mswhitetrader

@t_mswhitetrader

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

mswhitetrader

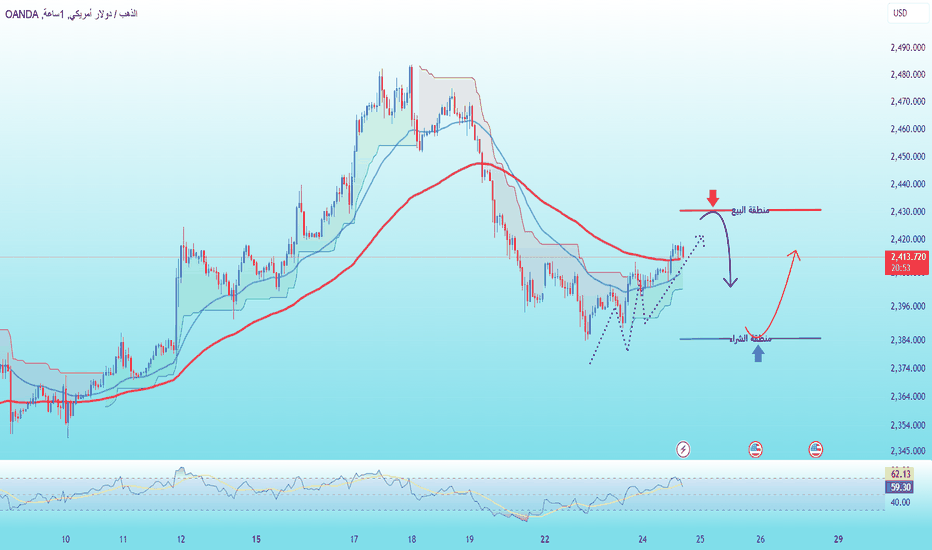

الذهب يتماسك: يزداد الطلب على المأوى

Gold prices (Xau/USD) continued their bullish momentum for the second consecutive day on Wednesday, to reach the highest new weekly level around the region of 2418 dollars during the Asian session. The main driving force for the height of this precious metal comes from two factors: the weak global stock market Federal Reserve. The GDP data for the second quarter in the United States and the US Personal Personal Consumption Index (PCE), scheduled for Thursday and Friday, will be the focus of market attention. Note the price scale: purchase area: 2383-2381 stop loss: 2377 profit 1: 2390 profits 2: 2400 sales zone: 2431-2433 stop loss: 2437 pounds Profit 1: 2420 profits 2: 2410

mswhitetrader

Low interest rates, weak USD, rising gold

The US dollar maintained its recovery momentum early Wednesday, as risk-off sentiment still dominated the market. Asian shares came under pressure after US tech earnings reports, with major companies such as Alphabet and Tesla disappointing. Alphabet is successful in terms of revenue and profits, but it takes time to see results from its investments in artificial intelligence. Tesla dropped 7% as profits did not meet expectations and postponed the Robotaxi event to October. Concerns about China's economic slowdown also supported safe-haven demand for the greenback. On Tuesday, the US dollar rebounded significantly on market jitters ahead of important earnings reports from US companies and a sharp rise in Treasury yields. Investors take profits on USD short positions ahead of Wednesday's preliminary Global Manufacturing and Services PMI data. Weak PMI data could spark recession fears, creating fresh demand for the US dollar. Gold prices could benefit from this scenario if concerns about the US economy reinforce dovish Fed expectations. The market is currently pricing the possibility of the Fed cutting interest rates in September at a 97% probability. All eyes are on the US Q2 GDP report on Thursday and June PCE inflation data on Friday to monitor gold price movements. Note the price range: Sell zones: 2424 - 2426 Stop loss: 2430 Take profit 1: 2415 Take profit 2: 2405 Sell zones: 2440 - 2442 Stop loss: 2446 Take profit 1: 2430 Take profit 2: 2420

