imaclone

@t_imaclone

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

imaclone

تحلیل بیت کوین، اتریوم و NFT: سطوح حیاتی، سناریوها و نقشه راه معاملاتی!

Policy/Scope: Informational market commentary. Not financial advice. No guarantees. Manage your own risk. Please, as always, DYOFR. Snapshot (USD, approx.) •BTC: ~112,400 (recent ATH ~125,000) •ETH: ~3,838 (recent peak ~4,780) •SOL: ~184 (weekly high ~224) Volatility remains high after the Oct 10 tariff-headline shock and large derivatives liquidations. Sentiment & Macro (neutral summary) •Early October optimism (“Uptober”) flipped to caution after the Oct 10 risk-off event. Fear & Greed moved from Greed to Fear intraday. •Rates: Market implies further Fed easing in 2025; a hawkish surprise is a downside risk. •USD: 2025 USD softness has coincided with stronger crypto; renewed USD strength can pressure prices. •Equities: Index swings continue to bleed into crypto via positioning and liquidity. Technical Maps & If/Then Plans Levels = areas of interest, not market orders. “Invalidation” = close beyond level on your execution timeframe. Bitcoin (BTC) — ~112,400 •Support: 110,000; 100,000. •Resistance: 113,500; 120,000; 125,000. •Mean-reversion: Confirmed holds 108,000–110,000 → TP 120,000 → 125,000 → 135,000. SL <108,000. •Breakout: 4H/D close >113,500 with volume → 118,000 → 122,000. SL ~111,000. •Invalidation: D close <110,000 weakens; <100,000 = deeper risk. Ethereum (ETH) — ~3,838 •Support: 3,600; 3,400. •Resistance: 4,000; 4,300; 4,780–4,865 (ATH zone). •Mean-reversion: Hold 3,600 → TP 4,000 → 4,300 → 4,800. SL ~3,350. •Breakout: D close >4,000 with volume → 4,300 → 4,600. SL <3,900. •Invalidation: D close <3,300. Solana (SOL) — ~184 •Support: 176–175; 150. •Resistance: 200; 224; 250. •Mean-reversion: Retest/hold 170–175 → TP 200 → 224 → 250. SL ~165. •Breakout: Close >200 with volume → 210 → 224. SL <190. •Invalidation: D close <150. Altcoins (concise setups; USD) •PENGU (~0.023): Support 0.020; Resistance 0.030 → 0.040. Idea: Mean-revert near 0.020 (if tagged) → TP 0.030 / 0.040. SL <0.018. High risk. •JUP (~0.34): Support 0.30 / 0.25; Resistance 0.40 / 0.46. Idea: Breakout >0.40 → TP 0.46 / 0.55. SL ~0.36. Or buy deeper retrace ~0.25 with tight risk. •ME (~0.40): Support 0.30; Resistance 0.50 / 0.64. Idea: Speculative swing toward 0.50 / 0.60. SL <0.29. New token; unlock risk. •S (Sonic, ~0.18): Support 0.10; Resistance 0.27 / 0.50. Idea: High-beta mean-reversion 0.12–0.15 → TP 0.27 / 0.50. SL 0.09. Very high risk. •LTC (~120): Support 115 / 100; Resistance 130 / 145–150. Idea: Swing near 110–115 → TP 130 / 145. SL <99. •SNS (~0.00223): Support 0.0020; Resistance 0.0028 / 0.0035. Idea: Small-size accumulation near 0.0020 → TP 0.0028 / 0.0035. SL 0.0015. •GRASS (~0.55): Support 0.50 / 0.30; Resistance 0.70 / 0.84 / 1.00. Idea: Mean-revert 0.45–0.50 → TP 0.70 / 0.85. SL 0.40. Extreme volatility. •DOGE (~0.19): Support 0.16 / 0.13; Resistance 0.22 / 0.25 / 0.30. Idea: Buy dips 0.16–0.17 → TP 0.22 / 0.25 / 0.30. SL 0.14. •AVAX (~28): Support 25 / 22; Resistance 30 / 35 / 40. Idea: Accumulate 25–26 → TP 30 / 35 / 40. SL 22. •ADA (~0.80): Support 0.75 / 0.67 / 0.60; Resistance 0.93 / 1.00. Idea: Dip buy ~0.70 → TP 0.90 / 1.00 / 1.10. SL 0.62. Breakout >0.93 → 1.00. Solana NFT Floors (informational; floors in SOL ≈ USD using SOL~$184) NFT TA is illiquid and imprecise. Use wider mental stops. Consider fees/royalties. •DeGods (Solana): Floor ~6.1 SOL (~$1,120). Context: Legacy Solana stub after migration; very low liquidity. Levels: Support ~5 SOL; Resistance ~10 SOL then 20 SOL. Idea: Mean-reversion only; tiny size. Break <5 SOL = caution. •y00ts (Solana “reveal” stub): Floor ~0.85 SOL (~$162). Context: Chain-migrated; minimal activity. Levels: Support 0.75; Resistance 1.0 then 1.5. Idea: Technical scalps only; liquidity risk is high. •Cets on Creck (CETS): Floor ~0.30 SOL (~$67). Levels: Support 0.25; Resistance 0.50 then 1.0. Idea: Base-range mean-reversion; SL if floor <0.25. •Udder Chaos: Floor ~1.06 SOL (~$197). Levels: Support 0.90 / 0.75; Resistance 1.2 then 1.5. Idea: Relative-strength candidate; swing toward 1.3 / 1.8 / 2.2 if market stabilizes. •Primates: Floor ~0.18 SOL (~$40). Levels: Support 0.15; Resistance 0.30 then 0.4–0.5. Idea: Lotto-style mean-reversion; tiny size; pre-list targets. Risk framework (for all sections) •Risk 1–3% of account to the hard stop per idea. •Scale out 40% / 40% / 20% at TP1 / TP2 / runner; move stop to breakeven after TP1. •Pause alt exposure if BTC closes below 110,000 or if USD strength spikes materially. •Revalidate levels after policy data, tariff headlines, or outsized equity moves. Pine Script® Disclosure: Educational only. Not investment advice. No solicitations or performance claims. Data reflects the provided context and can change rapidly. Verify with real-time sources before acting.

