Thorne-

@t_Thorne-

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

استراتژی خرید بیت کوین: چرا اکنون زمان ورود (لانگ) به بازار است؟

1. Macroeconomic Policy: Unabated Rate Cut Expectations, Liquidity Easing Underpins Markets With the Federal Reserve’s December FOMC meeting approaching, market expectations for a rate cut have surged to a high of 89.2%. Major investment banks including Bank of America and Goldman Sachs have successively raised their rate cut forecasts. Key Fed officials continue to release dovish signals, which, combined with a weak U.S. labor market, provide real-world support for a rate cut. Bitcoin has a -0.75 negative correlation with the U.S. Dollar Index (DXY) — a weaker dollar directly benefits crypto assets. Previous policy uncertainties have been fully digested amid sustained pullbacks. Currently, the "exhaustion of bearish factors + easing expectations" forms the core macro logic for bullish positions. 2. Capital Flows: Institutional Bottom-Hunting + Dwindling Selling Pressure, Optimized Capital Structure Capital markets are showing clear bottoming characteristics: - Institutions maintain continuous accumulation via ETFs, with the institutional ownership ratio of U.S. spot Bitcoin ETFs climbing to a new high of 40%. - Exchanges recorded a 24-hour net outflow of over 4,200 BTC, pushing tradable supply to a six-year low as chips concentrate in the hands of long-term holders. - Off-exchange (OTC) large-value order volume has increased significantly. Whales are actively absorbing selling pressure around the $89,000 level, in stark contrast to retail panic selling, indicating that selling pressure has entered a state of exhaustion. Bitcoin trading strategy buy:88500-89500 tp:91000-92000 sl:87500With the expectation of a loose policy, the bullish momentum for Bitcoin has been fully unleashed.

تحلیل بیت کوین: مرحله حیاتی ریکاوری با مومنتوم قوی؛ آیا $100,000 در دسترس است؟

Bitcoin Technical Analysis: Critical Recovery Phase with Solid Momentum Bitcoin is in a pivotal technical recovery stage: On the daily timeframe, BTC has rallied over 15% from its $80,500 low, establishing a clear short-term uptrend and successfully holding above the key $90,000 psychological level—breaking free from the weak trading range. Indicator Confirmation of Upward Momentum RSI: Rebounded strongly from the oversold zone to around 55, moving well away from downside pressure while remaining below the overbought threshold (70), leaving ample room for further upside. MACD: A bullish golden cross has materialized, with the green histogram fully contracting. This signals continuous accumulation of upward momentum, reinforcing the bullish bias. Clear Support & Resistance Structure Support Zones: Immediate support: $90,000 (recent high-volume trading cluster), serving as the primary defense level. Strong support: $84,000 (78.6% Fibonacci retracement level), forming a robust secondary risk buffer. Resistance Levels: Near-term resistance: $95,000 (61.8% Fibonacci retracement level), a key technical hurdle. Major resistance: $100,000 (psychological milestone + 50% Fibonacci retracement level), a high-impact level for market sentiment. Healthy Volume-Price Validation Trading volume during the rebound has surged 62% above the 5-day average, reflecting strong buying interest. The positive volume-price synchronization confirms the validity of the uptrend, indicating that the recovery is supported by solid market participation rather than speculative momentum alone.The volatile market. Don't let emotions control you. Instead, make plans for trading, for profits, and for stop-losses.

