Technical analysis by FeelsStrategy about Symbol BTC on 10/25/2025

FeelsStrategy

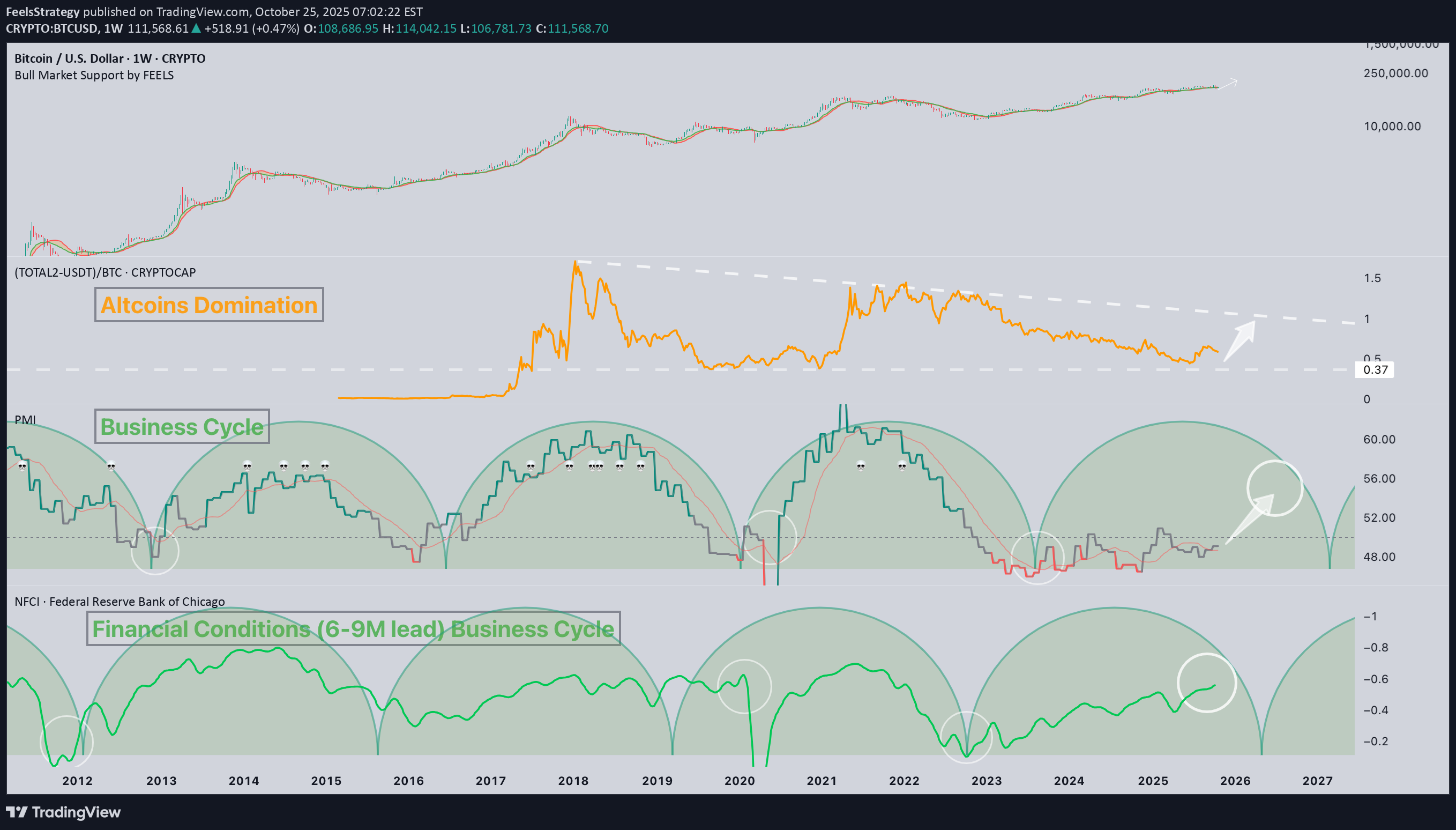

پایان چرخه بیت کوین؟ نشانههای کلیدی از آینده اقتصاد و بازار ارزهای دیجیتال

BTC & Business Cycles 🔄 (Part 3) In my previous posts, I showed how the ISM PMI index reflects macroeconomic business cycles, and how liquidity (Global M2) cycles tends to lead these movements by several months. 📍 Today, let’s go one step further. The Financial Conditions Index (NFCI) leads the ISM by roughly 6–9 months, offering an even earlier look into where the economy and risk assets (like crypto) might be heading next. 📝 While this leading indicator comes with a little bit larger margin of error, understanding its key drivers — credit spreads, volatility, and interest rates — gives valuable insight into how tight or loose financial conditions are. 💡 When these conditions ease, liquidity flows increase, supporting both the business cycle and market expansion (especially in liquidity-dependent assets like #altcoins). And as we can see, the current trend suggests improving conditions, hinting that the next expansion phase of the macro cycle could be forming soon.