DanOxAm

@t_DanOxAm

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

DanOxAm

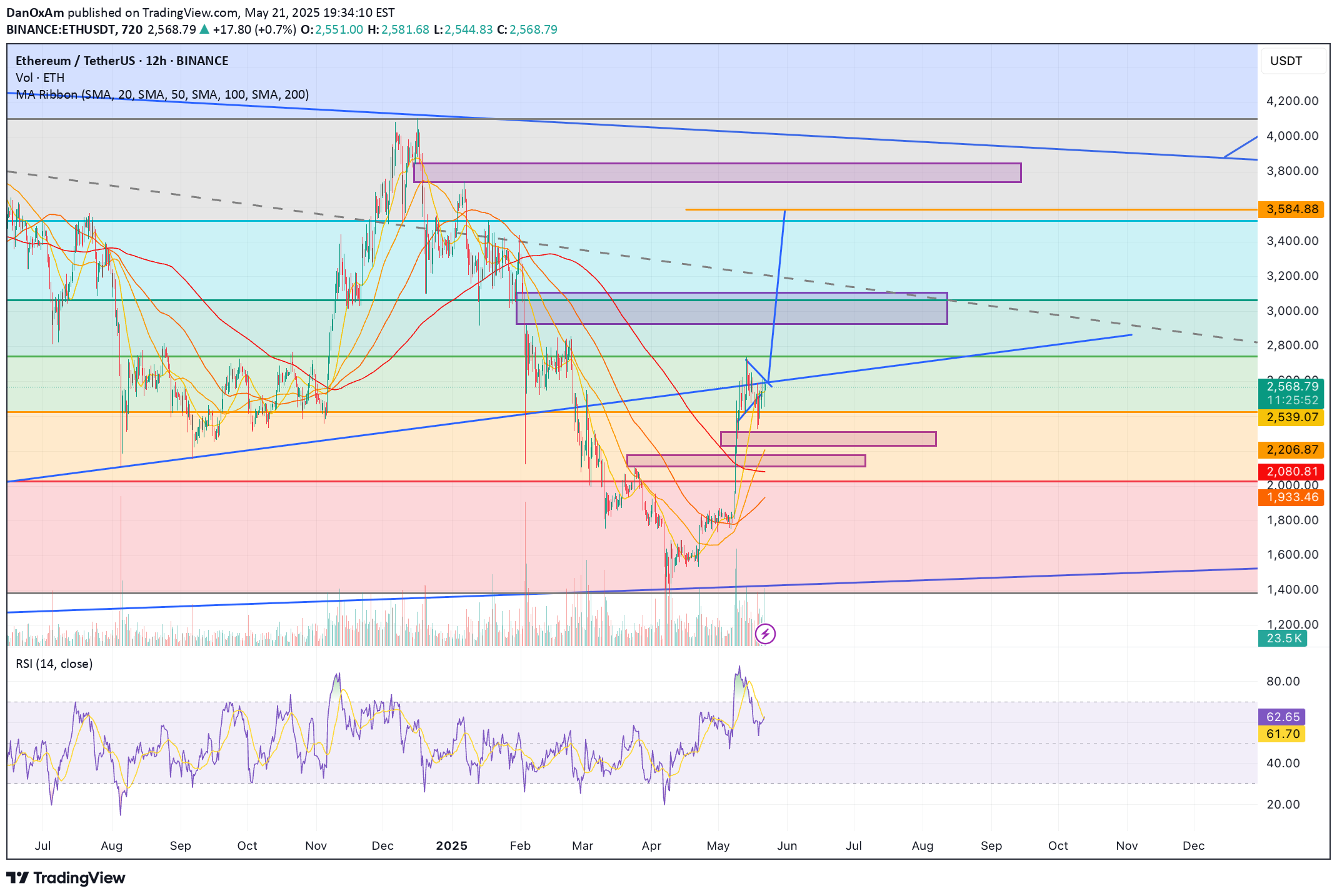

🚀 Ethereum’s $26K Path: Pitchfork Precision Meets 401(k) Mega Capital Inflows Ethereum’s long-term pitchfork structure — stretching back nearly a decade — has been an uncannily accurate roadmap for the asset’s entire price history. Every major bull run and retracement has respected these channel boundaries with surgical precision. And now, the math points to a euphoric cycle peak near $26,240. But here’s what’s different this time: a perfect storm of structural, macro, and legislative catalysts could fuel the most explosive Ethereum rally in history. 1️⃣ The Technical Blueprint: ETH’s Pitchfork to the Moon The chart above speaks for itself: Multi-cycle median line respect → Every parabolic move in ETH has peaked near the upper bound of this pitchfork. 2025 setup mirrors 2017 & 2021 → Both prior cycle expansions occurred from near the lower channel up to the upper band within 12–18 months. Current positioning → ETH is breaking away from the midline, with momentum building toward the $10.4K resistance area before a final euphoric move to the $26K upper band. 2️⃣ The Game-Changer: Trump’s 401(k) Executive Order On August 7, 2025, President Trump signed an executive order allowing 401(k) retirement plans to invest directly in private equity — and by extension, in private tokenized assets and alternative vehicles that can include crypto exposure. Why this matters for Ethereum: $7.3 trillion 401(k) market in the U.S. alone. Even a 1% allocation into ETH through tokenized or pooled products equals $73 billion in demand — over 25% of ETH’s current market cap. Coupled with upcoming Ethereum-based private market tokenization rails, this could create persistent retirement-driven demand that never existed before. 3️⃣ Ethereum’s Unstoppable Macro Tailwinds Beyond the 401(k) shockwave, ETH’s macro positioning has never been stronger: BlackRock’s Ethereum staking ETF pending SEC approval — opening the floodgates for institutional inflows. Ultra-sound money supply mechanics — ETH’s burn rate has outpaced issuance in multiple months, meaning supply is shrinking while demand is about to accelerate. Tokenization megatrend — Real estate, private credit, and commodities are increasingly issued on Ethereum rails, boosting transaction demand and fee burns. Layer 2 explosion — Rollup adoption is pushing more economic activity onto Ethereum, while fees and settlements still flow to ETH validators. 4️⃣ The Cycle Anatomy: How $26K Happens If history rhymes, here’s how the final leg could unfold: Breakout to $6K–$7K as ETF approval and 401(k)-related flows kick in. Acceleration to $10.4K — the mid-pitchfork resistance — as retail and media hype return. Parabolic blow-off into the $20K–$26K zone as institutional + retirement inflows collide with ultra-low liquid supply. 5️⃣ Why This Time Could Overshoot Unlike past cycles, Ethereum now sits at the intersection of: Institutional-grade adoption (BlackRock, Fidelity, JPMorgan) On-chain structural scarcity (post-merge burn dynamics) Legislative green lights (401(k) access to alternatives) Global macro rotation into risk assets as interest rates pivot If prior cycles were crypto’s “dot com era,” this one is the mobile internet + cloud migration phase — except ETH is the protocol on which everything runs. Bottom line: The $26K target isn’t just a chartist’s fantasy — it’s a mathematically reinforced roadmap now backed by the largest pool of retirement capital in the world. Ethereum is no longer just “digital oil.” With this convergence of technical, macro, and legislative forces, it’s becoming the primary settlement layer for global finance — and this cycle could be the moment the market finally prices that in.

