SGsauragestion

@t_SGsauragestion

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

SGsauragestion

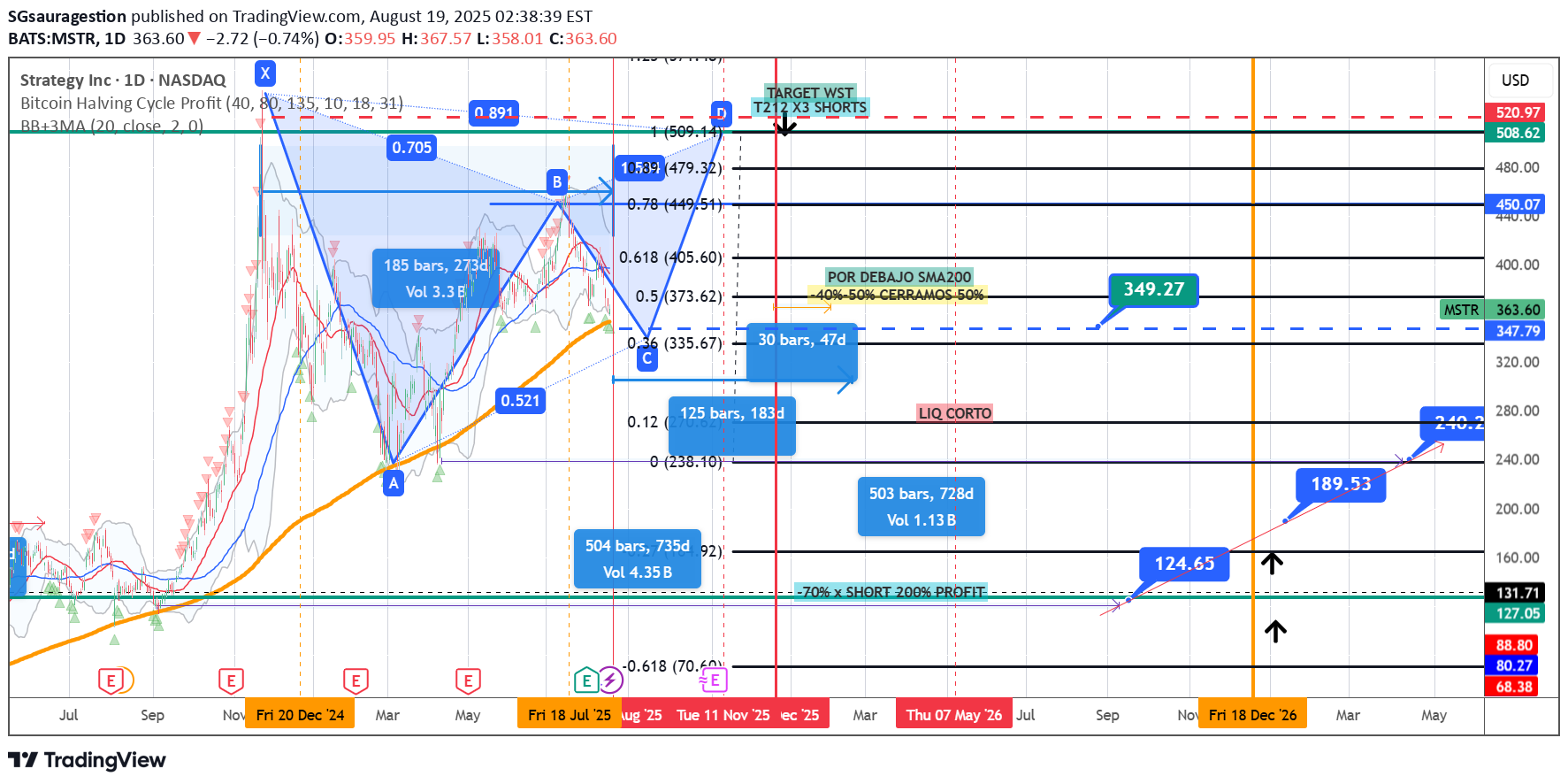

Here’s a polished extended version of your strategy note in English, structured and with some emphasis/emoji for clarity: --- 📉 **Preparing the Big Short – Strategy on Coinbase (COIN)** We are setting up a potential short trade on **Coinbase (COIN)**, to be executed and analyzed between **mid-November and mid-December**. 🔍 **Key Analytical Pillars:** 1. **Price vs. 200-day Moving Average (MA200)** → we will assess whether COIN is stretched above its long-term support/resistance line. 2. **Intrinsic Value** → current estimate around **\$180/share**, while we anticipate a possible decline into the **\$120–\$180 range**. 3. **On-chain Bitcoin Analysis** → since COIN’s performance is heavily correlated with BTC, we’ll integrate on-chain signals (whale activity, exchange flows, LTH supply, etc.) to refine timing. 🛠 **Options Structure (Put Strategy):** * **Core position**: Buy a **Put with a strike \~10–15% below current spot**, with an expiry around **6 months out** (to cover potential volatility into mid-2026). * **Premium optimization**: * Consider buying a **further OTM Put** (lower strike) to cheapen the overall premium (bear put spread). * Optionally, add a **Call hedge** to protect part of the operational upside in case of unexpected bullish momentum. * **Goal**: Keep the **premium low**, **breakeven not too far from spot**, and maintain convexity in case of a sharp downside move. 📊 **Additional considerations:** * **VIX** → we’ll monitor implied volatility. Lower VIX levels could make premiums cheaper, improving risk/reward. * **Timing** → precise entry will depend on macro context, Fed’s rate path, and BTC’s on-chain indicators. 🎯 **Target Outlook:** * Intrinsic Value: **\$180** * Expected downside: **\$120–\$180 zone** * Strategy: **Puts for directional downside exposure**, optimized with spreads/hedges. ⚠️ **Disclaimer:** *This is not financial advice. DYOR (Do Your Own Research).* ---

SGsauragestion

Bitcoin is going to fly the following 3 weeks arriving till 143k$-145k$ In September will see the price going down to visit the 125k$ level, and UPTOBER will bring us the last surprise, a bitcoin arriving till 167k$ And that´s all. Good luck to everyone. We´ll see 65k$ ending 2026 or begining 2027.