imaclone

Sonic Price Zones and Macro Context

Sonic (SUSDT:COINEX) - Macro + TA Context: Macro drivers: USD showing softness, yields stable, equities firm. Crypto majors holding higher ranges; sentiment neutral. Key Levels: Support zones: 0.300–0.305, 0.285, 0.270 Resistance zones: 0.335–0.350, 0.375–0.385, 0.400–0.410, 0.460 2H View: A 2H close above 0.335 with RSI > 50 would suggest room toward 0.350 / 0.375 / 0.400. A 2H close below 0.300 could open space toward 0.285 / 0.270 / 0.255. 4H View: The 200EMA around 0.34–0.35 remains an important zone. Sustained closes above 0.335–0.340 could leave upside potential to 0.350 / 0.375 / 0.400. Rejections near 0.350 with momentum slowing may see a move back toward 0.335 / 0.322 / 0.305. 1D View: Since July, price has ranged 0.30–0.35; supply sits at 0.40–0.46. Closes around 0.300–0.305 with constructive candles may lead toward 0.335 / 0.350 / 0.375. A daily close above 0.375 would highlight 0.400 / 0.430 / 0.460. A daily close under 0.300 would refocus attention on 0.285 / 0.270 / 0.250. 1W Lens: Market remains under weekly supply 0.40–0.46. A weekly close above 0.46 would bring 0.50–0.55 into view. 0.30–0.32 may act as an accumulation range while USD stays soft and majors stable; stronger USD or yields could shift focus toward 0.285–0.270. --- Risk Notes: Macro events (CPI releases, DXY moves, yield spikes) can shift these dynamics quickly. TL;DR: Constructive bias if 0.335 is reclaimed and held. Losing 0.300 would shift focus to 0.285 / 0.270. --- *Educational purposes only. Not financial advice. I also warrant that the information created and published here is not prohibited, doesn't constitute investment advice, and isn't created solely for qualified investors.*