DanOxAm

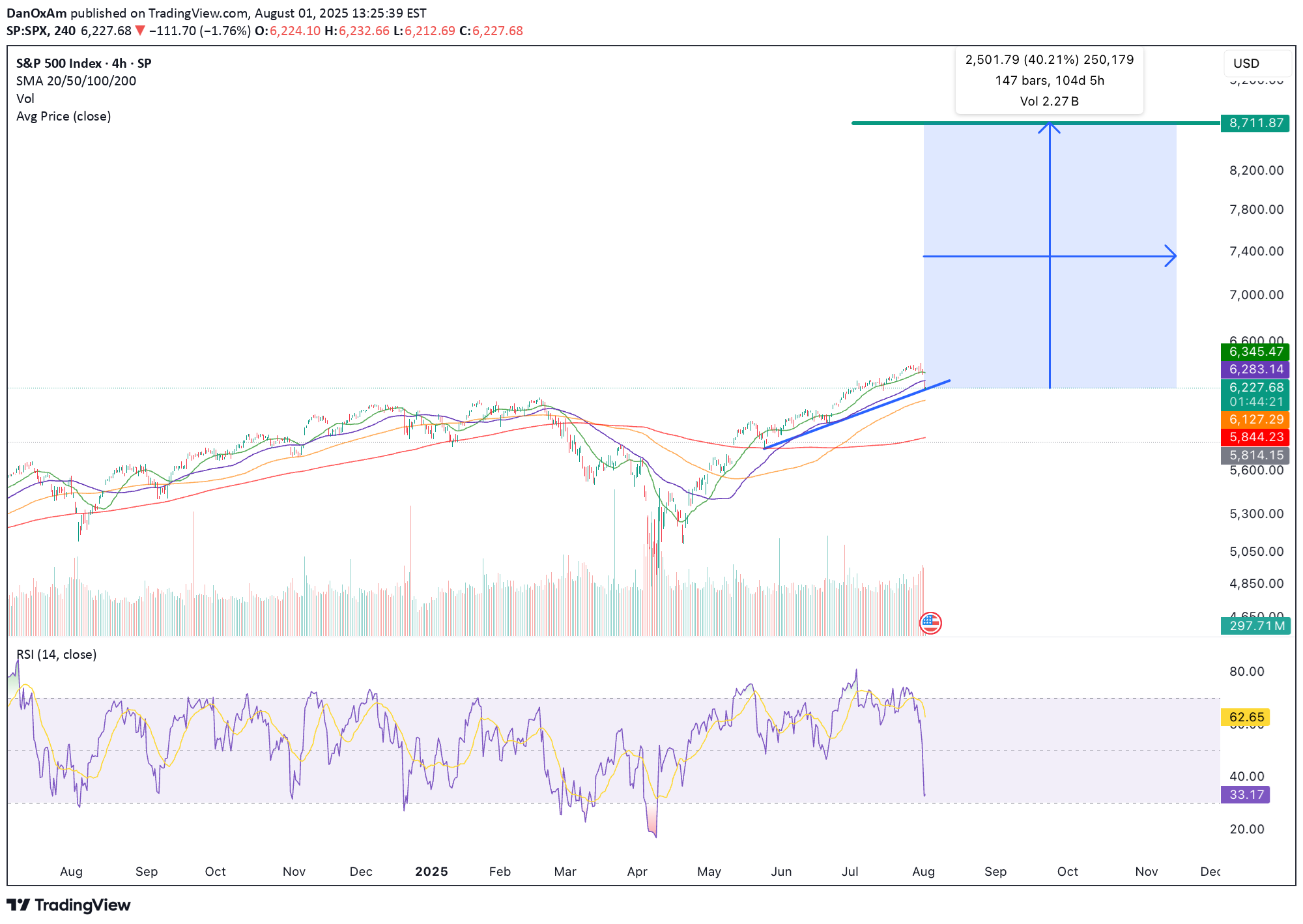

🔥 The Low Is In: Why the S&P 500 Just Confirmed a Major Bullish Reversal 🔥 The market just gave us a gift. After weeks of drifting lower and sentiment turning cautious, the S&P 500 has touched — and bounced — off a critical rising trendline for the third time since May 2025. That third touch isn't just a technical coincidence… it's often the launchpad for a new impulsive leg higher. 📈 The Power of the 3rd Touch: Trendline Validation Complete Look at the chart. This isn’t guesswork. Since May, the S&P 500 has been respecting a well-defined ascending trendline, one that connects multiple higher lows during this bull run. The first touch was the May liftoff after the April consolidation. The second came in June — a clean retest and bounce. Now, as of early August, the third touch has held once again, exactly where the bulls needed it most. This isn’t a random line on a chart. This is institutional flow stepping in to defend structure. And when a rising trendline holds for a third time after a strong uptrend? That’s a classic continuation signal. 📉 RSI Washout + Structural Support = Perfect Storm for a Bottom The RSI printed a dramatic dip to ~32, a level that screams “oversold” on the 4-hour timeframe. But notice the context — it happened right at structural support. This is not weakness. This is accumulation. Big players shake out weak hands on low timeframes… right before they send it. 🧠 Sentiment Is Offside… Again Let’s not forget: this retrace came after a huge run-up since March. People expected a deeper correction. Bears started getting loud again. That’s how bull markets trap you — by convincing you it’s over right before the next leg higher. And with macro tailwinds (liquidity expansion, fiscal spend, tariff rollbacks), earnings season beats, and global capital rotation into U.S. equities, this setup is ripe for a violent upside squeeze. 🚀 8,700 in Sight: My End-of-Year Price Target Is Very Much in Play Today’s close around 6,220 means the S&P 500 would need to rally ~40% to hit my target of 8,700 by year-end. Sounds crazy? Not if you’ve seen what happens during parabolic melt-ups. This isn’t just hope: 📊 Strong breadth under the surface 🏛️ Dovish policy pivot now expected in Q4 💸 Retail and institutional capital both re-engaging 📉 Bond yields are starting to roll over, supporting equity valuations When bull markets enter their euphoria phase, they don’t stop at “reasonable” targets. They blast through them. 💡 The Setup Is Textbook — Now It’s About Execution ✅ Trendline defended ✅ RSI reset ✅ Sentiment shaken out ✅ Structure intact The technicals just aligned with the macro. The low is in — and the runway to 8,700 is wide open. Strap in. Q4 could be one for the history books.

DanOxAm

