Zorroreny

@t_Zorroreny

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Zorroreny

VRA - correction over?

VRA dipped to new ATL but when looking at corrective pattern we see similar moves that we did in the past and are also similar to FET. Implying that current correction is likely over (capitulation dip after breaking last support range) and we can expect bounce up to at least fibb 0.382 range where we have S/R and diagonal resistance line. If we reject there expect one more dip to new ATL on other side if we break diagonal resistance line we trigger impulse like one in 2021 that can lead to ATH range.

Zorroreny

Zorroreny

Zorroreny

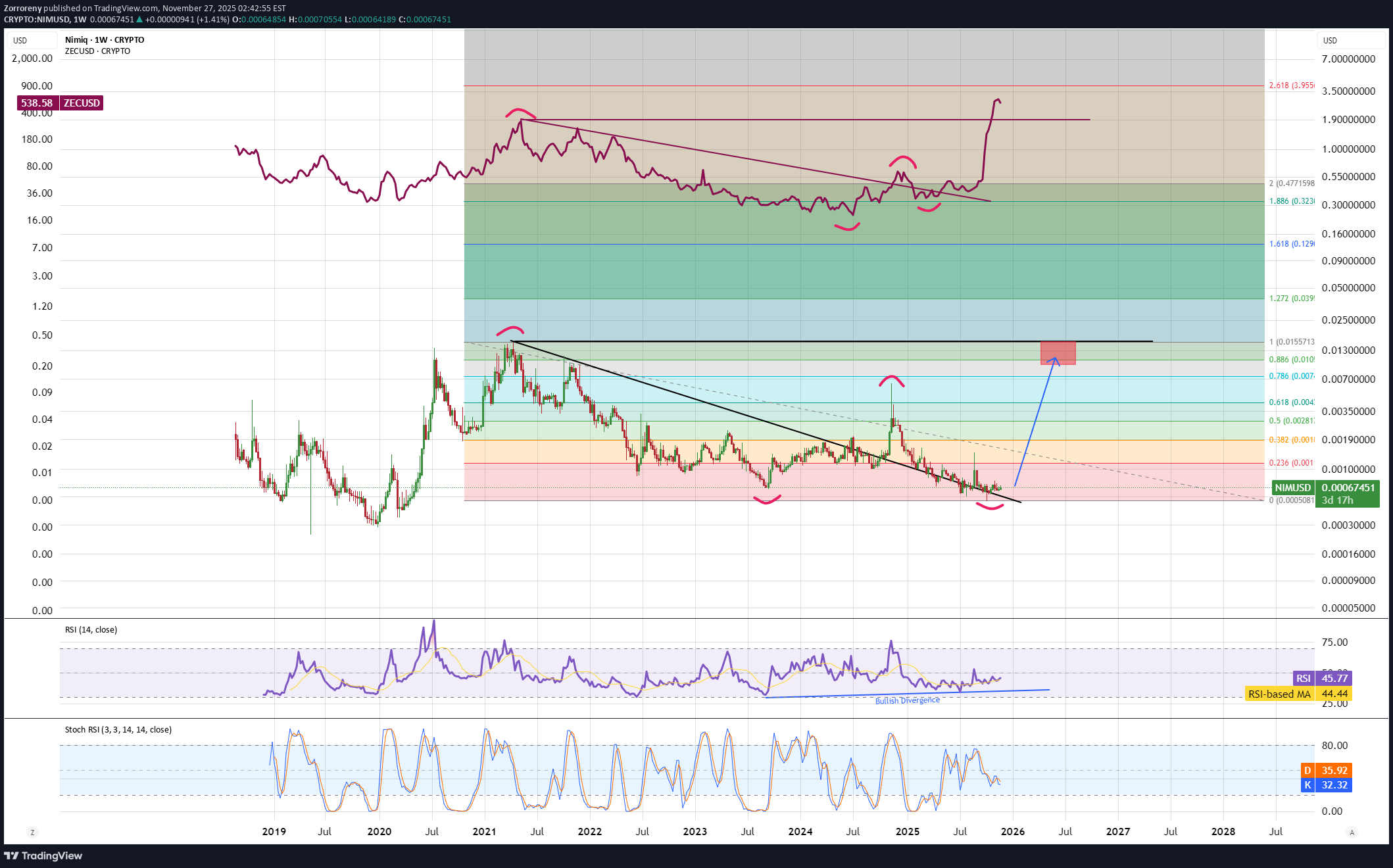

صعود انفجاری نیم (NIM) در راه است؟ پیشبینی شگفتانگیز تحلیلگران

Zorroreny

Zorroreny

Zorroreny

نقطه عطف بیتکوین: زمان بازگشت بزرگ پس از سقوط به کف کانال!

SYS diped to bottom of channel. Correction in size is same as it was in 2018-2020 bear market so time to reverse and bounce up is here. Looking at weekly or even monthly timeframe we are in large range with contracting RSI extremes. As long as we bounce here I expect price to visit top of the range again.

Zorroreny

آیا تاریخ تکرار میشود؟ پیشبینی انفجاری قیمت SOUL پس از ریزش شبیه به ۲۰۲۰!

SOUL lost bottom support just like in 2020. We are now oversold and at RSI support line. If we are repeating history then we can expect strong bounce from here toward SMA50 to flip it into support and by this open path for impulse to new ATH.

Zorroreny

الگوی تکراری در بازار: آیا حرکت بعدی رمزارز REP شبیه ZEC خواهد بود؟

REP another Dino coin that started moving. We have seen the same pattern before - ZEC took long correction, finally flipped SMA50 into support, tested it again and then blasted up. REP also flipped SMA50 into support and now I am expecting one more pullback to test SMA50 again before blasting to fibb 0.886 range.

Zorroreny

تحلیل انفجار قیمت PIVX: آیا پامپ بزرگ در راه است؟

PIVX another from Dino coins that had long correction phase and is now showing signs of strength. Pattern is similar to ZEC before it broke out major diagonal resistance line. I expect same move from PIVX with initial push going to fibb 0.886 range where if we form support above 2.5-3.0$ we open path to higher targets.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.