imaclone

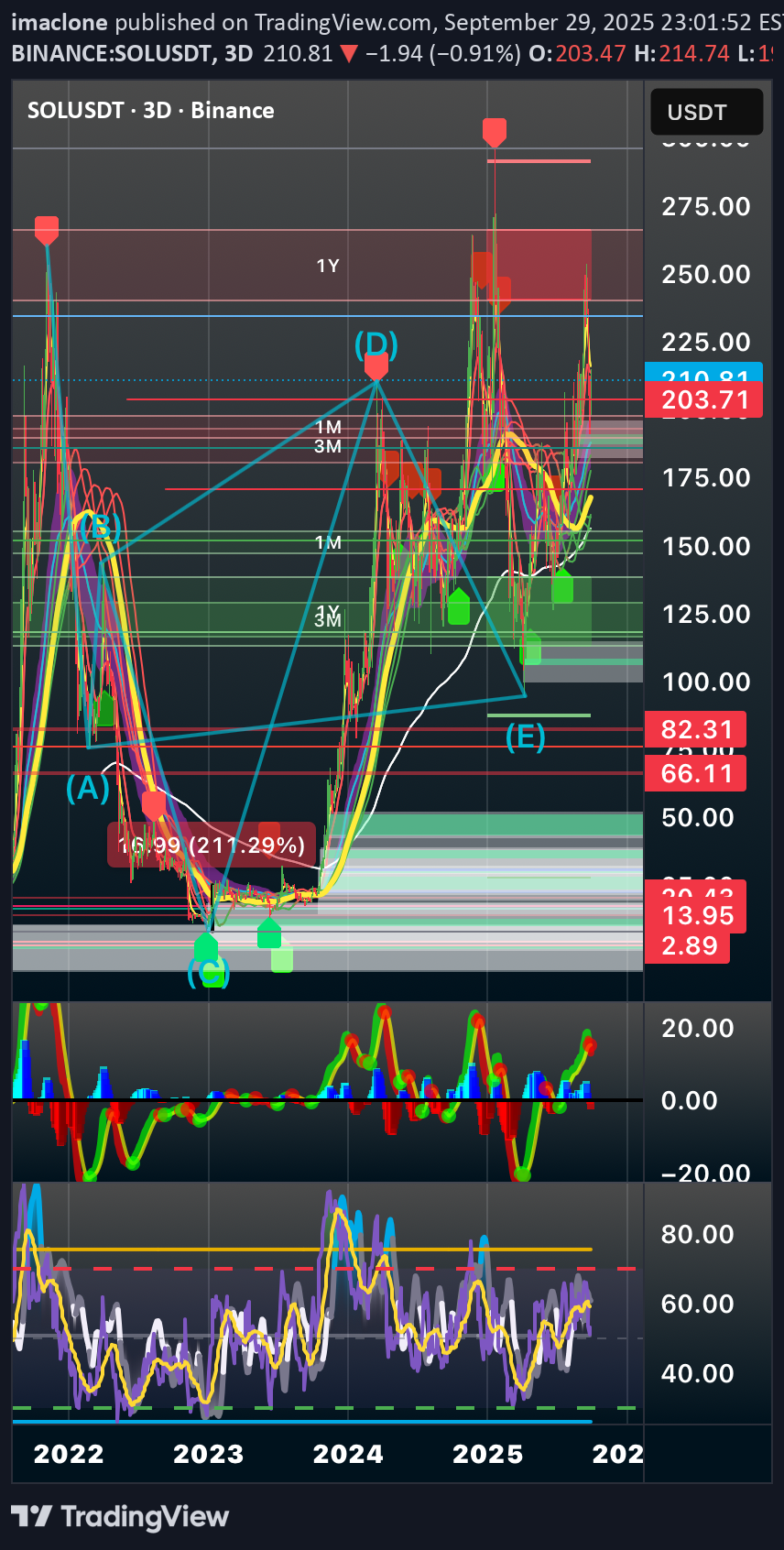

BTC & SOL Macro & TA

Current Prices •BTC ≈ $116,100 •SOL ≈ $247.6 Macro + Sentiment •DXY ~97–98, soft dollar = crypto tailwind. •USD/JPY ~147.6, elevated but stable. •UST 10Y ~4.0%, drifting lower = risk-on. •SPY near highs, equities firm. •CPI Aug +0.4% m/m, +2.9% y/y, Core +3.1%. Inflation sticky but cooling. •Fear & Greed = neutral. ~$1.5B liquidations flushed leverage, funding reset. BTC Technicals Key Levels •Support: $110k–112k, then $105k. •Resistance: $118k, then $125k. 2h •Long if break/close >$117.5k. •SL $113.5k → TP1 $118k, TP2 $120k, TP3 $122k. 4h •Neutral until >$118k or < $110k. •SL $109k → TP1 $120k, TP2 $125k, TP3 $130k. 1D •Hold >$110k keeps bull bias. •Break >$118k confirms push. •SL $104k → TP1 $125k, TP2 $140k, TP3 $160k. 1W •Long term bias bullish. •Accumulation $90k–105k. •Targets $140k, $180k, $220k. SOL Technicals Key Levels •Support: $200–220, then $180. •Resistance: $260, $300, $350. 2h •Bounce long if >$230. •SL $220 → TP1 $260, TP2 $280, TP3 $300. 4h •Base >$220, breakout >$260 triggers upside. •SL $190 → TP1 $300, TP2 $330, TP3 $380. 1D •Swing long if >$200 with volume. •SL $160 → TP1 $350, TP2 $450, TP3 $600. 1W •Big picture: alt momentum needed. •Accumulation $100–150. •Targets $500, $700, $1,000. Risk Management •Risk per trade: ≤1–2%. •After TP1 → stop to breakeven. •Partial exits ⅓ TP1, ⅓ TP2, ⅓ TP3. •Size smaller for SOL (higher volatility). •Macro triggers (CPI/Fed/DXY) = adjust exposure. Action Plan •BTC: long only if daily >$118k or bounce from $110k. •SOL: long only if >$260 with confirmation; avoid longs if < $200. •Watch DXY/UST yields; if USD strengthens → protect longs.

imaclone

$S and Money Market Breakdown (Macro + TA)

🌍 Big Picture and Context First, Always: Right now, everything’s about macro winds and liquidity. •BTC ~ $116,100, ETH ~ $4,668, SOL ~ $247.6 — majors still holding high ground. •DXY ~97–98 (weak dollar = good for alts), USD/JPY ~147.6 (still high). •SPY pushing highs, 10Y UST ~4.0%, inflation data’s cooling but sticky. •CPI last read: +0.4% m/m, +2.9% y/y. Core +3.1%. PPI softening slightly. •Fear & Greed Index = Neutral, TVL stable at ~$163B. Crypto funding mostly positive. •The wind’s not blowing hard, but it’s blowing favorably — if you’re positioned right. 