EXCAVO

@t_EXCAVO

تریدر چه نمادی را توصیه به خرید کرده؟

سابقه خرید

تخمین بازدهی ماه به ماه تریدر

پیام های تریدر

فیلتر

نوع پیام

EXCAVO

What I Expect from 2026

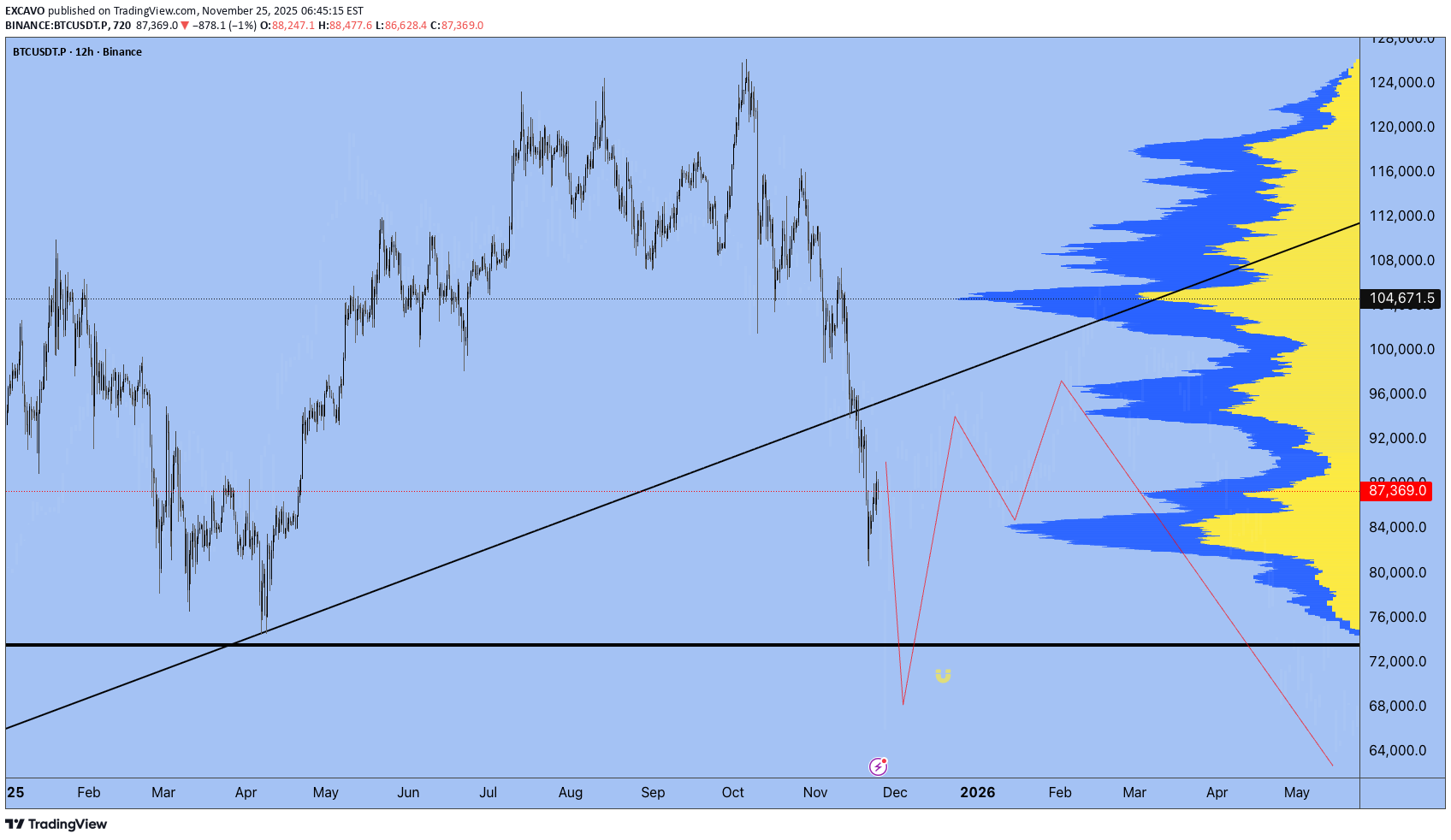

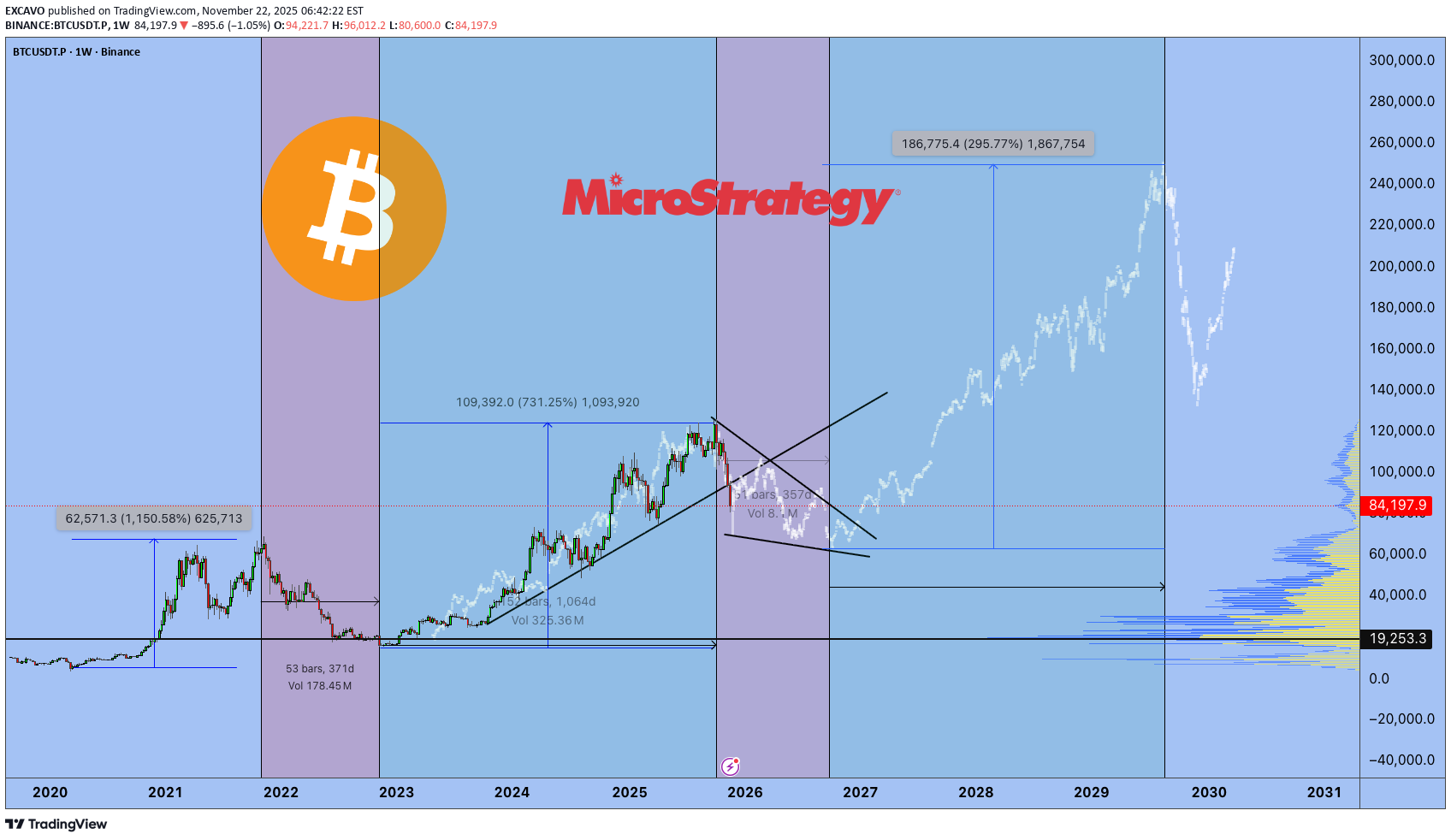

Scenarios • Markets • Levels • Positioning First of all, I want to thank everyone for the activity under my previous post . More than 300 likes are not just numbers to me — they show that you read, think, and ask the right questions. These are exactly the people who motivate me to keep sharing my perspective. I don’t write for algorithms. I write for those who want real results and understand that results come through process, discipline, and the right environment. This text is not about fast growth or guessing the bottom. It is about patience, structure, and working during moments of maximum pain. In 2026, the market will be selective: opportunities will become fewer, and the cost of mistakes will be higher. This is exactly when an advantage is built — by those who can wait and work systematically, not alone. ___________________________________________ Context and Philosophy of 2026 2026 is a year of reassessment and awareness. A year when the market stops rewarding haste and illusions. We are in a bearish phase, and according to my calculations, it will likely last almost until the end of the year. This is not a time for emotions or hope — it is a time for learning and preparing for the next cycle. It’s important to accept a simple truth: the market does not owe you opportunities every day. No trade is also a position. I’ve been in financial markets since 2009 and in crypto since 2016. I’ve seen how every cycle looks different but ends the same way — disappointment and denial. That is exactly where the market pushes the majority in 2026. ___________________________________________ What Really Happened in 2025 2025 became the year of maximum institutional involvement. ETFs, derivatives, structured products, and complex instruments fully integrated crypto into the global financial system. And the global financial market is: - highly competitive - professional - cold and calculated This is not a place for belief — this is where capital positions, hedges, and extracts liquidity. Crypto remains a young industry, but it is already playing by adult rules. Many failed to understand this — and paid for it. ___________________________________________ The Main Mistake Most Will Make in 2026 Two things: 1. Believing in a quick reversal 2. Increasing risk in an attempt to “win it back” Hope is the most expensive emotion in the market. The market does not pay for hope — it pays for timing, structure, and execution. Most people will leave not because the market is “bad,” but because they will break psychologically. I’ve seen it many times: different cycles, different faces — the same mistakes. If you stay in the market, you must relearn it every cycle. ___________________________________________ Macro Environment and Market Conditions Key factors I’m watching: - interest rates - regulation - capital flow direction - narratives that attract new liquidity Regulation is neither an enemy nor a savior — it is reality. Licenses, requirements, and rules are shaping a market that is becoming part of the global financial system. 2026 is a year of redistribution and accumulation, not growth. Liquidity is fragmented. There are too many projects, too many tokens, and not enough capital for everyone. Stablecoins are growing, but still not enough to “feed” the entire market. ___________________________________________ Altcoins in 2026: My View My position is strict and honest: Most altcoins face collapse, cleansing, and increased regulatory pressure. The reasons are clear: - an excessive number of tokens - fragmented attention - constant unlock pressure - funds sitting in long-term profit - lack of sustainable economics There will be exceptions — but they will be rare. Paradoxically, memecoins (despite my skepticism) did one useful thing: they forced people to learn on-chain analysis, search for inefficiencies, and track capital flows. What remains structurally alive RWA (tokenized real-world assets) infrastructure DeFi v2 as an alternative to the traditional system At the same time, we must be honest: potential returns in altcoins are structurally declining compared to previous cycles. ___________________________________________ Bitcoin — Base Scenario for 2026 and Key Levels My base scenario is continued pressure and bottom formation. Capitulation will affect: - traders - investors - miners - funds - large corporations The market will be cleansed of large holders. This process is always painful — and always necessary. Key ranges - base: 48,000 – 74,000 - extreme zones: 38,000 – 46,000 My operating logic - the first meaningful accumulation zone is around 64k - limit orders are placed lower - buying only during moments of panic - no rush, no emotions There is an old saying: “ We enter the market when there is blood in the streets .” This is not drama — this is how asymmetric advantage is built. Short squeezes are possible, but they will be short-lived. Markets do not trend higher on disappointment. In my view, the final deep phase of this cycle and the shift toward early bullish conditions align closer to September 2026. ___________________________________________ Other Markets and Diversification One of the biggest mistakes crypto traders make is thinking the world ends with crypto. Blockchain is infrastructure — not the entire market. That’s why in 2026 I diversify across: - gold - oil - indices - stocks - and only very selectively crypto assets Other markets are: - more liquid - more structured - often cleaner in execution S&P 500 So far there are no clear reversal signals, but after new highs I expect correction or stagnation. The reasons are obvious: the AI bubble, debt pressure, and liquidity concentration. Gold A historical safe haven. The trend remains intact. My long-term target is $6,000 ± $1,000. DXY Weakening is possible, but the dollar is likely to maintain dominance due to digitization and global settlement demand. Oil One of my key instruments. Expensive oil is not beneficial for the US, and I see no strong reasons for sustainably high prices in the short term. ___________________________________________ Narratives Beyond Crypto The world is reaching the limits of energy supply. Energy is becoming a strategic advantage. Those who produce electricity efficiently will be in a strong position. Alternative energy sources and the entire energy chain will play a key role. AI is not just hype. AI will drive breakthroughs in medicine, energy, data analysis, and financial markets. Global instability is no longer a forecast — it is a condition. We are moving toward a reset of global processes and agreements. ___________________________________________ My Trading Approach in 2026 - more cash - short-biased trading when structure allows - only selective entries - waiting for panic - minimized risk If there is no setup - there is no trade. That is discipline. And one more thing: if you are tired - rest. The market will not disappear. Your capital and your mindset are your main