quickshiftinn

@t_quickshiftinn

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

quickshiftinn

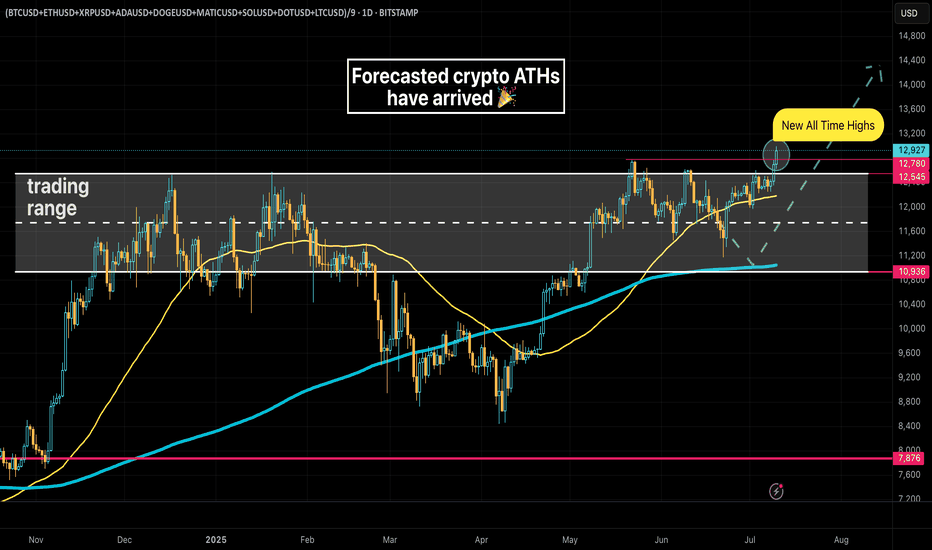

Last month I shared a chart of an equal-weight crypto basket suggesting crypto may be on the cusp of fresh All Time Highs -- those highs have arrived! While that is certainly exciting for crypto holders one should take note of other aspects of the rally. The US Dollar has depreciated substantially against foreign currencies this year (2025) Bitcoin has yet to reach a fresh high against Gold Bitcoin is strongly correlated to US equities, which are also at all time highs USD Decline The US Dollar is down a whopping 10% against a basket of foreign currencies this year, lead ostensibly by President Trump's raucous political policies, most notably aggressive tariffs across the globe and industries. The crypto rally therefore could be characterized as more of a Dollar softening than a crypto strengthening. Bitcoin v Gold Bitcoin - still the epicenter of all things crypto has not topped Gold. Gold in fact has been on a heater of late against the Dollar. Many folks still regard Gold as "real money". As such crypto could be said to be in a "stealth bear market", especially considering the declining momentum against Gold while failing to match its highs. Bitcoin v Stocks Bitcoin is also strongly correlated to US equity performance, despite claims that it's a hedge. The correlation has only grown stronger as Bitcoin's price against the Dollar has soared. That said, it does consistently outperform equities, as long as the music is still playing! Closing Thoughts Most people likely don't care about how Bitcoin is faring against Gold. Bitcoin, the highest quality form of crypto is itself still highly speculative. While an equal-weight basket of cryptos is impressively reaching an all time high against the Dollar, coins with smaller market caps will surely be the first to go when this speculative impulse subsides. There's probably still some gas in the tank at this point, but now is a good time to consider trimming positions before you miss the chance 🤑

quickshiftinn

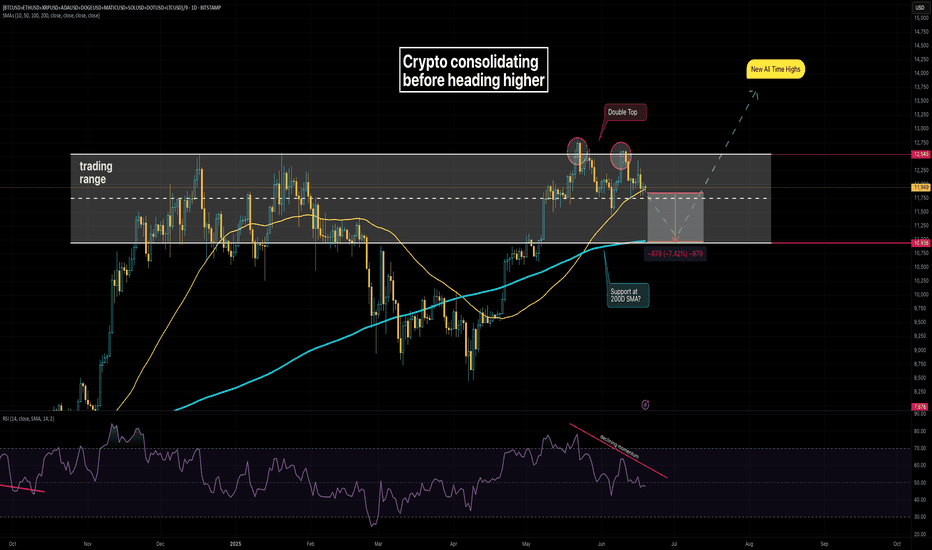

With US equity markets closed for Juneteenth, I'm checking in on an equal weight basket of cryptos. Recently I said crypto looked to be heating up for a run at new highs. As I look today, prices appear range bound on the daily chart. There's a bearish double-top formation, beside declining momentum. The bottom of the range resting at the 200 Day Moving Average, and a test of it seems likely. Should there be a bounce off the 200 Day SMA, and a break through the top end of the range we might get a shot at those new All Time Highs.

