WagsCapital

@t_WagsCapital

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

WagsCapital

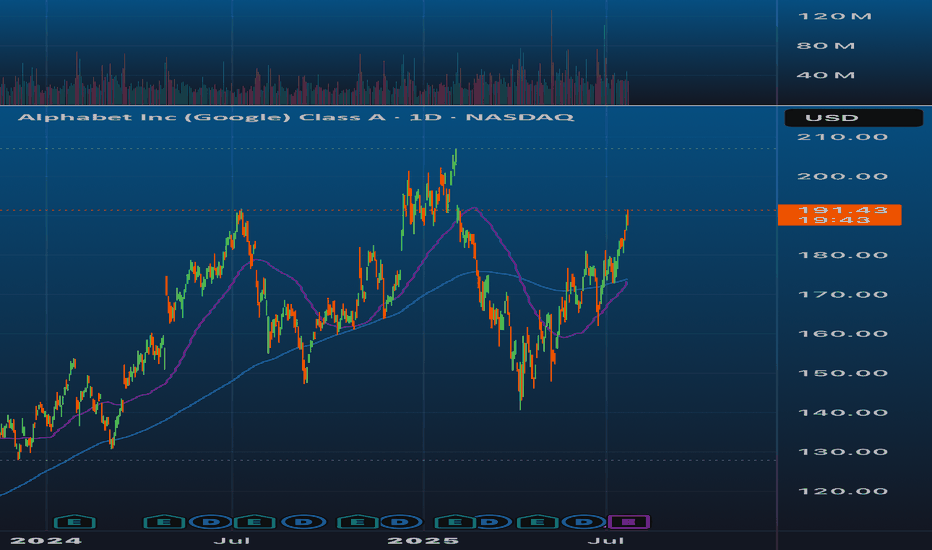

Alright, no dashes, just straight talk: If you believe agentic AI is going to take off and actually become a core part of everyone’s daily life, Google is the best setup out there. They already have the user base, the data, and the infrastructure. Think search, Android, Gmail, YouTube, Maps, Chrome, and their cloud business. When agents start handling people’s shopping, emails, research, travel bookings, and even business ops, who do you think is going to provide all the backend and get the cut on every transaction? Google. It’s the same reason Nvidia exploded. Everyone needed their GPUs for AI. Now, when everyone needs a digital agent, that agent will run through Google’s stack and Google will get a slice every time. Whether it is transaction fees, premium AI services, cloud usage, or new ways to monetize ads, Google will be there at every layer. If agentic AI becomes as big as people are predicting, it will basically become the new operating system for how the world gets things done. Google is in the best position to own the rails and the agents themselves. Everyone else just becomes an app inside Google’s world. My trade is simple. I keep buying GOOGL, especially on pullbacks. I ignore the noise and sit on it. You get the protection of their old businesses and massive upside if AI agents really take off. TLDR: When the agentic AI wave hits, Google will be the casino. Everyone else will be just a player at the table.