mswhitetrader

الذهب: المعركة بين المشترين والبائعين

تکافح أسعار الذهب (XAU/USD) للاستفادة من مکاسب الجلسة الآسیویة یوم الثلاثاء، على الرغم من بقائها فوق أدنى مستوى لها فی أکثر من أسبوع الذی بلغته فی الیوم السابق. أدى انسحاب الرئیس الأمریکی جو بایدن من الانتخابات الرئاسیة لعام 2024 إلى زیادة فرص أن یصبح دونالد ترامب الرئیس المقبل، مما خلق الآمال فی بیئة تنظیمیة أکثر مرونة. إلى جانب ذلک، قام بنک الشعب الصینی (PBoC) بتخفیض أسعار الفائدة بشکل غیر متوقع یوم الاثنین، مما یدعم اتجاه المخاطرة الإیجابی ویشکل ضغطًا على المعدن الثمین الذی یعتبر ملاذًا آمنًا. ومع ذلک، لا تزال أسعار الذهب محمیة من التوقعات الحذرة من بنک الاحتیاطی الفیدرالی. ویعتقد المستثمرون أن بنک الاحتیاطی الفیدرالی سیبدأ فی خفض أسعار الفائدة فی سبتمبر ویمکن أن یقوم بتخفیضین إضافیین بحلول نهایة العام. وقد أدى ذلک إلى انخفاض عوائد سندات الخزانة الأمریکیة، والضغط على الدولار، وتقدیم بعض الدعم للذهب الذی لا یدر عائداً، مما خلق الحذر قبل الاستعداد لانخفاض أعمق من أعلى المستویات القیاسیة الأخیرة. مناطق أسعار مثیرة للاهتمام: منطقة الشراء : 2383 – 2385 وقف الخسارة: 2379 جنی الربح 1: 2395 جنی الربح 2: 2405 منطقة المبیعات: 2417 - 2419 وقف الخسارة: 2423 جنی الربح 1: 2407 جنی الربح 2: 2400

mswhitetrader

Gold revives after a plunge: Will the uptrend last?

On Monday, spot gold prices continued to decline, with XAU/USD trading around $2,390. The precious metal peaked last week at a record high of $2,483.63, then fell to current levels. The US dollar gained strength after Wall Street opened, while stocks recovered after one of their worst weeks of the year. Optimism seems to be favoring the USD despite the political noise from the weekend. President Joe Biden has decided to resign from the presidential race, which has boosted hopes of a victory for Donald Trump, who is known to be more "pro-market". Meanwhile, upcoming headline US economic figures keep investors in wait-and-see mode. This week, the country will release its first estimate of second-quarter Gross Domestic Product (GDP), along with an adjustment to the Fed's preferred inflation measure for the first quarter, the Personal Consumer Price Index. (PCE). Additionally, the US will release June PCE inflation on Friday. Interesting price areas: Buy zone: 2373 - 2371 Stop loss: 2369 Sell zone: 2431 - 2433 Stop loss: 2437 Buy scalp: 2386 - 2384 Sell scalp: 2422 - 2420 Resistance : 2420 - 2431 - 2436 - 2450 Support : 2385 - 2375 - 2368 - 2360 Upper border breakout: 2411 - 2421 Lower border breakout: 2394 - 2384Comment: Gold prices (XAU/USD) are struggling to capitalize on Tuesday's Asian trading session gains, despite remaining well above their lowest in more than a week hit the previous day. US President Joe Biden's withdrawal from the 2024 Presidential election has increased the chances of Donald Trump becoming the next US President, raising hopes of a looser regulatory environment. Additionally, the People's Bank of China's (PBoC) surprise interest rate cut on Monday still supported the market's optimistic sentiment and became the main factor acting as a drag on precious metals This safe haven.Comment: Gold prices (XAU/USD) remain on the defensive, slightly below circular resistance at $2,400 during the European session on Tuesday. The precious metal remains under pressure amid solid speculation that Donald Trump could win the United States (US) presidential election in November.Comment: Gold recovered and traded above $2,400 on Tuesday after closing its fourth straight trading day in the negative on Monday. The pullback seen in US Treasury yields helps XAU/USD cling to modest daily gains despite the US Dollar's resilience.Comment: Gold prices are struggling to capitalize on the previous day's recovery from more than a week's low. The USD rose to its highest level in nearly two weeks on Wednesday and acted as a drag on the metal. A softer risk tone and dovish Fed expectations should limit the decline ahead of global PMIs.

