niclaxfx

@t_niclaxfx

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

niclaxfx

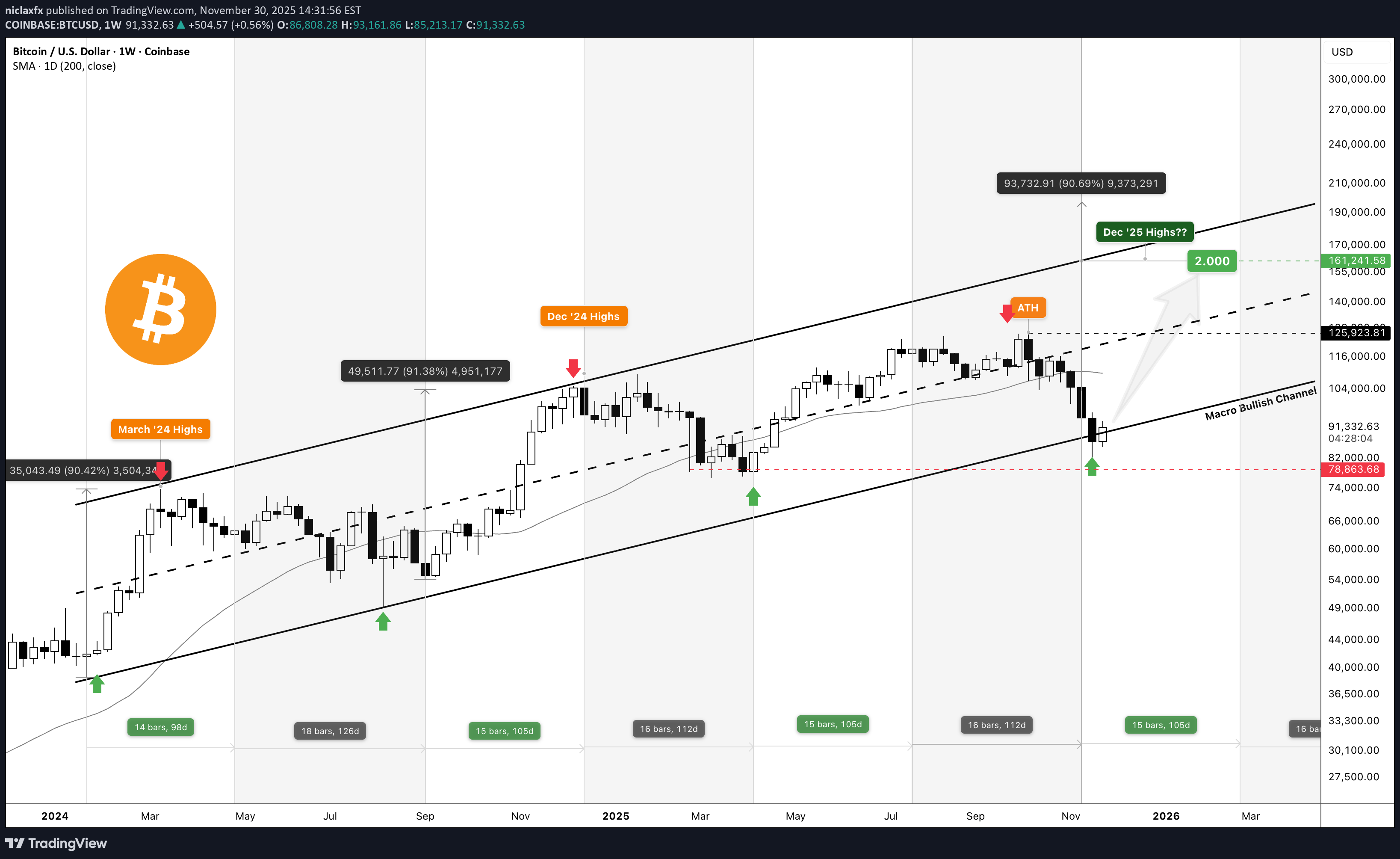

بیت کوین به ۲۵۰ هزار دلار میرسد؟ مسیر بازیابی و پیشبینی هفتههای آینده

Hey guys in this video, I shared my thoughts on the current market state of BTCUSD , why I believe the bull market isn't over yet and also what to expect the coming weeks. If you find this content helpful, like, share, follow and most importantly share your thoughts in the comment below if you agree or disagree with my view. Lets help each other. Cheers.💚

niclaxfx

بیت کوین در آستانه جهش بزرگ: راز الگوی "کف دوقلو" فاش شد!

After weeks of consolidation and a sharp dip that shook out weak hands, BITCOIN appears to be setting up for its next major leg higher. The 4-hour chart reveals a textbook double bottom formation, a pattern that often marks the end of a correction and the beginning of a fresh uptrend. The Setup Following Bitcoin's rejection from the $126K zone in early November, we witnessed a measured retracement that found support near the $98K-$100K level. This crucial support zone has now been tested twice, forming two distinct lows that create the foundation of our double bottom pattern. The neckline, sitting around $104.6K, has been breached with conviction, suggesting buyers have regained control. What makes this setup particularly compelling is the measured move target. By projecting the formation height from the breakout level, we arrive at a first target around $111.5K—conveniently aligned with the 0.618 Fibonacci retracement level. This confluence adds weight to the bullish thesis. The risk-reward here is attractive. With a stop loss positioned just below the recent swing low at $101K, roughly a 3:1 reward-to-risk ratio. The Path Forward If BITCOIN maintains support above the neckline and current price action, the path of least resistance appears to be upward. The measured move projection suggests we could see a structured advance through the $108K-$111K zone in the coming sessions. Beyond the immediate target, the chart hints at even more ambitious levels, with the all-time high region at $126K coming back into focus if momentum continues. Of course, BITCOIN doesn't move in straight lines. Expect consolidation phases and potential retests of the neckline as support. The key is whether buyers continue to defend the $104K-$105K zone on any pullbacks. 📝 TL;DR Bitcoin has formed a double bottom pattern after testing $98K-$100K support twice. The neckline breakout at $104.6K targets $111.5K, offering an attractive risk-reward setup. Invalidation occurs below $101K. --- Invalidation: A sustained break and 4H close below $101K would negate the bullish structure and suggest the correction may extend lower toward the $98K support zone. --- *Note: This analysis is for educational purposes. Always conduct your own research and manage risk appropriately.*

