johntradingwick

@t_johntradingwick

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

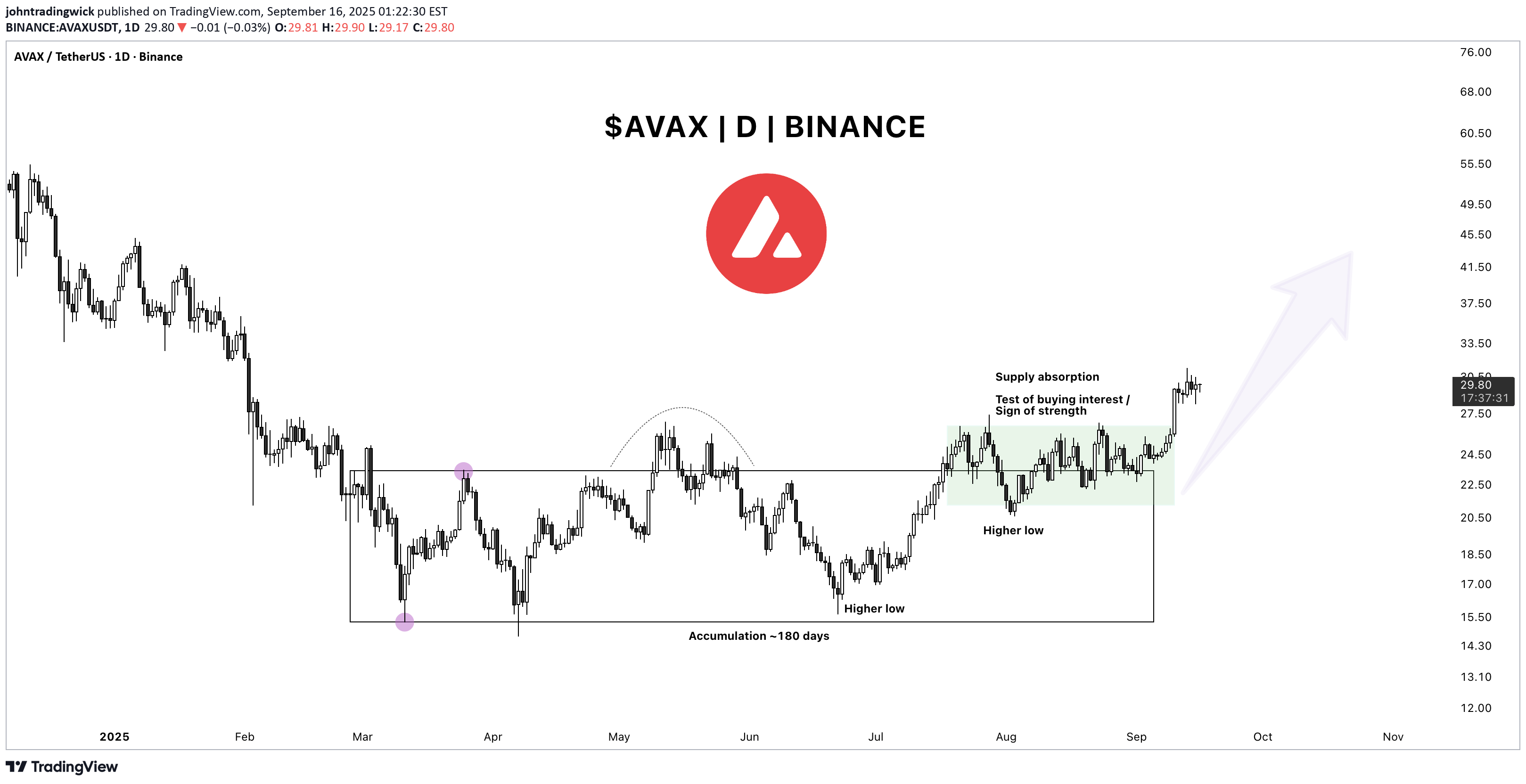

Avalanche has been quietly working on one of the cleanest Wyckoff accumulation structures we’ve seen across majors this year. For more than six months, essentially from late February until mid-August, the price rotated in a broad range, chewing through supply and frustrating impatient longs. From a Wyckoff perspective, we had an extended accumulation phase of ~180 days , clear higher lows forming into the summer, and a decisive show of strength in early September. With supply finally cleared at the top of the range, it has given us a clean breakout that suggests it’s ready to reprice higher into Q4 . 🔥 Zooming Into the 4H On the 4H, the price action since the breakout shows a textbook sequence : an impulsive expansion leg higher, followed by a pause for balance. The initial leg in early September was initiative buying, pushing AVAX from ~$25 to $30. Since then, we’ve been consolidating in a relatively tight box between $28–31 , establishing a new base of value. The point of control ( POC ) for this entire impulse sits right around $28 . That’s the key balance point where both buyers and sellers agreed on fair value during the expansion. As long as AVAX holds above that POC, the path of least resistance remains up . Acceptance above $28 tells me the market is comfortable repricing higher, and responsive buyers are ready to defend pullbacks into that zone. The other level to watch is the untested demand zone at $26–27 . This was the origin for the impulsive move, and it hasn’t been revisited yet. If we do pull back, that’s where I expect responsive flows to step in. In other words, dips into $26–27 are likely to find buyers with conviction. For active traders, that’s a clean area to structure risk: defined demand zone, clear invalidation below $25, and upside targets much higher. 🔥 Catalysts The technicals aren’t the only thing working in AVAX’s favor. There are also some fundamental tailwinds. This week, news broke of Avalanche’s partnership with Kalshi , a growing prediction markets platform. More importantly, Bitwise filed an S-1 with the SEC for a Spot Avalanche ETF . It’s still early in the process, but the filing itself is a meaningful step. Even if approval takes time, the headline alone positions AVAX as one of