CyroTrades

@t_CyroTrades

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

CyroTrades

BTC SHORT

HEY GUYS BTC has recently swept previous weeks liquidity at around 117K made a top and also a clear weekly range candle On the chart you can see my entry but I i were you I would open a CMP short at low leverage. Or you can wait for the 4h FVG to get filled as you can see on the chart My first TP is at the 50% of the range and full tp is the whole weekly range candle. Questions? ask me in comments ;)TP 1 HIT

CyroTrades

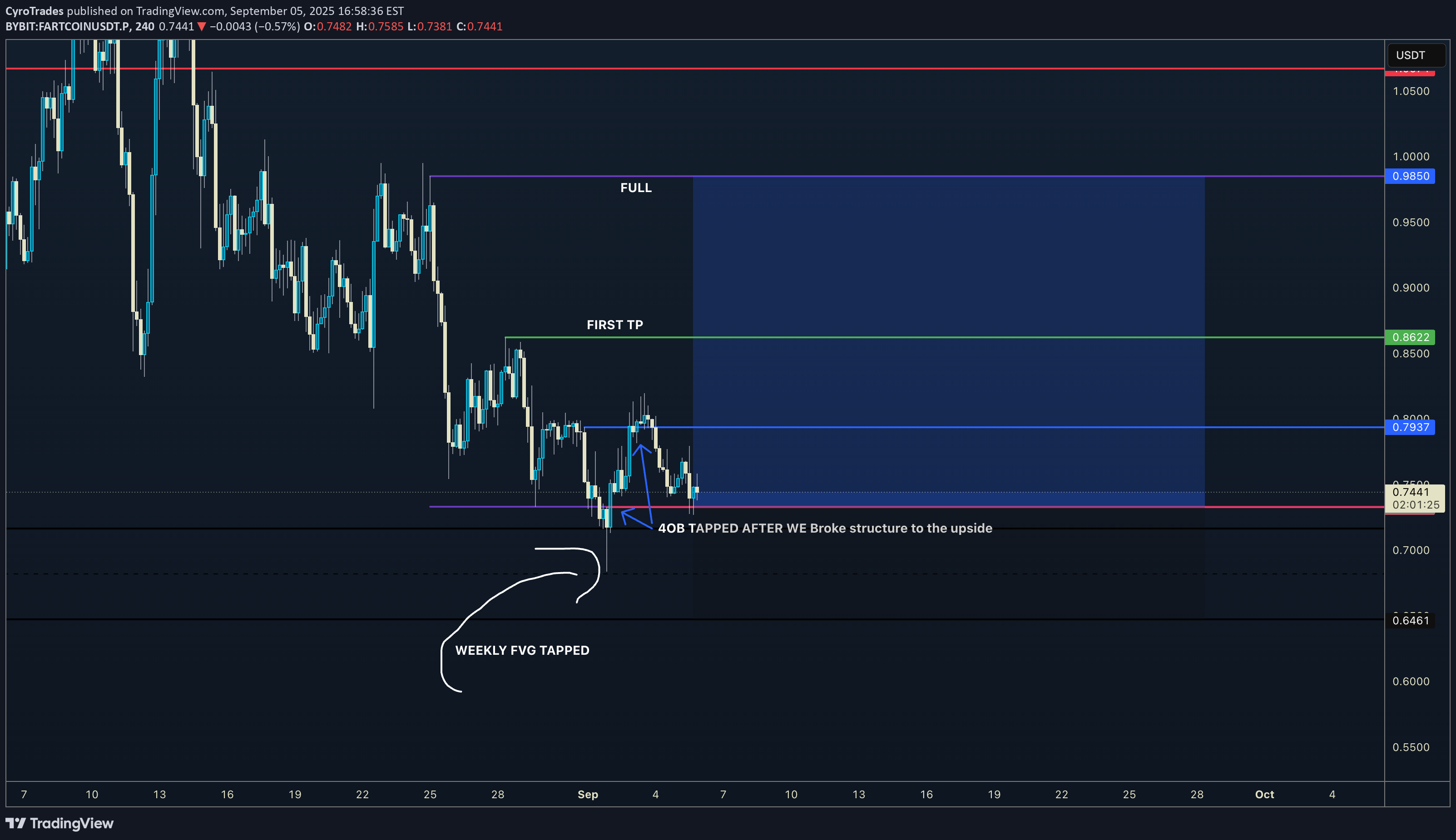

FARTCOIN LONG

Soo hello and welcome back I have identified a new weekly range and a potential to make some gains with fartcoin On the graph you can see why 1. Weekly bull FVG gap filled 2. LQ swept hence there is money to make a move 3. CIOD on the 4H and tapped a 4H OB anything else is seen on the graph ! Good luck and do not overtrade

