lybeedo

@t_lybeedo

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

[ TimeLine ] Gold 11 August 2025

📆 Today’s Date: Thursday, Aug 7, 2025 📌 Upcoming Signal Dates: • Aug 11, 2025 (Monday) — Single-candle setup • Aug 11–12, 2025 (Monday–Tuesday) — Two-candle combined range 🧠 Trading Outlook & Notes ✅ Gold has recently surged sharply from 3268 to 3396, approaching the key psychological level of 3400. Current market momentum still favors the bulls, and this trend may continue. ✅ I’ll be actively trading both the Aug 11 and Aug 11–12 setups as part of my strategy testing and live trade execution. ✅ This timing method and structure can also be applied across other instruments — including BTC, the US Index, and major commodities. ⚠️ For those taking a more cautious approach, feel free to skip the single-candle setup on Aug 11 and instead wait for the more confirmed two-day range (Aug 11–12). 📋 Execution Guidelines 🔹 Range Identification: • Allow the high–low of the selected candle(s) to close fully. • Purple lines will mark the formed range. • After the daily close, the chart will be updated with: • 60-pip breakout buffer • Fibonacci zones • Supporting indicators 🔹 Entry Conditions: • Only trade breakouts that clearly move beyond the full range, including the buffer. • No pre-break assumptions — wait for confirmation. 🔹 Risk Management – Recovery Logic: • If SL is hit, either exit or reverse the trade. • The next valid setup will use a doubled lot size to attempt recovery. 📉📈 Chart Snapshots: TV/x/Y33gLJNh/ (change TV to Tradingview and paste in your browser) 📌 Stick to the plan, follow the system, and let the chart lead the way. 🛡️ Capital protection comes first — always manage your risk.