the few assets outside Bitcoin, Ethereum, and Solana that could potentially get mainstream ETF access. What’s your read on this move? Do you see AVAX sustaining this breakout, or is it setting up for a deeper pullback? ——————x——————x——————x——————x——————x——————x—————— ⚠️ Disclaimer: Crypto products, NFTs, Memecoins are unregulated and can be highly risky. There may be NO regulatory recourse for any losses arising from such transactions. This content is for educational and informational purposes only and does NOT constitute financial, investment, tax, or legal advice. Cryptocurrencies are highly volatile and speculative — you may lose part or ALL of your investment. I am NOT liable for your losses. Please do NOT copy my trades. Always consult YOUR financial advisor before making any investment or trading decisions. Or at the very least, consult your cat. 🐱

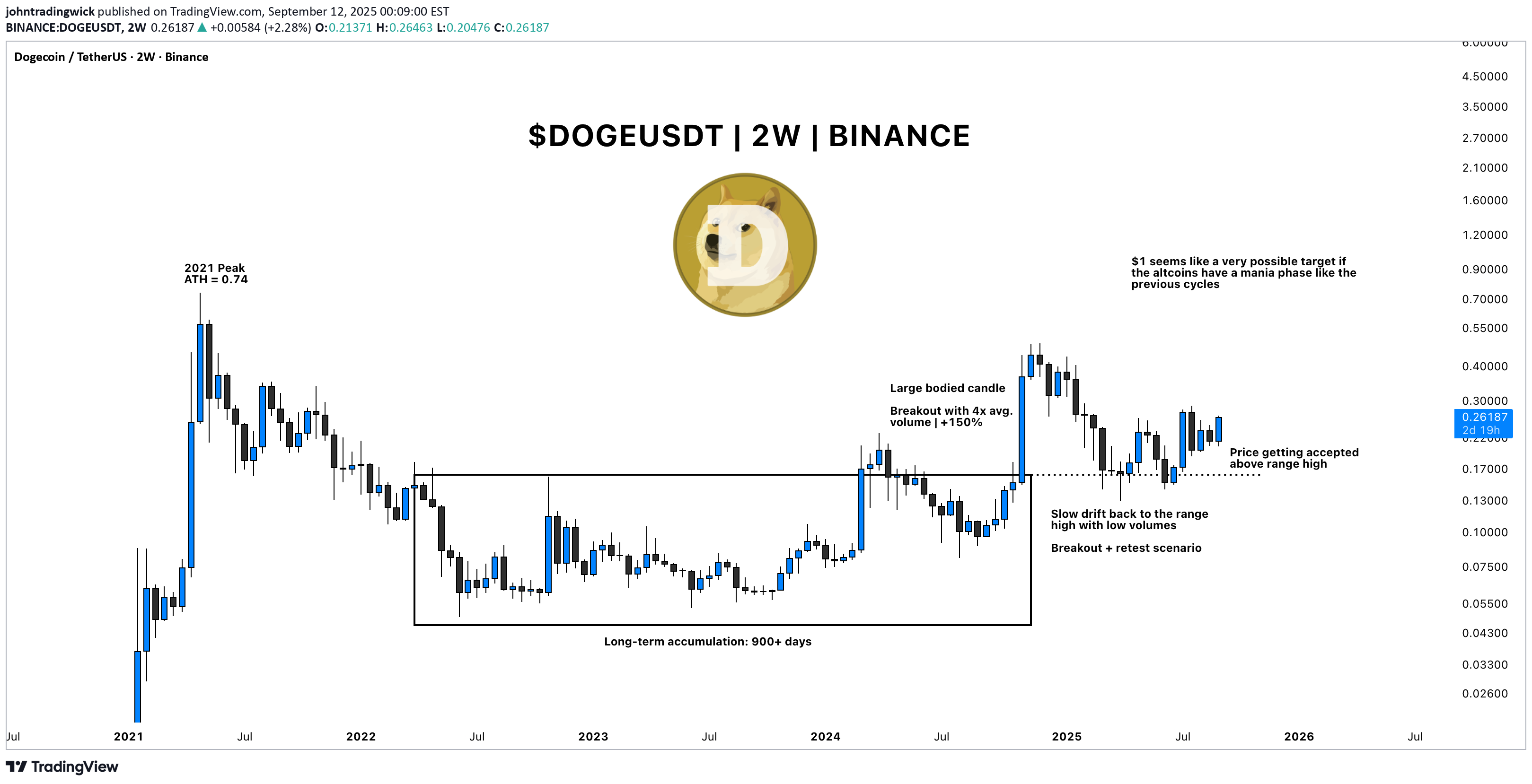

The structure, price action, and catalysts all look incredibly bullish. That’s why I rotated half of my PEPE stack into $DOGE. My overall target for this barbell distribution is a 3x from current levels. ⦿ Key Highlights - Breaking out after a very long-term consolidation - Breakout + retest seems complete - Crypto may be entering the late bull phase - Altcoins could soon enter the mania stage - DOGE, as the top and most established memecoin, is well-positioned to lead the pack - Treasury and ETF launches add strong tailwinds - DOGE Digital Asset Treasuries (DATs) have started purchasing DOGE - CleanCore bought $500M worth of DOGE this week, with another $500M planned in the coming weeks - Rex-Osprey Dogecoin ( $DOJE ) goes live today ✅ What’s your read on this move? Is this the real rotation to alts, or just another fakeout? Drop your take or send this to someone trading memecoins this week. 📢 ⚠️ Disclaimer: Crypto products, NFTs, Memecoins are unregulated and can be highly risky. There may be NO regulatory recourse for any losses arising from such transactions. This content is for educational and informational purposes only and does NOT constitute financial, investment, tax, or legal advice. Cryptocurrencies are highly volatile and speculative — you may lose part or ALL of your investment. I am NOT liable for your losses. Please do NOT copy my trades. Always consult YOUR financial advisor before making any investment or trading decisions. Or at the very least, consult your cat. 🐱

