NMR

Numeraire

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 11/9/2025 |

Price Chart of Numeraire

سود 3 Months :

سیگنالهای Numeraire

Filter

Sort messages by

Trader Type

Time Frame

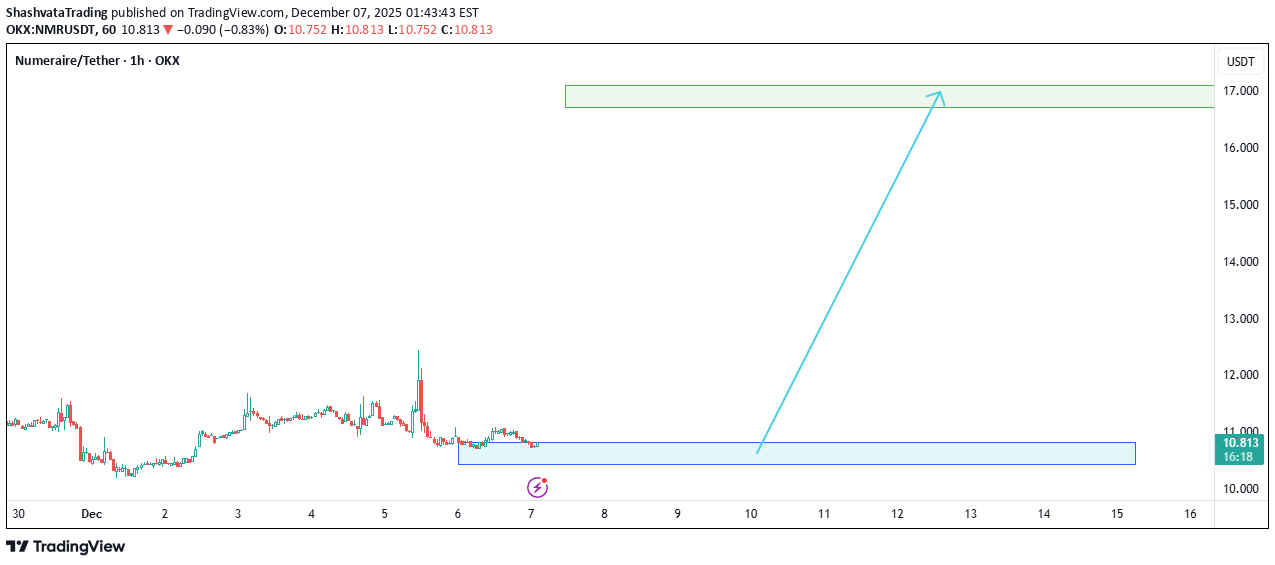

ShashvataTrading

BandForBands

FortuneAI

$NMR is ready to fly

NMR technicals bullish NMR’s chart reflects a mix of institutional validation (JPMorgan), proactive tokenomics (buybacks/staking), and technical momentum. While broader crypto sentiment remains fearful, NMR’s unique AI hedge fund model and scarcity drivers position it for volatility with upside potential.NMR PUMPED HARD

اگر بازار به کانال بالایی برسد: هدف اول کجاست و چه خطراتی در کمین است؟

It can make a fake first and come back, or it can go down to the bottom of the channel after the fake, if it breaks the channel and goes down, it can even go down to 6, but altcoins will bleed..

Bithereum_io

تحلیل تکنیکال NMR/USDT: فرصت خرید در کف کانال نزولی و اهداف صعودی بزرگ!

#NMR is currently trading within a falling wedge pattern on the daily chart. Consider accumulating a small position near the support zone, which aligns with the daily SMA200. In case of a breakout above the wedge resistance, the potential upside targets are: 🎯 $13.23 🎯 $14.62 🎯 $15.74 🎯 $16.86 🎯 $18.46 🎯 $20.50 ⚠️ Always remember to use a tight stop-loss and maintain proper risk management.

Kapitalist01

ساعت 22:19: یادداشتهای کوتاهمدت برای بازار آتی (توصیه خرید و فروش نیست)

......................................... ........................................................................ short term note to self It is not a buy or sell tut recommendation. for futures market

Miraqcapital

تحلیل جریان سفارشات نهادی NMR/USDT: آیا قیمت به ۱۱ دلار سقوط میکند؟ (دیدگاه ICT)

Price recently delivered a sharp move down from the upper bearish Order Block (OB) around the 14.0 region, filling previous imbalances (-iFVG) and confirming a short-term Market Structure Shift (MSS) to the downside. Currently, NMR is reacting within a bullish Fair Value Gap (+iFVG) zone, but liquidity beneath the recent low remains uncollected. This indicates the probability of another liquidity sweep toward the lower OB (~11.0-11.2 zone), where multiple confluences align Old demand zone + OB +FVG (Fair Value Gap) Institutional Discount Zone Potential Inducement setup (SMT and IDM levels marked) After liquidity is taken and we see displacement with bullish intent, price could retrace back toward the 13.8-14.0 OB, which aligns with premium re-pricing. Execution Plan: Watch Zone: 11.0–11.3 → Look for bullish confirmation (MSS + displacement). Target Zone: 13.6–14.0 OB. Invalidation: Clean break below 10.8 with no bullish displacement. Note: Stay patient & DYOR — let liquidity form first. Reaction at the 11.0 handle will define the next leg.💡 Bias: Bullish after liquidity sweep toward 11.0 zone 📈 Trade Type: Reversal Play from Discount → Premium Range

TradeTheVolumeWaves

راز ورود شورت موفق با متدولوژی درس ۱۵: راهنمای کامل تحلیل نمودار

Reading the chart using Lesson 15 1. Fib Location (sellers could enter hear) 2. Fake Break 3. Placed AVWAP at the beginning of the wave 4. Largest down wave after a while 5. Push Down PD 75.7S abnormakl speed index 6. Hard to Move up , 74.0S abnormal speed index 7. Entry Short on PRS plutus signal Enjoy!Didn't expect that!

