Og_Bitpool

@t_Og_Bitpool

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Og_Bitpool

ARKM BREAKOUT WATCH

🔥 $ARKM long setup (1 D) 🚀✅ Entry Zone: $0.44 – $0.41 (triple-tested demand)🎯 Targets• TP-1: $0.75 (Jan-25 supply flip)• TP-2: $1.30 (post-IPO breakdown block)⛔ Stop-LossDaily close < $0.37📊 Thesis• Arkham Intel Exchange = world’s first on-chain intel marketplace; >1,300 bounties posted 🕵️♂️• Intel-to-Earn DATA program pays sleuths in $ARKM, driving real fee demand 🔁• **AI Oracle** lets anyone query blockchain data with ChatGPT-style prompts 🤖• Institutional API live – same endpoint Arkham uses internally, now sold to funds & banks 🏦• Swift pilot: CCIP-style proof-of-concept pipes Arkham labels to TradFi (under NDA) 💼• Binance Launchpad #32; oversubscribed × 990; 114 k users staked BNB to get $ARKM ⚡• Buy-back wallet removing 100 k+ ARKM / week from open market 🔥• Supply fixed at 1 B; 80 % already circulating, no inflation 🟢

Og_Bitpool

ARKM SCALP

🔥 ARKM Long Setup (30m) 🚀✅ Entry Zone: $0.4524 – $0.449🎯 Targets• TP-1: $0.481• TP-2: $0.501⛔ Stop-Loss: $0.441

