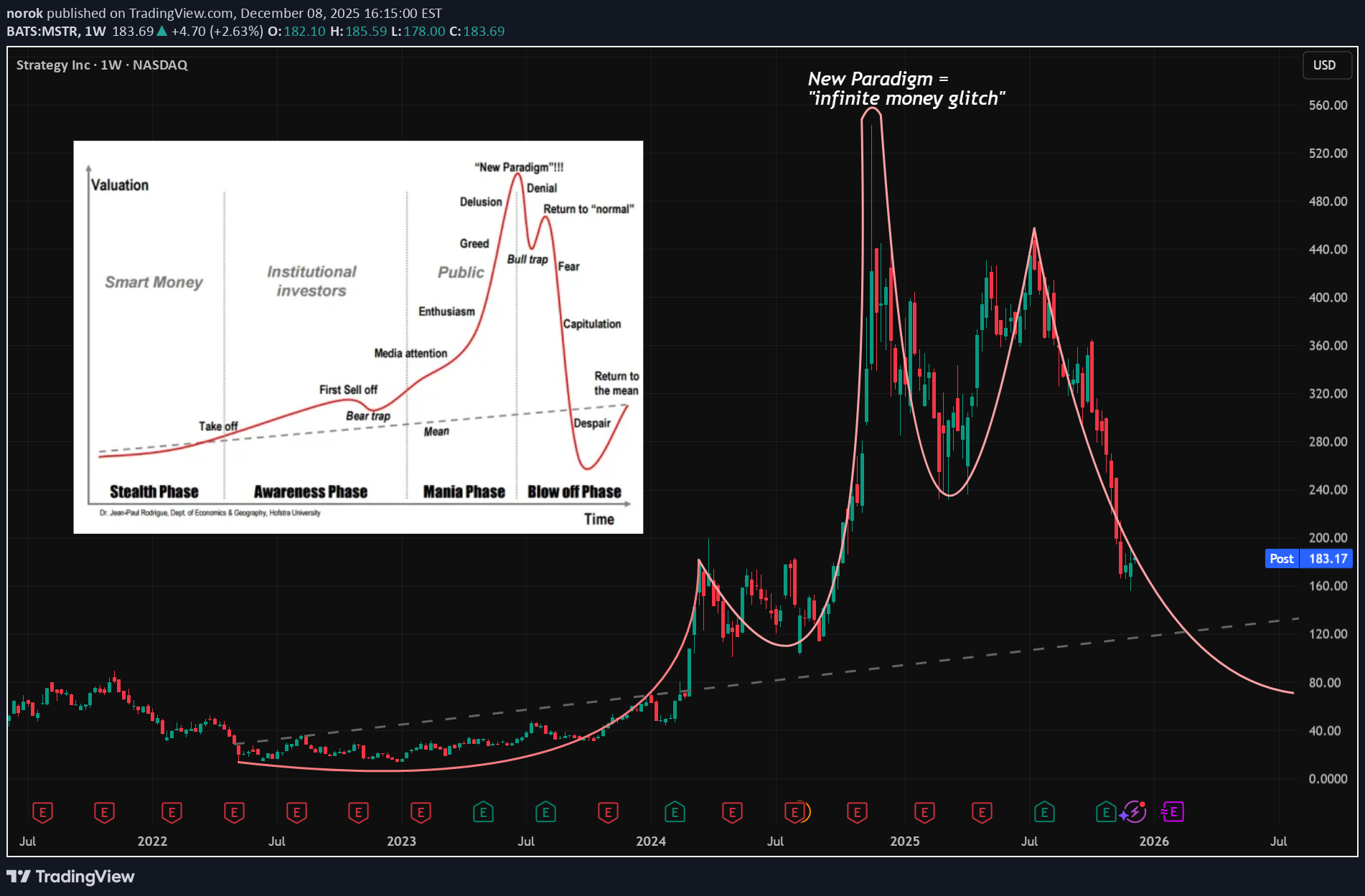

MSTR: Now I can't unsee it

در جریان پخش زنده جمعه بودم و در مورد زمان کوتاه (اکنون بسته) من صحبت می کردم و به بازه زمانی ماهانه منتقل شدم $NASDAQ:MSTR. من قبلاً این الگو را بارها دیده ام و اکنون نمی توانم آن را ببینم. معلوم شد هیچ چیز جدیدی تحت sun... امور مالی وجود ندارد. همه الگوهای یکسان رفتار انسان فقط با روایت های مختلف تکرار می شوند.