CyroTrades

ADA WEEKLY LONG

ADA has tapped 4H while swept liquidity. Weekly range has also been showed because previous weeks LQ has been swept and the weekly closed under the weekly close. Im waiting for the next volumized OB to be tapped, this is seen with the green line on the chart as that would be my entry

CyroTrades

XRP LONG

I have marked out the weekly range on XRP which has swept the liquidity of the last week. As well as tapped into the weekly Bullish FVG. This gives me confluence to long XRP as seen on the graph. My entry lies on the body of a 30M OB. Take profit targets and SL are visible on the chart. Feel free to comment and ask! Good luck and don't overtrade.Also the AUGUST lows have been swept out, that I forgot to mention but it is a key element!

CyroTrades

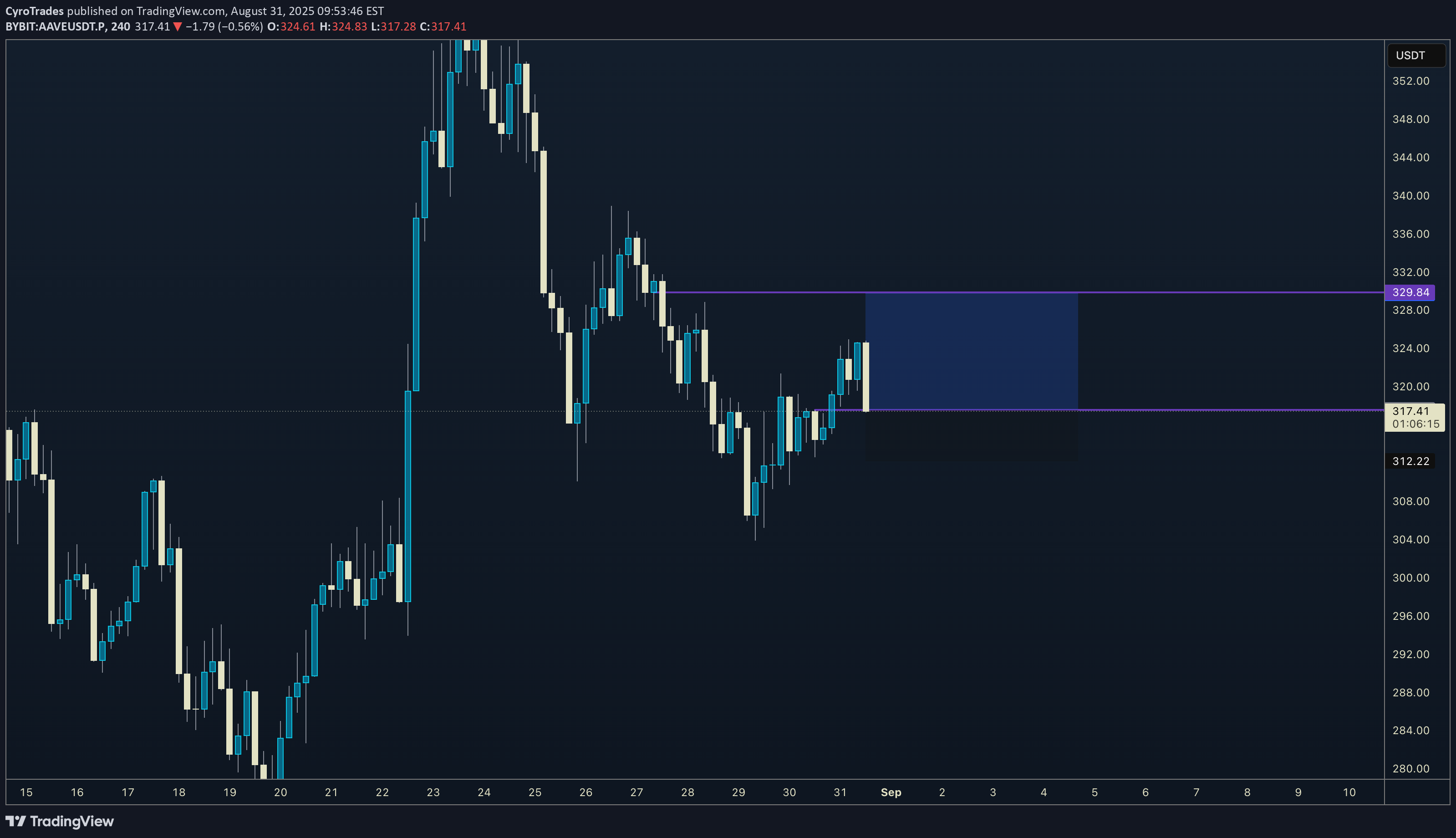

AAVE LONG

4H/D demand zone tapped Clear CIOF Tapped volumized OB 4H, targetting next line of resistance.

