SebastianofMoon

@t_SebastianofMoon

تریدر چه نمادی را توصیه به خرید کرده؟

سابقه خرید

تخمین بازدهی ماه به ماه تریدر

نمودار سیگنال های تریدر

معیارهای ارزیابی عملکرد تریدر

پیام های تریدر

فیلتر

نوع سیگنال

SebastianofMoon

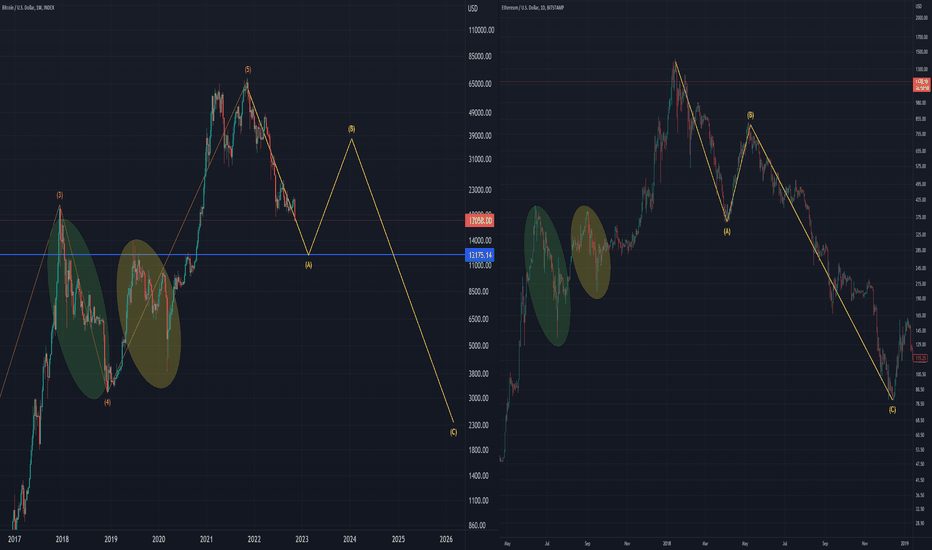

سلام ، مدتی است که من آخرین بار ارسال کردم ، اما فکر کردم وقت آن رسیده است که در 1-2 سال گذشته احساس را به اشتراک بگذارم. من فکر کرده ام که بالای بیت کوین در سال 2021 در صدر اولین Bitcoin Supercycle Grand Grand بود. یک موج تاریخی 5 در تصویر Eliott. در یک موج 5 ، تنها معدود شرکت کنندگان در بازار بیشتر دستاوردهای بازار را تشکیل می دهند. در سال 2021 ، برخلاف سال 2017/18 ، تنها درصد نسبتاً کمی از سکه ها شاهد دستاوردهای بزرگی بودند ، در حالی که اکثریت در واقع کاملاً ضعیف عمل می کردند. معمولی در یک موج 5.2. افزایش قیمت اما کاهش حجم. این باعث می شود من باور کنم که افزایش در سال 2023 شروع یک ضربه جدید نبود ، بلکه یک حرکت اصلاحی است. اقتصاد کلان: منحنی عملکرد به طرز ناخوشایندی معکوس است ، و یک وارونگی از نظر تاریخی هرگز چیز خوبی برای بازارهای سهام نبود. Bitcoin هنوز هم با بازار سهام ایالات متحده بسیار ارتباط دارد و بنابراین یک سقوط بزرگ در بورس ، همچنین Bitcoin به پایین می رود که اکثر مردم نمی توانند ، یا بهتر بگویند تصور نمی کنند .4. غرق غیر منطقی: در یک چرخه بازار تاریخی ، یک ارتباط باورنکردنی بین ارزیابی ها و واقعیت وجود دارد. من فکر می کنم تجمع بازار سهام سال گذشته به ما نشان داده است که این قطع ارتباط کاملاً مجنون است. در آنجا ، فقط چند سهام بزرگ اکثریت بزرگی از کل سود را تشکیل می دهند. سرخوشی مجنون در مورد نصف کردن ، ETF و غیره: سرخوشی بیش از حد ، که غالباً تاپ های محلی را نشان می دهد. ETF شروع به ایفای نقش کرد ، اما کاملاً آهسته ، و اثر نصف اکنون بسیار پایین تر از گذشته است. در کل ، فکر می کنم اکنون احتمال بیشتری وجود دارد که چنین چیزی اتفاق بیفتد. این مهم است که ببینیم این احتمالات در اینجا است ، اما شما می توانید نمودارهای من را از آنجا که من در سال 2014 شروع به ارسال کردم ، بررسی کنید ، و من همیشه یک Permabull بوده ام ، تا اوایل سال 2022. این زمانی است که من در بعضی از موارد شروع به تعویض Bearish کردم ، و علی رغم این آخرین حرکت ، من می گویم که این اتفاق می افتد ، فقط این است که من قبل از هر نقطه ای بیشتر از هر زمان که در اینجا وجود دارد ، می بینم. اگر چنین سناریوی افراطی اتفاق می افتد ، فقط در صورت تصادف در بورس اوراق بهادار. ما به پایین موج 4 می رفتیم ، بنابراین حدود 3000 دلار USD ، که البته اکنون مجنون به نظر می رسد ، اما بیش از 2-3 سال به نظر می رسد. پس از آن شاهد شروع یک سوپر چرخه جدید Bitcoin جدید هستیم که ما را به چند صد هزار دلار می رساند.