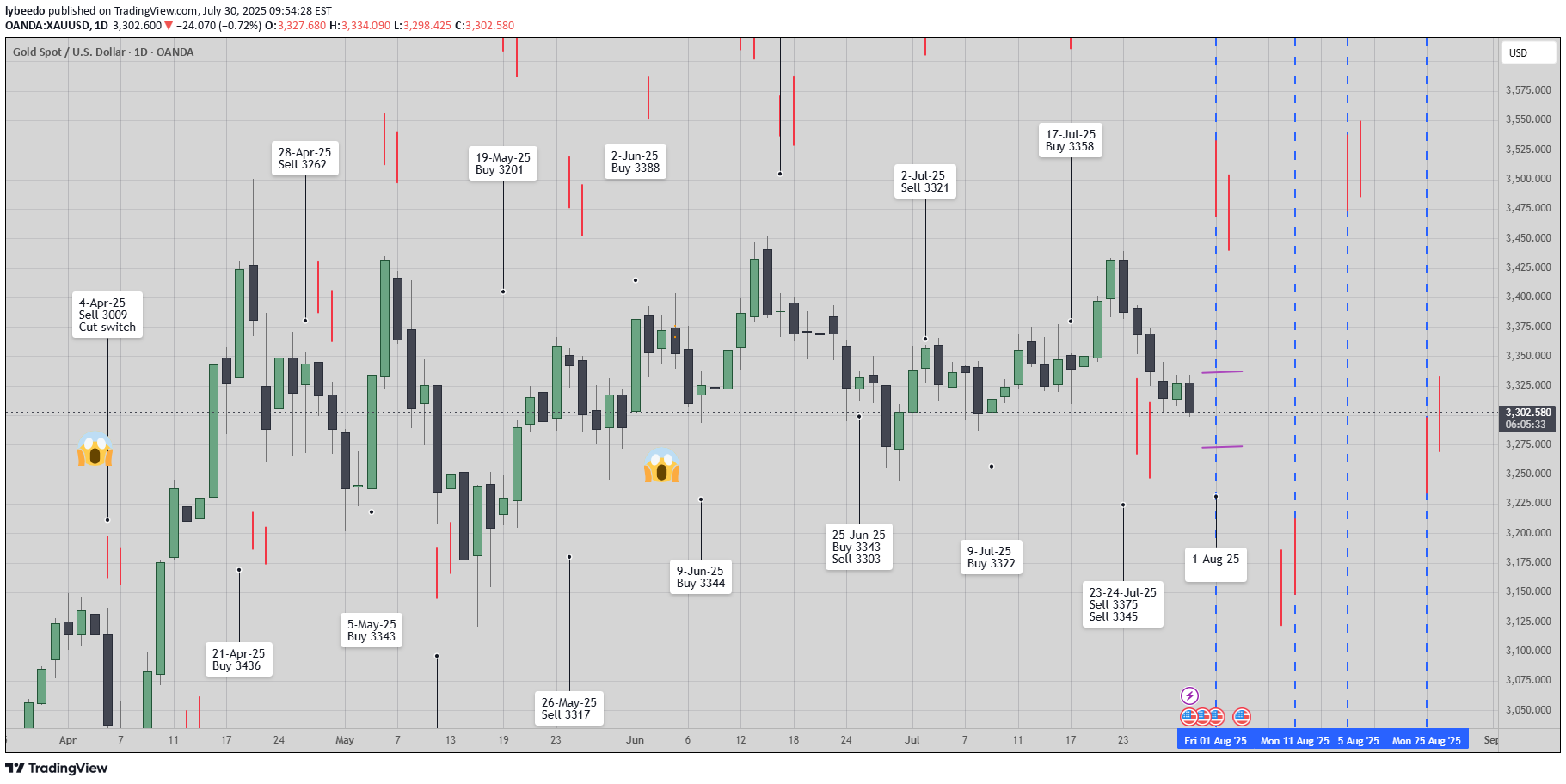

[ TimeLine ] Gold 31 July 2025

📆 Today’s Date: Wednesday, July 30, 2025 📌 Upcoming Signal Dates: • July 31, 2025 (Thursday) — Single-candle setup • July 31–August 1, 2025 (Thursday–Friday) — Two-candle combined range 🧠 Trading Outlook & Notes ✅ Gold has recently dropped sharply from 3439 to 3298, and current conditions suggest this bearish momentum may continue. ✅ I’ll be actively trading both the July 31 and July 31–August 1 setups as part of my ongoing strategy testing and live analysis. ✅ This method and timing structure can also be applied to other assets like BTC, the US Index, and various commodities. ⚠️ For those taking a more cautious approach, it’s absolutely okay to skip the single-candle setup on July 31 and wait for the more confirmed 2-day range setup (July 31–August 1). 📋 Execution Guidelines 🔹 Range Identification: • Let the Hi-Lo range of the chosen candle(s) form completely. • Purple lines will mark these ranges on the chart. • After the daily close, charts will be updated to include a 60-pip buffer, Fibonacci zones, and relevant indicators. 🔹 Entry Conditions: • Trades are triggered only if price breaks above/below the full range, including the buffer zone. 🔹 Risk Management – Recovery Logic: • If the Stop Loss is triggered, the trade is exited or switched, and the next valid breakout setup will use a doubled lot size to attempt recovery. 📉📈 Chart Snapshot 🔗 Paste this in TradingView: TV/x/fykxBG6w/ 📌 Stick to the plan, follow the system, and let the chart lead the way. 🛡️ Capital protection comes first — always manage your risk.