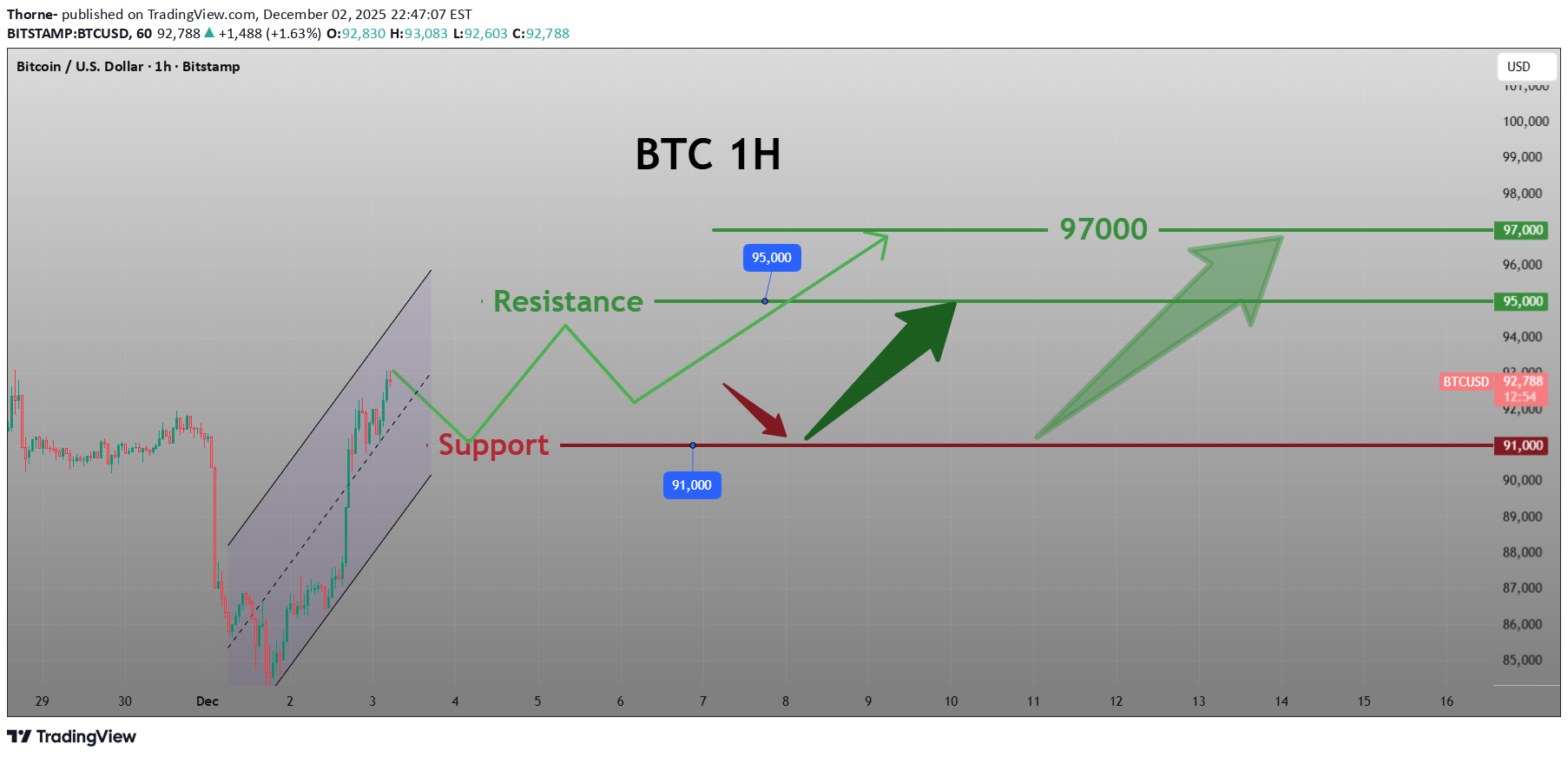

بیتکوین ۹۲ هزار دلار را شکست: سیگنال صعود قدرتمند با حجم بالا!

Bitcoin is currently at a critical technical breakthrough juncture: On the daily chart, BTC has broken through the $92,000 integer mark and the previous downward trendline with increased volume, firmly standing above the 20-day moving average, forming a clear reversal signal. On the indicator front: The RSI has rebounded from the oversold zone (below 30) to 58, escaping the weak range; the MACD green histogram continues to shrink, with the fast and slow lines approaching a golden cross, indicating accelerating accumulation of upward momentum. The support system is clear and resilient: The $90,000–$91,000 range has formed a recent rebound springboard, while the $88,000–$89,000 zone constitutes a strong support belt, providing an effective risk buffer for long positions. From a trend structure perspective, the current price is in the rebound cycle of "low at $84,000 → resistance at $94,000." Trading volume has increased by 62% compared to the 5-day average, in line with the technical rule that "valid rebounds require volume confirmation," confirming the health of the rebound trend.

بیت کوین صعودی شد: رازهای پشت جهش قیمت و ورود گاوهای بزرگ!

1.Macroeconomic Policy: Rising Rate-Cut Expectations, Liquidity Easing Expectations Underpin the Market As the Federal Reserve's December monetary policy meeting approaches, the market's expectation of a rate cut has soared from 32.7% in late November to 87%, with nearly a 90% probability of a 25-basis-point rate cut. Despite lingering divisions within the Federal Reserve, dovish officials have continuously released easing signals. Core officials including Christopher Waller and Mary Daly have explicitly endorsed a December rate cut. Coupled with the slowing trend of U.S. economic data, weakened consumption momentum and lackluster manufacturing performance provide practical justification for the rate cut. This expectation of liquidity easing has boosted risk appetite. The three major U.S. stock indexes have all closed higher recently, and Bitcoin has directly benefited from its 0.75 correlation with these indexes. Meanwhile, the policy uncertainty that previously suppressed the market has been fully absorbed amid the sharp decline, and the current macroeconomic environment has created favorable conditions for Bitcoin's short-term rebound. 2. Capital Flows: Short Squeezes + Bargain-Hunting Capital Inflow, Eased Selling Pressure The short-term capital landscape has shown clear bullish signals. Since Bitcoin rebounded from its low of $83,800, the cumulative scale of short squeezes has exceeded $300 million. A large number of passive purchases from stop-loss orders have formed a short - squeezing effect. Off-exchange capital has responded actively: the volume of over-the-counter (OTC) orders for 50 BTC or more per transaction has tripled compared with the previous week. Exchanges recorded a net outflow of over 4,200 BTC within 24 hours, with chips concentrating in the hands of short-term holders, leading to a significant reduction in immediate selling pressure. Although U.S. spot Bitcoin ETFs saw a cumulative outflow of $4.6 billion over the past month, they posted a net inflow of $70 million last week. This indicates that the pace of institutional selling has slowed marginally, and the capital side has demonstrated a positive characteristic of "short-term improvement + long-term to be verified".