SebastianofMoon

XRP update: The pump WILL come. With or without SEC FUD. It's time to look again at good old XRP, the historically most brutal coin to hold, and it again does confirm its reputation. The price action of XRP has been really subpar compared to some other coins, that have already seen strong rises, in accordance to the rise of BTC to new all-time highs. This is of course largely due to the SEC vs Ripple case, and the subsequent delisting of XRP from american exchanges. However, I am convinced that XRP will see epic pumps, no matter what happens in the future with the SEC lawsuit. First of all, I am following the case and it looks as if either Ripple wins or settlement happens with a probability of close to 100%. The SEC are total clowns that have an extremely weak case, and actually they are now even under scrutiny for suspicion of corruption as a direct result. But chart-wise, what XRP is doing, is nothing new. This coin always was insanely stable in BTC runups, and then after everyone had given up, see insane short bursts of extreme rise in the matter of mere weeks. This is the modus operandi of that coin, and we all knew it would be hard to have XRP. Also, historically it was always one of the very last coins to pump in a bullmarket. Actually one could even say: When XRP has pumped, the bullmarket is over. Being the last coin to pump, this statement could be verified again pretty soon. I mistakenly thought that we would get a 2017 repeat. However, BTC is NOT doing a 2017 repeat, this rally is really different from 2017. It looks more like a weird version of 2013. So, why shouldn't the correct XRP behavior also lie as far back as 2013, which is relevant to our analysis? In 2013, we can actually see some fascinating stuff that happened. XRP made an insanely similar structure to what it is doing now ! I marked it with the two ellipses. First fake pump, then dump to a lower XRP/BTC ratio. Then from there pump, retrace, another smaller pump, and by that logic, we should soon see a dump, followed by an outrageous pump. Fascinatingly, this would coincide with a very likely BTC dump, before the epic pump towards the end of the year. I also expect the US dollar DXY to further weaken and further fuel the crypto rally. Everything is aligning nicely and XRP will be again one of the last coins to pump, but I still believe that the reward for all people that were insane enough to hold this coin through all that brutal time, will be extremely high.Comment: XRPBTC going down as expected. This will continue at first, should BTC now go directly towards new ATHs. Then suddenly, out of nowhere, XRPBTC will explode and pump straight without pause for 4-6 weeks. Let's see what BTC will do now. We are still not in the clear yet. I will start to get cautiously optimistic once we go over 53k.Comment: A nice triangle is forming in XRPBTC:Comment: We are in a really nice trendchannel here: I think breakout will happen soon.Comment: We could also see a fake brakeout to the downside in XRPBTC before the pump: also, I talk about XRP on my new youtube channel: youtu.be/e71GrTtVbQgComment: I see many people are panicking now because the lawsuit got extended. I think we will see a massive pump with or without the lawsuit. Remember: The only thing necessary for a coin to see massive pumps, is to not have sellers left any more. And in the case of XRP, there are only hardcore strong hodlers left. All weak hands