📆 Market Recap & Signal Timeline – Gold (July 31, 2025) 📍 Hi-Lo Ranges with 60-Pip Buffer • July 31 — Single-Candle Setup: 3270 – 3321 • July 31 — Two-Candle Combined Range: 3270 – 3369 ✅ Performance Overview Both setups triggered clean bullish breakouts. • Single-Candle Signal: The move extended from the breakout zone up to 3363–3397, generating potential profits of 280 to 750 pips, depending on entry and execution timing. ⚠️ Fibonacci Re-Entry Insights (Based on 2-Candle High-Low Range) • 100% Level: 3363 • 127.2% Level: 3388 • 161.8% Level: 3417 (not yet reached at the time of writing) These levels provided strategic zones for re-entries on pullbacks after the initial breakout. 💡 Key Takeaways ✔️ Both setups were profitable when paired with disciplined risk management and cut/switch logic. ✔️ The two-candle setup offered a cleaner structure and more predictable breakout behavior. ✔️ Fibonacci extensions proved useful for identifying re-entry points during trending continuation. 🧠 Pre-Signal Trading Plan 🔹 Planned live trades for both setups as part of ongoing market research 🔹 Similar date-based setups were valid across BTC, US Index, and select commodities 🔹 Advised re-entry only after significant pullbacks, especially due to the wider range of the two-candle setup 📋 Execution Strategy Recap Wait for Hi-Lo range to form Add 60-pip buffer above/below range Execute breakout trade only after price breaks buffered levels If SL is hit: Cut → Switch → Double position size on next valid setup to recover loss 📉📈 Chart Reference 🔗 TradingView Chart TV/x/XffpxB8s/ 🛡️ Final Reminder: Let structure guide your trades, not emotions. Protect capital. Stick to logic. Stay focused.

