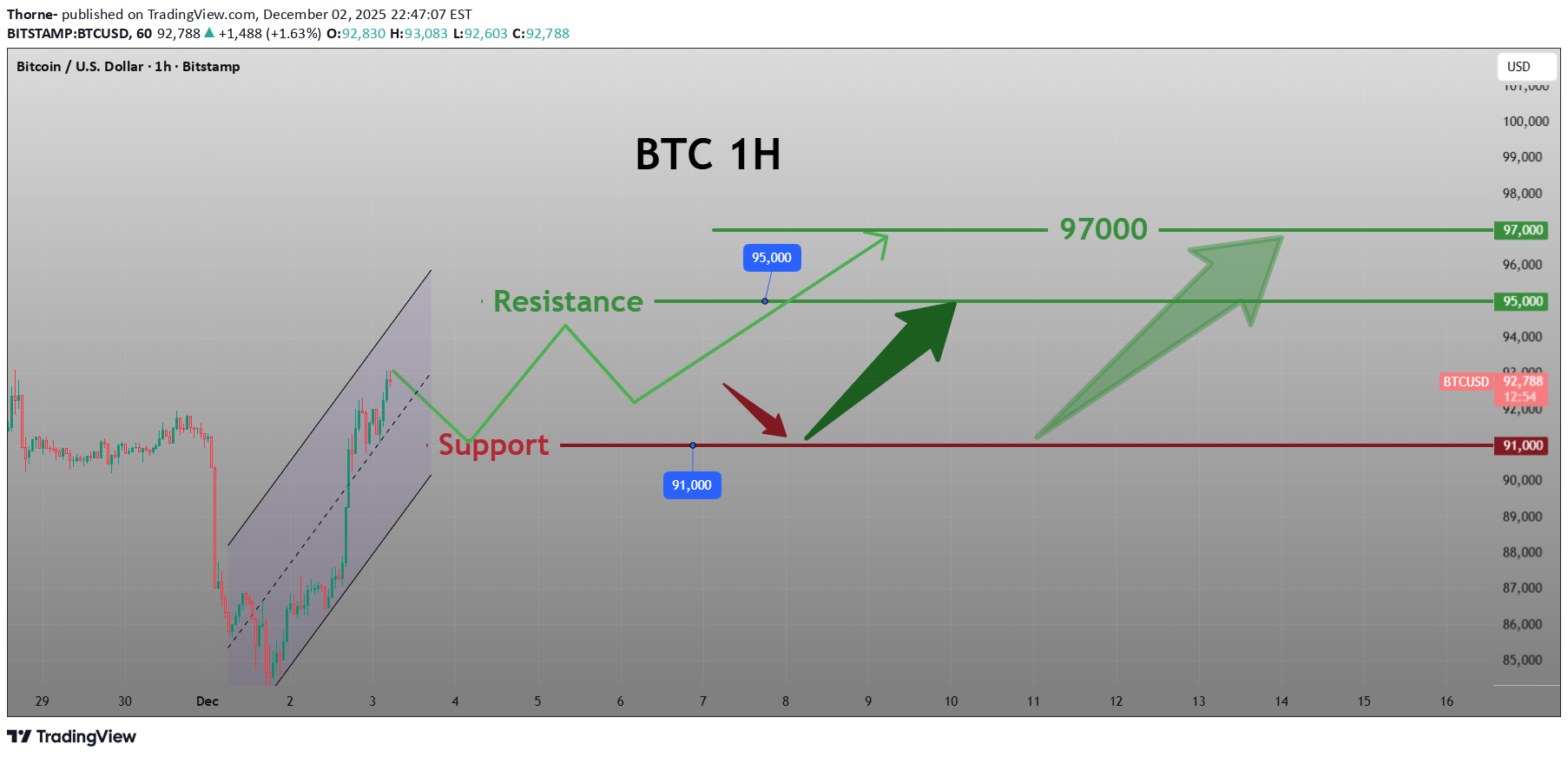

Technical analysis by Thorne- about Symbol BTC: Buy recommendation (12/3/2025)

استراتژی معاملاتی بیت کوین: جهش پس از تخلیه عوامل نزولی - نقاط ورود و خروج دقیق

Concentrated Release of Bearish Factors + Policy Expectation Adjustments: Bitcoin Rebound Gains Momentum Concentrated Release of Bearish Factors The three core bearish drivers that previously suppressed the market—Fed hawkish expectations, PBoC risk warnings, and USDT rating downgrades—have been fully digested during the sharp sell-off on December 1-2. Bitcoin has rebounded over 10.7% from its low of $83,786, demonstrating the characteristics of a "technical recovery after the exhaustion of bearish factors." Subtle Shifts in Policy Expectations Although market divergence persists regarding the probability of a Fed rate cut in December, the extreme earlier expectation that "the rate cut probability would fall below 50%" has marginally eased. Coupled with the long-term support from the Trump administration’s "Strategic Bitcoin Reserve" policy (institutional lock-up of 200,000 BTC), this provides the underlying logic for the rebound. Improved Cross-Asset Correlation U.S. tech stocks have stabilized and rebounded, with risk appetite marginally recovering. The correlation between Bitcoin and the Nasdaq 100 Index has returned to 0.75, as Bitcoin benefits from the reset of capital risk preferences. Bitcoin trading strategy buy:91000-92000 tp:93000-95000 sl:90000