haysicayim

@t_haysicayim

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

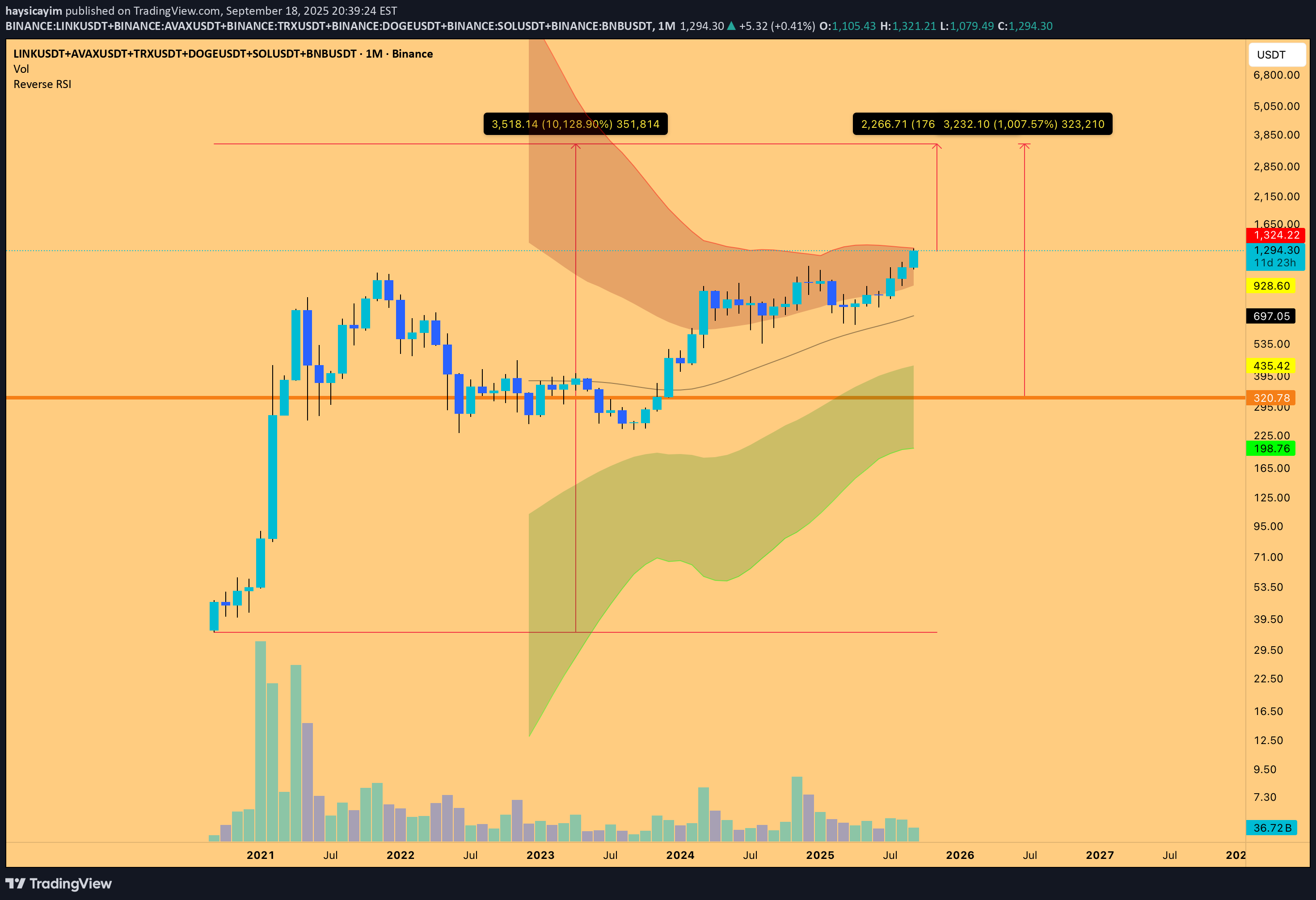

LINK, AVAX, BNB, TRX, DOGE, SOL composite look. These coins still can do more bullish moves

This is very unexpected, I know but the question of "can a memecoin reach 1 trillion dollar market cap" giving me thrills.

potential pathway for ETH. It is following these trend lines so far by targeting 1k price range.

Potential SOL coin targets. I projected previous moves as expectations. I used 3monthly and 1 monthly charts and second parabolic SAR signals to detect the range.

XRP is about to go back to 0.6 region. This is just a probability, but it is highly likely to me. It is considered as a transaction coin which means some hodlers of it might be in denial for long time but not until the sub 2usd levels.

I keep producing these guesses by observing narrow statistical pool. These are important guesses about the future actions of Bitcoin for me.

I love producing charts. At the previous cycle's ATH I forgot to produce charts. I won't forget doing that this time. Because I called the 15.6k as a potential dip 1 year earlier previously and I didn't have a a proof. Maybe this time, I'll find the next bottom again and able to find a proof for that. My call is 30k this time. Let's keep it as a note here.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.