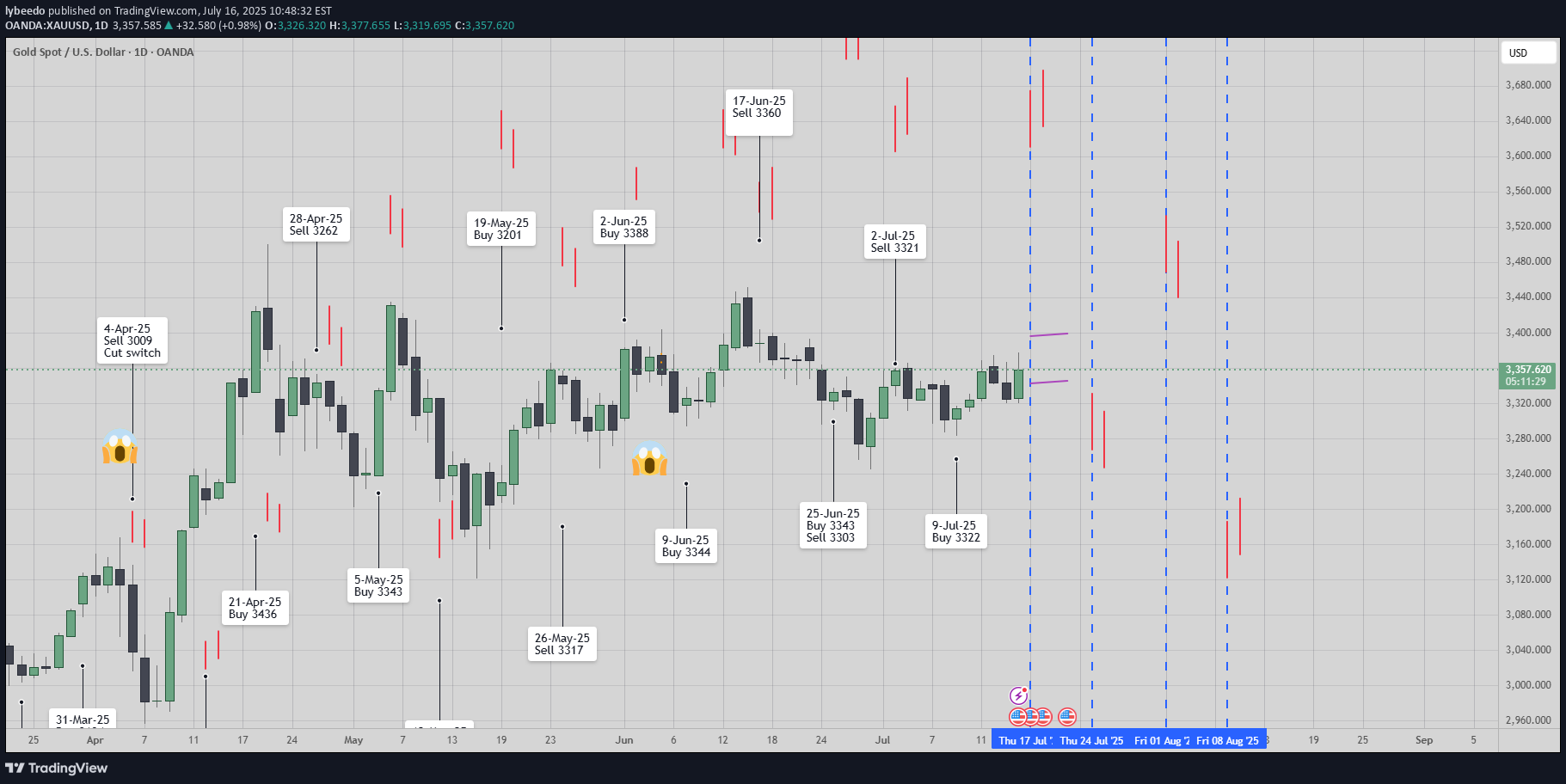

[ TimeLine ] Gold 17 July 2025

📆 Today is Wednesday, July 16, 2025 📌 Upcoming Signal Dates: • July 17, 2025 (Thursday) — Single-candle setup • July 17–18, 2025 (Thursday–Friday) — Two-candle combined range 🧠 Trading Plan & Notes ✅ Gold recently moved in a wide range between 3365 to 3282, and by the time this signal is published, we’re seeing signs of a strong reversal. ✅ I will be trading both the July 17 and July 17–18 signals as part of my ongoing live research and strategy development. ✅ The same timeframe and signal approach also applies to other instruments such as BTC, US Index, and several commodity pairs. ⚠️ If you’re feeling cautious or risk-averse, it’s perfectly fine to skip the July 17 single-candle setup and wait for the 2-day range (July 17–18) for added confirmation. 📋 Execution Plan 🔹 Range Formation: • Wait for the Hi-Lo range from the selected candle(s) to fully form. • Ranges will be marked with purple lines on the chart. • After market close, the chart will be updated with 60-pip buffer zones, Fibonacci retracement levels, and supporting indicators. 🔹 Entry Trigger Rule: • Entry only if price breaks out beyond the defined range, including the 60-pip buffer. 🔹 Risk Management – Recovery Strategy: • If Stop Loss (SL) is hit, the trade will be cut/switch, and position size doubled on the next valid breakout signal to aim for recovery. 📉📈 Chart Reference 🔗 Copy & paste into TradingView: TV/x/6x8VJKs1/ 📌 Stay disciplined, trust the process, and let the chart guide your decisions. 🛡️ Manage your risk — protect your capital.📆 Market Recap & Signal Timeline – Gold (July 17, 2025) 📍 Hi-Lo Ranges (with 60-pip buffer): • July 17 — Single-candle setup: 3303 – 3358 • July 17–18 — Two-candle combined range: 3303 – 3367 ✅ Overview: Both the single-candle and two-candle setups successfully triggered clean bullish breakouts. The move peaked around 3439, delivering a potential +810 pips depending on your entry and execution. ⚠️ Fibonacci Re-Entry Insight: Re-entry opportunities near the 38.2% (≈3333) and 50% (≈3344) retracement levels offered low-risk continuation entries. 💡 Key Notes: ✔️ Both setups proved effective using risk management and cut/switch logic. ✔️ The two-candle setup showed a cleaner structure and breakout behavior. 🧠 Trading Plan – Original Notes Before the Signal: 🔹 I had planned to trade both setups live as part of my research strategy. 🔹 Same date setups were also valid across assets like BTC, US Index, and select commodities. 🔹 For cautious traders, I advised focusing on the two-day setup for stronger confirmation. 📋 Execution Strategy: • Wait for Hi-Lo range to form • Add 60-pip buffer zone • Execute breakout trade only when price breaks above/below buffered levels • If SL hit: Cut → Switch → Double position size on next setup to recover loss 📉📈 Chart Reference: 🔗 TradingView chart: TV/x/FqMW8Z0B/ Stay focused. Let structure guide you, not emotions. 🛡️ Protect capital. Trade with logic.

