Technical analysis by FeelsStrategy about Symbol BTC on 10/20/2025

FeelsStrategy

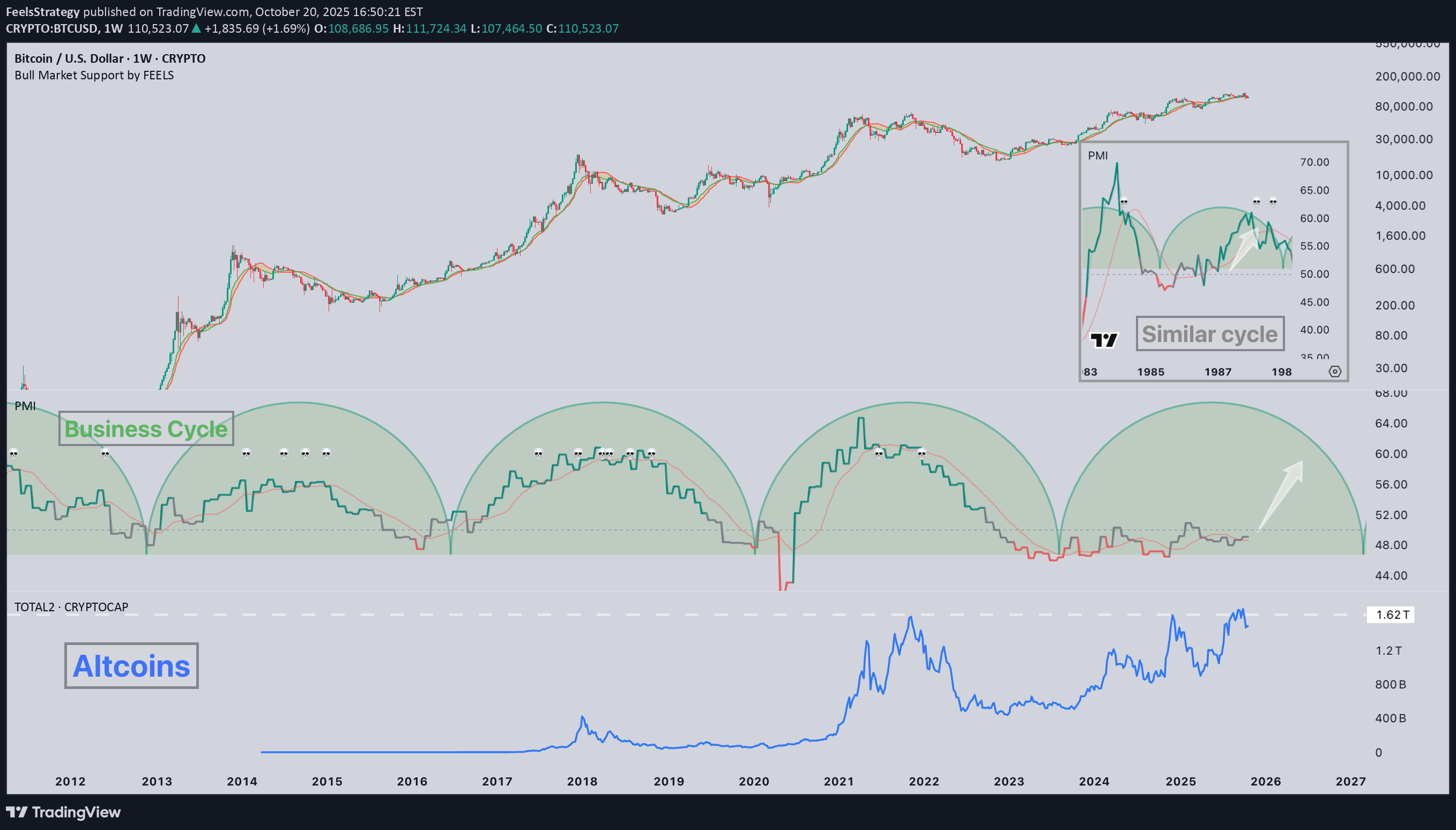

پایان چرخه بیت کوین فرارسیده؟ کلید ماجرا در شاخصهای اقتصادی پنهان است!

BTC & Business Cycles 🔄 While most investors focus solely on the halving cycles, Bitcoin’s long-term rhythm is also deeply connected to the broader business cycle, reflected in indicators like the ISM PMI. 📝 As we can see, Bitcoin’s macro tops and bottoms tend to align with expansions and contractions in global liquidity — not just halving dates. Interestingly, in this current cycle, Bitcoin has performed relatively well, but altcoins have underpeformed and even dont beat the 4 years old peak (not adjusted by inflation), suggesting that liquidity hasn’t yet fully reached the broader crypto market. 📍 The crypto market is becoming more integrated with traditional financial cycles, so business indicators now play a bigger role than ever. The 1980s pattern show a similar case where a cycle extended due to delayed liquidity effects — and that could be what’s happening now. 💡 This may mean the current cycle could stretch a few more months, giving the market a bit more time before the next major shift.