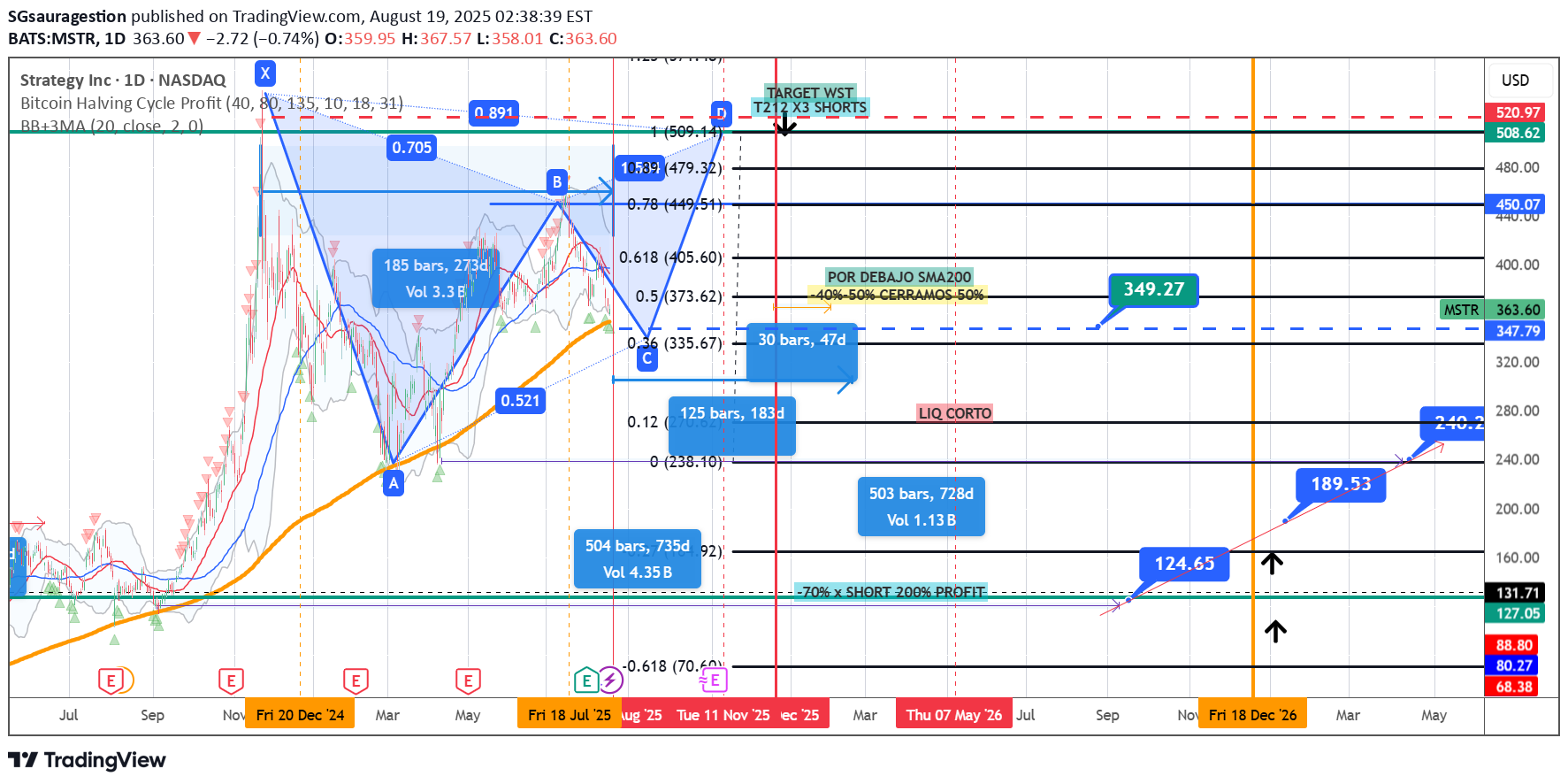

Technical analysis by SGsauragestion about Symbol MSTRX: Sell recommendation (8/19/2025)

SGsauragestion

Here’s a polished extended version of your strategy note in English, structured and with some emphasis/emoji for clarity: --- 📉 **Preparing the Big Short – Strategy on Coinbase (COIN)** We are setting up a potential short trade on **Coinbase (COIN)**, to be executed and analyzed between **mid-November and mid-December**. 🔍 **Key Analytical Pillars:** 1. **Price vs. 200-day Moving Average (MA200)** → we will assess whether COIN is stretched above its long-term support/resistance line. 2. **Intrinsic Value** → current estimate around **\$180/share**, while we anticipate a possible decline into the **\$120–\$180 range**. 3. **On-chain Bitcoin Analysis** → since COIN’s performance is heavily correlated with BTC, we’ll integrate on-chain signals (whale activity, exchange flows, LTH supply, etc.) to refine timing. 🛠 **Options Structure (Put Strategy):** * **Core position**: Buy a **Put with a strike \~10–15% below current spot**, with an expiry around **6 months out** (to cover potential volatility into mid-2026). * **Premium optimization**: * Consider buying a **further OTM Put** (lower strike) to cheapen the overall premium (bear put spread). * Optionally, add a **Call hedge** to protect part of the operational upside in case of unexpected bullish momentum. * **Goal**: Keep the **premium low**, **breakeven not too far from spot**, and maintain convexity in case of a sharp downside move. 📊 **Additional considerations:** * **VIX** → we’ll monitor implied volatility. Lower VIX levels could make premiums cheaper, improving risk/reward. * **Timing** → precise entry will depend on macro context, Fed’s rate path, and BTC’s on-chain indicators. 🎯 **Target Outlook:** * Intrinsic Value: **\$180** * Expected downside: **\$120–\$180 zone** * Strategy: **Puts for directional downside exposure**, optimized with spreads/hedges. ⚠️ **Disclaimer:** *This is not financial advice. DYOR (Do Your Own Research).* ---