FeelsStrategy

@t_FeelsStrategy

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

FeelsStrategy

تعطیلی دولت آمریکا و ضربه ناگهانی به نقدینگی بیت کوین: چه اتفاقی در راه است؟

BTC & US Fiscal Stress (Shutdown Effects)⚠️ In the previous post, I explained how the ISM PMI reflects the macroeconomic business cycle and its correlation with crypto. This time, let’s look at how the US government shutdown is already causing liquidity stress. 📝 The TGA (Treasury General Account) balance has been rising again, meaning liquidity is being drained from the system, a typical pattern during fiscal tightening. This shift is part of the broader fiscal cycle, tracked by the WTREGEN indicator, which strongly influences market liquidity and, consequently, crypto performance. 📍 At the same time, stress is visible in repo (Overnight Repurchase Agreements), signaling temporary funding pressure within short-term money markets. This often precedes interventions aimed at restoring stability. 💡 The base scenario remains that the shutdown will likely end shortly after mid-November, which should relieve pressure and act as a short-term positive for risk assets, including Bitcoin and altcoins.

FeelsStrategy

پایان چرخه بیت کوین؟ نشانههای کلیدی از آینده اقتصاد و بازار ارزهای دیجیتال

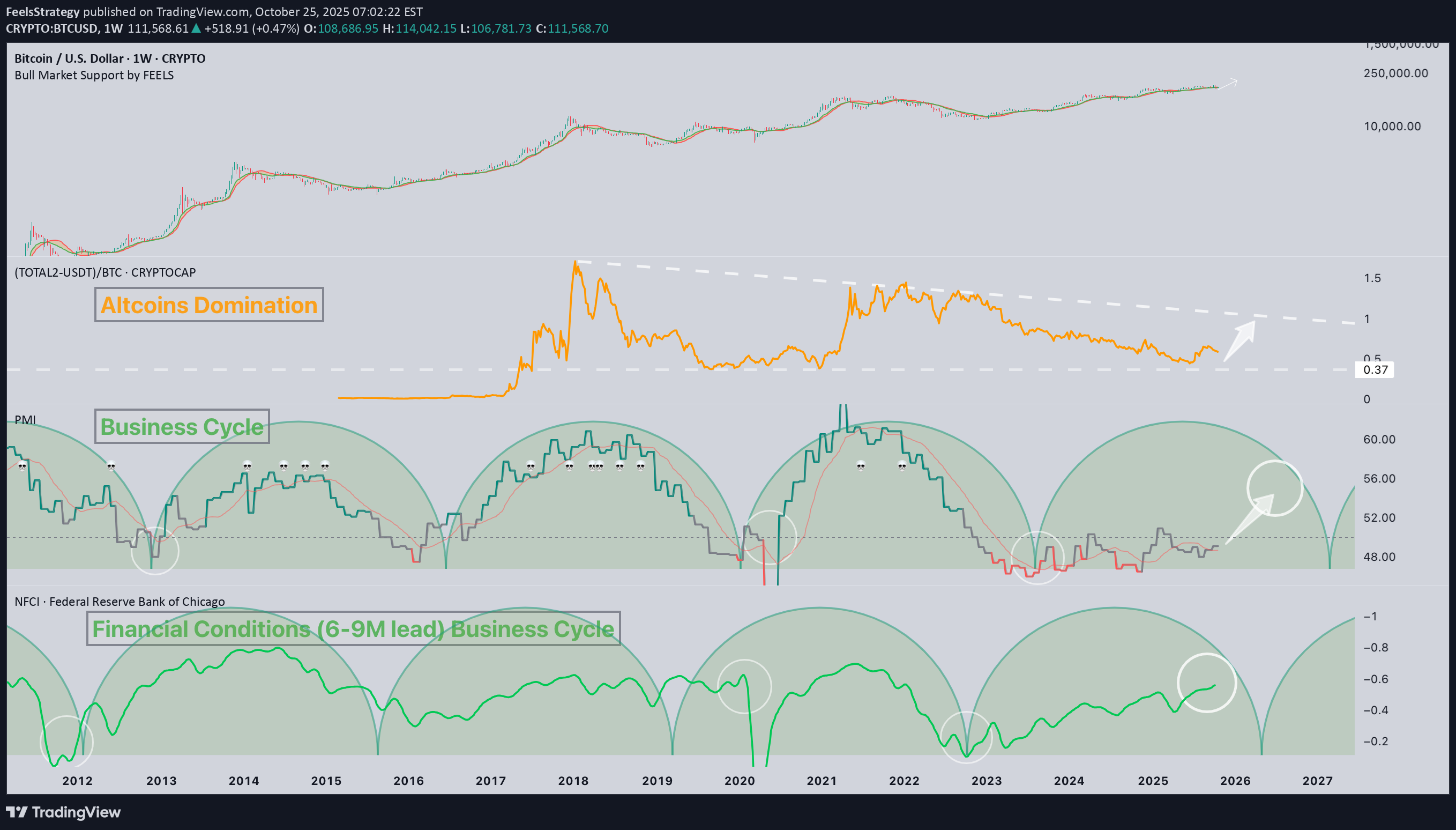

BTC & Business Cycles 🔄 (Part 3) In my previous posts, I showed how the ISM PMI index reflects macroeconomic business cycles, and how liquidity (Global M2) cycles tends to lead these movements by several months. 📍 Today, let’s go one step further. The Financial Conditions Index (NFCI) leads the ISM by roughly 6–9 months, offering an even earlier look into where the economy and risk assets (like crypto) might be heading next. 📝 While this leading indicator comes with a little bit larger margin of error, understanding its key drivers — credit spreads, volatility, and interest rates — gives valuable insight into how tight or loose financial conditions are. 💡 When these conditions ease, liquidity flows increase, supporting both the business cycle and market expansion (especially in liquidity-dependent assets like #altcoins). And as we can see, the current trend suggests improving conditions, hinting that the next expansion phase of the macro cycle could be forming soon.

FeelsStrategy

پایان چرخه بیت کوین؟ سرنخهای پنهان در شاخص کسبوکار (ISM PMI)