niclaxfx

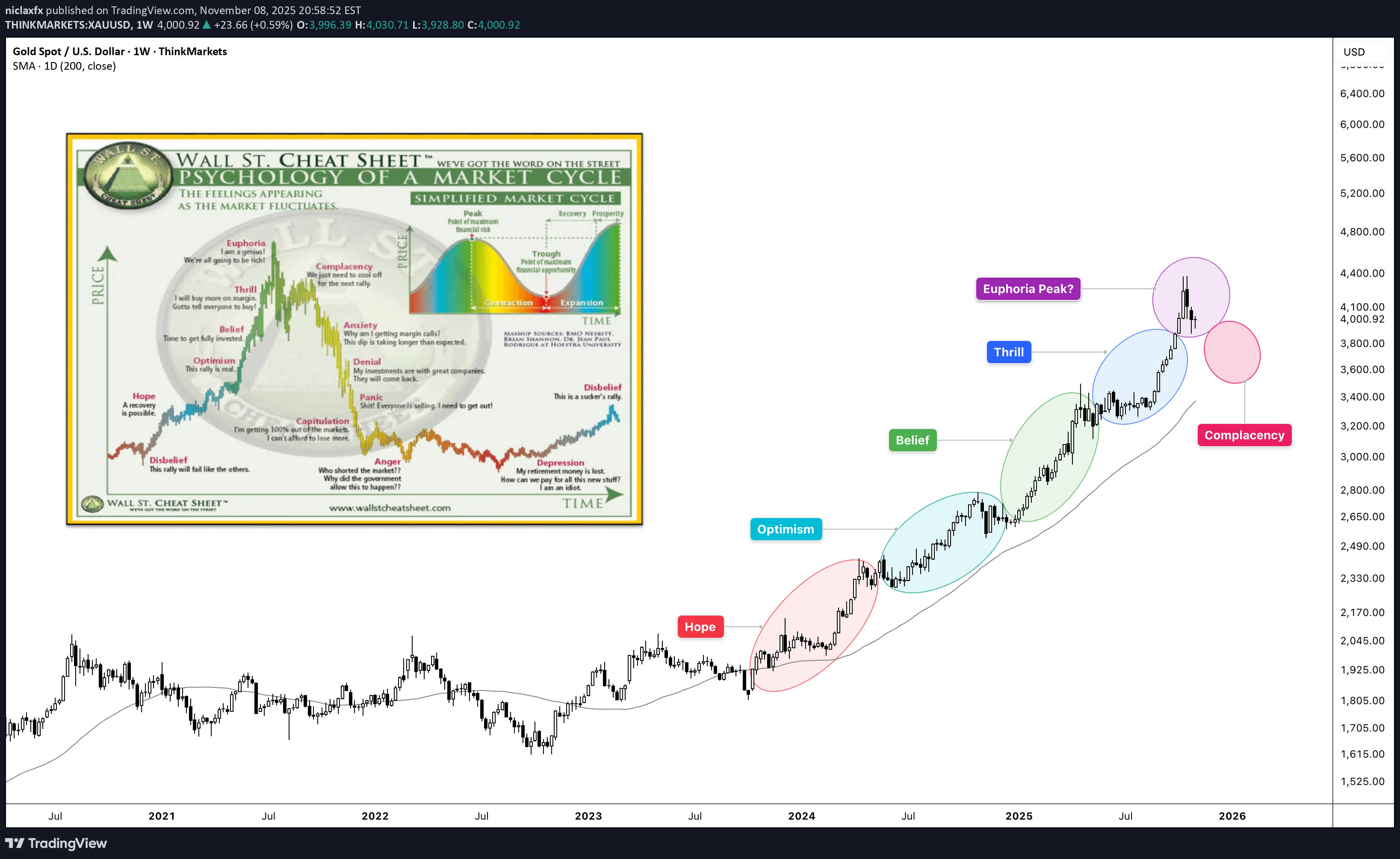

نبرد روانی طلا و بیت کوین: کدام دارایی واقعاً به اوج رسید؟

🧠 The Psychology Test That Changes Everything Here's a simple test that will tell you everything about where GOLD and BITCOIN is in its cycle: Look at these two charts. Which one screams "bull market euphoria"? ──────────────────────────────────── Chart One 🥇 GOLD : A Textbook Bull Market Current Price: $4,000.92 Peak Price: $4,390 (Recently hit) RSI: 69.15 Phase: EUPHORIA → COMPLACENCY (Post-peak pullback) What the Psychology Chart Shows: Looking at XAUUSD price action overlaid with the Wall Street Cheat Sheet: ✅ Clean parabolic structure - No ambiguity ✅ Multiple phases completed - Hope → Optimism → Belief → Thrill → Euphoria ✅ Peak already hit at $4,390 - The pink Euphoria circle was touched ✅ Now pulling back from peak - Classic post-euphoria behavior ✅ RSI cooling from overbought - Down from 85+ to 69.15 ✅ Volume still elevated as reality sets in This is what a COMPLETED bull market looks like. When you see this chart, you don't second-guess. You don't wonder "is this a bull market?" You KNOW it is. ──────────────────────────────────── Chart Two ₿ BITCOIN : Still in Early Stages Current Price: $101,802.2 RSI: 44.61 Phase: OPTIMISM (not even Belief yet) What the Psychology Chart Shows: Looking at BTCUSD price action overlaid with the Wall Street Cheat Sheet: ⚠️ "We are here" marker - Sitting in the OPTIMISM phase ⚠️ Haven't reached Belief yet - The green zone is still ahead ⚠️ Thrill phase - Blue circle far above current price ⚠️ Euphoria phase - Pink circle even further away ⚠️ RSI at 44.61 - Not even close to overbought ⚠️ Fourth Halving marker - April 22, 2024 clearly noted This is what mid-cycle consolidation looks like. ──────────────────────────────────── 🔍 The Critical Difference Let me use an analogy: Think of market cycles like a marathon. GOLD (Chart 1): Mile 26 - Just crossed finish line - Race is over, starting to cool down Runners are slowing down after sprint (Post-euphoria) Crowd peaked, now dispersing (Volume still high but declining) Everyone saw the finish (Peak at $4,390) Now wondering if they should have sprinted harder BTC (Chart 2): Mile 8 of 26 - Still early in the race Runners are fresh and steady (Optimism) Crowd is watching but not cheering wildly yet Most people aren't even at the venue yet Many spectators think the race might be cancelled ──────────────────────────────────── 📊 Side-by-Side Psychology Comparison ──────────────────────────────────── 🎯 What This Tells Us About BITCOIN If BTCUSD were truly at a cycle top, it would look like GOLD : ❌ Parabolic vertical moves ❌ RSI pinned above 75 for weeks ❌ Volume exploding ❌ Everyone saying "Bitcoin to $500K" ❌ Taxi drivers asking about crypto ❌ Magazine covers everywhere ❌ No doubt whatsoever about the trend But BTCUSD looks nothing like that: ✅ Choppy consolidation ✅ RSI in neutral zone (44.61) ✅ Volume moderate ✅ Everyone asking "Is the bull market over?" ✅ Retail despair and fear ✅ Zero mainstream coverage ✅ Maximum doubt about the trend ──────────────────────────────────── 💡 The Psychology Principle Here's the key insight from behavioral finance: **"If you have to ask whether you're in a bubble, you're not in a bubble."** GOLD : No one is asking if GOLD is in a bull market. It's obvious. BITCOIN : Everyone is asking if BITCOIN is in a bull market. That's your answer. ──────────────────────────────────── 🧩 Where Each Asset Really Is GOLD - Post-Peak Bear Market Transition: Completed Phases: ✅ Hope (Oct '23 - May '24) ✅ Optimism (May '24 - Dec '24) ✅ Belief (Dec '24 - May '25) ✅ Thrill (May '25 - Sep '25) ✅ EUPHORIA - PEAKED at $4,390 (Oct '2025) Current Phase: 🔶 COMPLACENCY - "It'll come back to $4,390" Price: $4,000.92 (down ~9% from peak) Classic post-euphoria denial behavior What's Next: Anxiety → Denial → Panic → Capitulation (2026+) Time Remaining: Bull market is OVER - bear phase beginning ──────────────────────────────────── BTCUSD - Early-Mid Bull Market: Completed Phases: ✅ Hope (2023 - Post-FTX recovery) 🟡 OPTIMISM (Current - 2024-2025) Phases Still Ahead: ⬜ Belief ⬜ Thrill ⬜ Euphoria What's Next: Break into Belief phase → Thrill → Euphoria Time Remaining: Given BTC high volatile nature - 2-6 months of upside potential ──────────────────────────────────── 🎨 The Visual Test (Do This Right Now) Step 1: Look at the GOLD chart Does it look like a bull market? YES Could you be wrong? NO Is there any doubt? ZERO Step 2: Look at the BITCOIN chart Does it look like a bull market? MAYBE? Could you be wrong? POSSIBLY Is there any doubt? TONS Step 3: Ask yourself **"Would a cycle TOP have this much doubt and fear?"