mswhitetrader

Gold demand has stagnated, prices are difficult to break out

Gold prices (XAU/USD) edged up slightly during the Asian session on Monday, ending a three-day losing streak from last week's record high. Dovish expectations from the Fed and President Joe Biden's exit from the presidential race prompted some investors to pull back on bets on a Trump victory, supporting gold prices. In addition, concerns about slowing economic growth in China, geopolitical risks from the Russia-Ukraine war and conflict in the Middle East also helped increase gold prices. However, XAU/USD refrained from a strong buying move as traders awaited Friday's US Personal Expenditures Price Index (PCE) data for clues on Fed policy. From a technical perspective, last week's correction from all-time highs stopped short of the $2,390-$2,385 horizontal support level, coinciding with the 50% retracement of the June-July rally and the Moving Average. 100-period simple moving average (SMA) on the 4-hour chart. This area will be an important pivotal point for short-term traders. If the price breaks below this threshold, it will likely pave the way for deeper losses, dragging gold prices down to the 61.8% Fibo level around the $2,366-2,365 area, and then to the $2,352-2,350 area. Further selling could push the price down to the 78.6% Fibo level near the $2,334-2,332 zone, before XAU/USD eventually drops to the $2,300 mark. Interesting price areas: Buy zone: 2392 - 2390 Stop loss: 2386 Sell zone: 2419 - 2421 Stop loss: 2425 Resistance : 2420 - 2431 Support : 2403 - 2397 - 2392 - 2382 Upper border breakout: 2411 - 2421 Lower border breakout: 2403 - 2392Comment: Gold prices show uncertainty near key support at $2,400 during the European session on Monday. The precious metal remains on edge amid growing speculation that Republicans led by Donald Trump will win the US presidential election in November.Comment: Gold (XAU/USD) is under bearish pressure after breaking the key $2,400 level, currently trading below $2,390. Technical developments appear to be leading to further price declines, especially as there are no fundamental drivers supporting gold prices at this time. This can be related to market psychology and technical factors such as support and resistance levels.Comment: Gold prices extended their recent correction from record highs hit last week and fell to their lowest in more than a week on Monday. US President Joe Biden's withdrawal from the 2024 Presidential election has increased the chances of Donald Trump becoming the next US President, raising hopes of a looser regulatory environment.

mswhitetrader

نمو الذهب متواضع، ولم يحدث انفراج بعد

Gold prices (Xau/USD) decreased to nearly $ 2,410 during the European session on Friday, to continue a three -day series of losses. Gold faces profits after it recorded a high record at $ 2480 on Tuesday, due to the recovery of the US dollar and bond returns. The expectations of Donald Trump's return as President of the United States after his assassination. The rumors that جو Biden may abandon the candidacy for his re -election because of his health condition of Trump's chances of winning a fever, which increases the attractiveness of the US dollar. The US dollar index (DXY) increased near 104.30, making investment in gold more expensive. The return on US Treasury bonds has increased for 10 years to 4.21%, which increases the cost of alternative opportunity to possess gold, which is an origin that does not generate return. Price areas are worth paying attention to: purchase area: 2378 - 2380 stop loss: 2374 pounds of profit 1: 2390 pounds profit 2: 2400 sales zone: 2432 - 2430 stop loss: 2436 pounds profit 1: 2420 profit gain 2: 2410 gold (Xau/USD) is exposed to downward pressure after the main level penetration of $ 2,400, and is currently being circulated under $ 2,390. Technical developments seem to lead to a further decline in prices, especially since there are no basic engines that support gold prices at the present time. This can be linked to the psychology of the market and technical factors such as support and resistance levels. Gold prices continued their last correction from its highest standard levels that it recorded last week and decreased to its lowest levels in more than a week on Monday. The withdrawal of the US President جو Biden from the 2024 presidential elections has increased opportunities for Donald Trump to become the next president of the United States, which increases hopes in a more flexible organizational environment. Gold prices are struggling to benefit from the previous rise in the Kuwait Investment Authority from its lowest level in more than a week. The dollar rose to its highest levels in about two weeks on Wednesday and served as pressure on the minerals. The most softened risk tone and cautious expectations from the Federal Reserve will limit the declining direction before the indicators of global procurement managers.