Og_Bitpool

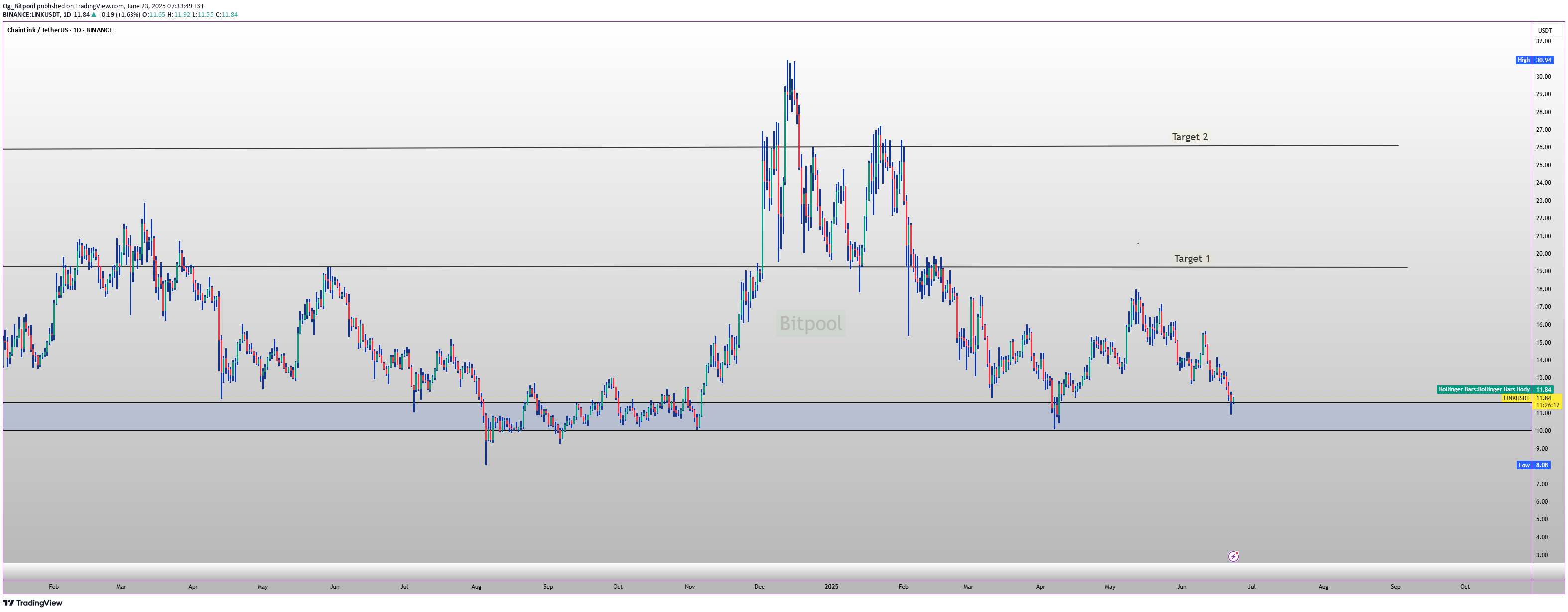

Link targets for august

🔥 LINK long setup (1 D) 🚀✅ Entry Zone: $10.50 – $11.80 (18-month demand)🎯 Targets• TP-1: $19.50 (Dec-23 supply flip)• TP-2: $26.00 (Apr-24 breakdown block)⛔ Stop-LossDaily close < $9.40📊 Thesis• #CCIP live on 8 L1/L2s; Swift + 10 banks pilot tokenization via CCIP 🏦• #Staking v0.2 (45 M LINK) secures Data Streams & CCIP 🔒• Q1-25 product update: Data Streams + Functions → #mainnet for DeFi ⚡• #Hong Kong CBDC swap & #ANZ stable-coin tests run on CCIP 🌐• $260 T #untokenized assets addressable; BlackRock tokenized fund cites Chainlink 🏛️• 55 % circulating LINK locked in staking or DeFi; supply inflation 0 % 🟢

Og_Bitpool

Pol targets for 2025

🔥 POL long setup (1D) 🚀✅ Entry: $0.16 – $0.18 (launch-base demand)🎯 Targets• TP-1: $0.45• TP-2: $0.58⛔ Stop-Loss1 d Close < $0.14📊 ThesisPolygon 2.0 migration ✔️. AggLayer mainnet (Feb-25) + Breakout Program → airdrops for POL stakers. Gigagas upgrade aims 1 k + TPS. 2 % annual emission = staking yield. zkEVM sunset frees resources for PoS & AggLayer. 🔥 risk-reward.

Og_Bitpool

DOT PLAN FOR 2025

🔥 DOT long setup (1D) 🚀✅ Entry Zone: $3.10 – $3.40 (triple-tested demand)🎯 Targets• TP-1: 8.80 (’24 breakdown line)• TP-2: $10.40 (pre-bear support)⛔ Stop-LossDaily close < $2.5📊 ThesisPolkadot 2.0 is rolling out NOW: Agile Coretime marketplace, JAM smart-contract hub & 6-sec blocks via Asynchronous Backing. On-chain OpenGov controls a 508 M DOT treasury, while DeFi hubs (HydraDX, Moonbeam) just posted 200 %+ QoQ tx growth. Active accounts up 35 % YoY, >50 % of DOT already staked, and a Grayscale spot-DOT ETF is in the SEC queue. 🔥 risk-reward.

