Technical analysis by johntradingwick about Symbol AVAX: Buy recommendation (8 hour ago)

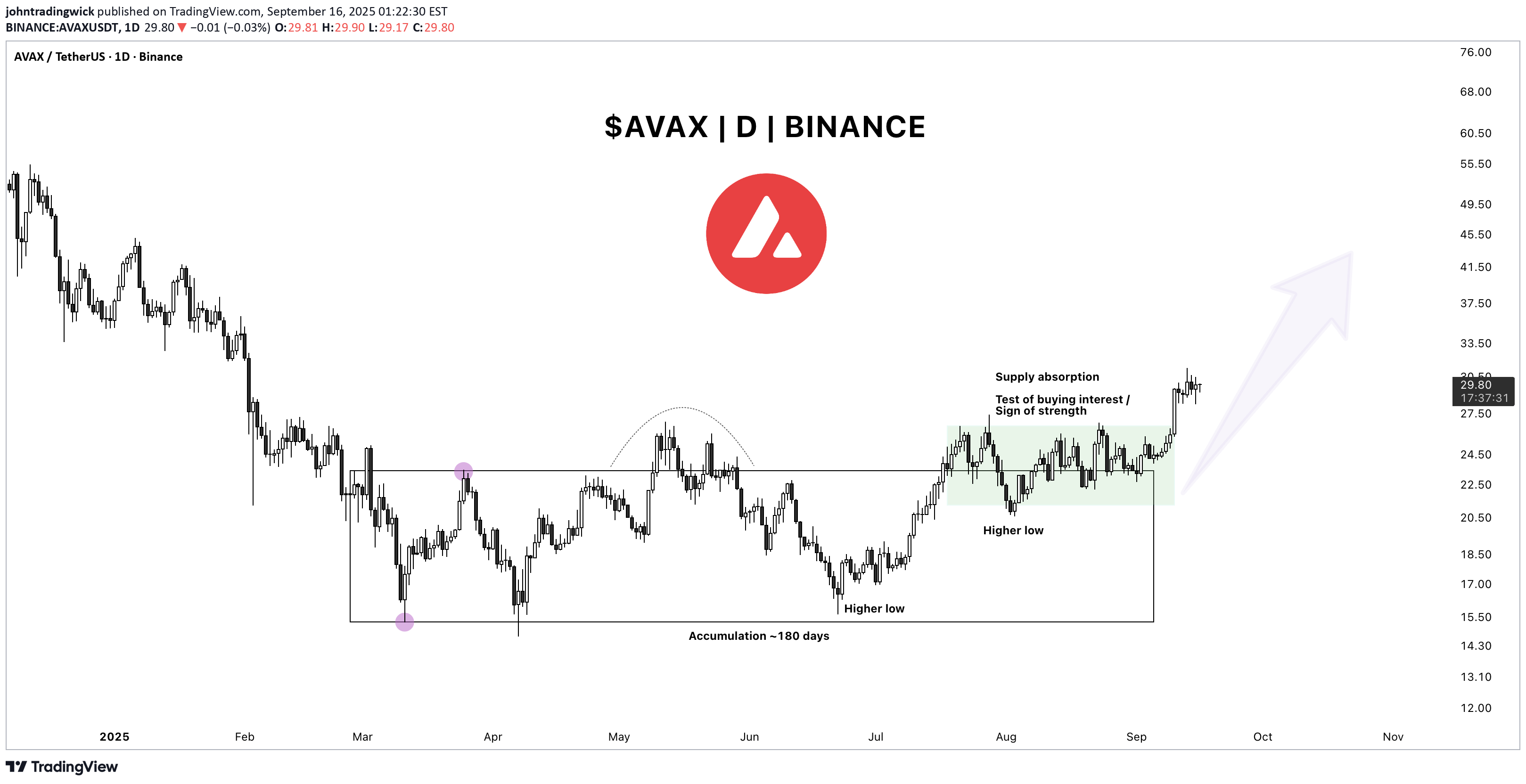

Avalanche has been quietly working on one of the cleanest Wyckoff accumulation structures we’ve seen across majors this year. For more than six months, essentially from late February until mid-August, the price rotated in a broad range, chewing through supply and frustrating impatient longs. From a Wyckoff perspective, we had an extended accumulation phase of ~180 days , clear higher lows forming into the summer, and a decisive show of strength in early September. With supply finally cleared at the top of the range, it has given us a clean breakout that suggests it’s ready to reprice higher into Q4 . 🔥 Zooming Into the 4H On the 4H, the price action since the breakout shows a textbook sequence : an impulsive expansion leg higher, followed by a pause for balance. The initial leg in early September was initiative buying, pushing AVAX from ~$25 to $30. Since then, we’ve been consolidating in a relatively tight box between $28–31 , establishing a new base of value. The point of control ( POC ) for this entire impulse sits right around $28 . That’s the key balance point where both buyers and sellers agreed on fair value during the expansion. As long as AVAX holds above that POC, the path of least resistance remains up . Acceptance above $28 tells me the market is comfortable repricing higher, and responsive buyers are ready to defend pullbacks into that zone. The other level to watch is the untested demand zone at $26–27 . This was the origin for the impulsive move, and it hasn’t been revisited yet. If we do pull back, that’s where I expect responsive flows to step in. In other words, dips into $26–27 are likely to find buyers with conviction. For active traders, that’s a clean area to structure risk: defined demand zone, clear invalidation below $25, and upside targets much higher. 🔥 Catalysts The technicals aren’t the only thing working in AVAX’s favor. There are also some fundamental tailwinds. This week, news broke of Avalanche’s partnership with Kalshi , a growing prediction markets platform. More importantly, Bitwise filed an S-1 with the SEC for a Spot Avalanche ETF . It’s still early in the process, but the filing itself is a meaningful step. Even if approval takes time, the headline alone positions AVAX as one of the few assets outside Bitcoin, Ethereum, and Solana that could potentially get mainstream ETF access. What’s your read on this move? Do you see AVAX sustaining this breakout, or is it setting up for a deeper pullback? ——————x——————x——————x——————x——————x——————x—————— ⚠️ Disclaimer: Crypto products, NFTs, Memecoins are unregulated and can be highly risky. There may be NO regulatory recourse for any losses arising from such transactions. This content is for educational and informational purposes only and does NOT constitute financial, investment, tax, or legal advice. Cryptocurrencies are highly volatile and speculative — you may lose part or ALL of your investment. I am NOT liable for your losses. Please do NOT copy my trades. Always consult YOUR financial advisor before making any investment or trading decisions. Or at the very least, consult your cat. 🐱