There's something the market teaches you over time that no book, course, or checklist ever really prepares you for - “how to live with uncertainty” . It's amazing how quickly the market can make you doubt yourself. You can be doing everything right - following your process, managing your risk, sticking to your plans, and then volatility hits. Suddenly, nothing seems to make sense. The moves feel random. Your setups fail. Your confidence fades. You start questioning not just your trades, but yourself. You'll have stretches where patience feels like the hardest thing in the world. Watching markets whip up and down without direction, sitting on your hands when you want to trade just to feel in control again, it's exhausting in a different way. It's not the exhaustion of doing too much. It's the weight of doing nothing when your instincts scream at you to act. That’s the part most people don’t talk about. It’s not the losing trades that break most traders, it’s the feeling of being stuck. The uncertainty of not knowing when the noise will fade. The frustration of watching opportunities slip by without a clear way to take part. It’s the slow grind of sitting through volatility while your discipline quietly wears down, day after day. Patience isn’t something you can show off. Most of the time, it looks like doing nothing. And often, it feels like falling behind. Good trading isn't about finding opportunities in every move, it's about knowing when the market favours you, and when it doesn't. It's about understanding your edge and protecting it. Some environments aren't built for your system, your style, or your strengths. Volatile markets don't offer you clean setups or easy entries. They offer noise, confusion, and temptation. Most traders don’t struggle because of volatility itself, but because of the impatience it creates. They force trades. They chase moves. They try to squeeze something out of the market simply because the waiting feels unbearable. But waiting is not a weakness. Sitting still is not inaction. Restraint is a skill. Your progress won’t always be visible. It won’t always show up on a chart at the end of the day. Sometimes, progress is simply preserving your capital. Sometimes, it’s maintaining your discipline. And sometimes, it’s protecting your mindset so you’re ready when the right opportunities finally come back