** The answer is NO. ──────────────────────────────────── 📈 What the RSI Divergence Tells Us GOLD RSI Pattern: Peaked above 85 during euphoria Currently cooling at 69.15 Rolling over from overbought Classic post-peak behavior This is bear market transition BITCOIN RSI Pattern: Sitting at 44.61 Plenty of room to run Not even approaching overbought Recent "Bear" signals flushing out This is early-cycle behavior Think of it like a gas tank: GOLD : Hit redline at $4,390, now coasting down on fumes BITCOIN : 45% full, tons of room to run ──────────────────────────────────── 🔥 The Contrarian Insight What the majority thinks: " GOLD is in a bubble, BITCOIN topped" What the charts actually show: GOLD is in a mature bull market (near end) BITCOIN is in early-mid bull market (tons of runway) The irony: Everyone trusts GOLD rally (late stage) Everyone doubts BITCOIN rally (early stage) This is exactly backwards. ──────────────────────────────────── 🎭 The Emotional State Comparison GOLD Holders Right Now: 😰 Starting to feel anxious (down from $4,390) 🤔 "It'll bounce back, right?" 📉 Checking price hoping for recovery 🙃 "I should have sold at $4,390" 😬 "This is just a healthy correction" This is COMPLACENCY - the denial phase after euphoria. BITCOIN Holders Right Now: 😰 Anxious and doubtful 🤐 Not talking about their positions 😔 Wondering if they should sell 📉 Feeling defeated 💀 "Maybe the cycle is over" Which emotional state typically marks: Post-cycle tops? → GOLD current state (Complacency/Denial after Euphoria peak) Cycle middles? → BITCOIN current state (Doubt during Optimism) ──────────────────────────────────── 💎 The Bottom Line Using the Wall Street Cheat Sheet as our guide: GOLD : Phase: Thrill → Euphoria Completion: ~95% through cycle Risk/Reward: High risk, limited reward Action: Take profits soon BITCOIN : Phase: Optimism (just finished Hope) Completion: ~30% through cycle Risk/Reward: Moderate risk, massive reward Action: Accumulate aggressively ──────────────────────────────────── 🧠 The Psychology Lesson The market is designed to make you feel wrong at exactly the wrong time: When GOLD peaked at $4,390 (Euphoria) → You felt confident, " GOLD to $5K!" Now GOLD is pulling back (Complacency) → You feel like "it's just a correction" When BITCOIN is cheap and poised (Optimism) → You feel scared to buy This is why most people: Miss selling tops (felt too good at $4,390) Hold through corrections (denial and complacency) Sell bottoms during fear (Optimism feels scary) To win, you must: Trust the structure over the sentiment Buy when it feels uncomfortable (Optimism/Belief) Sell when it feels amazing (Euphoria/Peak) ──────────────────────────────────── 📍 Where We Actually Are HOPE → OPTIMISM( BITCOIN ) → BELIEF → THRILL → EUPHORIA ( GOLD $4390 Peak) → COMPLACENCY → ( GOLD Current) BITCOIN is 3-4 phases behind GOLD . GOLD already peaked. BITCOIN hasn't even started its parabolic phase yet. ──────────────────────────────────── 🎯 What This Means for Your Portfolio If you're holding GOLD at $4,000: You missed the peak at $4,390 You're in post-euphoria complacency "It'll bounce back" is denial Risk/reward is terrible now Exit strategy needed YESTERDAY If you're doubting BITCOIN at $102K: You're sitting in Optimism You're early to the party Peak is 3-4 phases away Risk/reward is excellent Accumulation strategy needed NOW ──────────────────────────────────── 🔚 Final Thought The next time someone tells you " BITCOIN topped," show them these two charts side by side. Ask them: "Which one actually topped?" The answer is clear: GOLD peaked at $4,390 and is now in complacency denial. BITCOIN is still in optimism. GOLD finished its race. BITCOIN is just finishing Act 1. The Golden Bull Run isn't over—it's barely begun. ──────────────────────────────────── This is educational content comparing market psychology across asset classes. Not financial advice. Always do your own research and manage risk appropriately. ────────────────────────────────────