CyroTrades

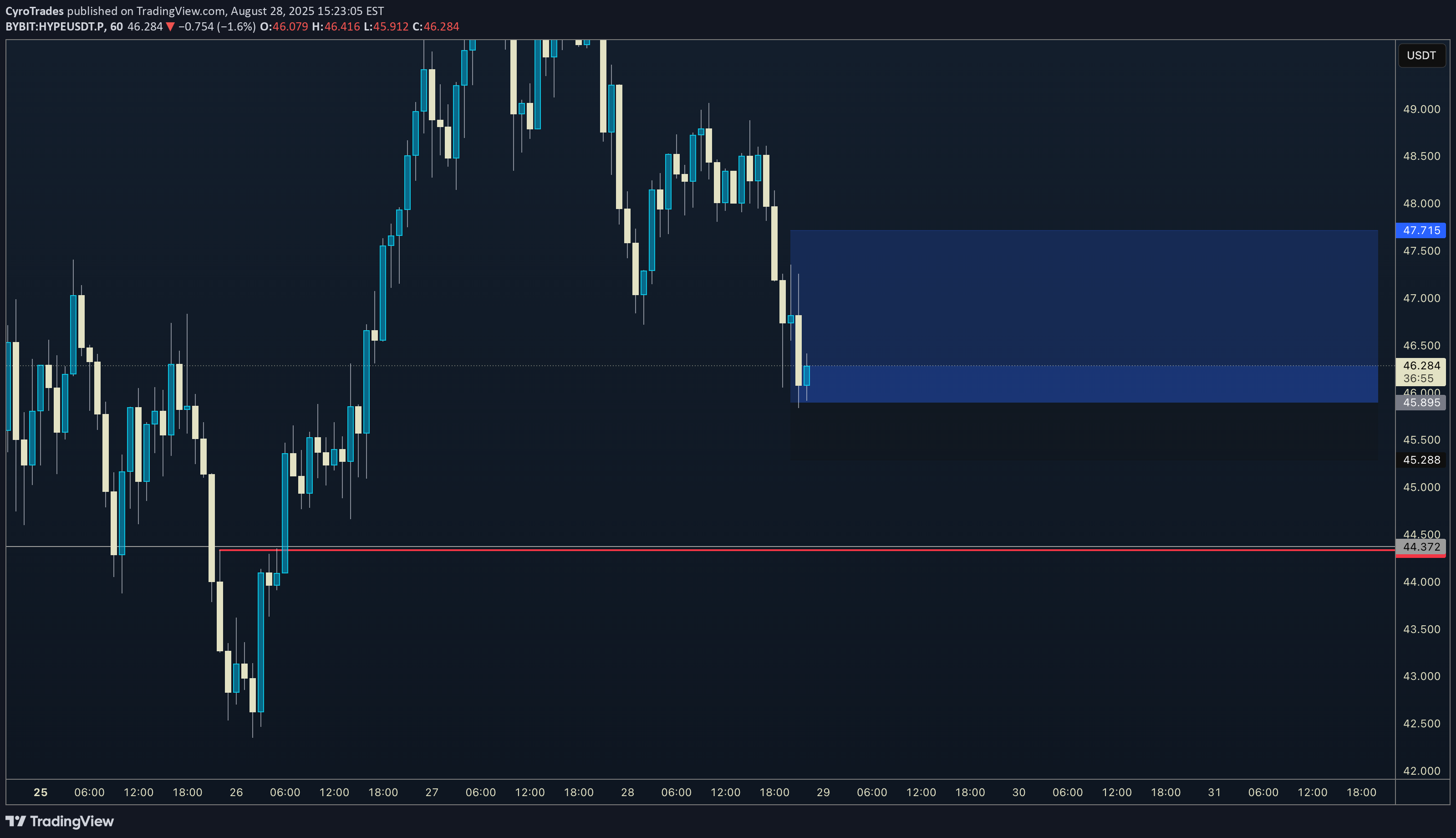

HYPE LONG

Manipulated into 4H demand zone. Bullish biased confirmed - weekly highs already taken. Targetting fixed 3RR don't be greedy goodluck

