تحلیل تکنیکال holeyprofit درباره نماد BTC : توصیه به فروش (۱۴۰۳/۶/۱۱)

holeyprofit

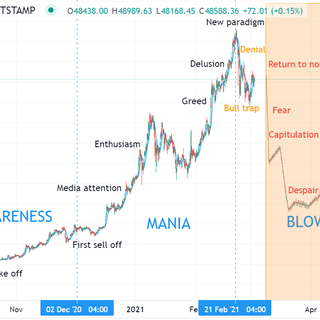

The 4 year cycle narrative would have it that the most volatile asset, that will drop over 70% the most times and then have the most explosive gains to the upside will also the one that is the most predictable and the most popular one for people to have all in exposure on. Which I consider optimistic. While getting ultra wealthy being long this accommodatingly predictable asset we also get to revolutionise the world and bring down those dastardly bankers. Back in 2021 I observed the same broad mood. At the time it was largely focused into GME, AMC (Handful of other stocks) and crypto. At the time I made a post saying this is either "The brave new world or the same old trap". I feel this post sums up my thoughts on the crypto market at present. Let's look at all the different things that challenge the idea. 1 - Statistically insignificant. A four cycle determined over 12 years is just bad maths. We perhaps have enough for a suggestion which we could create a forward looking test hypothesis on, but at this point we have something that is statistically insignificant. Like if a roulette wheel is spun 12 times and lands on red every four times. We don't have a "Four spin cycle". 2 - Ignoring more obvious and tighter correlations If you'd always assumed over the last decade BTC would act mostly the same as SPX - you'd have been right most of the time. This would have accurately forecast the major bull and bear swings in BTC better than the idea of the halving cycle. The correlation of risk on / off with the SPX is more statistically useful. 3 - Related models not working At this point the premise is now the BTC bull is under way we should see alts doing well. Alts have never done well. Briefly going into "Alt season" before crashing. The alts have never recovered from 2021. With only a few exceptions, the crypto market currently has a 2021 top (With most things being well over 50% off the highs). Another popular model cited is the S2F model. But when you read up on this model and what it predicts/historically predicts - many pro crypto sites will state that it's not really working. Hasn't been working for a while. Based on the estimates people gave me based on the S2F model on my posts 6 months ago, it appears it's not working now. The idea of predictable market cycles in crypto has already been faltering. And it seems no one promoting these models wants to give clear failure conditions. Or not ones that would be helpful in a decline, anyway. Any time I speak with people using these models, they do not have a suitable way to protect themselves from being wrong. Not a stated one, anyway. Closest I've come to one was someone told me "IF BTC does not make a new high in the next 2 halvings the model fails". Okay ... cool. So the plan is just to lose for 8 years and then accept that was a bad idea. I don't consider that a plan. Sounds like "Hopefulness" to me. 4- Entire disregard for tail risk The idea of a four year cycle entirely ignores any chance of any influence of anything outside of this cycle. It overlooks the lifetime known of markets that 99% of models have no way of accounting for tail risk. However, any time there's been a tail risk like event in risk markets - BTC has reacted to it. So it's reasonable to assume that could happen again if something massively unexpected happened. 5 - Ignores historical tendency for models to breakI love using models. Mine are different in style than this, but I do almost all of my trading and analysis based on models. They're good when they work, but generally everything will have a big failure. As a general rule, the more well observed a pattern is the closer it is to breaking - and the most viciously it will break (Perhaps exogenous event). 6 - Logically inconsistent The idea of a well known four year cycle is logically inconsistent because if there's a known known in the market this is a free lunch. Why would the sharps in the market not spot this and front run it? And these people are sharps so they're doing a lot of volume - and thus the very existence of such a cycle would predict market dynamics change that cycle. It's similarly logically inconsistent to pass off any move that does not fit into the mould as Whales manipulation". I am willing to accept BTC is probably a cornered market. Probably always has been and this is probably why it tends to move in such direct bursts, be it up or down. So I'd not reject the idea of "Whale manipulation". What I reject is the idea you know what the whales think. That these people who've been able to accumulate so much power and influence in the market must have a simple to understand 2D plan. It's equally possible these people have a 5D plan that includes making you believe you have a sure bet at the high so they can dump onto you. 7 - Assumptive of demand The four year cycle works on a bit of a logical fallacy. Which is when you say because one thing is true that means other things have to be true. Like if someone is pulled into a police station and they say, "I came in - I must be telling the truth". These two statements do not have to relate to each other. It's true they came in. The other is not proven by them being there. Similarly the four year model. The truth is there will be a decline in future supply on a relatively predictable set period of time. From this it's inferred that there will always be growing or consistent demand and therefor the supply and demand dynamics have to push price higher. But it's logically inconsistent because it does not address where the demand is coming from and any attempt to address this is 100% of the time "Price going up will create demand". Again, not a point I'd argue. If something goes up, more people may want to buy it - but we are assuming price will go up and using that to assume our demand. Which kinda reduces the bull thesis down to "If BTC goes up it will go up". I should not say 100%. There are a small percentage of people who will argue for adoption and growth of real world use to come, but there's no evidence of this. At all. There's not a growth in people using Bitcoin for anything other than transferring it into fiat. Either cashing out or cashing in. Almost no one is using it as money. And it remains entirely irrational to think it will be adopted because businesses simply can not run with a currency risk of +/- 10% on any given hour. It's 1,000,000% impractical. Only made practical by converting the BTC to fiat or a stablecoin tied to fiat instantly - and then that's just using USD with more steps. Outside of speculation, there is no case for growing demand. And when we link the demand with speculation we have to accept that the demand can boom or dry up to almost nothing entirely based on what the market does. Hypothetically there could be only one Bitcoin in existence and still no one wants it. Certainly no one wants it enough to pay 100K for it. Demand based on price rises can very fickle. ====All in all, I think the idea of a predictable four year cycle should be at best considered a hypothesis which we can track and test going forward. There is no promise. And the fact there's an implied sense of there being a promise in the air - I think is incredibly risky.Red lines are halvings. Green lines are leap years. Blue lines are world cups. There is a better edge historically to buying at the end of the year there's a world cup than the havling. This can be done with any number of things that happen every four years that we can all objectively agree upon having no influence of the BTC price. And the same principle can be applied to most things that have uptrended for a decade. What this is showing is really the ebb and flow of an uptrend. At this time these also fit well with the narrative of the halving. But how easily could that change? The entire narrative could become redundant within 5 years. If the market goes into any sort of downtrend or crash move rather that follow the cycle, virtually all of the BTC models that aim to forecast price moves entirely fail in unison. The whole narrative that exists today might not even exist in 5 years time. There are people who have all in bets based on models and narratives and if there was to be some sort of crash event and then the market even just ranged for a number of years - the ideas they are betting on would no longer exist as credible ideas. 12 years is not a long time for a market. No major asset class had its largest bear event in the first 12 years. Narratives that exist in the first 12 years can be entirely dispelled over the coming years. The ideas people are betting on are very fragile. I'm not saying they won't work. My ideas are as liable to be wrong as anyone else's, what I saying is the ideas can fail entirely. Absolutely and entirely. And after that, they no longer exist as credible ideas. They never mattered - there was just an illusion they did.