تحلیل تکنیکال ProjectSyndicate درباره نماد BTC : توصیه به فروش (۱۴۰۴/۹/۱۱)

ProjectSyndicate

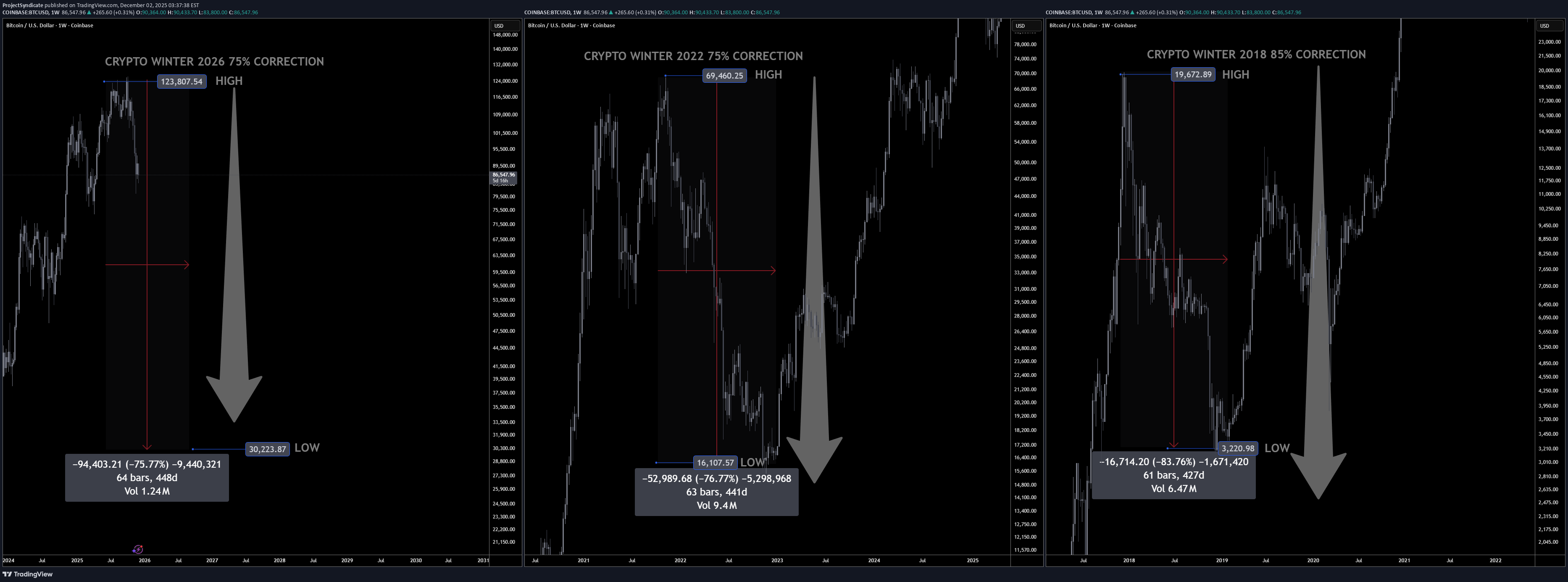

فروپاشی بزرگ بیت کوین در ۲۰۲۶: آیا BTC تا ۳۰,۰۰۰ دلار سقوط میکند؟

Investment Memo: Anticipating a 2026 Bitcoin Crypto Winter By ProjectSyndicate ________________________________________ 1. Executive Summary ❄️ Summary view: This memo treats 2026 as the high-probability crypto winter year for Bitcoin following the 2024 halving, with a working top around 123,000 USD and an expected cycle low near 30,000 USD, implying roughly a 75–76% drawdown from the peak. This is fully consistent with historical Bitcoin bear markets, which have typically seen 75–85% corrections from all-time highs. ❄️ Contrarian hook: While mainstream narratives still focus on ETFs, institutional adoption, and “crypto as macro asset,” the explosion of leverage (Aster DEX up to 1001x), CZ-backed perps, and BNB-chain meme-coin mania are treated here as late-cycle excess—classic topping signals rather than sustainable foundations. ________________________________________ 2. Thesis & Target Range 📊 Cycle top assumption: cycle high of ~123,000 USD per BTC. That is well within the band implied by recent ATH prints ~125–126k in mid-2025 and aligns with a typical “blow-off” overshoot above the prior psychological milestone at 100k. 📊 Cycle low assumption: 30,000 USD downside target represents a drawdown of ~75.6% from 123,000 USD—slightly shallower than the 2018 crash (~84%) and broadly in line with the 2021–22 bear (~77% from 69k to ~15–16k). That keeps this winter brutal but not apocalyptic, consistent with a maturing asset still capable of deep mean reversion. 🧮 Math check on prior winters •2017–18: 19k → 3k ≈ 84% drawdown •2021–22: 69k → 16k ≈ 77% drawdown •2025–26 (your base case): 123k → 30k ≈ 76% drawdown This places scenario squarely inside the historical corridor of 75–85% post-peak corrections. ________________________________________ 3. Historical Pattern: Why Large Drawdowns Are the Base Case 📉 Structural volatility: Bitcoin’s entire price history is punctuated by massive post-parabolic drawdowns—early cycles saw 86–93% collapses, later ones 75–80%. Each halving-to-peak run has ended in a violent crash once marginal buyers are exhausted and leverage saturates. 📉 Time dimension: Historically, the “winter” phase has lasted 9–18 months from peak to capitulation and then a long grinding accumulation. The 2017 peak to 2018–19 bottom spanned roughly a year; the 2021 peak to 2022–23 nadir similarly took about a year, with a further period of sideways chop. 📉 Drawdown normalization: Traditional asset allocators increasingly frame Bitcoin as an alternative macro asset, but the statistical reality is unchanged: drawdowns of 70%+ are not outliers—they are typical. An assumption of only shallow corrections is the non-consensus view; a 75% winter is actually the boringly normal scenario from a historical distribution standpoint. ________________________________________ 4. Where We Are in the Current Cycle ⏳ Post-halving positioning: The fourth Bitcoin halving occurred in April 2024, cutting block rewards to 3.125 BTC and effectively tightening supply. Historically, the major blow-off tops occur 12–18 months after halving, as reduced supply + narrative momentum pulls in late-stage retail and leverage. ⏳ Evidence of late-cycle behavior: By mid-2025, Bitcoin had already pushed