crypto_poet

@t_crypto_poet

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

crypto_poet

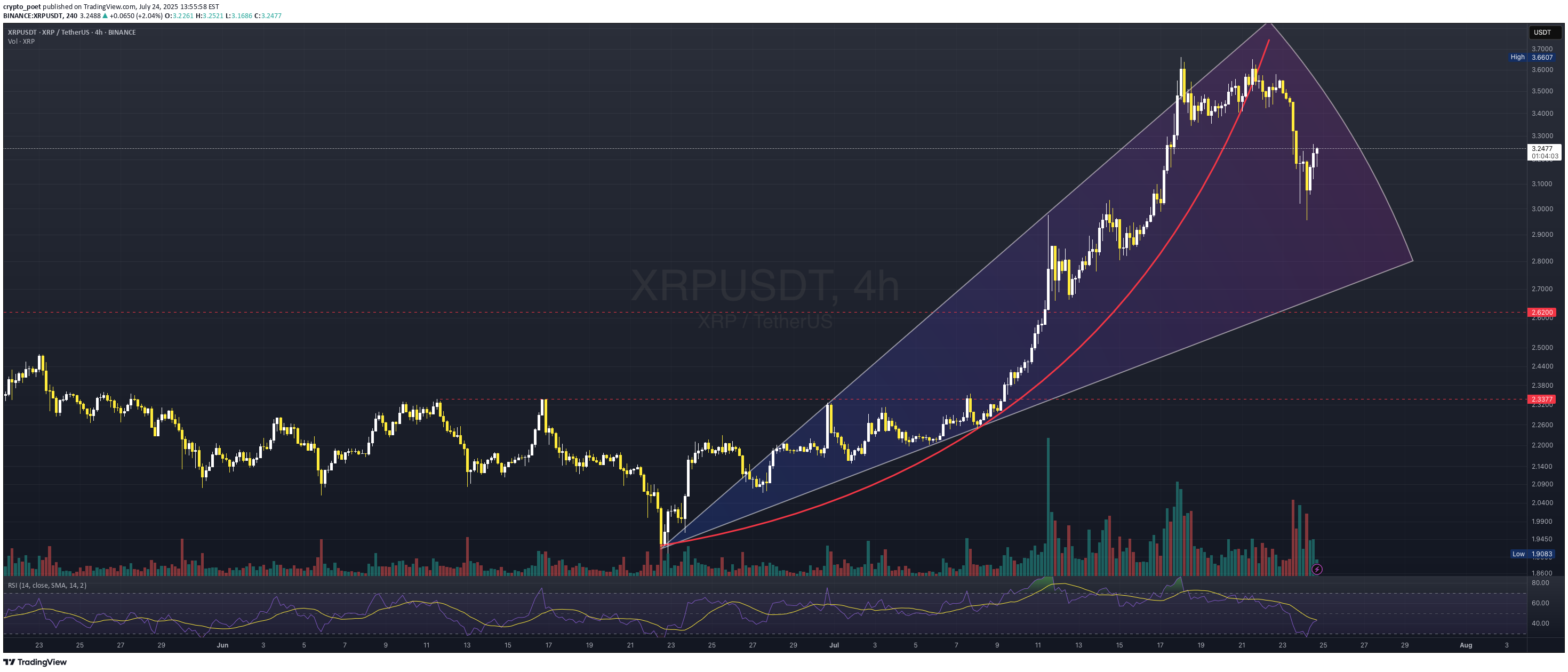

XRP - in the future is room for past

The chart of XRP/USDT on the 4-hour timeframe reveals a classic example of a parabolic rise within a well-defined ascending channel, which has recently been broken to the downside. The price rallied strongly, forming higher highs and higher lows, supported consistently by the curved trajectory of a long-term trendline and multiple short-term moving averages. However, the steepness of the ascent, culminating in a local high around 3.66, appears to have exhausted momentum. Following the peak, a sharp correction has taken place, breaching both the dynamic support and the lower boundary of the rising wedge structure. This breakdown signals a potential shift in market sentiment. The recent rebound seems more like a temporary relief or dead-cat bounce rather than a decisive reversal. From a broader perspective, this move appears to be part of a larger cyclical retracement—where price may revisit and test previous high levels (now flipped into potential support) around the 2.62 and 2.33 zones. These levels are historically significant and could serve as key areas for demand reaccumulation in a longer-term bullish continuation, assuming macro conditions remain favorable. In essence, while the immediate trend shows weakness, the larger structure still supports a healthy market correction. A return to prior resistance-turned-support would not only be expected but potentially constructive for sustainable future growth.