WagsCapital

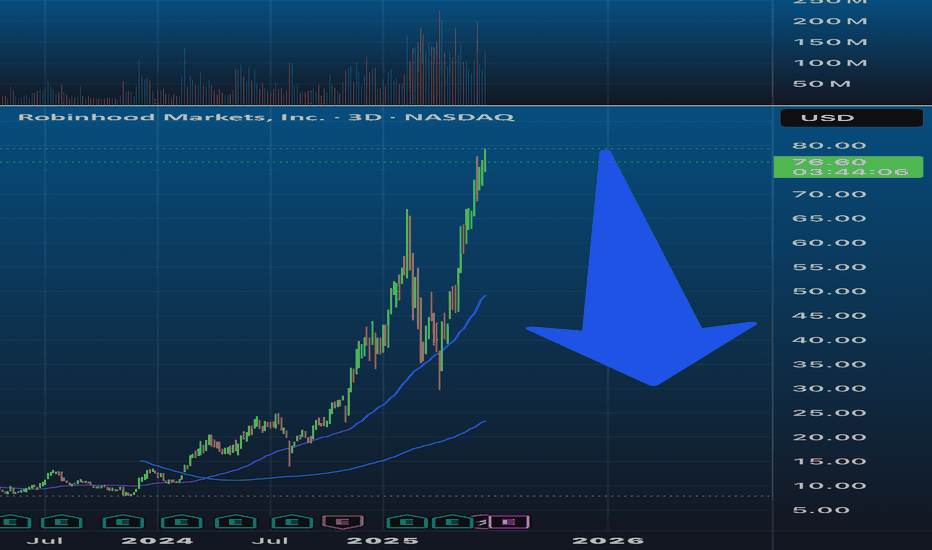

ROBINHOOD: from meme stock to margin call. Parabolic moves end the same way — vertical down. Retail about to learn what “liquidity event” really means. Enjoy the round trip 📉

WagsCapital

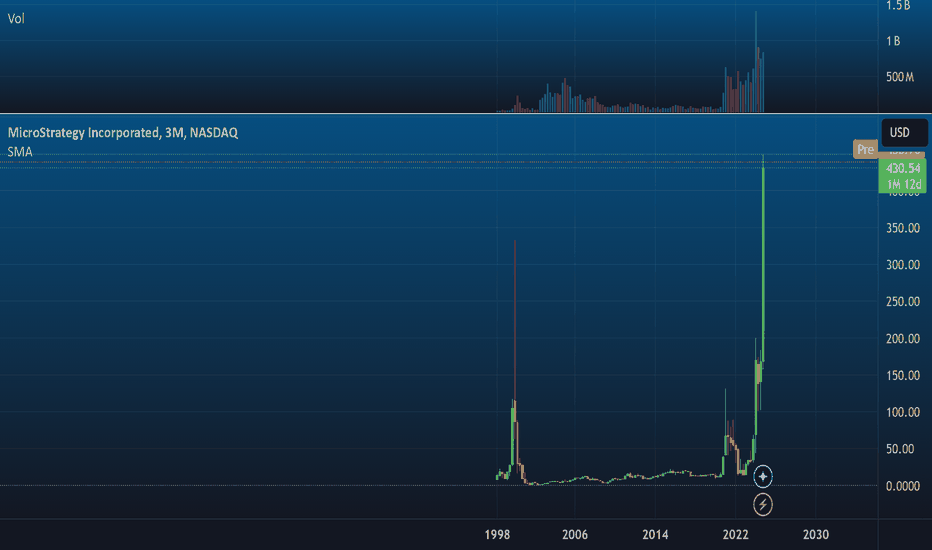

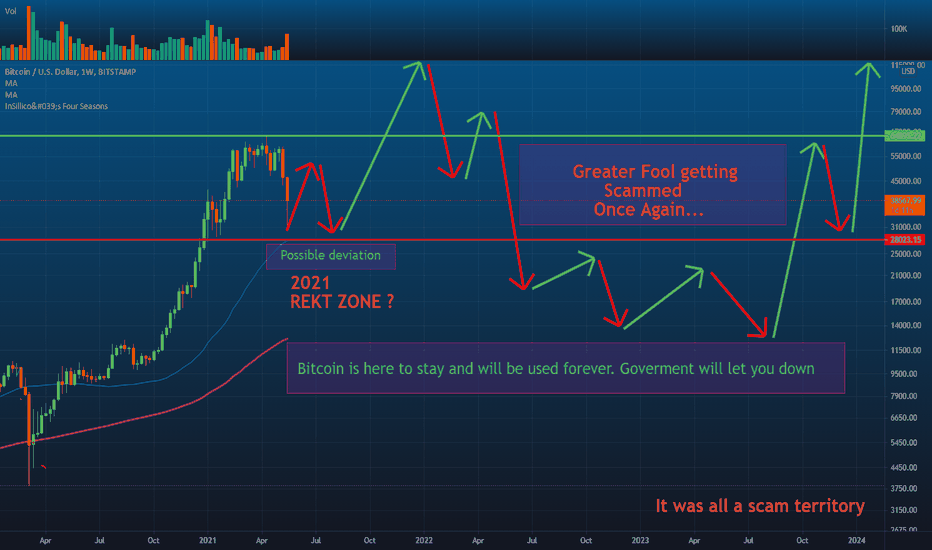

Mass delusions are usually not sustainable. Trading 3x above btc holdings, insiders selling at fastest pace, btc rally is delusional and driven by short term idea of a Trump Trade which will be crushed after his inauguration when we face the reality of harsh negotiations with Russia. Saylor is another Sam.The success of issuing 0% convertible bonds hinges on investor confidence in the company’s strategy and stock performance. Any erosion in this confidence could impede future fundraising efforts. Do you understand?Taking 80% profits at 397, I aint greedy bear