assets. ___________________________________________ Personal Commitment and Community In 2026, I will relaunch the Academy and deeply integrate AI tools. For members of my community, the Academy will be free under specific conditions. Discipline is not motivation. Discipline is the ability to follow a plan regardless of emotions. Growth is slow alone. It is faster in the right environment. I am building a strong trading community where: - thinking evolves - on-chain capital flows are analyzed - portfolios with limit orders are structured - experience is shared, not illusions Some of these portfolios have already started activating, and one position is around +15%. This is not luck — this is systematic work. ___________________________________________ One Honest Question Ask yourself honestly: Are you here to prove something to the market — or to achieve a sustainable result? Because results only come through self-study, discipline, and a repeatable process. ___________________________________________ Final Thoughts Markets reward preparation, not urgency. Give the market time. Give the system time. If you are still here in 2026 — you are already ahead of most. The main task is simple: stay in the game. Build positions when it hurts. Grow when it is quiet. Best regards EXCAVO

EXCAVO

Bull Market 2023–2025: Final Results (27.12.25)

Public history, responsibility, and the environment without which you don’t belong in the market First of all, I want to thank TradingView In 2025, I received the WIZARD badge. This is not just a label — it is recognition of my contribution as an active member of the TradingView Community. For me, this matters not because of status, but because of responsibility. This badge means I have the ability to propose changes and improvements to the platform, and some of these proposals have already been implemented. I’m genuinely glad to be one of those community members who helps make TradingView better for everyone. Why TradingView is about responsibility, not social media I have been an active member of the TradingView Community for a long time, and I strongly believe this platform is fundamentally different from any other financial media space. First — the chart as the core tool of analytical thinking. Second — publications and the Play button, which lock ideas in time. Third — and most important — the impossibility of deleting published ideas. Fourth - indicators You cannot rewrite history here. You cannot erase mistakes. You cannot hide behind “the context has changed.” That is why I approach every single publication on TradingView with full responsibility. Why there is no noise or random content here I do not use TradingView the way many people use Twitter or Telegram. There are no: emotional reactions random thoughts posts made for reach or hype As of December 2025, my audience consists of 132,000 followers, and I fully understand the responsibility that comes with that. Yes, every publication is not financial advice. But for myself, I set a clear internal rule: every idea must be logical, verifiable, and honest. Why the timeline starts in 2023 I intentionally start this review from 2023 because that is when the bottom of the previous cycle was forming. At the time, it was not obvious to the majority of the market: - fear was at its peak - trust was minimal - negative narratives dominated I’ve been in the market for a long time and have lived through multiple full cycles. This Bitcoin cycle was my third, and I consider it the most professionally executed one so far. Each cycle is different: - different narratives - different audiences - different speed But market logic and crowd psychology repeat. Publications that cannot be adjusted after the fact Back in late 2022, an idea was published: Bitcoin cycles + logistic curve = New bull run 2023–2025. This was done before the move, not after. Every marker you see on this chart represents a public idea published in real time on TradingView. It’s important to highlight: - all key ideas were LONG - there were no public SHORT ideas during the bull phase Why? Because in a true bull market, speculating against the trend makes no sense. The upside potential always outweighs the logic of catching small pullbacks. Timing and the end of the cycle If you open each publication, you’ll see: - market phases - time-based expectations - structural projections On most higher-timeframe ideas, the end of the bull market was publicly marked in red. My key time reference was stated in advance — September 2025. September 2025: when most still believed in continuation Starting in September 2025, while market euphoria was still present, I began publishing ideas stating that: - the bull market was over - positions were closed - Bitcoin was forming a reversal - the market was entering a bull trap phase - you were warned in advance These ideas were based not on emotions, but on market structure, cycles, and psychology. Experience, no FOMO, and a mature position After years in the market, I have zero FOMO. I don’t worry about: - missing a coin - missing a narrative - not participating in every move The market is: - fast - volatile - heavily manipulated You cannot be everywhere. The core task of the market is simple: buy low — sell high. That’s exactly what I’ve been doing for over 12 years, with more than 10,000 hours spent in the market. The reality of the modern market Today’s market consists of: - funds - corporations - algorithms - quantitative strategies On lower timeframes and chaotic moves, retail traders are simply outmatched. The gap between emotional decision-makers and those who operate with structure, data, and discipline will only continue to widen. If you are in the market — you must be in the environment Here I’ll be as direct as possible. If you are in financial markets, if you plan to continue trading, if you want to survive and adapt — you must be part of a strong community. A lone trader in today’s market is easy prey. Over the years, a community of like-minded traders has formed around me — people who: approach the market systematically - discuss scenarios - analyze entries and exits - stay connected during difficult periods I share my public ideas for free, and that remains a core principle. But if you truly intend to stay in this market, you need an environment, feedback, and shared logic. What you do next is your decision. Trading is a marathon Trading is not a sprint. It’s a marathon. Sometimes the best position is no position. Sometimes the best trade is the one you didn’t take. Patience, waiting, and discipline are skills — without them, you don’t belong in this market. The current moment and what’s ahead At the moment, crypto is in a phase where I take very few trades. Some positions are already open — at predefined levels, within a structured risk framework. I’m not leaving financial markets: - crypto - Forex - equities - tokenized assets - gold - oil Instruments change. Principles don’t. In conclusion If this chart receives 300 likes, I will publish a separate post outlining: - goals - scenarios - positioning for 2026. Wishing everyone clarity, discipline, and a cold mind. May 2026 be better than 2025. And may there be peace on our planet. Yours, EXCAVO