niclaxfx

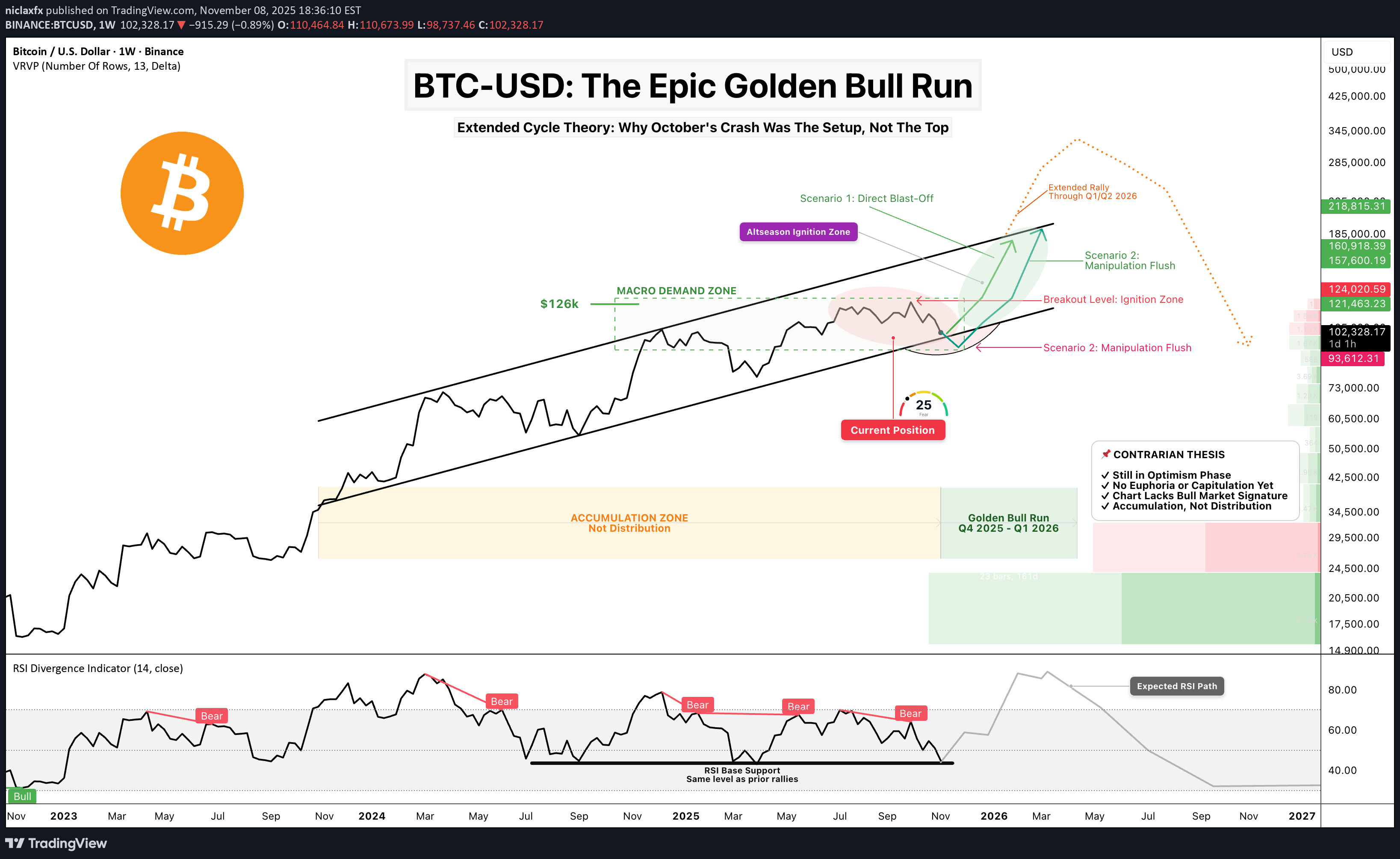

سقوط بیت کوین توهم بود؟ چرا رالی طلایی واقعی تازه شروع نشده است!