پیشبینی بلندمدت بیتکوین: پایان رالی گاوی و آغاز فاز خرسی تا ۲۰۲۶!

همیشه زود، هرگز شک نکنید من قبلاً از Bitcoin مرتبط خود خارج شده ام ( IBIT قرار می دهد) شورت و MSTR قرار می دهد. من مطمئن بودم که زودتر آمد زیرا این عادت من است. بدون شک در نقطه ای یک تجمع امدادی وجود داشت که ممکن است دوباره وارد آن شوم. پیش بینی بلندمدت من این است که فاز صعودی چرخه قیمت هالوینینگ به پایان رسیده و فاز نزولی آغاز شده است. بیایید هر مولفه اکشن قیمت را که در حال تماشای آن هستم تجزیه کنیم... ابتدا اجازه دهید یک قدم به عقب برگردیم تا بدانیم چرا به اینجا رسیدیم. شکست نادرست یا همان طور که من آنها را "Spike" می نامم یکی از قابل اعتمادترین سیگنال هایی است که من معامله می کنم. اگر یک عنصر واحد قیمت را مطالعه می کنید، باید این باشد. وقتی قیمت نتواند بالاتر از ATH قبلی (یا کمتر از major پایین) بسته شود، این بالاترین احتمال برگشت است. روانشناسی بازار نشان می دهد که معامله گران از ادامه تجمع خودداری کردند و اکنون بسیاری از آنها "به دام افتاده اند". این دلیل انحلال های گسترده در ماه اکتبر بود که این روند نزولی را آغاز کرد. خیلی ها فکر می کردند که یک شکست درست است اما تایید نشد. یک روز پس از توییت "Trump" روند Daily Ichimoku Cloud نزولی را تایید کرد. این یکی دیگر از شاخص های روند بیت کوین است که برای تمام تاریخ بیت کوین مفید بوده است. همچنین این همان چیزی است که بعداً در هفته نامه ارزیابی کرد. در این مرحله مهمترین سطحی که باید تماشا کرد، 50% Retracement برای کل فاز گاو نر است که به پایینترین حد نوامبر 2022 بازمیگردد. سطوح نمایه حجمی برای تماشا وجود دارد، اما ما فرض میکنیم که قیمت 50% را مجدداً آزمایش میکند و آنچه را که در زمینه روند Ichimoku Cloud آنجا اتفاق میافتد ارزیابی میکند. در آوریل 2025، زمانی که قیمت Weekly یک move به Weekly Ichimoku Cloud داشت، قیمت هرگز به ابر نرسید و به داخل ابر نرسید و Momentum شانس معقولی برای عبور از نزولی نداشت. "این بار فرق می کند" زیرا اگر قیمت 50% Retracement را آزمایش کند، نشان دهنده تایید روند نزولی کامل در بازه زمانی هفتگی بود. در طول آخرین چرخه، روند نزولی زمانی پایان یافت که عنصر زمان بندی ابر ماهانه ایچوموکو به سمت بالا چرخید. یک عنصر زمان بندی مشابه در ماهنامه اکنون در نوامبر 2026 وجود دارد. حدس و گمان اساسی من مبتنی بر روانشناسی بازار این است که خریداران ETF از ژانویه 2023 باید صبر خود را آزمایش کنند. این قیمت حدود 43 هزار تومان است. TL:DR; روند نزولی قیمت به 43 هزار کاهش می یابد و مرحله نزولی در حدود نوامبر 2026 به پایان می رسد.

