KDA

Kadena

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Kadena

سود 3 Months :

سیگنالهای Kadena

Filter

Sort messages by

Trader Type

Time Frame

XV214

تحلیل تکنیکال KDA/USDT: ریسکها و نکات حیاتی پیش از سرمایهگذاری

Risk warning, disclaimer: the above is a personal market judgment based on published information and historical chart data on Tradingview, all analysis is only subjective. Hope investors consider, that I am not responsible for your investment decision. Thank you. Good luck

vmoradian6

Osang

کادنا (KDA) سقوط آزاد! آیا این یک پولکشی برنامهریزی شده است؟

Strength_in_numbers

پتانسیل نهفته کادنا (KDA): کف قیمتی رسید؟ (تحلیل تکنیکال قوی)

Kadena has recently ceased operations with some exchanges delisting KDA from their platform. HOWEVER from a technical standpoint we are seeing a bottom 0.05 - 0.06: this is a new ATL for KDA. The RSI is oversold on every time frame including the daily and weekly TF. Seeing increased strength on the 2H. Putting news events to one side, the technicals suggest that a long position could be favourable here. Breaks below 0.05 would invalidate this thesis.

volcoin

حمایت ۰.۰۲؛ آیا ارز KDA توسط یک صرافی بزرگ نجات پیدا میکند؟

It will find support around 0.02, most likely a stock market will support it :)

CryptoAnalystSignal

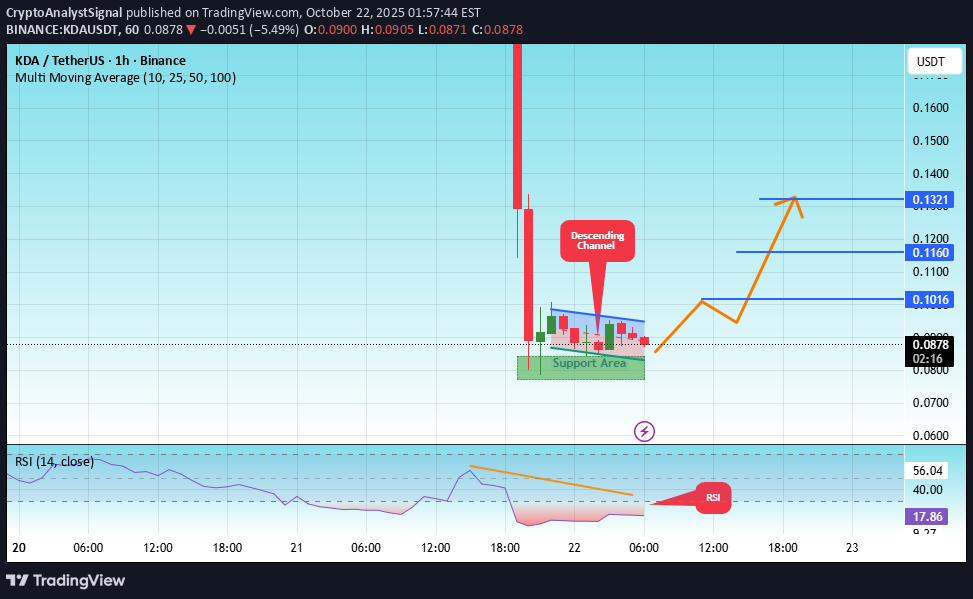

تحلیل تکنیکال KDA/USDT: ساختار صعودی قوی و فرصت خرید با اهداف مشخص

#KDA The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest. We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout. There is a major support area in green at 0.0800, representing a strong support point. We are heading for consolidation above the 100 moving average. Entry price: 0.0876 First target: 0.1016 Second target: 0.1160 Third target: 0.1321 Don't forget a simple matter: capital management. When you reach the first target, save some money and then change your stop-loss order to an entry order. For inquiries, please leave a comment. Thank you.

Zorroreny

سقوط ۹۹ درصدی کیدیای: آیا زمان انفجار بزرگ و بازگشت به قله فرا رسیده است؟

KDA hit new ATL, since November 2021 it dropped 99%! Looking at past data we have seen similar drops from KDA which then resulted in strong reversal leading to new ATH. As we had biggest drop till now I expect a very strong reversal - conservative target would be test of November 2021 pivot range at ca. 25$.Rugpull...

CryptoAnalystSignal

تحلیل تکنیکال KDA/USDT: آمادهسازی برای انفجار صعودی بزرگ!