mswhitetrader

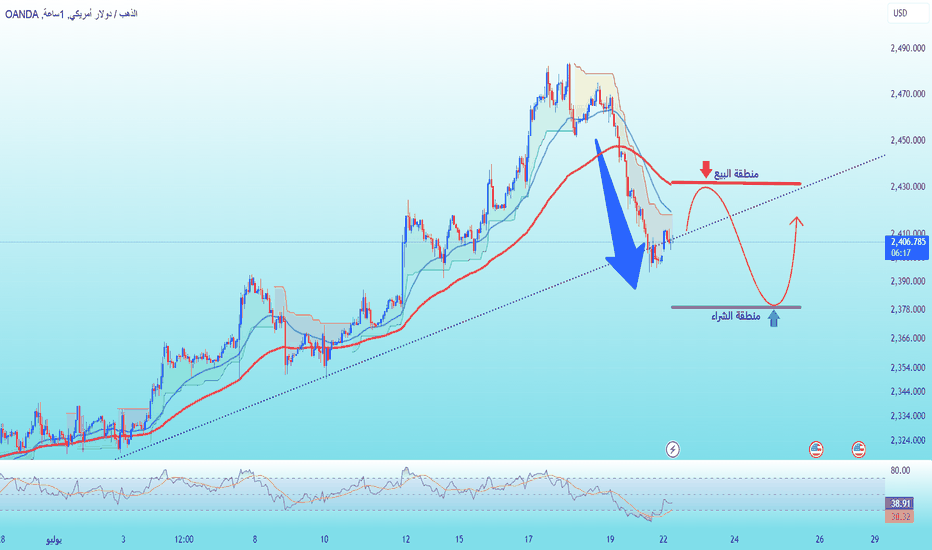

XAUUSD Trading Plan (July 22 - July 26)

Gold price (XAU/USD) increased to $2,410, ending a three-day losing streak in the first session of the week in Asia, thanks to political instability in the US after President Joe Biden withdrew from the re-election race. He will give a national address later in the week to announce details. Biden's withdrawal is expected to increase market volatility, causing investors to seek safe havens. Additionally, stricter new regulations in China also supported gold prices, as the $715 billion hedge fund industry faced pressure. Dovish comments from the Fed and the possibility of an interest rate cut in September did not boost gold prices on Friday. The IMF said the Fed should not cut interest rates until the end of 2024. This week, investors will monitor US economic data, including PMI, Q2 GDP and personal consumption price index (PCE). , to evaluate the interest rate outlook. Interesting price areas: Resistance : 2420 - 2427 - 2436 - 2450 - 2467 Support : 2392 - 2382 - 2371 - 2360 - 2352 Upper border breakout: 2421 - 2438 - 2458 Lower border breakout: 2392 - 2380 - 2359Comment: Gold prices show uncertainty near key support at $2,400 during the European session on Monday. The precious metal remains on edge amid growing speculation that Republicans led by Donald Trump will win the US presidential election in November.Comment: Gold (XAU/USD) is under bearish pressure after breaking the key $2,400 level, currently trading below $2,390. Technical developments appear to be leading to further price declines, especially as there are no fundamental drivers supporting gold prices at this time. This can be related to market psychology and technical factors such as support and resistance levels.Comment: Gold prices extended their recent correction from record highs hit last week and fell to their lowest in more than a week on Monday. US President Joe Biden's withdrawal from the 2024 Presidential election has increased the chances of Donald Trump becoming the next US President, raising hopes of a looser regulatory environment.

mswhitetrader

Gold market is gloomy, what is the trend for the future?

Gold prices (XAU/USD) continued to come under selling pressure for the third straight day on Friday, falling further from all-time highs reached earlier in the week. The decline was mainly due to the US Dollar's (USD) recovery from its lowest in more than three months on Thursday, reducing demand for USD-denominated commodities. However, dovish expectations from the Federal Reserve (Fed) appear to have limited the decline in gold prices. The USD rose thanks to a solid recovery from a more than four-month low, largely due to the decline of the Euro after the European Central Bank (ECB) meeting. This is the main factor putting downward pressure on commodity prices, including gold. This price decline can also be attributed to profit-taking following a price increase of more than 6.5% since the beginning of the month. Geopolitical tensions and buying demand from central banks also helped limit gold price declines, suggesting that any further price declines could be seen as buying opportunities for investors. private. Price areas worth paying attention to: Buy zone: 2417 - 2415 Stop loss: 2412 Buy zone: 2400 - 2398 Stop loss: 2395 Resistance: 2480 - 2465 - 2453 - 2443 Support: 2417 - 2405 - 2400 - 2391 Upper border breakout: 2433 - 2443 Lower border breakout: 2414 - 2405Comment: Buy zone: 2417 - 2415 +40pips entry 2415Trade closed: target reached: Buy zone: 2417 - 2415 +70pips entry 2415Comment: Gold prices extended their losing streak for a third trading day, falling to nearly $2,410 during the European session on Friday. The precious metal is facing profit-taking after rising to a new record high above $2,480 on Tuesday.Comment: The gold price falling to the lowest level of 2,394 USD during the US session on Friday showed strong market volatility. This may be due to the impact of the stronger USD and high bond yields. When the USD appreciates, gold becomes more expensive for investors holding other currencies, reducing demand for gold. At the same time, higher US bond yields increase the opportunity cost of holding gold, since gold does not yield interest, making it possible for investors to turn to bonds to take advantage of higher yields.Comment: Gold prices attracted some buyers and broke a three-day losing streak amid a slightly weaker USD. US political developments prompted some reversal of the 'Trump deal' and weighed on the dollar. Bets on a Fed rate cut in September continue to weaken the USD and favor the unprofitable currency pair XAU/USD.