SGsauragestion

It will go up till 500-600$, then we´ll enter in ETF with PUT options with LEADS to visit 100$, and then spot again till 1200$. Let´s dance... GO GO GO.

SGsauragestion

A lot of people still don’t get $BRETT — they see it as just another meme coin. But let me break it down. 🧠📉📈 BRETT isn’t random. It comes straight from the Base ecosystem, backed by the viral success and culture of Matt Furie — the same creator behind Pepe the Frog 🐸. Yeah, that Pepe. This isn’t just memes — it’s crypto culture, and BRETT is becoming its poster child on Base. 🚀 The Base chain is still heating up, and BRETT is right in the middle of that early wave. Early coins on new chains? Historically huge upside. ⛓️🔥 💰 I got in because I believe we haven’t even scratched the surface. Yes, it's pulled back a bit — normal in crypto. But that’s not the end. I’m personally expecting a rebound of at least +350% from here. That would barely get us back to its momentum highs, and with community and narrative catching fire again... the upside could be even crazier. 🌪️📊🌕 Let the impatient sell. Let the crowd move on. I’m here holding BRETT, because when this thing pops off again… I don’t want to be watching from the sidelines. 🏁💎 +350% isn’t a fantasy. It’s the next leg up. Don’t fade the frog. 🐸🔥

SGsauragestion

Honestly, I’ve seen a lot of people say Ethereum isn’t what it used to be — not as active, not as hyped, maybe even “dying” compared to a couple of years ago. 🚶♂️📉 But here’s the thing: I didn’t get into ETH for the quick hype. I got in around $1,300, and I’m not planning on touching it until we’re somewhere around $6,500 or more. 🚀💎🙌 Ethereum is still the backbone of most real innovation in Web3 — smart contracts, DeFi, layer 2s, NFTs (yes, still alive), and massive institutional interest brewing beneath the surface. 🧠🔥 People forget: the best gains come when no one’s paying attention. The crowd’s asleep now… perfect. 😴🕵️♂️ I'm not here for short-term noise — I'm here for long-term value. I’d rather hold strong while the market underestimates it, than chase FOMO later when it’s back on headlines. 💼🕰️📈 Let them doubt — I’m holding. Let them forget — I’m positioning. Let them sell — I’m accumulating. ⚖️🧘♂️ $6,500 isn’t a dream, it’s just the beginning. ETH isn’t dead — it’s just recharging. ⚡️💻🧬