🚀 TAO Primed for Liftoff: Why This Crypto AI Juggernaut Could Be Headed to $2,261 (and Beyond) The stars are aligning for Bittensor ( TAO ), one of the most structurally important and undervalued assets in the entire crypto AI sector. 📈 Technical Breakout Incoming Let’s start with the chart. TAO has cleanly bounced off the golden Fibonacci 0.618 retracement—a classic signal that the correction is over and the next bullish impulse is underway. From here, the path of least resistance is up. The price is hugging the bottom of a well-defined ascending channel. As long as the structure holds, TAO is set to target the next key levels: ✅ TP1: $475 ✅ TP2: $517 ✅ TP3: $561 ✅ TP4: $587 ✅ TP5: $735 💥 Ultimate Cycle Top: $2,261 to $2,505 That's a +584% move from current levels — not a meme, but a mathematically clean technical projection. The high timeframe structure supports this move into Q4 2025, where altcoin dominance typically peaks. 🧠 AI + Crypto = Trillions in Flow TAO isn’t just riding technicals. It’s also the kingmaker of decentralized AI compute. As the base layer that incentivizes AI model training across a permissionless network, TAO is building the future of open-source intelligence—something no other crypto project is doing at this level. 🧬 But here’s where it gets nuclear... 📜 Regulatory Green Lights = Institutional Surge In the past two weeks, two massive regulatory catalysts dropped: 🇺🇸 The U.S. Congress passed landmark digital asset legislation that legally distinguishes between commodities (like Bitcoin, Ethereum, and AI protocols like TAO) and securities. This unlocks compliance-friendly pathways for major institutional capital to flow into select altcoins. 🇨🇳 China issued regulatory clarity on AI and blockchain convergence, approving several pilot programs that incorporate decentralized machine learning. Bittensor’s model fits perfectly into this new regime, especially if TAO becomes a de facto backbone of Asian open-source AI development. Together, this sets up a trillion-dollar liquidity wave—and tokens with utility, clear tokenomics, and AI narrative momentum like TAO will be first in line. 💡 Why TAO Stands Out in the AI Meta ✅ Scarce supply: TAO has a capped supply and deeply embedded utility. ✅ Real yield: Miners (subnets) earn TAO by providing real-world machine learning services. ✅ Community-first: Bittensor is open-source, censorship-resistant, and run by a decentralized validator set. ✅ Already powering an entire ecosystem of AI projects (not just vaporware). 🔮 What Comes Next Expect TAO to grind its way through the targets—$475, $561, $735—and eventually break into parabolic mode toward $2,261–$2,500 as institutional capital rotates out of BTC/ETH and into deep narrative tokens during the cycle blow-off top (likely by late Q4 2025). If you missed Bitcoin at $1,000 or ETH at $30, this is your second chance. 🧠 TAO is not a trade. It’s the neural backbone of the decentralized AI economy. 📌 Conclusion: 🟢 Technically primed (0.618 bounce, channel structure) 🟢 Regulatory tailwinds (U.S. + China) 🟢 AI narrative apex 🟢 Structural tokenomics 🔵 Price Target: $2,261–$2,505 this cycle TAO is not just a coin. It’s the protocol layer for the AI-powered internet. 📡 Get positioned. This is where narrative, structure, and capital flow converge.