EXCAVO

اهداف بیت کوین ۲۰۲۵: توهم یا واقعیت؟ حقیقت تلخ پیشبینیها

پیش بینی آسان است. حق با hard است. 1. زمانی که اهداف به توهم تبدیل می شوند به این نمودار نگاه کنید. Bitcoin در 90000 دلار. شانزده روز تا سال 2025 باقی مانده است. و هر هدف "متخصص" - JPMorgan، VanEck، Standard Chartered، Tom Lee، Kiyosaki، BlackRock، Cathie Wood - همه آنها را از دست دادند. تک تک. چرا؟ زیرا زمانی که مالک داراییای هستید که پیشبینی میکنید، هدف ماندن تقریباً غیرممکن است. وقتی موقعیتی را حفظ می کنید، ذهن شما بی نهایت را ترسیم می کند. شما دیگر بازار را نمی بینید - شروع به دیدن امیدهای خود می کنید. شما تجزیه و تحلیل را متوقف می کنید - شروع به باور می کنید. این اهداف قیمتی هرگز پیش بینی نشده بودند. آنها خیالبافی بودند و لباس تحلیل می پوشیدند. 2. موقعیت من - سالم بمانید در پستهایم، همیشه سعی میکنم عینی و ثابت بمانم. من احساسات را معامله نمی کنم. من آنچه را که واقعاً می بینم، مشاهده می کنم، تجزیه و تحلیل می کنم و به اشتراک می گذارم - نه آنچه را که می ببینم. و این چیزی است که اکنون می بینم: آن اهداف صعودی ممکن است هنوز یک روز به دست آیند - اما نه تا پایان سال 2025. نه حتی تا پایان سال 2026. طبق تجزیه و تحلیل چرخه من، اوج بعدی بازار گاوی واقعی در حدود سال 2029 بود. و حتی پس از آن، نامگذاری یک عدد دقیق hard است. اما اگر تاریخ تکرار شود - و هر چرخه جدید چرخه قبلی را دو برابر کند - سپس سطوحی مانند 250 هزار دلار، 275 هزار دلار یا حتی 300 هزار دلار امکان پذیر است. با این حال، حتی این کلمات را باید زیر سوال برد. زیرا بازار یک درس ثابت دارد - فروتنی. و کسانی که اعتماد به نفس بیشتری دارند معمولا اولین کسانی هستند که اشتباه می کنند. 3. چرا Bitcoin به هر حال به رشد خود ادامه داد با وجود همه هرج و مرج و عدم اطمینان، یک چیز روشن است: Bitcoin در دراز مدت به رشد خود ادامه داد. دلایل ساختاری هستند، نه احساسی: دشواری استخراج مدام در حال افزایش است، رقابت بین ماینرها در حال افزایش است، صنعت در حال گسترش است، علاقه نهادی در حال رشد است، عرضه در گردش در حال کاهش است، بازار در حال تبدیل شدن به تمرکز، اهرمی و نوسان بیشتر است. ما شاهد حرکاتی هستیم که چند سال پیش غیرقابل تصور بود. یک نوسان روزانه 20000 دلاری دیگر شوکه کننده نیست - این یک امر عادی جدید است. فقط به 11 اکتبر نگاه کنید - Bitcoin 20000 دلار در یک روز کاهش یافت. این یک رکورد است. و دوباره شکسته شد. چون بازی مدام در حال افزایش است. Bitcoin نمی میرد. بر خلاف هزاران آلتکوین که در معرض فراموشی قرار می گیرند، Bitcoin بازیکنان زیادی دارد، سرمایه زیادی دارد، جاذبه زیادی برای ناپدید شدن دارد. 4. جایی که ما اکنون هستیم بیایید صادق باشیم - ما حتی نیمی از این بازار نزولی را طی نکرده ایم. حتی نزدیک نیست. شاید 20 درصد از راه. درد واقعی هنوز در پیش است - ناامیدی، تسلیم شدن، و خستگی. و نه تنها در میان خرده فروشان. صندوقها، ماینرها، شرکتها - همه آنها با آن مواجه شد. هر چرخه ای حداکثر رد را می طلبد. نیاز به تسلیم شدن جمعیت دارد. به این ترتیب بازارها دوباره تنظیم می شوند. بازارهای نزولی سقوط نیستند - آنها آهسته هستند و کاهش امید را از بین می برند. آنها ابتدا سرمایه را از بین نمی برند - آنها اعتقاد را از بین می برند. 5. استعاره دوچرخه اگر قصد دارید تا آخر عمر در این بازار بمانید، من شما را با مردی که در سراشیبی دوچرخه سواری می کند مقایسه می کنم. به خودش می گوید: "بله، من پایین می روم، اما به پدال زدن ادامه می دهم. وقتی دیگران کنار رفتند، من جلوتر بود.» اما حقیقت این است - وقتی به پایین رسید و سربالایی بعدی آغاز می شود او قدرتی برای صعود داشت. او از بین رفت - از نظر روحی، مالی، عاطفی. او آن را به کوه بعدی رساند. 6. اکنون چه اتفاقی می افتد در حال حاضر، ما در مرحله اصلاح هستیم. انگیزه move تمام شده است. جهش های کوچکی که می بینید - آنها یک معکوس نیستند، فقط تسکین موقت قبل از پای بعدی. این شروع یک بازار صعودی جدید نیست - این یک مکث بین کاهش است. راه اندازی کلان هنوز از رشد پشتیبانی نمی کند. ساختار آنجا نیست بازار به سادگی آماده نیست. هر چرخه ای سنگین تر می شود. هر کدام درد بیشتر، زمان بیشتر، پاکسازی بیشتر می خواهند_. 7. خط پایین توهم ندارم هیچ خیالی در مورد رالی های فوری تا 300 هزار دلار وجود ندارد. فقط واقع گرایی و صبر. بازار خودش را مرتب کرد. اما تا زمانی که گاو نر واقعی بعدی شروع شود، بسیاری از کسانی که هنوز در حال "پدال زدن در سراشیبی" هستند انرژی - یا ایمان - برای صعود دوباره را داشت. با احترام، EXCAVO