into focus. You have to learn to stomach the discomfort of volatility without tying your self-worth to every swing in your account. The noise always feels permanent in the moment. Doubt grows louder. You start questioning your system, your progress, and even yourself. (More on this in a future post.) That's normal. What matters is what you do with those feelings. Whether you let them push you into reckless trades just to feel something again, or whether you have the maturity to sit still, protect your capital, protect your mindset, and wait. There’s no hack for this. No shortcut. Patience is something you earn the hard way - forged in boredom, frustration, and the silence between trades. Patience isn’t about passively waiting; it’s about actively protecting yourself, your energy, your future self from the damage you could cause today. Not every moment in the market is meant for action. Not every day is meant for progress. Some days, weeks, or even months are simply about survival. Some seasons are for growth, and others are just for holding on. Knowing the difference is what keeps you in the game long enough to eventually see the rewards. The market will calm. Patterns will return. Opportunities will align. Your edge will reappear. The chaos always fades. The clarity always returns. When it does, you want to be ready - not emotionally drained, not financially wrecked, and not scrambling to recover from the mistakes impatience forced on you. But if you lose patience and start chasing just to feel active, you risk more than money. You risk undoing the very discipline you’ve worked so hard to build. Volatility will always test you. That's its nature. Patience will always protect you. That's your choice. If you’re in one of those stretches right now - high volatility, failing setups, doubt creeping in; remind yourself this is part of the process. It’s normal, and it’s not the time to force progress. Let the market burn itself out. If you can do that, you’ll find yourself ahead, not because you forced results, but because you endured the pain when others couldn’t. The rewards won’t come from predicting the next move. They’ll come from knowing you didn’t let the storm in the market create a storm within you. Trust that clarity will return. Your only job is to make sure you’re still here when it does. There’s strength in waiting. There’s wisdom in restraint.