WagsCapital

Presidential debates in a few days. Historically, significant political events such as presidential debates have coincided with increased volatility and positive price performance for Bitcoin. Technically, BTC has pulled back but remains in a key range between $56,000 and $65,000. A bullish breakout above $65,000, coinciding with political catalysts, could open the path toward previous highs near $70,000.

WagsCapital

Drawing parallels from the market’s resilience post-Reagan assassination attempt, BTC stands as a robust hedge in turbulent times. Historical Market Recovery After the assassination attempt on President Ronald Reagan in 1981, the S&P 500 demonstrated remarkable resilience. Despite the initial shock, the market quickly stabilized and began to recover within three weeks, illustrating the market's ability to absorb political shocks and continue its upward trajectory. This historical context underscores the inherent strength and adaptability of financial markets in the face of unforeseen political events. Bitcoin as a Modern Hedge In today's political and economic climate, Bitcoin ( BTC ) exhibits similar characteristics as a resilient asset. With its decentralized nature and growing acceptance as a store of value, Bitcoin has increasingly been viewed as a hedge against traditional market volatility and political uncertainty. Anticipating the Bitcoin Conference Impact The upcoming Bitcoin Conference (July 25–27, 2024, in Nashville) is expected to be a significant event for the cryptocurrency market. Historically, such conferences have acted as catalysts, driving increased interest and investment in Bitcoin. The discussions and announcements made during these conferences often lead to positive market sentiment and price movements. Comparing Resilience: S&P 500 and Bitcoin Drawing a parallel between the S&P 500's quick rebound post-Reagan and Bitcoin's potential for resilience, we can anticipate that Bitcoin might also exhibit strong recovery patterns in times of political turbulence. Here’s why: Institutional Adoption: Just as the S&P 500 benefitted from institutional confidence and investment, Bitcoin's increasing institutional adoption provides a solid foundation for its resilience. Digital Gold Narrative: Bitcoin's positioning as "digital gold" enhances its appeal as a safe-haven asset, similar to how gold has traditionally been viewed during times of uncertainty. Global Nature: Unlike the S&P 500, which is tied to the U.S. economy, Bitcoin’s global nature diversifies its risk, making it less susceptible to localized political events. Technological Evolution: Advancements in blockchain technology and Bitcoin infrastructure improve its robustness and accessibility, further supporting its resilience. Conclusion As we approach the Bitcoin Conference in Nashville, it’s important to recognize Bitcoin’s potential to mirror the historical resilience of the S&P 500 post-Reagan. With its unique properties and increasing mainstream acceptance, Bitcoin stands out as a robust hedge in today's turbulent times. Investors looking for stability and growth in an uncertain political landscape may find Bitcoin to be a strategic addition to their portfolios, just as historical investors trusted the S&P 500 to bounce back and thrive.