SGsauragestion

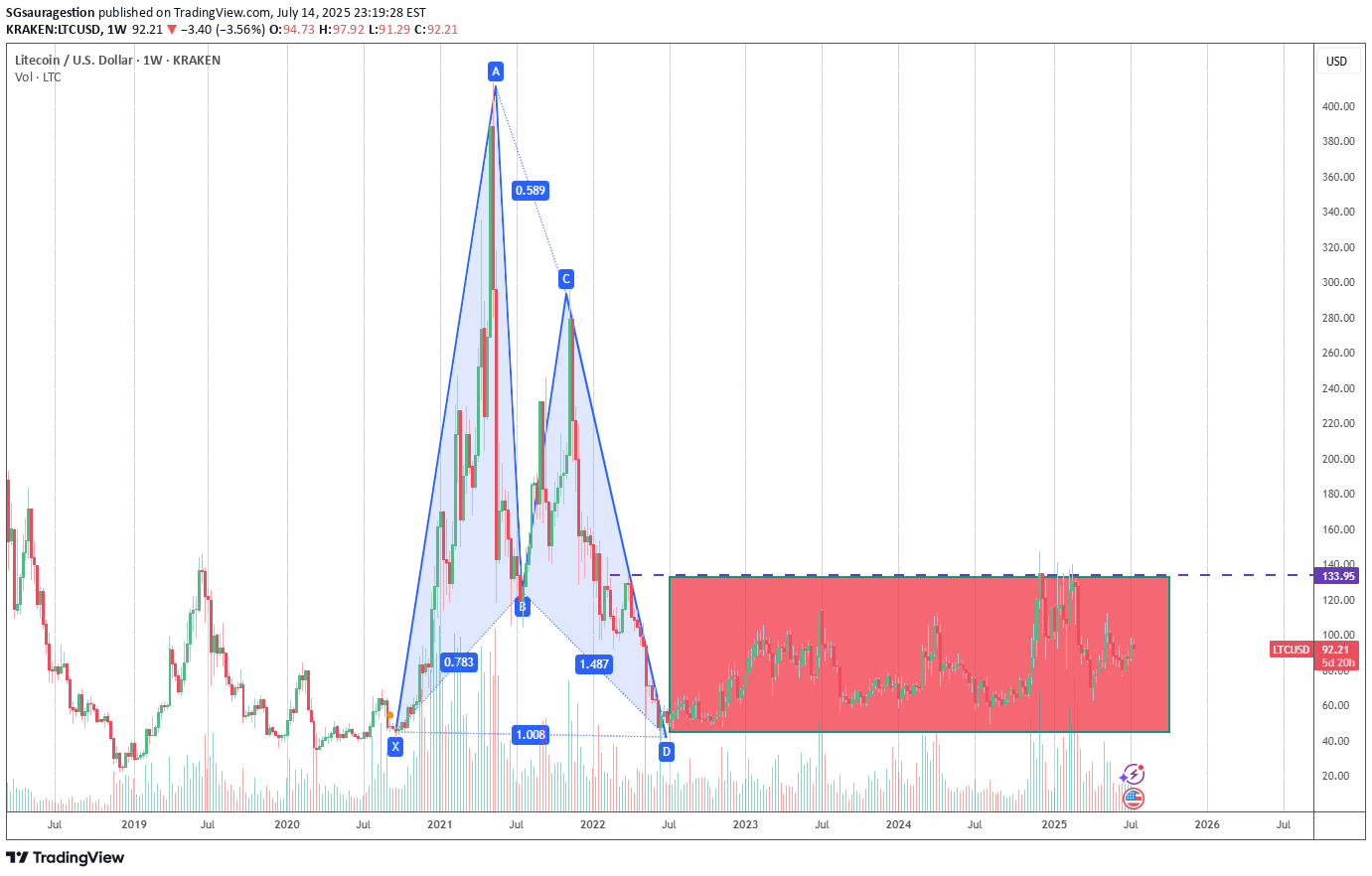

💥 LET’S TALK ABOUT LITECOIN (LTC) – THE SILVER OF CRYPTO IS WAKING UP ⚡ For years, Litecoin was seen as the silver to Bitcoin’s gold – a trusted, fast, decentralized payment coin that’s been around since the early days. But lately… it’s been flying under the radar. Almost no one talks about it. 👀 And that’s exactly why smart investors are watching it closely right now. 📈 🔍 From a technical perspective, if you zoom out and compare the macro structure of LTC to XRP, you’ll notice some striking similarities: ✅ A massive bullish harmonic pattern forming ✅ Multi-year accumulation zone – strong hands have been loading ✅ Volatility compression + breakout structure ✅ Ready for a beast-mode expansion phase 🚀 We’re not throwing wild guesses here – the technical case for a major move is solid. Seeing LTC revisit the $900 zone? Not just possible — plausible, especially as market sentiment shifts back toward legacy altcoins with proven track records. 🧠 Don’t sleep on this just because it’s not the shiny new alt. Often, the biggest moves come from forgotten giants. 💡 If you're not comfortable buying crypto directly, many brokers offer ETPs (Exchange Traded Products) linked to Litecoin. Just search for Litecoin ETP or LTC tracker on your preferred platform. TL;DR: Litecoin is coiled. Fundamentals are strong. Technicals are explosive. The silver is about to shine again. 🌕⚒️ #Litecoin #LTC #CryptoAlert #CryptoTrading #Accumulation #Altseason #SilverOfCrypto #BreakoutIncoming #ETP #TechnicalAnalysis