CyroTrades

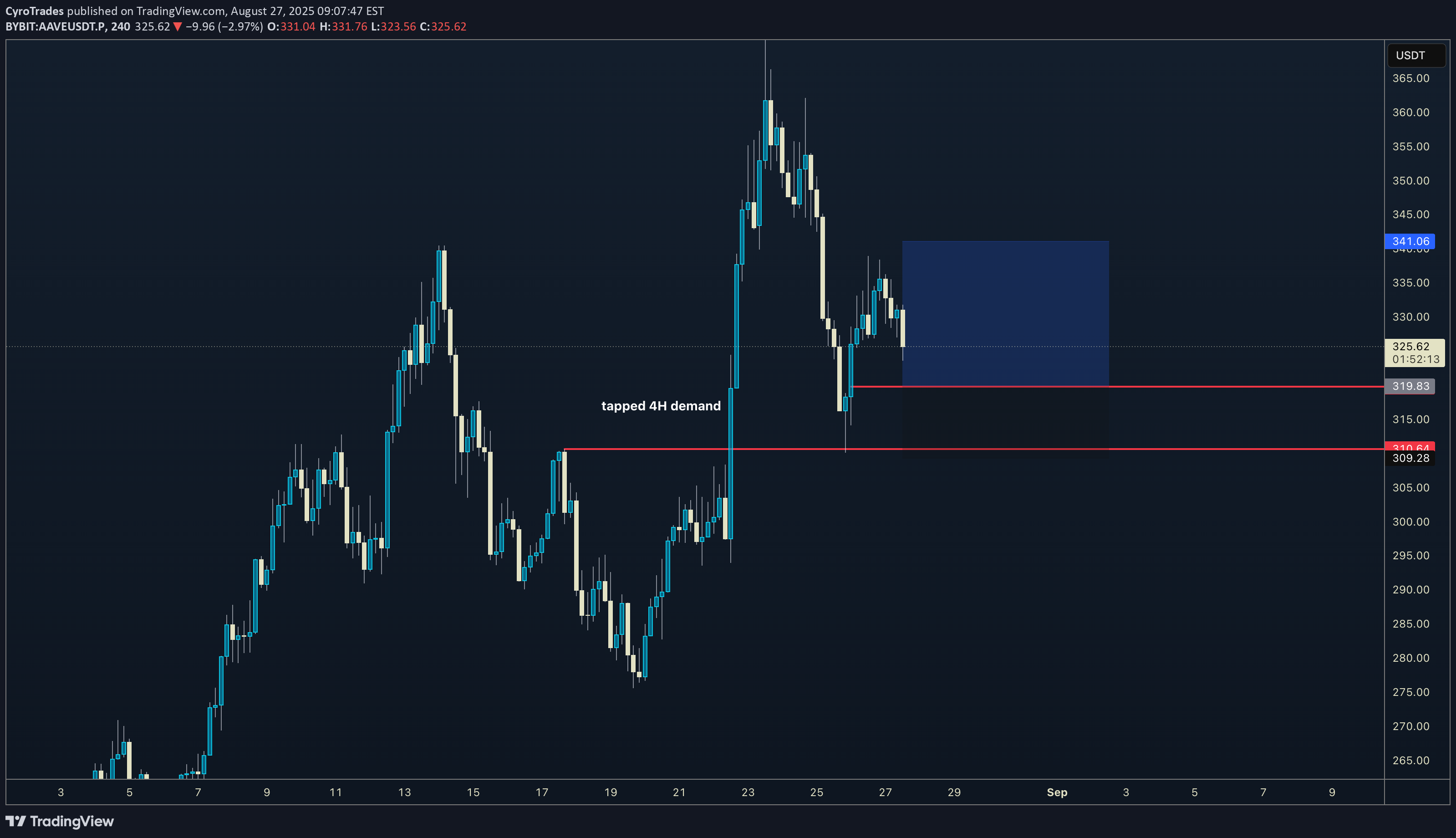

AAVE LONG

1D Technical Analysis for AAVE with Supply Zone and 4H Demand Confirmation On the daily timeframe, AAVE is currently navigating a key supply zone around the $285 to $308 range which has historically acted as a strong resistance area, causing pauses or pullbacks during prior rallies. Recently, the price of AAVE dropped sharply after failing to hold above $307.86 and found strong support in a key 4-hour demand zone near $255. This demand zone provides a crucial technical floor confirming buyers’ presence and a potential base for recovery. Following the tap of the 4H demand, AAVE has seen a bounce of approximately 12%, attempting to re-enter the resistance zone while testing overhead supply congestion. Momentum indicators on the daily chart, such as RSI and moving averages, indicate neutral to mildly bullish conditions; the key to sustained upside will be maintaining price above the $255 demand and breaking above the $285–$308 supply with solid volume. Failure to reclaim and hold above this supply zone risks resumption of the downtrend, with lower support levels around the $250 mark serving as critical decision points for bulls and bears.

CyroTrades

LINK LONG

1D Technical Analysis for LINK Surrounding Supply Zone and 4H Demand Confirmation On the daily chart, LINK is currently testing a key supply zone around $25 to $26, where sellers have historically stepped in to limit upside price moves. This zone acts as a significant overhead resistance level, creating a challenge for bulls to maintain momentum beyond it. Recently, LINK price action confirmed strong buying interest after tapping the 4-hour demand zone, indicated by back-to-back bullish 4H candles. This demand zone provided a critical short-term floor that has supported a bounce and recovery wave. The confirmation at the 4H demand zone adds confidence to bulls' attempts to push through the nearby daily supply zone, suggesting a growing battle of power between buyers reclaiming control and sellers defending