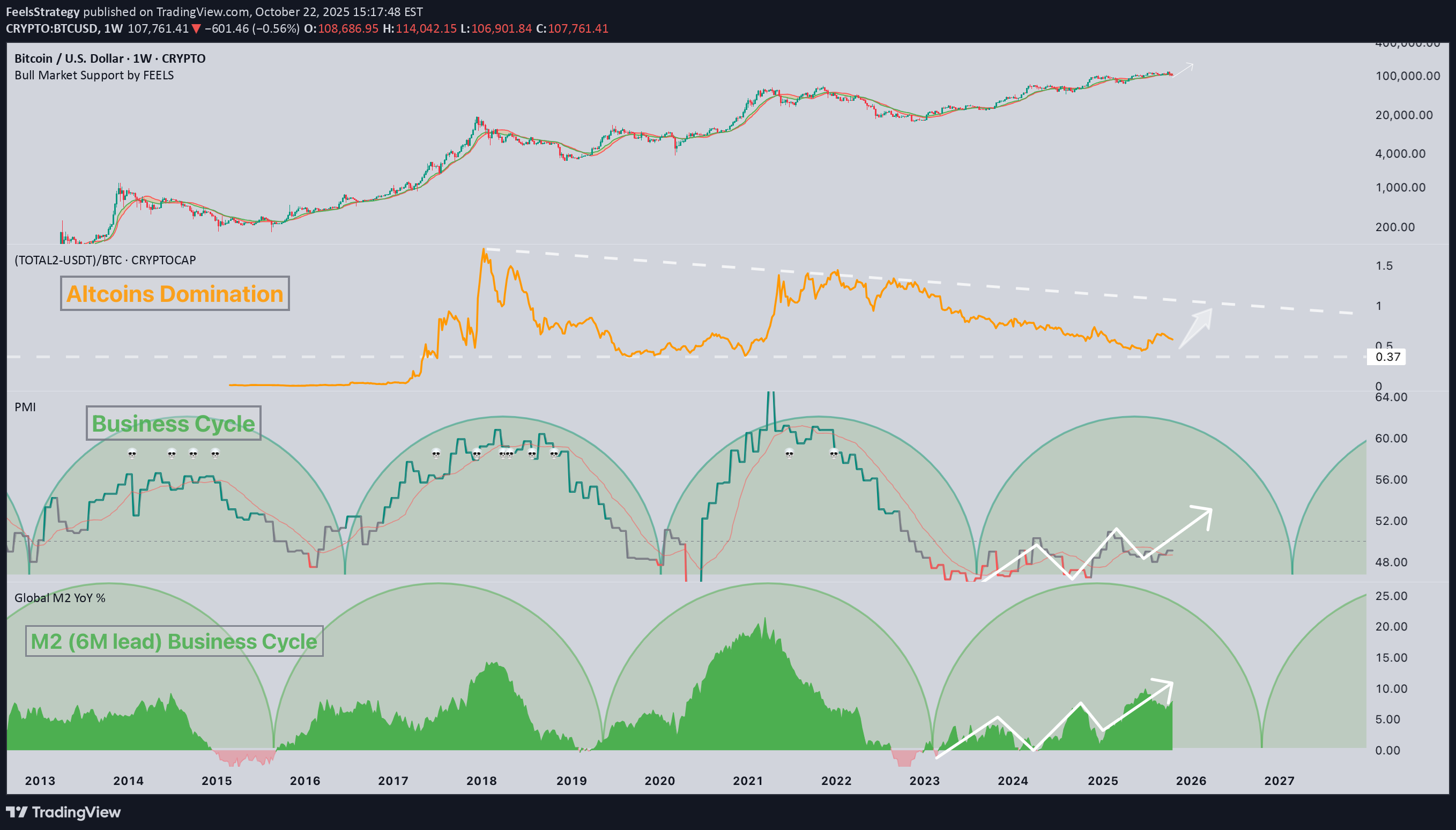

BTC & Business Cycles 🔄 (Part 2) In the previous post, I explained how the ISM PMI reflects macroeconomic business cycles — now let’s look at how we can actually anticipate these cycles. 📈 The Global M2 (money supply) tends to lead the business cycle by about 6 months. When liquidity starts expanding, it fuels economic growth and risk appetite — and the crypto market, being one of the most liquidity-sensitive assets, reacts early. 📝 This is why #altcoins are especially dependent on liquidity flows. While Bitcoin can perform under tighter conditions due to its store-of-value narrative, altcoins rely heavily on surplus liquidity and speculative capital to thrive. 💡 The liquidity cycles continue to expand, which shows us where the ISM PMI will be in 6 months. Therefore, we can say with a high probability that we will not have a lost business cycle, but it will simply develop later.

FeelsStrategy

پایان چرخه بیت کوین فرارسیده؟ کلید ماجرا در شاخصهای اقتصادی پنهان است!