There was once a tree that stood alone at the edge of a cliff, overlooking the vast sea. Some days, the sun shone bright, the winds gentle, the water below calm and peaceful. Other days brought heavy storms, fierce winds, crashing waves, rain so relentless it seemed the skies might never clear again. The seasons came and went. The skies changed again and again. But the tree never thought of itself differently because of the weather. It did not feel more valuable on a sunny day. It did not feel broken or weak when storms battered its branches. The tree simply stayed rooted. It understood something quietly powerful - “ the weather was never personal. It wasn’t about the tree.” The tree remained, growing slowly over years, not because the conditions were always perfect, but because it had learned to stand through all of it. This is something most traders forget. We step into the market with good intentions, hungry to learn, eager to succeed. But somewhere along the way, we make a mistake. We let our self-worth become tied to the numbers on the screen. A green day makes us feel smart, in control, like we’ve cracked the code. A red day, on the other hand, shakes us to the core, makes us question our place, our skill, even our worth, like we never belonged here at all. The danger isn’t just in the financial losses. It’s in how we let the market shape how we see ourselves. But here’s the truth the market won’t tell you upfront: the market doesn’t know who you are, and it doesn’t care . It doesn’t remember what you did yesterday, how many hours you’ve spent learning, or how desperately you want this to work. The market moves how it moves. Sometimes it moves with you, sometimes it moves against you. It’s neither a punishment, nor a reward. It’s just movement. Your wins don’t make you superior. Your losses don’t make you dumb. Both are part of the same cycle, and part of the environment you’ve chosen to work in. If you build your self-image on the outcome of your last trade, you’ll forever live on a fragile edge. Every swing will shake you. Every drawdown will feel like a verdict on who you are. But trading isn’t about who you are today. It’s about who you become over time. Your job isn’t to seek approval from a system built on randomness and probability. Your job is to build yourself on steadier ground. To stay rooted, like a tree. To let your process define you, not your P&L. The storms will come. They always do. Volatility, uncertainty, periods where nothing seems to work - these are all part of the environment. The traders who survive are NOT the ones who try to outmuscle the market. They are the ones who protect their capital, their energy, and their mindset through it all. They understand that being steady is more important than being brilliant - that surviving is more valuable than being right. Detach your self-worth from the swings. Build your identity on discipline, patience, humility - the quiet habits you control. These are your roots. And when the storm rolls in, they’re what keep you grounded. When you stop tying your self-image to your short-term results, you begin to see the market more clearly. You stop forcing trades to make yourself feel better. You stop chasing moves to prove something. You start letting your process do its work, even when it feels slow. You start to realise that progress in trading is quiet and unfolds slowly, almost invisibly, much like a tree growing through the seasons. Small shifts accumulate over time, often going unnoticed, until one day you look back and truly see how far you’ve come. When you understand this, red days lose their sting. Green days lose their arrogance. Both just become part of the weather. You adapt, endure, and move forward. You don’t measure yourself by how much you made this week, this month, or even this year. You