سقوط بزرگ مایکل بری در راه است؟ بستن پوزیشن شورت MSTR با طعم سود!

من پوزیشن فروش استقراضی MSTR را نوامبر گذشته، همزمان با رشد ناگهانی و هیجانی بازار توسط خردهفروشان، باز کردم. واقعاً از اینکه سِیلور به مردم میگفت تمام داراییشان را رهن بگذارند تا Bitcoin بخرند و سپس سهام شرکت خودش را بخرند، ناراحت بودم. تاریخ مالی پر از کلاهبردارانی است که چنین حرفهایی میزنند و چنین کارهایی میکنند. تاریخ تکرار نمیشود، اما با آن هموزن است. اکنون این سهام روی یک سطح حمایت کلیدی قرار گرفته است؛ سقف مارس ۲۰۲۴ و سطح اصلی پروفایل حجم (Volume Profile) مربوط به روند صعودی. وقت آن است که این پوزیشن را با سود ببندم و ببینم در ادامه چه رخ داد. رسیدن MSTR به سطح حمایت همزمان شده است با رسیدن major به یک حمایت پروفایل حجمی. نمودار هفتگی ایچیموکو همچنان صعودی باقی مانده است. امکان دارد یک پولبک بازیابی از همینجا اتفاق بیفتد. در طول سال گذشته، من مجبور بودم چرخه "درست بودن" و "اشتباه بودن" را طی کنم، در حالی که موضعم در میان دوستان ماکسی Bitcoin علنی بود. آنها در تمام این مدت از طعنه زدن و کنایه fun به من لذت میبردند. تکبر و نیشوکنایههای آنها عقیده من را تغییر نداد، بلکه به من این اطمینان را داد که در مسیر یک معاملهگر متضاد (Contrarian) درست قرار گرفتهام. غرور و تکبر در سرمایهگذاری هرگز نتیجهبخش نیست. هر معامله عالی که انجام دادهام، در فضای عدم قطعیت deep آغاز شده (و دوام آورده) است. ریسک کردن یعنی همین. من همچنان معتقدم که روایت MSTR هنوز به طور کامل در میان وفاداران از بین نرفته است، اما عادتی دارم که همیشه "خیلی زود" سودم را برداشت میکنم. عاقلانه معامله کنید. به اعتقاداتتان پایبند باشید.

نوسان قیمت بیت کوین: رمزگشایی حرکت صعودی یا سقوط مجدد؟

در نمودار یکساعته جفتارز BTCUSD، یک جهش قیمتی رخ داد که روند بازیابی از سطح حمایتی ۱۰۰,۳۰۰ را متوقف کرد. این وضعیت، زمینه را برای یک شکست صعودی (Bullish Breakout) و سپس آزمایش مجدد سقف تاریخی (ATH) فراهم میکند. در غیر این صورت، قیمت برای آزمایش مجدد سطح حمایت کاهش یافت. سطح حمایتی اصلی، ۵۰ درصد فیبوناچی اصلاحی (Retracement) از پایینترین قیمت ماه آوریل تا سقف تاریخی اخیر است.

مونرو (Monero): بهترین شرط غیرمتقارن کریپتو که نباید آن را معامله کرد!