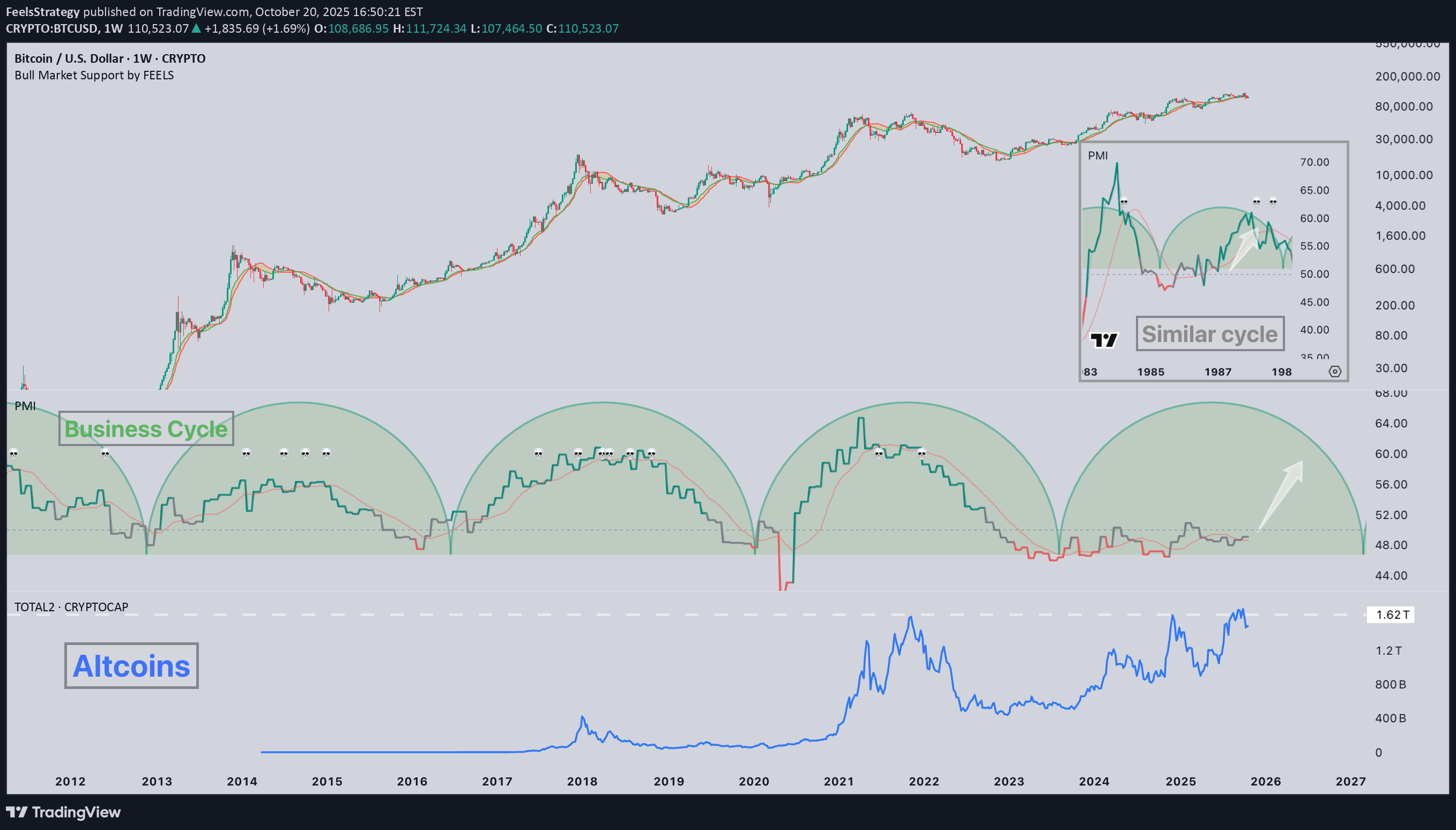

BTC & Business Cycles 🔄 While most investors focus solely on the halving cycles, Bitcoin’s long-term rhythm is also deeply connected to the broader business cycle, reflected in indicators like the ISM PMI. 📝 As we can see, Bitcoin’s macro tops and bottoms tend to align with expansions and contractions in global liquidity — not just halving dates. Interestingly, in this current cycle, Bitcoin has performed relatively well, but altcoins have underpeformed and even dont beat the 4 years old peak (not adjusted by inflation), suggesting that liquidity hasn’t yet fully reached the broader crypto market. 📍 The crypto market is becoming more integrated with traditional financial cycles, so business indicators now play a bigger role than ever. The 1980s pattern show a similar case where a cycle extended due to delayed liquidity effects — and that could be what’s happening now. 💡 This may mean the current cycle could stretch a few more months, giving the market a bit more time before the next major shift.