EXCAVO

The Real Bitcoin Bottom: It’s in the Power Bill

The Cost of Mining 1 BTC – Autumn 2025 Deep Dive First of all, I want to say that I already made a similar publication in 2020 about the cost of Bitcoin, and we reached these levels (the chart is below). Introduction: The Bitcoin mining industry in Autumn 2025 stands at a crossroads. Network difficulty has soared to all-time highs, squeezing miner profit margins as hashpower races ahead of price. The hashprice – the daily revenue per unit of hashing power – has slumped to record lows around $54 per PH/s-day (down from ~$70 a year ago). Analysts expect this metric to languish between $50 and $32 until the next halving in 2028, underscoring how challenging the economics have become. In this environment, understanding the cost to mine 1 Bitcoin is more crucial than ever. Below, we present a detailed comparison of popular ASIC miners and analyze which rigs remain profitable (or not) at current prices. We’ll also explore how the cost of production acts like a magnetic price level for BTC – often drawing the market down to this “floor” before a rebound – and what that means for investors now. Cost to Mine 1 BTC by ASIC Miner Model (at $0.03–$0.10/kWh) To quantify Bitcoin’s production cost, we compare leading ASIC miners from Bitmain, MicroBT, Canaan, Bitdeer, and Block. Table 1 below shows key specs and the estimated cost to mine one BTC under different electricity prices (from very cheap $0.03/kWh to pricey $0.10/kWh): Key Takeaways: Electricity price is the dominant factor in mining cost. At an ultra-cheap $0.03/kWh (possible in regions with subsidized power or stranded energy), even older-generation miners can produce BTC for well under $30k per coin. In our table, all models have a cost per BTC between ~$21k and $27k at $0.03/kWh – a fraction of Bitcoin’s current ~$90k–$95k market price. At a mid-tier rate of $0.05/kWh (typical for industrial miners in energy-rich areas), the top machines still show healthy margins. Bitmain’s flagship S21 XP leads with roughly $36k cost per BTC, while other new-gen rigs fall in the ~$39k–$45k range. These figures imply profit margins of 50–60% for efficient miners at $0.05 power. At a pricey $0.10/kWh (common for retail electricity or high-tariff regions), mining costs skyrocket. Only the very latest ASIC (S21 XP) stays comfortably below the current BTC price, at around $72k per coin. Most other models hover in the $78k–$90k range, meaning their operators are earning little to no profit at spot prices. In fact, at $0.10/kWh, a miner like the Avalon A15 Pro would spend about $89k to generate one BTC – essentially breakeven with Bitcoin at ~$90k. This illustrates why high-power-cost miners struggle or shut off during downturns. Profitable vs. Unprofitable: Current Market Reality Which miners are still profitable at today’s rates? Given Bitcoin’s price in the low $90,000s and typical industrial electricity around $0.05–$0.07/kWh, the newest generation ASICs remain comfortably profitable, while older, less efficient models are on the edge. For example: Latest-gen winners: The Bitmain S21 XP – with industry-best ~13.5 J/TH efficiency – can mine a coin for roughly $36k at $0.05/kWh, leaving a huge cushion against price. Even at $0.07/kWh (a common hosting rate), its cost per BTC would be on the order of ~$50k, still well below market price. Other 2024–2025 flagship units (Whatsminer M60S++, Bitdeer A2 Pro, Block’s Proto) likewise have breakeven power costs around $0.12–0.13/kWh; they remain viable in most regions except the very expensive ones. Older-gen on the brink: By contrast, an earlier-gen workhorse like the Antminer S19 XP ( ~21.5 J/TH) or similarly efficient rigs from 2021–2022 generation become marginal at moderate power rates. An S19 XP mining at $0.08/kWh sees its cost per BTC climb to roughly ~$94k (near current price), and at $0.10 it exceeds $110k (mining at a loss). Many such units are only profitable in locales with <$0.05 power. This is why we’ve seen miners with older fleets either upgrade or retire hardware as the margin for profitability narrows. The efficiency gap: The spread between best-in-class and older miners translates directly into survivability. A miner burning 30–40 J/TH can only stay online if they have extremely cheap electricity or if BTC’s price is far above average production cost. As of Q4 2025, Bitcoin’s price is indeed high, but so is the network difficulty – meaning inefficient gear yields so little BTC that electricity costs outweigh revenue in many cases. According to one industry report, the cost of mining 1 BTC varies widely across companies – from as low as ~$14.4k for those with exceptional power contracts (e.g. TeraWulf’s U.S. facilities) to as high as ~$65.9k for others like Riot Platforms, even before accounting for overhead. (Riot’s effective cost was brought down to ~$49.5k after cost-cutting measures.) This huge range shows how electricity pricing and efficiency determine which miners thrive. In early 2025, the situation became so extreme that CoinShares analysts found the average all-in production cost for public mining companies spiked to ~$82,000 per coin – nearly double the prior quarter (post-halving impact) – and up to $137,000 for smaller operators ixbt.com . At that time Bitcoin was trading around $94k, meaning many miners, especially smaller ones, were underwater and operating at a loss. In high-cost regions like Germany, the breakeven cost even hit an absurd ~$200k per BTC, making mining there utterly unviable. Bottom line: At current prices, only miners with efficient rigs and reasonably cheap power are making money. Those with older equipment or expensive electricity have minimal margins or are already in the red. This dynamic naturally leads to miners shutting off machines that don’t profit, which in turn caps the network hashrate growth until either price rises or difficulty drops. It’s a self-correcting mechanism – one that ties directly into Bitcoin’s production cost acting as a market floor. Production Cost as Bitcoin’s “Magnetic” Price Level There’s a saying in the mining community: “Bitcoin’s price gravitates toward its cost of production.” In practice, the production cost often behaves like a magnet and a floor for the market. When the spot price climbs far above the cost to mine, it invites more hashing power (and new investment in miners) until rising difficulty pulls costs up. Conversely, if price falls below the average production cost, miners start to capitulate – selling coins and shutting rigs – until the difficulty eases and the market finds a bottom. This push-pull keeps price and cost loosely tethered over the long run. Notably, JPMorgan’s research this cycle highlighted that Bitcoin’s all-in production cost (now around ~$94,000) has “empirically acted as a floor for Bitcoin” in past cycles. In other words, the market has rarely traded for long below the prevailing cost to mine, because at that point fundamental supply dynamics kick in. As of late 2025, they estimate the spot price is hovering just barely above 1.0 times the cost (~1.03x) – near the lowest end of its historical range. This implies miners’ operating margins are razor-thin right now, and any extended move significantly below ~$94k would likely trigger miner capitulation and supply contraction. In plainer terms: downside from here is naturally limited – not by hope or hype, but by the economics of mining. If BTC dropped well under the cost floor, many miners would simply turn off machines rather than mine at a loss, removing sell pressure and helping put in a price bottom. History supports this magnetic pull. In previous bear markets, Bitcoin has tended to retest its production cost during the worst of capitulations. For example, during the late-2018 crash and again in the 2022 downturn, BTC prices plunged to levels that put numerous miners out of business. But those phases were short-lived. Prices found support once enough miners quit and difficulty adjusted downward, allowing the survivors to breathe. The market “wants” to stay near the cost of production, as that is a sustainable equilibrium where miners neither drop like flies nor earn excessive profits. Whenever price strays too high above cost, it usually invites a surge in competition (hashrate) that raises the cost floor; when price sinks too low, hashpower falls until cost drops to meet price. It’s an elegant economic dance built into Bitcoin’s design. Why Price Often Meets Cost Before Rebounding If Bitcoin production cost is a de facto floor, why do we often see price fall all the way down to it (or even briefly below it) before the next big rally? The answer lies in miner psychology and market cyclicality: Miner Capitulation & Shakeouts: Markets are cruel to the over-leveraged and inefficient. During bull runs, miners expand operations, often taking on debt or high operating costs under the assumption of continually high prices. When the cycle turns, Bitcoin’s price can free-fall toward the cost of production, erasing margins. The weakest miners (highest costs or debt loads) capitulate first – selling off their BTC reserves and unplugging hardware. This wave of forced selling can push price right to (or slightly under) the cost floor, marking a final “shakeout” of excess. Only when the weakest hands are flushed does the market rebound. It’s no coincidence that major bottoms often align with news of miner bankruptcies or mass liquidations. The Iron Law of Hashrate: Miners are competitive and will run at breakeven or even slight loss for some time, hoping for recovery, rather than quit immediately. This means the network can temporarily operate above sustainable difficulty levels. Eventually, however, reality sets in. When enough miners can’t pay the bills, hashrate plateaus or drops, halting difficulty growth or causing it to decline. At that inflection point, the cost of mining stabilizes (or falls), giving relief to the remaining miners. The stage is set for price to rebound off the now-lower equilibrium. In essence, Bitcoin often has to tag its production cost to force a network reset and purge imprudent operators. Only after that cleansing can a fresh uptrend begin with a healthier foundation. Investor Sentiment at the Floor: From a contrarian market perspective, a convergence of price and production cost typically corresponds with maximum pessimism. If Bitcoin is trading at or below what it “should” cost to make, it signals extreme undervaluation to savvy investors. In late 2022, for instance, estimates of BTC’s cost basis in the $18k–$20k range coincided with the market trading in the mid-$15k’s – a level where miners were going bankrupt and sentiment was in the gutter. Yet those willing to be greedy when miners were fearful reaped the rewards when price recovered. The same pattern could be unfolding now in late 2025: the public is fearful of Bitcoin’s recent pullback, but its cost floor (~$94k) suggests fundamental value support. Smart money knows that when price meets cost, downside is limited and upside potential grows. Conclusion – Steeling Ourselves at the Cost Floor In EXCAVO’s signature fashion, let’s cut through the noise: Bitcoin’s production cost is the line in the sand – the magnetized level where price and reality meet. As of Autumn 2025, that line hovers in the mid-$90,000s, and Bitcoin has indeed been gravitating here. The data shows miners barely breaking even on average. This is a make-or-break moment. If you’re bullish because everyone else is, check your thesis – the real reason to be bullish is that BTC is scraping its cost floor, a level from which it has historically sprung back with vengeance. Conversely, if you’re panicking out of positions now, remember that you’re selling into the teeth of fundamental support. The market loves to punish latecomers who buy high and sell low. Yes, the mining industry is under stress; yes, the headlines scream fear. But those very pressures are what forge the next bull run. Every miner that shuts off today is one less source of sell pressure tomorrow. Every uptick in efficiency raises the floor that much higher, like a coiled spring tightening. Bitcoin has been here before – when production cost and price locked jaws in late 2022, and again in early 2025 post-halving. Each time, the doom and gloom was followed by a dramatic recovery as the imbalances corrected. Our contrarian take: The cost of mining 1 BTC isn’t just a number on a spreadsheet – it’s the secret pulse of the market. Right now it’s telling us that the bottom is in or very near. Prices might chop around this magnet a bit longer, even dip slightly below in a final fake-out, but odds of a deep crash under the ~$94k cost basis are slim. The longer Bitcoin grinds at or below miners’ breakeven, the more hashpower will fall off, quietly tightening supply. When the spring releases, the next upward leg could be explosive (as even mainstream analysts like JPMorgan are eyeing ~$170k targets). In summary, Bitcoin tends to revisit its production cost for one last test – and when it holds, it launches. Autumn 2025 appears to be giving us that test. The savvy, data-driven operator will view this not with panic, but with patience and resolve. After all, if you can accumulate Bitcoin near its intrinsic mining value while the herd is fearful, you position yourself on the right side of the trade once the inevitable rebound kicks in. As the saying goes, bears win, bulls win, but miners (and hodlers) who understand the cost dynamics win big in the end. Brace yourself, stay analytical, and remember: Bitcoin’s true floor is built in watts and hashes, and it’s solid as steel. Best regards EXCAVOYesterday, the network's total hash rate fell by ~100 EH/s, representing a decline of ~8%, with at least 400,000 BTC mining rigs being shut down. The main reason for this is the closure of mining farms in Xinjiang, China.

