BADQOMOCAWGOWLD

@t_BADQOMOCAWGOWLD

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

BADQOMOCAWGOWLD

BADQOMOCAWGOWLD

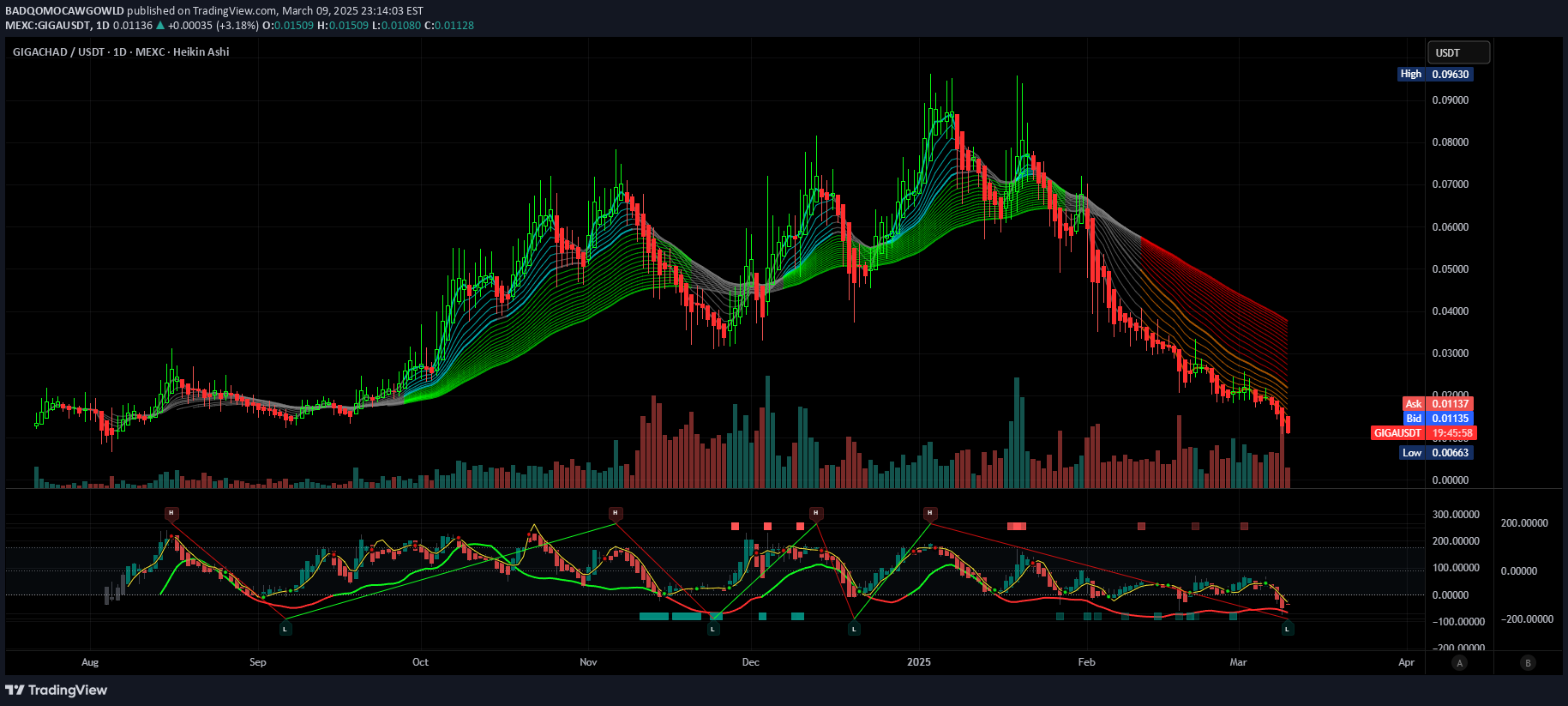

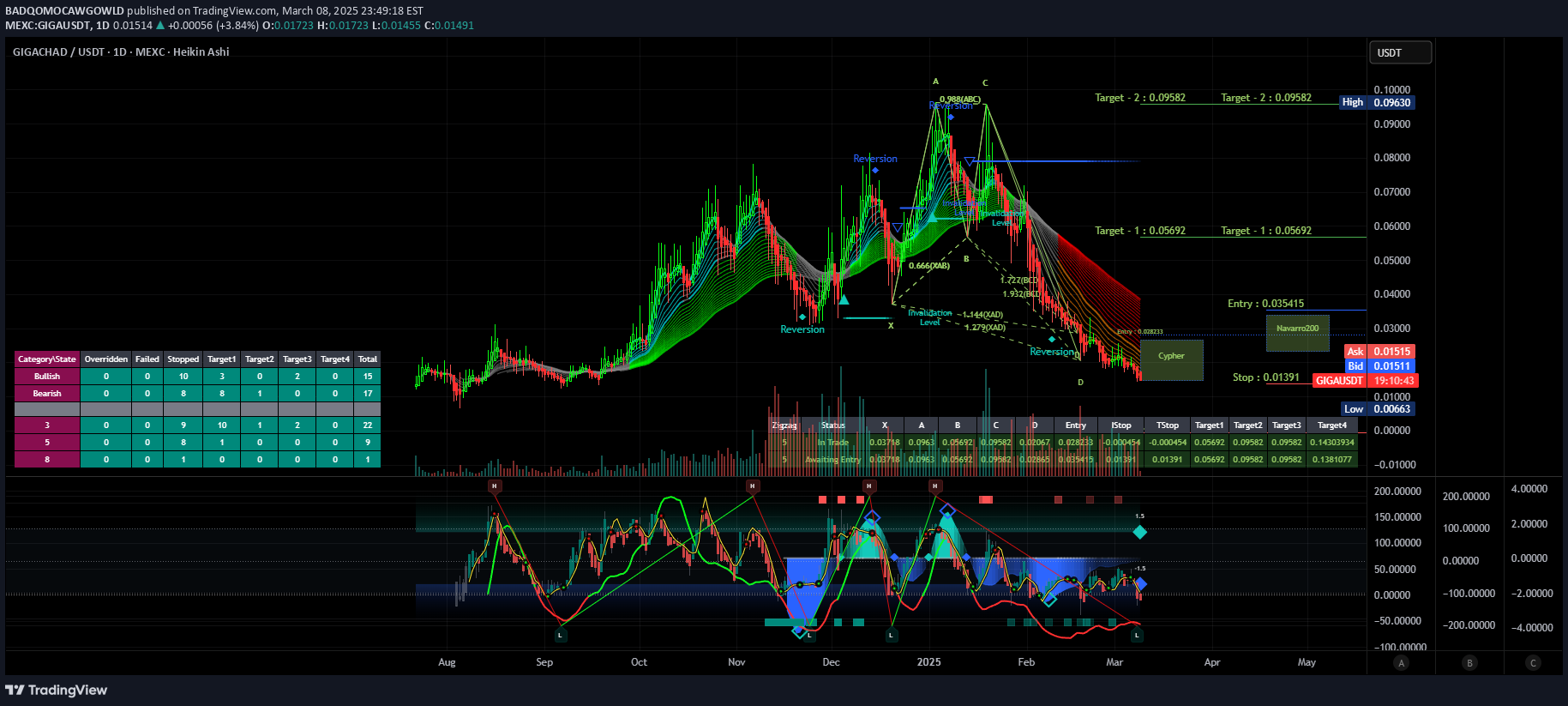

$GIGA GIGACHAD

GIGA GIGACHAD (MARKET CAP $108.90M --> **$50Bil MC**) entry PTs 0.0044 -- 0.01158 --> 12.14 = 1,070X (Timeline: End of July) Next Target PTs 5.19-12.14 and higherrr Returns +459X fm $108.90Mil MC-1,070X 63LfDmNb3MQ8mw9MtZ2To9bEA2M71kZUUGq5tiJxcqj9

BADQOMOCAWGOWLD

$BTC Bitcoin

BADQOMOCAWGOWLD

$GIGA GIGACHAD Supernova!!!