the resistance. Momentum indicators on the daily timeframe show positive signs: the RSI hovers above neutral 50, Bollinger Bands contract signaling potential volatility expansion, and moving averages are aligned bullishly with a recent golden cross event. Volume surges during recent rebounds further validate the buying strength that emerged after the 4H demand was respected, hinting at possible continuation toward the next resistance targets near $27–$30 if bulls sustain above supply.

CyroTrades

SUI

1D Technical Analysis for SUI at Supply Zone $3.087 On the daily timeframe, SUI is currently trading slightly above the psychological and technical supply zone at $3.087. This level represents a significant area where sellers previously stepped in, creating overhead resistance that could cap upward momentum. Price action in recent sessions shows SUI facing selling pressure near this zone, with multiple wick rejections on the daily candles hinting at potential resistance holding firm. Volume around the supply zone maintains moderate levels, suggesting active battle between buyers and sellers but no overwhelming dominance. The RSI at a near-neutral level (~52) on the daily suggests indecision and room for further moves either way without being overbought or oversold. MACD and short-term EMAs display mixed signals: momentum is balanced but leaning slightly bullish if price can defend above this zone. If SUI can decisively break and hold above $3.087 supply, it would likely open path targets around $3.45–$4.00, with analyst resistance clusters noted near $3.67 and $4.00 in the medium term. Failure to hold above this supply zone risks a rejection down to strong support areas closer to $2.50–$2.70, which aligns with previous consolidation ranges and long-term demand.

CyroTrades

ETH SHORT

Hey everyone I have analyzed a Untapped supply 4H zone which I will be shorting and targetting weekly lows. as thats where most of the liquidity sits. Its a basic boring setup but lets see.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.