have sold. So only buyers remain. Soon this wedge will end and we will see a strong pump:Comment: XRP is about to start a big move to the upside. Countdown has begun, I think about 1-2 more weeks, probably shortly before the Ripple Swell Conference:Comment: The triangle is still at play: I suppose breakout around the Ripple Swell conference on 9-10th of November.Comment: If XRPBTC breaks through this falling wedge to the upside, we could see a nice rally:Comment: This is my current view: Nice falling wedge in play, breakout probably in March or April. It would fit nicely with the expected end of the SEC lawsuit. Target: Sounds insane, yes, but I really think it will play out that way. XRP has been brutal, but normally, the more brutal, the higher the reward.Comment: It's been a while since the last update, and XRP has disappointed us all. It appears that indeed, the obvious is happening: XRP will ONLY pump, if the SEC lawsuit is resolved, and by that I mean resolved FAVORABLY to Ripple. The markets have become spectacularly obvious, meaning that it's really happening what everybody is thinking. Also, extremely worryingly, BTC is now super correlated to the stock market, which in these times is not so nice of course. So, I see XRP only pumping when lawsuit is over, and then BTC goes into the next cycle. But this will depend on the current stock market, and how long this bearmarket will last. So in short:Comment: So now lawsuit over, but where is the big pump? Well, I think that the big pump can only occur, if Bitcoin pumps. Bitcoin needs to go to 40k and more, then yes, XRP can go higher. But 20 USD and more? Only if Bitcoin makes new alltime highs, I'm afraid. There simply is not enough liquidity in the market yet, and so we have to see what Bitcoin will do. If Bitcoin dumps, then so will XRP, despite this whole thing.

SebastianofMoon

بنابراین XRP در رالی 2021 ناامید شد، اما در آینده، مثل همیشه، یکی میتوانست انتظارش را داشته باشد. لعنت به گذشته :) به نظر می رسد که XRPUSD در حال تشکیل یک مگا گوه غول پیکر چند ساله است، مشابه اولین مگا گوه 2013-2017، این دومین خواهد بود. یک از 2018-2024، بنابراین 2 سال بیشتر از یک اول. البته جهت شکست به موارد زیر بستگی دارد: 1. نتیجه گیری از پرونده SEC 2. جهتی که BTC در پیش خواهد گرفت بنابراین اگر SEC برای Ripple به خوبی حل شود و BTC در چرخه 2024/25 بالاترین رکوردهای جدید ایجاد کند، بله ، XRP به ارزشهای خوب حداقل 10 دلار خواهد رسید. اگر SEC برای پمپهای ریپل و BTC بهخوبی حل میشود، انتظار قیمتهای هدف بسیار پایینتری را داشته باشید. اگر SEC برای تخلیه های ریپل و BTC به خوبی حل شود، قیمت های هدف نیز بسیار پایین تر خواهد بود. بدترین حالت مسلماً تخلیه BTC است، بنابراین در سال 2024 تجمعی وجود ندارد و آنها نیز این پرونده را از دست می دهند. سپس انتظار داشته باشید که این مگا گوه به سمت پایین بشکند. بنابراین ما می توانیم ببینیم، همه چیز به مورد SEC و BTC بستگی دارد. اما خرید اگر BTC به سطوح ATH در سال 2024 برود منطقی خواهد بود، زیرا ریسک/پاداش قابل پرداخت است. خوب بدترین چیزی که در آن زمان ممکن است اتفاق بیفتد این است که اگر کیس را گم کنند، فقط کمی پمپ می شود. بنابراین این برنامه بلند مدت برای XRP است. یک سکه واقعاً بی رحمانه، احتمالاً بیمعنیترین سکه که میتوان آن را برای مدت طولانی نگه داشت. اما پاداش ریسک در سال 2024 و بعداً اگر همه چیز خوب پیش برود، می تواند زیاد باشد. نظر: من اکنون این دو احتمال را می بینیم: بسته به کاری که بیت کوین قرار است انجام دهد. من نزولی را کمی محتملتر میبینم، اما این کاملاً به بیت کوین و در نتیجه به بازار سهام و محیط کلی اقتصاد کلان بستگی دارد.