FeelsStrategy

Bitcoin & Tariffs

📉 In the short term, Trump's proposed tariffs add to the current risk-off sentiment—ETF flows, correlations with stocks, and macro uncertainty are already weighing on Bitcoin.🗣 While debates rage on about whether tariffs will hurt importers or exporters or whether Trump will roll back some after negotiations, one thing is certain: inflation. And inflation is historically a positive for $BTC. 🌊Liquidity injections, growth of money supply (M2) and potential QE will follow as a weak economy struggles with disrupted supply chains—another long-term positive for Bitcoin⚖️ During trade wars and geopolitical uncertainty, investors run to gold. With Bitcoin’s correlation to gold, this could be another tailwind💡 So while tariffs may be a short-term drag, structurally, they are bullish for Bitcoin in the long run. You also need to remember that quite a lot of negativity is already built into the price, and if there is no new round of counter-tariffs, positive sentiment may appear sooner.#Bitcoin & Macro Update 📝As I said earlier, tariffs may be a short-term drag, but they are bullish for Bitcoin in the long run. And what we see now is that Bitcoin remains structurally strong.🧠 While headlines focus on risks, the deeper driver is liquidity. Historically, expansions in global money supply (M2) have been a key tailwind for Bitcoin, and BTC continues to mirror M2 with a 3-month lag.💡 Some short-term pullbacks are still possible, but overall, I expect the broader uptrend to continue. This will provide a breath of fresh air for the crypto market, which we are already beginning to witness.#Bitcoin & Liquidity Outlook 📝 When BTC dropped to $75K, many were quick to declare the start of a new bear market. But I repeatedly emphasized that this was a short-term correction, not a structural reversal. And so far, price action has followed that thesis.📍 As noted earlier, macro liquidity remains the key driver. Bitcoin continues to mirror the M2 money supply with a 3-month lag, and the latest surge in global liquidity is clearly reflected in BTC’s renewed strength.💡 While the broader picture remains bullish, opening light hedge shorts (on a small portion of the portfolio) in the $102K–$107K range could be a smart risk management option in the late phase of the market.

FeelsStrategy

Bitcoin Gaussian Channel (Local bottom ?)

#Bitcoin Gaussian Channel 🐍 🗣In my last post, I pointed out that we had moved up too quickly and noted the possibility of consolidation or even a correction—which played out. On the oscillator, it was also indicated how this would unfold. 📉 Right now, we are testing the lower band of the channel. We could remain around these levels for a while, consolidating. 💡 What's next? Looking at multiple parameters, we appear to be nearing a local bottom. I firmly believe that we haven’t seen the global peak yet, and this year, we will break it multiple times. 🚀(Update) 🗣As I mentioned in the last post, we were likely forming a local bottom — and that’s exactly what happened. Since then, BTC has bounced back strongly and continued its uptrend. 📈Right now, we’re breaking ATH and approaching the upper band of the Gaussian Channel. Green bars are returning on the oscillator, which usually signals a continuation of the trend for a while longer. 💡But don’t forget: we’re already pretty close to the cycle peak. If your risk appetite is lower, some profit-taking here is a smart move. Also, there are still many altcoins that have not shown movement, our developments will help you choose them.

FeelsStrategy

Bitcoin on Bollinger Band touch the Bottom?

📝 Bitcoin is currently testing the baseline of the Bollinger Bands, which historically indicates that the sideways phase is nearing its end.📉 Volatility is stabilizing, and the market structure is tightening—this often precedes a significant new move.💡 The next big trend is on the horizon. Will it be an explosive breakout or a controlled rally like in 2021? I'm leaning more toward gradual growth, what do you think?#Bitcoin Bollinger Signal — Playing Out Just Like Expected 🎯📝 As I pointed out in my last post, this zone has historically acted as a launchpad rather than a breakdown point — and that’s exactly what we’re seeing now. 📍Despite all the macro noise — tariffs, rate fears, and rising volatility — BTC bounced cleanly from the bottom of the Bollinger Bands, just like in past cycles.🔄 The volatility is expanding again, but this time in Bitcoin’s favor. The market structure held firm, and that’s a good signal in itself.💡 While some short-term pullbacks are always possible, the trend is intact — and as long as BTC continues to hold above mid-band support, the path of least resistance is still up.Bollinger Update — Played Out Perfectly 🎯📝 In my last post, I said that we could expect a strong move up. And that’s exactly what happened.📈 BTC broke out from the mid-Bollinger band and rode the upper band with strength, just like in previous cycles where this pattern marked the beginning of major upside momentum.🔄 Volatility is now expanding in Bitcoin’s favor, and the breakout confirms strong structural support. Even with macro noise around tariffs and yields, the setup didn’t break—it launched.💡 While local pullbacks are always on the table, the main trend remains bullish. If you followed the signal early, this is where smart profit-taking and risk management come into play. Stay objective, stay ready.

