FARTCOIN

Fartcoin

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 11/28/2025 |

Price Chart of Fartcoin

سود 3 Months :

سیگنالهای Fartcoin

Filter

Sort messages by

Trader Type

Time Frame

minno91

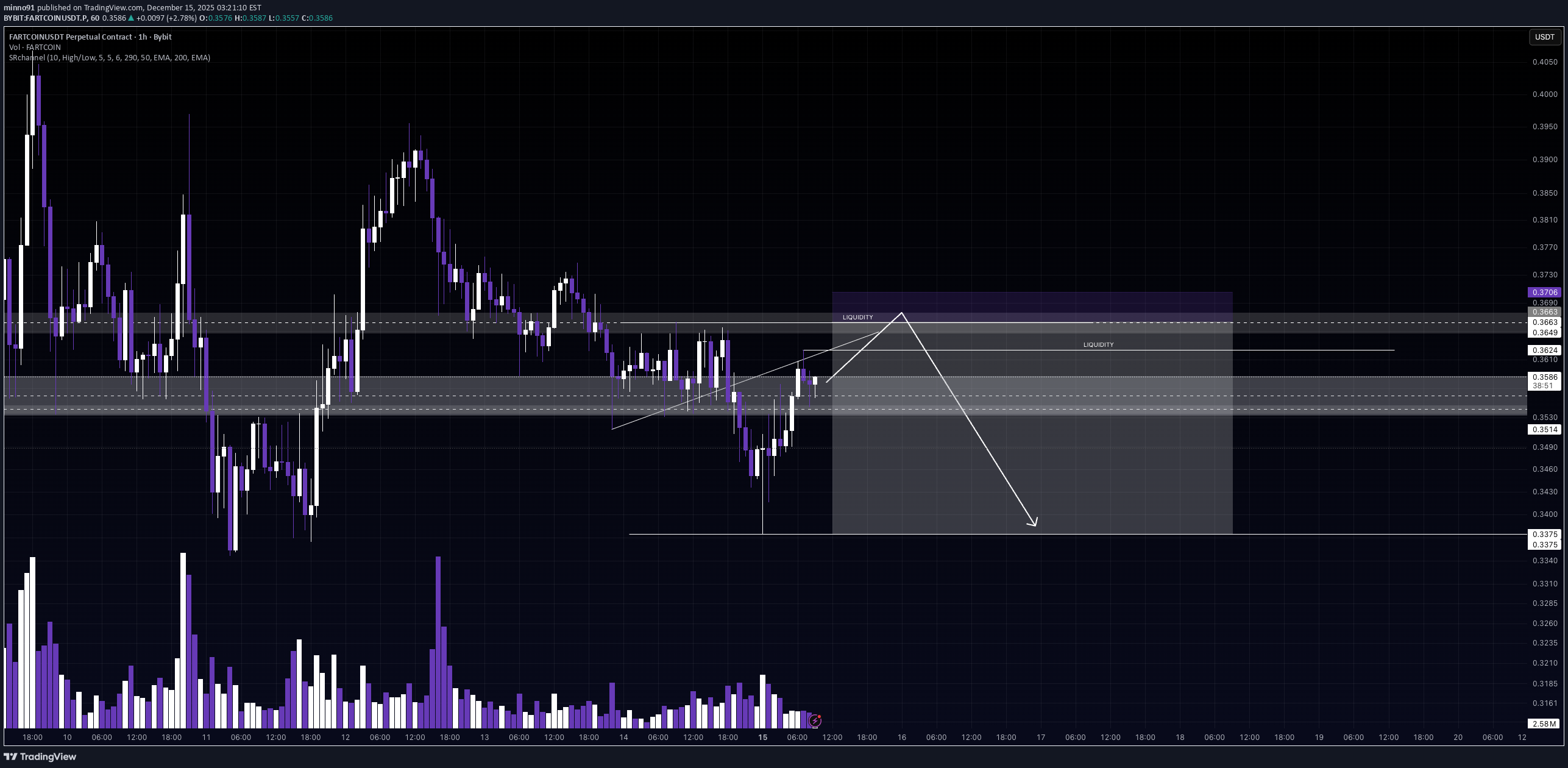

FARTCOIN - Down After a Liquidity Grab?