[ TimeLine ] Gold 2 July 2025

📆 Today is Sunday, June 29, 2025 📌 Upcoming Gold Signal Dates: • July 2, 2025 (Wednesday) — Single-candle setup • July 2–3, 2025 (Wednesday–Thursday) — Two-candle combined range 🧠 Trading Plan & Notes ✅ Gold recently experienced a sharp bearish reversal of ~2000 pips, dropping from the recent high at 3451 to 3251, after failing to hold above the key psychological support at 3300. ✅ I will personally be trading both the July 2 and July 2–3 signals as part of my live research and development strategy. ⚠️ If you’re feeling cautious or risk-averse, it's perfectly reasonable to skip the July 2 single-candle setup and focus instead on the 2-day range (July 2–3) for greater confirmation. 📋 Execution Plan 🔹 Wait for the Hi-Lo range to fully form based on the selected candle(s): • Ranges will be initially marked with purple lines on the chart. • After the market closes, I’ll update the chart with 60-pip buffer zones, Fibonacci levels, and other supporting indicators. 🔹 Entry Trigger Rule: • A trade is executed only when price breaks out beyond the defined range plus a 60-pip buffer. 🔹 Risk Management – Recovery Strategy: • If Stop Loss (SL) is hit, we will cut/switch the position and double the size on the next valid breakout setup to potentially recover the loss. 📉📈 Chart Reference 🔗 Copy & paste this into your TradingView URL: TV/x/zKeXpt67/📆 Market Update: Signal Timeline – Gold (July 2, 2025) 📍 Hi-Lo Ranges (with 60-pip buffer): • Single-candle setup: 3321 – 3366 • Two-candle range: 3305 – 3372 ✅ Overview: Both the single-candle and two-candle setups successfully triggered a clean bearish breakout, reaching as low as 3282. 📊 Fibonacci Re-Entry Insight: The 50% and 61.8% retracement zones near 3345 provided ideal re-entry points, allowing traders to capture additional profit on the retracement. 💡 Key Notes: ✔️ Both setups performed effectively when paired with proper risk management and cut/switch execution. ✔️ The two-candle range offered a clearer breakout, while the single-candle setup required a more tactical response. 🔁 I also used the July 9 candle’s high/low as a confirmation signal, although it was not published publicly. The signal confirmed a bullish reversal, leading me to close remaining short positions and initiate a long entry from the 3316 level (or 3322 with buffer). 📉📈 Chart Reference: 🔗 Copy & paste this into TradingView: TV/x/LCbRa8Pf/ Stay sharp, follow the plan, and manage risk wisely. 📊💰