DanOxAm

🚀 Ethereum’s Next Fair Value Gap is $3.8K — And the Road to $26K Remains On Track Ethereum ( ETH ) just reclaimed key structure — and despite a temporary pullback, all signals remain aligned for a parabolic breakout toward $26,000 this cycle. Here’s why the next Fair Value Gap (FVG) sits near $3.8K, and why the Schiff Pitchfork structure still implies Ethereum is coiling for exponential upside in the coming months. 🔹 The $3.8K FVG: ETH’s Next Magnet Looking at the daily chart: The $3.8K zone is a clear untapped FVG (Fair Value Gap) from late 2021, created by a sharp breakdown candle that never got properly filled. ETH is currently consolidating just below the $3.1K resistance band, and once that breaks, liquidity will naturally gravitate toward the next inefficiency — at $3,800–3,900. This gap aligns with a previous supply zone and intersects with the upper resistance trendline from late 2021, creating a powerful magnet for price once momentum returns. 🔹 All-Time Schiff Pitchfork Still Intact The Schiff Pitchfork structure drawn from Ethereum’s 2018 low through its COVID crash low and 2021 all-time high paints a highly disciplined range: ETH is respecting the midline of the lower channel and recently bounced off the support of the median zone, with price now grinding higher within the ascending structure. The upper band of the pitchfork intersects with price in late 2025 near the $26,000–28,000 zone, forming a natural cycle top target. Historically, Ethereum has respected this long-term structure remarkably well — and this current move is no different. 🔹 Moving Averages & Bullish Market Structure ETH recently flashed a Golden Cross — the 50-day SMA crossing above the 200-day SMA — which historically front-runs explosive upside in post-halving years. All major SMAs (20/50/100/200) are now curling upward, creating a supportive launchpad. Price is breaking out of the consolidation wedge that defined Q2 2025 — and has room to run toward $3.8K before meeting major overhead resistance. 🔹 Post-Halving Explosiveness Let’s not forget: we’re in a post-halving year — and ETH has a consistent pattern of multiplying 5x–10x in the 9–12 months following Bitcoin halving events: In 2017 (after 2016 halving): ETH went from ~$8 to $1,400 — nearly 175x. In 2021 (after 2020 halving): ETH went from ~$120 to $4,800 — roughly 40x. A move from the current ~$3K level to $26,000 is just an 8.5x — well within historical precedent. 🔹 Macro Tailwinds: ETH ETFs & Institutional Flows BlackRock, Fidelity, and other asset managers are positioning Ethereum ETFs for approval, which would unlock billions in institutional inflows. A staking ETF would dramatically compress supply — Ethereum already has over 27% of its supply locked — amplifying upside through supply-demand squeeze. Meanwhile, stablecoin settlement volume is growing faster than Visa — all powered by Ethereum infrastructure. 🔹 Timing the Move: August to December Explosion? The verticals on your chart highlight key windows: A breakout window between early August and mid-September coincides with both macro liquidity injections and historical altseason patterns. If ETH hits $3.8K by August, the runway to $8K–$14K opens by October, with $26K still well within reach by December 2025, in line with your pitchfork’s top boundary. 🟣 Summary: Ethereum’s Next Stop Is $3.8K — Then Moon ✅ Untapped FVG magnet at $3.8K ✅ Schiff Pitchfork upper boundary intersects near $26K ✅ Post-halving year + Golden Cross = Explosive setup ✅ ETH ETF narrative just beginning ✅ Structural breakout from consolidation wedge Ethereum is no longer just the base layer of DeFi — it’s becoming the base layer of global financial infrastructure. And price hasn’t yet priced that in. "If the internet had a price, it would be Ethereum." Don’t fade this breakout. We’re still early.