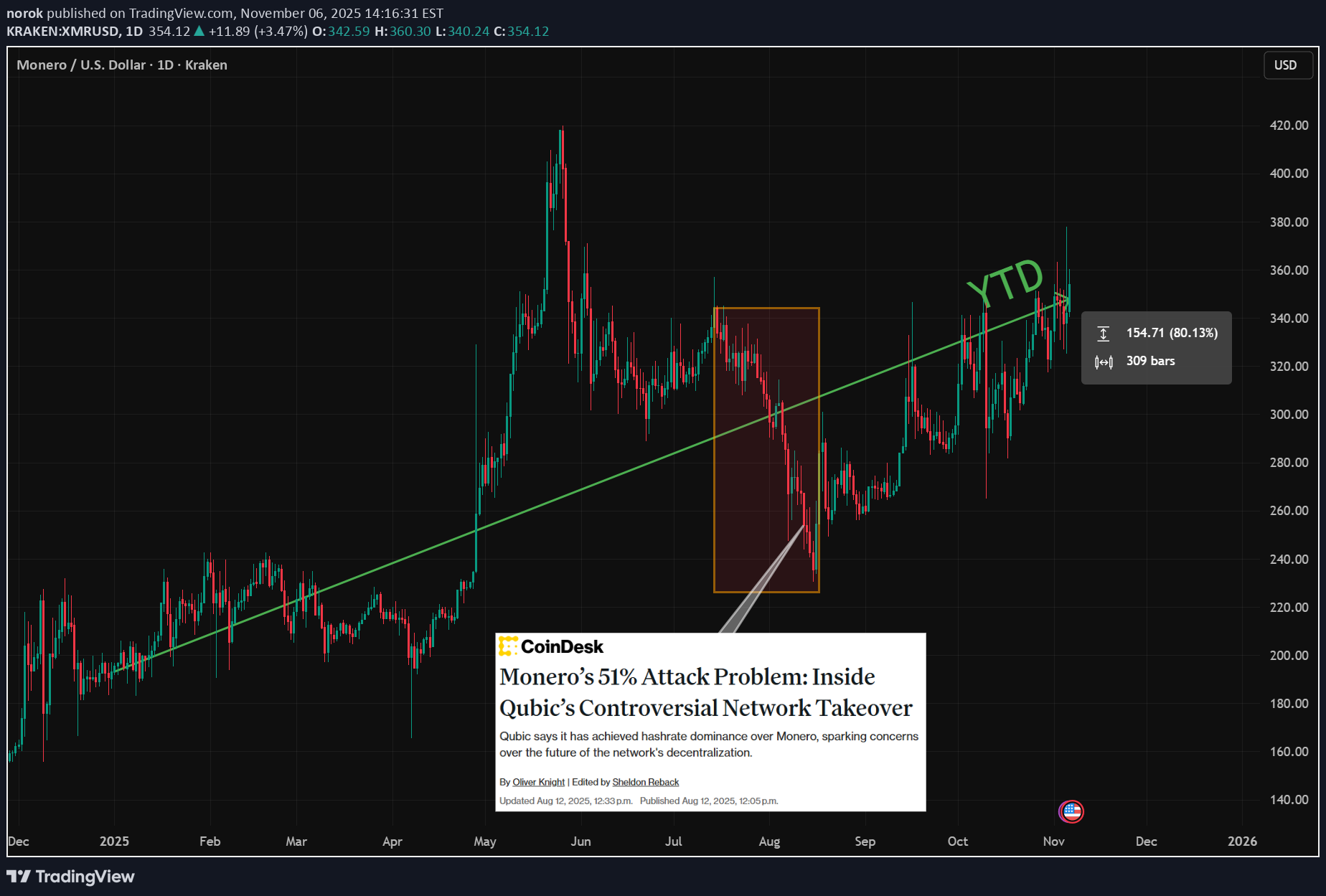

برندگان شما هرگز به اندازه کافی بزرگ نیستند. به یاد نمیآورم چه کسی برای اولین بار این جمله را گفت، اما اعتبار رواج این اصل (ماکسیم) را به معاملهگر افسانهای پیتر برانت میدهم – اصلی که تسلیبخش هر معاملهگر محتاطی است که اگرچه اعتقادش درست از آب درآمده، اما اندازه موقعیتش (پوزیشنش) بسیار کوچک بوده است. کمی بیش از دو سال پیش، متوجه شدم که Monero تجسم اخلاقیاتی است که Bitcoin زمانی داشت: پول خصوصی، غیرمتمرکز و غیرقابل سانسور، عاری از کنترل دولت و شرکتها. Bitcoin از آن زمان از آن ایده آل فاصله گرفته است. شاید امروز به عنوان یک ذخیره ارزش عمل کند، اما بیشتر نقش خود را به عنوان واسطه مبادله در اینترنت تسلیم کرده است. Monero بیسروصدا آن mantle را تصاحب کرده است. تماشای ردیابی و مصادره شدن سرقتهای major Bitcoin – زیرا Bitcoin در واقع قابل ردیابی است – تنها دیدگاه من را تقویت کرد: ارزش مونرو به عنوان پول خصوصی واقعی با درک بیشتر بازار، به رشد خود ادامه داد. از زمان شکلگیری آن باور، شاهد دو رویداد بودهام که به نظر میرسید بقای مونرو را تهدید میکنند – اما در نهایت انعطافپذیری آن را اثبات کردند. اولین مورد، حذف مونرو از بایننس بود که تحت فشار مقررات اروپایی مبنی بر ممنوعیت کوینهای حریم خصوصی صورت گرفت. بازار وحشت کرد؛ XMR یک شبه ۳۰٪ سقوط کرد. در ابتدا، ترسیدم