to new ATHs above 100k and then into the ~120–126k region, with growing signs of ETF saturation, institutional FOMO, and leverage-driven upside. From a purely cyclical lens, we are more likely in the “euphoria / distribution” band than in early bull territory. ________________________________________ 5. Aster DEX & Meme-Coin Mania as Contrarian Top Signals 🚨 Aster DEX as the “Hyperliquid of BNB Chain”: Aster DEX, emerging from APX Finance and Astherus and explicitly leveraging Binance’s network, is marketed as a high-performance perp DEX with MEV-resistant trading and leverage up to 1001x, backed by CZ/affiliate ventures. From a contrarian perspective, this is textbook late-cycle: maximum leverage offered to the broadest possible audience at or near cycle highs. 🚨 BNB meme-coin carnival: Simultaneously, BNB-chain meme coins and speculative listings (Maxi Doge, PEPENODE, various new BNB meme projects) are being pushed as high-beta “next 100x” plays. Historically, similar episodes—2017 ICOs, 2021 dog-coin and NFT mania—have coincided with or slightly lagged Bitcoin’s macro top rather than signal early-cycle value. 🎭 Narrative pattern recognition: In prior cycles, the market’s center of gravity shifted from Bitcoin to highly speculative edges (ICOs, NFTs, obscure DeFi, meme coins) at the very end of the bull. Late-cycle liquidity rotates into lottery tickets while BTC quietly transitions from “must own” to “source of funds.” The current Aster + BNB meme complex rhymes strongly with that historical script. ________________________________________ 6. Why a 75% Drawdown to 30,000 USD is Plausible 🧊 From 123k to 30k mechanically: A move from 123k to 30k doesn’t require structural failure; it merely requires a reversion to historical drawdown. That kind of move can be achieved by: •ETF inflows slowing or turning to mild outflows •Derivatives funding turning negative as carry trades unwind •A moderate macro risk-off (equities correction, higher real yields) 🧊 Maturing, not invincible: As adoption broadens—spot ETFs, institutional mandates, integration into macro portfolios—Bitcoin’s upside may gradually compress, but liquidity cycles and leverage cycles haven’t vanished. Even if each cycle’s drawdown edges slightly lower from ~85% to ~77%, there’s no reason to assume sub-50% drawdowns are the new regime. A respectable winter at 30k is almost conservative relative to earlier -80%+ events. ________________________________________ 7. Why the Floor Might Hold Above Prior Lows 🛡️ On-chain + macro floor logic: Without pinning to proprietary on-chain models, two simple supports for a 30k floor are: •Institutional cost basis: A growing chunk of supply is held via ETFs and treasuries accumulated in the 40–70k band. Many of these players may defend positions with hedging or incremental buying in the high-20k / low-30k region rather than panic-sell at -70–80%. •Realized price ratcheting higher: Across cycles, Bitcoin’s long-term realized price average on-chain cost basis tends to step up structurally. Past winters have bottomed not far below that long-term average; as the realized base rises, so does the likely bear-market floor. 