Yes, I get it. Everyone thinks we're already in a bear market. Hope is lost. Life-changing money evaporated. The October crash saw $19 billion in forced liquidations —the largest in crypto history. Some tragically took their own lives. No one wants false hope right now. But I don't think the bull market is over. And here's why—backed by data, not hopium. ──────────────────────────────────── ⚠️ DISCLAIMER This post is strictly my personal beliefs and thoughts, and should NOT be construed as financial advice, nor does it mean the market must go this way. This will be a long read but would be worth the time. Sit tight and grab a beer 🍻 ──────────────────────────────────── Context: Where I Stood in September First, I want to share that as of the last week of September, I gave a detailed breakdown of the market and shared why I thought the bull market was over, which I tagged "The Great Convergence." Read below if you missed that:👉 In that post, I worked with the BITCOIN halving cycle theory (along with SPX and GOLD ), which for over a decade has been the most efficient, accurate, and proven method for timing BITCOIN rallies, tops, and bottoms. By halving theory, the bull market should have ended by August/September 2025. What Actually Happened: Early October : BITCOIN briefly touched a new ATH near $126,296 October 1st : US government shutdown begins, draining $700B+ from markets via TGA October 10th : Trump's 100% China tariff threat triggers $19.13B liquidation cascade in 24 hours BITCOIN crashed from $126K to below $104K—an 18% drop in days October became the first "red October" since 2018 1.6 million traders liquidated—20x larger than COVID crash, 12x larger than FTX November 8th (Today) : Market hovering around $100-102K in extreme fear (Fear & Greed Index: 21) ──────────────────────────────────── 🔍 What's Different About This Current Cycle Here's what stands out as fundamentally different: 1️⃣ The Recent TOTAL Crypto Liquidation Wasn't Capitulation—It Was Infrastructure Cleansing This wasn't profit-taking or true capitulation. The numbers tell the story: $19.13 billion in forced liquidations in 24 hours 1.6 million traders wiped out 20x bigger than the March 2020 COVID crash ($1.2B) 12x bigger than the FTX collapse ($1.6B) This was leverage-driven, not sentiment-driven. The weak hands and overleveraged positions got flushed out. Meanwhile, strong hands (institutions, whales) continued accumulating through the chaos. Key Difference : In true bear market capitulations, holders capitulate. In October, leveraged speculators capitulated while spot holders held firm . ──────────────────────────────────── 2️⃣ The Liquidity Vacuum Is Temporary (This Is Critical) Here's what most people are missing about October: The crash wasn't just about tariffs—it was about a government-induced liquidity crisis . What Happened: US government shutdown began October 1st Treasury General Account (TGA) balance swelled from $800B to over $1 trillion in just 20 days That's $200+ billion drained from the financial system Standing Repo Facility (SRF) usage hit $50.35 billion on October 31—highest since the pandemic crisis in March 2020 This indicated severe dollar shortage in the system Why This Matters: BTCUSD correlation with dollar liquidity remains near 0.85 When the government shutdown ends and resumes spending, that liquidity floods back BitMEX analysts project a strong relief rally when hundreds of billions are injected back This isn't a structural bear market—it's a temporary liquidity vacuum. ──────────────────────────────────── 3️⃣ Institutional Holders Aren't Selling Like Retail Did in Past Cycles Whale Accumulation Data: 1,455 wallets now hold over 1,000 BTC UTXO Age Distribution shows a 5% spike in "Over 8 Years" buckets Long-term holders are doubling down , not distributing Whale Originating Transaction Count: Miner Behavior: Post-halving, miners anticipated higher prices and chose to hold rather than sell immediately While smaller miners face profitability pressure, institutional holders are not showing distribution patterns ETF Context: U.S. spot Bitcoin ETFs saw $1.2B+ in outflows during the crash week October 16 alone: $536 million in panic redemptions BlackRock's IBIT : $268.6M out | ARK's ARKB: $275.2M out BUT HERE'S THE KEY : These were temporary panic outflows, not structural distribution. Year-to-date, institutional accumulation has been relentless . The October outflows represent weak hands being shaken out—exactly what you'd expect in a mid-cycle correction, not a cycle top. ──────────────────────────────────── 4️⃣ No FOMO. No FUD. No Euphoria. (Strongest Psychological Indicators) Let's compare sentiment metrics: Current Sentiment: Crypto Fear & Greed Index: 21-25 (Extreme Fear) as of November 7-8 BTCUSD RSI as at Oct ATH: ~60 (far below euphoric 75+ levels) Market Mood: Despair, capitulation narrative, "bear market confirmed" True Bull Market Top Sentiment (for comparison): Fear & Greed Index: 80-95 (Extreme Greed) RSI: 75-85 (overbought for weeks) Market Mood: "Bitcoin to $500K," taxi drivers asking about crypto, covers of mainstream magazines We haven't even come close to euphoria. The 2024 meme coin craze was a micro-cycle within the broader structure—too early and too isolated to be considered true market-wide euphoria. ──────────────────────────────────── 5️⃣ The CHART Does Not Reflect a Bull Market Yet This is where I'll let the charts speak. First, Look at Gold's Bull Market: 👉 Clean. Parabolic. Obvious. No second-guessing needed. Now Look at Bitcoin: 👉 Ask Yourself Honestly: Does this chart scream "parabolic bull market"? Does the recent ATH look like a blow-off top? Does the volume profile suggest distribution? If you can't answer YES with conviction, then the answer is NO. A Simple Psychology Principle I Use: If I can't say YES without doubting my decision, then the answer is NO. ──────────────────────────────────── 6️⃣ Cycle Coincided with AI Tech Mania and GOLD Super Rally This cycle is unique because capital had competing destinations: AI Tech Mania : Nvidia, AI stocks absorbed massive capital flows GOLD Super Rally : GOLD broke out to all-time highs, attracting safe-haven capital Risk-On Delay : BTCUSD became less attractive as capital rotated elsewhere This delayed the typical BITCOIN Bitcoin cycle dynamics—it didn't end them. ──────────────────────────────────── 🧠 My Contrarian Thesis While this might sound crazy, I believe we are still in the OPTIMISM phase of this rally. Unlike previous cycles, I believe we will experience an extended rally lasting through Q1/Q2 2026. My Thesis is NOT Based On: ❌ Traditional Halving Cycle Theory — I believe that timeline will be extended and recalibrated this time ❌ Stock-to-Flow (S2F) Alone — Though I lean toward its supply dynamics My Thesis IS Based On: ✅ Pure naked price action and structure ✅ Volume profile analysis showing accumulation ✅ Market structure and RSI positioning ✅ Government liquidity mechanics and TGA dynamics ✅ Institutional vs retail behavior divergence ✅ Psychological playbook of market cycles ──────────────────────────────────── 🔄 Why the Halving Cycle Is Extended, Not Broken Many are saying "the 4-year cycle is dead." I disagree. It's not broken—it's being distorted and extended by new factors: The ETF Factor Changed Everything: Traditional Halving Cycle: Post-halving scarcity → slow accumulation → parabolic phase ~500-550 days later 2024-2025 Cycle: January 2024: Spot BTCUSD ETFs approved ETFs brought forward typical post-halving demand 12 months early This created an early rally into March 2024, then consolidation October 2025: Temporary ETF panic outflows (weak hands exit) Framework : The cycle hasn't ended—it's been stretched across a longer timeframe Historical Context: Historically, most significant price appreciation occurred between days ~500-550 post-halving For the April 2024 halving, that window ends Q3 2025 ... but if we factor in the time lag and the now running ~2-Months Govt shutdown delay then that window could be adjusted to Q3 2025 - Q1 2026 See it like a football match, time delay during match is added as extra time, it doesn't mean the 90min rule is broken simply means wasted time must be accounted for. We're literally in the window right now Expert Analysis: Leading analysts suggest the era of the strict 4-year cycle is evolving Market maturity, institutional concentration, and dampened volatility mean the traditional rhythm is being replaced by liquidity-sensitive, macro-correlated behavior The cycle isn't gone—it's adapting to a new market structure ──────────────────────────────────── 📈 The Current Chart Breakdown Look at the Chart Again: 👉 Four Critical Questions: 1. Does this move look like a completed rally? → No. It looks like mid-cycle consolidation with a violent shakeout. 2. Does the recent ATH reflect a distribution top? → No. Volume and RSI don't support distribution behavior. The ATH was a brief spike , not a prolonged distribution phase. 