EXCAVO

INTERVIEW: EXCAVO View 12/12/25

In my previous post, I invited you to ask any questions you had about the current market, the cycle structure, Bitcoin dominance, altcoins, timing, and everything in between. You asked - and here are the detailed answers. This is the continuation of our interview series. I have taken every question from the comments, grouped them under your usernames, and provided full, transparent explanations based on my current market view. Let's dive in. just5 Q: Why do you say the bear market started in November? If it started earlier, why not in October? Where does the 126k top come from? Why is Bitcoin dominance so high? Why haven't many altcoins (ETH, SOL) broken their previous highs? How far can they fall? Your analysis is based on past cycles and fractals. Do you admit you can be wrong? A: I do not define the beginning of a bear market strictly by the date of the absolute top. For me, the trigger is the structure on the weekly timeframe. The formal high was reached in October, but the signal that confirmed the start of the bear phase was the first strong red weekly candle, which appeared in November. That is why I mark November as the beginning of the bear market. The 126k level is not something random - the market simply traded there (around 126,250 USD depending on the exchange). So the level itself is not in question. As for Bitcoin dominance - it is very simple. We have one main instrument in the market: BTC. It defines the weather for the entire crypto market. When BTC rises, some alts rise and others lag. When BTC falls, everything falls - especially assets with weaker liquidity or fundamentals. Historically, people traded a lot of alt/BTC pairs. Many even believed altcoins were created mainly to accumulate more BTC. Today this logic still works: liquidity and attention gravitate toward Bitcoin, which naturally leads to high dominance. Regarding ETH and SOL: I honestly expected ETH to break its previous ATH. On SOL, I have written a separate idea (I will attach the link) where, back when ETH was around $1700 and SOL was around $150, I already said that between these two I prefer ETH because cycles matter. Above $200-250 on SOL and $4900-5000 on ETH there is a large liquidity cluster. The market will eventually go there, but the question is when. This expectation kept many people in top altcoins without taking profit. How far can altcoins fall? My baseline scenario is a 50-60% correction from their peaks, and that is the minimum. Crypto cycles often surprise with deeper drawdowns. Regarding the fractal and cycle approach - yes, my view is based on previous cycles. But of course, I admit that I can be wrong. If I am wrong, I will acknowledge it publicly. TradingView does not allow deleting ideas, everything stays visible, so everyone can judge my track record objectively. louistran_016 Q: If the 41% drop (126k -> 75k) happened in 2 months, why would the move to 60k take another 10 months? Is the 60k downside target too high? Is September 2026 too late for a market bottom? If the previous bottom in 2022 was at the 100-month EMA (around 16k), should not the next bottom be around 44k? A: I never said the drop to 60k must take 10 months. The chart is not obligated to move like "stick down -> stick up". We have only two axes: price and time. The market can: drop quickly, then consolidate, then spend months accumulating before the next move. Even if we hit 60k in 3 months, it does not mean the market will immediately reverse. Accumulation can take time. The 60k target is indeed a "high" bottom for a bear market because it is only about a 50% correction from the peak. I do not exclude deeper scenarios: 60-65-70% drawdowns are normal for crypto. But even 60k is a much better long-term buying zone than 90-100k or current prices. September 2026 is not "too late" in my view. It aligns well with the classical cycle structure: distribution -> decline -> depression -> accumulation. Regarding the 44k idea based on the 100-month EMA: It is absolutely possible. I do not rule it out. But tactically, I first target the 60-64k zone and then will reassess whether deeper levels become realistic. ikkie Q: Many people are calling this a bear market. Is that a bad sign? A: What I actually see is many influencers publicly questioning whether this is a bear market because they did not exit in time, and now it is hard for them to admit it to their audiences. The fact that many people call it a bear market is completely normal. The real question is not how people label the market, but what you do with your money. Being out of the market is also a position, sometimes the best one. When price enters a transition phase, staying flat can be a very strong decision. luaselene Q: What about ETH? A: ETH has a large liquidity zone above $4900-5000. I expect this region to be taken in one of the future bullish phases, but not in the near future. More realistically, this is a 2026-2027 story. Within the current part of the cycle, I do not expect ETH to sustainably break the ATH. mpd Q: I expect a retest of 100k before a crash to 35k. Thoughts? A: A very realistic scenario. A retest of 100k is the perfect psychological trap: it attracts the last wave of euphoric buyers, it loads the market with long positions (usually with leverage), and then the market can wipe them out with a deeper drop, even toward your 35k target. Crypto loves this pattern: round number -> FOMO -> leverage -> liquidation. KoDPrey Q: Why should the drop to 70k lead to a long correction instead of being a quick liquidity sweep before a move to 150-200k? Why do you think this cycle repeats previous ones? Can BTC dominance reach 70% in a bear market? Aren't we in the middle of a bull market? If you were wrong on PORTAL longs, can you also be wrong about the entire cycle? A: I do not think the drop to 70k must be a simple wick with an instant reversal. Historically, Bitcoin cycles include a depression phase where people lose hope, liquidity gets washed out, and even long-term holders capitulate. After this phase, a move toward 150-200-250k makes much more structural sense. A simple "drop -> instant all-time-high" scenario resembles the old "supercycle" meme. Possible? Maybe. Likely? In my view - not now. This cycle is indeed different: almost no broad altseason, many more participants, institutions, and countries involved, much more infrastructure that can liquidate traders' positions, more derivatives, more leverage, more points of failure. But Bitcoin's macro-cycle structure is still fractally consistent. The shapes and speeds change - the logic does not. Can Bitcoin dominance hit 70%? Yes. In crypto anything is possible. I consider this scenario totally realistic, even within a bear market. Are we in the middle of a bull market? In my view - no. I do not think we are anywhere near the middle of a bull run. Regarding PORTAL: yes, I was wrong. And not only there, I have been wrong many times. But even with those mistakes, I closed my positions, exited both spot and margin, and avoided much deeper drawdowns. Of course I can be wrong about the cycle. I am sharing my view, not claiming infallibility. My win rate is far from perfect, and every idea remains public on TradingView. Anyone can check them later. houari14 Q: What do you think about the USDT Dominance index (USDT.D)? Is it reliable? A: Honestly, I barely use USDT.D in my analysis. Yes, it shows whether market participants prefer sitting in stablecoins or taking risk, but for me it is not a primary metric. I focus more on: BTC price, market structure, dominance of BTC itself, volume behavior, and how major altcoins react. anatta_ Q: How far can BTC fall in this bear market? How long will the bear market last? If BTC holds 80-85k for a few months, can it start a new bull cycle? A: I expect at least a 50% correction from the top. Realistically, 60-65-70% drawdowns are absolutely possible. More than 75% I do not consider my baseline, but in crypto nothing is impossible. Regarding duration: My estimation is that the bear market should end toward late 2026. Around September 2026 I expect a major bottom, a zone where long-term accumulation becomes attractive. If BTC holds 80-85k for a few months, yes, theoretically it could trigger a new bullish phase, especially if a strong new narrative appears. But I am not betting on that scenario. I prefer staying out of the market until the cycle structure becomes clear. tommayhew Q: Is there a connection between the recent Cloudflare security incident and the crypto drop? A: The timing was surprising, and it is natural to link the two events. But at this moment I do not see solid evidence that the incident caused the market drop. Maybe more information will appear later, but for now I treat it as a coincidence rather than a catalyst. simplejoe1 Q: We already have ETFs and a pro-BTC U.S. president. Could this be the absolute top? A: ETFs and a pro-Bitcoin president do not automatically guarantee continuous growth, nor do they define the market top. The president also has: his own memecoin, check how its chart looks, his own crypto-investing fund, check its token too. These examples show that one person, even the U.S. president, does not determine the entire market. The market is bigger and more complex than a single headline. Best regards, EXCAVO

