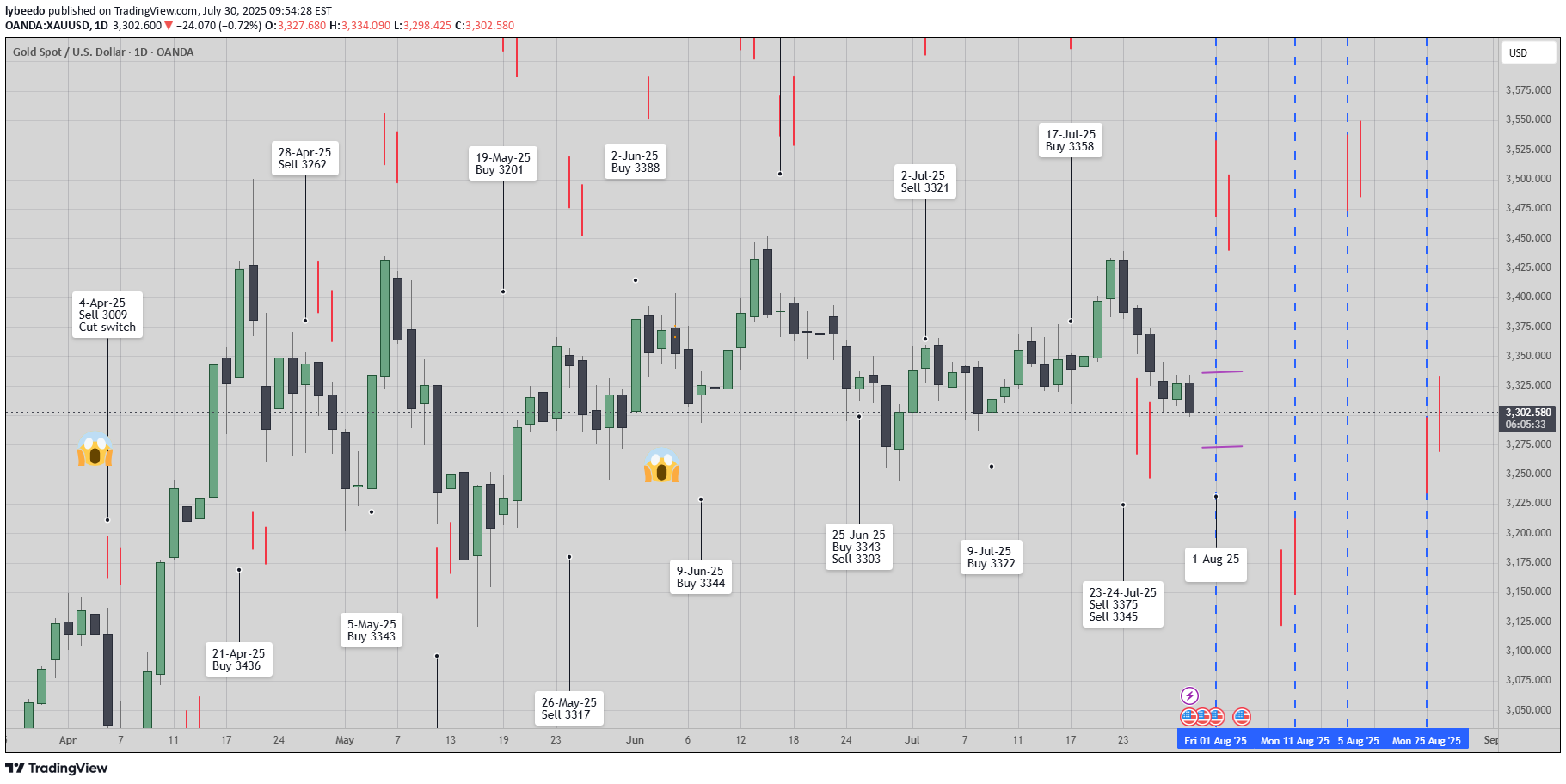

Technical analysis by lybeedo about Symbol PAXG on 7/30/2025

[ TimeLine ] Gold 31 July 2025

📆 Today’s Date: Wednesday, July 30, 2025 📌 Upcoming Signal Dates: • July 31, 2025 (Thursday) — Single-candle setup • July 31–August 1, 2025 (Thursday–Friday) — Two-candle combined range 🧠 Trading Outlook & Notes ✅ Gold has recently dropped sharply from 3439 to 3298, and current conditions suggest this bearish momentum may continue. ✅ I’ll be actively trading both the July 31 and July 31–August 1 setups as part of my ongoing strategy testing and live analysis. ✅ This method and timing structure can also be applied to other assets like BTC, the US Index, and various commodities. ⚠️ For those taking a more cautious approach, it’s absolutely okay to skip the single-candle setup on July 31 and wait for the more confirmed 2-day range setup (July 31–August 1). 📋 Execution Guidelines 🔹 Range Identification: • Let the Hi-Lo range of the chosen candle(s) form completely. • Purple lines will mark these ranges on the chart. • After the daily close, charts will be updated to include a 60-pip buffer, Fibonacci zones, and relevant indicators. 🔹 Entry Conditions: • Trades are triggered only if price breaks above/below the full range, including the buffer zone. 🔹 Risk Management – Recovery Logic: • If the Stop Loss is triggered, the trade is exited or switched, and the next valid breakout setup will use a doubled lot size to attempt recovery. 📉📈 Chart Snapshot 🔗 Paste this in TradingView: TV/x/fykxBG6w/ 📌 Stick to the plan, follow the system, and let the chart lead the way. 🛡️ Capital protection comes first — always manage your risk.📆 Market Recap & Signal Timeline – Gold (July 31, 2025) 📍 Hi-Lo Ranges with 60-Pip Buffer • July 31 — Single-Candle Setup: 3270 – 3321 • July 31 — Two-Candle Combined Range: 3270 – 3369 ✅ Performance Overview Both setups triggered clean bullish breakouts. • Single-Candle Signal: The move extended from the breakout zone up to 3363–3397, generating potential profits of 280 to 750 pips, depending on entry and execution timing. ⚠️ Fibonacci Re-Entry Insights (Based on 2-Candle High-Low Range) • 100% Level: 3363 • 127.2% Level: 3388 • 161.8% Level: 3417 (not yet reached at the time of writing) These levels provided strategic zones for re-entries on pullbacks after the initial breakout. 💡 Key Takeaways ✔️ Both setups were profitable when paired with disciplined risk management and cut/switch logic. ✔️ The two-candle setup offered a cleaner structure and more predictable breakout behavior. ✔️ Fibonacci extensions proved useful for identifying re-entry points during trending continuation. 🧠 Pre-Signal Trading Plan 🔹 Planned live trades for both setups as part of ongoing market research 🔹 Similar date-based setups were valid across BTC, US Index, and select commodities 🔹 Advised re-entry only after significant pullbacks, especially due to the wider range of the two-candle setup 📋 Execution Strategy Recap Wait for Hi-Lo range to form Add 60-pip buffer above/below range Execute breakout trade only after price breaks buffered levels If SL is hit: Cut → Switch → Double position size on next valid setup to recover loss 📉📈 Chart Reference 🔗 TradingView Chart TV/x/XffpxB8s/ 🛡️ Final Reminder: Let structure guide your trades, not emotions. Protect capital. Stick to logic. Stay focused.