measure yourself by how well you followed your process , how calmly you handled the volatility, and how patient you remained when there was nothing to do. The market doesn’t ask for perfection - only consistency. And consistency comes from within, not from chasing highs or avoiding lows, but from standing firm through both. Like the tree on the cliff, your strength is not in avoiding the weather. Your strength is in understanding that the weather will pass. It always does. Your roots - your process, your discipline, your patience, are what keep you standing until it does. ⦿ Learn to protect your energy. ⦿ Learn to lose without self-doubt. ⦿ Learn to win without ego. ⦿ Learn to wait without fear. ⦿ Learn to wait patiently Your worth is not in your wins or losses. It’s in how you carry yourself through both. Stay rooted. The seasons will change. And when they do, you’ll still be here, stronger than you were before.Volatility will always test you. That's its nature. Patience will always protect you. That's your choice. If you’re in one of those stretches right now - high volatility, failing setups, doubt creeping in; remind yourself this is part of the process. It’s normal, and it’s not the time to force progress. Read this 👇Trading is a mirror. It reflects your fear, your greed, your impatience. It shows you who you really are. Ignore what it reveals and you’ll keep paying for the same lesson until you finally learn it. In the end, this game isn’t about the market. It’s about YOU .There comes a point in every trader’s journey when you do everything right, and it still goes wrong. You plan the trade meticulously, plot the levels, define your risk, wait patiently for the setup, and enter with the kind of discipline that would make any textbook proud. You follow your rules. You trust your process. And yet, the market does what it does! If you have experienced this, read this. 👇

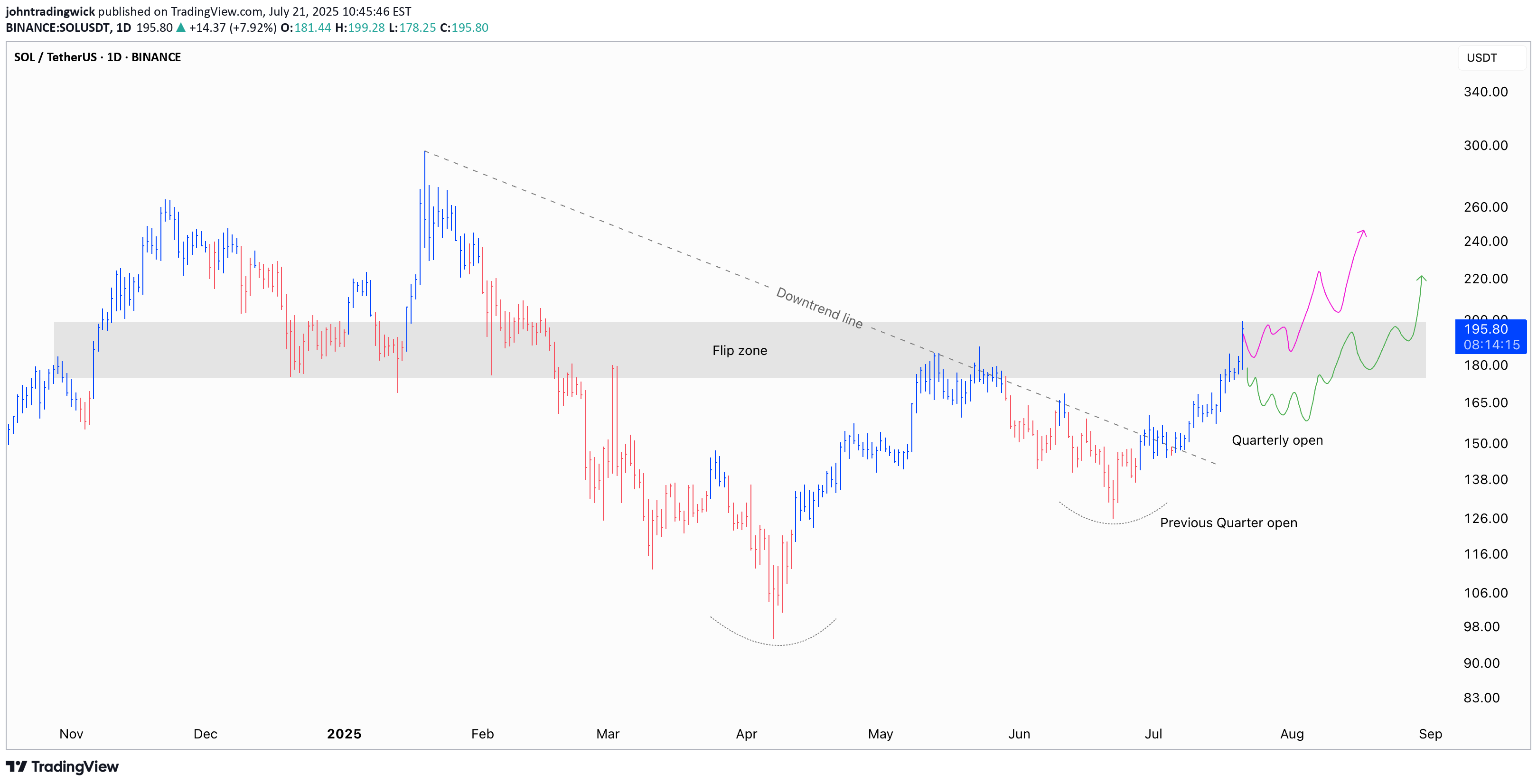

Solana’s been stealing the spotlight again and not just for the memes this time! After months of getting smacked down at key levels, it’s finally reclaiming the lost ground with conviction. Price is grinding its way through zones that had been solid resistance for ages, flipping sentiment along the way. The combination of structure, volume, and market psychology paints a clear story here. Let's break it down piece by piece in simple terms. ———x———x———x——— Table of Contents ⦿ Volume Profile ⦿ Key Technical Levels & Insights ⦿ Market Structure ———x———x———x——— ⦿ Volume Profile The Volume Profile offers crucial insight into where meaningful participation has taken place throughout this range and how these levels continue to influence the current structure. Point of Control (POC) – ~145 USDT This is the level where the highest volume changed hands during the entire consolidation. In simple terms, this is where buyers and sellers were most active in establishing positions. The POC is like a price magnet where the market finds equilibrium when direction becomes uncertain. If bulls lose momentum, the price may gravitate back towards it. Value Area Low – ~123.50 USDT Below this threshold, prior market interest thinned out significantly. A breakdown here would likely accelerate downside as it signals acceptance below value, typically inviting stronger bearish flows and forcing trapped longs to capitulate. Value Area High – ~213 USDT This area marks a logical short-term upside target if the current rally can sustain its footing. VAH is where the prior range began to thin out and sellers historically pushed back. If buyers want to reclaim control, this is a key level to watch. Currently, the price has cleanly reclaimed the POC and is now pressing into what I’d define as the Flip Zone (an area where former resistance is getting retested as potential support). Acceptance