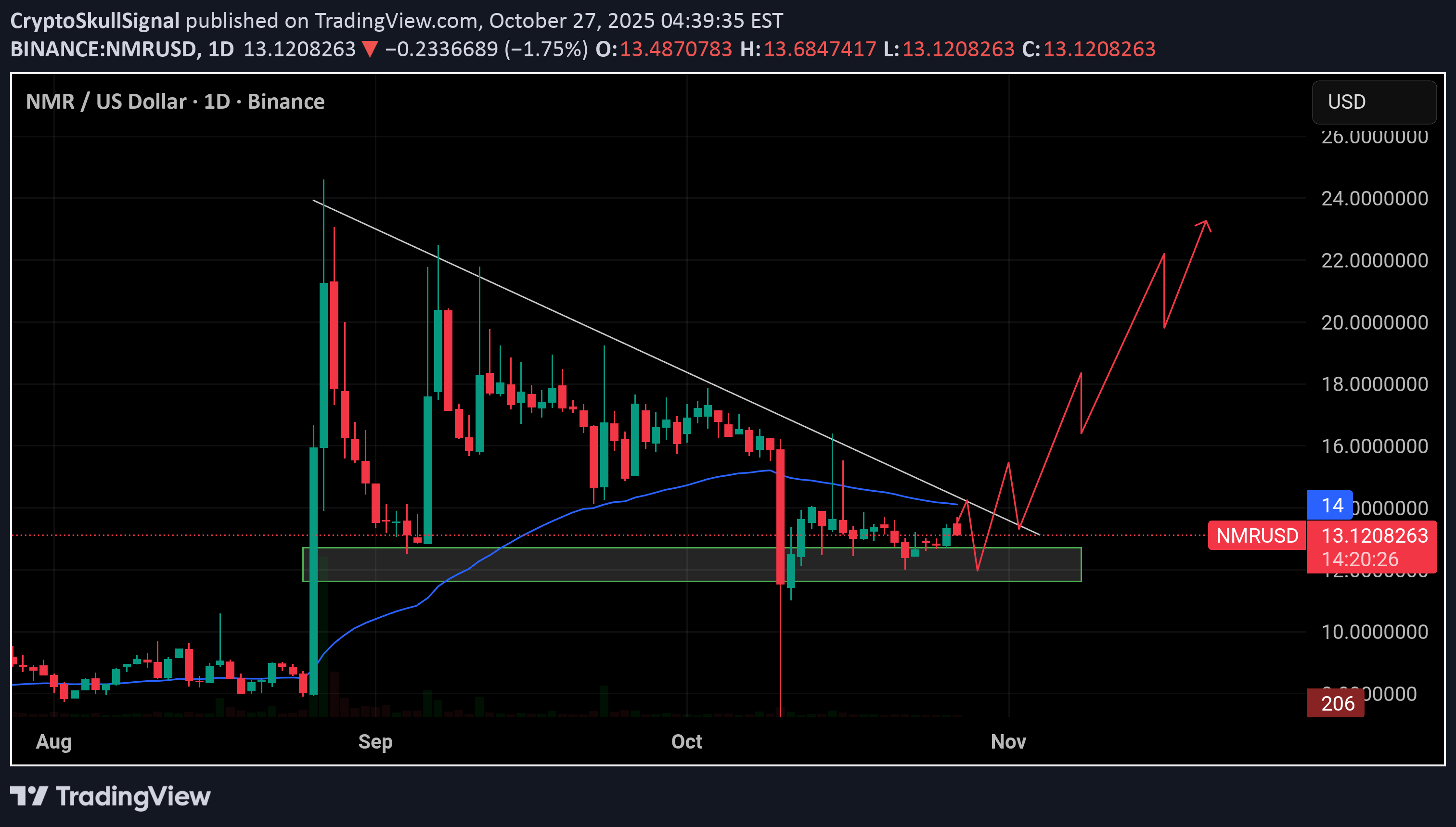

CryptoSkullSignal

قیمت NMR آماده انفجار است: آیا حرکت صعودی بزرگ در راه است؟

NMR looks ready for a breakout. Price has been consolidating above key support around $11.5–$13, forming a potential reversal base. A break above the descending trendline could trigger a bullish move toward $17.5, $20, and possibly $23+ in the coming weeks. As long as price holds above the green zone, the bias remains bullish. #btc #nmr

rmzn42

آیا موج صعودی #NMR در راه است؟ شرط کلیدی برای جهش بزرگ!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.