SebastianofMoon

وقت آن است که کانال روند بلندمدت بیت کوین را بهروزرسانی کنیم. اساساً همه کانالهای رشد لگاریتمی Bitcoin بسیار خوشبینانه بودند. بیت کوین بسیار کندتر از اکثر مردم دوست دارند، اما این فقط واقعیت است و ما باید بر این اساس انتظار اهداف بسیار پایین تری را در آینده داشته باشید. اگر این روند ادامه پیدا کند، و این یک اگر بزرگ است، میتوان انتظار داشت حدود 130 تا 150 هزار دلار به عنوان هدف بیتکوین< /a> در اوایل تا اواخر سال 2025. من مدت زمانی را که طول کشید تا BTC بعد از هر نصف شدن به اوج برسد، ترسیم کردم، و همیشه همینطور بود در بازه زمانی از 300 چیزی تا 500 چیزی روز. رالی 2021 عجیب بود زیرا نوعی قله دوگانه وجود دارد، بنابراین بستگی دارد که ما چه چیزی را به عنوان قله ببینیم. اما ما باید با اهداف عجیب و غریب صدها هزار ایمهو خداحافظی کنیم. 130-150k در سال 2025 چیزی است که ما به طور واقع بینانه به دست می آوریم، با شانس فراوان 180k، اما من فکر می کنم که در حال حاضر چنین خواهد بود. یک هدف بسیار عالی بهتر است در سمت محافظه کار باشید. در سال 2021، BTC تنها توانست 3 برابر بالاتر از قبل پیش رود، و به نظر می رسد که این نسبت در حال کاهش است، بنابراین 2 برابر نسبت به سال 2021 چندان بدبینانه به نظر نمی رسد. مشکل این است که پذیرش بسیار کندتر از آن چیزی است که هر کسی انتظار داشت. ما فقط باید به تراکنش های روزانه و تعداد کیف پول های منحصر به فرد استفاده شده نگاه کنیم: این نمودارها نسبت به اکثر افراد بسیار کندتر رشد می کنند. الف> باور می کرد البته، لطفاً به خاطر داشته باشید که اگر بازار سهام به شدت سقوط کند، این سناریو در اینجا اتفاق نخواهد افتاد، زیرا در این صورت را می کشد. بیت کوین به ورطه فرود آمد. این سناریو در اینجا تنها زمانی می تواند اتفاق بیفتد که سهام ثابت بماند و در بدترین حالت به سمت پایین حرکت کند. و من نمی دانم چنین سناریویی با تورم بسیار بالا + منحنی بازده معکوس فوق العاده چقدر واقعی است. زمانهای بسیار نامشخص، و این اولین بار در تاریخ است که من فقط 50 تا 70 درصد شانس یک بیتکوین جدید را میبینم. چرخه حتی رخ می دهد. اما اگر این اتفاق بیفتد، ما باید با اهداف قیمتی بسیار پایینتری نسبت به آنچه بیشتر افراد میخواستند زندگی کنیم.