above the VAH will lead a rally towards the ATH. ⦿ Key Technical Levels & Insights Several key factors are aligning here to create a compelling case and it’s about the broader narrative these levels are constructing together. Quarterly Open – ~150 USDT The recent breakout and push above the QO shows a clear intent buyers' intent. It’s a important reference point for ongoing structure. Yearly Open – ~188 USDT Reclaiming the Yearly Open is rarely a trivial event. Currently, the price is flirting with the YO. If the price manages to reclaim it with a strong push, it'll shift the broader sentiment back in favour of the bulls. Flip Zone – 175–190 USDT This zone has historically been a battleground, serving as both support and resistance since March 2024. A clean breakout above this zone won't just clear resistance, it'll open the door for further upside as sidelined participants as well as trapped shorts will be forced to react. Downtrend Line – Broken The trend line that was established earlier this year has been breached now, adding another positive factor for the bulls. 200 EMA / 200 SMA – ~163 USDT Both KMAs are converging here, adding weight to this level as a reference for long-term trend direction. Price reclaiming and holding above these MAs often signals a meaningful shift in market sentiment. The confluence of reclaiming major opens, breaking downtrend resistance, and positioning above critical moving averages strengthens the bullish case. ⦿ Market Structure The current structure shows a market transitioning from bearish exhaustion, through a phase of accumulation, and now stepping confidently into breakout territory. Double Bottom Formation (April lows ~95 USDT to recent highs): This is a textbook accumulation. It’s not a fast V-shape reversal but a slow build. These kinds of structures often lay the groundwork for sustained trends. Higher Lows in Place: 95 → 126 → 150 → 190 USDT Each successive low is higher than the last, showing consistent buyer strength and deliberate positioning by participants with a longer-term view. Breakout Above Prior Range Highs (187–190 USDT): This area acted as clear resistance in previous attempts, capping price for months. Once this range is reclaimed with force, expect higher prices for multiple weeks/months. TLDR ✅ Current Bias: Bullish while above 175–190 USDT. ✅ Structure: Breakout of multi-month downtrend, reclaiming key levels. ✅ Volume: Strong above POC, targeting Value Area High next. ✅ Invalidation: Failure below 150 USDT flips bias back to bearish. I’m only focused on bullish continuation or healthy pullback scenarios for now, as I plan to keep holding my existing spot positions. If you found this breakdown helpful, drop a like and let me know your thoughts in the comments. Always keen to hear how others are seeing the market. 👇 ⚠️ Disclaimer As always, this post is purely for educational purposes. I am not a financial advisor, and nothing here should be taken as financial advice. Always consult your financial advisor before making any investment or trading decisions. Or at the very least, consult your cat. 🐱

SUI is back in focus as price pushes into a critical zone of resistance that has capped previous rallies. With key moving averages reclaimed and volume shifting in favour of bulls, the question now is simple - can it break free, or is this another trap before rotation lower? Let’s break down the current structure and what comes next! SUI is trading at a critical inflection point after staging a strong recovery off the March and April lows . The broader context shows a market transitioning from a bearish phase into a more constructive accumulation structure. The recent price action has been guided largely by reclaiming key areas of previous acceptance and value. However, sellers are still active at the upper bounds