GIGA GIGACHAD (MARKET CAP $144.77M --> $50Bil MC) entry PTs 0.0065 - 0.01 - 0.014 Next Target PTs 5.19-12.14 and higherrr Returns +345X fm $144.77Mil MC-805X 63LfDmNb3MQ8mw9MtZ2To9bEA2M71kZUUGq5tiJxcqj9

BADQOMOCAWGOWLD

BADQOMOCAWGOWLD

$BTC Bitcoin Flagging

About Bitcoin (BTC) Bitcoin (BTC) is the first cryptocurrency built on blockchain technology, also known as a decentralized digital currency that is based on cryptography. Unlike government-issued or fiat currencies such as US Dollars or Euro which are controlled by central banks, Bitcoin can operate without the need of a central authority like a central bank or a company. The decentralized nature allows it to operate on a peer-to-peer network whereby users are able to send funds to each other without going through intermediaries. Who created Bitcoin? The creator is an unknown individual or group that goes by the name Satoshi Nakamoto with the idea of an electronic peer-to-peer cash system as it is written in a whitepaper. Until today, the true identity of Satoshi Nakamoto has not been verified though there has been speculation and rumor as to who Satoshi might be. What we do know is that officially, the first genesis block of BTC was mined on 9th January 2009, defining the start of cryptocurrencies. How does Bitcoin work? While the general public perceives Bitcoin as a physical looking coin, it is actually far from that. Under the hood, it is a distributed accounting ledger that is stored as a chain of blocks - hence the name blockchain. Let's compare how Bitcoin is different from a commercial bank, which operates as a centralized system. Given a situation where Alice wants to transact with Bob, the bank is the only entity that holds the ledger that describes how much balance Alice and Bob has. As the bank maintains the ledger, they will do the verification as to whether Alice has enough funds to send to Bob. Finally when the transaction successfully takes place, the Bank will deduct Alice’s account and credit Bob’s account with the latest amount. Bitcoin conversely works in a decentralized manner. Since there is no central figure like a bank to verify the transactions and maintain the ledger, a copy of the ledger is distributed across Bitcoin nodes. A node is a piece of software that anybody can download and run to participate in the network. With that, everybody has a copy of how much balance Alice and Bob has, and there will be no dispute of fund balance. Now, if Alice were to transact with Bob using bitcoin. Alice will have to broadcast her transaction to the network that she intends to send $1 to Bob in equivalent amount of bitcoin. So how does the system determine if Alice has enough bitcoin to execute the transaction? This is where mining takes place. Bitcoin Mining A Bitcoin miner will use his or her computer rigs to validate Alice’s transaction to be added into the ledger. In order to stop a miner from adding any arbitrary transactions, they will need to solve a complex puzzle. Only if the miner is able to solve the puzzle (called the Proof of Work), which happens at random, then he or she is able to add the transactions into the ledger and the record is final. Since running computer rigs cost money due to capital expenditure, which includes the cost of the rigs and the cost of electricity, miners are rewarded with new supply of bitcoins. This is the monetary system behind Bitcoin, where the fees for validating transactions on the network is paid by the person who wishes to transact (in this case it is Alice). This makes the Bitcoin ledger resilient against fraud in a trustless manner. While it is resilient, there are still some risks associated with the system such as the 51% attack where by miners control more than 51% of the total computation power and also there can be security risks outside of the control of the Bitcoin protocol.