quickshiftinn

Whenever I want a decent understanding of what crypto is doing on aggregate, I consult an equal weight portfolio of 10 of the top cryptos by market cap. The sector has been building another pennant, trying for a push to fresh highs, but momentum is flagging. The last time this happened, not too long back, there was a solid drawdown before the pump. By the look of it, there's room for a 30% drop. Given that so many cryptos have doubled, tripled, 5x, 25x, etc don't be surprised if there's a crash soon.

quickshiftinn

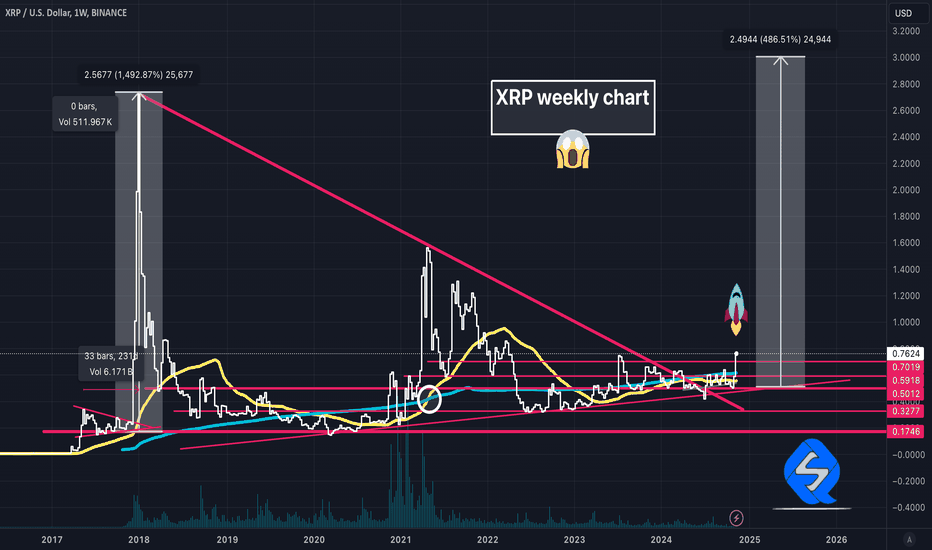

The XRP weekly chart staged a crazy upward breakout through a longstanding triangle formation. The price exploded above the 200 week moving average, and now we can realistically start thinking about the height of that triangle formation to project price targets. $3.00 looks a likely target using this sort of projection, and is conservatively well below the all time high around $3.8. Technically we now keenly await a golden cross on the weekly as confirmation of a bullish trend. The best thing about betting on a coin like XRP is its deep liquidity. XRP is not nearly as speculative as the GOATs (meme coin) of the world, yet ships with massive upside potential.

quickshiftinn

The XRP weekly chart staged a crazy upward breakout through a longstanding triangle formation. The price exploded above the 200 week moving average, and now we can realistically start thinking about the height of that triangle formation to project price targets.$3.00 looks a likely target using this sort of projection, and is conservatively well below the all time high around $3.8. Technically we now keenly await a golden cross on the weekly as confirmation of a bullish trend. The best thing about betting on a coin like XRP is its deep liquidity. XRP is not nearly as speculative as the GOATs (meme coin) of the world, yet ships with massive upside potential.

quickshiftinn

The SEC has until October 7th to file an appeal in their securities case against Ripple. Some suspect the recent debut of the Grayscale XRP Trust suggests there won't be one. The XRP price has shown sensitivity to big dates in the case, and the SEC seems bent on pushing further action in new forms. Closure of the securities case itself though could be the catalyst that sets the XRP price free to climb. On the other hand, an appeal could last to a precipitous drop!

quickshiftinn

Risk assets are in the green today, notably the small cap Russel 2000 up over 2% and Bitcoin a whopping 6% against the Dollar. XRP has been consolidating across timeframes from the daily all the way through monthly and beyond. Back in 2021 Bitcoin and Ethereum were rallying whilst XRP was asleep at the wheel. Suddenly it almost tripled in just 2 days! Varying perspectives often draw attention to a 7 year triangle buildup that could provide explosive power this time.

quickshiftinn

Revisiting a weekly chart of a 9 symbol crypto mega cap index (BTC, ETH, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC) one can't help but notice price resting on a shelf that was formed during momentum running deep into overbought territory. As the shelf is more or less flat for many months, we see momentum cooling into saner levels. Price could continue to base out in what turns out to be a bullish flag, especially with the Nasdaq 100 ripping fresh records, inflation cooling, rate cuts likely etc... It's also a scary place to think about going long on crypto though as there's a big gap down to the major support level!My mate pointed out the chart was a bit cluttered. Here's a cleaned up version that's hopefully easier to digest! tradingview.com/chart/c44rPKB4/

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.