of this range. The next few sessions will determine whether SUI transitions into full breakout mode or requires further consolidation below resistance. ⦿ Volume Profile The Value Area Low (VAL) is anchored around $1.62 . This area marked the exhaustion point for sellers, triggering the current recovery leg. The Point of Control (POC), which represents the highest traded volume zone, sits at approximately $2.27 . This zone acted as a magnet for price through May and June and is now firmly reclaimed, reinforcing its importance as a structural support. The Value Area High (VAH) comes in at $3.82 . Price has recently reclaimed this level, which suggests buyers have shifted control of the auction. Acceptance above the VAH often implies that the previous range is no longer valid and a new range expansion could be underway. ⦿ Key Technical Insights Several technical levels align with this recovery. The 200-day MA and the anchored VWAP from the all-time high converge between $3.00 and $3.50. This area has been successfully reclaimed and held, adding further conviction to the bullish case. Above current prices, $4.12 represents the Yearly Open and a clear horizontal supply level. The market has shown hesitation here, as expected. The price action suggests sellers are attempting to defend this zone, but the overall structure remains bullish as long as higher lows are maintained. Support levels to monitor include $3.82, the Value Area High, and $3.50, where both the VWAP and the 200-day Moving Average provide dynamic support. Below that, the POC at $2.27 remains a crucial level of last defense for bulls. ⦿ Market Structure Structurally, the market has transitioned from a downtrend into a rounded bottom formation, which typically precedes more sustained uptrends. The higher low structure since the March lows confirms this shift. The recent push above both the POC and VAH further validates the strength of this reversal. Volume has supported this breakout. We saw clear expansion through the $3.00 handle, suggesting conviction among buyers. The visible consolidation just below $4.12 reflects natural supply pressure but not yet evidence of distribution. ⦿ Scenarios to Consider 1. Bullish Scenario: If buyers manage to establish acceptance above $4.12, particularly with daily closes through this level, the path higher opens cleanly. The low-volume node between $4.12 and approximately $5.00 suggests limited resistance in this zone. Price could expand swiftly toward $5.36 to $6.00 as a first target. 2. Healthy Pullback Scenario: Should price reject the $4.12 zone, a pullback toward $3.82 or even $3.50 would be healthy and expected. As long as the structure of higher lows remains intact and price holds above the reclaimed POC at $2.27, this pullback would likely serve as a base for the next leg higher. 3. Bearish Breakdown Scenario: A sustained loss of $3.00 would be the first real warning sign for bulls. Breaking below the POC at $2.27 would suggest a failed breakout and could see the price cycle back toward the lower end of the volume profile, targeting $2.26 or even the Value Area Low at $1.62. However, given current strength, this scenario looks less likely unless broader market sentiment shifts. I’m primarily focused on bullish scenarios or potential pullbacks, as the current market looks stronger compared to a few months ago. I believe we’re likely to see some decent long opportunities moving forward. Let me know your thoughts in the comments! 👇 ⚠️ Disclaimer As always, this post is purely for educational purposes. I am not a financial advisor, and nothing here should be taken as financial advice. Always consult your financial advisor before making any investment or trading decisions. Or at the very least, consult your cat. 🐱

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.