🎯 Focus Token: $S (Sonic) | Price: ~$0.316 We’re still range-bound. But range ≠ random. Key support: $0.300–0.305, $0.285, $0.270 Key resistance: $0.335–0.350, $0.375–0.385, $0.400–0.410, $0.460 🧭 2H Strategy: Micro-Trigger Zone •Bullish Setup: 2H close > $0.335 with RSI > 50 → go long. → TP1 $0.350, TP2 $0.375, TP3 $0.400 → SL $0.324 •Bearish Setup: 2H close < $0.300 (esp. if DXY spikes or SPY turns red). → TP1 $0.285, TP2 $0.270, TP3 $0.255 → SL $0.306 🧱 4H Strategy: Structure Check •4H 200EMA is the ceiling: $0.34–0.35 area is the battleground. •Long on Retest: Break above $0.335–0.340, retest holds → → TP1 $0.350, TP2 $0.375, TP3 $0.400 → SL $0.329 •Fade the Hype: Wick into $0.350, RSI > 65, MACD stalls → → TP1 $0.335, TP2 $0.322, TP3 $0.305 → SL $0.358 🕰 1D Strategy: Swing Map •Range Structure: July-present = sideways channel $0.30–0.35 Major supply cap = $0.40–0.46 •Swing Long (Base): Enter $0.300–0.305 on bullish 1D candle or RSI divergence → TP1 $0.335, TP2 $0.350, TP3 $0.375 → SL $0.292 •Breakout Swing: Daily close above $0.375 + hold → TP1 $0.400, TP2 $0.430, TP3 $0.460 → SL $0.362 •Bear Flip: Daily close below $0.300 = exit longs or consider shorting → TP1 $0.285, TP2 $0.270, TP3 $0.250 → SL $0.307 📆 1W Strategy: Positioning Lens •Weekly still under major supply $0.40–0.46 •A weekly close above $0.46? You unlock $0.50–0.55 •Accumulation Bias: If majors stay strong (BTC/ETH/SOL) & DXY stays soft → accumulate $0.30–0.32 with wide stops. •Wait + Watch: If yields or DXY jump → sideline until $0.285–0.270 ⚖️ Risk Rules (Always On) •Risk 0.5–1.5% per trade and always remember to size appropriately •After TP1, move stop to break-even •Trim risk on macro volatility (CPI surprises, DXY spikes, yields above 4.2%) 🧠 TL;DR: My Personal Mental Model Soft dollar. Stable rates. Neutral sentiment. Big caps not breaking. → $S is in a cautious bullish pocket if it clears $0.335 → But if it loses $0.300, and the macro turns, don’t even hesitate to flip bearish and look toward $0.285 / $0.270 Notes: You don’t chase breakouts. You prepare for them. You don’t panic on drops. You plan for them. You trade when the market gives you the nod, not when your emotions do. Remember this and always, always, DYOFR. Sources: CoinGecko, CoinMarketCap, Yahoo Finance, BLS.gov, Alternative.me, DeFiLlama, CoinGlass. All trades mapped with structure, not hope.