3. What does the volume profile show? → Accumulation zone. Heavy volume during the $95K-$110K range indicates re-accumulation, not distribution. 4. What is the RSI telling us? → Sitting on base support —the same level that triggered every prior bull market explosion in this cycle. Conclusion: If both price action and volume show accumulation rather than distribution, we're in a re-accumulation phase, not a post-rally distribution phase. ──────────────────────────────────── 🎯 The Macro Setup BTC is Positioned Perfectly: ✅ Inside the macro demand zone that has held since late 2023 ✅ On the ascending channel that guided every major leg of this cycle ✅ Channel from 2023 is intact and pointing into six-figure territory ✅ Weekly demand zone holding with precision — re-accumulation, not distribution ✅ Weekly RSI on base support — same level that triggered every bull explosion ✅ Nothing is broken. Nothing is topping. This is positioning, not exhaustion. ──────────────────────────────────── I shared this analysis yesterday, you can read the full or the summarized version below: 📅 Cycle Structure: The 14-15 Week Expansion Pattern Every expansion leg in this cycle has followed a pattern: 14-15 weeks of expansion Followed by 16-18 weeks of correction Where Are We Now? End of the correction window Beginning of the next expansion phase Historical Precedent: If we follow 2017's pattern (euphoric Nov-Dec Rally) where BTC gained +200% in price between Nov 17 -Dec 17 from 5.6k+ to 19.6k+, we could see an explosive acceleration starting from Next week Mid-November - December 2025 With institutional adoption and extended liquidity cycles, this could push into Q1 2026 This would make the current cycle the longest on record , not the end of one ──────────────────────────────────── 🔥 What the Chart Is Screaming Key Technical Signals: Ascending Channel Intact — Channel from late 2023 still pointing to six figures Demand Zone Holding — Weekly demand zone defended with precision Breakout Level Clear — $126K break = ignition point for macro acceleration RSI Base Support — Weekly RSI at the exact level that preceded every rally Projection Untouched — Path to $150K–$170K remains structurally intact ──────────────────────────────────── 🚀 Two Scenarios Moving Forward Scenario 1: Direct Blast-Off ⚡ Demand zone holds firm here Government shutdown ends → liquidity snap-back $126K breaks decisively within weeks New ATH confirmed Vertical acceleration into $150K–$170K by December 2025 Extended rally continues through Q1 2026 Scenario 2: One Final Manipulation Flush 🌊 Wick below demand zone (liquidity grab to $95K-$98K) Mid-channel tap for final shakeout Violent V-shaped recovery and reclaim Same ultimate target: $160K–$170K Timeline delayed by 4-8 weeks but destination unchanged Both scenarios end at the same place. The path differs, but the structure remains intact. ──────────────────────────────────── ❌ The Only Invalidation I will abandon this thesis if: Primary Invalidation: Weekly close below the ascending channel (currently ~$80K) Secondary Warning Signals: TGA doesn't release liquidity when government reopens Institutional ETF outflows continue for 2+ consecutive months Fear & Greed Index stays below 30 through EOY 2025 BITCOIN fails to reclaim $110K by end of November 2025 Weekly RSI breaks below 40 and stays there Until these conditions are met, the bull thesis remains structurally intact. ──────────────────────────────────── 💡 The Liquidity Snap-Back Thesis Here's the mechanism most traders are missing: How Government Shutdowns Affect Crypto: Phase 1: Shutdown (October 1 - Present) Government stops spending TGA balance grows ($800B → $1T+) Liquidity drained from system Dollar shortage (SRF at $50B+) Risk assets crash Phase 2: Reopening (Coming Soon) Government resumes spending TGA balance depletes back down $200B+ floods back into system Dollar shortage resolved Risk assets rally violently BTCUSD 0.85 correlation with dollar liquidity means: When liquidity drains → Bitcoin falls When liquidity returns → Bitcoin rips This isn't speculation—it's mechanical. The October crash was a liquidity event, not a sentiment event. When that liquidity returns, BTC will respond proportionally. ──────────────────────────────────── 📊 Why October's Liquidation Was Different From Bear Markets Let's compare major crypto crashes: The Critical Difference: Previous crashes: Spot holders capitulated October 2025: Spot holders accumulated while leveraged traders got wiped out This is cleansing, not capitulation. ──────────────────────────────────── 🎨 Compare: What a Real Bull Market Top Looks Like Signs of a Cycle Top We DON'T Have: ❌ Fear & Greed Index at 90+ for weeks ❌ RSI pinned above 75 ❌ Parabolic vertical price action ❌ "Bitcoin is going to $1 million" headlines everywhere ❌ Taxi drivers and hairdressers asking about crypto ❌ Massive miner selling at highs ❌ Whales distributing to retail ❌ Everyone you know is suddenly a crypto expert ❌ Cover stories on TIME, Forbes, Bloomberg ❌ New ATHs multiple weeks in a row Signs of Mid-Cycle Correction We DO Have: ✅ Fear & Greed at 21 (Extreme Fear) ✅ RSI at 46 (neutral to oversold) ✅ Choppy consolidation in range ✅ "Bull market is over" narratives everywhere ✅ Retail giving up and selling ✅ Whales accumulating quietly ✅ Liquidation event clearing out leverage ✅ Volume profile showing accumulation ✅ Market despair and hopelessness We're not at a top. We're in the middle of the game. ──────────────────────────────────── 💰 Why I'm All In In my last post I said I went ALL IN on BITCOIN and my selected alts. (after earlier shorting around 120k and sitting on cash) Not because I'm reckless. Not because I'm ignoring risk. But because: The macro structure is intact The demand zone is holding RSI is at historical launch support Volume shows accumulation, not distribution No euphoria has occurred yet The chart does not reflect a completed bull market Government liquidity will return mechanically Largest liquidation in history = weak hands removed Institutional holders aren't selling We're in the historical extended post-halving window This is structure. This is patience. This is conviction based on data. ──────────────────────────────────── 🙏 Final Thoughts I know many of you are hurting right now. I know hope feels dangerous. But look at the data objectively: October was the largest forced liquidation in history—not organic selling The government shutdown created a temporary liquidity vacuum Zero signs of euphoria anywhere in the market Institutional holders and whales are accumulating The chart structure shows mid-cycle correction , not cycle top Sometimes, the best opportunities come when: Everyone is bearish The crowd has capitulated Fear is at its peak And the chart is quietly building the foundation for the next explosive leg This is not hopium. This is structure. This is the setup. The Golden Bull Run hasn't even started breathing yet. We're not at the end— we're at the reset point before the real parabolic phase. ──────────────────────────────────── 📌 Key Levels to Watch Support Levels: Primary Demand Zone: $98K - $104K (current position) Mid-Channel Support: $90K - $95K Critical Invalidation: $85k-$90K (weekly close) Breakout Levels: Ignition Point: $126K (previous ATH) Confirmation: $130K (weekly close above) Targets: Conservative: $150K - $160K (Q2 2025) Base Case: $170K - $180K (Q3 2025) Extended Cycle: $200K+ (Q4 2025 - Q2 2026) Timeline Checkpoints: End of November 2025: Reclaim $110K December 2025: Break $126K and establish new ATH Q1 2026: Parabolic acceleration phase and potential cycle peak(extended thesis) ──────────────────────────────────── 🎯 What Would Make Me Change My Mind? I will publicly update and reassess if: Weekly close below $85k-$90K (channel break) TGA remains elevated 4+ weeks after shutdown ends Institutional ETF outflows persist through December RSI breaks and holds below 40 Fear & Greed stays below 30 through Q1 2026 Failure to reclaim $110K by November 31, 2025 I'm bullish, but not blind. The market will tell us if the thesis breaks. ──────────────────────────────────── 🔚 Bottom Line This bull market isn't slowing down—it's resetting for the real parabolic phase. BTC is gearing up for expansion, and alts will follow with the delayed but inevitable altseason wave. This next 12-18 months is where: Generational wealth is made or missed The real euphoria begins The masses FOMO in—not out The chart finally looks like a bull market Don't let October's liquidation event fool you into thinking this is over. The chart says accumulation. The structure says intact. The liquidity says temporary. The sentiment says despair. That's not a bear market— that's the setup for the next leg. 🐂🔥 ──────────────────────────────────── Not financial advice. This is my personal analysis based on current data. Markets are unpredictable. Trade responsibly. Manage your risk. Do your own research. If you found this analysis valuable, feel free to boost/share. Let's see who's still standing when BITCOIN crosses $150K. ────────────────────────────────────