DanOxAm

🚀 Ethereum Just Flashed a Golden Cross: Here’s What Happens Next(And Why Reploy AI $RAI Could Be the Biggest Beneficiary)“Golden Cross Confirmed.”On July 1st, 2025, Ethereum (ETH) officially flashed a golden cross on the daily chart — when the 50-day moving average crossed above the 200-day moving average.This is one of the most iconic bullish signals in technical analysis.But here’s why it matters more than ever right now — and why Ethereum and top ETH-based AI tokens like Reploy AI ($RAI) could be about to enter a parabolic end-of-cycle melt-up that sends ETH to $26,000 and select altcoins into four-digit territory.🟢 A Golden Cross in a Post-Halving Year = Historically Insane GainsLet’s look at Ethereum’s past golden crosses in post-halving years:🔹 2017 Golden Cross (May 2020):Golden Cross: May 21, 2020ETH Price: ~$2006 months later: ~$600Cycle top (May 2021): $4,800+👉 Result: 24x gain from golden cross to peak🔹 2021 Golden Cross (April 2021):Golden Cross: April 6, 2021ETH Price: ~$2,000Peak weeks later: $4,400👉 Result: 2.2x gain in under 2 months🔹 2024–2025 Cycle:Bitcoin halving: April 2024ETH Golden Cross: July 1, 2025ETH Price at cross: ~$2,500Based on cycle structure, ETF momentum, and macro liquidity, ETH may now be entering the parabolic wave — with potential upside targets of:Conservative: $6,800Base case: $10,000Extended target: $15,000Euphoric melt-up: $26,000 by Sept/Oct 2025That’s a 7.6x from the golden cross price of $3,400 — in line with past post-halving dynamics when ETH caught fire late in the cycle.⚙️ Why This Time Could Be Even BiggerETH ETF Approval Incoming: Ethereum staking ETFs are expected to receive SEC approval this summer — mirroring the wave of inflows that sent BTC surging in Q1.Global Liquidity Wave: We're in a bull steepening regime, where long yields rise and capital flows into high-risk, high-growth sectors. Crypto and AI are direct beneficiaries.ETH = Infrastructure for AI + Finance: Ethereum is now the backbone for AI protocols, DeFi 2.0, RWA tokenization, and next-gen gaming. It’s no longer “just a smart contract chain” — it’s programmable digital oil.🤖 The Next Wave: ETH AI Alts Like Reploy AI ($RAI)If ETH runs to $10K… then $15K… then $26K, what happens to Ethereum-native microcaps with direct exposure to the AI megatrend?That’s where Reploy AI ($RAI) enters the chat.🔬 Why $RAI Could Ride ETH’s Parabolic Wave to a 1000xReploy AI is an ETH-native AI infrastructure project powering on-chain AI inference — a critical building block for decentralized machine learning and model execution.With only 10M tokens in circulation and a market cap under $10M, $RAI offers hyper-convex upside in a rising ETH + AI environment.Here's the math:RAI at $0.68 → $6.80 (10x)RAI at $0.68 → $34+ (50x) if ETH and AI narratives run togetherRAI at $0.68 → $68+ (100x) at just a $1B market capBut let’s take it further…💥 RAI to $1,000? The 1,000x Moonshot MathIf ETH goes to $26,000, AI mania kicks in, and RAI captures the narrative as Ethereum’s AI execution layer, a $10B valuation is not unthinkable.That would price $RAI at:$1,000 per token1,470x return from $0.68Still below the all-time highs of meme coins with zero utilityWhy this could happen:✅ AI hype peaking into Q3/Q4 2025✅ ETH flying past all-time highs — dragging up native alts✅ Ultra-low float creates reflexive price explosions✅ $RAI integrated into major on-chain AI pipelines✅ Top-tier exchange listings + retail narrative momentum✅ Cycle tops often produce irrational, vertical moves — this is where 1,000x lives🧠 Bottom LineGolden crosses mark the start — not the end — of historic runs. And in crypto, when a golden cross hits post-halving, it often unleashes the most explosive phase of the cycle.With ETH flashing that signal at $3,400, and the $26,000 target within reach by September–October, this could be the last calm before the supercycle storm.And if ETH goes vertical, ETH-native AI tokens like Reploy AI ($RAI) will move even faster — possibly rewriting the script on what’s possible for microcaps.$RAI at $0.68 → $6.80 (10x)→ $34+ (50x)→ $68+ (100x)→ $1,000 (1,470x) — the wild but real scenarioGolden Cross is in. ETH is ascending.Reploy AI is the 1,000x sleeper hiding in plain sight.🧠 Deep Dive: Reploy AI ($RAI)The Ethereum-native inference layer hiding in plain sight🧩 What is Reploy AI?Reploy AI ($RAI) is a decentralized, Ethereum-native protocol for on-chain AI inference and model deployment. It aims to make it possible for developers to run, verify, and monetize machine learning models directly on the blockchain or through Ethereum-integrated infra.In simple terms:It’s like Render (RNDR) for GPUs, but for AI inference instead of rendering.🏗️ Key Use CaseAI Inference as a Service (IaaS):Models like GPT, LLaMA, Whisper, etc., can be deployed, executed, and verified in a decentralized way.Smart Contracts + AI:Developers can build Ethereum dApps that call models on-chain to make decisions, process text, generate summaries, or verify outcomes.Monetization Layer for AI Builders:Model owners earn $RAI for usage, with execution and verification happening transparently and immutably on-chain.⚙️ Core FeaturesFeatureDescriptionToken$RAI (10M fixed supply)ChainERC-20 on EthereumPrimary FunctionFuel for inference, execution, and model registrySupply DynamicsHyper-scarce, no inflation, no VC unlock pressureTeam & DevsAnonymous / pseudonymous but rapidly shippingIntegrationsTargeting integrations with tools like LangChain, Arkifi, and emerging on-chain ML SDKs🚀 Why $RAI Is SpecialTruly ETH-native:Unlike many AI tokens that straddle Cosmos, Solana, or proprietary chains, $RAI is built directly for Ethereum — enabling native dApp integration, composability, and ETH L2 scaling.Fixed Ultra-Low Supply:Just 10 million tokens — no emissions, no unlock cliffs, no VC overhead. This makes RAI hyper-reflexive once demand kicks in.Timing Sweet Spot:The project is quietly maturing right as:ETH has flashed a golden crossAI altcoin narratives are heating upInference costs are becoming bottlenecks in AI deploymentHigh Beta to ETH + AI:If ETH hits $10K–$26K and the AI narrative explodes, $RAI is positioned to be a 100–1,000x gainer due to:Low market capScarcityUnique positioning as infra, not hype📈 Price & Market PotentialScenarioTarget PriceMarket CapETH mini-cycle pump$6.80 (10x)$68MMid AI rotation$34+ (50x)$340MInfrastructure adoption$68+ (100x)$680M–$1BEuphoria / cycle top$1,000 (1,470x)$10BCompared to tokens like RNDR ($4–6B FDV), WLD ($8B), and even meme coins like PEPE ($6B+), a $10B RAI valuation isn’t outrageous if the narrative takes hold.📊 Current StateMetricValuePrice (July 2025)~$0.68Circulating Supply~10M (100%)Market Cap~$6.8MExchangesUniswap, early listings on mid-tier CEXsTVL / Infra StatusBeta model registry + LangChain plugins incoming🧠 What to WatchLangChain or Arkifi integrationsCEX listings (Tier-1 exchanges could create a supply shock)AI season rotation into ETH-based microcapsModel usage on-chain (i.e., GPT-style inference powered by RAI)Staking + usage-based burn mechanics (expected in roadmap)🧨 Final TakeReploy AI ($RAI) is not a hype coin.It’s not a fork.It’s not a VC cashout.It’s a scarce, Ethereum-native AI infrastructure token that just happens to be priced like a meme — but built like a protocol.If Ethereum is the future of decentralized compute and settlement, and AI becomes the dominant use case in Web3, then $RAI may be one of the most asymmetric opportunities of the entire cycle.