[ TimeLine ] Gold 25-26 June 2025

📆 Today is Friday, June 20, 2025📌 Upcoming Gold Signal Dates:• June 25, 2025 (Wednesday) — Single-candle setup• June 25–26, 2025 (Wednesday–Thursday) — Two-candle combined range🧠 Trading Plan & Notes✅ Gold recently experienced a sharp bearish reversal of approximately 1100 pips, after touching the key psychological resistance at 3451.🔁 Several re-entry opportunities have emerged, especially around Fibonacci retracement levels, which have acted as reliable reaction zones.✅ I will personally trade both signals (June 25 and June 25–26) as part of my ongoing live research and strategy development.⚠️ If you're feeling cautious, it’s completely valid to skip the June 25 signal and prioritize the 2-day range (June 25–26) instead for added confirmation.📋 Execution Plan🔹 Wait for the Hi-Lo range to fully form from the selected candle(s):▫ Ranges will be initially marked with purple lines on the chart.▫ After market close, I’ll update with buffer zones, Fibonacci levels, and other supporting indicators.🔹 Entry Trigger:• Executed only when price breaks out beyond the range, including a 60-pip buffer.🔹 Risk Management – Recovery Rule:• If the trade hits Stop Loss (SL), we will cut/switch direction and double the position size on the next valid breakout setup for potential recovery.📉📈 Chart Reference🔗 Copy & paste this into your TradingView URL: TV/x/fzDQQ7oo/📆 Market Update: Signal Timeline – Gold (June 25–26, 2025)📍 Hi-Lo Ranges (with 60-pip buffer):• June 25, 2025 — Single-candle setup: 3306 – 3343• June 25–26, 2025 — Two-candle range: 3304 – 3356✅ Overview:The two-candle range setup triggered a clean bearish move, while the single-candle setup gave an initial false breakout but provided recovery via the cut/switch mechanism.🔹 Single-Candle Setup – Initial Buy & Cut-Switch to Sell• Buy Triggered: 3343• Initial bullish breakout reached 3350 before a sharp reversal.• Trade hit Stop Loss, then entered cut/switch mode for a sell entry from 3306 (or 3317 if using buffer).• The reversal dropped to 3255, yielding a ~620 pip recovery, which covered initial losses and delivered overall profit due to double lot size on the switch.📉 Net Result: ~260 pip drawdown followed by ~620 pip gain.🔹 Two-Candle Range – Clear Sell Signal• Sell Triggered: 3303• Bearish momentum continued cleanly to 3255, resulting in a ~510 pip gain.• This setup proved more reliable with less volatility.💡 Key Notes:✔️ Both setups worked effectively with proper risk management and cut/switch logic.✔️ The two-candle range provided the cleaner breakout, while the single-candle setup required tactical response.📉📈 Chart Reference🔗 Copy & paste this into TradingView: TV/x/GRhlh0n3/

[ TimeLine ] Gold 2-3 June 2025

Hello everyone,📆 Today is Friday, May 30, 2025📌 Upcoming Gold Signal Dates:• June 2, 2025 (Monday) — Single candle setup• June 2–3, 2025 (Monday–Tuesday) — Two-candle range🧠 Trading Plan & Notes✅ Gold recently made a bearish move of ~780 pips, breaking below the prior key support at 3323, down to 3245🔁 Multiple re-entry opportunities were identified using Fibonacci retracement levels, which provided solid price reaction points.⚠️ If the June 2 Hi-Lo range appears wide and sideways, we may consider holding off until June 4 for confirmation of clearer directional bias.✅ I will be trading both signals (June 2 and June 2–3) as part of my ongoing research and strategy⚠️ If the range is narrow or shows false breakout risk, it's okay to skip the June 2 signal and focus instead on the June 2–3 combined range.📋 Execution Plan🔹 Wait for the Hi-Lo range from the selected candle(s) to fully form.▫ These will be marked initially with purple lines on the chart.▫ After market close, I’ll update the chart with additional indicator levels.🔹 Entry triggers will be based on breakouts beyond the range, with a 60-pip buffer.🔹 If the trade hits SL, the plan is to cut/switch direction and double position size on the next valid signal as part of the recovery strategy.📉📈 Chart ReferenceCopy & paste this code into your browser and add TradingView URL:🔗 TV/x/iQrX0gJW/✅ Stay alert and follow the signal flow — upcoming entries could offer solid reward potential if executed with discipline.📌 I'll post the final Hi-Lo levels and updated chart after the June 2 and June 3 candles close.