niclaxfx

بیت کوین مرده نیست! راز انفجار بزرگ بعدی و شروع سیزن آلتکوینها

All In Before the Explosion: Bitcoin’s Next Leg and the Incoming Altseason Wave Once again I'm ALL IN on BITCOIN and a few selected ALTS. Bull market NOT over. 🔥Altseason hasn’t even started warming up and this is not hopium ... Here’s the raw macro truth the chart is yelling: BTCUSD is sitting cleanly inside the macro demand zone Still riding the ascending channel that has carried every major leg of this cycle No top. No breakdown. No weakness. This is positioning , not exhaustion. ⏱ Cycle Structure: • Each expansion leg: 14–15 weeks 📈 • Each correction: 16–18 weeks 📉 We’re exiting the correction window (ends Nov 10th🗓️)→ entering the next expansion phase. 📊 What the chart confirms: • Long-term channel from Jan 2024 still intact → trend pointing to six figures. • Weekly demand zone acting as controlled re-accumulation , not distribution. • Clear trigger: break above $126K → macro ignition. • Weekly RSI sitting on base support ⚫ → same level that preceded every major leg up. • High-timeframe target for this cycle still $150K–$170K →parabolic to 220k+ 🎯 • Volume profile shows accumulation not distribution 🎯 📝 Scenarios: 1️⃣ Direct Blast-Off 🚀 Demand zone holds → $126K break → new ATH → trend accelerates into $160K–$170K. 2️⃣ Manipulation Flush 🩸 Wick below demand(flash crash to $90k) → mid-channel tap → violent reclaim → same final target. ❌ Invalidation: Only a weekly close below the channel kills the structure. Nothing else matters. ✅ Bottom Line: This bull market isn’t cooling, it’s reloading . Bitcoin is gearing for its next expansion wave, and alts will follow with the delayed, violent, inevitable altseason. This next leg is where generational entries pay off or get regretted. My stake is on BITCOIN where is yours?Disclaimer: This analysis is for educational purposes only and should not be considered financial advice. Past performance does not guarantee future results. Always conduct your own research and consult with financial professionals before making investment decisions.Lower timeframes (H8/H4) show a clean double-bottom, lining up perfectly with the end of the 16-week correction on the macro. If this structure breaks by the weekend (Nov 10), it likely triggers the start of a 5-wave Elliott impulse to the upside. Watching closely here — Interesting week ahead✌🏾.

niclaxfx

سقوط آزاد طلا (XAU/USD): آیا حمایت حیاتی 3986 دلار شکسته میشود؟

GOLD topped out heavy at $4,380, neckline cracked around $4,200–$4,190 - classic Double Top formation. Since then, it’s been bleeding down inside a descending channel, and every bounce has died under pressure. $3,986 is the line in the sand ⚔️ — as long as price stays below, bears are in full control. We’re still trading inside the Zonal Drop Range ($3,986–$3,825) — where sellers keep hammering every push. 🎯 Targets: TP1 → $2920 (38.2% fib) TP2 → $3,858 TP2 → $3,790–$3,760 (Support Zone) 🧠 Setup: Short rejections between $3,980–$3,990. Stop above $4,040 — any close above that cancels the play and opens space back toward $4,103–$4,160. 📉 RSI: Neutral to bearish around 51. 📊 Volume: Drying up = pressure cooker before next drop. Until bulls reclaim $4,040, I’m hunting shorts only. Below $3,986, expect acceleration — liquidity vacuum toward $3,858, maybe a full flush into $3,790. Stay sharp, stay patient 💚.

niclaxfx

ریتم مخفی بیت کوین: پیشبینی مسیر صعودی تا ۱۶۰ هزار دلار (۱۲۰ هزار کلید است!)