EXCAVO

تحلیل اختصاصی EXCAVO: بازار خرسی شروع شد! سطح بحرانی بیت کوین و تله قیمتی پیش رو

1. آیا فکر می کنید بازار نزولی از قبل شروع شده است؟ اگر بله - از چه لحظه ای؟ بله. بازار خرسی در نوامبر 2025 آغاز شد. نمودار چرخه ای من آن را به وضوح نشان می دهد: هیچ سناریویی به ادامه روند صعودی اشاره نمی کند. هر نموداری که در TradingView ارسال کردم، معکوس شدن روند را تأیید می کند. 2. سیگنال اصلی تایید معکوس چه بود؟ هفته 153 رشد بیت کوین - یک نقطه فرسودگی تاریخی که تقریباً همیشه پایان یک چرخه را نشان می دهد. 3. چه سطوح BTC برای سناریوی نزولی حیاتی هستند؟ سطح افقی کلیدی 74000 دلار است. حداقل، من انتظار دارم یک فتیله تمیز در زیر آن وجود داشته باشد. 4. چه عوامل اساسی باعث شتاب بازار نزولی شد؟ محیطی که بیش از حد خرید شده است. حباب 2 ساله AI ارزش گذاری ها را بسیار بالاتر از ارزش منصفانه قرار داد. بازار بیش از حد گرم شد - حتی اگر AI اینجا بماند. 5. عوامل فنی تایید کننده کاهش؟ ما بدون هیچ دلیل واقعی سقوط می کنیم. هر عنوان کوچکی باعث فروش می شود. 11 اکتبر مربوط به Trump نبود - این یک دستکاری نهنگ در مبادلات بزرگ بود. چرخه های مرحله آخر اینگونه رفتار می کنند. 6. چرا اکثر معامله گران موفق به مشاهده این معکوس نشدند؟ - حافظه کوتاه - به مدت 3 سال برای "خرید هر شیب" - بدون برنامه خروج - بدون چارچوب مشخص - و البته: آنها EXCAVO را دنبال نمی کردند 7. BTC در هفته های آینده کجا می تواند برود؟ اول: انحلال موقعیت های فروش کوتاه. حتی ممکن است تا 94000 دلار افزایش پیدا کند. اما این یک تله قبل از ادامه رو به پایین بود. در ماه دسامبر، من انتظار تشکیل یکی از انتهای چرخه را دارم. 8. کدام سناریو محتمل تر به نظر می رسد - کاهش وحشت یا خونریزی گام به گام؟ به احتمال زیاد: خونریزی مرحله به مرحله. 9. آیا جهش جعلی قبل از کاهش بیشتر امکان پذیر است؟ بله. قبلاً به آن اشاره کردم: یک فشار کوتاه → سپس یک قطره بزرگ. بخش عملی 10. شما شخصاً در این بازار چه می کنید؟ من منتظرم مشاهده می کند. در حال مطالعه لازم نیست هر روز در یک معامله باشید. بیش از هر اصلاحی، معامله گران بیشتری را نابود کرد. 11. در حال حاضر مبتدیان چه کاری باید انجام دهند؟ دقیقاً همان کاری که متخصصان انجام می دهند: منتظر نقطه ورود آنها باشید. ما شکارچیان در بوته ها هستیم - فقط زمانی شلیک می کنیم که هدف نزدیک باشد. 12. معامله گران در حال حاضر چه چیزی را باید در استراتژی خود اصلاح کنند؟ - درک کنید که در چرخه کلان کجا هستیم - مشخص کنید چه چیزی کار می کند - آنچه را که نیست حذف کنید - بپذیرید که بازار نزولی طولانی و طاقت فرسا بود در حال حاضر در مرحله امید هستیم. ناامیدی در پیش است. با احترام EXCAVO اگر سوالی دارید، در صورت تمایل بپرسید. در پست بعدی با توجه به سوالاتی که زیر این یکی می گذارید می توانم مصاحبه دیگری انجام دهم.

EXCAVO

سقوط بزرگ در انتظار مایکرواستراتژی؟ برنامه سایبر در معرض خطر حذف از شاخصها!

MSCI ممکن است شرکتهای Crypto-Heavy را حذف کند: معنای آن برای میکرواستراتژی و بازار MSCI اخیراً پیشنهادی را منتشر کرده است که می تواند به طرز چشمگیری نحوه رفتار شاخص های جهانی با شرکت هایی را که در معرض کریپتوهای بزرگ قرار دارند، تغییر دهد. بر اساس این چارچوب، شرکت هایی که بیش از 50 درصد از سرمایه بازار خود را در دارایی های دیجیتال دارند، ممکن است از شاخص های ملی و بین المللی حذف شوند. این به نظر فنی می رسد - اما عواقب آن بسیار زیاد است. این در عمل به چه معناست اگر این قانون اجرا شود، شرکتهایی مانند MicroStrategy، Bitfarms، Marathon، Hut8، Coinbase یا هر شرکتی که درصد زیادی از ارز دیجیتال را در ترازنامه خود دارد، ممکن است: از شاخص های major حذف شوند، از دست دادن قرار گرفتن در معرض سرمایه گذاران نهادی، برای صندوقهای بازنشستگی، بیمهگران و صندوقهای تامینی محافظهکار، خارج از محدودیت باشد، با کاهش نقدینگی و فروش اجباری مواجه شد. این پیشرفت کمی نیست. این یک تغییر ساختاری است. 🧩 چرا میکرواستراتژی بیشتر در معرض دید قرار می گیرد مدل کسب و کار MicroStrategy بسیار ساده بوده است: سهام جدید منتشر کند افزایش بدهی (از جمله اسکناس قابل تبدیل) از درآمد برای خرید Bitcoin استفاده کنید افزایش BTC → افزایش MSTR افزایش MSTR → ظرفیت وام گیری بیشتر یک حلقه همیشگی اما اگر MSTR از شاخص های کلیدی حذف شود، حلقه شکسته می شود: صندوق های غیرفعال باید بفروشند سرمایه گذاران نهادی با خطر انطباق مواجه هستند نقدینگی خشک می شود نوسانات افزایش می یابد هزینه های وام افزایش می یابد و به یاد داشته باشید: MicroStrategy در حال حاضر کمتر از ارزش منصفانه دارایی های Bitcoin خود معامله می کند. خروج اجباری عدم تعادل ساختاری را تشدید می کند. ⚠️ چرا موسسات به جای Bitcoin، میکرواستراتژی را خریدند بسیاری از صندوق ها به طور قانونی نمی توانند Bitcoin را خریداری کنند. آنها همچنین نمی توانند سهام صرافی های کریپتو پرریسک مانند Coinbase را خریداری کنند. اما آنها می توانند خرید کنند: بدهی شرکت های معتبر اسکناس های قابل تبدیل حقوق صاحبان سهام از یک U فهرست شده S. شرکت مایکل سیلر به آنها یک شکاف نظارتی داد: Bitcoin در معرض قرار گرفتن می خواهید_؟ بدهی قابل تبدیل من را بخرید. اگر BTC افزایش یابد، اسکناس ها را به سهام تبدیل کنید. این راه حل اکنون در حال شکست است. دارندگان بدهی قابل تبدیل در شرایط سختی قرار دارند اگر MSTR از شاخص ها حذف شود: فروش صندوق های شاخص → کاهش قیمت سهام کاهش قیمت → اسکناس های قابل تبدیل ارزش خود را از دست می دهند مؤسسات دارای بدهی با زیان مواجه هستند ریسک ترازنامه افزایش می یابد به همین دلیل است که تصمیمات نظارتی اهمیت زیادی دارند. فروش داخلی: معاون Bitcoin در MicroStrategy به فروش 19.7 دلار 10> ارزش سهام زمان ... جالب است. شروع فروش در 18 سپتامبر فروش سهام مبتنی بر اختیار در لات های متعدد فروش تا 14 نوامبر ادامه دارد کل سود محقق شده: ~19.69$M فروش در عدم قطعیت نظارتی رفتار تصادفی نیست. این یک سیگنال است. خوراکی های کلیدی 1. پیشنهاد MSCI قوانین را تغییر می دهد: شرکتهایی که بیش از 50 درصد در معرض کریپتو قرار دارند ممکن است «غیر قابل نمایهسازی» شوند. 2. مدل core MicroStrategy - قرض گرفتن برای خرید BTC - به جریان های ورودی سازمانی بستگی دارد. حذف شاخص آن را مختل می کند. 3. سرمایه گذاران اسکناس قابل تبدیل ممکن است با فشار شدید مواجه شوند. 4. فروش خودی نشان دهنده آگاهی داخلی از ریسک ساختاری است. 5. اگر MSTR از شاخص ها حذف شود، فروش اجباری می تواند فشار نزولی قابل توجهی ایجاد کند. 📉 نتیجه گیری MicroStrategy برای مدت طولانی یک "ETF بیت کوین قبل از وجود ETF" بوده است. مؤسسات MSTR را خریداری کردند زیرا نمی توانستند مستقیماً BTC را خریداری کنند. اما حالا: Bitcoin ETF وجود دارد، مقررات در حال تشدید شدن هستند، ارائه دهندگان شاخص در حال به روز رسانی چارچوب های ریسک هستند. MicroStrategy ممکن است قربانی استراتژی موفقیت خودش شود. با احترام EXCAVO