[ TimeLine ] Gold 26-27 May 2025

Hello everyone,📅Today is Sunday, May 25, 2025📌 Upcoming Signal Dates:• May 26, 2025 (Monday)• May 27, 2025 (Tuesday) (using 2 candles)🧠 Trading Plan & Notes:✅ Gold has experienced a sharp bullish move of over 1000 pips, breaking out from the ranging area 3255 to 3366⚠️ If the upcoming Hi-Lo range is wide and shows bullish continuation, consider entries on corrections after breakout or setups based on Fibonacci retracement✅ I will be trading both signals as part of my ongoing research and strategy⚠️ If you're feeling risk-averse or uncertain, it's totally fine to skip the May 26 or May 27–28 (2-candle) signals📋 Execution Plan:🔹 Wait for the Hi-Lo range from the selected candles to fully form. These will be initially marked with purple lines on the chart, and I’ll update the chart with additional indicator lines once the range is fully confirmed after market close🔹 Entry will be triggered on breakout, with a 60-pip buffer🔹 If the trade hits Stop Loss (SL), cut/switch and double the position on the next valid setup to attempt recovery📉📈 Chart Reference:🔗 Copy & paste this code into TradingView URL: TV/x//BjdZ9IgR/Hello everyone,Market Update: Hi-Lo Range & Trade Result – May 26–27, 2025📍 Hi-Lo Ranges (including 60-pip buffer):• May 26, 2025: 3317 to 3363• May 27, 2025: 3279 to 3356✅ May 26 – Sell Signal🔹 Entry Triggered: 3317🔹 Price Action: Strong bearish breakout reaching 3285 (which became May 27's lowest level), yielding an approx. +320 pips gain⚠️ Note: The move retraced sharply around the 50–60% Fibonacci levels between 3317 and 3233 (low of May 26)✅ May 27 – Sell Signal🔹 Entry Triggered: 3280🔹 Price Action: Bearish momentum extended to 3245, with approx. 350 to 660 pips profit potential depending on entry and exit zones🔄 Re-Entry Execution – May 26 & 27Using Fibonacci retracement levels (50% and 61.8%), price respected these zones and resumed bearish momentum after failing to break below May 26’s low.On the lower timeframe, price structure clearly shows respect for:May 26 low and buffer zone50% and 61.8% fib levelsAs of writing this update, price has returned from 3323 (Fib zone) to 3272, offering an additional +500 pips opportunity.💬 I explained this setup and re-entry strategy during our group discussion.📉📈 Chart & Analysis:• Daily Timeframe🔗 TradingView Code: TV/x/VgKhWBnU/• Lower Timeframe (H1)🔗 TradingView Code: TV/x/N222QQlh/

[ TimeLine ] Gold 19-20 May 2025

Hello everyone,📅 Today: Monday, May 19, 2025📌 Upcoming Signal Dates:• May 19, 2025 (Monday) – Candle still forming at the time of this post• May 20, 2025 (Tuesday)🧠 Trading Plan & Notes:✅ Gold has experienced a sharp reversal of over 3,000 pips, dropping from 3435 to 3115⚠️ The Hi-Lo range on May 19 is approximately 400 pips — this is relatively wide, so consider waiting for the May 20 confirmation or focus on reversal entries using Fibonacci levels✅ I will be trading both signals as part of my ongoing research and strategy⚠️ If you’re risk-averse or uncertain, it’s perfectly fine to skip the May 19 signal and instead observe the May 20 candle for a more informed setup📋 Execution Plan:🔹 Wait for the price range from the selected candles to fully form (marked by green lines on the chart)🔹 Trigger entries upon breakout, with a 60-pip buffer🔹 If the trade hits Stop Loss (SL), execute a cut-and-switch strategy, doubling the next valid entry size to recover📉📈 Chart Reference:🔗 TradingView URL Code: TV/x/vs1ieqLS/Hello everyone,Market Update: Hi-Lo Range & Trade Result – May 19–20, 2025📍 Hi-Lo Ranges (including 60-pip buffer):• May 19, 2025: 3200 to 3255• May 20, 2025: 3198 to 3301✅ May 19 – Buy Signal🔹 Entry Triggered: 3255🔹 Price Action: Strong bullish breakout reaching 3295, yielding an approx. +400 pips gain⚠️ Note: The move faced a sharp correction, briefly dipping back near SL zone around 3204✅ May 20 – Buy Signal🔹 Entry Triggered: 3301🔹 Price Action: Bullish momentum continued from the psychological level at 3300, peaking at 3366 for an approx. +660 pips gain💡 Combined Result:🟢 Total potential gain of ~1100 pips, which is 200% of the 550-pip risk range🔁 Both trades demonstrated strong breakout characteristics and recovery after minor pullbacks📌 If you secured profits early — well done!📌 I'm now preparing the next signal for May 26–27 and the June trading cycle — stay tuned for updates.📉📈 Chart & Analysis:🔗 TradingView Code: TV/x/TJxCAT9Q/