پنجره خرید بیت کوین باز شد: فرصت ورود به بازار با احتمال کاهش نرخ بهره!

Macro perspective: Expectation of interest rate cut returns + Negative news is digested, liquidity marginally improves In December, the expectation of the Fed's interest rate cut showed a "V-shaped reversal" - although it dropped below 50% at the beginning of the month due to the hawkish remarks of officials, the CME FedWatch data on November 28th indicated that the probability of a 25 basis point interest rate cut in December had risen to 86.9%. The core demand for loose liquidity from the market remained unchanged. More importantly, during the process where Bitcoin dropped from $84,000 to $83,000 on December 1st - 2nd, the three major negative factors that had previously suppressed the market (Fed's hawkish expectations, intensified regulatory measures in China, and the withdrawal of $20 billion in liquidity from TGA accounts) had been concentratedly released, forming the basis for a "technical recovery after the exhaustion of negative news". Cross-asset linkage also provided support. The correlation between Bitcoin and the Nasdaq 100 Index rose to 46%, and the stabilization of US tech stocks led to the restoration of risk appetite, with funds beginning to flow back from safe-haven assets to high-flexibility assets. Bitcoin trading strategy buy:91500-92500 tp:93500-95000 sl:90500Risk appetite has rebounded, and Bitcoin has entered an upward trend.

استراتژی معاملاتی بیت کوین: جهش پس از تخلیه عوامل نزولی - نقاط ورود و خروج دقیق

Concentrated Release of Bearish Factors + Policy Expectation Adjustments: Bitcoin Rebound Gains Momentum Concentrated Release of Bearish Factors The three core bearish drivers that previously suppressed the market—Fed hawkish expectations, PBoC risk warnings, and USDT rating downgrades—have been fully digested during the sharp sell-off on December 1-2. Bitcoin has rebounded over 10.7% from its low of $83,786, demonstrating the characteristics of a "technical recovery after the exhaustion of bearish factors." Subtle Shifts in Policy Expectations Although market divergence persists regarding the probability of a Fed rate cut in December, the extreme earlier expectation that "the rate cut probability would fall below 50%" has marginally eased. Coupled with the long-term support from the Trump administration’s "Strategic Bitcoin Reserve" policy (institutional lock-up of 200,000 BTC), this provides the underlying logic for the rebound. Improved Cross-Asset Correlation U.S. tech stocks have stabilized and rebounded, with risk appetite marginally recovering. The correlation between Bitcoin and the Nasdaq 100 Index has returned to 0.75, as Bitcoin benefits from the reset of capital risk preferences. Bitcoin trading strategy buy:91000-92000 tp:93000-95000 sl:90000

استراتژی معاملاتی بیت کوین: شکار فرصت بازگشت سرمایه در بحبوحه ریسکپذیری محتاطانه!

US technology stocks closely linked to Bitcoin, such as Nvidia and Microsoft, have been rising continuously recently, driving the sentiment of the entire risky asset market to recover. Gold, as a safe-haven asset, is also on the rise, indicating that market funds want to earn risky returns but are reluctant to take on too much risk. Bitcoin is right in this "middle ground" and is thus easily attracting the attention of funds. Moreover, the funds that withdrew due to regulatory concerns earlier have started to flow back gradually as no new policies have been introduced for the time being. The core of this strategy is to capture the short-term rebound in the "overbought recovery + capital flow back" scenario, rather than a long-term trend reversal. During the operation, it is necessary to strictly follow the principle of "prioritizing signal confirmation", and the increase in position must wait for clear signals such as effective support and continuous capital inflow. Bitcoin trading strategy buy:85500-86500 tp:87500-88500 sl:84500Risk appetite has rebounded, and Bitcoin bulls are taking advantage of the opportunity to rise.