BADQOMOCAWGOWLD

BTC.X BTC Bitcoin Next Target PT **68,455** (Rebuy late 2026) --> **109,683**-200k-400k and higher coingecko.com/en/coins/bitcoinAbout Bitcoin (BTC)Bitcoin (BTC) is the first cryptocurrency built on blockchain technology, also known as a decentralized digital currency that is based on cryptography. Unlike government-issued or fiat currencies such as US Dollars or Euro which are controlled by central banks, Bitcoin can operate without the need of a central authority like a central bank or a company. The decentralized nature allows it to operate on a peer-to-peer network whereby users are able to send funds to each other without going through intermediaries.Who created Bitcoin?The creator is an unknown individual or group that goes by the name Satoshi Nakamoto with the idea of an electronic peer-to-peer cash system as it is written in a whitepaper. Until today, the true identity of Satoshi Nakamoto has not been verified though there has been speculation and rumor as to who Satoshi might be. What we do know is that officially, the first genesis block of BTC was mined on 9th January 2009, defining the start of cryptocurrencies.How does Bitcoin work?While the general public perceives Bitcoin as a physical looking coin, it is actually far from that. Under the hood, it is a distributed accounting ledger that is stored as a chain of blocks - hence the name blockchain.Let's compare how Bitcoin is different from a commercial bank, which operates as a centralized system. Given a situation where Alice wants to transact with Bob, the bank is the only entity that holds the ledger that describes how much balance Alice and Bob has. As the bank maintains the ledger, they will do the verification as to whether Alice has enough funds to send to Bob. Finally when the transaction successfully takes place, the Bank will deduct Alice’s account and credit Bob’s account with the latest amount.Bitcoin conversely works in a decentralized manner. Since there is no central figure like a bank to verify the transactions and maintain the ledger, a copy of the ledger is distributed across Bitcoin nodes. A node is a piece of software that anybody can download and run to participate in the network. With that, everybody has a copy of how much balance Alice and Bob has, and there will be no dispute of fund balance.Now, if Alice were to transact with Bob using bitcoin. Alice will have to broadcast her transaction to the network that she intends to send $1 to Bob in equivalent amount of bitcoin. So how does the system determine if Alice has enough bitcoin to execute the transaction? This is where mining takes place.

BADQOMOCAWGOWLD

XRP.X XRP XRP (MARKET CAP 138.98Bil) Retraces to entry PT **0.66-ish** --> Long term PT **13,145** (Timeline: Nov '26) Sky High! 🚀🌙What is Ripple?Ripple is a privately-held fintech company that provides a global payment solution via its patented payment network called Ripple Network (also known as RippleNet). RippleNet is a payment network that is built on top of Ripple’s consensus ledger, called XRP Ledger (also known as XRPL). Ripple funded the development of the open-source XRP Ledger.Unlike most cryptocurrencies out there that cater to peer-to-peer needs, Ripple was made to connect banks, payment providers and digital asset exchanges, enabling real-time settlement expeditions and lower transaction fees.What is the XRP Ledger?XRP Ledger (XRPL) is the open-source distributed ledger that is created by Ripple. The native cryptocurrency of the XRP Ledger is XRP. Compared to Bitcoin (BTC) which uses a distributed blockchain whose transactions are processed and secured by proof-of-work mining, XRP transactions are processed by a network of trusted validators on the XRP LedgerRipple transactions are publicly recorded on its open-source distributed consensus ledger which has a similar data structure to a blockchain where the successive data block includes the hash of the previous block. However, its consensus mechanism is different from Bitcoin or Ethereum. It does not rely on Proof of Work (PoW) and therefore there is no mining involved with XRP.XRP instead relies on a consensus algorithm known as the Ripple Protocol Consensus Algorithm. The XRPL’s integrity is maintained by a group of trusted nodes. All transactions must be agreed by a supermajority of these trusted nodes for it to achieve consensus and be included in the XRP Ledger.How does it reach a consensus if there is no mining?XRPL uses a different set of rules called the Ripple Consensus Protocol Algorithm (RCPA). The RCPA defines how XRPL is managed by a network of independent Ripple validator nodes. Any Ripple transaction needs to be verified by at least 80% of the nodes on the network.Anyone can become a validator. However, Ripple maintains a given set of validators that can be trusted. This trusted list of nodes is called the Unique Node List (UNL).If Alice wants to send 1,000 Japanese Yen to her cousin Bob in India, Alice could send it to the participating financial institutions. The JPY will be converted to XRP and will be validated by the servers in the network. Bob could withdraw the money in Indian Rupee once validated. The remittance can be done within seconds.