EXCAVO

بازار در دمای ۸۰ درجه است: چه اتفاقی در ۱۰۰ درجه (نقطه جوش) میافتد؟

با سلام خدمت همه امروز نمی در مورد اخبار صحبت کنم. من می در مورد آنچه واقعاً مهم است صحبت کنم: ساختار بازار. بسیاری از معامله گران در حال حاضر به دنبال یک رویداد خبری برای توضیح آرامش فعلی و پیش بینی move بعدی بیت کوین هستند. آنها در جهت اشتباه نگاه می کنند. این را به خاطر داشته باشید: اخبار علت move نیست. این فقط یک توضیح راحت است که پس از اینکه move قبلاً اتفاق افتاده است، به شما داده می شود. برای من نمودار اصلی است. و در حال حاضر، به story می گوید که اکثر مردم دوست ندارند. تصویر جهانی: اقتصاد حباب ها و آب جوش ما در era حباب زندگی می کنیم. ما دات کام، شیدایی لاله را داشتیم و اکنون شاهد حباب AI هستیم. بله، AI یک تغییر دهنده بازی است، و من فعالانه آن را در تمام فرآیندهای خود ادغام می کنم - احمقانه است که این روند را انکار کنم. اما این واقعیت داغ شدن بازارها را تغییر نمی دهد. کل اقتصاد جهانی در حال حاضر مانند آب گرم شده تا 80 درجه Celsius احساس می شود. هنوز به جوش نمی آید، اما نقطه جوش نزدیک است. چیزی در شرف وقوع است، و بخار آماده بیرون آمدن است. نبض بازار: جایی که جمعیت اشتباه می کند و جمعیت چطور؟ جمعیت دیگر در Bitcoin نیست. آنها در دام آلت کوین ها گرفتار شده اند، زیرا خود را به عنوان "پیشخدمت همیشه" کنار گذاشته اند. آنها برای فصل دوم دعا می کنند، اما متوجه نمی شوند که 20-30 درصد کوتاه pump ما دیدیم - این فصل فصل بود. قبلاً به meme تبدیل شده است. من پست های بی پایانی در مورد انحلال در رسانه های اجتماعی می بینم. احساسات ناامید کننده است. اکثر آنها قبلاً موقعیت های آتی خود را از دست داده اند یا آنها را از دست داد soon. آنچه در حال حاضر در بازار حاکم است ترس یا طمع نیست، بلکه درک آهسته ای است که بازار نزولی هرگز واقعاً از آن خارج نشد. تنظیم اصلی در نمودار: تله نقدینگی کلاسیک اکنون مهم ترین بخش - در نمودار Bitcoin چه اتفاقی می افتد؟ همانطور که می بینید، ما بر روی یک خط روند حیاتی حمایت هستیم. همه آن را می بینند. تازه کارها و معامله گران خرده فروشی این را به عنوان یک سیگنال واضح "خرید شیب" می بینند. و این بخشی از بازی است. یک تله عمدی در حال ایجاد است: تحکیم : قیمت به طور عمدی نزدیک خط حمایت نگه داشته می شود تا توهم قدرت و انباشته شدن موقعیت خریداران را ایجاد کند. انباشتن توقف ضررها : بازارسازان می دانند که جمعیت دقیقاً زیر این خط آشکار توقف می کند. اعدام : هنگامی که نقدینگی کافی ایجاد شد، یک شکست شدید رخ داد. این امر باعث ایجاد آبشاری از انحلالهای استاپ ضرر میشود که فقط سقوط را تسریع میکند. من کاملاً در سمت نزولی باقی میمانم تا زمانی که شاهد شکست مطمئنی از بالاترین سطح تاریخ باشیم. من هر جهشی از سطوح فعلی را فرصتی برای ورود بهتر به یک موقعیت کوتاه می دانم. بعد چه می شود؟ توصیه من به خودم برای 2-4 هفته آینده چیست؟ صبر کن بازار برای یک پاکسازی عالی آماده می شود. موجی از حذف پروژههای ناخواسته و سکههای meme - که به هیچ کس جز صرافیهایی که از آنها برای hype استفاده میکنند خدمات نمیدهند - در راه است. پس از این پاکسازی، فرصت های باورنکردنی برای خرید با قیمت های بسیار جذاب وجود داشت. اکنون زمان تحقیق deep در مورد پروژه هایی است که واقعاً به آنها اعتقاد دارید. وقت آن است که سفارشات محدود خود را آماده کنید و منتظر بمانید تا بازار به قیمت های شما برسد. از توجه شما متشکرم. با احترام EXCAVO شما.

