Smaryo3001

@t_Smaryo3001

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Smaryo3001

Has BITCOIN reached its maximum and is a bear market coming?

To make a prediction about Bitcoin’s next rally based on historical patterns, we should first examine the overall trends and how these increases and decreases have evolved in percentage terms. Data observations: 337,000% increase -> 93% decrease Massive increase, followed by a steep correction. 61,000% increase -> 86% decrease Significant increase, but smaller than the first, and the decline was still close in percentage terms. 11,000% increase -> 84% decrease Smaller increase, the decline remains large, but slightly milder. 2,000% increase -> 77% decrease Significantly smaller increase compared to previous cycles, and the decline continued to moderate. Observing a descending pattern: The increases seem to be getting smaller and smaller with each cycle, and the decreases also tend to be less severe. This shows diminishing returns on increases and a reduction in market volatility. Estimate for the next increase: Given this pattern, the next percentage increase could be significantly smaller than the last one (2,000%). If we apply a progressive reduction coefficient, as was the case in previous cycles, the increase could be around: ~300%-500%. This would mean a maximum increase of 5x from the low of the last cycle, and currently we have an increase of over 600%, that is, 6x. Is this ATH in this bull market? To estimate the duration of the next Bitcoin uptrend, we can analyze how the duration of these uptrend cycles has evolved over time: Historical data: 240 days 730 days 850 days 1050 days Notes: The increase in duration between cycles is not uniform, but follows a general trend of extending duration. The duration increase intervals were: From 240 -> 730: +490 days From 730 -> 850: +120 days From 850 -> 1050: +200 days Analysis: The duration extension appears to be accelerating moderately, with an irregular but generally increasing trend. If this pattern continues, the next cycle could add between 200 and 300 days to the previous duration (1050 days). Estimate: The duration of the next cycle could be: ~1250-1350 days. This estimate corresponds to a natural extension of Bitcoin cycles, reflecting wider adoption and lower volatility as the market becomes more mature.

Smaryo3001

Smaryo3001

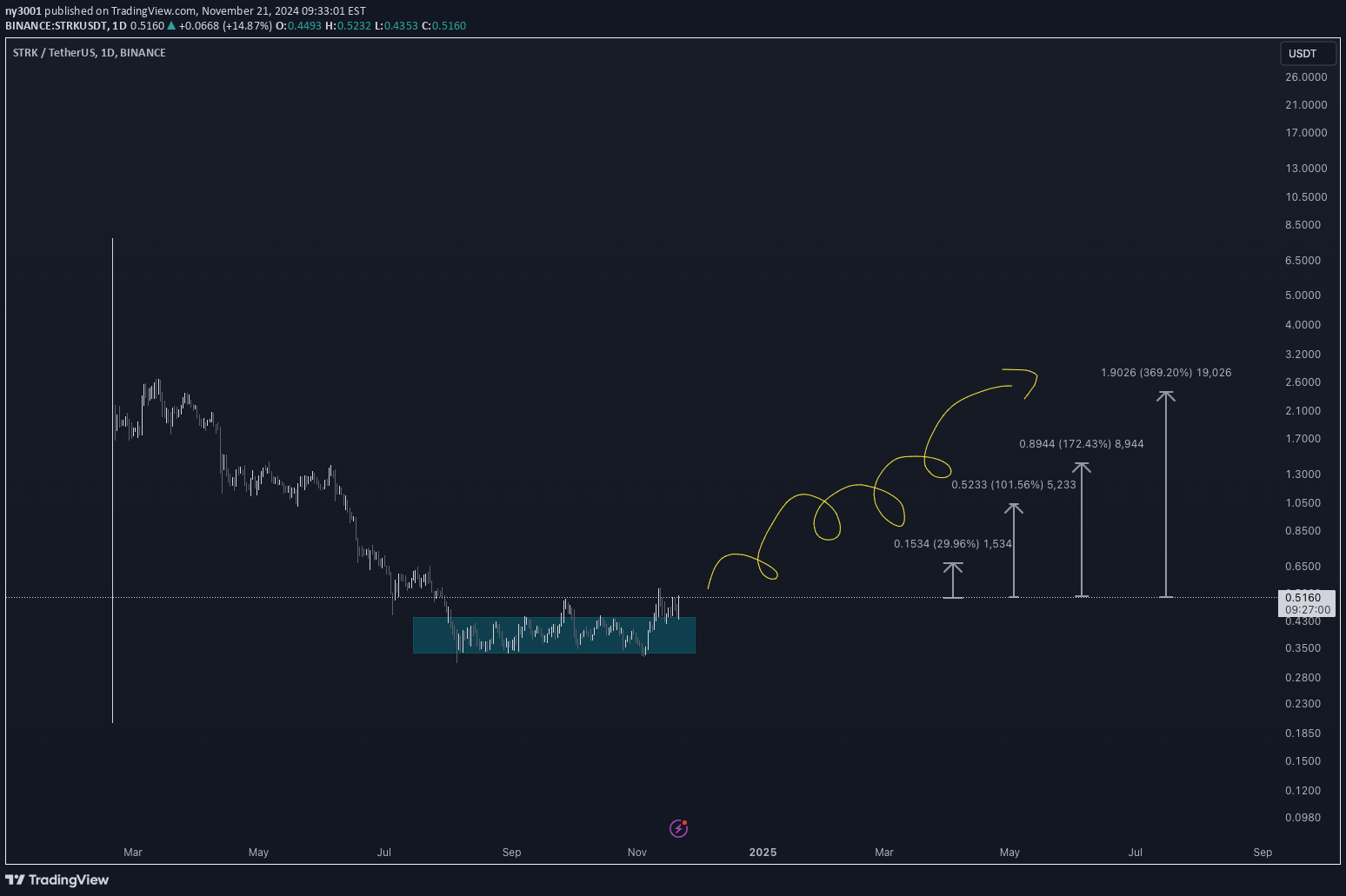

STRK - 300%

STRK after exiting this lateral channel, where it accumulated, has nothing else to do but try to go up. Of course, there may be a few more stops (accumulations and reaccumulations) on the upward trend, but the end can bring a gain of over 300%

Smaryo3001

TIA - 800%

TIA has been oscillating between $4 and $7. It has made a nice chart. I like it. I see it with great potential, even 700% TP3 is not unrealistic. For some time now, increasing volumes have been coming in.

Smaryo3001

JUP - 500%

JUP - I trust the growth potential of this coin. It has potential, it has marketcap, volumes will come and I see it going up with at least 300% gain.

Smaryo3001

ENA - 300% UP

ENA has changed its trend from bearish to bullish. It is likely, it has marketcap, volumes will come and I see it up with at least 300% gain.

Smaryo3001

CRO - 1$

CRO has been in a sideways channel for about 30 months with oscillations between $0.05 and $0.18. It's time for it to have its moment of glory and in this ETH bulltrend I see it even exceeding $1.

Smaryo3001

Smaryo3001

Smaryo3001

DOGE accumulation only

DOGE among the few cryptocurrencies that had a very long period of accumulation between $0.05 and $0.10 Now it breaks and pullbacks to dynamic resistance. If it does not go below this and tries 0.05$ again, I see that soon it can have a very big increase, a first TP at 0.14$

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.