SGsauragestion

🚨 BITCOIN IS ABOUT TO TAKE OFF AGAIN – DON’T MISS IT! 🚀 We’re seeing a healthy pullback in play – exactly the kind of mean reversion smart money watches for. BTC is currently retracing to test the standard deviation from the 200 EMA on the 30-minute chart ⏱️📉 🔍 There are two key demand zones setting up as high-probability buy areas: 1️⃣ Zone 1 – First reaction level: ideal for aggressive entries if momentum picks up. 2️⃣ Zone 2 – Deeper support: strong confluence with fibs + previous liquidity sweep. A goldmine for patient bulls. 💰 This isn’t just another dip – it’s a technical setup with potential for explosive upside. 📊 Stay sharp. Stay ready. BTC doesn’t wait. ⚡ #Bitcoin #BTC #CryptoTrading #BuyTheDip #EMA200 #TechnicalAnalysis #CryptoAlerts 🔥

SGsauragestion

🚀 What's Next for #Bitcoin? Time’s Ticking... Frankly, time is running out for Bitcoin to give us that final explosive leg we’ve been waiting for—the one that could take us to $145K before a correction in September, and ultimately reach $165K in early November, driven by pure FOMO. But right now, what truly matters is the chart, and the chart is speaking loud and clear: 👉 If today's daily close holds above $107,500, and we see a dip to the $105,600 zone tomorrow or Wednesday, that could be the perfect setup to fuel the fire for an epic rally. We're talking about a run toward $112,000 and a breakout to new ATHs. 📈 Let’s be clear: If Bitcoin doesn’t close below $107,500 today, we could skip the dip entirely and go straight up. The bullish trend would remain fully intact, and I’ll be there—waiting for daddy Bitcoin to make its move. Stay ready. This could get wild. 🧨

SGsauragestion

Bullish and bearish. Which one first? 📉 Gold and NDX: Seasonal Patterns and Short-Term Outlook Historically, gold tends to show weakness during the first three weeks of July, often setting the stage for one last leg up before institutional selling kicks in on U.S. equities. Based on seasonal patterns, this aligns with a typically bullish phase for the Nasdaq (NDX), which often extends until around July 24, with the usual volatility along the way. From there, gold tends to recover, historically offering a 3–5% return into mid-September. Keep in mind, this is purely based on statistics—always do your own analysis. 🔎 This week’s short-term setup: We may see a push higher in gold later today and into tomorrow, followed by potential downside during the second half of the week. While there might be brief upside opportunities, I won’t be taking any long positions—only looking to sell rallies—since the short-term trend remains more bearish than bullish. Stay sharp and trade safe. 📊I put the trade in breakeven.

SGsauragestion

Based on its current chart structure, underlying fundamentals and on‑chain metrics—and with XRP trading today at $2.29—XRP appears ripe for a near‑term 13% rally to roughly $2.59. Technically, XRP has been carving out a textbook ascending triangle over the past month, with steadily higher lows and a firm resistance level right at $2.33–$2.34; a decisive breakout above that ceiling—ideally on volume exceeding the 30‑day average—would project XRP toward our $2.59 target. From a fundamental standpoint, the network’s fee‑burn mechanism continues to shrink the circulating supply, while growing institutional adoption—illustrated by the recent integration of XRP liquidity rails by multiple payment providers—underscores real‑world demand. On‑chain analytics reinforce this bullish view: the NVT (network‑value‑to‑transactions) ratio has begun to decline off its multi‑year highs, signaling that transaction throughput is rising faster than market valuation, a classic precursor to price appreciation, and addresses holding over 1 million XRP have increased by 8% in the last two weeks. Taken together—structural setup, deflationary supply dynamics, improved usage metrics and concentrated buying by large holders—XRP is well positioned to deliver roughly a 13% advance from $2.29 to ~$2.59 in the coming sessions.I have already opened account with only 100$ in Ro bo forex (cent acc), with 9% profit this week, look for SereneTrades if you´re interested.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.