WagsCapital

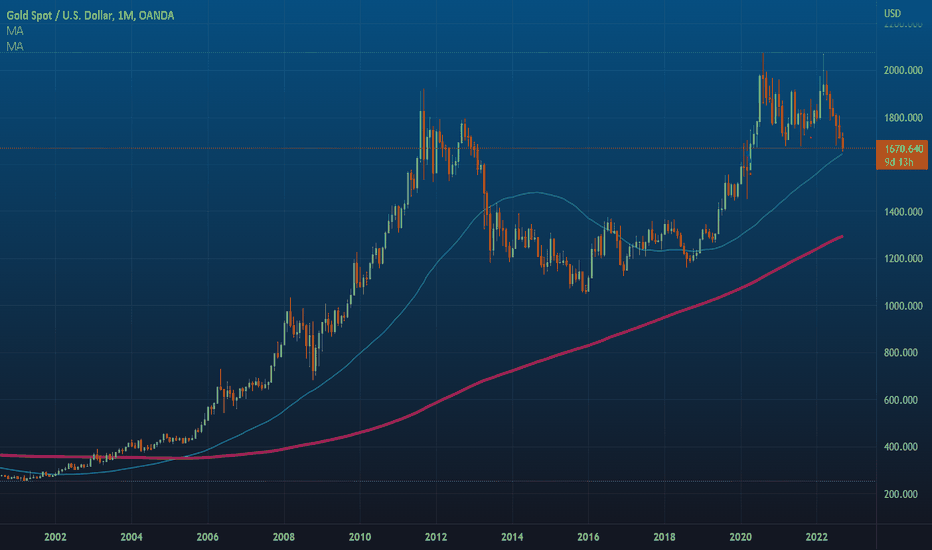

What do we have? 1) A pattern beloved by all boomers - Cup and Handle 2) Money printing because of covid and war 3) Mass draft and mobilisation of russian citizens who was serving in the army (90% of them did) happening since today 4) Potential North Korea and Russia Alliance to revenge for Korean War 5) Maximum panic and end of the world in the head of traders is possible, 69% chance

WagsCapital

Possible attack scenario: 1. Identify all major loans on @AaveAave and plan possible liquidation cascade 2. Send ETH from @TornadoCash to all wallets with major loans 3. Let AAVE block all wallets 4. Short ETH 5. Initiate ETH dump ... 6. Watch liquidation cascade and nobody can do sth. about it 🍿Keep shorting this shitcoin

