Technical analysis by mswhitetrader about Symbol PAXG: Sell recommendation (7/22/2024)

mswhitetrader

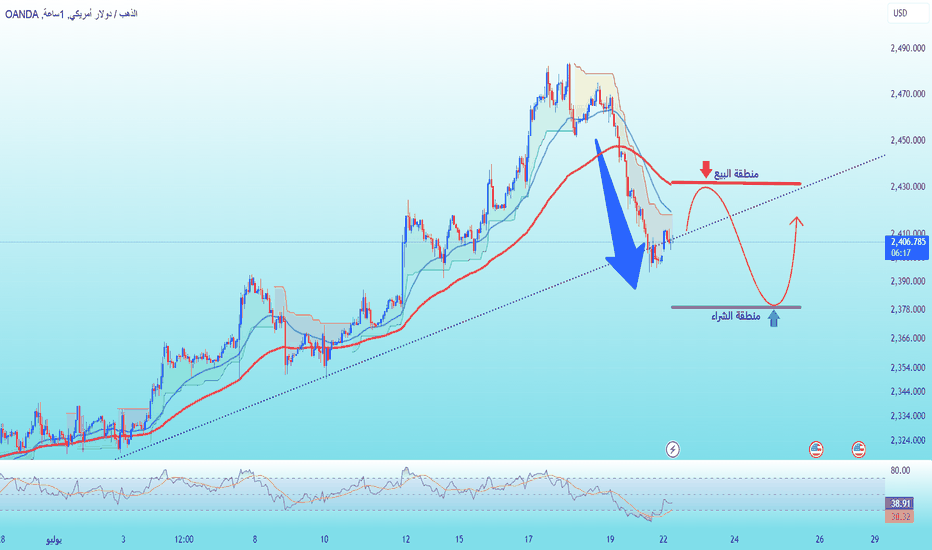

نمو الذهب متواضع، ولم يحدث انفراج بعد

Gold prices (Xau/USD) decreased to nearly $ 2,410 during the European session on Friday, to continue a three -day series of losses. Gold faces profits after it recorded a high record at $ 2480 on Tuesday, due to the recovery of the US dollar and bond returns. The expectations of Donald Trump's return as President of the United States after his assassination. The rumors that جو Biden may abandon the candidacy for his re -election because of his health condition of Trump's chances of winning a fever, which increases the attractiveness of the US dollar. The US dollar index (DXY) increased near 104.30, making investment in gold more expensive. The return on US Treasury bonds has increased for 10 years to 4.21%, which increases the cost of alternative opportunity to possess gold, which is an origin that does not generate return. Price areas are worth paying attention to: purchase area: 2378 - 2380 stop loss: 2374 pounds of profit 1: 2390 pounds profit 2: 2400 sales zone: 2432 - 2430 stop loss: 2436 pounds profit 1: 2420 profit gain 2: 2410 gold (Xau/USD) is exposed to downward pressure after the main level penetration of $ 2,400, and is currently being circulated under $ 2,390. Technical developments seem to lead to a further decline in prices, especially since there are no basic engines that support gold prices at the present time. This can be linked to the psychology of the market and technical factors such as support and resistance levels. Gold prices continued their last correction from its highest standard levels that it recorded last week and decreased to its lowest levels in more than a week on Monday. The withdrawal of the US President جو Biden from the 2024 presidential elections has increased opportunities for Donald Trump to become the next president of the United States, which increases hopes in a more flexible organizational environment. Gold prices are struggling to benefit from the previous rise in the Kuwait Investment Authority from its lowest level in more than a week. The dollar rose to its highest levels in about two weeks on Wednesday and served as pressure on the minerals. The most softened risk tone and cautious expectations from the Federal Reserve will limit the declining direction before the indicators of global procurement managers.