FeelsStrategy

BTC - Global M2 or Global Liquidity?

BTC Global M2 or Global Liquidity?👥Many people pay too much attention to Global M2 even though it is not nearly as important to Bitcoin as global liquidity.📝Global M2 mostly does not give us any data on real liquidity infusions, just an increase in the money supply, which simply shows us inflationary expectations.📝Of course, against the background of inflationary expectations, owning Bitcoin is a good idea, but it does not directly influence the asset.💡At the same time Global liquidity, shows the actual actions of central banks, such as QE/QT, fiscal measures, and lending, which is more important.

FeelsStrategy

BTC short-term

BTC I haven't done a short-term analysis for a long time.👀I decided to show the key levels to watch, because the moment when it will be necessary to enter the market is coming soon.💡If there are no new geopolitical upheavals, and I expect that there probably won't be any. I think we will go back over BMS and test the important 70k level this month.BTC short-term analysis (update) ✅As I said, we did not see new geopolitical risks in the short term, and we reached the levels indicated earlier. 👀 Now we are starting to break the figure of the downward trend, at such a moment the number of short-term traders mainly increases, we can see this now because of the increased open interest, as well as liquidations. ‼ So, I would tell non-professional traders to be careful in short-term trades, because the market will beat traders in 2 directions. 💡Investors have nothing to worry about, we will soon overcome this zone of turbulence and enjoy the flight.BTC short-term analysis (update) 👀Continuing to move sideways in this defined range. The political confrontation in the US is reaching its finale. We are seeing increased volatility in the dollar. 💡I would expect the movement to continue in this range until it becomes clearer who the favorite is. I think in 1-2 weeks we will go above this range.BTC short-term analysis (update) 📝Uncertainty has disappeared from the markets. As I said in the last post, in a week we will go above this range, as soon as we find out the favorite. Which is what happened today. 💡Now we have broken through important resistance, and reached ATH, of course, after such optimism there are small pullbacks, but in general I am bullish in the long term.

FeelsStrategy

Ethereum Keltner Channel, Bottom?)

📝Ethereum dropped to minimum values on the RSI indicator. Below is only when the bottom of the cycle. 📝Also, the price is testing the baseline of the Keltner channel, which is also strong support. 📝Of course, one cannot fail to mention that in the cycle where ether was accepted as a commodity on the market in the form of an ETF, it has not yet broken the fiat ATH, I think about the inflation of the dollar over the years and there is no need to remind. 🤔Trick question, are all these factors bullish or bearish for Ethereum?Four months ago, when Ethereum was falling below $2,000, I said that it was an attractive price. Even when it rose above $3,000, I still think it is undervalued and is certainly lagging the market. We will see more movement in Ethereum this year.#Ethereum Keltner Channel 👀 📝 ETH is now approaching the upper band of the Keltner Channel. In previous cycles, this level often signaled overbought conditions, but it’s important to recognize that we’re in the late stages of the cycle. 📍 What makes this phase different is that price can remain in the “red zone” for an extended period, just like in 2021. The same goes for RSI: while it’s entering overbought territory, history shows it can stay elevated during strong bullish legs. 🌍 For now, seasonality and macro factors are still driving volatility in both directions this month. However, in the medium-term trend, I’d expect ETH to continue pushing toward the upper boundary of this channel. 💡 Short-term swings possible, mid-term bias remains upward.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.