Technical analysis by lybeedo about Symbol PAXG on 7/16/2025

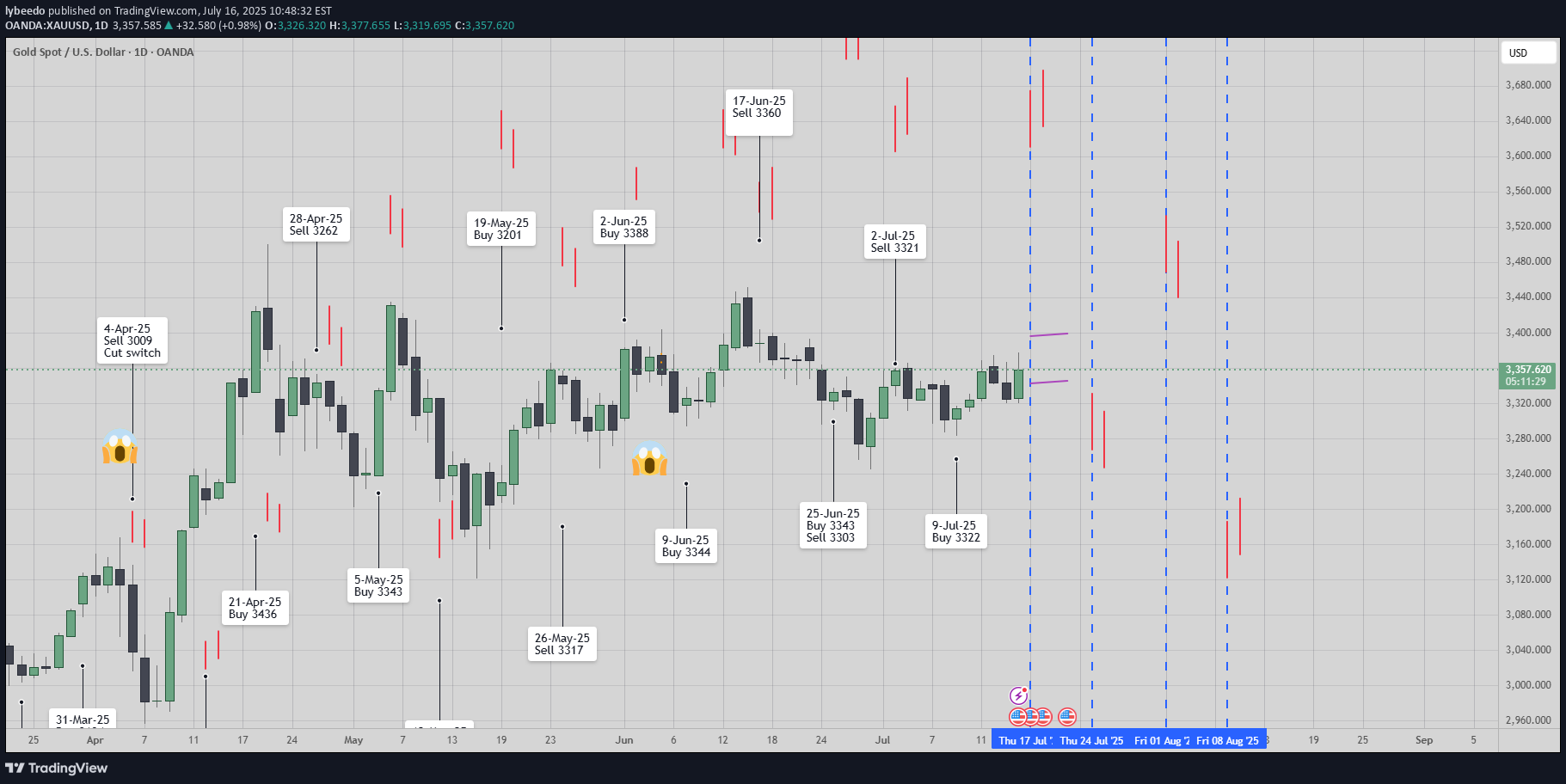

[ TimeLine ] Gold 17 July 2025

📆 Today is Wednesday, July 16, 2025 📌 Upcoming Signal Dates: • July 17, 2025 (Thursday) — Single-candle setup • July 17–18, 2025 (Thursday–Friday) — Two-candle combined range 🧠 Trading Plan & Notes ✅ Gold recently moved in a wide range between 3365 to 3282, and by the time this signal is published, we’re seeing signs of a strong reversal. ✅ I will be trading both the July 17 and July 17–18 signals as part of my ongoing live research and strategy development. ✅ The same timeframe and signal approach also applies to other instruments such as BTC, US Index, and several commodity pairs. ⚠️ If you’re feeling cautious or risk-averse, it’s perfectly fine to skip the July 17 single-candle setup and wait for the 2-day range (July 17–18) for added confirmation. 📋 Execution Plan 🔹 Range Formation: • Wait for the Hi-Lo range from the selected candle(s) to fully form. • Ranges will be marked with purple lines on the chart. • After market close, the chart will be updated with 60-pip buffer zones, Fibonacci retracement levels, and supporting indicators. 🔹 Entry Trigger Rule: • Entry only if price breaks out beyond the defined range, including the 60-pip buffer. 🔹 Risk Management – Recovery Strategy: • If Stop Loss (SL) is hit, the trade will be cut/switch, and position size doubled on the next valid breakout signal to aim for recovery. 📉📈 Chart Reference 🔗 Copy & paste into TradingView: TV/x/6x8VJKs1/ 📌 Stay disciplined, trust the process, and let the chart guide your decisions. 🛡️ Manage your risk — protect your capital.📆 Market Recap & Signal Timeline – Gold (July 17, 2025) 📍 Hi-Lo Ranges (with 60-pip buffer): • July 17 — Single-candle setup: 3303 – 3358 • July 17–18 — Two-candle combined range: 3303 – 3367 ✅ Overview: Both the single-candle and two-candle setups successfully triggered clean bullish breakouts. The move peaked around 3439, delivering a potential +810 pips depending on your entry and execution. ⚠️ Fibonacci Re-Entry Insight: Re-entry opportunities near the 38.2% (≈3333) and 50% (≈3344) retracement levels offered low-risk continuation entries. 💡 Key Notes: ✔️ Both setups proved effective using risk management and cut/switch logic. ✔️ The two-candle setup showed a cleaner structure and breakout behavior. 🧠 Trading Plan – Original Notes Before the Signal: 🔹 I had planned to trade both setups live as part of my research strategy. 🔹 Same date setups were also valid across assets like BTC, US Index, and select commodities. 🔹 For cautious traders, I advised focusing on the two-day setup for stronger confirmation. 📋 Execution Strategy: • Wait for Hi-Lo range to form • Add 60-pip buffer zone • Execute breakout trade only when price breaks above/below buffered levels • If SL hit: Cut → Switch → Double position size on next setup to recover loss 📉📈 Chart Reference: 🔗 TradingView chart: TV/x/FqMW8Z0B/ Stay focused. Let structure guide you, not emotions. 🛡️ Protect capital. Trade with logic.