thestockspicker94

@t_thestockspicker94

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

thestockspicker94

VIX daily - opex weekend at 28th Feb

We are heading into an OPEX this 28th of Feb. Volatility is running and seems like fear is all over. Crypto is crashing and people are talking about fear and losing everything.... Well, the big whales are buying the dip and Eric Trump just tweeted about buying the dips. For having a bottom process, it is essential to see the VIX hit that 23-25 area while its #RSI should be around 70 on the Daily chart. In that way, we are more likely to have the bottom area and see the market turn and hard. The US10Y is now at 4.3% which is going down and pushes the TLT to higher prices. I lean to the local bottom around 580-585 in the SPY with a nice capitulation move that seems to be coming exactly with the OPEX and with liquidity issues in the entire market and in crypto. I am looking to buy the dip and keep adding to my long positions in crypto. AVAX ETH BTC $PAAL $DSYNC $AINTI NHC ALU ASTRA $XBG and much more.

thestockspicker94

BTC PRICE ACTION 1Q - with Gann Fann

So this is my BTC chart, 1 Quarter every candle. I use the Gann Fann forcheking where are we now and why it is hard to push above the 100k$ and stay above. So we are cureently in the positive trend, keep grinding higer, in the 1/1-2/1 are of the fann, which is positive. We could see that every time we tried to cross into the quciker area of 2/1-3/1 of the fann, we were rejected as for that the asset BTC needs more energy and buyers for that. So we keep go upward in the trend, and once the big guys will ready they will start push it higher and faster. This is where i lean to the cross to the next Fann area. This may be followed by the RSI that will climb and may find some resistence in the trend line. Having said that,I find the area of 150K$ as the next key level and if we will see Mega Fomo in the crypto we may cross to the 1/3-1/4 area which will bring also oversold areas and we may break the RSI trend line. Historically BTC may find a top once the 1M chart RSI is around the 90+- There is long way to go there. Hope you like my content., you are welcome to share. NFA DYOR

thestockspicker94

BTC Dominance

This is a 1M chart of BTC.D When BTC dominance is areound 65% it get blocked into the resistence area and goes down That will bring the Altseason into life. We had in the past few weeks many manipulation in the entire market, while many big institutions and goverments jumped into the crypto space with buying BTC and ETH and SOL and AVAX and LINK and many more Once the Altseason willstart, it will be the ETH that will move first and take with it the entire market. We may see some more pain in the entire market beofre the Mega Move higher. Anyway, i am holding my bags in many projects. First move will be the ALTS ETH SOL AVAX LINK etc. Then AI industry like PAAL HASHAI LUSH AINTI and more Then Gaming like XBG SHRAP ALU Then again the MEMECOINS like TITS BUTTHOLE RUGGA TRUMP and more Just watch your capital take gains along the way NFA DYOR

thestockspicker94

ETH - Weekly chart

ETH weekly chart I can not ignore from the RSI that goes down, after having double top in the PA and RSI had a Bearish divergence, now we are after the execuiton, that means ATH is coming once we are out of the triangle. I lean to 8000$- 10,000$ target. NFA just my thoughts

thestockspicker94

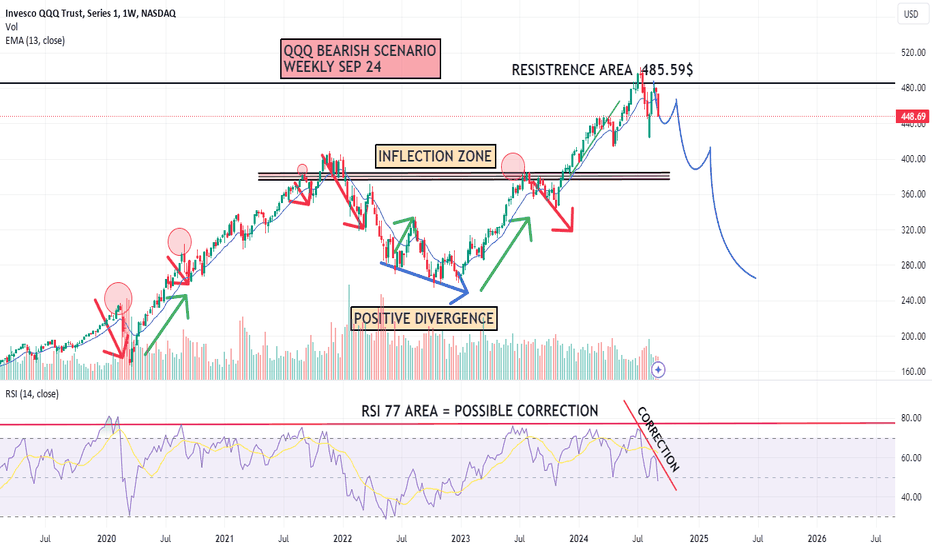

QQQ - WEEKLY CHART - BEARISH OPTION INTO 2025

This is a long term weekly chart of the QQQ It seems like, if we won't take the 485 out to the upside, we may see a di [ going into 2025 with potential of almost 50% correction I am holding 85% cash and waiting for the future to come

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.