WagsCapital

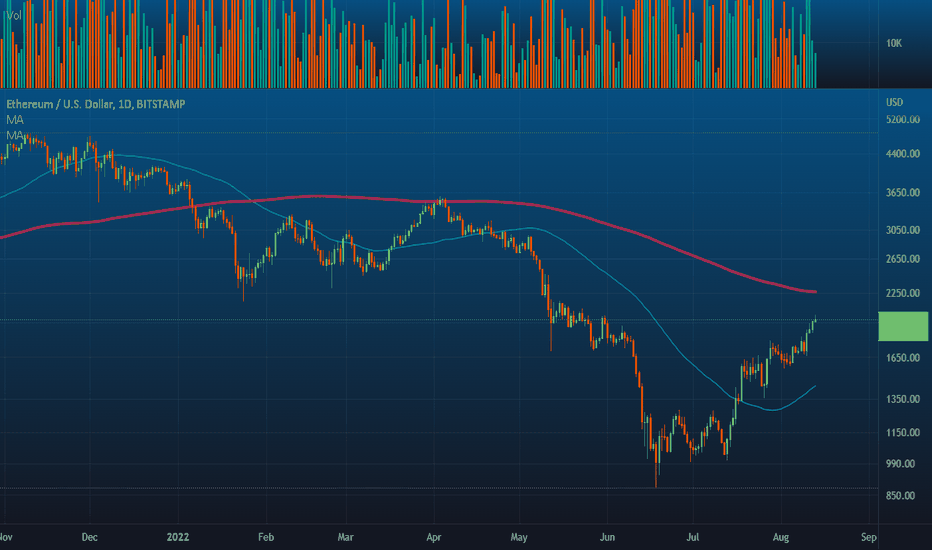

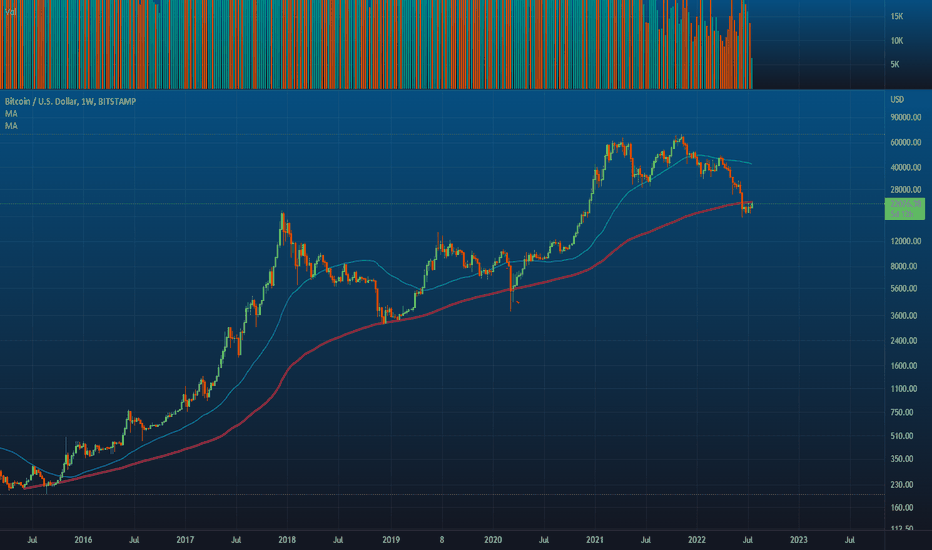

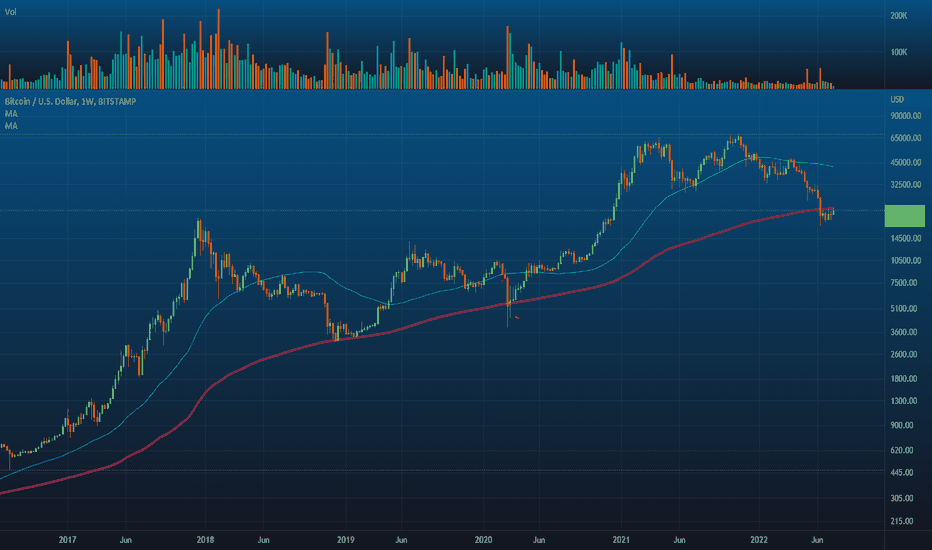

As you know most covid noob plebs already out of stonks and crypto and done with investing, rooting in a crisis. Would you buy the blood and fear here or sell with normies is the question?! FED probably change it's policy in September-Novemeber and revaluate food and energy weight in CPI indexes because BlackRock wants so. Dollar value is still going down since the day it was born no matter what, original cause of Bitcoin is still exist and Satoshi knows da way out. What other currency you can trust more then Bitcoin? Think about it. Ethereum PoS ponzi mini bull run and other funny stuff during long accumulation phase alongside with some possible black swan events ahead. Brace yourself.

WagsCapital

Long your longs before FED change it's policy in September-Novemeber and revaluate food and energy weight in CPI indexes because BlackRock wants so. Also most covid noob plebs already out of stonks and crypto and done with investing, rooting in a crisis. Would you buy the blood and fear here or sell with normies is the question?! Dollar value is still going down since the day it was born no matter what.

WagsCapital

Like it or not, but history always repeats itself. Banks and goverments always will be letting you down. You're always will see more people trusting btc instead. Dollars will always go down. Even if sometimes they will go up a lil bit coz of rate hikes in 2023. Bulls always will be winning. They believe in constant evolution. This is inevitable (until it's not though) Pigs always will be driven by emotions and fears. Bears always will be crushing a party, but Bears lives are short. Scammers always will scam and get jailed. Shitcoins always will be full of shit, unless a few one. Elon Musk will never reach Mars. You're will keep working in MCD. Justin Sun will be always screwing your wife. It is what it is.Keep it pumpingIn a dream, it was revealed: a halving, followed by a sell-off, priced in mid-March, causing meme coins to crumble. Yet, as the U.S. election looms, we shall witness a grand ascent, driven by BTC's Layer 2. A grand spectacle awaits.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.