BADQOMOCAWGOWLD

SPX.X SPX SPX6900 (MARKET CAP 662.01M) Scale-in Now and again at entry PTs 0.10 - **0.38**Long term PTs 65,000 and higherrr (**First 100Bil MC coin**) SPX6900 is an advanced blockchain **cryptography **token coin capable of limitless possibilities and scientific utilization. 🚀🌙dextools.io/app/en/ether/pair-explorer/0x52c77b0cb827afbad022e6d6caf2c44452edbc39?t=1729575098043XRP.X XRP XRP (MARKET CAP 138.98Bil) Retraces to entry PT 0.66-ish --> Long term PT 13,145 (Timeline: Nov '26) Sky High! 🚀🌙coingecko.com/en/coins/xrpBTC.X BTC Bitcoin **Next Target PT 68,455 (Rebuy late 2026) --> 109,683**-200k-400k and higher coingecko.com/en/coins/bitcoin

BADQOMOCAWGOWLD

XRP.X XRP XRP (MARKET CAP 138.98Bil) Retraces to entry PT 0.66-ish --> Long term PT 13,145 (Timeline: Nov '26) Sky High! 🚀🌙**__TradingView Charting Script for accurate charting/PTs__**- market-hq.com/ (USE Codes: ROCKYMONTH and ROCKYYEAR and get 10% off TradingView Charting Script) stocktwits.com/Market_HQ and tradingview.com/u/market_hq/stocktwits.com/Rocky369 and tradingview.com/u/BADQOMOCAWGOWLD/What is Ripple?Ripple is a privately-held fintech company that provides a global payment solution via its patented payment network called Ripple Network (also known as RippleNet). RippleNet is a payment network that is built on top of Ripple’s consensus ledger, called XRP Ledger (also known as XRPL). Ripple funded the development of the open-source XRP Ledger.Unlike most cryptocurrencies out there that cater to peer-to-peer needs, Ripple was made to connect banks, payment providers and digital asset exchanges, enabling real-time settlement expeditions and lower transaction fees.What is the XRP Ledger?XRP Ledger (XRPL) is the open-source distributed ledger that is created by Ripple. The native cryptocurrency of the XRP Ledger is XRP. Compared to Bitcoin (BTC) which uses a distributed blockchain whose transactions are processed and secured by proof-of-work mining, XRP transactions are processed by a network of trusted validators on the XRP LedgerRipple transactions are publicly recorded on its open-source distributed consensus ledger which has a similar data structure to a blockchain where the successive data block includes the hash of the previous block. However, its consensus mechanism is different from Bitcoin or Ethereum. It does not rely on Proof of Work (PoW) and therefore there is no mining involved with XRP.XRP instead relies on a consensus algorithm known as the Ripple Protocol Consensus Algorithm. The XRPL’s integrity is maintained by a group of trusted nodes. All transactions must be agreed by a supermajority of these trusted nodes for it to achieve consensus and be included in the XRP Ledger.How does it reach a consensus if there is no mining?XRPL uses a different set of rules called the Ripple Consensus Protocol Algorithm (RCPA). The RCPA defines how XRPL is managed by a network of independent Ripple validator nodes. Any Ripple transaction needs to be verified by at least 80% of the nodes on the network.Anyone can become a validator. However, Ripple maintains a given set of validators that can be trusted. This trusted list of nodes is called the Unique Node List (UNL).If Alice wants to send 1,000 Japanese Yen to her cousin Bob in India, Alice could send it to the participating financial institutions. The JPY will be converted to XRP and will be validated by the servers in the network. Bob could withdraw the money in Indian Rupee once validated. The remittance can be done within seconds.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.