که کد آن به خطر افتاده باشد. اما حقیقت سادهتر و بسیار صعودیتر (بولیشتر) بود. Monero به دلیل عملکرد دقیقاً همانطور که مورد نظر بود، شناخته میشد: بیش از حد خصوصی برای ردیابی توسط دولتها. دومین رویداد امسال با تلاش برای تصاحب ۵۱ درصدی نرخ هش (hashrate) رخ داد. آشفتگی حاکم شد و حتی من هم شک کردم که آیا این یک تهدید وجودی است یا خیر. با این حال، تصمیم گرفتم که اگر جهان دیگر نتواند پول خصوصی را حفظ کند، چیز دیگری اهمیت داشت. به اعتقادم پایبند ماندم – و Monero مقاومت کرد (دوام آورد). در تمام این مدت، Monero ثابت کرده است که سرسختترین ارز دیجیتال موجود است – که اکنون در بحبوحه یکی از شکاکانهترین مراحل چرخه صعودی فعلی در حال افزایش است. از منظر پرایس اکشن (Price Action)، بسته شدن هفتگی بالاتر از سقف قبلی ۴۲۰ دلار (بله، همین عدد) یک شکست قیمتی (بریک اوت) را تأیید میکند. اما فکر نمیکنم این مهم باشد. به عنوان یک معاملهگر، متوجه شدهام که Monero تقریباً غیرقابل معامله است – روشهای usual من به سادگی در مورد جفت XMR/USD کاربرد ندارند. نمودار آن برخلاف هر دارایی دیگری رفتار میکند. این دیگر مرا خسته (یا ناامید) نمیکند. مرا شیفته خود میکند. بهترین move با Monero این نیست که آن را معامله کنید – بلکه آن را مالک شوید. Monero همچنان بهترین شرط نامتقارن در دنیای کریپتو (ارزهای دیجیتال) باقی میماند.