Alright traders, let’s see what kind of nonsense we’re dealing with today. BTC is still stuck in a range, no fresh macro, no big news, which usually means one thing: perfect conditions for a liquidity grab. And if BTC plays the “grab liquidity first” game, FARTCOIN is more than happy to follow. 😅 The idea here is simple: a little grab, a little fake move, a little “gotcha”… and then continuation to the downside, possibly stretching into tomorrow before new macro steps in. Is this guaranteed? Of course not. This is crypto. BUT… if this plan actually works, the risk-to-reward is spicy — almost 7:1, which is the kind of math we like. 😄 So yeah, just a plan, just an idea, just crypto doing crypto things. ⸻ 👉 Range conditions 👉 Liquidity grab potential 👉 Downside continuation idea Good luck traders — and may the fart fade gracefully this time 💨📉😄Slightly change of plan, let's keep this more realistic and stuck with range for this week... :)ok, we moved lower already, not sure if this is going to be happen, cancelling this trade

تأیید الگوی سقف دوگانه: زمان فروش (شورت) فرا رسید؟

fart has been interesting quite sometime, I'm opening Short position after double top confirmed. there is more than usual volume build up at these levels with high open interest. Let me know what you guys doing Long or Short

minno91

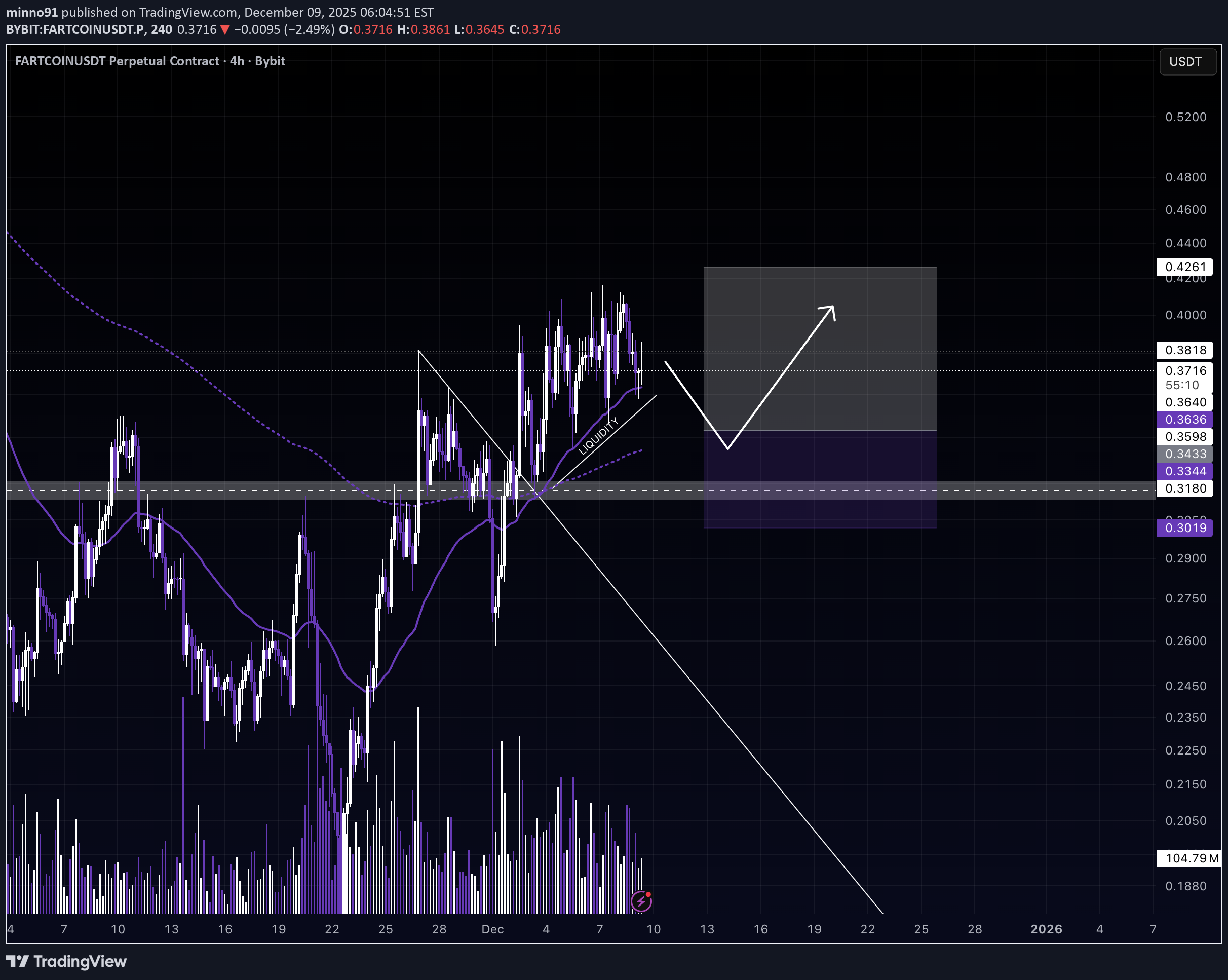

FARTCOIN – Liquidity Grab Hunter?