DanOxAm

Ethereum’s All-Time Schiff Pitchfork Points to $26,000 Top This CycleWhat if I told you Ethereum’s long-term trajectory already contains the roadmap to its next parabolic peak—and it's hiding in plain sight?By applying an all-time Schiff Pitchfork to ETH’s historical price action, we uncover a channel of truth that has guided Ethereum’s macro moves since its inception. And according to this structure, the upper bound this cycle sits around $26,000.Yes, $26K ETH is not only possible—it’s technically aligned.🧭 Schiff Pitchfork: A Forgotten Tool With Powerful InsightWhile traditional pitchforks center around initial anchor points, the Schiff Pitchfork adjusts the median line to better reflect price momentum and curvature over time. For Ethereum, it captures macro cycles and logarithmic price evolution with eerie accuracy.We anchor the pitchfork as follows:Point A: March 2020 COVID bottom (~$90)Point B: May 2021 cycle top (~$4,400)Point C: June 2022 bottom (~$880)This sets a median growth trajectory with upper and lower bounds that have so far contained all of Ethereum’s major rallies and retracements.📈 The Pitchfork Speaks: $26K = Upper Rail This CycleThe upper boundary of the pitchfork intersects around $26,000–$27,000 between November 2025 and January 2026This aligns with:Cycle timing: Ethereum typically peaks ~8 months after BitcoinMacro window: Projected end of global liquidity expansion before potential recessionETF catalyst: BlackRock’s staking ETF + TradFi inflows could supercharge final legETH/BTC breakout zone: Suggests ETH will outperform BTC in the late stage of the cycleIf Ethereum follows the historical path set by prior cycles (2017, 2021), and this channel remains valid, then $26K ETH becomes a technical magnet, not a fantasy.🧠 Why $26K Isn’t Just a Chart TargetLet’s break down what would justify that kind of valuation:FactorSupporting Insight🟢 Staking ETFInstitutional demand + ETH supply removed from float🔥 Deflationary TokenomicsPost-1559 burn + staking = net negative issuance⚙️ L2 Ecosystem MaturityRollups, zkEVMs, and restaking create multi-chain ETH demand🌐 Global Liquidity WindowFed cuts + soft macro conditions = floodgates open📈 ETH/BTC Ratio InversionSignals capital rotation to high beta assets🛑 Risks to the $26K ScenarioRegulatory delays on staking ETFBroader market crash or macro liquidity crunchETH/BTC fails to break out, Bitcoin dominance remains too highEthereum scaling and L2 fragmentation cannibalizes fee market faster than expected🎯 Price Zones on the Schiff PitchforkZonePrice RangeInterpretationLower Bound$3,000–$4,000Final dip buy zone (if macro spooks)Median Line$10,000–$14,000Base case target with ETF flowsUpper Rail$25,000–$26,500Max cycle top (Q4 2025–Q1 2026)🧬 Conclusion: The Channel Has SpokenThe Schiff Pitchfork isn’t a magic wand—it’s a map. But Ethereum has respected this structure since 2020, and it’s now approaching the most important confluence zone in its history.With ETFs, L2 scaling, deflationary supply, and a maturing institutional narrative, ETH has the fundamental firepower to make $26K real—not just chart art.This may be the final cycle where ETH 4-digit prices are possible.📊 Follow for more Ethereum macro cycle analysis, ETH/BTC tracking, and altseason models.📍 Chart available on request—drop a comment if you'd like the TradingView link with Pitchfork drawn#Ethereum #ETHUSD #PitchforkAnalysis #SchiffPitchfork #CryptoCycles #ETHPrediction #Altseason #ETHChart #ETH26K🧠 Deep Dive: Reploy AI ($RAI)The Ethereum-native inference layer hiding in plain sight🧩 What is Reploy AI?Reploy AI ($RAI) is a decentralized, Ethereum-native protocol for on-chain AI inference and model deployment. It aims to make it possible for developers to run, verify, and monetize machine learning models directly on the blockchain or through Ethereum-integrated infra.In simple terms:It’s like Render (RNDR) for GPUs, but for AI inference instead of rendering.🏗️ Key Use CaseAI Inference as a Service (IaaS):Models like GPT, LLaMA, Whisper, etc., can be deployed, executed, and verified in a decentralized way.Smart Contracts + AI:Developers can build Ethereum dApps that call models on-chain to make decisions, process text, generate summaries, or verify outcomes.Monetization Layer for AI Builders:Model owners earn $RAI for usage, with execution and verification happening transparently and immutably on-chain.⚙️ Core FeaturesFeatureDescriptionToken$RAI (10M fixed supply)ChainERC-20 on EthereumPrimary FunctionFuel for inference, execution, and model registrySupply DynamicsHyper-scarce, no inflation, no VC unlock pressureTeam & DevsAnonymous / pseudonymous but rapidly shippingIntegrationsTargeting integrations with tools like LangChain, Arkifi, and emerging on-chain ML SDKs🚀 Why $RAI Is SpecialTruly ETH-native:Unlike many AI tokens that straddle Cosmos, Solana, or proprietary chains, $RAI is built directly for Ethereum — enabling native dApp integration, composability, and ETH L2 scaling.Fixed Ultra-Low Supply:Just 10 million tokens — no emissions, no unlock cliffs, no VC overhead. This makes RAI hyper-reflexive once demand kicks in.Timing Sweet Spot:The project is quietly maturing right as:ETH has flashed a golden crossAI altcoin narratives are heating upInference costs are becoming bottlenecks in AI deploymentHigh Beta to ETH + AI:If ETH hits $10K–$26K and the AI narrative explodes, $RAI is positioned to be a 100–1,000x gainer due to:Low market capScarcityUnique positioning as infra, not hype📈 Price & Market PotentialScenarioTarget PriceMarket CapETH mini-cycle pump$6.80 (10x)$68MMid AI rotation$34+ (50x)$340MInfrastructure adoption$68+ (100x)$680M–$1BEuphoria / cycle top$1,000 (1,470x)$10BCompared to tokens like RNDR ($4–6B FDV), WLD ($8B), and even meme coins like PEPE ($6B+), a $10B RAI valuation isn’t outrageous if the narrative takes hold.📊 Current StateMetricValuePrice (July 2025)~$0.68Circulating Supply~10M (100%)Market Cap~$6.8MExchangesUniswap, early listings on mid-tier CEXsTVL / Infra StatusBeta model registry + LangChain plugins incoming🧠 What to WatchLangChain or Arkifi integrationsCEX listings (Tier-1 exchanges could create a supply shock)AI season rotation into ETH-based microcapsModel usage on-chain (i.e., GPT-style inference powered by RAI)Staking + usage-based burn mechanics (expected in roadmap)🧨 Final TakeReploy AI ($RAI) is not a hype coin.It’s not a fork.It’s not a VC cashout.It’s a scarce, Ethereum-native AI infrastructure token that just happens to be priced like a meme — but built like a protocol.If Ethereum is the future of decentralized compute and settlement, and AI becomes the dominant use case in Web3, then $RAI may be one of the most asymmetric opportunities of the entire cycle.