imaclone

Sonic Reversal Play with a High R/R Setup

Price has dropped right back into the same demand zone that held everything together during the last major flush. I noticed we’re getting clear RSI divergence thus price is bleeding lower, but momentum isn’t following. That usually means to me that sellers are getting tired. There’s also a large gap in the chart above it’s current base. If we reclaim even the low $0.40s, there’s room to rip to the upside. The liquidity supports the thesis of a 200%+ move straight into that inefficiency zone sitting just under $1.10. Why this matters: •RSI isn’t confirming the breakdown •Strong historical support is holding (green box) •That gap above hasn’t been revisited—yet •The crowd is convinced it’s dead, which is usually when it wakes up My levels: •Entry: Here, while it’s still bleeding •TP1: $0.50 •TP2: $0.90 •TP3: $1.10 •SL: Tight, just under $0.32 I’m not calling a moonshot. I’m just saying this chart is screaming for attention, and the reward looks too clean to ignore.

imaclone

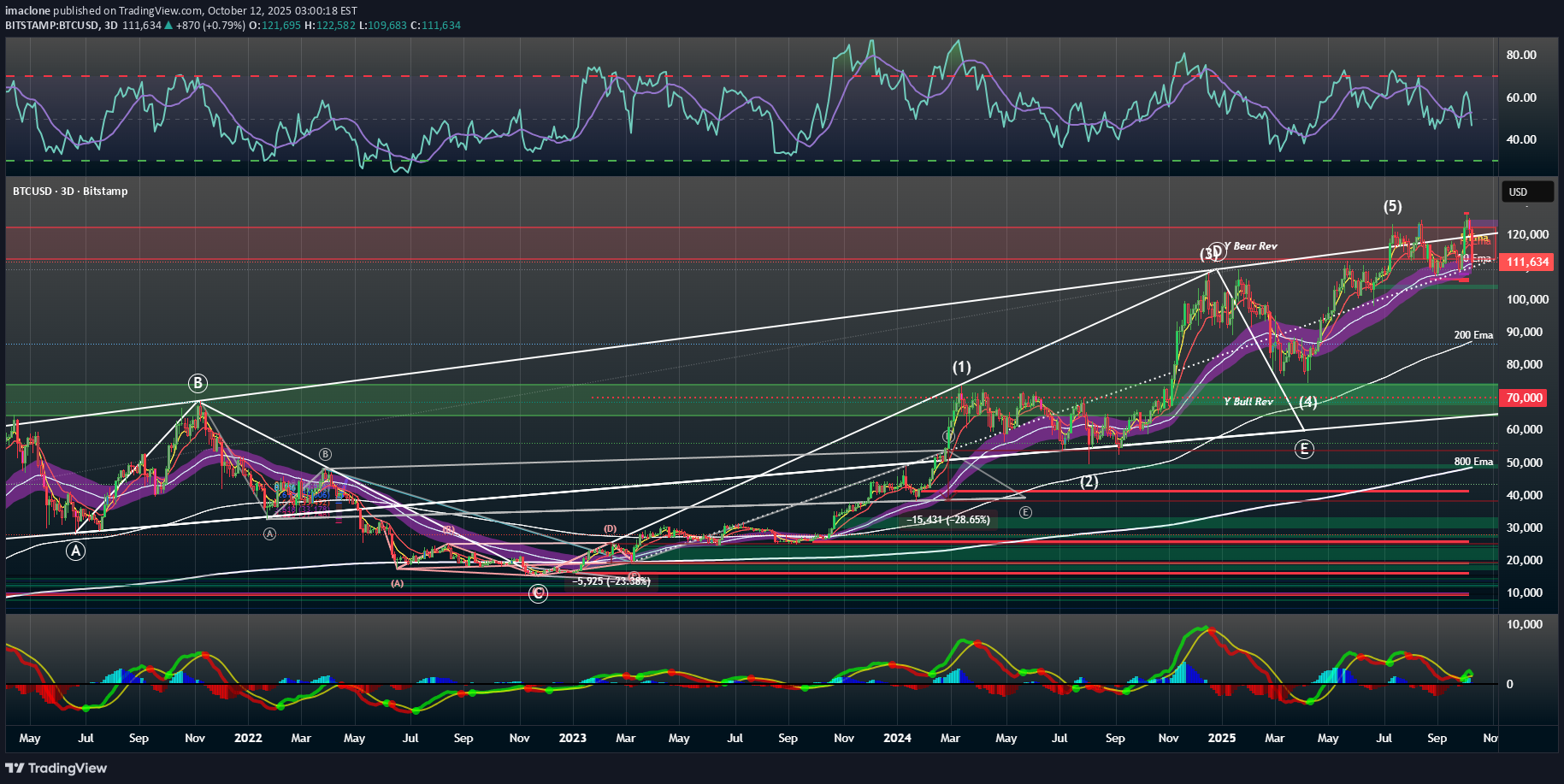

BTC will react here in a way that isnt parallel to the past.