Alright traders, let’s give this a shot. FARTCOIN is sitting on a pile of liquidity underneath, we’ve got wicks on both the top AND bottom, which basically means one thing: 👉 Market makers are cooking something. With FOMC coming up tomorrow, we could easily see some classic liquidity grabs → fakeouts → stop hunts → emotional damage… and hopefully a move upwards after the chaos settles. But hey, this is FARTCOIN — anything can happen and nothing makes sense anyway. 😅 Let’s see how this plays out. Stay safe, protect your capital, and may your positions not evaporate faster than the coin’s name implies. 💨🚀

minno91

شوت سریع FARTCOIN: فرصت کوتاه اما خندهدار که نباید از دست بدهید!

Alright traders, gather around. This setup could disappear faster than an actual fart in your “special place.” One minute it’s there… next minute it’s gone. Classic FARTCOIN behavior. 😅 But hey — I’m still posting it because… why not? It looks decent, it looks funny, and honestly, it might even work. A quick little pop to the upside is possible — very low commitment, very high meme potential. Let’s see if this plays out before it fades into the blockchain forever. 💨😂

WaveRiders2

فارت کوین (Fartcoin): آیا این ارز دوباره سیگنال صعودی قدرتمندی است؟

Looks like we are having the same set up than end of March post tariffs market correction: - divergence on daily RSI - EMA cross The coin seem to have been dumped by Wintermute which doesn't appears as a token holder on Arkham. Different times but this might play out again. Gradual profit taking at 0.6 / 0.9 / 1.5trade still ongoing but well crypto price actions is not helping and it looks like we are having many sellers around 0.4. price compression can indicate an incoming strong move to comeout at 0.29 didnt play out. bearish EMA cross, scenario invalidated, no strength on the move upwards with 0.4 as strong resistance the crypto market is extremely weak at the moment inflation numbers in the US today can ease the pain, but risk management says to close the position now

VIPCryptoVault

فارتکوین: بازگشت ساختار کلیدی بازار و نقطه ورود طلایی خرید!

We are looking at a classic break of market structure. After a downtrend and a notable fakeout earlier, price action managed to break above. Unlike the previous fakeout, we are seeing constructive consolidation above the demand zone after breaking the descending resistance line. As long as price holds above the support zone ($0.3280 - 0.3500), the bias remains bullish. I'm definitely looking for a continuation of this momentum. I will take a buy when the price relief down to support zone to have a better R:R setup. This setup will be invalidated if price daily closes below $0.2470 Good Luck!All crypto market is dumping. Swing trading is not preferred really. Out.

iMoneyTeam

سیگنال خرید قوی FARTCOIN: فرصت لانگ در حمایت کلیدی (تحلیل 4 ساعته)

Considering the strong bullish CH and BOS, the liquidity formed below the pivots, and the creation of a QM pattern, we can look for buy/long positions in the zone below the liquidity, which overlaps with the QM level. Since the stop level is far, it is recommended to trade this setup on spot. The targets have been marked on the chart. A daily candle closing below the invalidation level will invalidate this analysis. Do not enter the position without capital management and stop setting Comment if you have any questions thank you

TuffyBro

تحلیل حرکت بعدی ارز FART: دو سناریوی صعودی در انتظار کدام است؟

🔍 Analysis & Breakdown (My View) Market is currently moving inside a rising wedge and building liquidity on both sides. I’m keeping a bullish bias because the structure still supports an upside continuation. I see two possible scenarios here: 📌 Scenario 1: Move from CMP Price can pump straight from the current level if it breaks the wedge top cleanly. If it gives a higher-high and retest, the continuation becomes very likely. 📌 Scenario 2: Pullback to Bullish OB → Then Pump (More Probable) This is the cleaner setup for me. There’s an unmitigated bullish order block below the wedge. All the liquidity sits under these wedge lows. If price dips into that OB, sweeps liquidity, and gives a bullish reaction — that’s my best entry. This is the cleaner Smart Money model: Price breaks wedge down Falls into the Bullish OB Sweeps liquidity Reversal + sharp move up Why this scenario is strong: OB is fresh Liquidity sits below wedge lows Perfect demand + liquidity combodidnt hold ob

pullbacksignal

سیگنال خرید فوری بیت کوین فارتکوین (FARTCOINUSDT): فرصت ورود به بازار با اهداف قیمتی مشخص!

Trading Setup: A Trading Signal is seen in the FARTCOINUSDT Fartcoin (1h) Traders can open their Buy Trades NOW ⬆️Buy now or Buy on 0.32 ⭕️SL @ 0.29 🔵TP1 @ 0.4 🔵TP2 @ 0.43 🔵TP3 @ 0.5 Previous signal What are these signals based on? Classical Technical Analysis Price Action Candlesticks Fibonacci RSI, Moving Average , Ichimoku , Bollinger Bands Risk Warning Trading Forex, CFDs, Crypto, Futures, and Stocks involve a risk of loss. Please consider carefully if such trading is appropriate for you. Past performance is not indicative of future results. If you liked our ideas, please support us with your likes 👍 and comments .

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.