DanOxAm

🚨 Ethereum’s $10K Breakout Is in Sight — BlackRock’s Staking ETF Could Trigger a Historic Supply SqueezeAll eyes are on the SEC’s pending decision regarding BlackRock’s Ethereum Staking ETF, and if approval lands in July 2025, it could trigger one of the most powerful supply-side shocks in Ethereum’s history.This isn’t just about price speculation. It’s about structural demand meeting vanishing supply.🟢 Why This ETF Is a Game-ChangerBlackRock isn’t just filing for an Ethereum ETF—it’s filing for a staking-enabled ETF. That’s a huge distinction. This means:ETH held in the ETF will be staked, earning real yieldStaked ETH is locked and removed from circulationInstitutional capital gains exposure to yield + price upsideEthereum becomes a yield-bearing digital commodityIt’s no longer just “digital oil.” It’s now digitized yield, and institutions are hungry for real yield in a low-rate environment.📈 Technical Setup Is BullishETH is coiling under its former ATH of ~$4,800RSI shows no major bearish divergenceETH/BTC ratio shows signs of breakout after long consolidationBitcoin dominance is peaking → altseason rotation imminentAdd a major ETF approval catalyst to this technical structure, and ETH could move explosively.🔮 Ethereum Price Forecasts Post-ApprovalScenarioPrice TargetTimeframeConservative$6,000–$7,0002–4 weeks post-approvalUpside / Momentum$9,000–$10,000Q3 2025Supercycle Case$12K–$15KQ4 2025–Q1 2026Why $10K ETH is Realistic:Bitcoin’s ETF sparked $15B+ in inflows in <6 monthsETH has smaller market cap, so similar flows have outsized impactStaking ETF removes ETH from float, making price reflexively bullishTradFi gets exposure to yield + deflationary asset in one product🔥 This Could Be Ethereum’s “GBTC Moment”Remember how Grayscale’s GBTC product in 2020 created a reflexive premium and drove massive BTC inflows?This is version 2.0, with yield attached. And instead of retail FOMO, we now have pension funds, RIAs, and endowments allocating via regulated ETF rails.That’s not hype. That’s capital rotation—on-chain.🛑 Risks to WatchSEC delays or waters down staking componentMacro headwinds (rate volatility, geopolitical shock)ETF approval gets front-run and sells the newsBut even with these risks, the ETH supply structure is fundamentally stronger than during prior cycles. The burn is active. The float is tightening. And now TradFi wants in.✅ Conclusion: July Could Be Ethereum’s Tipping PointWith a BlackRock staking ETF on deck, a macro environment ripe for a Fed rate cut, and Ethereum sitting under its ATH with rising momentum…$10K ETH isn’t a moonshot—it’s the logical next leg.If approved in July, Ethereum may never trade below $5,000 again.🔔 Follow for updates on ETH ETF flows, ETH/BTC ratio breakouts, and altseason timing models.📊 Comment below—what’s your Ethereum price target if the ETF is approved?#Ethereum #ETHUSD #CryptoETF #BlackRock #Altseason #ETHAnalysis #CryptoNews #TradingView