SebastianofMoon

این الان واقعا بد به نظر می رسد. من فکر میکردم که وارد یک الگوی انباشت Wyckoff میشویم، اما ضعف مداوم بیتکوین باعث میشود از بدترین سناریو بترسم. هنوز زمان وجود دارد و ما میتوانیم برای الگوی Wyckoff خوش شانس باشیم، اما اگر BTC واقعاً کمتر شود، به احتمال زیاد از منطقه 12k بازدید خواهیم کرد. سپس بسیاری از مردم فکر میکنند: سکههای عالی و ارزان! این عالی است! من سکههای ارزان قیمت خواهم خرید و سپس بیتکوین پس از نصف شدن بعدی به بالاترین سطح تاریخ خواهد رسید. اما صبر کن! از منظر فنی، اگر بیت کوین واقعاً بسیار پایین بیاید، این واقعاً بد است. این اساساً تمام سطوح پشتیبانی مهم را می شکند، و این بدان معنی است که کل اجرای از 2010 تا 2022، یک سازه الیوت 5 موجی تکمیل شده است. و این بدان معنی است که ما یک تصحیح ABC عظیم دریافت خواهیم کرد، که در آن موج A به 12k می رود، و در نتیجه موج C بسیار پایین تر، به حدود 2k می رود. دیوانه کننده به نظر می رسد، اما این چیزی است که از منظر فنی اتفاق می افتد. موج B به حدود 40 هزار خواهد رسید و مردم دوباره واقعاً خوشبین خواهند بود، ما شاهد تعداد زیادی " CCMF" و چشم های لیزری، و غیره، اما در واقعیت این فقط یک جهش خواهد بود. و این همچنین برای زمانی که فکر میکنم رکود واقعی رخ خواهد داد همزمان است: به طور معمول حدود 6-12 ماه پس از چرخش FED شروع میشود. انتظار می رود FED در سه ماهه اول 2023 چرخش کند. بنابراین، ما شاهد شروع بازار پایین واقعی در اوایل سال 2024 خواهیم بود. این به نوبه خود به این معنی است که یک رکورد جدید برای بیت کوین نصف شدن. بله، مطمئناً، برخی از سکه ها این کار را می کنند به خوبی پمپاژ کنید، اما ما نمیتوانیم فاز شیدایی فوق العاده را که بسیاری از سکهها دیوانهوار پمپاژ میکنند، دریافت نکنیم. در سمت راست ETHUSD را کشیدم که چند سال پیش کاری مشابه انجام داد. ساختار بسیار شبیه است، و من فکر می کنم که این کاری است که BTC انجام می دهد. اما البته هنوز امیدوارم که ایده قبلی من درست باشد، الگوی انباشت Wyckoff. سپس به زودی شاهد جهش به 25k و فنر نهایی در حدود 16k خواهیم بود. بیایید به آن سناریو امیدوار باشیم، زیرا سناریوی 12k به معنای چند سال بازار بی رحمانه خواهد بود.

سلب مسئولیت

هر محتوا و مطالب مندرج در سایت و کانالهای رسمی ارتباطی سهمتو، جمعبندی نظرات و تحلیلهای شخصی و غیر تعهد آور بوده و هیچگونه توصیهای مبنی بر خرید، فروش، ورود و یا خروج از بازار بورس و ارز دیجیتال نمی باشد. همچنین کلیه اخبار و تحلیلهای مندرج در سایت و کانالها، صرفا بازنشر اطلاعات از منابع رسمی و غیر رسمی داخلی و خارجی است و بدیهی است استفاده کنندگان محتوای مذکور، مسئول پیگیری و حصول اطمینان از اصالت و درستی مطالب هستند. از این رو ضمن سلب مسئولیت اعلام میدارد مسئولیت هرنوع تصمیم گیری و اقدام و سود و زیان احتمالی در بازار سرمایه و ارز دیجیتال، با شخص معامله گر است.