Bitcoin moves in rhythm - not random, not reckless, but harmonic. Each rise and retrace plays like a melody from its own history, and once again, the chart hums that familiar tune. After tapping 126K , price retraced, tested 120K support , and bounced clean - a sign the rhythm’s still intact. The ATH–SR zone (120K–124K) now acts as the pivot, where momentum builds for what could be another November encore. Above this range, the next notes play at 138K, 147K, and possibly 160K+ if the tempo flows like Nov ’24–Dec ’24, now Oct ’25–Nov ’25. But if this beat breaks, 108K remains the base of the rhythm. BTCUSD doesn’t just move in price - it moves in patterns. Listen to the rhythm, not the noise. - Klaus | NFX Hub 💚 --------------------------- Even in critical times - it’s okay to play a little...📝 TL;DR: 🟠 120K–124K is the pivot zone. 📈 Hold above = targets at 138K, 147K, 160K+. 📉 Break below = 108K retest. 📆 The pattern rhymes with Nov '24, but stay flexible.Trade Closed Target reached 108kNow we wait for the reversal.

niclaxfx

بیت کوین در 123 هزار دلار: آیا گاوها یا خرسها پیروز میشوند؟ راز مقاومت سهگانه فاش شد!

Price has now tested the 123K resistance zone three times. On the third attempt, we saw a shallow breakout, hinting at absorption rather than rejection - a sign that sellers might be running thin((among them, I used to be lol). Now, all eyes are on the 123K retest - the potential make-or-break pivot. If this level flips to support, bulls could drive toward the next Fib extension at 129,700. But if the level gives way, we’re likely headed back into the 117K–118.5K base zone. Key Levels 🔴 Resistance Zone: 122,500 – 124,500 🟢 Target: 129,700 (Fib Ext 1.272) ⛔️ Invalidation: Below 122,000 🔵 Base Support: 117,000 – 118,500 📝 Thesis: Triple tests tend to weaken supply zones. The shallow breakout suggests accumulation rather than exhaustion. Confirmation comes if buyers defend the 123K handle - failure to hold flips momentum back to the downside. TL;DR: Triple resistance test → shallow breakout → retest in play. 123K is the pivot. Hold = 129,700. Fail = back to base. ⚠️Risk Note: Stay alert for fakeouts around macro events. Volume and close structure will tell the real story.

niclaxfx

طلا در منطقه حساس: تصمیم سرنوشتساز هفته آینده برای قیمت چیست؟

GOLD continues its impressive bullish structure, climbing cleanly through all prior resistance zones. Each expansion phase has been measured and consistent - alternating between ~1.7% impulsive legs and ~4.4% corrective expansions, forming a rhythmic price behavior that reflects controlled institutional flow rather than retail volatility. Price is now operating within Zone 4, approaching the $3,987–$3,990 resistance target. This level aligns with the upper boundary of the current expansion range, making it a critical decision point. If price follows the same historical rhythm observed in September, there’s a high probability we’ll see a tap of $3,987, followed by a retracement toward $3,914 (zone support) before any continuation attempt. However, it's important to note that we’re currently in a blackout phase, with no tangible U.S. economic data releases to fuel directional conviction. This means momentum here is largely technically driven, and could mark the final phase for gold before a broader trend shift. Key Note: Primary Bias: Bullish continuation remains valid while above $3,900 support. I expect price to hit 3987 and then pullback to 3914 where possible re-accumulation repeats. Volume remains steady but not euphoric - signaling disciplined accumulation rather than late FOMO. Conclusion: GOLD structure remains intact, but the market is entering a decision zone. The next move from here within 24-48 hours window, will likely determine whether we witness a final extension or the start of a deeper correction. 💭 Share your thoughts below if following this trade.

niclaxfx

ریزش بیت کوین در راه است؟ تحلیل فنی و ماکرو که نباید نادیده گرفت!

📝Thesis: Just entered a short on BTCUSD based on a confluence of technical and macro signals. This isn’t just about overbought RSI - it’s about asymmetric risk, deceptive bullish structure, and a broader bearish undertone most traders are ignoring. 📉 Setup Breakdown RSI (H4): 85.12 – Extremely Overbought. Historically, this zone has triggered sharp pullbacks. Previous RSI peaks marked “Bear” on chart confirm the pattern(July, August 2025). 📊 Chart Structure: Rising wedge approaching STR resistance zone + 78.6 fib level. Price action looks exhausted, and volume is fading. 🌐 Macro Bias: Despite local bullish momentum, the broader trend remains bearish. Credit spreads are widening, and macro liquidity is tightening. Risk-off tone is creeping in. ⚖️ RR Profile: ATH is just ~$4K above. Downside targets offer cleaner reward zones with tighter invalidation. Stop placed just above STR zone. 🎯 Trade Parameters ✅ Entry: Near STR resistance zone ⛔️ Stop: Above upper trend line / STR zone 🟠 Target 1: Mid-channel support 🟢 Target 2: Lower fib confluence zone 🧠 Macro Overlay U.S. credit spreads are widening (HY index at 2.75%, CDS spreads rising). Government shutdown risk is escalating. Fed is in risk-management mode - not panic yet, but tone is shifting. October is historically volatile (see 2008 analogs) - watch for liquidity stress. ⚠️ TL;DR Shorting BTCUSD here isn’t just technical - it’s strategic. Overbought RSI + bearish wedge + macro stress = asymmetric setup. Risk is capped, reward is clean. Let’s see how it plays out.Resistance Zone strongly rejected - watching to see where the candle closes tonight, will be a very significant confirmation of the bear market narrative or its invalidation.Thesis delayed, not denied. Price action has stretched the timing window, but the macro-bearish structure remains intact. To resolidify the thesis, we need a daily close below $119K - that’s the line in the sand. 🟠 Above $119K: reflexive strength, tactical patience, and volatility recalibration 🟢 Below $119K: thesis revalidated, distribution bias confirmed, downside targets reopened Until then, we hold narrative tension. The setup is still live-just waiting for price to cooperate.Setup Invalidated: Resistance Zone Breached Rejection did not hold - price broke through the resistance zone, invalidating the short thesis. Appreciate all the comments and feedback - always valuable in refining the lens. For now, I'm expecting sidelined movement and observing reflexive momentum. Will reassess once structure reasserts itself or signs of exhaustion emerge. Else, the bullish rally continues. Momentum favors continuation until proven otherwise. Watching for signs of overextension or divergence, but respecting strength until the tape says otherwise.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.