BTC's patterns are gorgeous but beyond new territory imo. DXY is staged for a shoebag to the down, yet BTC still has liq ~104k zone as do stocks have more room for growth via a strong Q1. Especially if Japanese YIN is able to keep news about their rates aside and work it out, the US dollar will hold more value this presidential cycle. Stabilizing the range for IF A DUMP OCCURS on Bitcoin, Wallstreet liq will keep a solid >60k btc. Imo 50's wont happen again, and it might get a little bit unpredictable for the second half of this 10yr cycle going into 2025-2030. Both ways- bull AND OR bear. Unless we have a reset; which I doubt will ever happen because the entire human race depends on the dollars stability. Short term tho; RSI said to exit 100k BTC. Long term tho; This is going to be an interesting 4 years of a Post-Biden America. I see health, but am concerned deep down for some reason. NFA DYOR IDK F*K ABOUT SH*TCompleted: Waves 1, 2, and 3. Pending imo Wave Four/Five for a final leg into price discovery. Realizing gains will be taken around TPs at 136k-142k.DXY’s been hovering below 100 since the election. Yen carry trade’s been snapping back and forth—tied to rate cut speculation that can’t make up its mind.

imaclone

LONG TERM TIME

The MAC D along with the RSI shows some interesting movement we havent seen since 2021 - 2022.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.