ترس و طمع در بازار: درس بزرگ من از هجمه FUD علیه مونرو

من مدت زیادی است که این تجارت و سرمایه گذاری ارزهای دیجیتال را انجام می دهم. هر تاجر عاقلی دائماً در حال یادگیری است و من این چیزی است که سعی می کنم انجام دهم. اما مانند هر موضوع انسانی که در برابر احساسات و هیستری انبوه آسیب پذیر است، گاهی اوقات ما نیاز به یادآوری دقیقی در مورد چگونگی هضم صحیح یا نادیده گرفتن احساسات "همه" داریم. زیرا «همه بازار هستند و «همه» (از جمله خودم) بازار. من مدتهاست که طرفدار Monero هستم XMRUSD زیرا نشان دهنده اخلاق واقعی ارز دیجیتال است. واقعاً غیرمتمرکز، غیرقابل ردیابی به طور پیش فرض، غیرقابل سانسور، پول خصوصی. استفاده واقعی آن به صورت آنلاین به عنوان یک وسیله مبادله همچنان قوی بوده و با حذف صرافی ها و تحریم های دولتی بی وقفه در حال گسترش است. پذیرش آن از زمان شروع آن در بیش از یک دهه پیش، آهسته، ارگانیک و بی وقفه بوده است. من معتقدم که نشان دهنده یک شرط نامتقارن با نزولی محدود و پتانسیل بالا است. من هرگز ادعا نمیکنم که کسی بازدهی عظیمی داشت، اما تاریخ قدردانی مرکب از ارزش را نشان داده است که همچنان ادامه دارد. آوریل 2025: در اوایل سال، شایعهای دائمی وجود داشت مبنی بر اینکه یک افزایش شدید قیمت به دلیل تخلیه مقدار زیادی از Bitcoin توسط هکری است که سپس آن را بدون توجه به نرخ ارز به Monero تبدیل کرد. چه درست باشد چه نباشد، این «دلیل» شکلگیری روایت بود که قیمت از محدوده معمولی و نسبتاً پایدار Monero به یک شکست قابل توجه افزایش یافت. هنگامی که این اقدام قیمت به اوج خود رسید، یک چرخه جدید "اخبار" در رسانه های اجتماعی شروع شد ... آگوست 2025: در آگوست 2025، پروژه دیگری به نام Qubic با ادعای حمله 51 درصدی به Monero از طریق استخر استخراج «Secur Proof of Work»، با ادعای کنترل موقت بیش از 50 درصد از هش ریت شبکه، باعث وحشت بازار کریپتو شد و باعث شد تا ماینرها با وعده های سه گانه سودمند شوند. رسانه هایی مانند CoinDesk و Cointelegraph این روایت را با گزارش های تایید نشده تقویت کردند، از جمله توییت CoinDesk در 18 اوت که به دروغ نشان می داد Qubic با موفقیت "حمله" به Monero داشته است. در این مدت، به عنوان مدافع طولانی مدت Monero که هستم... نگران شدم. من با حرص تمام اطلاعاتی را که می توانستم به صورت آنلاین از طریق رسانه های اجتماعی و وبلاگ ها مصرف کردم. من می خواستم تهدید را درک کنم تا به عنوان یک سرمایه گذار بتوانم act مناسبی داشته باشم. اجازه دادم ترس در وجودم نفوذ کند. ترسیدم. من نگران بودم، همانطور که بازار بود، که Monero ممکن است واقعاً محکوم به شکست باشد. در اواسط ماه اوت، تجزیه و تحلیل های مستقل از RIAT و کارشناسانی مانند لوک پارکر، این ادعاها را به عنوان غیرممکن های آماری و تبلیغات تبلیغاتی، بدون هیچ هزینه مضاعف یا کنترل پایدار، رد کرد. یکی از کارهایی که در آن زمان انجام دادم این بود که سعی کردم یک تراکنش در Monero برای آزمایش ارسال کنم. کار کرد. شبکه کاربردی بود. هنگامی که حمله به عنوان یک شکست در معرض دید قرار گرفت، قیمت افزایش قیمت عادی، هرچند نوسان و ثابت خود را از سر گرفت. بهترین فرصت برای یک سرمایه گذار زمانی است که «خون در خیابان ها باشد». "وقتی دیگران می ترسند حریص باشید." اما من وقتم را صرف تلاش کردم تا اطلاعات مفیدی را برای اطلاع از تصمیمم دریافت کنم. به طوری که وقتی قیمت به 250 دلار رسید، یک سطح پشتیبانی و حتی یک عدد ذکر شده توسط رهبر Qubic من به هلدینگهای خود اضافه کردم، اما مدت طولانی در پورت کامل YOLO پیش نرفتم. حالا در گذشته، "خطای" من واضح بود. این کاملاً اشتباه نبود که در هر سرمایهگذاری آنطور که باید آگاه به ریسک باشیم. اما این رویداد در داراییای که من به آن اعتماد استثنایی داشتم به من آموخت که FUD رسانههای اجتماعی را با دانهای عظیم نمک مصرف کنم. نمیدانم که آیا بهتر بود ندانم و فقط از قیمتها پیروی کنم. یکی از معماهای core سرمایه گذاری این است که ما باید مطلع باشیم، اما نمی توانیم به احساسات لحظه ای کشیده شویم. این احساس قبلاً در قیمت منعکس شده است. "اگر به مدت طولانی به پرتگاه خیره شوید، ورطه نیز به شما خیره می شود."