crypto_poet

IOTAUSD - high probability Long setup

IOTAUSD - high probability Long setup Usually breakouts create amazing trading opportunities for those who patiently wait for a confirmation. This chart presents another possible IOTA entry, which has quite significant values if it comes to positive results of prognosis. As seen on this logharitmic 1D historical price action we are currently breaking out of a downtrend which held since 10'th of May. I present here my scenario for the first 2 targets. Further updates will follow if levels reached, or stop-loss triggered. For now scenario presented a few weeks ago is still in play, considering possible Wyckof accumulation schematic. Please find attached a link to this material (bare in mind levels in there were optimised only for price - timeframe wasn't taken at all under consideration). Never invest in one asset more than 2% of your trading portfolio. Good luck trading, keep educating, remember of capital management and entry/exit/pause strategy. Regards, Adamsky.Trade active: Please note bullish divergence (RSI) formed between 23/05 and 22/06.Trade active: Buy order executed:Trade active: Current strong resistance as per ichimoku in the area of $0.848 : Close below the red support line (atm: $0.79) on the above 4H chart, will most likely send the price to the area already described as a Stop-loss.Trade active:Trade active: Target one reached.Trade closed: target reached

crypto_poet

Out of range, LTC as risky business

The long term trading range was broken already a while ago. Bottom of the rising wedge is now confirmed. For now staying on sidelines to observe further price action development. At the moment most of crypto assets look similar. It's a risky business until the channel is regained. For now I'm bearish.

crypto_poet

BTC - Fear is stronger than greed

Just having a coffee break in between my work duties. The Penguin indicator again is sitting on the chart. I can imagine we are in a danger zone here with 2 possible scenarios. I am presenting the more likely one. Weak confirmation of this rising wedge (bearish pattern) and sudden, rapid move to the downside. If current target won't hold, 20k will turn into resistance. For now if this isn't a fakeout (also possible), we are looking at sub 20k as target zone for BTC within the next 3-4 weeks. This move could be accelerated (affected) by external factors.tradingview.com/chart/C1WuNHGK/?symbol=BITSTAMP:BTCUSDNo LONG until price locks daily above 22k (atm)$18363 😶

crypto_poet

LTCUSD - Long Term

If we lose this support, things will most likely get ugly.Areas, where fear is tested, are common in price dumps with great recoveries. Most of the boundaries get tested. If in doubt - zoom out. Stay realistic, protect your capital - if you're new learn basics.The most important in making money is not losing it in the first place - use the tools available, be patient, know your limits and weaknesses.Long if above, Short if below.

crypto_poet

LTC - two possible scenarios

All depending on daily close within next two days. If bulls manage to close daily above the green 100 MA (green) - LTC will most likely move towards the stronger 200MA resistance. If tomorrow we close below, the possibility increase to drop down slightly below previous support levels. In this case, I would look at possible Wyckoff accumulation schematics with the potential of reaching new highs before December. Time will tell...Long at the confirmation:

crypto_poet

LTCUSD - levels to watch on the way up...

Possible long after confirmation of current resistive formation forming on Daily (thin yellow line). Theoretical confirmation circled.For whatever reason, the blue ghost is slightly shifted in the published idea...Idea updated :Possible reversal formation on 4H:Current view on daily:

crypto_poet

It's not game over yet.BTCUSD-LONG TERM

Only for a pure informational purpose, I would like to point your attention to a few timeframe related facts. In various colours I present here simple facts related to previous price action. Firstly the intense red/pink bars indicating amount of weeks it took BITCOIN to go back to the 20 Weekly Moving Average - I consider in this presentation only those weeks where value drop 35% or more. It never took more than 16 weeks (extreme) for the price to recover back to those levels. That would indicate that if the price would keep dropping, we wouldn't have to wait long (max 8 weeks) for the price to go back to those levels. Second to note is the length of the previous bull market (according to previous data we still have about 6 months to go). Third, notice the dropping transaction volume and steep, explosive price action. Considering the rising BTC awareness, dropping volume, timeframes, and the slowly building hidden bullish divergence, we did not see the final leg of this bull run yet.

crypto_poet

Here's how LTC will reach 1k (and you won't be ready)

Firstly pay attention to long-term RSI values, where signs of a hidden bullish divergence emerge. Secondary consider the blue scenario playing out (yellow) the same way as it did in the past.The more bearish the crowd they said. Fear and greed index currently at levels of EXTREME FEAR.

crypto_poet

7 Year old Bullish triangle

We just bounced off serious support, both within the LTCUSD and LTCBTC trading pairs. LTCBTC marked recently a historical low in relation to Bitcoin, hence we are witnessing increased volatility and significant growth in relation to USD.Considering the size of this triangular formation where support is clear targets in the area of previous top (c.413 USD) seem to be merely the beginning of the explosive growth which we will possibly witness within the coming weeks. T1 for this long term chart would be the psychological 1k, following further Fibo resistance levels.Never forget money management, risk/reward ratios, or stop-losses!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.