Og_Bitpool

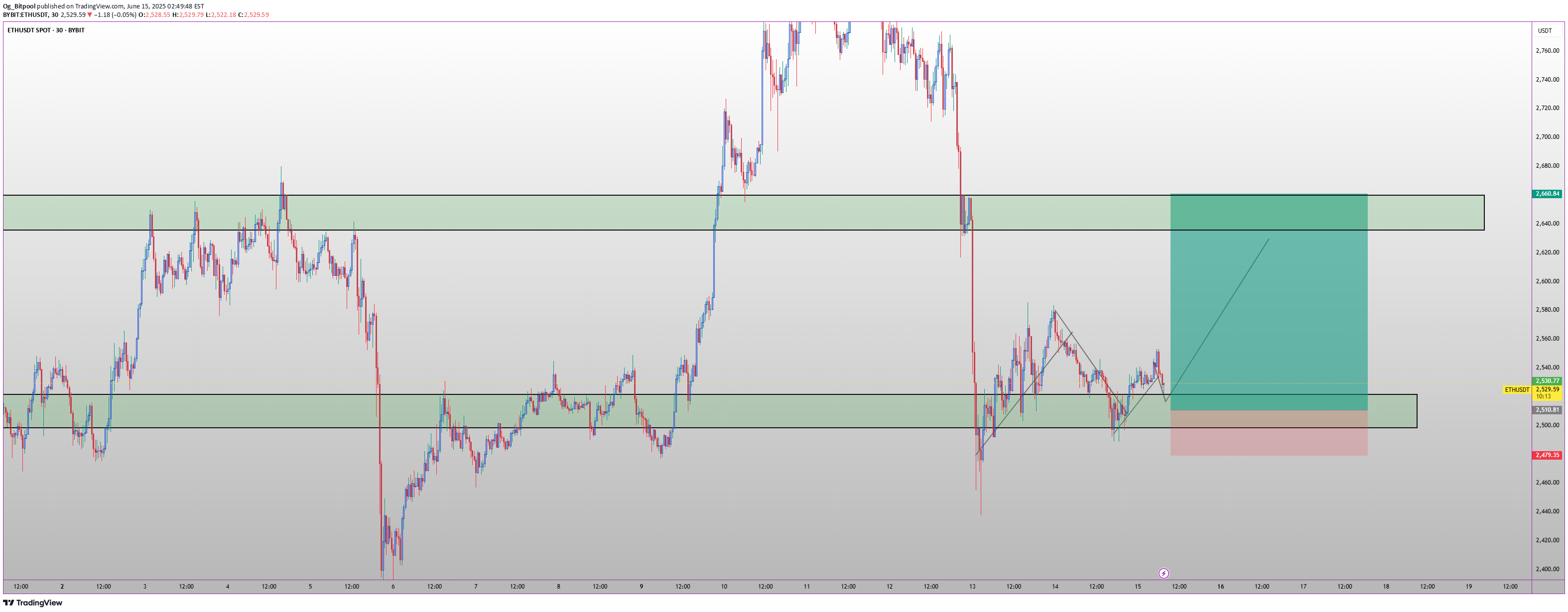

ETH SCALP LONG

🔥 ETH Long Setup (30min) 🚀✅ Entry Zone: $2,505 – $2,528🎯 Targets • TP-1: $2,660 • TP-2: $2,620 ⛔ Stop-Loss Close of a 15-min candle below $2,479📊 Thesis ETH is consolidating above a reclaimed demand zone ($2,510 – $2,535) after a clean breakout and minor retest. Structure remains bullish, and continuation toward the previous high-volume node around $2,660 is likely. A push beyond that level opens the path toward $2,700.💬 Trade live with us in our Discord — we trade 📈, learn 🧠, and help each other out. No fees ❌, no paid-group nonsense 🚫. Just a solid community 🤝

Og_Bitpool

LTC TARGETS FOR Q3

🔥 LTC swing setup (3D) 🚀✅ Entry Zone: $70 – $77 (multi-year demand)🎯 Targets• TP-1: $180 (2021 breakdown line)• TP-2: $240 (2020-21 pivot)⛔ Stop-Loss3-day close < $66📊 Thesis • #1 payment coin on BitPay in 2024-25 (201 K tx > BTC & ETH) • Active addresses +28 % YoY; record 92.8 M on-chain tx in 2024 • 27 % of transfers now use MWEB privacy layer 🔒 • SEC verdict on a spot-Litecoin ETF due 2025 🏛️ • Post-halving rallies average +300 % within 18 m — 2023 halving “digestion” almost done 😈

Og_Bitpool

CRV BULLISH Q3 2025

🔥 CRV long setup (1D) 🚀✅ Entry Zone: $0.52 – $0.48 (re-test of Nov-24 launchpad base)🎯 Targets• TP-1: $0.90 (Dec swing high)• TP-2: $1.30 (IPO wick fill)⛔ Stop-LossDaily close < $0.44📊 ThesiscrvUSD supply just hit a $179.8 M ATH 🏦, LlamaLend soft-liquidation markets are live, and the new Resupply loop lets users lever yields — all pushing protocol fees up while 98 % of CRV is already unlocked. Add CrossCurve’s cross-chain liquidity hub and record $35 B Q1-25 volume and the R/R is 🔥 (~5.8 R).

Og_Bitpool

DUSK Q3 2025 PLAN

🚀 $DUSK double-bottoming at 0.060-0.067 — the same demand that kick-started 200-300 % rallies before. 📉→📈Catalyst stack for 2025:• Mainnet live + privacy-first RWAs• Phoenix 2.0 upgrade (lower fees, easier dev)• MiCA-ready Dusk Pay & EURQ digital-euro launch• 21X EU pilot regime RWA exchange partner• Lightspeed EVM L2 for seamless ETH interoperability🎯 Targets: 0.17 / 0.25 ⛔ Invalidation: daily close < 0.055 ⚖️ Risk ≤ 2 %. NFA.

Og_Bitpool

C98 ANALYSIS FOR Q3 2025

🧠 $C98 is grinding against a 15-month down-trend at $0.055, sitting on a 0.048-0.055 demand that’s defended 7× since ʼ23. CMF + falling-wedge basing = compressed spring. 📉→📈2025 catalyst stack:• AI Wallet v15 w/ Cypheus assistant 👾• PowerPool Staking V2 + airdrops • SwapX cross-chain swap (Solana, TON, Base, Sui, Viction) • Telegram one-tap Web3 wallet rollout • DeFusion launchpad traffic & fee burn • 10 M users across 130+ chains already 🚀 • 98 % supply unlocked – near-zero vesting overhang🎯 Targets 0.16 / 0.20 ⛔ Invalidation: daily close < 0.048 ⚖️ Risk ≤ 2 %. NFA.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.