بهترین زمان برای فروش استقراضی بیت کوین: چرا اکنون وقت مناسبی است؟

Macro policies suppress risky assets: Previously, the market had some expectations for the Fed's December interest rate cut, but officials such as the president of the Boston Federal Reserve, Collins, made hawkish remarks, explicitly opposing the continuation of the rate cut in December, reducing the probability of a rate cut to only 40%. The cooling of the expectation for rate cuts pushed the US dollar to strengthen, while Bitcoin, as a typical risky asset, lost its appeal significantly under the backdrop of a strong US dollar, and lacked macro policy support for its price increase, providing a basis for short selling. Market enthusiasm has significantly cooled down: The institutional funds that previously drove the rise of Bitcoin are now withdrawing, and related funds have been flowing out of the market for several consecutive days, with a cumulative amount of 3.79 billion US dollars. Moreover, market trading volume is also decreasing, and the trading activity on major exchanges is not as active as before, indicating a decline in the enthusiasm of participants and a lack of momentum for the rise. Policy risks persist: The regulatory rules for Bitcoin have been delayed for a long time, and related bills have been in deadlock in the parliament, and there is no clear direction in sight in the short term. This has made many large institutions reluctant to enter the market, resulting in a lack of market confidence. Meanwhile, although there are rumors of a rate cut by the Fed, officials have repeatedly stated that "it is not a certainty", this uncertainty makes high-risk assets like Bitcoin prone to decline. Bitcoin trading strategy sell:88000-89000 tp:87000-85000 sl:90000The volatile market. Don't let emotions control you. Instead, make plans for trading, for profits, and for stop-losses.

استراتژی معاملاتی بیت کوین: حمایت ۹۰,۰۰۰ دلار کجاست و چه زمانی وارد شویم؟

A potential buying support point to consider: At the $90,000 mark, there is a high concentration of buy orders, with 16,000 BTC traded here in a single day, indicating that many people find this price reasonable. Large institutions with significant holdings of Bitcoin have purchased 23,000 BTC in the past month. Additionally, the cost of borrowing to buy Bitcoin in the market has turned from negative to positive. Technically, the excessive downward momentum has eased. All these factors can provide a floor for the price. Please provide the text you would like translated. The cautious risk points: At the $95,000 level, 40% of the positions are short (that is, many people are betting that it will fall here), and for it to rise past this point, the trading volume needs to be 60% higher than usual; in addition, some early Bitcoin holders, the "old players", have already sold a total of 815,000 coins, and many institutions are still on the sidelines, not daring to enter the market in a big way. All these factors will limit the upside potential. Bitcoin trading strategy buy:90000-91000 tp:92000-93000-95000 sl:89000Wish you a wonderful day!

Accumulation پنهان بیت کوین: نشانههای قطعی پایان فروش و آغاز رالی صعودی!

The "accumulation signal" of funds on the blockchain is prominent, and the selling pressure has abated, providing momentum for the bulls. The lock-up rate of long-term holders (LTH) has increased: In the past 30 days, the selling pressure of long-term holders with holdings exceeding 155 days has decreased by 42% compared to the previous period. The proportion of "dormant coins" (holdings exceeding 1 year) on the blockchain has risen to 68.3%, reaching a 3-month high. This indicates that the panic selling in the early stage is coming to an end, core holdings are gradually accumulating, and the selling pressure in the market has significantly weakened, providing a fundamental support for the price rebound. The clear trend of net outflow from exchanges is evident: In the past 7 days, the cumulative net outflow of Bitcoin from exchanges was 18,000 BTC. Among them, the two major exchange platforms, Coinbase and Binance, accounted for over 80% of the net outflow. The blockchain data shows that large amounts of funds (≥100 BTC) transferred from exchanges were mostly transferred to cold wallets for long-term storage rather than short-term trading accounts, reflecting the recognition of the current price by institutions, and the "exit" of funds has turned into "accumulation", indirectly reducing the market selling pressure. The selling pressure from miners has eased: Currently, the price of Bitcoin (88,000 USD) is approximately 6.7% higher than the average production cost line for miners (82,500 USD). The daily income of miners has rebounded to 12,000 USD, an increase of 35% compared to the low point in October. The miner sell pressure index (Miner Sell Pressure Index) has dropped from 0.8 to 0.4 (below 0.5 indicates low selling pressure), indicating that the miners' reluctance to sell has increased, further consolidating the bottom support. Bitcoin trading strategy buy:85500-86500 tp:87500-88500-90000 sl:84500The expectation of interest rate cuts has cooled down, exerting pressure on risky assets. The probability of the Fed cutting interest rates in December has sharply dropped from nearly 100% three weeks ago to 33%. Powell's hawkish stance emphasized "maintaining higher interest rates for a longer period", and the re-pricing of capital costs has put pressure on global risky assets. The high correlation of Bitcoin and the Nasdaq index at 0.78 makes it difficult for Bitcoin to remain unaffected alone.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.