#KDA The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest. We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout. There is a major support area in green at 0.2170, representing a strong support point. We are heading for consolidation above the 100 moving average. Entry price: 0.2184 First target: 0.2245 Second target: 0.2294 Third target: 0.2364 Don't forget a simple matter: capital management. When you reach the first target, save some money and then change your stop-loss order to an entry order. For inquiries, please leave a comment. Thank you.#KDA First target: 0.2245 Reached Second target: 0.2294 Reached Third target: 0.2364 Reached

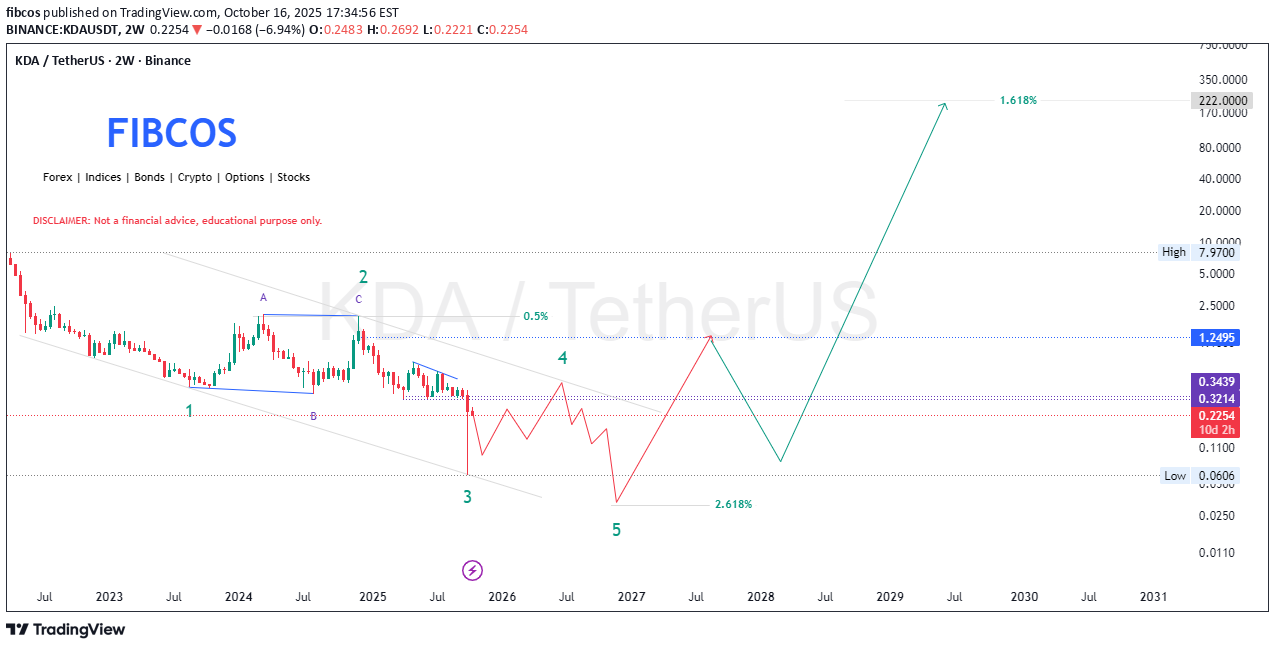

fibcos

پایان نزول تاریخی KDA؟ نشانههای تشکیل کف نسلی و بازگشت بزرگ!