ترس بزرگ بیت کوین: آیا این پایینترین قیمت برای ریزش است؟ (تحلیل FUD)

BTCUSD به عقب نشینی 50 درصدی از پایین ترین سطح آوریل 2025 به اوج اکتبر 2025 در 100300 بازگشته است. این می تواند پشتیبانی برای پایین نگه داشتن move اخیر باشد. بیت کوین کنندگان بهترین FUD را درخواست کرده اند تا تأیید کنند که این می تواند "پایین محلی" باشد. پایینها با ترس ساخته شدهاند، بنابراین به نظر میرسد که آنها سعی میکنند تا حد امکان در رسانههای اجتماعی ظاهر شوند تا تأیید کنند که در حال حاضر به همان اندازه پایین بود. روایت آشکار FUD چیزی در مورد چگونگی پایان فاز صعودی چرخه قیمت هالونینگ دقیقاً زمانی است که پیشبینی میشد (در 36 ماه از پایان نوامبر 2022) و چرخه نزولی آغاز شده است. با این حال، من فکر می کنم در اینجا برخی FUD های ترسناک تر برای بعد از هالووین وجود دارد: Compound نرخ رشد سالانه (CAGR) Bitcoin در دهه گذشته در حال کاهش بوده است. Bitcoin بالاتر رفته است و احتمالاً در آینده به اوجها و پایینهای بالاتر ادامه داد، اما با نرخی کاهشی. قیمت بیت کوین از منحنی نمایی منفی پیروی می کند. Bitcoin احتمالاً در مقطعی در آینده، در این دوره یا چرخه بعدی، به بالاترین سطح خود رسید، اما بازده سرمایه گذاران بسیار کمتر از آنچه در گذشته دیده شده است بود و در طول زمان حتی کمتر بود. نگاه خنثیتر به احتمالات آینده، مدلسازی نوسانات تاریخی و پیشبینی محتملترین نتیجه است. محدوده 1 انحراف استاندارد از قیمت امروز برای 365 روز آینده بین 159600 تا 64800 است. این بدان معنی است که احتمال 68٪ وجود دارد که Bitcoin در این محدوده در سال آینده معامله شود. FUD این است که band کمتر با گره نمایه حجم از ادغام سال 2024 که پشتیبانی را در آن منطقه ایجاد می کند مطابقت دارد. عاقلانه تجارت کنید. یک عنصر دیگر از FUD که فراموش کردم... شاید روایت انحلال مبادلات یا فروش نهنگهای قدیمی نباشد، اما Bitcoin به طور ذاتی با داراییهای ریسک و سهام مرتبط شده است، زیرا با نوسانات فزاینده با بازارهای ایالات متحده حرکت میکند. تست شماره 2 سطح... دید.

سلب مسئولیت

هر محتوا و مطالب مندرج در سایت و کانالهای رسمی ارتباطی سهمتو، جمعبندی نظرات و تحلیلهای شخصی و غیر تعهد آور بوده و هیچگونه توصیهای مبنی بر خرید، فروش، ورود و یا خروج از بازارهای مالی نمی باشد. همچنین کلیه اخبار و تحلیلهای مندرج در سایت و کانالها، صرفا بازنشر اطلاعات از منابع رسمی و غیر رسمی داخلی و خارجی است و بدیهی است استفاده کنندگان محتوای مذکور، مسئول پیگیری و حصول اطمینان از اصالت و درستی مطالب هستند. از این رو ضمن سلب مسئولیت اعلام میدارد مسئولیت هرنوع تصمیم گیری و اقدام و سود و زیان احتمالی در بازار سرمایه و ارز دیجیتال، با شخص معامله گر است.