🛡️ Regime shift vs. previous cycles: In 2018 and 2022, Bitcoin was still climbing the wall of institutional skepticism. By the mid-2020s, you have: •Spot ETFs •Corporate treasuries •Sovereign/FI experimentation These players typically do not capitulate to zero; they reduce risk, but they also accumulate in stress. That supports the idea of a shallower floor (30k) instead of a full 85–90% purge. ________________________________________ 8. Timing the 2026 Winter 🧭 Halving + 18-month lag template: Using the standard halving cycle template, major tops often occur 12–18 months post-halving, and winters then dominate the following year. With the fourth halving in April 2024, a 2025 ATH and a 2026 winter are exactly what the simple cycle model would project. 🧭 Scenario sketch •2025: Distribution at elevated levels (80–120k+), persistent Bitcoin as digital gold narrative, alt & meme blow-off, over-issuance of high-leverage products (Aster, other perps). •2026: Liquidity withdrawal + ETF fatigue + regulatory flare-ups → a stair-step decline through 80k, 60k, 45k, culminating in capitulation wicks into the 30–35k zone before a multi-month bottoming process. ________________________________________ 9. Market Structure Stress Points in a Winter Scenario 🧱 Leverage cascade risk: Perp DEXs offering hundreds to 1000x leverage attract the most price-insensitive flow at the worst time. When BTC breaks key levels (e.g., 80k → 60k → 50k), auto-deleveraging and forced liquidations can accelerate downside far beyond spot selling. Aster-style platforms, while innovative, mechanically create risk of cascading liquidations in a volatility spike. 🧱 Alt & meme vaporization: BNB meme coins and other speculative assets that rode the late-cycle pump will likely see 90–99% drawdowns, as in previous winters where smaller alts dramatically underperformed BTC. In your framework, BTC at 30k is actually the “high-quality survivor” outcome; the majority of late-cycle tokens may never reclaim their peaks. 🧱 Mining and infrastructure: With halved rewards and a much lower BTC price, marginal miners will be forced offline, just as in prior winters. That tends to deepen the short-term pain but ultimately improves the cost curve (strong miners consolidate, inefficient ones exit), laying groundwork for the next cycle. ________________________________________🎁Please hit the like button and 🎁Leave a comment to support our team!let me know your thoughts on the above in the comments section 🔥🏧🚀🚨🚨🚨 2026 CRYPTO WINTER PLAYBOOK – CONTRARIAN BTC OUTLOOK 🥶 Bitcoin cycle top penciled in around $123K, with a projected winter low near $30K (≈-75%). ❄️ Previous winters: 2018 -84%, 2022 -77% – a -75% drawdown is actually “normal” for BTC. 🌨️ 2024 halving → 2025 blow-off → 2026 winter fits the classic 12–18 month post-halving boom-and-bust pattern. 🧊 Aster DEX 1000x leverage + BNB meme coin mania = classic late-cycle euphoria, not the start of a new bull. 🌬️ Spot ETF + institutional FOMO can’t delete BTC’s historical 70–80% crash DNA – they just shift where the floor is. 🌨️ $30K acts as a plausible new floor, supported by higher institutional cost basis and long-term realized price. 🧊 Expect alt & meme coins to nuke 90–99%, while BTC “only” does -75% and survives to lead the next cycle. ❄️ Smart money sells euphoria near 6-figure BTC, builds dry powder, and targets gradual entries 40–35–30K. 🥶 Leverage is the enemy: perps and 1000x casinos likely accelerate the crash via liquidation cascades. 🌨️ Not financial advice – it’s a cycle-based contrarian framework for a statistically “normal” 2026 Bitcoin winter.final DEATH BOUNCE incoming shortly in December/January. then lights out.