EXCAVO

فاجعه رمزارزها: چرا بازار خونین شد و کف قیمت کجاست؟

من می که شما از نزدیک به این نمودار نگاه کنید. اینها فقط خط و شمع نیستند. این یک جدول زمانی از هشدارها است. 12 سپتامبر ، 23 ، 30 ، 6 اکتبر ، 10 اکتبر - من فریاد می زدم که صدر جدول است. من به شما گفتم که از بازار خارج می شوم. برای این کار ، من بیش از آنچه که در کل حرفه ام داشتم نفرت کردم. 90 ٪ نظرات با من مخالف بودند. اما من می دانستم که برای چه چیزی ثبت نام می کنم. من می خواستم به شما هشدار دهم. و من از کسانی که گوش می دهند سپاسگزارم. و امروز ، ما شاهد قیمت بازار برای سرخوشی بودیم. این یک Meme نیست. این یک فاجعه است امروز فقط "گرفتن نقدینگی" نبود. این سرقت 1.6 میلیون معامله گر با 10 میلیارد دلار بود. و اینها فقط اعداد نیستند. امروز ، یک معامله گر که من از مسابقات می شناختم ، کوستیا کودو ، جان خود را گرفت. این دیگر شوخی نیست. این A meme نیست. مردم در حال مرگ هستند. بهترین ها ترک هستند. ما نمی توانیم این را تماشا کنیم مانند این که اینترنت است meme در حالی که زندگی واقعی از بین می رود. چگونه این اتفاق افتاد؟ آناتومی یک طوفان کامل البته کسی حجم زیادی را رها کرد. اما چرا سقوط چنین deep و خیلی سریع بود؟ انحلال آبشار: اولین موج فروش باعث واکنش زنجیره ای شد. یک خلاء در کتاب سفارش: من این را از سال 2019 می شناسم. در هنگام تصادفات مانند این ، سازندگان بازار به سادگی الگوریتم های خود را خاموش می کنند تا از دست دادن پول خودداری کنند. آنها نقدینگی خود را می کشند. کتاب سفارش خالی می شود. هر سفارش فروش ، قیمت را صدها ، هزاران دلار کاهش می دهد. این یک بازار نیست. خلاء است. مبادلات برندگان هستند: اکنون آن 10 میلیارد دلار کجا هستند؟ با مبادلات متمرکز و هیچ کس جبران نمی شود. فقط به شما گفته می شود ، "دفعه دیگر ریسک خود را مدیریت کنید." چرا این فقط آغاز است. جاده به پایین من نمی توانم انحلال کنم. من کاملاً در Stablecoins هستم ، همانطور که گفتم که بود. من از این محیط تهاجمی خسته شده ام. اما چرا مطمئن هستم که پایین می رویم؟ فقط معامله گران آینده تاکنون انحلال شده اند. اما ارتش بازیکنان وجود دارد که از طریق وثیقه از اهرم استفاده می کنند. آنها BTC/ETH را وثیقه می کنند ، stablecoin را دریافت می کنند ، BTC/ETH بیشتری را با آنها خریداری می کنند و دوباره وثیقه می کنند ... ایجاد هرم. آنها منتظر BTC با 200 کیلو دلار هستند. با افت 40-60 ٪ از اوج ، این هرم شروع به فروپاشی می کند و باعث ایجاد موج جدیدی از فروش اجباری می شود. پایین ، با محاسبات من ، حدود 60،000 دلار - 65،000 دلار بود. و چه کسی به این انحلال نیاز دارد؟ بازیکنان مالی major که به یک نقطه ورود خوب نیاز دارند. آنها در اوج خریداری نمی کنند. آنها با خون خریداری می کنند. آدرس به هر معامله گر من می با همه شما صحبت کنم. تحلیلگران ، معامله گران ، سرمایه گذاران ، دلالان. شما به تنهایی کار می کنید یک به یک با تصمیمات خود ، با مشکلات خود ، در front یک صفحه نمایش. من به همه کسانی که در این مسیر قدم گذاشته اند احترام زیادی دارم. شما وارد یک محیط خصمانه شده اید که در آن باهوش ترین الگوریتم ها و کل شرکت ها می پول شما را بگیرند. من خودم ناامید شده ام. من انتظار "فصلی" را داشتم که هرگز نیامد. و من آن را به موقع پذیرفتم: "Altseason" کلاهبرداری است. A meme که دیگر با یک میلیون سکه در بازار کار نمی کند. این یک فلیپ فلاپ نیست. من برنامه خود را دنبال می کردم: تا سپتامبر بمانید. برای کسانی که منتظر هستند تا بازار "بدون چمدان اضافی" پرواز کنند - شانس خوب. من در آن شرکت نمی کنم. من به خرید فعال نزدیک به سپتامبر 2026 باز گشت. چه کسی مانده است تا بازار را به سمت بالا سوق دهد؟ 1.6 میلیون معامله گر نقدینگی؟ معامله گران که دیگر با ما نیستند؟ این پست دلپذیر نیست. درد است. و این یک هشدار نهایی است. از خود و سرمایه خود محافظت کنید. با احترام Excavothete شمع هفتگی بعدی red بود

EXCAVO

BTC is in 'The Final Trap' Before the Crash (Wyckoff Phase C)

در آخرین پست خود، پایان دوره صعودی را اعلام کردم و برنامه خود را برای دو سال آینده به اشتراک گذاشتم. توضیح دادم که از منظر اقتصاد کلان، چه کاری انجام می دهم و چرا. در این پست، به شما نشان داد که چگونه با استفاده از تحلیل تکنیکال به این نتیجهگیریها رسیدم. این یک حس درونی نیست. این یک ساختار است که در حال حاضر روی نمودار شکل میگیرد - یک طرح توزیع وایکوف کلاسیک. توزیع وایکوف چیست؟ به زبان ساده، توزیع وایکوف مدلی است که نشان میدهد چگونه «پول هوشمند» (بازیکنان بزرگ، افراد خودی) به تدریج داراییهای خود را به سرمایهگذاران خرد در اوج بازار میفروشند. این فرآیند از چندین مرحله تشکیل شده است که برای ایجاد حداکثر سرخوشی و جذب هر چه بیشتر خریداران قبل از شروع کاهش طراحی شده است. توضیحات مفصل: مثالها: تجزیه و تحلیل مرحله به مرحله نمودار Bitcoin (به نمودار خود مراجعه کنید که ویژگی اصلی پست بود) اکنون به نمودار Bitcoin نگاه کنید. شباهت به یک مثال کتابی چشمگیر است: فاز A (توقف روند): ما عرضه اولیه (PSY) و اوج خرید (BC) را دیدیم، جایی که روند صعودی شروع به از دست دادن شتاب کرد. فاز B (ایجاد "علت"): یک محدوده تثبیت طولانی مدت که در آن "پول هوشمند" شروع به توزیع دقیق موقعیت های خود بدون سقوط قیمت کرد. فاز C (تله نهایی): مهمترین مرحله. ما شاهد UTAD (فشار رو به بالای پس از توزیع) بودیم - یک فشار نهایی به سمت بالا که توهم ادامه رالی را ایجاد کرد. این لحظه اوج سرخوشی است که برای به دام انداختن آخرین خریداران طراحی شده است. دقیقاً در این مرحله هستیم. فازهای D و E (کاهش قیمت): همانطور که نمودار نشان می دهد، پس از فاز C، یک کاهش پایدار (کاهش قیمت) آغاز می شود که نشانه شروع بازار نزولی است. مسیر پیش بینی شده روی نمودار کاملاً با برنامه من برای خارج ماندن از بازار تا سپتامبر 2026 مطابقت دارد. نتیجه گیری و فراخوان برای بحث این نمودار یک پیش بینی 100٪ دقیق از آینده نیست. این یک نقشه از روانشناسی بازار است. نشان می دهد که وضعیت فعلی آشوب نیست، بلکه یک فرآیند ساختاریافته است که بارها در طول تاریخ رخ داده است. این ساختار است که به من در تصمیمم برای خروج از بازار اطمینان می دهد. من به احساسات اعتماد نمی کنم؛ به یک سیستم اعتماد می کنم. شما در نمودار چه می بینید؟ آیا با این تحلیل موافق هستید؟ چه سوالاتی در مورد این طرح دارید؟ بیایید در نظرات در مورد آن بحث کنیم. پی نوشت. آخرین پست من که اوج را پیش بینی می کرد، نفرت زیادی به همراه داشت. من بیش از 160 نظر را خواندم. در اینجا پاسخ های من به 3 استدلال اصلی از سوی گاوها آمده است. استدلال شماره 1: "اما ETF ها و مؤسسات! متفاوت است!" پاسخ من: بازیکنان جدید، همان بازی. بازی، روانشناسی انسان است. سرخوشی هنوز سرخوشی است، مهم نیست چه کسی می خرد. استدلال شماره 2: "شما خیلی زود هستید! هیچ فصل آلت کوین واقعی وجود نداشت!" پاسخ من: دقیقاً. فقدان یک فصل آلت کوین به سبک 2017 ثابت می کند که چرخه به پایان رسیده است. بازار حداکثر قدرت خود را به ما نشان داد و این همان بود. استدلال شماره 3: "شما فقط سعی می کنید زمان اوج را مشخص کنید!" پاسخ من: من زمان اوج کندل را مشخص نمی کنم. من در طول مرحله توزیع خارج می شوم. زود بودن یک استراتژی است. دیر بودن یک فاجعه است. مقدار زیاد خشم احساسی در نظرات من، تأیید نهایی است که به آن نیاز دارم. من بر موضع خود پایبندم. شما را در سال 2026 می بینم. #بیتکوین با احترام EXCAVO

سلب مسئولیت

هر محتوا و مطالب مندرج در سایت و کانالهای رسمی ارتباطی سهمتو، جمعبندی نظرات و تحلیلهای شخصی و غیر تعهد آور بوده و هیچگونه توصیهای مبنی بر خرید، فروش، ورود و یا خروج از بازارهای مالی نمی باشد. همچنین کلیه اخبار و تحلیلهای مندرج در سایت و کانالها، صرفا بازنشر اطلاعات از منابع رسمی و غیر رسمی داخلی و خارجی است و بدیهی است استفاده کنندگان محتوای مذکور، مسئول پیگیری و حصول اطمینان از اصالت و درستی مطالب هستند. از این رو ضمن سلب مسئولیت اعلام میدارد مسئولیت هرنوع تصمیم گیری و اقدام و سود و زیان احتمالی در بازار سرمایه و ارز دیجیتال، با شخص معامله گر است.