[ TimeLine ] Gold 12-13 May 2025

Hello everyone,📅 Today is Friday, May 9, 2025📌 Upcoming Signal Dates:• May 12, 2025 (Monday)• May 12 & 13, 2025 (Monday & Tuesday)🧠 Trading Plan & Notes:✅ Gold has experienced a sharp reversal of over 1,650 pips, falling from 3435 to 3270⚠️ If the upcoming Hi-Lo range is wide, consider reversal entries or setups based on Fibonacci retracement levels✅ I will be trading both signals as part of my ongoing research and strategy⚠️ If you're feeling risk-averse or uncertain, it's totally fine to skip the May 12 & 13 signals📋 Execution Plan:🔹 Wait for the price range from the specified candles to fully form (marked by green lines on the chart)🔹 Entry will be triggered on breakout, with a 60-pip buffer🔹 If the trade hits Stop Loss (SL), cut/switch and double the position on the next valid setup to attempt recovery📉📈 Chart Reference:🔗 TradingView URL Code: TV/x/Au2Hjg0M/Hello everyone,📍 Hi-Lo Range (May 12–13, 2025):3201 to 3331 (includes a 60-pip buffer)✅ May 12–13 Sell Signal:🔹 Entry Triggered: 3201🔹 Price Action: Strong bearish breakout down to 3120, delivering an approx. 800-pip gain💡 This move offered attractive profit potential—800 pips is nearly 60% of the 1,300-pip risk range⚠️ After hitting 3120, the market reversed back toward the entry zone📌 If you secured profits early, well done!📌 I'm currently preparing the next signal for the upcoming week — stay tuned.📉📈 Chart & Analysis:🔗 TradingView Link: TV/x/BmmvlLCN/

[ TimeLine ] Gold 5-6 May 2025

📅 Today is Friday, May 2, 2025📌 Upcoming Signal Dates:May 5, 2025 (Monday) orMay 5 & 6, 2025 (Monday & Tuesday)🧠 Trading Plan & Notes:✅ Gold has undergone a significant reversal of over 2000 pips, from its ATH of 3500 down to 3200⚠️ If the upcoming Hi-Lo range is wide, consider reversal entries or setups based on Fibonacci retracement levels✅ I will personally be trading both signals as part of my research and ongoing strategy⚠️ If you're risk-averse or uncertain, it’s okay to skip the May 5–6 signals📋 Execution Plan:🔹 Wait for the price range from the selected candles to fully form (marked by green lines on the chart)🔹 Entry will be triggered upon breakout, including a 60-pip buffer🔹 If SL is hit, cut/switch and double the position on the next valid setup for potential recovery📉📈 Chart Reference:🔗 Copy & paste this code into TradingView URL: TV/x/C5zZyXar/Hello everyone,📍 Hi-Lo Range (May 5, 2025):3231 to 3343 (includes a 60-pip buffer)✅ May 5 Buy Signal:🔹 Entry Triggered: 3343🔹 Price Action: Strong bullish breakout followed by a rally to 3435, yielding an approx. 920-pip gain💡 This move offered attractive profit potential, allowing for multiple entries and achieving a 1:1 risk-reward ratio⚠️ After reaching 3435, the market reversed sharply, moving back toward—and briefly below—the entry zone📌 If you secured profits early, well done!📌 I'm now preparing the next signal for the upcoming week — stay tuned.📉📈 Chart & Analysis:🔗 TradingView Link: TV/x/hgHBLfMB/

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.