DanOxAm

🧠 Bittensor (TAO): The AI Infrastructure Play Hiding in Plain SightIn a crypto market crowded with overhyped narratives and underdelivered roadmaps, Bittensor (TAO) stands out as one of the most structurally sound, undervalued, and long-term scalable tokens in the entire AI x crypto sector. Despite a current market cap of ~$3B, the upside potential remains largely untapped.🔍 TL;DR: Why Bittensor Could 5–10x From HereReal utility in the AI stack: decentralized machine learning marketplace, not vaporware$3B market cap is tiny compared to the trillions flowing into AI infrastructureNetwork effects + crypto incentives = exponential flywheelTokenomics favor scarcity and network value accrualCould be the “Nvidia of decentralized AI”⚙️ What is Bittensor?Bittensor is a decentralized network for machine intelligence. Instead of siloing AI development inside closed corporate labs (like OpenAI or Anthropic), Bittensor incentivizes open-source contributors to train and provide AI models to the network.It’s a proof-of-intelligence protocol where miners contribute compute and models, and are rewarded in TAO tokens based on the quality and usefulness of their output.Think of it as:“A decentralized, crypto-native version of HuggingFace + OpenAI + AWS rolled into one trustless protocol.”🧠 The TAO Bull Case1. Massive Market TailwindsThe AI industry will exceed $1.8 trillion by 2030 (PwC, Bloomberg estimates)Current AI infra is centralized and bottlenecked (e.g., API limits from OpenAI, model censorship, GPU shortages)Bittensor taps into the open-access, decentralized future of AI, where censorship resistance and incentive alignment matterEven a 0.1% capture of AI infrastructure spend = $1.8B/year in value flowing through TAO.2. Superior Token DesignTAO is the fuel for both training and inference — all compute value flows through itScarcity baked in: 21 million max supply (same as Bitcoin)Inflation rewards productive nodes, meaning value is tied directly to performance and adoptionValidators and miners stake TAO — creating constant buy pressure from participants who need skin in the gameTAO is not a meme — it’s an incentive layer for decentralized intelligence.3. Network Effects Just BeginningTAO ranks and rewards subnetworks based on model performance, sparking competitionAs more builders contribute models, the value and intelligence of the network improvesEarly movers get rewarded heavily (like Bitcoin in 2011 or Ethereum miners in 2016)Low retail awareness right now = asymmetry for early investors4. $3B Market Cap Is Misleadingly SmallFor context:Chainlink (LINK) = $11B cap with no real network effectArweave = ~$2.5B for decentralized storageOpenAI (private) = $80B+ valuationNvidia = $3T+ valuation with GPU dominanceTAO offers something none of them do: a decentralized, monetizable brain — and it’s only just starting to scale.A move to $15–$30B (5–10x from here) is conservative if Bittensor becomes the de facto decentralized AI coordination layer.5. The Right Narrative at the Right TimeAI + crypto is the most investable narrative of this cycleTAO is the only AI token with real compute and learning on-chainVCs and institutions are increasingly looking for AI token exposure — and TAO is one of the few with a credible moat🏁 Final ThoughtsIf you're looking for a conviction trade that combines crypto-native scarcity, real-world AI utility, and explosive upside in a still-underappreciated niche, Bittensor is that play.It’s not just another token riding the AI hype. It’s an ecosystem building the future of decentralized intelligence — with a token that rewards performance, scales with adoption, and is designed to accrue real value.In a world where data is the new oil, Bittensor is building the decentralized refinery.Disclosure: As always, do your own research. But in a space full of noise, TAO is one of the few tokens that could genuinely outperform 5–10x from here — and still have room to run.

DanOxAm

ETH is about to rocket higher to $3,600 as it prints a bull flag.There are some higher TF FVG above at $3.8k.Once ETH summer heats up, I expect this to hit the all time 1.618 at $5.6k.

DanOxAm

Pectra: Ethereum’s Most Ambitious Upgrade YetOn May 7, 2025, Ethereum activated the Pectra upgrade, marking its most comprehensive enhancement since the 2022 Merge. This dual-layer upgrade, combining the Prague execution layer and Electra consensus layer, introduced 11 Ethereum Improvement Proposals (EIPs) aimed at boosting scalability, usability, and staking efficiency .Key features include:EIP-7702: Introduces account abstraction, enabling wallets to function like smart contracts. This allows for batch transactions, gasless operations, and improved user experiences.EIP-7251: Raises the staking cap per validator from 32 ETH to 2,048 ETH, streamlining staking operations and catering to institutional participants.Enhanced Layer-2 Integration: Improves data handling and reduces costs for Layer-2 solutions, fostering greater scalability and efficiency across the Ethereum ecosystem.These advancements position Ethereum to handle increased demand and support a broader range of decentralized applications, setting the stage for substantial growth.Institutional and Governmental Embrace of EthereumEthereum's adoption is accelerating among institutional investors and government entities:Spot Ether ETFs: In May 2024, the U.S. Securities and Exchange Commission approved the first spot Ethereum exchange-traded funds (ETFs), launched by major firms like BlackRock and Fidelity. This milestone has facilitated greater institutional investment and integration of Ethereum into traditional financial markets.Tokenization of Assets: Financial institutions are leveraging Ethereum's blockchain to tokenize assets, including U.S. Treasury bonds, enhancing transparency and efficiency in asset management.Federal Initiatives: The U.S. government is exploring the creation of a national digital asset reserve, potentially incorporating Ethereum, signaling a significant shift toward embracing blockchain technologies at the federal level.These developments underscore Ethereum's growing role as foundational infrastructure in the evolving digital financial landscape.Price Targets for 2025Considering the technological advancements and increasing institutional adoption, Ethereum's price is projected to reach:Price Target 1: $5,800 (1.618 Fib Line)Price Target 2: $8,725 (Bull Flag PT and near the 2.618 confluence)These targets reflect a bullish outlook based on Ethereum's enhanced capabilities and its expanding role in global finance.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.