mswhitetrader

سوق الذهب: تقلبات غير متوقعة

Gold prices (Xau/USD) continued their declining correction from its standard standard levels earlier in the week and decreased for the third day in a row on Friday. The US dollar (USD) has been recovered steadily after more than four months of recession, partly due to the decrease in the euro in the wake of the European Central Bank's decision (ECB), and this is the main factor that presses gold and other currencies. Goods. This decrease in prices may be driven by profit making operations after the sharp rise in prices by more than 6.5 % since the beginning of the month. Initial unemployment claims from the United States issued on Thursday provided additional evidence that the labor market is declining. In addition to signs of relieving inflationary pressures, this paves the way for the possibility of the Fed Bank reduced interest rates in September, which will have a positive impact on gold prices that are not returns. In addition, geopolitical tensions and demand from central banks will also help reduce the declines of gold prices, which indicates that any other declines in prices can be considered purchase opportunities for investors. Price areas that deserve attention In it: the purchase area: 2402 - 2400 stop loss: 2396 pounds of profit 1: 2410 profit profit 2: 2420 sales zone: 2440 - 2442 stop loss: 2446 pounds profit 1: 2430 pounds profit 2: 2420 gold prices continued to chain their losses for the third day in a row, and decreased to nearly 2410 dollars during the European session on Friday. The precious metal faces profits after its rise to a new standard level above 2480 dollars on Tuesday. The price of gold has shown to the lowest level of $ 2,394 during the American session on Friday, strong fluctuations in the market. This may be due to the impact of the power of the US dollar and the high bond returns. When the price of the US dollar rises, gold becomes more expensive for investors who hold other currencies, which reduces the demand for gold. At the same time, the high revenue of American bonds increases the cost of an alternative opportunity to possess gold, because gold does not bring benefit, which makes it possible for investors to resort to bonds to take advantage of the high returns. Gold prices have attracted some buyers and broke a series of losses that lasted three days amid a slight weakness of the US dollar. American political developments have prompted the "Trump deal" and burdened the dollar. Bets continue to reduce the federal interest rate in September to weaken the US dollar and prefer unbelievable Xau/USD currency. Gold prices try to recover from a level of $ 2400, after breaking a three -day correction from the highest standard level at 2484 dollars. Gold prices have benefited from the wide weakness of the US dollar, as well as slowing the returns of US Treasury bonds, even as the market is reluctant to risk.

mswhitetrader

Gold prices trade with modest gains

Gold prices rose to $2,450 during the Asian session on Thursday, buoyed by risk-off sentiment and expectations the Fed will cut interest rates in September. Wednesday's pullback was likely due to profit-taking after the Prices hit record highs. Factors driving gold prices include expectations of a Fed rate cut, which according to the FedWatch Tool, the market predicts this will happen in September and continue into December, along with strong physical gold demand from China. India. The political situation also plays an important role, with the assassination of former President Trump and US-China trade tensions helping to lift market sentiment. However, modest USD gains and a slight recovery in US Treasury yields could limit gold's gains. US unemployment benefits data and statements from the Fed will be important factors affecting gold prices, along with policy announcements from the ECB. Note price range: Buy zone: 2442 - 2440 Stop loss: 2436 Buy zone: 2432 - 2430 Stop loss: 2426 Support: 2463 - 2455 - 2450 - 2442 - 2432 Resistance: 2471 - 2481 - 2495 - 2500 - 2515 -2525 Upper border breakout: 2482 Lower border breakout: 2462 - 2452Comment: Gold prices (XAU/USD) edged up to nearly $2,470 an ounce on Thursday, remaining near a record high amid growing optimism that the Federal Reserve (Fed) will cut interest rates in September.Comment: Gold held firm above $2,460 on Thursday after posting a small loss on Wednesday. However, the recovery seen in the US dollar amid risk-off sentiment and resilience in US Treasury yields limited XAU/USD's upside during the US session .

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.