🚨 KDA/USDT - Approaching the End of Macro Wave 3 – Reversal Imminent? After nearly 2 years of consistent decline, Kadena (KDA) appears to be in the final stages of its macro corrective structure. Using a blend of Elliott Wave Theory , Smart Money Concepts (SMC) , Fibonacci tools , and Price Action analysis , there is compelling evidence that we may be forming a generational bottom . The chart outlines a clean 5-wave Elliott impulse to the downside. With Wave 3 nearing completion in a historically strong demand zone ($0.06–$0.03), the probability of a long-term trend reversal is increasing. This zone also aligns with: A full 2.618 Fibonacci extension, Prior accumulation levels, A potential liquidity sweep below Wave 3, Oversold market conditions likely visible on higher timeframes (RSI/MACD divergence). On the fundamentals side, Kadena continues to innovate with its high-throughput PoW Chainweb architecture , human-readable smart contracts via Pact , and growing DeFi infrastructure. It remains one of the most undervalued layer-1s in the market with zero major security exploits since launch. 🔮 If the reversal confirms , long-term targets lie at: $1.25 (0.5 Fib Retracement) $7.97 (prior high) $222 (1.618 macro extension, multi-year projection) This setup may not play out overnight, but it's the type of structure that smart money patiently builds positions into , while retail fears the bottom. 📊 1. Elliott Wave Theory Confluence Looking at the macro Elliott Wave structure: 🔹 A clear 5-wave impulsive decline appears to be forming: Wave 1 & 2 have already played out. Wave 3, being the most aggressive, is complete or near completion. Wave 4 retracement was shallow and corrective (possibly a bear flag/pennant). Wave 5 is projected to complete with a final leg lower— potential bottom expected before a strong reversal. 🔹 Post wave 5, an ABC corrective wave or a larger impulsive reversal is projected (labeled on chart), suggesting a macro trend shift . 🧠 2. Smart Money Concepts (SMC) 💰 Accumulation Zones: Price is hovering in a demand zone (between $0.06 - $0.25). This area has high probability of institutional accumulation as retail sells into fear. 📉 Liquidity Sweeps: Recent price action shows a sharp move down, likely a liquidity grab below previous swing lows (a classic SMC manipulation before reversal). The anticipated "spring" move from this zone aligns with Wyckoff accumulation patterns. 🔄 Break of Structure (BoS): A break above the corrective structure post-wave 5 would confirm a bullish market structure shift . 🌀 3. Fibonacci Retracement & Extension 🔹 Fibonacci Extension: Wave 3 extension seems to have reached the 2.618% level , which is a textbook Elliott wave projection level. This provides high confluence that Wave 5 bottom may be close. 🔹 Fibonacci Retracement Targets: Retracement to 0.5 - 0.618 Fibonacci zone (~$1.25 - $7.97) expected in post-wave rally. The ultimate 1.618 extension target (~$222) could play out if a macro bull cycle aligns , possibly by 2029. 🕵️♂️ 4. Price Action Analysis 📉 Bearish Channel Breakdown : Price has followed a descending channel and is nearing the lower boundary. False breakdowns often result in violent reversals . 📈 Bullish Divergence (likely on RSI) : If RSI or other momentum indicators show divergence, this adds confirmation for a reversal setup . 📌 Key Levels to Watch : Resistance : $0.3439, $1.25, $7.97 Support : $0.13, $0.06, $0.03 A break and hold above $1.25 could signal the start of a macro uptrend . 🔮 Final Thoughts 🔁 We're likely nearing the end of a macro bearish cycle (Wave 3) . 💼 With institutional accumulation signs , Fibonacci confluence , and solid fundamentals **, KDA presents a strong asymmetric opportunity . 🧨 If Wave 5 completes near $0.06 - $0.03, the upside potential toward $7.97 (first macro target) and possibly $222 (1.618 extension) offers high R/R (risk/reward) for long-term investors. ⚠️ DISCLAIMER: This analysis is educational and not financial advice. Always DYOR (Do Your Own Research). #KDA #KDAUSDT #Kadena #CryptoAnalysis #ElliottWave #SmartMoney #Wyckoff #TechnicalAnalysis #CryptoReversal #AltcoinAnalysis #PriceAction #Fibonacci #Layer1 #CryptoFundamentals #TradingSetup #LongTermHold #Accumulation #CryptoMacro #TradingEducation #WaveTheory #CryptocurrencyKDA/USDT Market Update KDA/USDT has experienced a significant 70% retracement, in line with our previous technical forecast. This move appears to have efficiently swept major liquidity below key support levels, signaling a potential completion of Wave 3 within the broader Elliott Wave structure. The current price action suggests a transition phase, where selling pressure is beginning to exhaust. We're now observing early signs of accumulation and potential bullish divergence on lower timeframes, which could mark the beginning of Wave 4 or even the early stages of a new impulsive cycle. From a strategic standpoint, this zone offers a high-reward buying opportunity for medium- to long-term positions, provided confirmation is met through volume support, structural shifts, and key breakout levels. We remain vigilant and will continue to monitor the development of the next moves closely, adjusting our strategy accordingly.

CryptoAnalystSignal

تحلیل KDA/USDT: ساختار صعودی قوی در کمین است! (با اهداف مشخص)

#KDA The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest. We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout. There is a major support area in green at 0.2400, which represents a strong support point. We are heading for consolidation above the 100 moving average. Entry price: 0.2534 First target: 0.2607 Second target: 0.2694 Third target: 0.2780 Don't forget a simple matter: capital management. When you reach the first target, save some money and then change your stop-loss order to an entry order. For inquiries, please leave a comment. Thank you.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.